Академический Документы

Профессиональный Документы

Культура Документы

Steven Paul

Загружено:

Sonu PathakАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Steven Paul

Загружено:

Sonu PathakАвторское право:

Доступные форматы

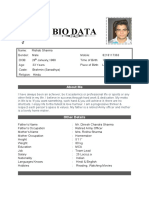

Steven Paul Steve Jobs (born February 24, 1955) is an American business magnate and inventor.

He is co-founder, chairman, and former chief executive officer of Apple Inc. Jobs also previously served as chief executive of Pixar Animation Studios; he became a member of the board of directors of The Walt Disney Company in 2006, following the acquisition of Pixar by Disney. Hes a composite leader in an extreme way, someone to be both greatly feared and greatly admired. Jobs dual personality that his rare blend of the charismatic and tyrannical has been the key to Apples success. The reason why Steve Jobs is hero to me and millions of others is that though many of his creations were original, expensive and stylish, they improved productivity and enhanced pleasure. Without the mouse this column would have taken longer to write and robbed me a little of the joy.

My Role Model Steve Jobs

Posted: August 27, 2011 in News

0

Steven Paul Steve Jobs (born February 24, 1955) is an American business magnate and inventor. He is co-founder, chairman, and former chief executive officer of Apple Inc. Jobs also previously served as chief executive of Pixar Animation Studios; he became a member of the board of directors of The Walt Disney Company in 2006, following the acquisition of Pixar by Disney. He was credited in the 1995 movie Toy Storyas an executive producer. In the late 1970s, Jobs, with Apple co-founder Steve Wozniak, Mike Markkula,and others, designed, developed, and marketed one of the first commercially successful lines of personal computers, the Apple II series. In the early 1980s, Jobs was among the first to see the commercial potential of the mousedriven graphical user interface which led to the creation of the Macintosh. After losing a power struggle with the board of directors in 1984, Jobs resigned from Apple and founded NeXT, a computer platform development company specializing in the higher education and business markets. Apples subsequent 1996 buyout of NeXT brought Jobs back to the company he co-founded, and he served as its CEO from 1997 until 2011. In 1986, he acquired the computer graphics division of Lucasfilm Ltd which was spun off as Pixar Animation Studios. He remained CEO and majority shareholder at 50.1% until its acquisition by The Walt Disney company in 2006. Consequently Jobs became Disneys largest individual shareholder at 7% and a member of Disneys Board of Directors.

Jobs history in business has contributed much to the symbolic image of the idiosyncratic, individualistic Silicon Valley entrepreneur, emphasizing the importance of design and understanding the crucial role aesthetics play in public appeal. His work driving forward the development of products that are both functional and elegant has earned him a devoted following.

The unputdownable!

Subrata Roy Sahara should come out winning on all fronts in the current face-off with SEBI! And why the erroneous Supreme Court judgment against Sahara goes beyond Parliamentary Acts and is being misused by SEBI to its own benefit! BY Arindam Chaudhuri ARINDAM CHAUDHURI, EDITOR-IN-CHIEF, THE SUNDAY INDIAN | Issue Dated: April 21, 2013, New Delhi Tags : Subrata Roy Sahara | SEBI | Sahar group | Supreme Court order | Allahabad Hogh Court | K M Abraham | OFCD |

There are a few things about Subrata Roy Sahara that even his harshest critics accept. That the man is a visionary his mammoth investments in media, housing, hotel, sports

and other industries being compelling evidence. That his open assertions of being a patriot have their weight in the various behemoth social initiatives undertaken by his group with no apologies to the slanted English media in India which, I feel, hypocritically slanders anyone who represents the other India (lest you should forget, it was this very media that shamelessly reported gossip a few years ago about him being critically ill and on his deathbed; no surprises then that the same English media chose to ignore reporting how sprightly he was while meeting UK Prime Minister David Cameron a few weeks back in a closed door meeting discussing educational and research initiatives). And yes, that the man religiously knows his numbers and has a financial acumen that is better than the combined intellect of all Indian regulators in the industries where he operates. There are a few things about India that even its damnedest supporters dont deny. That the License Raj era spewed out a few handfuls of family businesses that shamelessly chewed away the very idea of India, criminally sucking it hollow by monopolising industries, encouraged by corruption soaked politicians and encouraging them in return. That this venomous combination over the decades led to a jaundiced India that today has hundreds of millions of illiterate people below the poverty line; that has no global brands to speak of, but many billionaires borne out of the excesses of the License Raj era (I call most of them blood billionaires, given that theyve made the money on the blood of Indians). That the same group of blood billionaires, in cahoots with a similar group of corrupt bureaucrats (regulators included) and politicians, have fought and will fight tooth and nail, criminally and illegally, to ensure that there is no new honest and ethical claimant to their industry space, especially if such an entrepreneur were from the proletariat. That Subrata Roy Sahara titles himself as the Managing Worker of his group only adds to the ire of Indias caustic bourgeoisie, which, hand in hand with the English media, would be loath to have such an unabashed community representative of workers amongst their well oiled and greased group. So every time Subrata Roy Sahara and his likes attempt to tread the path of diligent and astute effort assuming the same equated to returns theyre pulled down acerbically and vindictively by the group representing the old, feudal India. You see, this group believes that only they know how India should be run and by whom. Look around and youll see many examples strewn across India of how honest upstarts have been trampled upon by the powers that be before they could gain ground wherever there has been anyone attempting to improve the condition of India, theyve had a horde of regulatory, tax, police and judicial bodies running up their door to initiate the so-called enquiries and search.

The current face-off that Subrata Roy Sahara has with SEBI actually exemplifies all this too well. A group that has issued OFCDs (Optionally Fully Convertible Debentures) since the year 2001 with all relevant government permissions, and which has regularly submitted all details as required by the concerned government authorities, suddenly gets a prohibitory order from SEBI in November 2010 against the OFCDs issued by two unlisted group companies (Sahara Housing Investment

Corporation Ltd. and Sahara India Real Estate Corporation Ltd.) and this despite the fact that just seven months before that, SEBI had, through its own communication to Ministry of Corporate Affairs, commented that as these were unlisted companies and had not filed a draft red herring prospectus with SEBI, any complaint with respect to these two companies should be handled by the Ministry of Corporate Affairs. What changed between April and November 2010 that led SEBI to issue such expansive orders without app ropriate investigation? Especially when, as per SEBIs own rules, they had and have no role to play in the case of unlisted companies that have no intention to list in the future. Was it that the Commonwealth Games scam and the telecom scam (both of which reached their zenith in midto-late-2010), was getting too hot to handle for the parties in power and they needed diversionary tactics? SEBI was undone by some scrupulous individuals within the system itself. In December 2010, the Department of Legal Affairs, Government of India, noted in its official report (FTS No.4140/LS/2010), The company in the given case being [an] unlisted company and not intending to get its securities listed...cannot be said to have gone in the fold of SEBI by merely becoming a group company of an unrelated separate company which has no intention to get its shares listed... Ministry of Corporate Affairs, in its written submission to the Allahabad High Court in 2010, mentioned, The issuance of OFCD [by] the petitioner company aft er the registration with the Registrar of Companies has been permissible under law. The Central Government remains the regulating authority for the company. The Additional Solicitor General of India, Mohan Parasaran, in his official opinion note dated February 8, 2011, confirmed with extreme clarity after documenting multiple pages of logic, For the reasons mentioned above and in my considered view, SEBI has no jurisdiction over unlisted companies like the Sahara Group of Companies, which are not intending to get themselves listed. Two days later, in an official noting, the Minister of Corporate Affairs, Veerappa Moily, noted, I agree with [the] Additional Solicitor General Mohan Parasaran. It should be noted that Parasaran is now the Solicitor General of India. A. M. Ahmadi, former Chief Justice of India, had given an opinion in 2010, The SEBI has no role (if an offer of specified securities, even if it exceeds 50, is made to a select class of people). C. Achutan, former Presiding Officer, Securities Appellate Tribunal (SAT), Mumbai, gave an opinion that the companys OFCD issue was not governed by SEBIs rules and regulations, but by the Central Government. Similar was the opinion of S. P. Kurdukar, former Judge, Supreme Court. SEBIs own submission in the oft quoted Kalpana Bhandari case (Mumbai High Court, 2003), mentioned that SEBIs jurisdiction...is restricted by the provisions of the SEBI Act...to listed public companies and companies intending to list. SEBI, in its official communique to the Ministry of Corporate Affairs in June 2010 with respect to a case dealing with a Reliance Industries complaint, says, SEBIs primary mandate is over listed companies. In the Kunnamkulam Paper Mills vs. SEBI case in Kerala High Court (2009), honourable judge C. K. Abdul Rehim mentions, ...In respect of matters relating to companies which are not coming within the description of Section 55A(a) and (b) [that is, companies that are not listed and have no intention to list], SEBI cannot usurp into the jurisdiction vested on the Central Government, on the basis of a contention that the offer for right issue of shares made by the 1st petitioner company can be deemed as a public issue. Given all this, in November 2010, the Allahabad High Court stayed this order. Although this stay was vacated a few months later, the Supreme Court which Sahara subsequently approached advised SEBI to ensure that Sahara is allowed a fair chance to defend their case to SEBI. True to its past, SEBI disregarded all the expert opinions from within the government itself and brought out an elongated order against the two Sahara companies in June 2011, demanding that they immediately pay back all the moneys collected through OFCDs, with due interest. Some economists I talked to called this a kangaroo forum order. The reasons, as per them, were not far to see.

Firstly, the so called order was passed by one man called K. M. Abraham and not technically by a board of SEBI members. Secondly, K. M. Abraham passed this order with only a month left for his own deputation ending. Thirdly, twenty days before releasing the order, on June 1, 2011, K. M. Abraham wrote a paranoid letter to the Prime Minister of India, complaining childishly, among other things, about being quite hurt by the fact that SEBI Chairman U. K. Sinha, after the Allahabad High Court gave the go-ahead signal to SEBI to act against Sahara, told him, See that your officers do not gloat over this. And when U. K. Sinha apparently told Abraham to be careful in the final order against the Sahara group and to see to it that nothing harsh be done, Abraham reached a conclusion that U. K. Sinha was being subjected to undue pressure by vested interests...operating through the office of the Honourable Finance Minister. This was a veiled accusation at Sahara. Clearly, Abraham had already made up his mind about giving a negative order on Sahara weeks before investigating the issue. This also exposed his grave conflict of interest and inability to maintain a neutral point of view while considering all facets of the case. But the best was yet to come. In its r esponse to Abrahams paranoid letter, the Ministry of Finance responded, The recent allegations by Abraham are defamatory, devoid of any truth and are a complete distortion of facts... Numerous complaints were received against Abraham from several sources... The complaints ranged from abuse of power to corruption and purchase of a flat at a concessional rate from an entity that had benefited from the sale of office space to National Stock Exchange, which is regulated by SEBI, and of which Abraham was a whole-time member...

U. K. Sinha, the SEBI Chairman, also responded that all of Abrahams allegations were false... a figment of imagination... unfounded... motivated. Abraham was frustrated as he was neither given extension as SEBI, wholetime member, nor given the post of Director, NISM, which he canvassed with the Chairman to the state of embarrassment... MCX SX has under oath alleged, amongst others, bias in the mind of Dr. Abraham; they have also complained against him to the CVC. Abraham told me he keeps a recording of his phone calls... I told him that such conduct is unethical... He also said he comes from a well known media family and will teach a lesson to everybody involved in harassing him. Abrahams behaviour is erratic and he seems to be under delusion of some threat percept. For the last one month or so, Dr. Abraham is under severe stress and tension. He appears to be suffering from an insecurity complex. He appears to be in a deeply disturbed state of mind, suffering from a persecution complex and delusions that everybody is out to harm him. Please necessarily note that all these statements alluding to Abraham being mentally unstable, facing corruption allegations, and more came out within 15-18 days of Abraham passing the Sahara order. Irrespective of which side you take, how can any sensible individual accept an order from such a member of SEBI who, by the Chairmans own admission, was under severe stress and strain...in a deeply disturbed state of mind? Should not all such orders passed by Abraham be summarily cancelled and revisited by the Supreme Court of India, especially as there is prima facie evidence of Abraham being mentally unbalanced? Will the respected Supreme Court accept such a member in their chambers passing orders, and that too as a single-bench, unless there has been a review of whether the member is mentally stable? Why hasnt the stupendously morally corrupt English media woken up to slamming such a member of SEBI passing extremely important orders with huge ramifications? After subsequent hearings in the Securities Appellate Tribunal, finally in August 2012 in the Supreme Court, the two Sahara firms unfortunately again received the short end of the judgement, where the judges asked Sahara to pay back the OFCD moneys with interest. Although I respect the Supreme Court considerably and should not want the judges to be slighted, the fact is that a few of the statements within the Sahara judgement seemed to have either clearly missed covering critical details or seem completely wrong. The respected judges mention, The SAT [which had ruled partly in favour of Sahara] was therefore, wholly unjustified in ignoring the conclusions drawn by the SEBI (FTM) [namely, K. Abraham]... That is so, specially because there are no allegations of bias, prejudice or malice against either the SEBI or the Investigating Authority. To that extent, the order passed by the SAT cannot be legally sustained... We, therefore, find, on facts as well as on law, no illegality in the proceedings initiated by SEBI as well as in the order passed by SEBI (WTM) dated 23.6.2011... In my opinion, these statements would have been faultless if the judges had given due consideration to the worrisome issues raised by the Ministry of Finance and the SEBI Chairman about the mental balance of the SEBI whole time member, namely Abraham, and rejected (or accepted) the issues raised. Clearly, allegations of bias are out in the open against Abraham, and these are no secret. Lest the Supreme Court forget, Abrahams letter t o the Prime Ministers office itself documents his own allegations of bias against SEBI Chairman U. K. Sinha in this very case. I must mention something glaring out here on September 27, 2012, the Supreme Court itself issued notices to SEBI, President Pranab Mukherjees advisor Omita Paul and to Government of India with respect to a petition that challenged the SEBI chiefs appointment on various counts, like ineligibility and suppression of facts. On March 29, 2013, the Supreme Court again sent a notice to the Government of India on another long standing PIL that challenged the changing of SEBIs rules allowing the finance minister to nominate two people on the selection board of SEBI for appointing the SEBI Chairman. But given the fact that the Supreme Court did not deliberate on these issues, and in fact commented that there were no allegations of bias against SEBI, there is a weighty argument for them to reconsider their judgement, or provide an addendum. In March 2011, the Supreme Court annulled th e Chief Vigilance Commissioner P. J. Thomass appointment to his post. The court observed, All the civil servants and other persons empanelled shall be outstanding civil servants or persons of impeccable integrity. Thomas was one of the accused in the Ke rala palmolein case. One of the judges who ruled against Thomas was K. S. Radhakrishnan interestingly, he is the same judge who also gave the judgement in the Sahara case. Why didnt he then subject SEBIs Abraham to the same level of scrutiny? As per the SEBI Act, the Central Government may remove any SEBI member who is of unsound mind and/or has committed an act that amounts to moral turpitude. Could that have been the reason that Abraham wasnt given any extension and was eased out of SEBI just around a month after giving the Sahara verdict? While I am not judging on this issue, I am sure it would have been morally and ethically appropriate for the Supreme Court to have at least picked the topic up of SEBIs whole time members alleged moral turpitude and mental state. Why did the Supreme Court not consider these facts and why did it in fact give statements that were quite contrary to reality?

Referring to the hard copy of investors details that Sahara had handed over to the court, one of the judges m entions in the order, It was not possible to persuade oneself to travel beyond the first page of the voluminous compilation. While that itself seemed an unexpectedly abrasive statement from a Supreme Court judge whom one would have expected to give tempered remarks, what followed subsequently in the order seemed completely without basis. According to the judge, one of the introducer/agents mentioned in the hard copy, a man named Haridwar, apparently couldnt have had that name. The judge writes, Haridwa r, as a name of a person of Indian origin, is quite uncomprehendable [sic]. In India, names of cities do not ever constitute the basis of individual names. One will never find Allahabad, Agra, Bangalore, Chennai or Tirupati as individual names. It took me all of five minutes to put paid to the Supreme Court judges contentions. For example, typing Haridwar on Google got me to Dr. Haridwar, much awarded erstwhile Director of DRDO, Ministry of Defence. (To added effect, some media organisation actually traced out the Sahara agent called Haridwar.). Honble Sh. Tirupati is apparently the Civil Judge (Senior Div.) and Additional Chief Judicial Magistrate in Rajasthan Judicial Service. The late Bharat Ratna awardee and famed Carnatic singer M. S. Subbulakshmi, was better known as Madurai S. Subbulakshmi. Dr. Sarvepalli Radhakrishnan, Indias second President, was named after Sarvepalli, his ancestral village in Andhra Pradesh. With due apologies if it seems Im showing contempt for the court, I have to say such aggressive and misplaced statements surely lead to a lowering of respect for the judgement in the eyes of the common viewer. Its not that a few wrong statements negate the whole judgement but the fact cant be denied that if the Supreme Court judges seem to not have shown due diligence in checking such simple facts, one would be quite perturbed at imagining the diligence they may have shown, or not shown, in checking complicated facts. And I have evidence for this too. For a definite example, while one of the judges giving the order on Sahara believed that the OFCD money collected by two Sahara firms was around Rs.27,000 crore (Saharas have no right to collect Rs.27,000 crore from three million investors, Justice K. S. Radhakrishnan), the other judg e believed that the amount collected was around Rs.40,000 crore (What the two companies chose to collect through their OFCDs was a contribution to the tune of Rs.40,000 crore, Justice Jagdish Singh Khehar). I cant talk for others, but for me, such a div ergent figure between two judges giving the same order is shocking. What is strange is that none of the judges referred even once in their final order to the OFCD outstanding liability figure reported by the two Sahara firms in their submission to the Supreme Court Rs.24,029.73 crore as on August 31, 2011. In summary, we have two respected Supreme Court judges, unsure about the amount collected through OFCDs, unsure how Indians are named, not in the know of the evident allegations of corruption and mental instability against the SEBI member who prepared the initial order against Sahara, but completely convinced that Sahara is in the wrong. Notwithstanding all this, the Supreme Court gave in its closing directions, Saharas (SIRECL & SHICL) would refund the amounts collected through RHPs dated 13.3.2008 and 16.10.2009 along with interest @15% per annum to SEBI from the date of receipt of the subscription amount till the date of repayment, within a period of three months from today, which shall be deposited in a Nationalized Bank bearing maximum rate of interest. Saharas are also directed to furnish the details with supporting documents to establish whether they had refunded any amount to the persons who had subscribed through RHPs dated 13.3.2008 and 16.10.2009 within a period of 10 (ten) days from the pronouncement of this order and it is for the SEBI (Whole Time Member) to examine the correctness of the details furnished. The three most critical points to be noted in the Supreme Court judgement are as follows:

1. Sahara was to hand over to SEBI the unrefunded amount with details about the investors. Sahara was also supposed to inform SEBI about the investors to whom it has already handed over the amount. 2. In the event of SEBI finding that the genuineness of the subscribers is doubtful, Supreme Court mentioned that Sahara was to get the opportunity to satisfactorily establish the same as being legitimate and valid. As per the court, It shall be open to the Saharas, in such an eventuality to associa te the concerned subscribers to establish their claims. The decision of SEBI (Whole Time Memeber) in this behalf will be final and binding on Saharas as well as the subscribers. The emphasis being that it was open to Sahara to associate the concerned subs criber to the refund claim. 3. If Sahara did not refund the money, SEBI could take recourse to legal remedies, including attachment and sale of properties, freezing of bank accounts etc. for realizations of the amounts. The same was repeated by Supreme Court

in

rehearing

of

the

case

in

December

2012.

The Supreme Court judgement is structurally faulty and deeply erroneous due to the following five reasons: 1. The Supreme Courts final directions in its August 2012 judgement do not contain the exact am ount to be refunded to investors. The full judgement too, as mentioned earlier, contains amounts divergent by thousands of crore mentioned by each judge (the Rs.27,000 crore claimed by one judge versus the Rs.40,000 crore mentioned by the other). This could well be because none of the Supreme Court judges got around to having a diligent idea on the exact amount. In the rehearing of the case in December 2012 in the Supreme Court, Chief Justice of India Altamas Kabir, Justice Surinder Singh Nijjar, Justice J. Chelameswar came up with a startling new figure of Rs.22,520 crore as being the amount to be refunded, apart from the interest. SEBI, in a new February 2013 order based on the Supreme Court judgements, claims the amount to be refunded is Rs.25,780 crore plus interest. This leaves me wondering: is this a kangaroo court series redux where we are slapped with any figure that the SEBI investigating officer conjures up? 2. The Supreme Courts August 2012 judgement wrongly gives powers to SEBI much beyond the S EBI Act, and that itself makes the Supreme Court judgement open to being reviewed/modified by the Court itself or open to being struck down by a Parliamentary Committee. The Supreme Court has directed SEBI to attach all and any bank accounts related to the two companies in case the two Sahara firms fail to comply with the orders. But as per the SEBI Act, SEBI can attach only those bank accounts or any transaction entered therein, so far as it relates to the proceeds actually involved in violation of any of the provisions of this Act, or the rules or the regulations made there under...; also, the bank accounts can be attached for only a month. In other words, only the bank accounts which were related to the actual proceeds can be attached under the SEBI Act. You can imagine how any sane reader would be surprised at Supreme Courts clear move beyond the SEBI Act (and Im referring to the SEBI Act, amended as recent as in January 2013). But wasnt the Supreme Courts mandate simply to interpret laws? Or was it to make new ones? Unfortunately, with the shockingly wide leeway that SEBI has got due to the Supreme Court judgement, it has now proceeded to attach each and every bank account of not just the two Sahara companies, but also of Subrata Roy Sahara and a few other persons, claiming they represent the company. Might I mention here that in case SEBIs objective was to simply follow the Supreme Court judgement to the tee, then there was no mention of action against Subrata Roy Sahara or any other individual. And in case SEBI believes that they can haphazardly and illegally combine the SEBI Act and the Supreme Court judgement to their convenience (choosing only those statements that they like), even then attaching Subrata Roy Sahara's and other individuals bank accounts falls beyond the SEBI Act, as these accounts any which way were not related to the proceeds. The Parliament has deliberately kept away these powers from SEBI and individual whole time members. What SEBI is currently doing seems completely illegal and worth open admonishment. 3. I repeat, it is most worrying that the Supreme Court seems to now be replicating the role of the Parliament of India. It has most erroneously given powers through the final orders to SEBI to attach and sell properties of the Sahara group. The Securities and Exchange Board of India Act, 1992 has specifically restricted SEBI from attaching properties as the same has been deliberately not mentioned in the SEBI Act. The Supreme Court order has resulted in SEBI moving ahead and attaching not just the movable and immovable properties of the two companies involved (which itself is illegal vide the SEBI Act, and which Supreme Court wrongly ignores), but also of other group companies (and this anyway wasnt mentioned even in th e Supreme Court judgement). Like I said, SEBI seems to be combining whichever statement they feel is good for them. 4. The Supreme Court also has erroneously given powers to SEBI to recover the amount through the above said attachment of properties and bank accounts. The SEBI Act gives powers to SEBI to freeze specific bank accounts, but not for recovering any money, only for freezing transactions. The SEBI Act does not give any power to SEBI to appropriate any money in the frozen bank account to settle them against dues. Then how is the Supreme Court authorizing SEBI to undertake actions beyond its mandate? 5. The Supreme Court wrongly titles the original OFCD drive by the two Sahara companies as illegal. How can anything be titled illegal with a retrospective effect when every past year the Ministry of Corporate Affairs has considered the OFCD issuance totally legal? The Additional Solicitor General of India Ashok Nigam noted in the Allahabad High Court, The issuance of OFCD [by] the petitioner com pany after their registration with the Registrar of Companies has been permissible under law. How can we simply dismiss these certifications? And why are we forgetting the Additional Solicitor General and Department of Legal Affairs, with a special noting from the Union Minister of Corporate Affairs, who all have reviewed the Sahara issue and have passed the same to their full satisfaction? There is no way that this can be termed illegal with retrospective effect based on a rule that is being made now, as Sahara has always obtained legal permission from the Registrar of Companies and other relevant

authorities, after submitting each and every document required. The maximum the Supreme Court could have mentioned is that the OFCDs be discontinued from the said date of the judgement, but to title them as illegal with retrospective effect is disregarding the legal certifications of a Union Ministry and the Registrar of Companies. The Court mentions in its judgement, Ministry of Corporate Affairs, it is well k nown, does not have the machinery to deal with such a large public issue of securities, its powers are limited to deal with unlisted companies with limited number of share holders or debenture holders and the legislature, in its wisdom, has conferred power s on SEBI. I have no idea how this view was well known. The then Additional Solicitor General of India, Mohan Parasaran, had mentioned in his official note in 2011, The Ministry of Corporate Affairs is as powerful as the SEBI and cannot be regarded as a toothless or powerless organization. If the Court believes that the Ministry is of no use in handling large issues from unlisted companies, then rather than give unconstitutional rights to SEBI, the Court should approach the Parliament to spruce up the so-called machinery at the Ministry. But making an off-hand statement about the Ministrys well-known lack of machinery, is, in my opinion, not welcome. Then why did the Registrar of Companies exist in the first place, if they apparently had "no machinery? SEBIs mindless drive to attach accounts and properties of other group companies of Sahara and of shareholders goes not just beyond the SEBI Act, but beyond the very basis of capitalism and the distinction between group entities and between shareholders, that the Indian Companies Act clearly defines. All industrialists and experts I talked to were stunned at SEBIs attempt to do this. A company, whether private or public, has to be necessarily considered an entity distinct from other companies belonging to the same group. One cannot extend the punishments being meted out on any indicted company to its group entities or its shareholders unless it is clearly proved beyond doubt that these group entities or shareholders were also involved in the same issues on which the company is being acted against. The Sahara Group has been forced to approach the High Court in Lucknow in March 2013 to immediately stop SEBIs ridiculous approach. As a basic tenet of capitalist business, no sensible investor would ever invest in an Indian company in case SEBI and the Indian courts start transgressing the clear line that demarcates a companys incorporation giving it a definitely independent legal status as compared to its group companies and its shareholders. This demarcation of legal culpability is the very reason one could not attach the properties of the promoters when ABCL collapsed. That is the very reason one could not attach assets of Vijay Mallya or of United Breweries when Kingfisher collapsed. Our respected finance minister spoke last month that we cannot have rich promoters and sick companies, and that banks therefore should start acting against promoters in such cases. I wish to mention to him, Sir, every public sector company has the President of India as its titular head and the Parliamentarians as their top promoters. You yourself are the finance minister, in other words the head of Indias finances when India is technically a dramatically loss making entity with unmanageable deficits. How comfortable would you be if your banks extended this rule to your own bank accounts and personal assets? What if I recommend that the Rashtrapati Bhawan be attached for the losses that the remarkable Air India has made in the previous years? Please Sir, respect the basic premise on which capitalism rests and on which thousands of companies and millions of investors depend. Group companies are different entities. Shareholders are limited by the extent of their shareholding in their risk exposure to the company in concern. Lets not cross that line in clarion calls for socialist -nationalism; something which leaders in African nations like Zimbabwe are better known to do, not out here. In summary, I repeatedly see a clear case of the Supreme Court going beyond a Parliamentary Act and an attempt by the court to give unrestrained powers to a single individual (like a SEBI Whole Time Member) this was never the intention of the SEBI Act. If the Supreme Court so wishes to increase the powers of SEBI, it should approach the Parliament to pass an Act or amend the SEBI Act, rather than attempt to replicate the Parliaments role. The Supreme Court order is structurally faulty and should be reviewed immediately by the court itself or should be struck down by a Parliamentary consensus because the court is attempting to give powers to SEBI to freeze properties and to recover monies specifically not mentioned in the SEBI Act. If the Supreme Court is trying to take over the powers of the Parliament of India in passing amendments to SEBI Acts, then I have to say, this kind of democracy is not what I bought into. There seems to be a one-minded objective to bring Saharas operations to a stop, and this kind of daylight lynch -mobbing is what the Supreme Court should have been originally stopping. As per Sahara, in its communication post the Supreme Court order, the total collection of the Sahara companies through the OFCD issue was Rs.25,781.32 crore. Out of this, even before any direction, Sahara had already repaid Rs.22,117.39 crore to the respective investors. Thus, Sahara was supposed to repay to SEBI the balance of Rs.3,663.93 crore remaining on the date of the order, along with 15% annualised interest, an additional Rs.1,370.53

crore. This comes to close to Rs.5,033.93 crore. Sahara did better they paid up to SEBI an amount of Rs.5,120 crore.

So what would one have expected the slanted SEBI to do post this? You guessed it right. From refusing to accept documents from Sahara (Sahara apparently got delayed by a handful of hours in su bmitting the million plus documents, leading to SEBIs churlish stand), to claiming there are less than hundred true investors in Saharas OFCD, SEBI is trying every rule not in the book to kill the mocking bird. As per SEBI, only 68 people responded to SEBIs mailers to investors; I ask, is that final evidence that therefore all others must be fake? Is this a logical method to reach the figure of real investors? Are people expected to reply to English language mailers from SEBI within a few days? And that too, through Indian post? And in this case, when a majority of Saharas OFCDs investors are in the rural belt? Frankly, if I were to write letters to all Supreme Court judges, asking them to reply to me personally within a handful of weeks to provide evidence that they exist, I might reach a conclusion that no Supreme Court judge exists. Sahara has given an extremely logical solution to all this. Theyve requested SEBI to repeatedly advertise on national media (at Saharas costs) and have undertaken that theyll repay all the investors who might believe theyve been left out and may approach SEBI post the advertisements. Sahara is also providing government certified auditors reports for all its actions deposits refund, investors identification etcetera. SEBI could even do what RBI did a few years back with Sahara. After initially ordering Sahara to stop collecting deposits, RBI reversed its stand and allowed Sahara to accept deposits provided Sahara included independent directors to oversee the board and adhered to a few procedures. Recently, a group of investors even approached SEBI requesting that SEBI treat investors repayments on a first come first serve basis. SEBI clearly has objectives other than investors benefit in mind and has not responded positively to any of these. To add to it, the Supreme Court, disregarding Saharas contention that it had already paid back to a majority of investors and had deposited more than the remaining amount with SEBI, directed Sahara to deposit the original amount again with SEBI. How can Sahara be asked, for the lack of a better analogy, to give away the cake and give it away again? Were talking about thousands of crore; and were talking about unlisted companies. In a seminar on April 3, 2013, SEBI Chairman U. K. Sinha commented sarcastically, There is a famous case. I need not name it, but there is this particular company that claims to have returned more than Rs.20,000 crore to their socalled investors and more than 90% of this refund has been made in cash in the last 3-4 months... I want you to ponder over it and think how feasible, how credible this story can be. This is what I call a kangaroo court. Ask a person to jump off a cliff, knowing very well that he wont survive. And when the person jumps off t he cliff and somehow survives, ask him to jump off again, claiming nobody could have survived such a jump.

So you dont believe Sahara jumped off the cliff Mr. Sinha; what exactly are you attempting to do? Isnt returning the money in three months exactly what you wanted this company to do? Did not the Supreme Court also tell Sahara the same time duration? Or are you saying that you originally knew that it was impossible for any company to return this much money in this less a time, yet went ahead earlier to claim that they should return the money in a lesser amount of time? Why are you afraid to bring out advertisements asking troubled investors to approach SEBI directly for refunds? Are you worried that not more than 68 investors would turn up asking for a refund, putting paid to all your grand plans to control all unlisted companies? Your more recent statements demanding that there should be a single regulator aka SEBI regulating all financial transactions in the country, have not been missed. Allow me to mention, they seem quite similar to the statements of one famous German leader, whom I need not name, who existed in the middle of the previous century. Please dont get me wrong Mr. Sinha, dont kill capitalism in this country, dont kill risk taking entrepreneurs in this country, dont disregard rules laid down by the Indian Companies Act, and please dont try to control unlisted companies. And now, media reports mention that SEBI is appealing to the Supreme Court to give powers to SEBI to ar rest and detain Subrata Roy Sahara in a civil prison. What in heavens is going on out here? Since when have SEBIs whole time members become individuals who can arrest and detain others and completely beyond the powers specified in Parliamentary Acts. My fear is that given the Supreme Courts recent past in disregarding the limitations of powers of SEBI given in its act, it might even approve the above request. Or it might not, if it adjudges diligently. I repeat, all this seems purely like a lynch-mob to me, without significant sense leading to desperate advertisements from Sahara beseeching Enough is enough and calling the SEBI Chairman to an open media debate. In conclusion, all I can say is that the current case against Sahara seems to be completely against the laws of natural justice, Parliamentary Acts and Supreme Court mandates. If sense has to prevail, either the Supreme Court or/and the Parliament should immediately review their stand and take sensible steps in repayment to investors rather than give lynch-mobbing powers to SEBI beyond their legal act. That is what would raise respect for the judiciary and even SEBI. And the more SEBI tries to control unlisted companies that have no intention to list in the future, the more the farce of it all will be out in the open.

It is unfortunate that the English media in India has still not woken up to this travesty being engineered against Sahara. Castigate Sahara and Subrata Roy Sahara for all you want, but legally and sensibly. For the sake of the English media, let me mention a few descriptions provided by foreign media. Tony Munroe of Reuters reported this year that among many poorer residents of Uttar Pradesh, Indias most populous state, Sahara has substance... Sahara customers interviewed in Uttar Pradesh said they trusted the company, which has been around more than 30 years. BBC reported how Subrata Roy Sahara is referred to as Indias Howard Hughes. Alex Perry wrote in the TIME Magazine, Giving to the poor doesnt only mean giving money. S ubrata Roy...exemplifies how wealth can benefit more than just the wealthy... Roy also employs 700,000 people. In a little more than a quarter-century, he has become Indias second largest employer after the railways. Eric Bellman reports in the Wall Street Journal, In the past 30 years, Mr. Roy has built a $10 billion empire spanning finance to real estate to media, powered by the savings of mostly poor and rural savers. Similar are the reviews by The New York Times. I wonder then why is the English media being so uncharitable to Subrata Roy Sahara? A few weeks back, I had written an editorial titled, The Modi and secular media tussle is a fight between Bharat supported by the common man and India supported by the Nehruvian Network! (http://www.thesundayindian.com/en/story/the-modi-and-secular-media-tussle-is-a-fight-between-bharat-supportedby-the-common-man-and-india-supported-by-the-nehruvian-network/45324/) In it, discussing the bias of our English media against Narendra Modi, I had mentioned, The fact is: it is a fight between India and Bharat. Narendra Modi for me represents Bharat while the English media represents India. Why am I saying it? The simple reason is that I am convinced that the English media is now a voice of the old feudal India where just a few people claim to know what is best for both India and Indians. On the other hand, Modi represents the other India Bharat, if you will which is deeply frustrated by the monopoly that the English media and its secular warriors exercise over information and messaging. I suspect that in the case of Subrata Roy Sahara, it is a similar line of thought driving the English media. While Subrata Roy Sahara represents the other India I call Bharat, the English media just cant handle the trust this other India holds in him and his Sahara group of companies.

I have met Subrata Roy Sahara in the past, spent much time interviewing him and critically analysing and scrutinising his financials I can personally say that he is no criminal. I have found him committed to uplifting Indias masses, legally! His commitment to rural India, to sports, to banking, to media, to housing, is for all to see. Yes, when he started working in 1978 armed purely with a mechanical engineering diploma and a two wheeler (a Lambretta), one could not have forethought his business gumption. But capitalism does work for some; and if one is jealous that he is ultra-rich and his group has acquired riches too much, too soon, then lynch-mobbing is not the appropriate way to respond. Capitalism was never about pulling down growing corporations by hanging them in public. And if that is what it has become in India, then we have to change it, rationally and immediately.

Вам также может понравиться

- How To Calculate The Lux Level in A RoomДокумент21 страницаHow To Calculate The Lux Level in A RoomSonu Pathak100% (1)

- Print - Udyam Registration Certificate PAGE 1Документ1 страницаPrint - Udyam Registration Certificate PAGE 1Sonu PathakОценок пока нет

- Form GST REG-06: Government of IndiaДокумент3 страницыForm GST REG-06: Government of IndiaSonu PathakОценок пока нет

- Torrent Downloaded From Demonoid - WWW - Demonoid.pwДокумент1 страницаTorrent Downloaded From Demonoid - WWW - Demonoid.pwSonu PathakОценок пока нет

- Municipal Administration and Water Supply Department Maraimalai Nagar Municipality Contract No. /2020 Notice InvitingДокумент74 страницыMunicipal Administration and Water Supply Department Maraimalai Nagar Municipality Contract No. /2020 Notice InvitingSonu PathakОценок пока нет

- Handbook On Solar Light System PDFДокумент62 страницыHandbook On Solar Light System PDFrajeevgopanОценок пока нет

- Print - Udyam Registration CertificateДокумент4 страницыPrint - Udyam Registration CertificateSonu PathakОценок пока нет

- Price List 24.08.2020Документ4 страницыPrice List 24.08.2020Sonu PathakОценок пока нет

- Scott B. Stock Market Investing For Beginner... (4 Books in 1) 2021Документ345 страницScott B. Stock Market Investing For Beginner... (4 Books in 1) 2021Sonu Pathak100% (1)

- Analysis of Market Characteristi Cs and Promoti On Strategy of Rooftop PVДокумент103 страницыAnalysis of Market Characteristi Cs and Promoti On Strategy of Rooftop PVSonu PathakОценок пока нет

- For Assistance Dial 1912 5616195: For Bill SMS BILL Pay Your Bill OnДокумент1 страницаFor Assistance Dial 1912 5616195: For Bill SMS BILL Pay Your Bill OnKapil KumarОценок пока нет

- Greensphere Autonomy 24 Hrs Integrated Solar Street LightДокумент18 страницGreensphere Autonomy 24 Hrs Integrated Solar Street LightSonu PathakОценок пока нет

- District List - NagesДокумент80 страницDistrict List - NagesSonu PathakОценок пока нет

- 12w Solar Street Light SystemДокумент8 страниц12w Solar Street Light SystemSonu PathakОценок пока нет

- Manufactured & Marketed By: DPL Lightings: A-8, Sector-66, Noida (U.P.) 201301 Contact: +91-9355736489, +91-9990584408Документ1 страницаManufactured & Marketed By: DPL Lightings: A-8, Sector-66, Noida (U.P.) 201301 Contact: +91-9355736489, +91-9990584408Sonu PathakОценок пока нет

- 4 Feet Profile The Indian ExpressДокумент3 страницы4 Feet Profile The Indian ExpressSonu PathakОценок пока нет

- Clean Solar Energy: The Impact of Nanoscale Science On Solar Energy ProductionДокумент24 страницыClean Solar Energy: The Impact of Nanoscale Science On Solar Energy ProductionSonu PathakОценок пока нет

- Aster Vibe Street LightДокумент2 страницыAster Vibe Street LightSonu PathakОценок пока нет

- The Illumination Pundit... : WWW - Spanco.bizДокумент4 страницыThe Illumination Pundit... : WWW - Spanco.bizSonu PathakОценок пока нет

- Eputy Anager Arketing Ales: - Maintain Their Brand Entity at All TimesДокумент2 страницыEputy Anager Arketing Ales: - Maintain Their Brand Entity at All TimesSonu PathakОценок пока нет

- 1629357267616resume NageshДокумент2 страницы1629357267616resume NageshSonu PathakОценок пока нет

- Rishab Sharma's Bio DataДокумент2 страницыRishab Sharma's Bio DataSonu PathakОценок пока нет

- Appointment LT 183Документ8 страницAppointment LT 183rajeshmsitОценок пока нет

- Candlestick Patterns Every Trader Should KnowДокумент65 страницCandlestick Patterns Every Trader Should KnowDxtr V Drn100% (1)

- PARTHA ROY Fuzzy Candlestick ApproachДокумент11 страницPARTHA ROY Fuzzy Candlestick ApproachVitor DuarteОценок пока нет

- F3ltd-Payroll With Payslip FormatДокумент6 страницF3ltd-Payroll With Payslip FormatSonu PathakОценок пока нет

- LetterДокумент9 страницLetterSonu PathakОценок пока нет

- Salary Slip NarenderДокумент77 страницSalary Slip NarenderSonu PathakОценок пока нет

- ABC Engineers Head Salary DetailsДокумент2 страницыABC Engineers Head Salary DetailsrajeshmsitОценок пока нет

- Pur Top 600: Top 600 Pu Rto p6 00Документ4 страницыPur Top 600: Top 600 Pu Rto p6 00Sonu PathakОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- NL Back Pressure Valve Brochure 032613Документ9 страницNL Back Pressure Valve Brochure 032613EquilibarОценок пока нет

- Chapter 76 - Engine Controls: BHT-206L4-MM-9Документ22 страницыChapter 76 - Engine Controls: BHT-206L4-MM-9Raisa RabeyaОценок пока нет

- Geology 554 - Interpretation Project Big Injun Sand, Trenton/Black River Plays, Central Appalachian Basin, WV Lab Exercise-Part 3Документ17 страницGeology 554 - Interpretation Project Big Injun Sand, Trenton/Black River Plays, Central Appalachian Basin, WV Lab Exercise-Part 3Abbas AbduОценок пока нет

- IPS-ENERGY - Available Relay ModelsДокумент597 страницIPS-ENERGY - Available Relay Modelsbrahim100% (2)

- Cambridge English For The Media Intermediate Students Book With Audio CD Frontmatter PDFДокумент5 страницCambridge English For The Media Intermediate Students Book With Audio CD Frontmatter PDFBrenda Funes67% (3)

- Physics Project On Dual Axis Solar TrackerДокумент10 страницPhysics Project On Dual Axis Solar TrackerDanish AhamedОценок пока нет

- Social Engineering and IslamДокумент8 страницSocial Engineering and Islamaman_siddiqiОценок пока нет

- Importance of TransportationДокумент24 страницыImportance of TransportationGiven Dave LayosОценок пока нет

- To Compare The Efficacy, Safety and Cost - Effectiveness of Two Different Antisnake Venom Formulations (Antisnake Venom Powder and Antisnake Venom Liquid) at DHQ Hospital BadinДокумент5 страницTo Compare The Efficacy, Safety and Cost - Effectiveness of Two Different Antisnake Venom Formulations (Antisnake Venom Powder and Antisnake Venom Liquid) at DHQ Hospital BadinInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Economic SystemДокумент7 страницEconomic Systemrisma ramadhanОценок пока нет

- Accounting For Corporations IДокумент13 страницAccounting For Corporations Iibrahim mohamedОценок пока нет

- 083E Relative Humidity Sensor Accurate and ReliableДокумент2 страницы083E Relative Humidity Sensor Accurate and Reliablehuguer1Оценок пока нет

- Cybercrime Prevention Act of 2012Документ1 страницаCybercrime Prevention Act of 2012Jerwin LadioОценок пока нет

- Business Strategy and CSR 1Документ19 страницBusiness Strategy and CSR 1Vania WimayoОценок пока нет

- Commercial Dispatch Eedition 7-10-19Документ16 страницCommercial Dispatch Eedition 7-10-19The DispatchОценок пока нет

- HG50 MCCB EngДокумент1 страницаHG50 MCCB EngMiroslaw LabudaОценок пока нет

- JHA ConcretingДокумент3 страницыJHA Concretingfatimah beluhi75% (4)

- Status of ISO 9000 Family of StandardsДокумент4 страницыStatus of ISO 9000 Family of StandardsRajan SteeveОценок пока нет

- Procedural Due Process - Refers To The Mode of Procedure Which GovernmentДокумент13 страницProcedural Due Process - Refers To The Mode of Procedure Which GovernmentCharlene M. GalenzogaОценок пока нет

- R Markdown: Cheat SheetДокумент2 страницыR Markdown: Cheat SheetzibunansОценок пока нет

- Summary of Sales Report: Dranix Distributor IncДокумент6 страницSummary of Sales Report: Dranix Distributor Incshipmonk7Оценок пока нет

- Regulating Admin AccountsДокумент5 страницRegulating Admin Accountsami pritОценок пока нет

- Simultaneous Translation Booth SystemsДокумент13 страницSimultaneous Translation Booth SystemsJuan Ignacio Estay CarvajalОценок пока нет

- Romac Flanged Couplings for Water and Sewer PipesДокумент3 страницыRomac Flanged Couplings for Water and Sewer PipesAl JameelОценок пока нет

- Strategic Management Session XVIIДокумент29 страницStrategic Management Session XVIIharisankar sureshОценок пока нет

- Financial Statement Analysis of HUL and Dabur India LtdДокумент12 страницFinancial Statement Analysis of HUL and Dabur India LtdEdwin D'SouzaОценок пока нет

- List of ports used by trojansДокумент9 страницList of ports used by trojansJavier CabralОценок пока нет

- Contract of SaleДокумент3 страницыContract of SaleLeila CruzОценок пока нет

- ITR62 Form 15 CAДокумент5 страницITR62 Form 15 CAMohit47Оценок пока нет

- Kuwait University Dept. of Chemical Engineering Spring 2017/2018Документ8 страницKuwait University Dept. of Chemical Engineering Spring 2017/2018material manОценок пока нет