Академический Документы

Профессиональный Документы

Культура Документы

Solving Sarbanes Oxley Document

Загружено:

opkaramОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Solving Sarbanes Oxley Document

Загружено:

opkaramАвторское право:

Доступные форматы

Business Intelligence

A Business Intelligence Perspective

Solving Sarbanes Oxley:

SETLabs Technology Analysis and Product Evaluation Group Infosys Technologies Limited Bangalore, India

SETLabs

Solving Sarbanes-Oxley: A Business Intelligence Perspective

Acknowledgements

The author would like to acknowledge the contribution of Sreekumar S in the preparation of this document.

Disclaimer

SETLabs 2003, Infosys Technologies Limited. Infosys acknowledges the proprietary rights of the trademarks and product names of other companies mentioned in this document. The information provided in this document is intended for the sole use of the recipient and for educational purposes only. Infosys makes no express or implied warranties relating to the information contained in this document or to any derived results obtained by the recipient from the use of the information in this document. Infosys further does not guarantee the sequence, timeliness, accuracy or completeness of the information and will not be liable in any way to the recipient for any delays, inaccuracies, errors in, or omissions of, any of the information or in the transmission thereof, or for any damages arising there from. Opinions and forecasts constitute our judgment at the time of release and are subject to change without notice. This document does not contain information provided to us in confidence by our clients.

For More Information

Please contact Anoop Nambiar anoop_nambiar@infosys.com or visit http://www.infosys.com for more details.

October 2003

Page 2 of 5

SETLabs

Solving Sarbanes-Oxley: A Business Intelligence Perspective

Solving Sarbanes-Oxley: A Business Intelligence Perspective

By Anoop Nambiar Software Engineering and Technology Labs Infosys Technologies Ltd. http://www.infosys.com

In the wake of accounting irregularities and financial scandals that rocked corporate America, the Sarbanes-Oxley Act was introduced in 2002. The scandals that drove corporations into bankruptcies and wiped out life-savings of thousands of employees have eroded the faith of the public in the financial market. The Sarbanes-Oxley is aimed at restoring this faith and introducing more transparency and accountability into the financial management process. The chief officers are now personally responsible for certifying the financial numbers as well as under pressure to do so under tighter deadlines. During the past decade, Business Intelligence (BI) has been widely adopted by smart companies for a consolidated view of enterprise data. It builds a single version of the truth by integrating data from disparate systems to a common repository. BI enables organizations to capitalize on new opportunities, improve operational efficiencies and provide superior customer service. With the advent of active warehouses these systems also provide real-time visibility into the data. BI has already proved to be a powerful tool for analyzing information critical to corporate strategy. Financial managers are turning to technology solutions to comply with the new Sarbanes-Oxley regulations. There is a need to deliver corporate results more quickly than ever and with the highest level of accuracy. Organizations that have already taken a strategic approach to financial reporting and analysis will find that with modifications to key processes, current systems can take care of most of the stringent regulations. BI can provide the framework for implementing the controls and processes to easily and efficiently manage and report on financial data. While provisions such as Insider Accountability and Corporate Governance have a profound effect on how corporations fundamentally behave and operate, technology has a major impact on other provisions. Specifically: Section 302 requires management certification that financial statements reflect accurately in all material respects the companys financial condition and that disclosure controls and procedures are in place. Section 404 requires management certification that financial report preparation processes have effective internal controls and procedures. Section 409 requires companies to provide timely reports to investors, the SEC, and other involved parties on material changes in financial conditions and operations.

Executive Summary

Sarbanes-Oxley Regulations

Organizations must now take a greater responsibility for the accuracy of the financial statements and ensure that the controls, processes and systems are in place for financial reporting. Forward-looking organizations have realized the importance of having a BI framework in place for a complete view of enterprise data. BI systems turn data into actionable information. At the center of a BI solution is a data warehouse that standardizes and integrates data from multiple systems. BI tools ensure timely dissemination of data for reporting and analysis across the enterprise. In addition, the tools that consolidate, manage and distribute data also maintain an audit trail of the data where it came from, what happened to it, and who receives it.

Business Intelligence Systems

October 2003

Page 3 of 5

SETLabs

Solving Sarbanes-Oxley: A Business Intelligence Perspective

A Compliance Framework Using BI

- Consolidated view - Real-time visibility

Dashboard of Financial Metrics

- Alerts on variances

- Standardize reports across enterprise - Collaborative environment - Role based access

Query and Reporting Tools

- Detailed analysis - Drill down to transactions

Metadata Management

- Definition - Controls - Reports

- Consolidate multiple data sources - Workflow - Data integration - Data quality

Enterprise Data Warehouse

General Ledger

Accounts Payable

Billing

Other Transactional Data

Source: Infosys Research

With each department having its own reporting solution, it becomes difficult to reconcile numbers or agree upon standard definitions for even simple terms. Organizations typically have 20-30 sources of data that range from Excel to Mainframes to pull information from. An enterprise data warehouse integrates information from various systems to a single repository applying common rules in the process. The ability to consolidate all financial and related data for a single version of the truth - is fundamental to reporting accuracy. An enterprise data warehouse provides a consistent view of data for all users across the enterprise. End users do not have to worry about merging multiple formats from a variety of sources. While it is critical to ensure data accuracy, doing so in a timely manner is also important. ETL tools ensure that the data warehouse is updated with current data. BI tools enable the users to rapidly analyze the transactional data stored in the warehouse and to identify any trends that may lead to a material event. The enterprise warehouse lays the foundation for complying with sections 302, 404 and 409 of the Sarbanes-Oxley Act by consolidating financial information in a single place, thus ensuring data integrity. Departments do not operate in silos anymore; changes in a single department can be communicated to the rest of the organization resulting in increased transparency. The entire organization benefits by having a single reporting environment across the enterprise. To sign-off on the numbers, the financial management team must have faith in the numbers and the process used to arrive at those numbers. Sections 302 and 404 require that management take responsibility for the accuracy of the financial statements. An effective data management process can ensure data control, quality, traceability and auditability. ETL tools play a major role in implementing an enterprise wide data integration strategy. The tools can answer how the data was collected, what changes were applied to the data and by whom. Metadata data about data plays a major role in making this happen. Metadata allows you to see the lineage of the content.

Single Version of the Truth

Checks and Balances

October 2003

Page 4 of 5

SETLabs

Solving Sarbanes-Oxley: A Business Intelligence Perspective

BI tools store metadata on reports and report catalogs. This together with ETL metadata gives a complete history of enterprise data. End-users can easily understand the data and trace its origins. Reports can be generated from the metadata and gives management the confidence to attest the numbers. To monitor and effectively manage corporate performance, real-time visibility to data is needed. Business users are increasingly relying on the data warehouse for up-to-date information to make operational decisions on an ongoing basis. The new generation of ETL tools are capable of loading data to the warehouse in real-time. BI tools also provide real-time reporting capabilities. BI tools serve as a single point of access to secure data. Roles can be set up and individuals can view data based on their roles. The tools also allow the creation of dashboards to define and actively monitor financial control metrics in real-time. Rules can be set up to automatically detect variances and to alert when thresholds are crossed. If required, the user can drill into detail data in the warehouse for further analysis. The real-time features of BI tools help in complying with section 409 by providing real-time monitoring and alerting of variances. This enables rapid disclosure to shareholders of any material events. Availability of integrated data in a collaborative environment along with real-time visibility ensures certification of financial results under tighter deadlines. With CFOs now personally accountable for the accuracy of financial statements, the market is flooded with companies that offer overnight Sarbanes-Oxley solutions. Rather than reacting to the Act with quick-fix solutions, progressive organizations are taking a more strategic approach. They are realizing that IT can play a vital role in measuring and managing corporate performance. Organizations that already have an enterprise reporting strategy in place are finding that a majority of the regulations can be met with existing BI tools and systems. From integrating and storing financial data to providing real-time visibility to information in a collaborative environment, BI solutions provide the overall framework to ensure regulatory compliance. Companies that want to have a greater visibility and control over financial performance will benefit from having an enterprise strategy for BI. If your company doesnt already have one, SarbanesOxley may be the perfect reason to lay that foundation.

About the author: Anoop Nambiar is a Data Warehousing Architect with Infosys and is associated with the Software Engineering and Technology Labs. He has several years of experience in business intelligence and has successfully implemented large data warehouses. He may be reached at anoop_nambiar@infosys.com.

Real-Time Visibility

Conclusion

October 2003

Page 5 of 5

Вам также может понравиться

- Auditing Information Systems: Enhancing Performance of the EnterpriseОт EverandAuditing Information Systems: Enhancing Performance of the EnterpriseОценок пока нет

- Solidcore SOX White PaperДокумент10 страницSolidcore SOX White PaperillreallynevercheckОценок пока нет

- Full Download Core Concepts of Accounting Information Systems 14th Edition Simkin Solutions ManualДокумент36 страницFull Download Core Concepts of Accounting Information Systems 14th Edition Simkin Solutions Manualhhagyalexik100% (31)

- Choosing The Right BIДокумент7 страницChoosing The Right BISathish VenkataramanОценок пока нет

- Core Concepts of Accounting Information Systems 14th Edition Simkin Solutions ManualДокумент15 страницCore Concepts of Accounting Information Systems 14th Edition Simkin Solutions Manualtaradavisszgmptyfkq100% (14)

- Oracle DBI For Financials: Daily Business Intelligence - Automating Operational ReportingДокумент16 страницOracle DBI For Financials: Daily Business Intelligence - Automating Operational Reportingmaanee.8Оценок пока нет

- Assignment # 2Документ21 страницаAssignment # 2haroonsaeed12Оценок пока нет

- Oracle Financial Analytics: Key Features and BenefitsДокумент5 страницOracle Financial Analytics: Key Features and Benefitsjbeatofl0% (1)

- AFIS AssignmentДокумент3 страницыAFIS Assignmentbsaf2147266Оценок пока нет

- SOX 404 & IT Controls: IT Control Recommendations For Small and Mid-Size Companies byДокумент21 страницаSOX 404 & IT Controls: IT Control Recommendations For Small and Mid-Size Companies byDeepthi Suresh100% (1)

- Asset Management Save Money Improve ProductivityДокумент7 страницAsset Management Save Money Improve ProductivitygerardoNapОценок пока нет

- BI AssignmentДокумент6 страницBI Assignmentssj_renukaОценок пока нет

- Solution Manual For Core Concepts of Accounting Information Systems 14th by SimkinДокумент14 страницSolution Manual For Core Concepts of Accounting Information Systems 14th by SimkinRuben Scott100% (31)

- AIS Questions and Own AnswersДокумент33 страницыAIS Questions and Own AnswersjhobsОценок пока нет

- AiS Module 1Документ5 страницAiS Module 1jhell dela cruzОценок пока нет

- White Paper Company Losing Control Controls Risks Governance and Stewardship of Enterprise Data Standard FINAL 111810Документ6 страницWhite Paper Company Losing Control Controls Risks Governance and Stewardship of Enterprise Data Standard FINAL 111810Pia Angela ElemosОценок пока нет

- Core Concepts of Accounting Information Systems 12th Edition Simkin Solutions ManualДокумент12 страницCore Concepts of Accounting Information Systems 12th Edition Simkin Solutions ManualPatrickMathewspeagd100% (11)

- Discussion Questions Chapter 1 3Документ16 страницDiscussion Questions Chapter 1 3April Ann C. GarciaОценок пока нет

- Full Download Core Concepts of Accounting Information Systems 12th Edition Simkin Solutions ManualДокумент36 страницFull Download Core Concepts of Accounting Information Systems 12th Edition Simkin Solutions Manualhhagyalexik100% (40)

- BI Lab FileДокумент25 страницBI Lab FileAniket Kumar 10Оценок пока нет

- 2 The Information EnvironmentДокумент19 страниц2 The Information Environment2205611Оценок пока нет

- Business JustificationДокумент15 страницBusiness JustificationadamstownОценок пока нет

- Case Summary: What Is BI?Документ3 страницыCase Summary: What Is BI?ashishОценок пока нет

- Report For AIS 1Документ5 страницReport For AIS 1Samer IsmaelОценок пока нет

- BIA Unit 1 NotesДокумент20 страницBIA Unit 1 Notes2111cs030057Оценок пока нет

- SystemsДокумент4 страницыSystemsJenyl Mae NobleОценок пока нет

- Accounting 1Документ5 страницAccounting 1Dương Nguyễn ThuỳОценок пока нет

- Definition of Business Intelligence: More About The History of BIДокумент25 страницDefinition of Business Intelligence: More About The History of BISyeda Mariyam ZehraОценок пока нет

- Information SystemДокумент8 страницInformation SystemElla MaguludОценок пока нет

- Data Governance With Oracle PDFДокумент27 страницData Governance With Oracle PDFAnonymous ESZtmyx9100% (1)

- Accounting Information System: HistoryДокумент6 страницAccounting Information System: HistorySamer IsmaelОценок пока нет

- Role of Data GovernanceДокумент12 страницRole of Data GovernanceAlberto HayekОценок пока нет

- 9511 1st AssignmentДокумент7 страниц9511 1st AssignmentUmair JavedОценок пока нет

- Accounting Information Systems: Importance in BusinessДокумент1 страницаAccounting Information Systems: Importance in BusinessKwini CBОценок пока нет

- Business Intelligence and Analytics FundamentalsДокумент21 страницаBusiness Intelligence and Analytics FundamentalsKazu KawashimaОценок пока нет

- Sarbanes Oxley ActДокумент3 страницыSarbanes Oxley ActMary Grace CiervoОценок пока нет

- Accounting Information SystemsДокумент9 страницAccounting Information SystemsSheila Mae AramanОценок пока нет

- What Are The Benefits of A Financial Management Information SystemДокумент5 страницWhat Are The Benefits of A Financial Management Information SystemSandra MagnoОценок пока нет

- Data AnalyticsДокумент10 страницData AnalyticsAbilashini jayakodyОценок пока нет

- Accounting Information SystemДокумент33 страницыAccounting Information SystemBir MallaОценок пока нет

- Accounting Information Systems - Paper 1Документ6 страницAccounting Information Systems - Paper 1NicoleneОценок пока нет

- A Ubm Techweb WP 1538100Документ5 страницA Ubm Techweb WP 1538100Ram ViОценок пока нет

- Audit Command LanguageДокумент12 страницAudit Command LanguageFrensarah RabinoОценок пока нет

- A Data Warehouse SumДокумент23 страницыA Data Warehouse SumwanderaОценок пока нет

- Data IntegrationДокумент26 страницData Integrationapi-3750267Оценок пока нет

- Turning Big Data Into Useful InformationДокумент14 страницTurning Big Data Into Useful InformationElioBolañosОценок пока нет

- Chaudhary Devi Lal University, Sirsa: Submitted To: Submitted By: Poonam Bhatia M.Tech (PT) 2 Sem. Roll No. 14Документ18 страницChaudhary Devi Lal University, Sirsa: Submitted To: Submitted By: Poonam Bhatia M.Tech (PT) 2 Sem. Roll No. 14Poonam AnandОценок пока нет

- Assignments OmegaДокумент7 страницAssignments OmegaJulianОценок пока нет

- Module-2 Business IntelligenceДокумент25 страницModule-2 Business IntelligencePushpa PrakashОценок пока нет

- JD Edward On Hindustan PetroleumДокумент18 страницJD Edward On Hindustan PetroleumAmit DevОценок пока нет

- Name: Banibrata Das Subject Code: MI0027 Subject Name: Registration No: 510929409 Learning Centre Set No: 01Документ17 страницName: Banibrata Das Subject Code: MI0027 Subject Name: Registration No: 510929409 Learning Centre Set No: 01Pravas DasОценок пока нет

- ERP Evaluation TemplateДокумент5 страницERP Evaluation Templatejancukjancuk50% (2)

- Accounting Information Systems and The Accountant Discussion QuestionsДокумент14 страницAccounting Information Systems and The Accountant Discussion Questionscharisse vinz BucoyaОценок пока нет

- The Role of Accounting Information System On Business PerformanceДокумент9 страницThe Role of Accounting Information System On Business Performanceindex PubОценок пока нет

- Soa Compliance FactsheetДокумент2 страницыSoa Compliance FactsheetferryandiОценок пока нет

- Accountants: What Is An Accounting Information System (AIS) ?Документ3 страницыAccountants: What Is An Accounting Information System (AIS) ?Eilyn Serelia WidodoОценок пока нет

- The IT Director's Practical Guide To Sarbanes-Oxley ComplianceДокумент17 страницThe IT Director's Practical Guide To Sarbanes-Oxley ComplianceSapaОценок пока нет

- Modern Enterprise Business Intelligence and Data Management: A Roadmap for IT Directors, Managers, and ArchitectsОт EverandModern Enterprise Business Intelligence and Data Management: A Roadmap for IT Directors, Managers, and ArchitectsОценок пока нет

- Electronics - IJECE - Power Control Techniques in - Komal D BhoiteДокумент8 страницElectronics - IJECE - Power Control Techniques in - Komal D Bhoiteiaset123Оценок пока нет

- Deep Learning For Consumer Devices and ServicesДокумент9 страницDeep Learning For Consumer Devices and ServicesctorreshhОценок пока нет

- HMSCДокумент5 страницHMSCjesimОценок пока нет

- Leader Election in Rings - O (n2) Algorithm, Bully AlgorithmДокумент40 страницLeader Election in Rings - O (n2) Algorithm, Bully AlgorithmVenkat AravindОценок пока нет

- Liquid Crystal DocumentationДокумент7 страницLiquid Crystal DocumentationLeeWeiОценок пока нет

- C5 2007-06-01 Silent Corruptions P KelemenДокумент28 страницC5 2007-06-01 Silent Corruptions P KelemendjkflhaskjОценок пока нет

- TSC TTP-243 Pro Series BrochureДокумент2 страницыTSC TTP-243 Pro Series BrochureJohnny BarcodeОценок пока нет

- Fortimanager - Vmware Esxi CookbookДокумент35 страницFortimanager - Vmware Esxi CookbookHamoud HamdanОценок пока нет

- Trainer Name: Jabivulla Vanalli Email: Mobile: +91 7829533577 Youtube ChannelДокумент4 страницыTrainer Name: Jabivulla Vanalli Email: Mobile: +91 7829533577 Youtube ChannelChaitanya IT ReturnsОценок пока нет

- en-YN YNT 001 AДокумент1 135 страницen-YN YNT 001 AYonni ShaolinОценок пока нет

- Timer and CountersДокумент4 страницыTimer and CountersMathematics TutorОценок пока нет

- Load Monitoring and Activity Recognition in SmartДокумент14 страницLoad Monitoring and Activity Recognition in SmartNexgen TechnologyОценок пока нет

- Lecture Notes DBM SДокумент11 страницLecture Notes DBM SRomeo BalingaoОценок пока нет

- Configuring A Port Channel Interface - Free CCNA WorkbookДокумент3 страницыConfiguring A Port Channel Interface - Free CCNA WorkbookRoger JeríОценок пока нет

- Lec 10 SocketProgtamming-Creating Network ApplicationsДокумент22 страницыLec 10 SocketProgtamming-Creating Network ApplicationsDivyankk VyasОценок пока нет

- Explore (Ict Concepts)Документ17 страницExplore (Ict Concepts)rose dela cruzОценок пока нет

- Corel DrawДокумент10 страницCorel DrawRaafi'ud Fauzi NОценок пока нет

- Oracle Hyperion DRM (Data Relationship Management) Online TrainingДокумент5 страницOracle Hyperion DRM (Data Relationship Management) Online TrainingMindMajix TechnologiesОценок пока нет

- HSF AdminДокумент116 страницHSF Adminarnoarno55Оценок пока нет

- WWW - Syng: Create by ARIJIT DEДокумент1 страницаWWW - Syng: Create by ARIJIT DEAshish KumarОценок пока нет

- TycoДокумент6 страницTycofarazali2919Оценок пока нет

- Sakshi Soo1Документ2 страницыSakshi Soo1sakshi soodОценок пока нет

- LEVEL I - ATA 46 Air Traffic Control SystemДокумент12 страницLEVEL I - ATA 46 Air Traffic Control SystemwagdiОценок пока нет

- VTU DSP Lab Manual 5th Sem E C Matlab Programs and CCS Studio ProgramsДокумент63 страницыVTU DSP Lab Manual 5th Sem E C Matlab Programs and CCS Studio ProgramsSona Uttappa50% (2)

- Protecting SAP Systems From Cyber Attack v4Документ39 страницProtecting SAP Systems From Cyber Attack v4jamilwaОценок пока нет

- ATM Requirement DocumentДокумент9 страницATM Requirement Documentdeverpo leandroОценок пока нет

- 12 Tips To Use Your Japanese IME Better - NihonshockДокумент14 страниц12 Tips To Use Your Japanese IME Better - NihonshockHuy RathanaОценок пока нет

- Teachnook MINOR PROJECT - PYДокумент9 страницTeachnook MINOR PROJECT - PYCameoutОценок пока нет

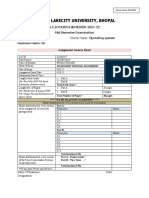

- Jagran Lakecity University, Bhopal: Course Code: BCAC402 Course Name: Operating SystemДокумент2 страницыJagran Lakecity University, Bhopal: Course Code: BCAC402 Course Name: Operating Systemritika nigadeОценок пока нет

- Civil Engineering Consulting Companies in Kenya - Kenyan Student EngineerДокумент69 страницCivil Engineering Consulting Companies in Kenya - Kenyan Student EngineerDaniel Kariuki100% (1)