Академический Документы

Профессиональный Документы

Культура Документы

Liability of Warehouseman and Surety

Загружено:

Vev'z Dangpason BalawanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Liability of Warehouseman and Surety

Загружено:

Vev'z Dangpason BalawanАвторское право:

Доступные форматы

II. Credit Transactions 1. YHT Realty Corp vs CA, GR No. 126780 2. Martinez vs PNB, GR No. L-4080 3.

Gonzales vs Go Tiong, GR No. L-11776 4. PNB vs Benito Se., Jr etal, GR No. 119231 5. Severino vs Severino, 56 Phil 185 6. Castellvi vs Sellner, 41 Phil 142

Case Digest on Martinez v. PNB (93 Phil 765) Where the transaction involved in the transfer of a warehouse receipt (quedan) is not a sale but a pledge or security, the transferee or endorsee does not become the owner of the goods. He may only have the property sold and then satisfy the obligation from the proceeds of the sale. If the property covered by the quedans is lost without the fault or negligence of the mortgagee / pledgee or the transferee / endorsee of the quedans, then said goods are to be regarded as lost on account of the real owner, mortgagor or pledgor. Case Digest on Gonzales v. Go Tiong Facts: GT operated a bonded warehouse and accepted deliveries of palay among which were several sacks belonging to RG. The issues which GT issued were ordinary receipts, not the warehouse receipts defined by the Warehouse Receipts Act. One day, the warehouse burned, together with its contents of palay, which included RGs sacks. RG sued on GTs bond with Luzon Surety to recover his loss. GT and Luzon Surety opposed this, saying among others that: (1) RGs claim was covered by the Civil Code and not the Bonded Warehouse Law since the receipts were ordinary receipts and not the warehouse receipts prescribed by the Warehouse Receipts Act; (2) The deposits of palay by RG were gratuitous, and therefore the destruction of the goods by fire extinguished GTs obligation. During the trial, it was found that GT had been accepting deposits in excess of the limit permitted under his license. Ruling: GT and Luzon Surety are liable to RG for the destruction of the goods under the Warehouse Receipts Act. Any deposit made with a bonded warehouseman is necessarily governed by the General Bonded Warehouse Act. The kind or nature of the receipts issued for the deposits is not very material, much less decisive. The issuance of warehouse receipts in the provided by Sec. 1 of the Warehouse Receipts Act is merely permissive and directory, and not obligatory. [Note: Under the General Bonded Warehouse Act, the term receipt means any receipt issued by a warehouseman for commodity delivered to him. (Sec. 2)] The defense that the palay was destroyed by fire and thus loss of the thing exempts the obligor in a contract of deposit from depositing the goods is not availing here. The fact that GT exceeded the limit of his authorized deposit militates against his defense of non-liability. The surety cannot avoid liability from the mere failure of GT to issue the prescribed warehouse receipt. Such defense is not available in an action on the bond. Case Digest on PNB v. Judge Benito C. Se, Jr. (256 SCRA 380) A prior judgment holding that a party is a warehouseman obligated to deliver sugar stocks covered by the warehouse receipts does not necessarily carry with it a denial of its lien over the same sugar stocks. Thus where the judgment creditor (in this case PNB) makes an unconditional presentment of warehouse receipts for delivery of sugar stocks against the warehouseman (Noahs Ark), it thereby admits the existence and validity of the terms, conditions and stipulations written on the face of the warehouse receipts, including the unqualified recognition of the payment of warehousemans lien for storage fees and preservation expenses. Thus, PNB may not retrieve the sugar stocks without paying the warehousemans lien. The warehouseman need not file a separate action to enforce payment of storage fees. He may enforce his lien before delivering the sugar stocks covered by the warehouse receipts.

Republic of the Philippines SUPREME COURT Manila EN BANC RAMON GONZALES vs.GO TIONG and LUZON SURETY CO., G.R. No. L-11776 August 30, 1958 Defendants Go Tiong and Luzon Surety Co. are appealing from the decision of the Court of First Instance of Manila, Judge Magno S. Gatmaitan presiding, the dispositive part of which reads as follows: In view whereof, judgment is rendered condemning defendant Go Tiong and Luzon Surety Co., jointly and severally, to pay plaintiff the sum of P4,920 with legal interest from the date of the filing of the complaint until fully paid; judgment is also rendered against Go Tiong to pay the sum of P3,680 unto plaintiff, also with legal interest from the date of the filing of the complaint until fully paid. Go Tiong is also condemned to pay the sum of P1,000 as attorney's fees, plus costs. The appeal was first taken to the Court of Appeals, the latter indorsing the case to us later under the provisions of Section 17 (6) of Republic Act No. 296, on the ground that the issues raised were purely questions of law. Go Tiong owned a rice mill and warehouse, located at Mabini, Urdaneta, Pangasinan. On February 4, 1953, he obtained a license to engage in the business of a bonded warehouseman (Exhibit N). To secure the performance of his obligations as such bonded warehouseman, the Luzon Surety Co. executed Guaranty Bond No. 294 in the sum of P18,334 (Exhibit O), conditioned particularly on the fulfillment by Go Tiong of his duty or obligation to deliver to the depositors in his storage warehouse, the palay received by him for storage, at any time demand is made, or to pay the market value thereof, in case he was unable to return the same. The bond was executed on January 26, 1953. Go Tiong insured the warehouse and the palay deposited therein with the Alliance Surety and Insurance Company. But prior to the issuance of the license to Go Tiong to operate as bonded warehouseman, he had on several occasions received palay for deposit from plaintiff Gonzales, totaling 368 sacks, for which he issued receipts, Exhibits A, B, C, and D. After he was licensed as bonded warehouseman, Go Tiong again received various deliveries of palay from plaintiff, totaling 492 sacks, for which he issued the corresponding receipts, all the grand total of 860 sacks, valued at P8,600 at the rate of P10 per sack. On or about March 15, 1953, plaintiff demanded from Go Tiong the value of his deposits in the amount of P8,600, but he was told to return after two days, which he did, but Go Tiong again told him to come back. A few days later, the warehouse burned to the ground. Before the fire, Go Tiong had been accepting deliveries of palay from other depositors and at the time of the fire, there were 5,847 sacks of palay in the warehouse, in excess of the 5,000 sacks authorized under his license. The receipts issued by Go Tiong to the plaintiff were ordinary receipts, not the "warehouse receipts" defined by the Warehouse Receipts Act (Act No. 2137). After the burning of the warehouse, the depositors of palay, including plaintiff, filed their claims with the Bureau of Commerce, and it would appear that with the proceeds of the insurance policy, the Bureau of Commerce paid off some of the claim. Plaintiff's counsel later withdrew his claim with the Bureau of Commerce, according to Go Tiong, because his claim was denied by the Bureau, but according to the decision of the trial court, because nothing came from plaintiff's efforts to have his claim paid. Thereafter, Gonzales filed the present action against Go Tiong and the Luzon Surety for the sum of P8,600, the value of his palay, with legal interest, damages in the sum of P5,000 and P1,500 as attorney's fees. Gonzales later renewed his claim with the Bureau of Commerce (Exhibit S). While the case was pending in court, Gonzales and Go Tiong entered into a contract of amicable settlement to the effect that upon the settlement of all accounts due to him by Go Tiong, he, Gonzales, would have all actions

pending against Go Tiong dismissed. Inasmuch as Go Tiong failed to settle the accounts, Gonzales prosecuted his court action.. For purposes of reference, we reproduce the assignment of errors of Go Tiong, as well as the assignment of errors of the Luzon Surety, all reading thus: I. The trial court erred in finding that plaintiff-appellee's claim is covered by the Bonded Warehouse Law, Act 3893, as amended, and not by the Civil Code. II. The trial court erred in not exempting defendant-appellant Go Tiong for the loss of the palay deposited, pursuant to the provisions of the New Civil Code.". xxx xxx xxx

I. The trial court erred in not declaring that the amicable settlement by and between plaintiff-appellee and defendant Go Tiong constituted a material alteration of the surety bond of appellant Luzon Surety which extinguished and discharged its liability. II. The trial court erred in bolding that the receipts for the palay received by Go Tiong, though not in the form of "quedans" or warehouse receipts are chargeable against the surety bond filed under the provisions of the General Bonded Warehouse Act (Act No. 3893 as amended by Republic Act No. 247) as a result of a loss. III. The trial court erred in not holding that the plaintiff had renounced and abandoned his rights under the Bonded Warehouse Act by the withdrawal of his claim from the Bureau of Commerce and the execution of the "amicable settlement". IV. The trial court erred in not holding that the palay delivered to Go Tiong constitutes gratuitous deposit which was extinguished upon the loss and destruction of the subject matter. V. The trial court erred in not declaring that the transaction between defendant Go Tiong and plaintiff was more of a sale rather than a deposit. VI. The trial court erred in declaring that the Luzon Surety Co., Inc., had not complied with its undertaking despite the liquidation of all the claims by the Bureau of Commerce. VII. The lower court erred in adjudging the herein surety liable under the terms of the Bond. We shall discuss the assigned errors at the same time, considering the close relation between them, although we do not propose to discuss and rule upon all of them. Both appellants urge that plaintiff's claim is governed by the Civil Code and not by the Bonded Warehouse Act (Act No. 3893, as amended by Republic Act No. 247), for the reason that, as already stated, what Go Tiong issued to plaintiff were ordinary receipts, not the warehouse receipts contemplated by the Warehouse Receipts Law, and because the deposits of palay of plaintiff were gratuitous. Act No. 3893 as amended is a special law regulating the business of receiving commodities for storage and defining the rights and obligations of a bonded warehouseman and those transacting business with him. Consequently, any deposit made with him as a bonded warehouseman must necessarily be governed by the provisions of Act No. 3893. The kind or nature of the receipts issued by him for the deposits is not very material much less decisive. Though it is desirable that receipts issued by a bonded warehouseman should conform to the provisions of the Warehouse Receipts Law, said provisions in our opinion are not mandatory and indispensable

in the sense that if they fell short of the requirements of the Warehouse Receipts Act, then the commodities delivered for storage become ordinary deposits and will not be governed by the provisions of the Bonded Warehouse Act. Under Section 1 of the Warehouse Receipts Act, one would gather the impression that the issuance of a warehouse receipt in the form provided by it is merely permissive and directory and not obligatory: SECTION 1. Persons who may issue receipts. Warehouse receipts may be issued by any warehouseman., and the Bonded Warebouse Act as amended permits the warehouseman to issue any receipt, thus: . . . . "receipt" as any receipt issued by a warehouseman for commodity delivered to him. As the trial court well observed, as far as Go Tiong was concerned, the fact that the receipts issued by him were not "quedans" is no valid ground for defense because he was the principal obligor. Furthermore, as found by the trial court, Go Tiong had repeatedly promised plaintiff to issue to him "quedans" and had assured him that he should not worry; and that Go Tiong was in the habit of issuing ordinary receipts (not "quedans") to his depositors. As to the contention that the deposits made by the plaintiff were free because he paid no fees therefor, it would appear that Go Tiong induced plaintiff to deposit his palay in the warehouse free of charge in order to promote his business and to attract other depositors, it being understood that because of this accommodation, plaintiff would convince other palay owners to deposit with Go Tiong. Appellants contend that the burning of the warehouse was a fortuitous event and not due to any fault of Go Tiong and that consequently, he should not be held liable, appellants supporting the contention with the ruling in the case of La Sociedad Dalisay vs. De los Reyes, 55 Phil. 452, reading as follows: Inasmuch as the fire, according to the judgment appealed from, was neither intentional nor due to the negligence of the appellant company or its officials; and it appearing from the evidence that the then manager attempted to save the palay, the appellant company should not be held responsible for damages resulting from said fire. . . . . The trial court correctly disposed of this same contention, thus: The defense that the palay was destroyed by fire neither does the Court consider to be good for while the contract was in the nature of a deposit and the loss of the thing would exempt the obligor in a contract of deposit to return the goods, this exemption from the responsibility for the damages must be conditioned in his proof that the loss was by force majeure, and without his fault. The Court does not see from the evidence that the proof is clear on the legal exemption. On the contrary, the fact that he exceeded the limit of the authorized deposit must have increased the risk and would militate against his defense of non-liability. For this reason, the Court does not follow La Sociedad vs. De Los Santos, 55 Phil. 42 quoted by Go Tiong. (p. 3, Decision). Considering the fact, as already stated, that prior to the burning of the warehouse, plaintiff demanded the payment of the value of his palay from Go Tiong on two occasions but was put off without any valid reason, under the circumstances, the better rule which we accept is the following: . . . . This rule proceeds upon the theory that the facts surrounding the care of the property by a bailee are peculiarly within his knowledge and power to prove, and that the enforcement of any other rule would impose great difficulties upon the bailors. ... It is illogical and unreasonable to hold that the presumption of negligence in case of this kind is rebutted by the bailee by simply proving that the property bailed was

destroyed by an ordinary fire which broke out on the bailee's own premises, without regard to the care exercised by the latter to prevent the fire, or to save the property after the commencement of the fire. All the authorities seem to agree that the rule that there shall be a presumption of negligence in bailment cases like the present one, where there is default in delivery or accounting, for the goods is just a necessary one. . . . (9 A.L.R. 566; see also Hanes vs. Shapiro, 84 S.E. 33; J. Russel Mfg. Co. vs. New Haven, S.B. Co., 50 N.Y. 211; Beck vs. Wilkins-Ricks Co., 102 S.E. 313, Fleishman vs. Southern R. Co., 56 S.E. 974). Besides, as observed by the trial court, the defendant violated the terms of his license by accepting for deposit palay in excess of the limit authorized by his license, which fact must have increased the risk. The Luzon Surety claims that the amicable settlement by and between Gonzales and Go Tiong constituted a material alteration of its bond, thereby extinguishing and discharging its liability. It is evident, however, that while there was an attempt to settle the case amicably, the settlement was never consummated because Go Tiong failed to settle the accounts of Gonzales to the latter's satisfaction. Consequently, said non-consummated compromise settlement does not discharge the surety: A compromise or settlement between the creditor or obligee and the principal, by which the latter is discharged from liability, discharges the surety, . . . . But an unconsummated . . . agreement to compromise, falling short of an effective settlement, will not discharge the surety. (50 C. J. 185) In relation to the failure of Go Tiong to issue the warehouse receipts contemplated by the Warehouse Receipts Act, which failure, according to appellants, precluded plaintiff from suing on the bond, reference may be made to Section 2 of Act No. 3893, defining receipt as any receipt issued by a warehouseman for commodity delivered to him, showing that the law does not require as indispensable that a warehouse receipt be issued. Furthermore, Section 7 of said law provides that as long as the depositor is injured by a breach of any obligation of the warehouseman, which obligation is secured by a bond, said depositor may sue on said bond. In other words, the surety cannot avoid liability from the mere failure of the warehouseman to issue the prescribed receipt. In the case of Andreson vs. Krueger, 212 N.W. 198, 199, it was held: The surety company concedes that the bond which it gave contains the statutory conditions. The statute . . . requires that the bond shall be conditioned upon the faithful performance of the public local grain warehouseman of all the provisions of law relating to the storage of grain by such warehouseman. The surety company thereby made itself responsible for the performance by the warehouseman of all the duties and obligations imposed upon him by the statute; and, if he failed to perform any such duty to the loss or detriment of those who delivered grain for storage, the surety company became liable therefor. Where the warehouseman receives grain for storage and refuses to return or pay it, the fact that he failed to issue the receipt, when the statute required him to issue on receiving it, is not available to the surety as a defense against an action on the bond. The obligation of the surety covers the duty of the warehouseman to issue the prescribed receipt, as well as the other duties imposed upon him by the statute. We deem it unnecessary to discuss and rule upon the other questions raised in the appeal. In view of the foregoing, the appealed decision is hereby affirmed, with cost

EN BANC [G.R. No. L-4080. September 21, 1953.] JOSE R. MARTINEZ, as administrator of the Instate Estate of Pedro Rodriguez, deceased, Plaintiff-Appellant, vs. As of February 1942, the estate of Pedro Rodriguez was indebted to the defendant Philippine National Bank in the amount of P22,128.44 which represented the balance of the crop loan obtained by the estate upon its 1941-1942 sugar cane crop. Sometime in February 1942, Mrs. Amparo R. Martinez, late administratrix of the estate upon request of the defendant bank through its Cebu branch, endorsed and delivered to the said bank two (2) quedans according to plaintiff-appellant issued by the Bogo-Medellin Milling Co. where the sugar was stored covering 2,198.11 piculs of sugar belonging to the estate, although according to the defendant-appellee, only one quedan covering 1,071.04 piculs of sugar was endorsed and delivered. During the last Pacific war, sometime in 1943, the sugar covered by the quedan or quedans was lost while in the warehouse of the Bogo-Medellin Milling Co. In the year 1948, the indebtedness of the estate including interest was paid to the bank, according to the appellant, upon the insistence of and pressure brought to bear by the bank. Under the theory and claim that sometime in February 1942, when the invasion of the Province of Cebu by the Japanese Armed Forces was imminent, the administratrix of the estate asked the bank to release the sugar so that it could be sold at a good price which was about P25 per picul in order to avoid its possible loss due to the invasion, but that the bank refused the request and as a result the amount of P54,952.75 representing the value of said sugar was lost, the present action was brought against the defendant bank to recover said amount. After trial, the Court of First Instance of Manila dismissed the complaint on the ground that the transfer of the quedan or quedans representing the sugar in the warehouse of the Bogo-Medellin Milling Co. to the bank did not transfer ownership of the Sugar, and consequently, the loss of said sugar should be borne by the plaintiff-appellant. Administrator Jose R. Martinez is now appealing from that decision. We agree with the trial court that at the time of the loss of the sugar during the war, sometime in 1943, said sugar still belonged to the estate of Pedro Rodriguez. It had never been sold to the bank so as to make the latter owner thereof. The transaction could not have been a sale, first, because one of the essential elements of the contract of sale, namely, consideration was not present. If the sugar was sold, what was the price? We do not know, for nothing was said about it. Second, the bank by its charter is not authorized to engage in the business of buying and selling sugar. It only accepts sugar as security for payment of its crop loans and later on pursuant to an understanding with the sugar planters, it sells said sugar for them, or the planters find buyers and direct them to the bank. The sugar was given only as a security for the payment of the crop loan. This is admitted by the appellant as shown by the allegations in its complaint filed before the trial court and also in the brief for appellant filed before us. According to law, the mortgagee or pledgee cannot become the owner of or convert and appropriate to himself the property mortgaged or pledged (Article 1859, old Civil Code; Article 2088, new Civil Code). Said property continues to belong to the mortgagor or pledgor. The only remedy given to the mortgagee or pledgee is to have said property sold at public auction and the proceeds of the sale applied to the payment of the obligation secured by the mortgage or pledge. The position and claim of plaintiff-appellant is rather inconsistent and confusing. First, he contends that the endorsement and delivery of the quedan or quedans to the bank transferred the ownership of the sugar to said bank so that as owner, the bank should suffer the loss of the sugar on the principle that "a thing perishes for its owner". We take it that by endorsing the quedan, defendant was supposed to have sold the sugar to the bank for the amount of the outstanding loan of P22,128.44 and the interest then accrued. That would mean that plaintiff's account with the bank has been entirely liquidated and their contractual relations ended, the bank, suffering the loss of the amount of the loan and interest. But plaintiff-appellant in the next breath contends that had the bank released the sugar in February 1942, plaintiff could have sold it for P54,952.75, from which the amount of the loan and interest could have been deducted, the balance to have been retained by plaintiff, and that since the loan has been entirely liquidated in 1948, then the whole expected sales price of P54,952.75 should now be paid by the bank to appellant. This second theory presupposes that despite the endorsement of the quedan, plaintiff still retained ownership of the sugar, a position that runs counter to the first theory of transfer of ownership to the bank. In the course of the discussion of this case among the members of the Tribunal, one or two of them who will dissent from the majority view sought to cure and remedy this apparent inconsistency in the claim of appellant and sustain the theory that the endorsement of the quedan made the bank the owner of the sugar resulting in the payment of the loan, so that now, the bank should return to appellant the amount of the loan it improperly collected in 1948. In support of the theory of transfer of ownership of the sugar to the bank by virtue of the endorsement of the quedan, reference was made to the Warehouse Receipts Law, particularly section 41 thereof, and several cases decided by this

court are cited. In the first place, this claim is inconsistent with the very theory of plaintiff-appellant that the sugar far from being sold to the bank was merely given as security for the payment of the crop loan. In the second place, the authorities cited are not directly applicable. In those cases this court held that for purposes of facilitating commercial transaction, the endorsee or transferee of a warehouse receipt or quedan should be regarded as the owner of the goods covered by it. In other words, as regards the endorser or transferor, even if he were the owner of the goods, he may not take possession and dispose of the goods without the consent of the endorsee or transferee of the quedan or warehouse receipt; that in some cases the endorsee of a quedan may sell the goods and apply the proceeds of the sale to the payment of the debt; and as regards third persons, the holder of a warehouse receipt or quedan is considered the owner of the goods covered by it. To make clear the view of this court in said cases, we are quoting a portion of the decisions of this court in two of these cases cited which are typical. "As to the first cause of action, we hold that in January, 1919, the bank became and remained the owner of the five quedans Nos. 30, 35, 38, 41, and 42; that they were in form negotiable, and that, as such owner, it was legally entitled to the possession and control of the property therein described at the time the insolvency petition was filed and had a right to sell it and apply the proceeds of the sale to its promissory notes, including the three notes of P18,000 each, which were formerly secured by the three quedans Nos. 33, 36, and 39, which the bank surrendered to the firm." (Philippine Trust Co. vs. National Bank, 42 Phil., 413, 427). ". . . Section 53 provides that within the meaning of the Act 'to "purchase" includes to take as mortgagee or pledgee' and "purchaser" includes mortgagee and pledgee.' It therefore seems clear that, as to the legal title to the property covered by a warehouse receipt, a pledgee is on the same footing as a vendee except that the former is under the obligation of surrendering his title upon the payment of the debt secured. To hold otherwise would defeat one of the principal purposes of the Act, i.e., to furnish a basis for commercial credit." (Bank of the Philippine Islands vs. Herridge, 47 Phil. 57, 70). It is obvious that where the transaction involved in the transfer of a warehouse receipt or quedan is not a sale but pledge or security, the transferee or endorsee does not become the owner of the goods but that he may only have the property sold and then satisfy the obligation from the proceeds of the sale. From all this, it is clear that at the time the sugar in question was lost sometime during the war, estate of Pedro Rodriguez was still the owner thereof. It is further contended in this appeal that the defendant- appellee failed to exercise due care for the preservation of the sugar, and that the loss was due to its negligence as a result of which the appellee incurred the loss. In the first place, this question was not raised in the court below. Plaintiff's complaint failed to make any allegation regarding negligence in the preservation of this sugar. In the second place, it is a fact that the sugar was lost in the possession of the warehouse selected by the appellant to which it had originally delivered and stored it, and for causes beyond the bank's control, namely, the war. In connection with the claim that had the bank released the sugar sometime in February, 1942, when requested by the plaintiff, said sugar could have been sold at the rate of P25 a picul or a total of P54,952.75, the amount of the present claim, there is evidence to show that the request for release was not made to the bank itself but directly to the official of the warehouse, the Bogo-Medellin Milling Co. and that the bank was not aware of any such request, but that before April 9, 1942, when the Cebu branch of the defendant was closed, the bank through its officials offered the sugar for sale but that there were no buyers, perhaps due to the unsettled and chaotic conditions then obtaining by reason of the enemy occupation. In conclusion, we hold that where a warehouse receipt or quedan is transferred or endorsed to a creditor only to secure the payment of a loan or debt, the transferee or endorsee does not automatically become the owner of the goods covered by the warehouse receipt or quedan but he merely retains the right to keep and with the consent of the owner to sell them so as to satisfy the obligation from the proceeds of the sale, this for the simple reason that the transaction involved is not a sale but only a mortgage or pledge, and that if the property covered by the quedans or warehouse receipts is lost without the fault or negligence of the mortgagee or pledgee or the transferee or endorsee of the warehouse receipt or quedan, then said goods are to be regarded as lost on account of the real owner, mortgagor or pledgor. In view of the foregoing, the decision appealed from is hereby affirmed, with costs.

Вам также может понравиться

- G.R. No. L-11776 August 30, 1958Документ5 страницG.R. No. L-11776 August 30, 1958Tovy BordadoОценок пока нет

- Credit Tran Gonzales Vs Go TiongДокумент5 страницCredit Tran Gonzales Vs Go TiongNilsaОценок пока нет

- Gonzales vs. Go Tiong, 104 Phil 492, 30 August 1958Документ2 страницыGonzales vs. Go Tiong, 104 Phil 492, 30 August 1958Bibi JumpolОценок пока нет

- Ramon Gonzales V Go TiongДокумент5 страницRamon Gonzales V Go TiongTtlrpq100% (1)

- Gonzales v. Go TiongДокумент2 страницыGonzales v. Go Tiongmichelle zatarainОценок пока нет

- Warehouse Receipt Law CasesДокумент24 страницыWarehouse Receipt Law CasesAlexis Anne P. ArejolaОценок пока нет

- Gonzalez vs Go Tiong RulingДокумент3 страницыGonzalez vs Go Tiong RulingartОценок пока нет

- Marie-Gonzales v. Gotiong and Sanchez v. BueviajeДокумент2 страницыMarie-Gonzales v. Gotiong and Sanchez v. BueviajeAna AltisoОценок пока нет

- Gonzales v. Go TiongДокумент2 страницыGonzales v. Go TiongJasmine LeañoОценок пока нет

- Ramon Gonzales v. Go Tiong Case DigestДокумент2 страницыRamon Gonzales v. Go Tiong Case DigestIa HernandezОценок пока нет

- Gonzales Vs Go TiongДокумент2 страницыGonzales Vs Go TiongCAJОценок пока нет

- 47 Gonzales V Go Tiong (Santos)Документ2 страницы47 Gonzales V Go Tiong (Santos)itsmestephОценок пока нет

- Gonzales V Go TiongДокумент4 страницыGonzales V Go TiongRomy Ian LimОценок пока нет

- Gonzales v. Go Tiong: Bonded Warehouse Law Covers Ordinary ReceiptsДокумент3 страницыGonzales v. Go Tiong: Bonded Warehouse Law Covers Ordinary ReceiptsJezreel Y. ChanОценок пока нет

- Special Comm LawДокумент3 страницыSpecial Comm Lawbayi88100% (1)

- PNB vs. AtendidoДокумент3 страницыPNB vs. Atendidotine murilloОценок пока нет

- 9 PNB V SayoДокумент43 страницы9 PNB V SayoMaryland AlajasОценок пока нет

- COMLAWREV - Catindig 2009 ReviewerДокумент196 страницCOMLAWREV - Catindig 2009 Reviewercmv mendozaОценок пока нет

- Philippine National Bank vs. Sayo, JR., 292 SCRA 202, July 09, 1998Документ34 страницыPhilippine National Bank vs. Sayo, JR., 292 SCRA 202, July 09, 1998j0d3Оценок пока нет

- PNB V SAYOДокумент2 страницыPNB V SAYOGui PeОценок пока нет

- Credit Tran PNB Vs SayoДокумент35 страницCredit Tran PNB Vs SayoNilsaОценок пока нет

- Ummary: Opic in YllabusДокумент6 страницUmmary: Opic in YllabusRio PortoОценок пока нет

- G.R. No. L-6342 - PNB V AtendidoДокумент2 страницыG.R. No. L-6342 - PNB V AtendidoKyle AlmeroОценок пока нет

- Article 1355Документ22 страницыArticle 1355DexterJohnN.BambalanОценок пока нет

- Deposit DigestДокумент14 страницDeposit DigestRizza MoradaОценок пока нет

- Warehouse Receipt CasesДокумент5 страницWarehouse Receipt CasesYieMaghirangОценок пока нет

- Cases 4 - Warehouse Receipts LawДокумент16 страницCases 4 - Warehouse Receipts LawCris Licsi MantesОценок пока нет

- Case Law On Warehouse Receipts LawДокумент9 страницCase Law On Warehouse Receipts LawynnaОценок пока нет

- Knecht vs. United Cigarette CorpДокумент17 страницKnecht vs. United Cigarette CorpVern Villarica CastilloОценок пока нет

- COMLAWREV Catindig 2009 ReviewerДокумент196 страницCOMLAWREV Catindig 2009 ReviewerShara LynОценок пока нет

- Sales-Cases-Batch-2 - AsusДокумент87 страницSales-Cases-Batch-2 - AsusMA LOVELLA OSUMOОценок пока нет

- Sales Digest Part 2Документ14 страницSales Digest Part 2Kkee DdooОценок пока нет

- Warehouse DigestДокумент8 страницWarehouse DigestRizza MoradaОценок пока нет

- Online Digests - Warehouse Receipts LawДокумент9 страницOnline Digests - Warehouse Receipts LawMaria Reylan Garcia100% (2)

- Chrysler Philippines Corp v Court of Appeals dispute over unpaid automotive productsДокумент6 страницChrysler Philippines Corp v Court of Appeals dispute over unpaid automotive productsKkee DdooОценок пока нет

- 16 Concept of Loss of ThingДокумент10 страниц16 Concept of Loss of ThingJong PerrarenОценок пока нет

- Primer On Warehouse Receipts, 2001 EditionДокумент18 страницPrimer On Warehouse Receipts, 2001 EditionNodlesde Awanab ZurcОценок пока нет

- Digested Case On General Bonded Wares House and Trust Receipt LawДокумент4 страницыDigested Case On General Bonded Wares House and Trust Receipt LawVebsie D. MolavinОценок пока нет

- Case 1: Compania General de Tabacos vs. French and Unson G. R. No. L-14027, 1919 FactsДокумент29 страницCase 1: Compania General de Tabacos vs. French and Unson G. R. No. L-14027, 1919 FactsMercy LingatingОценок пока нет

- Case DigestsДокумент4 страницыCase DigestsErika Cristel DiazОценок пока нет

- Yuliongsiu v. PNB (Digest)Документ4 страницыYuliongsiu v. PNB (Digest)Arahbells100% (1)

- Concept of Delivery AcceptanceДокумент15 страницConcept of Delivery AcceptanceCrisDBОценок пока нет

- Supreme Court Rules in Favor of Shipping Company Tax RefundДокумент8 страницSupreme Court Rules in Favor of Shipping Company Tax RefundColeen Navarro-RasmussenОценок пока нет

- PNB vs. Sayo - GR 129918 - Full TextДокумент36 страницPNB vs. Sayo - GR 129918 - Full TextJeng PionОценок пока нет

- OBLICON CASES VRSN 2Документ12 страницOBLICON CASES VRSN 2DexterJohnN.BambalanОценок пока нет

- Letter of CreditДокумент7 страницLetter of Creditmeiji15Оценок пока нет

- SuretyДокумент2 страницыSuretyTeacherEliОценок пока нет

- PLEDGE VALIDITYДокумент43 страницыPLEDGE VALIDITYAnonymous fnlSh4KHIgОценок пока нет

- Sales Final SetДокумент27 страницSales Final SetLouОценок пока нет

- CredTrans Collated Digests 28-32 - Warehouse ReceiptsДокумент4 страницыCredTrans Collated Digests 28-32 - Warehouse Receiptsyeusoff haydn jaafarОценок пока нет

- Yu Tek & Co. v. GonzalesДокумент7 страницYu Tek & Co. v. GonzalesDavid Anthony PadreОценок пока нет

- Lopez vs. Del Rosario and Quiogue, 44 Phil. 98, November 27, 1922Документ8 страницLopez vs. Del Rosario and Quiogue, 44 Phil. 98, November 27, 1922Roberto OberoОценок пока нет

- CA Agro-Industrial Dev. Corp. v. Court of Appeals and Security Bank and Trust Company, G.R. No. 90027, March 3, 1993, 219 SCRA 426 FactsДокумент6 страницCA Agro-Industrial Dev. Corp. v. Court of Appeals and Security Bank and Trust Company, G.R. No. 90027, March 3, 1993, 219 SCRA 426 Factsaudreydql5Оценок пока нет

- Liability of Surety on Receiver's BondДокумент85 страницLiability of Surety on Receiver's BondJoan Szanne PulmonesОценок пока нет

- Credit Transaction Notes DepositДокумент16 страницCredit Transaction Notes DepositCeCe EmОценок пока нет

- Flancia v. CAДокумент6 страницFlancia v. CAEdward StewartОценок пока нет

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyОт EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyОценок пока нет

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsОт EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsРейтинг: 3 из 5 звезд3/5 (1)

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesОт EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesОценок пока нет

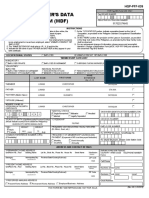

- Member'S Data Form (MDF) : HQP-PFF-039Документ2 страницыMember'S Data Form (MDF) : HQP-PFF-039LiDdy Cebrero BelenОценок пока нет

- Computer ScrapbookДокумент2 страницыComputer ScrapbookVev'z Dangpason BalawanОценок пока нет

- Computer Scrapbook2Документ1 страницаComputer Scrapbook2Vev'z Dangpason BalawanОценок пока нет

- Promoting A Culture of NonДокумент2 страницыPromoting A Culture of NonVev'z Dangpason BalawanОценок пока нет

- Final - Financial Audit ManualДокумент164 страницыFinal - Financial Audit ManualVev'z Dangpason BalawanОценок пока нет

- Crim RevДокумент55 страницCrim RevchrisОценок пока нет

- France My Performance OutputДокумент2 страницыFrance My Performance OutputVev'z Dangpason BalawanОценок пока нет

- Computer Scrapbook2Документ1 страницаComputer Scrapbook2Vev'z Dangpason BalawanОценок пока нет

- Computer ScrapbookДокумент2 страницыComputer ScrapbookVev'z Dangpason BalawanОценок пока нет

- 2016 IPCRF and Annual Accomplishment ReportДокумент2 страницы2016 IPCRF and Annual Accomplishment ReportVev'z Dangpason BalawanОценок пока нет

- Crim RevДокумент55 страницCrim RevchrisОценок пока нет

- Table of Contents - PrintableДокумент21 страницаTable of Contents - PrintableVev'z Dangpason BalawanОценок пока нет

- Final Crim DigestsДокумент53 страницыFinal Crim DigestsVev'z Dangpason BalawanОценок пока нет

- Cases On Crim LawДокумент79 страницCases On Crim LawKelly JohnsonОценок пока нет

- MP June 2016Документ2 страницыMP June 2016Vev'z Dangpason BalawanОценок пока нет

- Criminal Procedure San Beda.Документ2 страницыCriminal Procedure San Beda.Russell HarescoОценок пока нет

- Individual Action Plan 2015Документ6 страницIndividual Action Plan 2015Vev'z Dangpason Balawan100% (2)

- DCP QuestionnaireДокумент2 страницыDCP QuestionnaireVev'z Dangpason BalawanОценок пока нет

- Letter of Commendation To Sheila BayanganДокумент1 страницаLetter of Commendation To Sheila BayanganVev'z Dangpason BalawanОценок пока нет

- Sources of LightДокумент1 страницаSources of LightVev'z Dangpason BalawanОценок пока нет

- Types of CloudsДокумент1 страницаTypes of CloudsVev'z Dangpason BalawanОценок пока нет

- Excel EstamolДокумент6 страницExcel EstamolVev'z Dangpason BalawanОценок пока нет

- DCP QuestionnaireДокумент2 страницыDCP QuestionnaireVev'z Dangpason BalawanОценок пока нет

- Est AmolДокумент7 страницEst AmolVev'z Dangpason BalawanОценок пока нет

- Kalinga Colleges of Science and TechnologyДокумент3 страницыKalinga Colleges of Science and TechnologyVev'z Dangpason BalawanОценок пока нет

- Benefits Summary PhilippinesДокумент1 страницаBenefits Summary PhilippinesVev'z Dangpason BalawanОценок пока нет

- AyasinДокумент9 страницAyasinVev'z Dangpason BalawanОценок пока нет

- Evidence Cases 3Документ23 страницыEvidence Cases 3Vev'z Dangpason BalawanОценок пока нет

- AyasinДокумент9 страницAyasinVev'z Dangpason BalawanОценок пока нет

- Law of Torts Worksheet ExplainedДокумент2 страницыLaw of Torts Worksheet Explainedkemesha lewisОценок пока нет

- Bailee's Duty of Care EvolutionДокумент26 страницBailee's Duty of Care EvolutionPratham MohantyОценок пока нет

- What Is The Legal Definition of A PersonДокумент78 страницWhat Is The Legal Definition of A PersonZoSo Zeppelin100% (3)

- Is Public Nuisance A Tort? Thomas W. MerrillДокумент72 страницыIs Public Nuisance A Tort? Thomas W. Merrillmuzhaffar_razakОценок пока нет

- Delay in ObligationsДокумент5 страницDelay in ObligationsKirsy Mae NarabeОценок пока нет

- Casumpang V CortejoДокумент5 страницCasumpang V CortejoGabby GuecoОценок пока нет

- Contract LawДокумент56 страницContract LawDownload_Scribd_stuf0% (1)

- Magaling v. Ong: Directors' LiabilityДокумент4 страницыMagaling v. Ong: Directors' LiabilityIyahОценок пока нет

- Planters Products, Inc. vs. Court of AppealsДокумент9 страницPlanters Products, Inc. vs. Court of AppealsImariОценок пока нет

- PFR Art 14-18 Edited 19 Unedited 20-25 NotesДокумент7 страницPFR Art 14-18 Edited 19 Unedited 20-25 NotesLEIGHОценок пока нет

- Cases 101-150Документ114 страницCases 101-150Supply ICPOОценок пока нет

- 07 44 Caranza Vda. de Saldivar vs. Cabanes Jr.Документ4 страницы07 44 Caranza Vda. de Saldivar vs. Cabanes Jr.Noo NooooОценок пока нет

- Transportation LawsДокумент222 страницыTransportation LawsAlvin Claridades100% (1)

- Lawrence Whittington v. Sewer Construction Company, Inc., 541 F.2d 427, 4th Cir. (1976)Документ20 страницLawrence Whittington v. Sewer Construction Company, Inc., 541 F.2d 427, 4th Cir. (1976)Scribd Government DocsОценок пока нет

- Bar Exam 151-200Документ50 страницBar Exam 151-200Glory TraderОценок пока нет

- Suggested Answers To Bar Exam Questions 2008 On Mercantile LawДокумент9 страницSuggested Answers To Bar Exam Questions 2008 On Mercantile LawsevenfivefiveОценок пока нет

- Roberto P. Fuentes Vs People of The PhilippinesДокумент3 страницыRoberto P. Fuentes Vs People of The PhilippinesFinn Asadil100% (1)

- A Comparitive Study On Inevitable Accident and Act of GodДокумент9 страницA Comparitive Study On Inevitable Accident and Act of GodAkash JОценок пока нет

- Torts Ravitch Fall 2003Документ15 страницTorts Ravitch Fall 2003juser2007Оценок пока нет

- Midterm Exams OBLICONДокумент4 страницыMidterm Exams OBLICONKristine Gianne Vista100% (1)

- 3a Newsletter Week 11Документ6 страниц3a Newsletter Week 11api-96195619Оценок пока нет

- Transpo Case DigestДокумент5 страницTranspo Case DigestChristy Ycong100% (1)

- 8 Yamada V Manila Railroad 1918Документ9 страниц8 Yamada V Manila Railroad 1918MaeJoОценок пока нет

- Court Rules on Rights of Lot Buyer Who Constructed Improvements on Wrong PropertyДокумент10 страницCourt Rules on Rights of Lot Buyer Who Constructed Improvements on Wrong PropertyJacquelyn AlegriaОценок пока нет

- Remulla, Estrella & Associates For Petitioners Exequil C. Masangkay For RespondentsДокумент17 страницRemulla, Estrella & Associates For Petitioners Exequil C. Masangkay For RespondentsJhon Rey SedigoОценок пока нет

- Acid Test: Four Years in The Making, The Solicitor Super-Exam' Launches Next Month. Will It Pass Muster?Документ36 страницAcid Test: Four Years in The Making, The Solicitor Super-Exam' Launches Next Month. Will It Pass Muster?Rabia BegumОценок пока нет

- Angela NotesДокумент7 страницAngela NotesAngela CanayaОценок пока нет

- SINAMICS S120 Parallelschaltung Active Line Modules V1 2 en 2023-12-22 2Документ34 страницыSINAMICS S120 Parallelschaltung Active Line Modules V1 2 en 2023-12-22 2c.ingemar.carlssonОценок пока нет

- American Express Vs CorderoДокумент3 страницыAmerican Express Vs Corderoruss8dikoОценок пока нет

- Syquia V CAДокумент8 страницSyquia V CASimeon SuanОценок пока нет