Академический Документы

Профессиональный Документы

Культура Документы

FORM16

Загружено:

sunnyjain19900%(1)0% нашли этот документ полезным (1 голос)

183 просмотров5 страницForm for tax

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документForm for tax

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0%(1)0% нашли этот документ полезным (1 голос)

183 просмотров5 страницFORM16

Загружено:

sunnyjain1990Form for tax

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

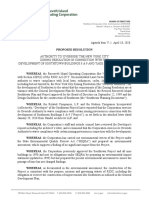

LARSEN & TOUBRO LIMITED

Form 16

Form16 Details :

Employee Name

Employee PAN

Employee Serial Number

Employee Designation

Form 16 Contr! Number

Assessment Year

SUNNY JAIN

ALLPugo4eH

20034845

CHARTERED ACCOUNTANT |

20034845/ALLPJ9048H/2011-2012

2012-2013

Signature Details :

This form has been signed and carified using a Digital Signature Certificate as Specified under Section 119 of

the Income-Tax Act, 1961. (Please refor Circular No.2/2007, dated 21-5-2007)

The Digital Signature of the Signatory has been affixed in the box provided below. To see the details and validate

the signatory, you should click on the box.

Digitally Signed By

NTA PAWAR

Digital Signature Certificated Issued By SafeScrypt sub-CA for RAI Class 22012

Serial Number of DSC

Number of Pages

16620068

5 (including tis page )

Validity unknown

aa ep

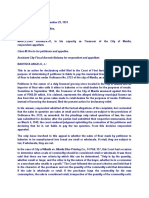

FORM NO.16

[See Rule31(1)(a)]

PART A

LaTiconsTRit1-121410

[Name and Adarone ofthe Employer Name and Designation of the Employee

ICs T HOUSE BALLARD ESTATEN M MARG.MUMBALA00001 earteReD accountant

PAN otihe bedacior Ta othe Beauctor PAN of Re Empioyee

ars ASSESSMENT PERIOD

iy : moment Code : 400002 zoa1s [REPRO TOMAR AIT

Summary of tax deducted at source

Goarer [Recap Numbers of ariginal statements of | Amount of tax deducted respect ot [Amount of ax dapoaied roniied

[Foe Under Sub-Sacton (3) of section employ respect of the employee

‘Guanert {JPOXBGFG B09 a9

‘Quaner2 eDxKZOD 0.09 209

‘Quarers SPOXRUYG 780.09 Fek0.00

‘Guan aPDBCzFE 2.09 29

PARTS (Refer Note)

‘DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUGTED ca ey =]

Salary os por ovisonscoviainea h sacion 17) es

[vate of Pera. ws 17(2¥as pa FORM 126A) wherever appcable 70359

Pets tu of salary us 173) (on por FORM 128A wharves appncabo a

[BALANCE (1-2)

(2) Enlenanment aowanae

(@) Taxon Enplopment Re

(@) EntanmentAlowsnas Re

[ecroaate of 418) 8) (6)

INCONE GHARGEABLE UNDER THE HEAD SALARIES 3)

@ [Ross TOTAL NCOWE 7)

In) Seaton 606, 80000, €0CCO

(a) Secon soc

[REPAY OF HSGLOANPRIN

IDUNDER SECTION #0CCG a a a

[QUNDER SECTION @0GcD a a 5

|b) OTHER SECTIONS UNDER CHAPTER Via a 5 5

[US EODD MAINT. OF HANDIGAP DEPENDENT (SEVERE DISABILITY, 0 a a

INow severe)

[Us BoDDe MEDICAL INSURANCE ON SPECIFIED DISEASE GR GTTIZEN a a a

lore

[US Boe HIGHER EDUCATION (NTEREST ONLOAN ONLY) 0) 5 o

[US B0U SELF HANDICAP (SEVERE DISABILITY. NON SEVERE) 0 5 5

[L11_[rora mcome 10) | | 1 19828]

[D2 [rex on rorat nooue | | I a

[Gs Jenucarion cess ge (Gn Tax Computed at S.No 12) | I | of

[44 [Fax Payatio(12+13) I | | of

[15 |Loss: Rebate Unde Sten 60 | I I |

[Loe [roxPayate- (16-5) ! L | |

Vancom

IITA PRWAR, sonuaugharo DATTATREYA SHAMKER KABADE wating the cpacly HEAD SHARED SERVICES, PAYROLL Goharby com hava sonal

[zs.200 rupees two thousand sh rand shy rupees on fas Baan dad ste and pal terest Gaal Goverarturar cet tate

[natn gen above ston conpas snd cone asad oe bts of sess acumen, 40S Sutantnt TOS doped and chr aval

ou

es enpoyedunde eran cg th yr a of he pyr sal ene Par ot

‘petgne war empoyad on Se oj Selena sch ne andj cre at emper

Girma cra ance nA pesto con aos Ae Hs eps cng mechan,

{ tnaFormenat be apa ny nreape tte Savon rae tay a pr

TETICONSTRIT-TaI470

(The Epler to prove paynant wise dell oft deducted and deposed wih respactto he employee)

FORM NO. 1288 LaTICONSTRI1-12/610

[See rule 26A(2)0))

‘Statement showing particulars of perquisites, other fringe benefits or

‘amenities and profits in lieu of salary with value thereof

[i Name and address of Employer TARSEN & TOUBRO LIMITED

L&THOUSE BALLARD ESTATE.N M MARGMUMBAI-400001

TAN ‘MUMLO0Os1C

‘TDS Assessment Range of the employer ‘TDS RANGE-2(1)

J4 Name, Designation and PAN of the employer SUNNY JAIN

CHARTERED ACCOUNTANT |

‘ALLPu9OgBH

IS Is the employee a director ora person with substantial No

interest in the company(where the employer is a company)

|S income under the head “Salaries” of the employee(other _263117.76

than from perquisites)

ly Financial year 2011-2012

la Valuation of Perquisites

[So [Nature of perquisites (eco rae 3) [vate of perquiate ae per Amoura, Wany received [Amount of perquahe

eos (Rs) tom the employee (Rs) [chargeable to tx (Rs)

a @ a @ @

[STOCK OPTIONS NON-QUALIFED OPTIONS) o 2.9 4]

frat vatve operates Tass 209 )

[ata vate of pots teu of sala as pe secon TT) 00 209 3.0

[oy Deas ot tax

a) Tax deducted om slay othe employee underina seeton 7B2(7) 880

by Tax pad by payer on Baal ane employe under seaion192(7A)

le) Total tax pane 80

a) Dae of payment nia Goverment Peasy Feter Form 16

Ina PAWAR,sancnugia of DATTATREYA SWANKER KABADE wring WEAD SHARED SERVICES, PAYROLL do ray dear on halo LARSEN & TOUBRO LTD

5

ee

Вам также может понравиться

- Form 16Документ3 страницыForm 16Alla VijayОценок пока нет

- Form 16Документ4 страницыForm 16Aruna Kadge JhaОценок пока нет

- Emp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANДокумент1 страницаEmp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANVBОценок пока нет

- PaySlip July 2022Документ1 страницаPaySlip July 2022Kaushal YadavОценок пока нет

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Документ4 страницыJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajОценок пока нет

- Udaan Evf L2Документ12 страницUdaan Evf L2mayank.dce123Оценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current Amountvarunk8275Оценок пока нет

- 1 1000 Form16Документ5 страниц1 1000 Form16Rakshit SharmaОценок пока нет

- Divya Yerrabolu Experience LetterДокумент3 страницыDivya Yerrabolu Experience LetterMuthu KrishnaОценок пока нет

- AprilДокумент1 страницаAprilabhinavbartarОценок пока нет

- Gmail - HCL Interview - 1st Aug.Документ2 страницыGmail - HCL Interview - 1st Aug.Kannu PriyaОценок пока нет

- June SalaryДокумент1 страницаJune Salaryaruna nadagouniОценок пока нет

- Punit Salary SlipДокумент1 страницаPunit Salary SlippulkittulsiyanОценок пока нет

- Appraisal Letter 2Документ1 страницаAppraisal Letter 2csreddyatsapbiОценок пока нет

- Offer Letter: Corporate Office Registered Office EmailДокумент2 страницыOffer Letter: Corporate Office Registered Office EmailAnkur TripathiОценок пока нет

- Appointment Letter - Mr. Vikas AroraДокумент5 страницAppointment Letter - Mr. Vikas AroraAnonymous OGIM8h100% (1)

- Part B PDFДокумент3 страницыPart B PDFDebesh KuanrОценок пока нет

- Experience LetterДокумент1 страницаExperience LetterSharathPundamalliОценок пока нет

- Kotak Mahindra (3719)Документ2 страницыKotak Mahindra (3719)Sagar PandeyОценок пока нет

- Offer LetterДокумент1 страницаOffer LetterRajesh PaniОценок пока нет

- Manish Dwivedi Nov-18Документ1 страницаManish Dwivedi Nov-18Anonymous 3P7aeUIW2Оценок пока нет

- Offer Letter SampleДокумент2 страницыOffer Letter Sampleyevadimata vinakuОценок пока нет

- RBL BankДокумент17 страницRBL BankorekishОценок пока нет

- Maruti Suzuki Job OfferДокумент3 страницыMaruti Suzuki Job Offerrampreetham4388Оценок пока нет

- Mr. Pankaj Kumar Tyagi APLДокумент8 страницMr. Pankaj Kumar Tyagi APLRashi SrivastavaОценок пока нет

- April 09, 2020Документ1 страницаApril 09, 2020Pavan Kumar VasudhaОценок пока нет

- Richard Lobo Senior Vice President - HRDДокумент8 страницRichard Lobo Senior Vice President - HRDAmberОценок пока нет

- Janani Offer LetterДокумент4 страницыJanani Offer LetterVigNeshОценок пока нет

- Payslip 1Документ1 страницаPayslip 1Tamoghna DeyОценок пока нет

- Linkquest Offer LetterДокумент4 страницыLinkquest Offer LetterGaurav SrivastavОценок пока нет

- 556salary Slip Template AAДокумент5 страниц556salary Slip Template AARameshОценок пока нет

- Pay SlipДокумент1 страницаPay SlipAnonymous QrLiISmpF100% (1)

- Pay SlipДокумент1 страницаPay SlipLakshman Samanth ReddyОценок пока нет

- Itfox Technologies LLP CIN AAQ-7602: Digital MarketingДокумент7 страницItfox Technologies LLP CIN AAQ-7602: Digital MarketingArushi SinghОценок пока нет

- Pay Slip March 2017Документ4 страницыPay Slip March 2017Anonymous AsVoWD04c0% (1)

- PrintTax14 PDFДокумент2 страницыPrintTax14 PDFarnieanuОценок пока нет

- Payslip MarДокумент1 страницаPayslip MarMaheshKandguleОценок пока нет

- April Salary SlipДокумент1 страницаApril Salary SlipTushar kumarОценок пока нет

- Payslip MarДокумент1 страницаPayslip Marabhijitj0555Оценок пока нет

- 2Документ2 страницы2Arun KumarОценок пока нет

- CT20110377825Документ13 страницCT20110377825Raghuram DasariОценок пока нет

- Matrimony - Offer LetterДокумент6 страницMatrimony - Offer LettersperoОценок пока нет

- Salary SlipДокумент3 страницыSalary Slippankaj singhОценок пока нет

- Salary Slip FebuaryДокумент1 страницаSalary Slip Febuaryapi-3846919Оценок пока нет

- Payslip Jul 2022Документ1 страницаPayslip Jul 2022thaarini doraiswamiОценок пока нет

- Final Agreement-Stamp Paper InfosysДокумент3 страницыFinal Agreement-Stamp Paper InfosystahseensiddiquiОценок пока нет

- UserFile 1 PDFДокумент8 страницUserFile 1 PDFAmit RawatОценок пока нет

- 1Документ9 страниц1Kiran KulkarniОценок пока нет

- Maruti Suzuki Recruitment OfferДокумент2 страницыMaruti Suzuki Recruitment Offerengrasim88Оценок пока нет

- Co Ntactus@ Af Orese Rve - Co. inДокумент4 страницыCo Ntactus@ Af Orese Rve - Co. inDhaval SoniОценок пока нет

- 8A. HDFC Estatement NOV2017Документ8 страниц8A. HDFC Estatement NOV2017Nanu PatelОценок пока нет

- Offer LetterДокумент1 страницаOffer LetterAniket ChakiОценок пока нет

- Stirne, Richard Allen 1000822270 - ATL-12K - OfferДокумент4 страницыStirne, Richard Allen 1000822270 - ATL-12K - OfferBartholomew SzoldОценок пока нет

- Ca Audit Report 2324Документ6 страницCa Audit Report 2324UmasankarОценок пока нет

- Income Tax Worksheet For The Financial Year APR-2018 To MAR-2019Документ1 страницаIncome Tax Worksheet For The Financial Year APR-2018 To MAR-2019svecraoОценок пока нет

- Offer Letter - Navneet JassiДокумент3 страницыOffer Letter - Navneet JassiEr navneet jassiОценок пока нет

- Form16Документ5 страницForm16er_ved06Оценок пока нет

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro Limiteddeepak9976Оценок пока нет

- 3657 Atmpa0825cДокумент5 страниц3657 Atmpa0825cnithinmamidala999Оценок пока нет

- Form No. 16: Part AДокумент5 страницForm No. 16: Part APunitBeriОценок пока нет

- Class - XII CommerceДокумент8 страницClass - XII CommercehardikОценок пока нет

- InvoiceДокумент2 страницыInvoiceAnshul KatiyarОценок пока нет

- Processing 1099 in PayablesДокумент15 страницProcessing 1099 in PayablesKotesh Kumar100% (2)

- 02 Allowable DeductionsДокумент56 страниц02 Allowable DeductionsHazel ChatsОценок пока нет

- PEFA ReportДокумент238 страницPEFA ReportDaisy Anita SusiloОценок пока нет

- C.A Bharathidasan UniversityДокумент30 страницC.A Bharathidasan UniversityWise MoonОценок пока нет

- Up Land LawsДокумент22 страницыUp Land LawsLakshit100% (1)

- Options:: Short Questions & Answers On Accounting Standard 29Документ2 страницыOptions:: Short Questions & Answers On Accounting Standard 29Dhirendra Kumar Dhal100% (1)

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareДокумент43 страницыInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareNoman KhalidОценок пока нет

- April 2018 RIOC Board Meeting MaterialsДокумент62 страницыApril 2018 RIOC Board Meeting MaterialsrooseveltislanderОценок пока нет

- ResolutionNo25Seriesof2016 (AnnexA Part1)Документ76 страницResolutionNo25Seriesof2016 (AnnexA Part1)Janaisha Bai TitoОценок пока нет

- 2020 - ED - BED - 001-WPS OfficeДокумент3 страницы2020 - ED - BED - 001-WPS OfficeAmbroseОценок пока нет

- Ak564po1000109 PDFДокумент3 страницыAk564po1000109 PDFgopal thapaОценок пока нет

- 2007 Summer Great Peninsula Conservancy NewsletterДокумент8 страниц2007 Summer Great Peninsula Conservancy NewsletterGreat Peninsula ConservancyОценок пока нет

- Promotion of Bajaj Finance EMI Card at Future India Outlets: Summer Internship Project Report OnДокумент22 страницыPromotion of Bajaj Finance EMI Card at Future India Outlets: Summer Internship Project Report OnSushant PawarОценок пока нет

- CH 11 Fiscal Policy and The Federal BudgetДокумент15 страницCH 11 Fiscal Policy and The Federal BudgetNabeel IqbalОценок пока нет

- Jollibee Food Corp - Group 5-1Документ14 страницJollibee Food Corp - Group 5-1Joan Perolino MadejaОценок пока нет

- P&A by LCGSДокумент17 страницP&A by LCGSLaüreanne Camille G. Simsuangco100% (1)

- TNTC 100Документ1 страницаTNTC 100Chandrasekar PeriyasamyОценок пока нет

- Soneri Bank A-Report 2013 FinalДокумент144 страницыSoneri Bank A-Report 2013 FinalMuqaddas IsrarОценок пока нет

- Political Law Review BongLo - CASES IVДокумент27 страницPolitical Law Review BongLo - CASES IVJan VelascoОценок пока нет

- Part 2 Punjab Univeristy Syllabus Course OutlineДокумент16 страницPart 2 Punjab Univeristy Syllabus Course OutlineWasim JamaliОценок пока нет

- Cert TitleДокумент2 страницыCert TitleDavid Valenzuela MendozaОценок пока нет

- Tender 2076.077.02Документ163 страницыTender 2076.077.02Amit RouniyarОценок пока нет

- TB Chapter03 Analysis of Financial StatementsДокумент68 страницTB Chapter03 Analysis of Financial StatementsReymark BaldoОценок пока нет

- Book1 SannyДокумент24 страницыBook1 Sannyzeeshan ulhaqОценок пока нет

- Tax ReviewДокумент22 страницыTax ReviewMarky De AsisОценок пока нет

- As You Sow, 3 Studies On The Soucial Consecuences of Agri-BuisnessДокумент535 страницAs You Sow, 3 Studies On The Soucial Consecuences of Agri-BuisnessjimborenoОценок пока нет

- G.R. No. L-2934Документ3 страницыG.R. No. L-2934Randy LorenzanaОценок пока нет

- Double Taxation Relief in IndiaДокумент7 страницDouble Taxation Relief in IndianeegariОценок пока нет