Академический Документы

Профессиональный Документы

Культура Документы

Gold Report: Analyst: Hareesh V

Загружено:

hitesh315Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gold Report: Analyst: Hareesh V

Загружено:

hitesh315Авторское право:

Доступные форматы

19-Jun-13

GOLD REPORT

A Daily Outlook on Spot Gold Analyst: Hareesh V.

Visit us at www.geojitcomtrade.com

Outlook:

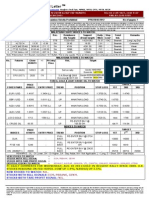

Spot gold inched lower after pausing in a tight range for the last few trading session as investors turned cautious ahead of the key US Federal Reserve policy meeting and on strong equities. The two day Federal Reserve meeting started yesterday and the policy statement is due later today followed by the Fed Chairman Bernankes news conference. Uncertainty whether the US Fed will scale back or halt its prevailing $85 billion bond buying program snapped support for gold. Earlier, the US Consumer Price Index showed inflation stabilizing in the country in May after a long decline. Meanwhile, physical demand for gold from the top consumer India is subdued as the peak marriage season ended and on stringent measures taken by the government to curb imports due to widening current account deficit. Previously, the Indian government had raised the import duty on gold by a third and restricted gold financing by banks. Demand from the second top buyer China too seems lackluster. At the same time, investment interest in gold still looks feeble with the SPDR Gold Trust, the worlds largest gold backed exchange traded fund, falling 0.2 percent yesterday to their lowest level in more than four years. A flat trading range is being witnessed inside $1398-1358 regions for the last couple of weeks. Enduring chart formation suggests that intraday bias should largely stay negative. Repeated and successful attempts to edge down below $1358 would take prices lower towards $1320 initially, which if given away would call for steep fall to $1280/1212 or more. A possible downside crossover in MACD and Bollinger Bands also signifies weakness in the counter. The 50,100 and 200 week moving averages suggest implied weakness as well. At the same time, inability to break the support of $1358 would call for choppy trading. A direct rise above $1408 would stretch the trend as far as $1421 but in a broader picture, it requires a close above $1510 for bigger rallies.

Trading strategies: Key levels for the day: Downside Immediate 1358/1338/1320/1280/1232 followed by 1212/1100 Upside Immediate: 1376/1392/1404/1421/1430/1448/1458-1462 followed by 1510. Sell on pullbacks to 1420 target 1392 SL above 1448. Sell on pullbacks to 1398 target 1372 SL above 1420. Sell below 1358 target 1340 SL above 1376. Sell below 1338 target 1280 SL above 1372 Buy above 1422 target 1442 SL below 1406. Buy above 1448 target 1488 SL 1414 Buy if unable to break 1358, target 1378 SL below 1352. Buy above 1392 target 1408 SL below 1378 Even as intraday bias looks feeble, breaking any of the sides of 1398-1358 regions would be required for suggesting fresh directional moves. MCX Aug: Intraday Levels are: Resistance seen at: 27980/28180/28350/28700/29200 Supports: 27800/27720/27500/27220/26950/26800

Page 1

Geojit Comtrade Limited 10th Floor, 34/659-P, Civil Line Road, Padivattom, Kochi-682 024, Kerala. Phone: 91 484 2901054/57 Email: customercare@geojitcomtrade.com, research@geojitcomtrade.com MCX Member code: 40220 FMC No.: MCX/TCM/CORP/1710, NCDEX Member code : 00920 FMC No.:NCDEX/TCM/CORP/0895, NMCE Member code : CL0324 FMC No.: NMCE/TCM/CORP/0245, ACE Member code: 6192 FMC No: ACEL/TCM/CORP/0429 NSEL Member Code : 12770

Disclaimer: Trading/investing in Commodity Derivatives involves considerable risk and you may lose part or all of the initial investment. It is not ideal for all types of investors, and you are advised to seek professional assistance before the same. Past performance may not necessarily be repeated in the future. The news and views posted on this report are based on information, which are believed to be accurate. They are provided to enable you to make your own investment decisions and should not be construed as investment advice. The author, directors and/or employees of Geojit Comtrade cannot be held responsible for the accuracy of the content posted on this report or for decisions taken by the readers based on such information.

Page 2

Вам также может понравиться

- Fred Tam News LetterДокумент7 страницFred Tam News LetterTan Lip SeongОценок пока нет

- Pid 14 MT23 160412Документ20 страницPid 14 MT23 160412Amol ChavanОценок пока нет

- 2012 01 09 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 09 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Commodity Market Newsletter 13-DecemberДокумент9 страницCommodity Market Newsletter 13-Decembertheequicom1Оценок пока нет

- Daily Market Commentary Sept 5Документ6 страницDaily Market Commentary Sept 5almakzomyОценок пока нет

- 2012 01 06 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 06 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Research Note Gold 14 Feb 2014Документ2 страницыResearch Note Gold 14 Feb 2014Pragneshjain20Оценок пока нет

- Weekly Commodity Report 16 SEP 2013 by EPIC RESEARCHДокумент5 страницWeekly Commodity Report 16 SEP 2013 by EPIC RESEARCHNidhi JainОценок пока нет

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyДокумент4 страницыRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470Оценок пока нет

- Technical Report 13th February 2012Документ5 страницTechnical Report 13th February 2012Angel BrokingОценок пока нет

- Gold Futures: 120 Mins Chart - Dec'11 ContractДокумент2 страницыGold Futures: 120 Mins Chart - Dec'11 ContractGaurav JaiswalОценок пока нет

- Free Commodity Market TipsДокумент9 страницFree Commodity Market TipsRahul SolankiОценок пока нет

- Equity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionДокумент3 страницыEquity Morning Note 12 August 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsОценок пока нет

- T I M E S: Markets Turn VolatileДокумент18 страницT I M E S: Markets Turn Volatileswapnilsalunkhe2000Оценок пока нет

- DGCX Gold Futures: Trading Ideas ForДокумент4 страницыDGCX Gold Futures: Trading Ideas Fornishyakasturi4829Оценок пока нет

- Free Prime Time Commodity TipsДокумент9 страницFree Prime Time Commodity TipsRahul SolankiОценок пока нет

- Weekly FX Insight: Citibank Wealth ManagementДокумент13 страницWeekly FX Insight: Citibank Wealth ManagementtrinugrohoОценок пока нет

- Commodity Market Trend With Market MovementДокумент9 страницCommodity Market Trend With Market MovementRahul SolankiОценок пока нет

- 2012 01 04 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 04 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- 2012 01 03 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 03 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Technical Format With Stock 14.12.2012Документ4 страницыTechnical Format With Stock 14.12.2012Angel BrokingОценок пока нет

- Money Times MagazineДокумент18 страницMoney Times MagazineAkshay Dujodwala0% (1)

- Ranges (Up Till 11.38am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.38am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Indian Commodity Market TrendДокумент9 страницIndian Commodity Market TrendRahul SolankiОценок пока нет

- Daily MCX Commodity Newsletter 24-DecemberДокумент9 страницDaily MCX Commodity Newsletter 24-Decembertheequicom1Оценок пока нет

- Commodity Market Movement and TipsДокумент9 страницCommodity Market Movement and TipsRahul SolankiОценок пока нет

- Weekly FX Insight: Citibank Wealth ManagementДокумент14 страницWeekly FX Insight: Citibank Wealth Managementngdaniel13029Оценок пока нет

- Technical Report 27th February 2012Документ5 страницTechnical Report 27th February 2012Angel BrokingОценок пока нет

- Alan Farley NewsletterДокумент12 страницAlan Farley NewsletterRamos LewisОценок пока нет

- Daily Commodity Market Tips Via ExpertsДокумент9 страницDaily Commodity Market Tips Via ExpertsRahul SolankiОценок пока нет

- Week in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Документ26 страницWeek in Review: Gold Fundamentals Are Intact. Current Prices Are A Buying Opportunity!Paolo GerosaОценок пока нет

- Equity Market Movement and UpdatesДокумент8 страницEquity Market Movement and UpdatesRahul SolankiОценок пока нет

- Ranges (Up Till 11.55am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Indian Commodity Market News and ReportДокумент9 страницIndian Commodity Market News and ReportRahul SolankiОценок пока нет

- MCX Tips On Gold and Silver 04-01-2012Документ8 страницMCX Tips On Gold and Silver 04-01-2012Theequicom AdvisoryОценок пока нет

- Daily Technical Report: Sensex (16973) / NIFTY (5146)Документ4 страницыDaily Technical Report: Sensex (16973) / NIFTY (5146)Angel BrokingОценок пока нет

- Gold Price Ponders Direction As The US Dollar and Treasury Yields Eye Higher Levels IG Bank SwitzerlandДокумент1 страницаGold Price Ponders Direction As The US Dollar and Treasury Yields Eye Higher Levels IG Bank Switzerlandrahal.manal2022Оценок пока нет

- Ranges (Up Till 12.08pm HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 12.08pm HKT) : Currency Currencyapi-290371470Оценок пока нет

- Better To Travel Than Arrive 20120522Документ4 страницыBetter To Travel Than Arrive 20120522Philip MorrishОценок пока нет

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Документ4 страницыDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingОценок пока нет

- Cross Asset: Technical VistaДокумент18 страницCross Asset: Technical VistaanisdangasОценок пока нет

- The Commodity Investor S 102885050Документ33 страницыThe Commodity Investor S 102885050Parin Chawda100% (1)

- Free Commodity MCX Market Research ReportДокумент9 страницFree Commodity MCX Market Research ReportRahul SolankiОценок пока нет

- Ranges (Up Till 11.50am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Daily Technical Analysis Report 20/october/2015Документ14 страницDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedОценок пока нет

- MCX Future Market News and TipsДокумент9 страницMCX Future Market News and TipsRahul SolankiОценок пока нет

- Assessment - 2 - S3867445 2Документ10 страницAssessment - 2 - S3867445 2ng kelvinОценок пока нет

- Commodity Market Trend 22 JuneДокумент9 страницCommodity Market Trend 22 JuneRahul SolankiОценок пока нет

- Daily-Commodity-Report 14 August 2013Документ8 страницDaily-Commodity-Report 14 August 2013Nidhi JainОценок пока нет

- Ranges (Up Till 11.50am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Technically Speaking - June 18, 2015Документ12 страницTechnically Speaking - June 18, 2015dpbasicОценок пока нет

- Commodity Market Updates 18 MayДокумент9 страницCommodity Market Updates 18 MayRahul SolankiОценок пока нет

- 2012 01 10 Migbank Daily Technical Analysis ReportДокумент15 страниц2012 01 10 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- Gold ForecastДокумент4 страницыGold ForecastPaul Michael AngeloОценок пока нет

- Markets in Panic Mode, 20th June 2013Документ6 страницMarkets in Panic Mode, 20th June 2013Angel BrokingОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-248643986Оценок пока нет

- 2011 12 02 Migbank Daily Technical Analysis ReportДокумент15 страниц2011 12 02 Migbank Daily Technical Analysis ReportmigbankОценок пока нет

- SBI Gold FundДокумент24 страницыSBI Gold FundsandeepbhutaniОценок пока нет

- Smart InvestmentДокумент8 страницSmart InvestmentManikantan K.RОценок пока нет

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Документ4 страницыThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021hitesh315Оценок пока нет

- TDS Nitoproof Damp Protect India2Документ2 страницыTDS Nitoproof Damp Protect India2hitesh315Оценок пока нет

- Nitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation CoatingДокумент2 страницыNitocote Wallguard: Elastomeric & Decorative Acrylic Water-Proofi NG Cum Anticarbonation Coatinghitesh315Оценок пока нет

- Don't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and InstrumentsДокумент1 страницаDon't Tinker With Your Long-Term Investment Plan. But It Is Always Better To Make Some Critical Changes, Based On New Tax Laws and Instrumentshitesh315Оценок пока нет

- N SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K JДокумент3 страницыN SF U D D e K SF M V H F J I K SV Z (E SV Y, o A, U T H Z) V R Aj K " V H C K T K J V R Aj K " V H C K T K Jhitesh315Оценок пока нет

- Commodity Market: 2018 BBU BBM BBL Weekly DailyДокумент2 страницыCommodity Market: 2018 BBU BBM BBL Weekly Dailyhitesh315Оценок пока нет

- Content: Market Highlights Day's Overview Outlook Important Events For TodayДокумент3 страницыContent: Market Highlights Day's Overview Outlook Important Events For Todayhitesh315Оценок пока нет

- Original Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal HerniaДокумент4 страницыOriginal Papers: Comparison of Shouldice and Lichtenstein Repair For Treatment of Primary Inguinal Herniahitesh315Оценок пока нет

- Dr. Chirag Pandya Year 2007Документ76 страницDr. Chirag Pandya Year 2007hitesh315Оценок пока нет

- Symbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790Документ3 страницыSymbol Positon Entry Entry Date & Time Stoploss Exit Kapas Long 796.50 10/11/14,15:45 790hitesh315Оценок пока нет

- Comparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal HerniaДокумент7 страницComparative Study Between Lichtenstein Patch Hernioplasty Versus Tailored Plug and Patch Hernioplasty As A Treatment of Inguinal Herniahitesh315Оценок пока нет

- Venous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose VeinsДокумент53 страницыVenous Disorder: Venous Thrombosis, Chronic Venous Insufficiency, Varicose Veinshitesh315Оценок пока нет

- Carcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, GotriДокумент55 страницCarcinoma of Penis: DR Hitesh Patel Associate Professor Surgery Department GMERS Medical College, Gotrihitesh3150% (1)

- Positional Call Nirmal BangДокумент1 страницаPositional Call Nirmal Banghitesh315Оценок пока нет

- Gold Short Term Report: StrategyДокумент3 страницыGold Short Term Report: Strategyhitesh315Оценок пока нет

- Commodities Weekly Outlook 16 12 13 To 20 12 13Документ6 страницCommodities Weekly Outlook 16 12 13 To 20 12 13hitesh315Оценок пока нет

- Copper Takes A Bullish Stance: Punter's CallДокумент3 страницыCopper Takes A Bullish Stance: Punter's Callhitesh315100% (1)

- RR 090620145Документ5 страницRR 090620145hitesh315Оценок пока нет

- Commodities Weekly Outlook 15 04 13 To 19 04 13Документ6 страницCommodities Weekly Outlook 15 04 13 To 19 04 13hitesh315Оценок пока нет

- Commodities Weekly Outlook 11 11 13 To 15 11 13 PDFДокумент6 страницCommodities Weekly Outlook 11 11 13 To 15 11 13 PDFhitesh315Оценок пока нет

- Commodities Weekly Outlook 10.12.2012 To 14.12.2012Документ5 страницCommodities Weekly Outlook 10.12.2012 To 14.12.2012hitesh315Оценок пока нет

- Commodities Weekly Tracker 10th June 2013Документ27 страницCommodities Weekly Tracker 10th June 2013hitesh315Оценок пока нет

- Commodities: I Vayda BazaarДокумент7 страницCommodities: I Vayda Bazaarhitesh315Оценок пока нет

- Mobike and Ofo: Dancing of TitansДокумент4 страницыMobike and Ofo: Dancing of TitansKHALKAR SWAPNILОценок пока нет

- Final Full Syllabus of ICAB (New Curriculum)Документ96 страницFinal Full Syllabus of ICAB (New Curriculum)Rakib AhmedОценок пока нет

- MarutiДокумент42 страницыMarutiVineet SinglaОценок пока нет

- Appendix 32 BrgyДокумент4 страницыAppendix 32 BrgyJovelyn SeseОценок пока нет

- Small Medium Enterprise (SME) PositioningДокумент31 страницаSmall Medium Enterprise (SME) Positioningnitish110009Оценок пока нет

- Advanced Cost and Management Accounting ConceptsДокумент17 страницAdvanced Cost and Management Accounting ConceptsharlloveОценок пока нет

- Rodrigo Rene Robles ResumeДокумент1 страницаRodrigo Rene Robles Resumeapi-530692408Оценок пока нет

- Chapter5 Project PlanningДокумент38 страницChapter5 Project PlanningSanchit BatraОценок пока нет

- Kasus 7.1 Mercator Corp.Документ3 страницыKasus 7.1 Mercator Corp.Septiana DA0% (3)

- Investment BankingДокумент62 страницыInvestment Bankingकपिल देव यादवОценок пока нет

- Er 2Документ2 страницыEr 2Komal Batra SethiОценок пока нет

- Test Code: ME I/ME II, 2009Документ15 страницTest Code: ME I/ME II, 2009paras hasijaОценок пока нет

- The Bombay Industrial Relations Act 1946Документ12 страницThe Bombay Industrial Relations Act 1946Pooja Bhavar100% (1)

- Marketing Management NotesДокумент57 страницMarketing Management NotesKanchana Krishna KaushikОценок пока нет

- CS Project Report PDFДокумент48 страницCS Project Report PDFswarajya lakshmi chepuri100% (2)

- 3.theory Base of Accounting NotesДокумент4 страницы3.theory Base of Accounting Notesjency.ijaОценок пока нет

- Quiz1 2, PrelimДокумент14 страницQuiz1 2, PrelimKyla Mae MurphyОценок пока нет

- Far 7 Flashcards - QuizletДокумент31 страницаFar 7 Flashcards - QuizletnikoladjonajОценок пока нет

- 810 Pi SpeedxДокумент1 страница810 Pi SpeedxtaniyaОценок пока нет

- BesorДокумент3 страницыBesorPaul Jures DulfoОценок пока нет

- Strategic MGMT HULДокумент10 страницStrategic MGMT HULTasha RobinsonОценок пока нет

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Документ1 страницаService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajОценок пока нет

- SAP SD Functional Analyst ResumeДокумент10 страницSAP SD Functional Analyst ResumedavinkuОценок пока нет

- Tax - Cases 1-15 - Full TextДокумент120 страницTax - Cases 1-15 - Full TextNoel RemolacioОценок пока нет

- 1.supply Chain MistakesДокумент6 страниц1.supply Chain MistakesSantosh DevaОценок пока нет

- Labor Bar Examination Questions 2018Документ34 страницыLabor Bar Examination Questions 2018xiadfreakyОценок пока нет

- Adjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedДокумент9 страницAdjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedShyam SunderОценок пока нет

- XXXXДокумент9 страницXXXXPrimaGriseldaОценок пока нет

- Monopolistic CompetitionДокумент36 страницMonopolistic CompetitionAmlan SenguptaОценок пока нет

- 1Документ343 страницы1GilОценок пока нет