Академический Документы

Профессиональный Документы

Культура Документы

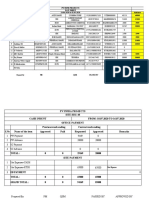

Dividend Yield Stocks CNX 200

Загружено:

vicky168Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dividend Yield Stocks CNX 200

Загружено:

vicky168Авторское право:

Доступные форматы

Dividend Yield Stocks CNX 200

March 28, 2013

Top 15 Dividend Picks out of CNX 200 Companies with dividend yield of 2% and above.

Sr

No Company

Dividend

(%) Latest

Dividend

TTM

52

52

(%) Equity EPS

Week Week Mkt Cap

Latest-1 Rs Cr

Rs High Rs Low Rs

Rs Cr

BSEQrtly

CMP FV Avg Vol

Rs Rs (In000)

5114.7 151.8

BV D/E Dividend

Rs Ratio

Yield % PE

1 Engineers India

120

100

168.5 18.9

266.0

151.0

21.9 56.4

0.0

4.0% 8.0

2 Rural Elec.Corp.

75

75

987.5 36.7

267.5

142.0

19324.6 195.7 10

201.1 149.9

5.8

3.8% 5.3

3 Union Bank (I)

80

80

661.6 32.4

288.0

150.1

14074.5 212.8 10

194.9 238.6

0.0

3.8% 6.6

4 Oil India

190

150

601.1 54.4

617.4

431.0

30634.1 509.6 10

64.0 301.1

0.0

3.7% 9.4

5 Coromandel Inter

700

700

28.3 17.2

304.8

191.3

21.6 84.8

1.0

3.6% 11.3

6 Coal India

100

39 6316.4 25.2

386.0

291.2 187943.3 297.6 10

271.2 64.0

0.0

3.4% 11.8

7 ONGC

195

175 4277.8 27.1

354.1

240.1 260601.1 304.6

458.2 159.5

0.1

3.2% 11.2

8 BPCL

110

140

723.1 25.0

449.0

315.6

26942.0 372.6 10

141.5 219.6

1.7

3.0% 14.9

9 GE Shipping Co

65

80

152.3 25.2

291.5

225.0

3499.6 229.8 10

13.7 393.7

1.0

2.8% 9.1

10 NTPC

40

38 8245.5 13.1

175.4

136.1 117415.4 142.4 10

527.8 90.2

0.8

2.8% 10.8

11 GAIL (India)

87

75 1268.5 30.6

396.0

303.1

39823.9 314.0 10

76.4 196.4

0.4

2.8% 10.2

5515.1 195.0

12 ACC

300

280

188.0 74.2

1515.0

1105.1

21729.8 1156.2 10

25.4 392.7

0.1

2.6% 15.6

13 Bank of Baroda

170

165

412.4 121.5

899.7

606.3

27223.3 660.2 10

101.1 692.7

0.0

2.6% 5.4

14 Bajaj Auto

450

400

289.4 104.9

2229.0

1423.1

52150.3 1802.2 10

27.5 210.2

0.1

2.5% 17.2

15 Power Grid Corpn

21.1

17.5 4629.7

124.5

100.1

48079.7 103.9 10

9.0

385.1 50.9

2.1

2.0% 11.5

DataSource: Capitaline

Other CNX 200 stocks with Dividend Yield of 2% and above.

Dividend

(%) Latest

270

200

59.3 11.0

142.0

72.6

2553.3

86.1

494.0 40.6

0.0

6.3% 7.8

2 Andhra Bank

55

55

559.6 22.9

130.0

89.7

5276.8

94.3 10

146.7 134.0

0.0

5.8% 4.1

3 Opto Circuits

30

45

242.3 23.8

216.9

43.2

1280.7

52.9 10

941.9 70.1

0.7

5.7% 2.2

4 Allahabad Bank

60

60

500.0 29.2

195.1

103.0

6342.9 126.9 10

223.7 214.4

0.0

4.7% 4.3

5 Indian Bank

75

75

429.8 38.0

244.4

152.0

7020.3 163.4 10

63.9 217.5

0.0

4.6% 4.3

6 IDBI Bank

35

35

1278.4 16.4

118.2

81.2 10

258.2 137.2

0.0

4.3% 4.9

7 Tata Steel

120

120

971.4

-0.6

482.0

313.5 30575.1 314.8 10

688.6 443.0

1.5

3.8% NA

8 IFCI

10

10

1660.8

3.1

43.9

24.0

4401.2

26.5 10

3749.2 33.1

4.6

3.8% 8.5

9 Chambal Fert.

19

19

416.2

8.8

84.8

47.4

2122.7

51.0 10

166.3 40.9

1.9

3.7% 5.8

6 12300.7

14.7 23986.4

19.5 10

Sr

No Company

1 Hexaware Tech.

10 NHPC Ltd

80.2 10374.4

2.1

29.4

320

311.5

489.5 27.6

274.5

12 Syndicate Bank

38

37

602.0 28.6

145.2

13 Power Fin.Corpn.

60

50

1320.0 29.9

227.0

14 S A I L

20

24

4130.5

7.2

101.8

15 Tata Chemicals

100

100

254.8 34.7

381.5

299.0

16 Punjab Natl.Bank

220

220

339.2 148.6

85

140

11 B H E L

17 H P C L

TTM

52

52

Equity EPS Week Week Mkt Cap

Rs Cr

Rs High Rs Low Rs

Rs Cr

BSEQrtly

CMP FV Avg Vol

Rs Rs (In000)

Dividend

(%)

Latest-1

BV D/E Dividend

Rs Ratio

Yield % PE

4341.9 23.3

0.6

3.6% 9.3

443.7 103.8

0.0

3.6% 6.5

6771.9 112.5 10

212.5 133.6

0.0

3.4% 3.9

139.0 23489.6 178.0 10

279.4 157.5

4.9

3.4% 6.0

63.0 10

462.1 97.5

0.5

3.2% 8.8

8183.5 321.2 10

69.1 251.9

1.0

3.1% 9.3

952.5

659.0 24554.9 724.0 10

95.7 820.3

0.0

3.0% 4.9

338.6 -63.2

381.4

275.3

9551.1 282.1 10

284.6 387.1

2.7

3.0% NA

4902.5

66.6 10

146.3 110.6

0.0

3.0% 6.6

306.0 16464.1 371.7 10

81.0 473.6

0.0

3.0% 5.5

4.0 780.0

0.0

2.8% 5.5

142.4 84.7

0.2

2.7% 13.7

178.0 43922.2 179.5

84.1

62.7 26022.3

18 Central Bank

20

25

736.1 10.1

107.1

19 Canara Bank

110

110

443.0 67.2

550.0

20 Bajaj Holdings

250

350

111.3 164.0

1058.0

730.0

21 PTC India

15

15

296.0

4.1

81.3

49.1

1645.8

55.6 10

22 India Infoline

75

150

58.0

8.2

93.4

44.1

1626.3

56.1

79.4 59.5

2.6

2.7% 6.8

400

350

86.9 36.8

207.9

148.2 13188.6 151.8

216.4 174.0

0.2

2.6% 4.1

24 India Cements

20

15

307.2

7.0

118.5

70.9

81.9 10

120.1 112.6

0.8

2.4% 11.7

25 Reliance Capital

75

65

246.0 35.6

508.0

282.0

7597.7 308.9 10

838.0 479.1

2.0

2.4% 8.7

70

70

574.5 51.3

392.2

253.8 16612.2 289.2 10

164.2 352.2

0.0

2.4% 5.6

190

175

197.0 16.9

493.9

176.8 15560.2 394.9

127.3 63.7

0.0

2.4% 23.4

23 Sesa Goa

26 Bank of India

27 Sun TV Network

Retail Research

62.3

9988.3 897.5 10

2515.8

28 Glaxosmit Pharma

500

450

84.7 80.1

29 Voltas

160

200

33.1

7.3

2520.0

138.5

1916.0 18248.2 2154.5 10

73.3

7.3 236.9

0.0

2.3% 26.9

75.1

272.1 44.7

0.1

30 United Phosp.

125

100

88.5 15.8

144.1

2.1% 10.3

105.0

5202.8 117.6

256.9 91.7

0.7

2.1% 7.4

9041.7 343.8 10

2481.9

31 Reliance Infra.

73

72

263.0 62.6

621.9

334.2

32 Ambuja Cem.

180

160

308.4 10.2

220.7

135.6 26710.9 173.2

35

35

117.3 29.7

258.7

200

175

46.6 14.6

347.0

33 Dewan Housing

34 Bharat Forge

445.1 898.5

0.6

2.1% 5.5

165.0 57.0

0.0

2.1% 16.9

142.3

1983.9 169.1 10

43.0 158.6

11.3

2.1% 5.7

200.0

4676.8 200.9

69.6 93.8

1.0

2.0% 13.8

DataSource: Capitaline

Note:

1. CMP as on 25th March 2013, EPS, BV and D/E are consolidated wherever applicable.

2. Unforeseen deterioration in performance could affect dividend payouts and consequently the dividend yields.

3. Companies which have declared Special/extraordinary dividends in recent past have been excluded

HDFC securities Limited, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station,

Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435

Disclaimer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This

document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy

any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be

relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time

solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional

Clients only.

Retail Research

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Nama RamayanaДокумент7 страницNama Ramayanavicky168Оценок пока нет

- Ali Zaki Haider Khan On Carrying Forward The Legacy of The Rudra VeenaДокумент2 страницыAli Zaki Haider Khan On Carrying Forward The Legacy of The Rudra Veenavicky168Оценок пока нет

- Raga EmotionДокумент2 страницыRaga Emotionvicky168Оценок пока нет

- Granth Sahib 59Документ2 страницыGranth Sahib 59vicky168Оценок пока нет

- Granth Sahib 58Документ2 страницыGranth Sahib 58vicky168Оценок пока нет

- Granth Sahib 38Документ2 страницыGranth Sahib 38vicky168Оценок пока нет

- Granth Sahib 37Документ2 страницыGranth Sahib 37vicky168Оценок пока нет

- Granth Sahib 36Документ2 страницыGranth Sahib 36vicky168Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- HR Database MumbaiДокумент35 страницHR Database MumbaiMohit Sondhi67% (3)

- PV Infr Projects Pay Sheet 24.04.2020 To 01.05.2020 Advance 40000 35000 2000 20000Документ107 страницPV Infr Projects Pay Sheet 24.04.2020 To 01.05.2020 Advance 40000 35000 2000 20000Senthil kОценок пока нет

- Aug 09Документ25 страницAug 09btsopsinghОценок пока нет

- CPSPM 6161040 1711919242Документ138 страницCPSPM 6161040 1711919242skhushbusahniОценок пока нет

- Branches With Corporate Banking ServicesДокумент9 страницBranches With Corporate Banking ServicesGaurav ShahОценок пока нет

- BWG B Si - 91772 1Документ1 страницаBWG B Si - 91772 1Azaz ShaikhОценок пока нет

- About Maharashtra Industrial Development Corporation (MIDC)Документ20 страницAbout Maharashtra Industrial Development Corporation (MIDC)Hrishikesh JoshiОценок пока нет

- Performance Management System in The Hospitality IndustryДокумент10 страницPerformance Management System in The Hospitality Industrybhautikbschoolstudy50% (2)

- Demonetisation & It's Impact On Indian Economy (Roll Nos.-06,39,53)Документ18 страницDemonetisation & It's Impact On Indian Economy (Roll Nos.-06,39,53)Prakash RoyОценок пока нет

- SMS Codes Decoding.Документ3 страницыSMS Codes Decoding.DESH RAJ BHANDARIОценок пока нет

- ToДокумент4 страницыToMohamed ThoufiqОценок пока нет

- List of Empanelled Service Providers LucknowДокумент3 страницыList of Empanelled Service Providers LucknowAmaan KhanОценок пока нет

- 1-25 ET 500 Company List 2022Документ2 страницы1-25 ET 500 Company List 20220000000000000000Оценок пока нет

- A1 Merged PDFДокумент121 страницаA1 Merged PDFMahesh BabuОценок пока нет

- 23 Delhi NCR DataДокумент35 страниц23 Delhi NCR DataDeep Kumar100% (1)

- E-Way Bill AISINДокумент1 страницаE-Way Bill AISINrahulgupta2101Оценок пока нет

- A Successful BusinessmanДокумент3 страницыA Successful BusinessmanPrakash GetzОценок пока нет

- New India Factbook - WEF DAVOS Jan 2023Документ28 страницNew India Factbook - WEF DAVOS Jan 2023shwetapradhanОценок пока нет

- Guesstimate Ultimate Cheet Sheet 1694522134Документ8 страницGuesstimate Ultimate Cheet Sheet 1694522134Aditya SinhaОценок пока нет

- BeneficiaryDetailForSocialAuditReport ALLCS 1813009 2019-2020Документ2 страницыBeneficiaryDetailForSocialAuditReport ALLCS 1813009 2019-2020Dipak Madhukar KambleОценок пока нет

- Mining Sector in IndiaДокумент6 страницMining Sector in IndiaSAMAYAM KALYAN KUMARОценок пока нет

- Leather Industry Report 1transparentДокумент18 страницLeather Industry Report 1transparentvikramullalОценок пока нет

- Indian Petroleum Industry ResearchДокумент30 страницIndian Petroleum Industry Researchabhijitsamanta1100% (3)

- CEOДокумент5 страницCEOPriyaranjan Pradhan0% (1)

- Airline IndustryДокумент11 страницAirline IndustryRahul Jagwani100% (1)

- Sl. No. Institution Code Institution Name: Public Sector BanksДокумент21 страницаSl. No. Institution Code Institution Name: Public Sector BanksRaja BeastmasterОценок пока нет

- Monthly MAD Compilation 1Документ58 страницMonthly MAD Compilation 1NRОценок пока нет

- Rapido Auto - Railway STN To OfcДокумент3 страницыRapido Auto - Railway STN To OfcShaik MastanvaliОценок пока нет

- SWOT Analysis of Indian EconomyДокумент11 страницSWOT Analysis of Indian EconomyArathi BmОценок пока нет

- Wirc Directory 2021 FinalДокумент214 страницWirc Directory 2021 Finalsonuv1005880% (1)