Академический Документы

Профессиональный Документы

Культура Документы

Commisson

Загружено:

Abhishek SinghОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Commisson

Загружено:

Abhishek SinghАвторское право:

Доступные форматы

Agents commission in Insurance Policies ?

by Manish Chauhan 173 comments

4

In this article we will see the commission structure of Insurance Policies . We will look at Endowment/Moneyback/ULIP plans and how much commission an agent earns per year out of those policies , We looked at Mutual funds commission earlier and now lets see how much commission an agent earns from Insurance policies. As per Insurance Act, 1938, The insurance companies are allowed to pay a maximum commission of 40 per cent of the first years premium, 7.5 per cent of the second years premium and 5 per cent from there on. The commission paid is limited to 2 per cent in case of single premium policies. In case of pension plans, the commission is limited to 7.5 per cent of the first years premium and 2 per cent there on. Currently most of the policies are very much paying these kind of commissions . Let us quickly look some of the facts on Life Insurance .

Average sum assured of the insured Indian is around Rs 90,000 1 trillion worth of policies lapsed in 2008-09 , this is mostly because investors have discarded their old policies to buy new ones , thanks to agents who tell people about another hot plan in market. Another reason is that investors buy policies which have higher premium than what they can afford in reality and later feel that its time to stop it .

India Insurance penetration is around 7.5% of global numbers . i.e: 0.16% of the GDP, which is , against a global average of 2.14 As per IRDA report 2008-09 , Insurance Industry had 29.37 lakh agents by the end of Mar 2009 , out of which 13 lakh agents were added during 2008-09 . Note : You might also be interested in understanding How commissions in Mutual Funds is calculated . Life Insurance Commission Example

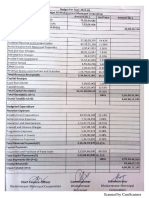

Policy Type

Endowment / Term Plans Endowment / Term Plans Endowment / Term Plans Endowment / Term Plans

Premium Paying Term

15+ yrs 10-14 yrs 5-9 yrs Single Premium

Upfront Commission (1st Year)

25% 35% * 20% 28% * 14% 2%

Trail Trail Commission Commission (2nd & 3rd yr) (from 4th yr)

7.5% 7.5% 5% 0% 5% 5% 5% 0%

Money Back ULIPs ULIPs

15+ yrs Regular Premium Single premium

15% 21% * 20 40% 2%

10% 2% 0%

5% 2% 0%

Note : Some of the numbers are in range, which means the commission can lie between that range . Mostly its minimum commission + Bonus if any

Example

Policy Type : Endowment Policy Premium Paying Term : 20 Yrs Premium/Year : Rs 1 Lacs Agents Commission

Year

1st Year 2nd Year 4-20th Year Total

Commission Amount

Rs 35,000 Rs 15,000 Rs 85,000 Rs 1.35 Lacs

Method

1 X 35% 2 X 7.5% 17 X 5% 6.75%

Q: So are you imaging which is more costly ? Mutual funds or Insurance Policies ? Ans: Its Mutual Funds (Read More) , Read subramoneys article on this topic.

How to use this information ? Agents have to make sure that they follow-up with clients and track the premium payment, this leads to overheads and regular feedback from agents side , apart from that there are operational expenses incurred by agents , so we should not forget those points . As a customer , you should be knowing how much an agent is making out of you , this should form the basis of the quality service for you . An agent should help you understand your Insurance requirement and provide you the best solution , He should assist you in buying the Policy and over the years he should update you/ help you with all the changes . Hot discussion topic As per a govt-appointed committee , Insurance commissions should totally be removed by 2011 . Immediately the upfront commissions embedded in the premium paid (to agents by insurance companies) be cut to no more than 15 per cent of the premium. This should fall to 7 per cent in 2010 and become nil by April 2011, said the consultation paper prepared by Committee on Investor Awareness and Protection. (Link) .

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Types of AccountsДокумент5 страницTypes of AccountsAbhishek SinghОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- M&A ListДокумент9 страницM&A ListAbhishek SinghОценок пока нет

- Fundamentals of OrganisingДокумент26 страницFundamentals of OrganisingAbhishek SinghОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Presentation 1Документ16 страницPresentation 1Abhishek SinghОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Presentation 1Документ16 страницPresentation 1Abhishek SinghОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Bank Statement PDFДокумент5 страницBank Statement PDFIrfanLoneОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Fin 630 Exam 1Документ19 страницFin 630 Exam 1jimmy_chou1314Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- IBT Lesson3Документ17 страницIBT Lesson3Melvin Ray M. MarisgaОценок пока нет

- Collateral Allocation MechanismsДокумент3 страницыCollateral Allocation MechanismsaОценок пока нет

- ASY Aisa: Mobile BankingДокумент17 страницASY Aisa: Mobile BankingFaraz Alam100% (2)

- BSBTEC601 - Review Organisational Digital Strategy: Task SummaryДокумент8 страницBSBTEC601 - Review Organisational Digital Strategy: Task SummaryHabibi AliОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Case Study LeanДокумент2 страницыCase Study LeanAnkur DhirОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Marketing Process: Analysis of The Opportunities in The MarketДокумент7 страницMarketing Process: Analysis of The Opportunities in The Marketlekz reОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Chapter 4 The Age of IndustrialisationДокумент11 страницChapter 4 The Age of IndustrialisationMaria JohncyОценок пока нет

- Study Id55490 FurnitureДокумент161 страницаStudy Id55490 Furniturekavish jainОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Analysis of Financial Statements in Insurance Companies - Final VersionДокумент17 страницAnalysis of Financial Statements in Insurance Companies - Final VersionKulenović FarahОценок пока нет

- Case PDFДокумент11 страницCase PDFm parivahanОценок пока нет

- Indonesias Changing Economic GeographyДокумент53 страницыIndonesias Changing Economic Geographyhyukkie1410Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Xii-Abt Exam Question Bank 2024Документ2 страницыXii-Abt Exam Question Bank 2024thombareakshay644Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Valuation Workbook 7Th Edition Mckinsey Company Inc All ChapterДокумент56 страницValuation Workbook 7Th Edition Mckinsey Company Inc All Chaptergerald.chamberland888100% (2)

- C30cy - May - P2021 - 2022-TZ2Документ2 страницыC30cy - May - P2021 - 2022-TZ2MeiliaОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Ch10 PindyckДокумент101 страницаCh10 PindyckNaveed DaarОценок пока нет

- Budget 2019-20Документ21 страницаBudget 2019-20Pranati ReleОценок пока нет

- Flinder Valves and Controls Inc.: Case 50Документ29 страницFlinder Valves and Controls Inc.: Case 50SzilviaОценок пока нет

- CIMB Strategy BriefДокумент328 страницCIMB Strategy BriefLesterОценок пока нет

- MTS - Application Form PrintДокумент4 страницыMTS - Application Form PrintSaqib RazaОценок пока нет

- C R L P A E: Hapter 2 Ajasthan: And, Eople ND ConomyДокумент26 страницC R L P A E: Hapter 2 Ajasthan: And, Eople ND ConomyprernajasujaОценок пока нет

- Regulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinerДокумент33 страницыRegulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinermarhelunОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Annual Report 2015-2016: Our MissionДокумент219 страницAnnual Report 2015-2016: Our MissionImtiaz ChowdhuryОценок пока нет

- Engineering Management: PlanningДокумент12 страницEngineering Management: PlanningDozdiОценок пока нет

- Accounting, Unit 1 - Topic 2 (Students)Документ64 страницыAccounting, Unit 1 - Topic 2 (Students)Teal Jacobs100% (1)

- Linkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsДокумент11 страницLinkedin 7 Ways Sales Professionals Drive Revenue With Social Selling en UsJosiah PeaceОценок пока нет

- Accounting Concepts: Unit 11Документ24 страницыAccounting Concepts: Unit 11LuhenОценок пока нет

- 4strategic Analysis ToolsДокумент14 страниц4strategic Analysis ToolsHannahbea LindoОценок пока нет

- Organization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperДокумент2 страницыOrganization of Commerce and Management March 2018 STD 12th Commerce HSC Maharashtra Board Question PaperJijo AbrahamОценок пока нет