Академический Документы

Профессиональный Документы

Культура Документы

Illustrative Bank Branch Audit Format

Загружено:

nil sheИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Illustrative Bank Branch Audit Format

Загружено:

nil sheАвторское право:

Доступные форматы

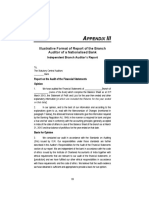

APPENDIX

An Illustrative Format of Report of the Branch Auditor of a Nationalised Bank

Independent Bank Branch Auditors Report

To, The Statutory Central Auditors ________ Bank Report on Financial Statements 1. We have audited the accompanying Financial Statements of _______________Branch of ____________ (name of the Bank) which comprise the Balance Sheet as at 31st March 20XX, Profit and Loss Account for the year then ended, and other explanatory information. Managements Responsibility for the Financial Statements: 2. Management of the Branch is responsible for the preparation of these Financial Statements that give true and fair view of the financial position and financial performance of the Branch in accordance with the Banking Regulation Act, complying with Reserve Bank of India Guidelines from time to time. This responsibility includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of the financial statements that are free from material misstatement, whether due to fraud or error. Auditors Responsibility: 3. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. 4. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The Procedures selected depend on the auditors judgement, including the assessment of the risks of material misstatement of the financial statement, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entitys preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of accounting policies

30

Guidance Note on Audit of Banks (Revised 2013) used and the reasonableness of the accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. 5. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our Audit opinion. Opinion 6. In our opinion, and to the best of our information and according to the explanation given to us, read with the Memorandum of Changes mentioned in paragraph 11 below, the financial statements give a true and fair view in conformity with the accounting principles generally accepted in India: (a) in the case of the Balance Sheet, of the state of affairs of the Branch as at March 31, 20XX; and (b) in the case of Profit and Loss Account, of the Profit / Loss for the year ended on that date; Report on Other Legal and Regulatory Requirements 7. The Balance Sheet and the Profit and Loss Account have been drawn up in accordance with Section 29 of the Banking Regulation Act, 1949; 8. Subject to the limitations of the audit as indicated in Paragraphs 3 to 5 above and paragraph 10 below, we report that: a. We have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of the audit and have found them to be satisfactory. The transactions of the branch which have come to my/our notice have been within the powers of the Bank. We further report that: the Balance Sheet and Profit and Loss account dealt with by this report are in agreement with the books of account and returns; in our opinion, proper books of account as required by law have been kept by the branch so far as appears from our examination of those books;

b. 9. a. b.

Other Matters 10. No adjustments/provisions have been made in the accounts of the Branch in respect of matters usually dealt with at Central Office, including in respect of: (a) (b) Bonus, ex-gratia, and other similar expenditure and allowances to branch employees; Terminal permissible benefits to eligible employees on their retirement (including additional retirement benefits), Gratuity, Pension, liability for leave

31

Appendices encashment benefits and other benefits covered in terms of AS 15 Employee Benefits issued by the Institute of Chartered Accountants of India; (c) (d) (e) (f) (g) (h) (i) Arrears of salary/wages/allowances, if any, payable to staff; Staff welfare contractual obligations; Old unreconciled/unlinked entries at debit under various heads comprising Inter branch/office Adjustments; Interest on overdue term deposits; Depreciation on fixed assets; Auditors fees and expenses; Taxation (Current Tax and Deferred Tax).

11. The following is a summary of Memorandum of Changes submitted by us to the branch management1. Memorandum of Changes (summary) No. Increase In respect of Income In respect of expenditure In respect of Assets In respect of Liabilities In respect of Gross NPAs In respect of Provision on NPAs2 In respect of Classification of Advances In respect of Risk Weighted Assets Other items (if any) Decrease

a. b. c. d. e. f. g. h. i.

For ABC and Co. Chartered Accountants Signature (Name of the Member Signing the Audit Report) (Designation)3 Membership Number

1 2 3

Where applicable. Applicable in cases where banks determine provision at Branch level. Partner or proprietor as the case may be.

32

Guidance Note on Audit of Banks (Revised 2013) Firm registration number Place of Signature Date

33

Вам также может понравиться

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОт EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОценок пока нет

- Illustrative Bank Branch Audit FormatДокумент3 страницыIllustrative Bank Branch Audit FormatAjay UpadhyayОценок пока нет

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"От Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Оценок пока нет

- Illustrative Branch Audit Report FormatДокумент5 страницIllustrative Branch Audit Report FormatCA K Vijay SrinivasОценок пока нет

- Concurrent Audit Certificate 2017 PDFДокумент3 страницыConcurrent Audit Certificate 2017 PDFSuresh SharmaОценок пока нет

- A Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaДокумент6 страницA Hand Book On Statutory Bank Branch Audit - Rajkumar S. AdukiaCA Lokesh MaheshwariОценок пока нет

- Report On The Financial Statements: StandaloneДокумент9 страницReport On The Financial Statements: StandaloneAbdul aОценок пока нет

- Independent Auditor'S Report: (For Listed Companies)Документ4 страницыIndependent Auditor'S Report: (For Listed Companies)AdindaОценок пока нет

- Website Citibank Financials 2020Документ85 страницWebsite Citibank Financials 2020Sankar RamОценок пока нет

- AmendmentДокумент17 страницAmendmentprinceramji90Оценок пока нет

- Audit Report Format - Companies Act 2013Документ4 страницыAudit Report Format - Companies Act 2013Suresh KadamОценок пока нет

- DLF Limited Auditor's Report AnalysisДокумент6 страницDLF Limited Auditor's Report AnalysisAvinash MulikОценок пока нет

- I Cai ReportДокумент22 страницыI Cai ReportInsta SickОценок пока нет

- Auditor Report FinancialsДокумент5 страницAuditor Report FinancialsJimitОценок пока нет

- To The Chief Executive Officer Bank of America N.A. (India Branches)Документ53 страницыTo The Chief Executive Officer Bank of America N.A. (India Branches)aditya tripathiОценок пока нет

- Annual Report 2012-13 PDFДокумент48 страницAnnual Report 2012-13 PDFAbhinav PrakashОценок пока нет

- 1197astra AR 19-20 Final Organized PDFДокумент8 страниц1197astra AR 19-20 Final Organized PDFelenaОценок пока нет

- Singapore Standard On AuditingДокумент14 страницSingapore Standard On AuditingbabylovelylovelyОценок пока нет

- Bank Audit Engagement LetterДокумент12 страницBank Audit Engagement LetterYhatunОценок пока нет

- Independent Auditors ReportДокумент4 страницыIndependent Auditors ReportMy NameОценок пока нет

- Audit Report New FormateДокумент4 страницыAudit Report New FormateVvs SastryОценок пока нет

- Independent Auditors' ReportДокумент14 страницIndependent Auditors' ReportNikhil KasatОценок пока нет

- Auditors' Report AnalysisДокумент3 страницыAuditors' Report AnalysisIshleen J. AhujaОценок пока нет

- BKT Tyres Limited Annual Report 2021-22Документ17 страницBKT Tyres Limited Annual Report 2021-22Madhusudan DubeyОценок пока нет

- Agrani Bank 2010Документ78 страницAgrani Bank 2010Shara Binte Hamid100% (1)

- 1Документ35 страниц1Rommel CruzОценок пока нет

- Special Purpose Audit ReportsДокумент7 страницSpecial Purpose Audit Reportsbless villahermosaОценок пока нет

- Comm - Ica Asa510 App1ill1Документ3 страницыComm - Ica Asa510 App1ill1Hay JirenyaaОценок пока нет

- To The Chief Executive Officer Bank of America N.A. (India Branches)Документ51 страницаTo The Chief Executive Officer Bank of America N.A. (India Branches)Shiva NandОценок пока нет

- Audit Report 18-19Документ6 страницAudit Report 18-19deepanshuca100Оценок пока нет

- Greenko Rego FS March-2022Документ13 страницGreenko Rego FS March-2022vineminaiОценок пока нет

- Singapore Standard On AuditingДокумент14 страницSingapore Standard On AuditingbabylovelylovelyОценок пока нет

- New Audit Report Format Including Caro 2016 by AniketДокумент10 страницNew Audit Report Format Including Caro 2016 by AniketarjunmarwadiОценок пока нет

- Financial StatementДокумент7 страницFinancial StatementEunice SorianoОценок пока нет

- OCL Standalone FS March+2021Документ84 страницыOCL Standalone FS March+2021NarayanPrajapatiОценок пока нет

- Kotak Mahindra Bank Limited - Standalone - 2016Документ74 страницыKotak Mahindra Bank Limited - Standalone - 2016Anonymous 6TyOtlОценок пока нет

- Icai PDFДокумент5 страницIcai PDFsimran. sОценок пока нет

- Module - 2 Auditor'S Report: Objectives of The AuditorДокумент20 страницModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarОценок пока нет

- New Audit Report Format Including CARO 2016Документ8 страницNew Audit Report Format Including CARO 2016CA Shivang SoniОценок пока нет

- Reliance BP Mobility LimitedДокумент63 страницыReliance BP Mobility LimitedMaheshОценок пока нет

- ICAI Appendices of Section A - 3Документ70 страницICAI Appendices of Section A - 3booksanand1Оценок пока нет

- .V Porwal: J IA Auto Components LTDДокумент12 страниц.V Porwal: J IA Auto Components LTDShyam SunderОценок пока нет

- Indiawin Sports Private LimitedДокумент37 страницIndiawin Sports Private LimitedAnna AugustineОценок пока нет

- Audit SBIДокумент5 страницAudit SBIanshul prakashОценок пока нет

- Audit Prsentation On WiproДокумент9 страницAudit Prsentation On WiproNaina ChaudharyОценок пока нет

- DHFL PRAMERICA LIFE INSURANCE FINANCIALSДокумент162 страницыDHFL PRAMERICA LIFE INSURANCE FINANCIALSmayurbuddyОценок пока нет

- Annual Report 2022Документ72 страницыAnnual Report 2022Sandesh ShettyОценок пока нет

- TVS Audit ReportДокумент5 страницTVS Audit ReportYashasvi MohandasОценок пока нет

- Auditor's Report - FORMAT 2022 WITHOUT CAROДокумент5 страницAuditor's Report - FORMAT 2022 WITHOUT CAROkannan associatesОценок пока нет

- 01 A AI Letter To Branch Management pg1-18Документ18 страниц01 A AI Letter To Branch Management pg1-18Nitesh kumarОценок пока нет

- Ssispl - Audit Report - Fy20-21Документ7 страницSsispl - Audit Report - Fy20-21flashfiction319Оценок пока нет

- Gaap and AuditДокумент35 страницGaap and AuditAayushi AroraОценок пока нет

- Auditing CIA 1Документ9 страницAuditing CIA 1Kalyani JayakrishnanОценок пока нет

- ISA 700 705 706 Audit Report UpdatedДокумент28 страницISA 700 705 706 Audit Report UpdatedAshraf Uz ZamanОценок пока нет

- Jio Limited: Financial StatementsДокумент27 страницJio Limited: Financial StatementsAbhishek BajoriaОценок пока нет

- Principles of Audit and AssuranceДокумент20 страницPrinciples of Audit and AssuranceUnique OfficialsОценок пока нет

- Report On The Consolidated Financial Statements 1Документ3 страницыReport On The Consolidated Financial Statements 1muradОценок пока нет

- Auditor Report Financials Unlisted CoДокумент15 страницAuditor Report Financials Unlisted CoRajiv JayaswalОценок пока нет

- Audit Report With CARO For PVT LTDДокумент5 страницAudit Report With CARO For PVT LTDSURYA SОценок пока нет

- Jio Platforms Limited Financial Statements 2020-21Документ47 страницJio Platforms Limited Financial Statements 2020-21Abhishek BajoriaОценок пока нет

- Co Act 2013 Good PresentationДокумент117 страницCo Act 2013 Good Presentationnil sheОценок пока нет

- Final Bank Branch Audit 2012Документ127 страницFinal Bank Branch Audit 2012nil she100% (1)

- Clss 2014Документ7 страницClss 2014nil sheОценок пока нет

- HT MYNM CatalogueДокумент32 страницыHT MYNM CatalogueKanchan ZopeОценок пока нет

- Draft Guidance Note On Revised Schedule ViДокумент151 страницаDraft Guidance Note On Revised Schedule Vinil sheОценок пока нет

- Import Export GlossaryДокумент47 страницImport Export Glossarynil sheОценок пока нет

- Checklistforprivatecompanies 1Документ5 страницChecklistforprivatecompanies 1nil sheОценок пока нет

- Sumproduct From XlDynamicДокумент24 страницыSumproduct From XlDynamicnil sheОценок пока нет

- RGESS Tax Scheme ExplainedДокумент16 страницRGESS Tax Scheme Explainednil sheОценок пока нет

- Wipro AR07 - 08Документ132 страницыWipro AR07 - 08pkpraveenОценок пока нет

- ProverbsДокумент67 страницProverbsjdmanorОценок пока нет

- Rewards CatalogueДокумент12 страницRewards Cataloguenil sheОценок пока нет

- 5 Tax Law NotesДокумент37 страниц5 Tax Law NotesVivek ReddyОценок пока нет

- Communicating The American WayДокумент180 страницCommunicating The American Waypjfrancisco100% (9)

- Introduction To Foreign ExchangeДокумент17 страницIntroduction To Foreign Exchangepstmdrn2gОценок пока нет

- Tax Calander 2011Документ13 страницTax Calander 2011bharatОценок пока нет

- Yoga ClassДокумент43 страницыYoga Classnil sheОценок пока нет

- Gregory University Library Assignment on Qualities of a Reader Service LibrarianДокумент7 страницGregory University Library Assignment on Qualities of a Reader Service LibrarianEnyiogu AbrahamОценок пока нет

- Salford Care Organisation Job Description & Person SpecificationДокумент14 страницSalford Care Organisation Job Description & Person SpecificationAyesha EhsanОценок пока нет

- The Daily Tar Heel For September 18, 2012Документ8 страницThe Daily Tar Heel For September 18, 2012The Daily Tar HeelОценок пока нет

- Horizontal Machining Centers: No.40 Spindle TaperДокумент8 страницHorizontal Machining Centers: No.40 Spindle TaperMax Litvin100% (1)

- DBIRS SyllabusДокумент2 страницыDBIRS SyllabusAshitosh KadamОценок пока нет

- Elective Course (2) - Composite Materials MET 443Документ16 страницElective Course (2) - Composite Materials MET 443يوسف عادل حسانينОценок пока нет

- Degree and Order of ODEДокумент7 страницDegree and Order of ODEadiba adibОценок пока нет

- 2019 IL and Federal Pharmacy Law Review PDFДокумент176 страниц2019 IL and Federal Pharmacy Law Review PDFAnonymous 3YNJfYNQ100% (5)

- Defining Public RelationsДокумент4 страницыDefining Public RelationsKARTAVYA SINGHОценок пока нет

- Kara&Suoglu ProjectreportДокумент4 страницыKara&Suoglu ProjectreportRicard Comas xacnóОценок пока нет

- Detailed Lesson Plan in MAPEH III I. ObjectivesДокумент19 страницDetailed Lesson Plan in MAPEH III I. ObjectivesJenna FriasОценок пока нет

- Jeremy Hughes ReviewДокумент5 страницJeremy Hughes ReviewgracecavОценок пока нет

- PA2 Value and PD2 ValueДокумент4 страницыPA2 Value and PD2 Valueguddu1680Оценок пока нет

- PPM To Percent Conversion Calculator Number ConversionДокумент1 страницаPPM To Percent Conversion Calculator Number ConversionSata ChaimongkolsupОценок пока нет

- History of English Prose PDFДокумент21 страницаHistory of English Prose PDFMeisyita QothrunnadaОценок пока нет

- Security Testing MatДокумент9 страницSecurity Testing MatLias JassiОценок пока нет

- How To Oven and Sun Dry Meat and ProduceДокумент12 страницHow To Oven and Sun Dry Meat and ProduceLes BennettОценок пока нет

- D2DДокумент2 страницыD2Dgurjit20Оценок пока нет

- Bolt Jul 201598704967704 PDFДокумент136 страницBolt Jul 201598704967704 PDFaaryangargОценок пока нет

- Professional Builder - Agosto 2014Документ32 страницыProfessional Builder - Agosto 2014ValОценок пока нет

- Socio-cultural influences on educationДокумент4 страницыSocio-cultural influences on educationofelia acostaОценок пока нет

- Reasons Why Coca Cola Has A Large Market Share in Kenya and The WorldДокумент9 страницReasons Why Coca Cola Has A Large Market Share in Kenya and The WorldAludahОценок пока нет

- OM - Rieter - UNIMix A76Документ321 страницаOM - Rieter - UNIMix A76Phineas FerbОценок пока нет

- Unitisation of Legal Methodsalsdkgh GHNJFKL A SDFG LKJH Asdfgf Lkjhasdfg LKKJ Asdfg LKJH A Slkjfs Aaaaaaaaaaaaslkdfj Asldkjf SLDKFJДокумент3 страницыUnitisation of Legal Methodsalsdkgh GHNJFKL A SDFG LKJH Asdfgf Lkjhasdfg LKKJ Asdfg LKJH A Slkjfs Aaaaaaaaaaaaslkdfj Asldkjf SLDKFJKailashnath Reddy AjjuguttuОценок пока нет

- Ir Pc-1: Pre-Check (PC) Design Criteria For Freestanding Signs and Scoreboards: 2019 CBCДокумент15 страницIr Pc-1: Pre-Check (PC) Design Criteria For Freestanding Signs and Scoreboards: 2019 CBCAbrar AhmadОценок пока нет

- Videocon ProjectДокумент54 страницыVideocon ProjectDeepak AryaОценок пока нет

- b2 Open Cloze - Western AustraliaДокумент3 страницыb2 Open Cloze - Western Australiaartur solsonaОценок пока нет

- Biotox Gold 2.0-2021 Relaunch ReviewДокумент6 страницBiotox Gold 2.0-2021 Relaunch ReviewChinthaka AbeygunawardanaОценок пока нет

- The Case of Ataraxia and Apraxia in The Development of Skeptic THДокумент11 страницThe Case of Ataraxia and Apraxia in The Development of Skeptic THeweОценок пока нет

- 50 Ways To Balance MagicДокумент11 страниц50 Ways To Balance MagicRodolfo AlencarОценок пока нет

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceОт EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceРейтинг: 4 из 5 звезд4/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideОт Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideРейтинг: 2.5 из 5 звезд2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionОт EverandBusiness Process Mapping: Improving Customer SatisfactionРейтинг: 5 из 5 звезд5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessОт EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessРейтинг: 5 из 5 звезд5/5 (1)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОт EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОценок пока нет

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksОт EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksРейтинг: 4 из 5 звезд4/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsОт EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsРейтинг: 5 из 5 звезд5/5 (1)

- Electronic Health Records: An Audit and Internal Control GuideОт EverandElectronic Health Records: An Audit and Internal Control GuideОценок пока нет

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsОт EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsОценок пока нет

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachОт EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachРейтинг: 4 из 5 звезд4/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersОт EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersРейтинг: 4.5 из 5 звезд4.5/5 (11)

- Audit and Assurance Essentials: For Professional Accountancy ExamsОт EverandAudit and Assurance Essentials: For Professional Accountancy ExamsОценок пока нет

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОт EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОценок пока нет

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОт EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОценок пока нет

- Lean Auditing: Driving Added Value and Efficiency in Internal AuditОт EverandLean Auditing: Driving Added Value and Efficiency in Internal AuditРейтинг: 5 из 5 звезд5/5 (1)