Академический Документы

Профессиональный Документы

Культура Документы

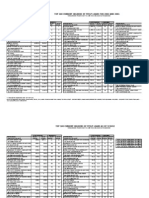

Manila Standard Today - Business Daily Stocks Review (July 1, 2013)

Загружено:

Manila Standard TodayАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Manila Standard Today - Business Daily Stocks Review (July 1, 2013)

Загружено:

Manila Standard TodayАвторское право:

MST Business Daily Stocks Review

M

S

T

Monday, July 1, 2013

52 Weeks

High Low

STOCKS

105.5

80.5

99

58.9

114

71.5

1.6

0.67

495

48

2.42

1.32

31

18

23.3

17.9

37.85

18.5

24

9.6

620

420

0.73

0.2

139.5

89.9

2.09

1.64

94.5

56

117

68.75

145

82

515

349

74.5

42.6

206.4

135

1122

879

160

98.95

2.92

1.71

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

Citystate Savings

COL Financial

Eastwest Bank

Filipino Fund Inc.

Manulife Fin. Corp.

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil Bank of Comm

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

40.5

12.56

2.26

48

1.59

39

11

3.12

29.3

30

8.6

7.9

15.9

17

27.45

113.8

21

0.027

15.98

5

151

12.24

53

3.65

28.4

2.5

41.4

8.24

24.2

22.5

397

6.88

16.3

19.48

11.18

6.15

3.8

7.6

125

950

3.34

2.1

0.220

3

132.6

2.18

2.08

15

2.4

31

6.22

1.26

25

1.23

17

2.3

2.47

8.61

22.3

7.2

5.42

6.15

8.88

17

73.25

13.5

0.0130

11.2

2.95

131.2

7.5

38

1.44

4.25

1.39

24.15

1.03

13.54

2.12

240

2.51

9.7

10.16

5.45

2.19

2.38

3

83

225.4

1.1

1.69

0.123

1.08

57.3

1.11

0.560

6.6

0.9

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alphaland Corp.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Del Monte

DNL Industries Inc.

Energy Devt. Corp. (EDC)

EEI

Federal Chemicals

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Jollibee Foods Corp.

Lafarge Rep

Liberty Flour

LMG Chemicals

LT Group

Mabuhay Vinyl Corp.

Manila Water Co. Inc.

Mariwasa MFG. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas Holdings

Salcon Power Corp.

San Miguel Corp `A

San MiguelPure Foods `B

Seacem

Splash Corporation

Swift Foods, Inc.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vivant Corp.

Vulcan Indl.

1.03

61

28.4

2.7

7.1

6.3

2.98

688

18.1

61.2

6.99

0.98

883.5

9.3

50

7.68

1.39

0.81

2.75

6.33

7.65

9.66

2.7

3.4

7.6

0.420

1213

1.4

0.315

0.425

0.770

0.63

44

10.86

1.9

4.45

3.000

0.9

405

0.02

49

3.87

0.1

481.4

4.26

31.4

5

0.63

0.320

1.620

4

4.7

3

1.02

2

3.4

0.290

701

1.04

0.189

0.250

0.330

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anglo Holdings A

Anscor `A

Asia Amalgamated A

ATN Holdings A

Ayala Corp `A

Cosco Capital

DMCI Holdings

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

MJCI Investments Inc.

Prime Media Hldg

Republic Glass A

Seafront `A

Sinophil Corp.

SM Investments Inc.

South China Res. Inc.

Unioil Res. & Hldgs

Wellex Industries

Zeus Holdings

48

3.89

2.26

0.240

35.7

7.1

6.73

5.6

5.2

2.44

3

1.29

0.083

0.91

1.21

0.445

2.76

2.27

3.8

1.49

4.31

0.209

0.840

0.68

4.33

26.9

4.63

3.95

9.6

21.9

1.35

4.55

1

2.92

15

2.02

0.47

0.168

19.7

4.64

3.7

2.8

2.65

1.35

2

0.97

0.060

0.49

0.72

0.157

1.73

1.23

1.31

1.05

2.06

0.101

0.420

0.4

2.4

16.9

2.35

2.48

5.72

12.54

0.62

3.42

0.49

1.71

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Cebu Prop. `A

Cebu Prop. `B

Century Property

City & Land Dev.

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Highlands Prime

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Development `A

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

3.15

1.62

47

24.1

18.98

1.05

0.95

0.6

16.88

8.5

0.2090

0.1010

10.5

3.1

84.8

52.4

12.5

9.9

6.56

3.84

1225

915

1172

11.7

1635

1020

11

8.15

100.5

65.9

10.42

1.75

0.07

0.017

0.0850

0.040

3.1400

1.950

9.9

6.59

1.9

1.2

3.05

2.1

1.06

0.6

4.08

2

22.95

13.78

3.47

2

17.06

12.10

3290

2480

43.6

25.05

3

0.79

22

3.53

0.56

0.35

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Centro Esc. Univ.

DFNN Inc.

FEUI

Globalports

Globe Telecom

GMA Network Inc.

I.C.T.S.I.

IP Converge

IP E-Game Ventures Inc.

Island Info

ISM Communications

Leisure & Resorts

Lorenzo Shipping

Macroasia Corp.

Manila Bulletin

Manila Jockey

MG Holdings

Pacific Online Sys. Corp.

Paxys Inc.

Philweb.Com Inc.

PLDT Common

Puregold

STI Holdings

Touch Solutions

Waterfront Phils.

0.0068

5.55

23.35

30

25.5

1.78

1.68

39.5

0.75

1.5

1.500

0.077

0.081

31.45

10.6

5.63

0.026

0.027

7.24

24.8

48

0.056

305.8

0.021

Abra Mining

Apex `A

Atlas Cons. `A

Atok-Big Wedge `A

Benguet Corp `A

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

0.0036

1.9

14.8

10

12

0.82

0.91

6.6

0.44

0.4600

0.4900

0.033

0.034

15.78

2.85

1.85

0.017

0.018

5.62

9.6

10

0.036

212.2

0.013

49.9

22.65

560

505

117

100

10.92

7.99

115

104.1

80.5

74.5

84

74.5

1080

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref `A

First Gen F

First Gen G

GMA Holdings Inc.

PCOR-Preferred

SMC Preferred A

SMC Preferred C

SMPFC Preferred

3.22

Megaworld Corp. Warrants

1.1

Previous

Close

High

Low

FINANCIAL

80

81

79

85.00

87.00

84.65

96.00

95.90

94.00

1.10

1.05

1.04

64.20

66.20

64.20

2.00

2.00

2.00

11.70

11.70

11.70

19

19

19

29.85

30.6

29.85

16.50

16.50

16.48

590.00

590.00

590.00

0.300

0.310

0.300

111.00

114.60

111.10

1.8

1.73

1.73

25.8

26.2

25.6

70.00

71.00

70.00

85.80

87.60

85.30

140.00

140.00

140.00

390

390.2

389.8

57.5

59.5

57.5

151.2

161

151.4

1055.00

1060.00

1056.00

139.50

142.00

139.80

2.36

2.38

2.35

INDUSTRIAL

34.8

35.1

34.8

5.75

5.92

5.7

1.44

1.43

1.4

20

20

20

1.25

1.25

1.24

18

18

17

7

7

7

2.80

2.92

2.82

16

15.9

15.6

24

25

23.9

6.4

6.800

6.49

5.79

6.00

5.70

13.24

13.30

13.16

5.30

6.75

6.75

17

17.9

17

73.15

80

76

13.98

13.98

13.98

0.0140

0.0150

0.0130

14.00

14.00

13.86

2.94

2.95

2.9

148.00

147.40

144.40

11.2

11.1

10.5

51.00

51.00

51.00

2.48

2.53

2.45

22.6

22.85

22

1.85

1.97

1.85

32.4

32.6

31.5

1.2

1.28

1.15

19.900

21.100

19.600

8.3

9.95

8.3

329.80

335.00

319.20

5.73

6

5.8

13.00

13.24

12.90

12.00

12.00

12.00

5.38

5.80

5.39

4.96

5.08

5.00

2.9

2.9

2.9

4.96

4.9

4.9

92.50

94.00

92.50

218

220

217.4

1.09

1.18

1.00

2.01

2.02

2.02

0.121

0.121

0.121

2.17

2.23

2.11

125.00

124.00

121.00

1.74

1.8

1.7

0.76

0.74

0.73

9.80

9.79

9.60

1.36

1.42

1.34

HOLDING FIRMS

0.63

0.65

0.62

50.20

50.80

46.00

23.40

24.50

23.40

2.00

1.97

1.83

6.95

7.00

6.90

3.11

3.65

3.11

1.13

1.2

1.2

580

626

585

9.59

9.78

9.49

51.60

52.35

49.50

4.90

4.92

4.90

0.219

0.216

0.153

795

795

788

7.54

7.53

7.45

40.00

40.85

39.00

5.12

5.3

5.12

0.65

0.68

0.68

0.540

0.600

0.570

1.65

1.67

1.65

5.28

5.27

5.13

5.85

5.9

5.9

3

3.2

2.5

1.650

1.650

1.560

2.55

2.61

2.6

1.60

1.85

1.80

0.300

0.310

0.300

1070.00

1113.00

1060.00

1.05

1.12

1.09

0.1610

0.1630

0.1600

0.2350

0.2400

0.2010

0.335

0.350

0.335

PROPERTY

23.50

25.00

23.50

2.05

2.05

1.91

1.280

1.340

1.290

0.212

0.219

0.214

30.40

31.30

30.20

5.1

5.32

5.1

5.85

5.83

5.7

5.2

5.2

5.2

5.2

5.2

5.2

1.36

1.43

1.34

2.35

2.35

2.30

1.14

1.06

1.06

0.069

0.069

0.068

0.61

0.61

0.58

0.940

0.960

0.930

0.241

0.250

0.250

1.80

1.86

1.84

1.70

1.81

1.74

2.01

2.01

2.01

1.25

1.34

1.26

3.3

3.44

3.2

0.1010

0.1100

0.0940

0.4050

0.4250

0.4150

0.4800

0.5000

0.4800

2.90

3.00

3.00

20.30

21.10

20.30

2.25

2.3

2.2

3.40

3.55

3.30

7.56

7.80

7.56

16.30

16.82

16.30

0.64

0.7

0.63

3.8

0.9

3.8

0.620

0.620

0.600

5.620

5.600

5.520

SERVICES

1.7

1.7

1.7

38.4

41

39

1.12

1.25

1.05

0.740

0.780

0.740

9.00

9.52

8.98

0.1180

0.1240

0.1170

3.49

3.59

3.5

66.6

68.1

66

11.74

11.76

11

3.84

3.84

3.80

1200

1200

1200

10.06

10.06

10.06

1610

1599

1520

8.40

8.50

8.46

87

89.2

86.5

6.6

6.5

6

0.018

0.018

0.017

0.0450

0.0530

0.0480

2.0800

2.0400

2.0200

7.51

7.51

7.49

1.25

1.32

1.32

2.28

2.30

2.30

0.70

0.72

0.70

1.97

2.15

2.1

0.530

0.510

0.430

14.8

14.8

14.7

2.08

2.08

2.05

14.66

14.72

14.62

2940.00

2960.00

2910.00

36.30

36.70

36.00

0.79

0.81

0.78

15

15

14

0.380

0.385

0.350

MINING & OIL

0.0035

0.0035

0.0034

3.12

3.14

3.12

14.80

15.58

14.80

20.50

20.50

17.80

10

10

8.8

0.8

0.8

0.8

0.93

0.93

0.93

5.90

6.50

5.85

0.43

0.44

0.43

0.440

0.485

0.445

0.470

0.530

0.480

0.0290

0.0320

0.0310

0.0300

0.0350

0.0320

15.5

15.98

15.3

2.87

2.91

2.8

1.190

1.240

1.160

0.0170

0.0190

0.0180

0.0200

0.0200

0.0200

6.00

6.10

6.04

9.95

10.420

9.950

10.5

11.06

10.7

0.035

0.038

0.036

276.80

265.00

250.00

0.0120

0.0120

0.0120

PREFERRED

41.6

43

40

518

518

509

113

115

110.2

114.2

115

114.2

8.95

8.9

8.9

110.6

110.6

110.5

77.4

77.6

77

80.5

81.45

81

1050

1050

1044

WARRANTS & BONDS

2.15

2.35

2.19

Close Change Volume

Net Foreign(Peso)

Trade/Buying

79.95

86.95

94.00

1.04

66.10

2.00

11.70

19

30

16.48

590.00

0.300

113.50

1.73

25.65

70.00

87.00

140.00

390

59

159.2

1056.00

140.00

2.38

-0.06

2.29

-2.08

-5.45

2.96

0.00

0.00

0.00

0.50

-0.12

0.00

0.00

2.25

-3.89

-0.58

0.00

1.40

0.00

0.00

2.61

5.29

0.09

0.36

0.85

121,140

2,415,720

982,700

156,000

86,820

17,000

200

100

480,300

700

510

980,000

2,041,850

26,000

52,100

2,370

865,400

250

51,290

467,440.00

868,450

310

21,710

445,000

-1,328,902.00

93,808,960.00

-40,082,421.00

34.95

5.75

1.4

20

1.24

18

7

2.90

15.6

25

6.8

6.00

13.20

6.75

17.1

80

13.98

0.0150

13.86

2.9

145.00

11

51.00

2.5

22.25

1.97

31.5

1.19

20.700

9.9

330.80

5.99

13.10

12.00

5.40

5.08

2.9

4.9

94.00

218

1.07

2.02

0.121

2.19

122.00

1.79

0.73

9.79

1.42

0.43

0.00

-2.78

0.00

-0.80

0.00

0.00

3.57

-2.50

4.17

6.25

3.63

-0.30

27.36

0.59

9.36

0.00

7.14

-1.00

-1.36

-2.03

-1.79

0.00

0.81

-1.55

6.49

-2.78

-0.83

4.02

19.28

0.30

4.54

0.77

0.00

0.37

2.42

0.00

-1.21

1.62

0.00

-1.83

0.50

0.00

0.92

-2.40

2.87

-3.95

-0.10

4.41

1,676,000

26,500

113,000

1,000

35,000

300

1,000

345,000

500

95,600

2,199,300

19,973,900

358,000

100

2,133,700

489,090

2,000

103,800,000

4,900

33,000

302,040

361,900

3,000

473,000

6,338,800

20,000

2,259,100

2,458,000

87,800

8,020,900

106,460

3,673,600

1,977,800

273,800

71,400

968,000

1,000

4,000

731,320

176,210

194,000

31,000

50,000

3,251,000

1,795,740

289,000

243,000

13,000

259,000

25,102,045.00

0.64

50.30

24.25

1.90

6.95

3.65

1.2

612

9.69

49.50

4.90

0.213

788

7.45

40.45

5.12

0.68

0.600

1.67

5.17

5.9

3.15

1.650

2.61

1.85

0.310

1100.00

1.12

0.1630

0.2340

0.350

1.59

0.20

3.63

-5.00

0.00

17.36

6.19

5.52

1.04

-4.07

0.00

-2.74

-0.88

-1.19

1.13

0.00

4.62

11.11

1.21

-2.08

0.85

5.00

0.00

2.35

15.63

3.33

2.80

6.67

1.24

-0.43

4.48

251,000

1,123,460

10,212,800

28,000

369,200

19,000

120,000

940,320

1,995,800

1,150,070

605,000

50,000

207,980

45,800

736,300

9,316,000

1,000

618,000

2,207,000

43,730,000

2,000

50,000

10,000

511,000

8,000

1,430,000

794,680

15,000

1,030,000

240,000

310,000

-68,040.00

42,945,396.50

99,922,495.00

23.50

2.05

1.340

0.218

30.85

5.15

5.7

5.2

5.2

1.4

2.30

1.06

0.069

0.60

0.960

0.250

1.84

1.78

2.01

1.31

3.33

0.1100

0.4250

0.5000

3.00

21.00

2.2

3.54

7.72

16.64

0.68

3.9

0.600

5.560

0.00

0.00

4.69

2.83

1.48

0.98

-2.56

0.00

0.00

2.94

-2.13

-7.02

0.00

-1.64

2.13

3.73

2.22

4.71

0.00

4.80

0.91

8.91

4.94

4.17

3.45

3.45

-2.22

4.12

2.12

2.09

6.25

2.63

-3.23

-1.07

10,000

7,000

221,000

1,790,000

6,481,300

8,949,200

17,100

31,000

31,000

14,946,000

7,000

10,000

450,000

796,000

501,000

40,000

2,241,000

25,181,000

1,000

6,472,000

80,368,000

2,650,000

940,000

3,340,000

2,000

3,176,600

3,408,000

18,000

2,336,100

20,568,400

2,096,000

140,000

377,000

6,286,900

25,000.00

1.7

40.3

1.24

0.760

9.50

0.1190

3.55

68

11.76

3.84

1200

10.06

1590

8.50

89

6.1

0.018

0.0530

2.0200

7.49

1.32

2.30

0.72

2.15

0.510

14.8

2.05

14.70

2930.00

36.40

0.79

14.18

0.385

0.00

4.95

10.71

2.70

5.56

0.85

1.72

2.10

0.17

0.00

0.00

0.00

-1.24

1.19

2.30

-7.58

0.00

17.78

-2.88

-0.27

5.60

0.88

2.86

9.14

-3.77

0.00

-1.44

0.27

-0.34

0.28

0.00

-5.47

1.32

35,000

2,600

137,000

6,708,000

8,944,900

24,730,000

100,000

151,190

400

113,000

15

400

16,030

44,900

1,727,350

38,700

5,600,000

7,200,000

6,000

427,800

11,500,000

1,000

141,000

161,000

57,000

9,600

362,000

1,588,800

115,385

1,032,000

7,834,000

80,300

220,000

0.0034

3.14

15.20

20.50

9

0.8

0.93

5.95

0.44

0.485

0.500

0.0320

0.0330

15.98

2.9

1.160

0.0180

0.0200

6.10

10.20

10.7

0.036

260.00

0.0120

-2.86

0.64

2.70

0.00

-10.00

0.00

0.00

0.85

1.16

10.23

6.38

10.34

10.00

3.10

1.05

-2.52

5.88

0.00

1.67

2.51

1.90

2.86

-6.07

0.00

21,000,000

12,000

360,600

2,100

166,200

10,000

416,000

253,300

230,000

56,970,000

5,200,000

68,800,000

30,900,000

395,200

82,000

4,857,000

148,100,000

2,000,000

17,000

1,228,700

206,300

190,100,000

200,430

2,100,000

-34,000.00

43

515

115

115

8.9

110.5

77.3

81

1044

3.37

-0.58

1.77

0.70

-0.56

-0.09

-0.13

0.62

-0.57

2,200

3,110

30

21,700

48,200

750

812,190

138,100

69,285

80,000.00

2.22

3.26

101,000

65,540.00

-7,801,865.00

-180,000.00

-19,886,062.00

12,950.00

-140,710.00

10,765,064.00

7,800.00

12,290,872.50

58,096,164.00

52,800.00

-692,838.00

1,205,965.00

4,740,697.00

78,930,419.00

-783,304.00

-28,089,642.00

-2,828,868.00

8,316.00

-78,350.00

10,041,776.00

-1,345,606.00

17,699,815.00

-4,846,875.00

6,590.00

19,997,388.00

2,434,268.00

9,895,105.00

12,083,524.00

-268,800.00

-229,690.00

48,270.00

-1,754,254.00

-20,147,566.00

-4,050.00

439,000.00

58,307,440.00

8,950.00

-148,000.00

1,886,909.00

323,042,085.00

4,532,785.00

35,512,537.00

5,010.00

1,138,535.00

10,790,810.00

9,637,328.00

-83,235,506.00

276,564,245.00

17,500.00

-30,240.00

136,771,660.00

5,750,073.00

-104,000.00

-104,000.00

-1,216,400.00

9,200.00

-176,800.00

2,216,200.00

-8,565,760.00

133,000.00

15,684,190.00

8,734,110.00

-931,770.00

-7,800.00

86,478,118.00

-16,038,226.00

-3,162,670.00

10,367,656.00

-2,400.00

-1,011,376.00

10,917,900.00

32,413,856.00

-116,153.00

-1,573,410.00

-8,820.00

20,500.00

3,768,704.00

119,790.00

7,311,860.00

-940,890.00

4,067,230.00

-7,250.00

26,500.00

-38,700.00

-9,800.00

-3,335,022.00

-116,000.00

-276,140.00

198,755.00

1,321,504.00

6,164,494.00

-22,212,894.00

661,500.00

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Charles Schwab&Co Case StudyДокумент13 страницCharles Schwab&Co Case StudySuhas VemuriОценок пока нет

- SND Amex 433Документ20 страницSND Amex 433raniayuva59Оценок пока нет

- 100 Top Venture Capital FirmsДокумент12 страниц100 Top Venture Capital FirmsAtrij DixitОценок пока нет

- UACS Object CodeДокумент42 страницыUACS Object CodeRachelle Joy Manalo TangalinОценок пока нет

- The Standard - Business Daily Stocks Review (June 8, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 5, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 2, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 4, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 3, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Документ1 страницаManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (June 9, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 15, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanОценок пока нет

- The Standard - Business Daily Stocks Review (May 26, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Документ1 страницаManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Документ1 страницаManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 29, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 22, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 15, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanОценок пока нет

- The Standard - Business Daily Stocks Review (May 25, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 20, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 12, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 18, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Документ1 страницаManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Документ1 страницаManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 13, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Документ1 страницаManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 6, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayОценок пока нет

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Документ1 страницаManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 11, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 7, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayОценок пока нет

- The Standard - Business Daily Stocks Review (May 5, 2015)Документ1 страницаThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayОценок пока нет

- Employers ListДокумент7 страницEmployers ListArthur SiuОценок пока нет

- List Number BankДокумент2 страницыList Number BankAsta SathiyaОценок пока нет

- Philippine Stock Exchange: Head, Disclosure DepartmentДокумент8 страницPhilippine Stock Exchange: Head, Disclosure DepartmentPaulОценок пока нет

- CP of Sbi BankДокумент4 страницыCP of Sbi Bankharman singh0% (1)

- KBC0457-54 Deposit Rate Matrix PDFДокумент3 страницыKBC0457-54 Deposit Rate Matrix PDFdeepakaggairbnbОценок пока нет

- Sr. No POP Reg No POP NameДокумент8 страницSr. No POP Reg No POP Name98675Оценок пока нет

- Statement JUL2023 523565579 UnlockedДокумент9 страницStatement JUL2023 523565579 UnlockedúméshОценок пока нет

- 10th BipartiteДокумент59 страниц10th BipartiteMohit YadavОценок пока нет

- Description: Tags: Top 100 Current Holders Cor Vers1Документ4 страницыDescription: Tags: Top 100 Current Holders Cor Vers1anon-20972Оценок пока нет

- DataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCДокумент12 страницDataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCMaryEllenCochraneОценок пока нет

- 733315Документ19 страниц733315assmexellenceОценок пока нет

- Hedge Fund GurusДокумент3 страницыHedge Fund Gurussreen2rОценок пока нет

- Union Bank IFSC Code'sДокумент198 страницUnion Bank IFSC Code'sAjit Singh0% (1)

- Referinta Arm Diaconu MariaДокумент2 страницыReferinta Arm Diaconu MariaMimiОценок пока нет

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Документ59 страницNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538sagar gurungОценок пока нет

- Godrej Industries Limited: Annual Report 2001-2002Документ2 страницыGodrej Industries Limited: Annual Report 2001-2002Raakze MoviОценок пока нет

- Chapter 13 Investing in Mutual Funds1233Документ33 страницыChapter 13 Investing in Mutual Funds1233ketkiparulekarОценок пока нет

- Thomson Reuters M&a Review (2015)Документ24 страницыThomson Reuters M&a Review (2015)Carlos MartinsОценок пока нет

- Rabobank Groep N.VДокумент29 страницRabobank Groep N.Vkrisz_fanfic7132Оценок пока нет

- List of Banks in IndiaДокумент10 страницList of Banks in Indiakhush444Оценок пока нет

- 06 Activity 1Документ5 страниц06 Activity 1Laisan SantosОценок пока нет

- 2023 06 11 18 02 55 Statement - 1699273975024Документ9 страниц2023 06 11 18 02 55 Statement - 1699273975024Anandhu SОценок пока нет

- Account - Statement - 011022 - 311022Документ17 страницAccount - Statement - 011022 - 311022Anjani DeviОценок пока нет

- Mobile Banking Codes PaybillДокумент2 страницыMobile Banking Codes PaybillMauriceОценок пока нет

- WMCДокумент116 страницWMCarjun_871645652Оценок пока нет

- Statement MAY2021 194229555Документ28 страницStatement MAY2021 194229555Deepak KumarОценок пока нет