Академический Документы

Профессиональный Документы

Культура Документы

Cash Flow Analysis and Value Added Measures

Загружено:

Shruti MaindolaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Flow Analysis and Value Added Measures

Загружено:

Shruti MaindolaАвторское право:

Доступные форматы

Cash Flow analysis, valuation and value

Concepts previously covered Drivers of profitability, five level breakdown Sustainable growth rate and focus on opeartional profitability To be covered 1 Why do companies strive for growth 2 Business valuation and value creation 3 The Discounted cash flow approach and introduction of cash flow 4 Free cash flow and the market value add approach 5 Linking MVA to the core operating activities 6 Does growth always lead to value

Sources of Cash inflow & outflow

Operating activities Sale of goods & services

Investing activities Sal e of fixed assets Sale of long term financial assets (investments) Collection of interest & dividend income Collection of loans made

CASH

Operating activities Purchase of supplies Selling, general & administrative expenses Tax expenses

Investing activities Capital expenditures & acquisitions Long term financial investments

Net cash flow from operating activities

Net cash flow from investing activities

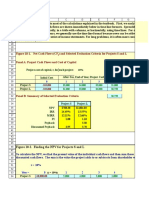

Preliminary cash flow statements Cash flow from operating activities

+ A

Net sales Cost of goods sold Selling, general & administrative expenses Tax expense Change in working capital requirement

Net cash flow from operating activities Cash flow from investing activities + Sale of fixed assets Capital expenditures & acquisitions Net cash flow from investing activities Cash flow from financing activities + Increase in long term borrowings + Increase in short term borrowings

C D E F G

Long term debt repaid Interest payments Dividend payments

Net cash flow from financing activities Total net cash flows (A+B+C) Opening cash Closing cash (E+D) Change in cash position

Mechanics of cash flow from operations Dynamics of a sales transactions Cash flow from operating activities + Net sales Cost of goods sold Selling, general & administrative expenses Tax expense Change in working capital requirement Increase in working capital requirement Decrease in working capital requirement

1 2 3 4

What is business valuation? Is value of a business a unique number? What causes the difference? Why business needs to be valued?

Avoiding the winner's curse / paying the fair value / going public etc.

Methods of valuation 1 Valuation by comparables 2 Discounted cash flow valuation (DCF) 3 Liquidation value / distress sale / fire sale 4 Replacement value

Business valuation using comparable firm's market performance ratios - Market measur Comparable firm 1 2 3 4 5 6 7 Accounting data Earnings after tax (EAT) Cash flow (EAT + Depreciation expense) Book value of equity Number of shares outstanding Earnings per share (EPS), 1/4 Cash flow (cash flow earnings per share), 2/4 Book value per share 3/4 $63.50 121 526 50 million $1.27 2.42 10.52

Financial market data, January 8 Multiples 9 10 11 Price - to - earnings ratio, 8/5 Price - to - cash earnings ratio, 8/6 Price - to - book value ratio, 8/7 Implies that the share of the company trades at 15.75 times its fundamental value Valuing our firm using multiples, in 2010 Value based on price - earnings multiple, 15.75 8.26 1.90 Share price $20

(Price - to - earnings ratio) * (Earnings $ 160.63

Value based on Price - to - cash earnings ratio,

(Price - to - cash earnings ratio) * (Cas $ 150.41 (Price - to - book value ratio) * (Book $ 146.39

Value based on Price - to - book value ratio,

Determinants of earnings and cash - flow multiples DCF = = Or, Share price = (Next year's cash flow per share) / Ke - g =

(Next year's cash flow) / (Required rate of return - Growth ra

Dt/Ke - g

(Share price) / (Next year's cash flow per share)

Impact of change of 'g' on valuation impact of change of 'k' on valuation

Discounted cash flow valuation (DCF) Which cash flow to consider, why? What discount rate to consider, why? Cash flow generated from assets through operating and investing activities Cash flow generated from assets through operating activities

Net operating cash flow (NOCF) = EBIT - Tax expense - change in working capital requirements + depreciat Cash flow generated from assets through investing activities = Net capital expenditures So, Cash flow generated from total assets through operating and investing activities, Free cash flow CFA = = = CFA = EBIT - Tax expense - change in working capital requirements + depreciation

NOPAT - (change in working capital requirements + net capital expend NOPAT - (Net assets + depreciation) NOPAT - change in Invested capital

The free cash flow becomes the basis for estimation of the firm's Market Value added

Driver's of value creation 1 2 3 Firm's operating profitability The firm's cost of capital The firm's ability to grow

1 2

Measures of value add? Market value add Economic value add ROIC = = Linking MVA to the core operating activities Market value added (MVA) = (ROIC - WACC) * Invested capital WACC -Constant growth rate ROIC - WACC EBIT (1-Tax rate) / Invested capital NOPAT / Invested Capital

When growth does not matter Expected ROIC 10% 13%

Firm A Firm B

Expected growth rate 7% 4%

nalysis, valuation and value added measures

ion of cash flow

f Cash inflow & outflow

nterest & dividend

Financing activities Issuance of stocks & bonds Long term borrowings Short term borrowings

nancial investments

Financing activities Purchase of stocks & bonds Repayment of long term debt Repayment of short term debt Interest payment Dividend payment

Net cash flow from financing activities

nary cash flow statements 31/12/2009 31/12/2010

$420 `353 43.7 5.3 4 53 400 48 6.8 14 468.8

$480

53 $367

468.8 $11.2

0 0 0

$2 12 -$10

$0 7 $7 8 $5 2 15

$7

15 -$8 $359 $6 $365

$12 1 $13 8 $7 3.2 18.2

$13

18.2 -$5.2 -$4.0 12 $8.0 $357.00

EBIT

s market performance ratios - Market measures Our firm $10.20 $18.20 77 10 million $1.02 1.82 7.7

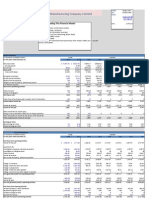

Income Statements 31-Dec-08 31-Dec-09 Net sales Cost of goods sold Gross profit Selling, General and Depreciation expenses Operating profits Extraordinary items Earnings before Interest & tax (EBIT) Net interest expense Earnings before tax (EBT) Income tax expense Earnings after tax (EAT) Dividends Retained earnings $ $390 -328 $62 -39.8 -5 $17.2 0 $17.2 -5.5 $11.7 -4.7 $7.0 -$2 5.00 $420 -353 $67 -43.7 -5 $18.3 0 $18.3 -5 $13.3 -5.3 $8.0 -2 $6.0

NA

NA NA NA

(Price - to - earnings ratio) * (Earnings after tax, EAT)

(Price - to - cash earnings ratio) * (Cash flow (EAT + Depreciation expense)

(Price - to - book value ratio) * (Book value of equity)

sh flow) / (Required rate of return - Growth rate)

sh flow per share) / Ke - g 1/ Ke - g

e in working capital requirements + depreciation

activities = Net capital expenditures

investing activities, Free cash flow

n working capital requirements + depreciation - Net capital expenditures

king capital requirements + net capital expenditure - depreciation)

PAT - (Net assets + depreciation)

PAT - change in Invested capital

n of the firm's Market Value added MVA = = = MVAE + MDAD (MVE - BVE) + (MVD - BVD) (MVE + MVD) - (BVE +BVD)

MV(D+E) - Total capital employed

T (1-Tax rate) / Invested capital

PAT / Invested Capital

OIC - WACC) * Invested capital WACC -Constant growth rate =

Proof in next worksheet

Return spread

Estimated WACC 13% 10%

Expected return spread -3% 3%

Invested capital $100 $100

MVA $ (50.00) $ 50.00

31-Dec-10 $480 -400 $80 -48 -$8 $24 $0 $24 -$7 $17 -6.8 $10.2 -$3.20 $7.00

Is value created? No Yes

Linking MVA, EVA, ROIC Market Value Added = Market value of Capital - Capital employed

Value that a firm generates from its assets contributes to its "Free Cash Flows" So, Market Value of the firm's assets = = Also, CFA = =

Cash flows generated by its assets / (WACC-Growt CFA / (WACC - G)

Free Cash Flows to the firm Free cash flow from operating activities + Free cash flows from investment activities EBIT (1-T) + Depreciation - change in WCR - Capital Expenditures NOPAT - (change in WCR + Capital Expenditures - Depreciation) NOPAT - [change in WCR + (Capex - Depreciation) NOPAT - Change in Invested Capital

= = = =

Replacing CFA in equation 2, Market Value of the firm's assets = (NOPAT - Change in Invested Capital) / (WACC - G)

Deducting Invested capital from both sides Market Value of the firm's assets - Invested capital Or, (from previous worksheet) Factoring out the term "Invested Capital" = = = MVA = =

[(NOPAT - Change in Investe

{NOPAT - Change in Invest

MVA MVA MVA

{(NOPAT/Invested Capital) - (C WACC +G}In

{(ROIC - G -WACC + G)Investe

(ROIC - WACC) Invested Ca

Economic Value added Factoring out the term "Invested Capital"

EVA

NOPAT - (WACC * Invested Capita

EVA EVA =

{NOPAT/Invested Capita Capita

(ROIC -WACC)*Invested C

MVA

EVA / (WACC - G)

pital - Capital employed

o its "Free Cash Flows" Gordon's Model

ws generated by its assets / (WACC-Growth rate) 2

ties + Free cash flows from investment ivities

nge in WCR - Capital Expenditures

xpenditures - Depreciation)

hange in Invested Capital) / (WACC - G)

[(NOPAT - Change in Invested Capital) / (WACC - G)] - Invested capital {NOPAT - Change in Invested Capital - Invested capital (WACC - G)}/ (WACC - G)

{(NOPAT/Invested Capital) - (Change in Invested Capital/Invested Capital) WACC +G}Invested Capital/(WACC - G) {(ROIC - G -WACC + G)Invested Capital}/WACC - G (ROIC - WACC) Invested Capital / (WACC - G)

NOPAT - (WACC * Invested Capital)

{NOPAT/Invested Capital) - [(WACC*Invested Capita)/Invested Capital)]}*Invested Capital (ROIC -WACC)*Invested Capital

EVA / (WACC - G)

Вам также может понравиться

- Valuation of FirmДокумент13 страницValuation of FirmLalitОценок пока нет

- Cash Flow Statement AnalysisДокумент19 страницCash Flow Statement AnalysisKNOWLEDGE CREATORS90% (10)

- Cost of Capital 2010Документ105 страницCost of Capital 2010Amit PandeyОценок пока нет

- Cost Volume Profit Analysis (Decision Making) - TaskДокумент9 страницCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikОценок пока нет

- Activity Based CostingДокумент35 страницActivity Based Costingudonsi100% (4)

- Cash Flow Analysis: Glim Dr. Manaswee K SamalДокумент29 страницCash Flow Analysis: Glim Dr. Manaswee K SamalAnirbanRoychowdhuryОценок пока нет

- Project NPV Sensitivity AnalysisДокумент54 страницыProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Project IRR Vs Equity IRRДокумент18 страницProject IRR Vs Equity IRRLakshmi NarayananОценок пока нет

- © 2010 Financial Management Prepared By: Amyn WahidДокумент66 страниц© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- Colgate Financial Model SolvedДокумент33 страницыColgate Financial Model SolvedVvb SatyanarayanaОценок пока нет

- Financial Analysis & Valuation of Godrej Consumer Product LimitedДокумент30 страницFinancial Analysis & Valuation of Godrej Consumer Product Limitedanshul sinhal100% (1)

- BCG ApproachДокумент2 страницыBCG ApproachAdhityaОценок пока нет

- SBDC Valuation Analysis ProgramДокумент8 страницSBDC Valuation Analysis ProgramshanОценок пока нет

- Value Based Management BCG ApproachДокумент14 страницValue Based Management BCG ApproachAvi AhujaОценок пока нет

- Financial Model of Zynga IPOДокумент76 страницFinancial Model of Zynga IPOJack Macharla100% (1)

- Ratio AnalysisДокумент17 страницRatio AnalysisSharmila DeviОценок пока нет

- Financial AnalysisДокумент44 страницыFinancial AnalysisEnrica SalursoОценок пока нет

- 5 - Cash Flow EstimationДокумент43 страницы5 - Cash Flow EstimationShivam UpadhyayОценок пока нет

- DCF FCFF ValuationДокумент0 страницDCF FCFF ValuationSneha SatyamoorthyОценок пока нет

- Reverse Discounted Cash FlowДокумент11 страницReverse Discounted Cash FlowSiddharthaОценок пока нет

- Corporate VAluationДокумент11 страницCorporate VAluationakshay raut100% (1)

- Ch10 Tool Kit NPV Dan IRRДокумент23 страницыCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalОценок пока нет

- Relative or Comparable ValuationДокумент21 страницаRelative or Comparable ValuationYash SankrityayanОценок пока нет

- Indian Financial Statement Excel Audit SoftwareДокумент115 страницIndian Financial Statement Excel Audit SoftwareRamesh Radhakrishnaraja100% (2)

- Finance Case Study SolutionДокумент4 страницыFinance Case Study SolutionOmar MosalamОценок пока нет

- Project On Operating Costing PPДокумент13 страницProject On Operating Costing PPVarun Malani50% (2)

- EBITDA Calculation Company XYZ Income Statement Company XYZ Cash Flow StatementДокумент2 страницыEBITDA Calculation Company XYZ Income Statement Company XYZ Cash Flow StatementGolamMostafaОценок пока нет

- Marginal CostingДокумент30 страницMarginal Costinganon_3722476140% (1)

- Startup Financial ModelДокумент102 страницыStartup Financial ModelkanabaramitОценок пока нет

- DCF Approach To Valuation PDFДокумент8 страницDCF Approach To Valuation PDFLucky LuckyОценок пока нет

- Numericals On Stock Swap - SolutionДокумент15 страницNumericals On Stock Swap - SolutionAnimesh Singh GautamОценок пока нет

- Company ValuationДокумент55 страницCompany ValuationAli Jumani100% (1)

- Ch11 Tool KitДокумент368 страницCh11 Tool KitRoy HemenwayОценок пока нет

- Decision Making Through Marginal CostingДокумент33 страницыDecision Making Through Marginal CostingKanika Chhabra100% (2)

- Ratio Analysis of Three Different IndustriesДокумент142 страницыRatio Analysis of Three Different IndustriesAbdullah Al-RafiОценок пока нет

- Cash Flow AnalysisДокумент29 страницCash Flow AnalysisUmer Zaheer100% (1)

- Risk Analysis in Capital BudgetingДокумент18 страницRisk Analysis in Capital BudgetingKushagra RaghavОценок пока нет

- Evaluation of Investment Project Using IRR and NPVДокумент6 страницEvaluation of Investment Project Using IRR and NPVchew97Оценок пока нет

- Financial Modelling ProjectДокумент114 страницFinancial Modelling Projectsun6raj18Оценок пока нет

- The Guide To Private Company ValuationДокумент15 страницThe Guide To Private Company ValuationShay BhatterОценок пока нет

- Capital Budgeting ExamplesДокумент21 страницаCapital Budgeting Examplesjustin_zelinОценок пока нет

- Sensitivity Analysis TableДокумент3 страницыSensitivity Analysis TableBurhanОценок пока нет

- Cold Storage Finance RohitДокумент11 страницCold Storage Finance RohitRohitGuleriaОценок пока нет

- Financial Model Flow ChartДокумент1 страницаFinancial Model Flow ChartTallal Mughal100% (1)

- EXERCISE - Calculating The Internal Rate of ReturnДокумент5 страницEXERCISE - Calculating The Internal Rate of ReturnNipun BajajОценок пока нет

- Financial ModelДокумент83 страницыFinancial Modelapi-376449680% (5)

- Ratio AnalysisДокумент12 страницRatio AnalysisSachinОценок пока нет

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelДокумент4 страницыHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- DCF ModelДокумент6 страницDCF ModelKatherine ChouОценок пока нет

- Shareholders Value CreationДокумент22 страницыShareholders Value CreationSameer GopalОценок пока нет

- Portfolio Return and Risk Analysis: X 2 y y 2 Xy 2Документ12 страницPortfolio Return and Risk Analysis: X 2 y y 2 Xy 2AbirMdZaberTauhidОценок пока нет

- Valuation Measurement and Creation - September 04Документ40 страницValuation Measurement and Creation - September 04goldi0172Оценок пока нет

- Corporate ValuationДокумент18 страницCorporate ValuationDilfaraz Kalawat100% (1)

- Pro Forma Financial Statements4Документ50 страницPro Forma Financial Statements4SakibMDShafiuddinОценок пока нет

- Free Cash Flow and Its UsesДокумент22 страницыFree Cash Flow and Its UsesAnand Deshpande67% (3)

- Boeing: I. Market InformationДокумент20 страницBoeing: I. Market InformationJames ParkОценок пока нет

- Discounted Cash FlowДокумент12 страницDiscounted Cash FlowViv BhagatОценок пока нет

- DCF Method of ValuationДокумент45 страницDCF Method of Valuationnotes 1Оценок пока нет

- Investment VI FINC 404 Company ValuationДокумент52 страницыInvestment VI FINC 404 Company ValuationMohamed MadyОценок пока нет

- Islamic Banking PrimerДокумент49 страницIslamic Banking Primerchughtai2000Оценок пока нет

- News Article - The Wisdom of HindsightДокумент3 страницыNews Article - The Wisdom of HindsightShruti MaindolaОценок пока нет

- 1 Forex Hedge Accounting TreatmentДокумент37 страниц1 Forex Hedge Accounting TreatmentPuneet_behki100% (1)

- International Finance - Wealth ManagementДокумент13 страницInternational Finance - Wealth ManagementShruti MaindolaОценок пока нет

- Rent Seeking - Commonwealth GamesДокумент6 страницRent Seeking - Commonwealth GamesShruti MaindolaОценок пока нет

- Cash-Flow Tells A StoryДокумент4 страницыCash-Flow Tells A StoryShruti MaindolaОценок пока нет

- Direct Marketing Data AnalysisДокумент15 страницDirect Marketing Data AnalysisShruti MaindolaОценок пока нет

- Problems - Non-Current Assets Held For SaleДокумент1 страницаProblems - Non-Current Assets Held For SaleChristine Alysza AnquilanОценок пока нет

- Manufacturing Account (With Answers) : Advanced LevelДокумент15 страницManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- Practice Question 1 - Published AccountsДокумент2 страницыPractice Question 1 - Published AccountsGnanendran MBA100% (1)

- Roe To CfroiДокумент30 страницRoe To CfroiSyifa034Оценок пока нет

- Tabel 1 Chart of AccountДокумент4 страницыTabel 1 Chart of AccountRendyyyОценок пока нет

- A8 Audit of Prepayments, Ip and Other NciДокумент7 страницA8 Audit of Prepayments, Ip and Other NciKezОценок пока нет

- FARI Daisy 2021 Mock ExamДокумент17 страницFARI Daisy 2021 Mock ExamLauren McMahonОценок пока нет

- Checklist For Various Heads of Audit Working Paper FileДокумент54 страницыChecklist For Various Heads of Audit Working Paper Filesialkotia92% (25)

- Practice Problems 1Документ16 страницPractice Problems 1James AguilarОценок пока нет

- Project Proposal On Personal Care-Indiris Abdulsamd-BurayuДокумент36 страницProject Proposal On Personal Care-Indiris Abdulsamd-BurayuTesfaye DegefaОценок пока нет

- FInal Quiz 1 Finman 2aДокумент6 страницFInal Quiz 1 Finman 2aella alfonsoОценок пока нет

- Chapter 17 Provisions and Post Balance Sheet EventsДокумент29 страницChapter 17 Provisions and Post Balance Sheet EventsHammad Ahmad100% (1)

- Business Plan For Small Construction FirmДокумент30 страницBusiness Plan For Small Construction Firmtbeedle100% (5)

- Unit 7 Project Management 7Документ31 страницаUnit 7 Project Management 7chuchuОценок пока нет

- CPA A2.3 - ADVANCED TAXATION - Study ManualДокумент92 страницыCPA A2.3 - ADVANCED TAXATION - Study ManualZIHERAMBERE AnastaseОценок пока нет

- Sem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease AccountingДокумент11 страницSem - 3 Advanced Corporate Accounting - 1 MCQ Accounting Standards (As) /lease Accountinglol0% (1)

- PPE NotesДокумент3 страницыPPE NoteskingОценок пока нет

- Mark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Документ19 страницMark Scheme (Results) Summer 2008: GCE Accounting (6002) Paper 01Faiz Mohammed ChowdhuryОценок пока нет

- AccountingДокумент4 страницыAccountinganca9004Оценок пока нет

- 75 Common and Uncommon Errors in Valuation!!!Документ0 страниц75 Common and Uncommon Errors in Valuation!!!Alex VedenОценок пока нет

- IAS 17 - Leases: Example 1Документ5 страницIAS 17 - Leases: Example 1danabcОценок пока нет

- tài chính doanh nghiệpДокумент44 страницыtài chính doanh nghiệptieuma712Оценок пока нет

- IAS 16: Property Plant and Equipment Objective of IAS 16Документ5 страницIAS 16: Property Plant and Equipment Objective of IAS 16Joseph Gerald M. ArcegaОценок пока нет

- 4 PDFДокумент10 страниц4 PDFAnonymous jAem9SVОценок пока нет

- FY22 UG Financial Proforma Instructions: Goal: To Develop An Intuitive Model That ProvidesДокумент9 страницFY22 UG Financial Proforma Instructions: Goal: To Develop An Intuitive Model That ProvidesBobby ChristiantoОценок пока нет

- Hire Purchase PPT 1Документ12 страницHire Purchase PPT 1sangeethamadan100% (2)

- Capital Budgeting AnswerДокумент18 страницCapital Budgeting AnswerPiyush ChughОценок пока нет

- Aecon Reviewer FinalДокумент64 страницыAecon Reviewer FinalZabeth villalonОценок пока нет

- MTP SolutionsДокумент67 страницMTP Solutionstusharmohite0Оценок пока нет

- Leather Coats & Jackets PDFДокумент10 страницLeather Coats & Jackets PDFvipul kumar0% (2)