Академический Документы

Профессиональный Документы

Культура Документы

Cases Secured Transactions

Загружено:

aisha20101954Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cases Secured Transactions

Загружено:

aisha20101954Авторское право:

Доступные форматы

Colinares vs CA Entrustor: Philippine Banking Corpoartion Entrustee: Colinares and Veloso Facts: Colinares and Veloso were contracted

by the Carmelite Sisters of Cagayan de Oro City to renovate the latters convent for 40,000 pesos. In order to pursue with the construction project due to lack of budget, Colinares applied for a commercial letter of credit with the Phil. Banking Corp. (PBC) to cover the full invoice value of the goods. They signed a pro-formal trust receipt as security. A case in violation of P.D. 115 (trust receipt law) in relation to Art. 315 of the RPC (estafa), was filed against Colinares for their failure to comply with the demand made by the Bank against them. Issue: Whether or not there was a breach of contract against the trustees. Ruling: SC court said that. - Colinares are contractors and are not importers acquiring the goods for re-sale, but obtained the goods for their construction project. The practice of banks of making borrowers sign trust receipts to facilitate collection of loans and place them under the threats of criminal prosecution should they be unable to pay t may be unjust and inequitable, if not reprehensible. Such agreement is contract of adhesion which borrowers have no option but to sign lest their loan be disapproved. Francisco v. Gorgonio GR No. L-59519 July 20, 1982 FACTS: Spouses Adela and Luis Francisco represented by their daughter Zenaida Boiser, in a contract agreed to lease a piece of land owned by Ching Siao and Lim O. Chu where a building should be constructed by the Franciscos. The contract provided, among others: the deposit to the account of the lessor-petitioner, Francsico the amount of 150k representing 30K goodwill money and 120K advanced rental and a stipulation that in case the parties will not agree as to the terms and conditions of the final contract of lease, the prelease contract shall be declared null and void and the petitioner shall return the deposit plus legal interest. Before final occupancy, Francisco declared the pre-lease contract null and void, leased the premises to another lessee and offered to return the150K deposit. Ching Siao and Lim O. Chu refused to accept so that Francisco was prompted to make a consignation of the money with the Court. Ching Siao and lim O. Chu then filed a complaint, hence respondent judge Gorgonio ruled in their favor with an order to pay the amount of deposit plus compensatory interests. Issue: Is the petitioner liable for payment of interest despite tender of payment before demand?

Held: No. The award for interests in an action for the recovery of a sum of money partakes of a nature of an award for damages. Thus, Article2209 of the Civil Code provides: Art. 2209. If the obligation consists in the payment of a sum of money, and the debtor incurs in delay, the in demnity for damages, there being no stipulation to the contrary, shall be the payment of the interest agreed upon, and in the absence of stipulation, the legal interest, which is six percent per annum. Clearly, the indemnity for interest on a monetary obligation attaches only whenthe obligor incurs delay, that is, when he is in default, it being a fundamental principle of law that: Those obliged to deliver or to dosomething incur in delay from the time the obligee judicially orextrajudicially demands from them the fulfillment of their obligation.(Art. 1169, Civil Code.) In the case at bar, it is not disputed that no demands, judicial or extrajudicial, were made by private respondents on defendant Boiser(Francisco) for the return of the amount of P150,000.00. There could not have been any because of the nature of the action filed by privaterespondents, which is for specific performance. Hence, there is nodelay of the latter's obligation, assum ing that she be eventuallyrequired in the decision of the Court to return the same. Thus, nointerest is due where there was tender of payment prior to anydemand to pay or perform the agreed act.

No interest is due where there was tender of paymentprior to demand to pay or perform an agreed act. Adebt orcannot be considered in delay who offered a check backedbysufficient deposit or ready to pay cash if the cre ditor chosethatmeans of payment.

STATE INVESTMENT VS. COURT OF APPEALS 198 SCRA 392

FACTS: On 5 April 1982, respondent spouses Rafael and Refugio Aquino pledged certain shares of stock to petitioner State Investment House Inc. (State) in order to secure a loan of P120,000.00. Prior to the execution of the pledge, respondent spouses Jose and Marcelina Aquino signed an agreement with petitioner State for the latters purchase of receivables amounting to P375,000.00. When the 1st Account fell due, respondent spouses paid the same partly with their own funds and partly from the proceeds of another loan which they obtained also from petitioner State designated as the 2nd Account. This new loan was secured by the same pledge agreement executed in relation to the 1st Account. When the new loan matured, State demanded payment. Respondents expressed willingness to pay, requesting that upon payment, the shares of stock pledged be released. Petitioner State denied the request on the ground that the loan which it had extended to the spouses Jose and Marcelina Aquino has remained unpaid.

On 29, June 1984, Atty. Rolando Salonga sent to respondent spouses a Notice of Notarial Sale stating that upon request of State and by virtue of the pledge agreement, he would sell at public auction the shares of stock pledged to State. This prompted respondents to file a case before the Regional Trial Court of Quezon City alleging that the intended foreclosure sale was illegal because from the time the obligation under the 2nd

Account became due, they had been able and willing to pay the same, but petitioner had insisted that respondents pay even the loan account of Jose and Marcelino Aquino, which had not been secured by the pledge. It was further alleged that their failure to pay their loan was excused because the Petitioner State itself had prevented the satisfaction of the obligation.

On January 29, 1985, the trial court rendered a decision in favor of the plaintiff ordering State to immediately release the pledge and to deliver to respondents the share of stock upon payment of the loan. The CA affirmed in toto the decision of the trial court. Held: The payment of regular interest constitutes the price or cost of the use of money and thus, until the principal sum due is returned to the creditor, regular interest continues to accrue since the debtor continues to use such principal amount. (State Investment House, Inc. v. Court of Appeals, G.R. No. 90676, June 19, 1991, 198 SCRA 390, 398). It has been held that for a debtor to continue in possession of the principal of the loan and to continue to use the same after the maturity of the loan without payment of the monetary interest, would constitute unjust enrichment on the part of the debtor at the expense of the creditor. Tio Khe Chio v. CAGR No. 76101-02 September 30, 1991 Facts: Tio Khe Chio shipped bags of imported fishmeals and insured the same with respondent insurance company Eastern Assurance & SuretyCorp (EASCO). During transit, the bags were found out to be damagedthus rendering the fishmeals useless. Petitioner filed a claim before theEASCO which denied the same, prompting the former to sue the latterat CFI Cebu who ordered EASCO to pay the petitioner's claim forinsurance with damages. Upon execution, respondent filed a petitionfor certiorari with the CA who set aside the lower court's decisionarguing that the latter has erred in fixing the legal interest on 12% perannum rather than the mandated 6%. Issue: What should the legal interest be for damages arising from lossof property? Held: Article 2209 of the Civil Code provides that if the obligation consists in the payment of a sum of money andthe debtor incurs in delay, the indemnity for damages, there being no stipulation to the contrary, shall be the payment of interest agreedupon, and in the absence of stipulation, the legal interest which is 6%per annum. The adjusted rate mentioned in the Circular No. 416, from which theCFI based its decision, refers only to loans or forbearances of money,goods or credits and court judgments thereon but not to court judgments for damages arising from inj ury to persons and loss of property which does not involve a loan.

Circular No. 416 of the Central Bank which took effect on July 29, 1974 pursuant to Presidential Decree No. 116 (Usury Law) raised the legal rate of interest from six (6%) percent to twelve (12%) percent. The adjusted rate mentioned in the circular refers only to loans or forbearances of money, goods or credits and court judgments thereon but not to court judgments for damages arising from injury to persons and loss of property which does not involve a loan. Eastern Shipping vs CA GR No. 97412, 12 July 1994 234 SCRA 78 FACTS Two fiber drums were shipped owned by Eastern Shipping from Japan. The shipment as insured with a marine policy. Upon arrival in Manila unto the custody of metro Port Service, which excepted to one drum, said to be in bad order and which damage was unknown the Mercantile Insurance Company. Allied Brokerage Corporation received the shipment from Metro, one drum opened and without seal. Allied delivered the shipment to the consignees warehouse. The latter excepted to one drum which contained spillages while the rest of the contents was adulterated/fake. As consequence of the loss, the insurance company paid the consignee, so that it became subrogated to all the rights of action of consignee against the defendants Eastern Shipping, Metro Port and Allied Brokerage. The insurance company filed before the trial court. The trial court ruled in favor of plaintiff an ordered defendants to pay the former with present legal interest of 12% per annum from the date of the filing of the complaint. On appeal by defendants, the appellate court denied the same and affirmed in toto the decision of the trial court. ISSUE (1) Whether the applicable rate of legal interest is 12% or 6%. (2) Whether the payment of legal interest on the award for loss or damage is to be computed from the time the complaint is filed from the date the decision appealed from is rendered. HELD (1.) a. In a loan, the interest due should be that stipulated in writing and in the absence thereof, the rate shall be 12% per annum. b. In case of other obligations, interest on the amount of damages may be imposed at the courts discretion at the rate of 6% per annum. c. When the money judgment becomes final and executory, the rate of legal interest shall be 12% per annum from such finality until its satisfaction, the interim period being an equivalent to a forbearance of credit. (2) From the date the judgment is made. Where the demand is established with reasonable certainty, the interest shall begin to run from the time the claim is made judicially or EJ but when such certainty cannot be so reasonably established at the time the demand is made, the interest shall begin to run only from the date of judgment of the court is made.

The Court held that it should be computed from the decision rendered by the court a quo.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Ip CasesДокумент5 страницIp Casesaisha20101954Оценок пока нет

- Corpo ReviewerДокумент32 страницыCorpo Revieweraisha20101954Оценок пока нет

- ClavanoДокумент47 страницClavanoaisha20101954Оценок пока нет

- Digests Estate TaxДокумент11 страницDigests Estate Taxaisha20101954Оценок пока нет

- Torts CasesДокумент7 страницTorts Casesaisha20101954Оценок пока нет

- Evid CasesДокумент5 страницEvid Casesaisha20101954Оценок пока нет

- Arce Sons and Company - IpДокумент1 страницаArce Sons and Company - Ipaisha20101954Оценок пока нет

- Ip CasesДокумент5 страницIp Casesaisha20101954Оценок пока нет

- Torts Razon CaseДокумент1 страницаTorts Razon Caseaisha20101954Оценок пока нет

- Labor ExplainedДокумент11 страницLabor Explainedaisha20101954Оценок пока нет

- Notes On Wills and SuccessionДокумент2 страницыNotes On Wills and Successionaisha20101954Оценок пока нет

- Cases Crim 2Документ6 страницCases Crim 2aisha20101954Оценок пока нет

- TortsДокумент2 страницыTortsaisha20101954Оценок пока нет

- EVIDENCE ReviewerДокумент42 страницыEVIDENCE Revieweraisha20101954Оценок пока нет

- Characteristics of SuccessionДокумент36 страницCharacteristics of Successionaisha20101954Оценок пока нет

- San Beda College of Law: Insurance CodeДокумент24 страницыSan Beda College of Law: Insurance Codeaisha20101954Оценок пока нет

- Labor Law Green Notes 2013Документ13 страницLabor Law Green Notes 2013aisha20101954Оценок пока нет

- Rules in Giving Intestate SharesДокумент2 страницыRules in Giving Intestate Sharesaisha20101954Оценок пока нет

- Constitutional CommissionsДокумент6 страницConstitutional Commissionsaisha20101954Оценок пока нет

- Digested Cases For Consti Law 1 Midterm ExamДокумент10 страницDigested Cases For Consti Law 1 Midterm Examaisha20101954Оценок пока нет

- Consti CasesДокумент13 страницConsti Casesaisha20101954Оценок пока нет

- Webb CaseДокумент16 страницWebb Caseaisha20101954Оценок пока нет

- Duration of PenaltiesДокумент1 страницаDuration of Penaltiesaisha20101954Оценок пока нет

- Partnership ReviewerДокумент18 страницPartnership Revieweraisha20101954100% (1)

- Notes On Wills and SuccessionДокумент2 страницыNotes On Wills and Successionaisha20101954Оценок пока нет

- Key Elements of Effective ProgramsДокумент4 страницыKey Elements of Effective Programsaisha20101954Оценок пока нет

- Administrative Order No. 7. Series 2008Документ34 страницыAdministrative Order No. 7. Series 2008Ur CrushОценок пока нет

- Notes On Wills and SuccessionДокумент2 страницыNotes On Wills and Successionaisha20101954Оценок пока нет

- Notes On Wills and SuccessionДокумент2 страницыNotes On Wills and Successionaisha20101954Оценок пока нет

- Notes On Wills and SuccessionДокумент2 страницыNotes On Wills and Successionaisha20101954Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Personal Data Breach Notifications in The GDPRДокумент17 страницPersonal Data Breach Notifications in The GDPRgschandel3356Оценок пока нет

- In Christ: Romans 6:4Документ6 страницIn Christ: Romans 6:4Bruce LyonОценок пока нет

- Cadila PharmaДокумент16 страницCadila PharmaIntoxicated WombatОценок пока нет

- Top 7506 SE Applicants For FB PostingДокумент158 страницTop 7506 SE Applicants For FB PostingShi Yuan ZhangОценок пока нет

- Lecture 7 - Conditions of Employment Pt. 2Документ55 страницLecture 7 - Conditions of Employment Pt. 2Steps RolsОценок пока нет

- Case Study For Southwestern University Food Service RevenueДокумент4 страницыCase Study For Southwestern University Food Service RevenuekngsniperОценок пока нет

- Homicide Act 1957 Section 1 - Abolition of "Constructive Malice"Документ5 страницHomicide Act 1957 Section 1 - Abolition of "Constructive Malice"Fowzia KaraniОценок пока нет

- ACCOUNT OF STEWARDSHIP AS Vice Chancellor University of IbadanДокумент269 страницACCOUNT OF STEWARDSHIP AS Vice Chancellor University of IbadanOlanrewaju AhmedОценок пока нет

- Roselie Ann A. de Guzman Bsihm3A Centro Escolar University - (Makati)Документ14 страницRoselie Ann A. de Guzman Bsihm3A Centro Escolar University - (Makati)Cristopher Rico DelgadoОценок пока нет

- Accounting For Revenue and Other ReceiptsДокумент4 страницыAccounting For Revenue and Other ReceiptsNelin BarandinoОценок пока нет

- TolemicaДокумент101 страницаTolemicaPrashanth KumarОценок пока нет

- Online Advertising BLUE BOOK: The Guide To Ad Networks & ExchangesДокумент28 страницOnline Advertising BLUE BOOK: The Guide To Ad Networks & ExchangesmThink100% (1)

- Webinar2021 Curriculum Alena Frid OECDДокумент30 страницWebinar2021 Curriculum Alena Frid OECDreaderjalvarezОценок пока нет

- 3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesДокумент30 страниц3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesThe Fort PointerОценок пока нет

- Option Valuation and Dividend Payments F-1523Документ11 страницOption Valuation and Dividend Payments F-1523Nguyen Quoc TuОценок пока нет

- A Documentary Report of Work Immersion Undertaken at The City Mayor'S OfficeДокумент17 страницA Documentary Report of Work Immersion Undertaken at The City Mayor'S OfficeHamdan AbisonОценок пока нет

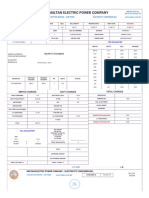

- Multan Electric Power Company: Say No To CorruptionДокумент2 страницыMultan Electric Power Company: Say No To CorruptionLearnig TechniquesОценок пока нет

- E.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Документ3 страницыE.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Carmille Marge MercadoОценок пока нет

- Final Technical Documentation: Customer: Belize Sugar Industries Limited BelizeДокумент9 страницFinal Technical Documentation: Customer: Belize Sugar Industries Limited BelizeBruno SamosОценок пока нет

- Michel Cuypers in The Tablet 19.6Документ2 страницыMichel Cuypers in The Tablet 19.6el_teologo100% (1)

- Evening Street Review Number 1, Summer 2009Документ100 страницEvening Street Review Number 1, Summer 2009Barbara BergmannОценок пока нет

- Sales Channel: ABB Limited, BangladeshДокумент4 страницыSales Channel: ABB Limited, BangladeshMehedyОценок пока нет

- Test Bank For Global 4 4th Edition Mike PengДокумент9 страницTest Bank For Global 4 4th Edition Mike PengPierre Wetzel100% (32)

- Page 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)Документ2 страницыPage 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)adtiiОценок пока нет

- Đề Cương CK - QuestionsДокумент2 страницыĐề Cương CK - QuestionsDiệu Phương LêОценок пока нет

- Bangladesh Labor Law HandoutДокумент18 страницBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadОценок пока нет

- SUDAN A Country StudyДокумент483 страницыSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- Schedules of Shared Day Companies - MITCOEДокумент1 страницаSchedules of Shared Day Companies - MITCOEKalpak ShahaneОценок пока нет

- OD428150379753135100Документ1 страницаOD428150379753135100Sourav SantraОценок пока нет

- Ais CH5Документ30 страницAis CH5MosabAbuKhater100% (1)