Академический Документы

Профессиональный Документы

Культура Документы

Gempensaw Vs CA

Загружено:

Mariam BautistaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gempensaw Vs CA

Загружено:

Mariam BautistaАвторское право:

Доступные форматы

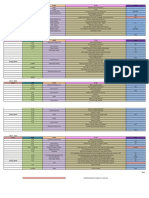

GEMPESAW V.

CA 218 SCRA 682

FACTS: Gempensaw was the owner of many grocery stores. She paid her suppliers through the issuance of checks drawn against her checking account with respondent bank. The checks were prepared by her bookkeeper Galang. In the signing of the checks prepared by Galang, Gempensaw didn't bother herself in verifying to whom the checks were being paid and if the issuances were necessary. She didn't even verify the returned checks of the bank when the latter notifies her of the same. During her two years in business, there were incidents shown that the amounts paid for were in excess of what should have been paid. It was also shown that even if the checks were crossed, the intended payees didn't receive the amount of the checks. This prompted Gempensaw to demand the bank to credit her account for the amount of the forged checks. The bank refused to do so and this prompted her to file the case against the bank. ISSUE: WON Gempensaw can still recover the amount of the forged checks HELD: Forgery is a real defense by the party whose signature was forged. A party whose signature was forged was never a party and never gave his consent to the instrument. Since his signature doesnt appear in the instrument, the same cannot be enforced against him even by a holder in due course. The drawee bank cannot charge the account of the drawer whose signature was forged because he never gave the bank the order to pay.

In the case at bar the checks were filled up by petitioners employee Galang and were later given to her for signature. Her signing the checks made the negotiable instruments complete. Prior to signing of the checks, there was no valid contract yet. Petitioner completed the checks by signing them and thereafter authorized Galang to deliver the same to their respective payees. The checks were then indorsed, forged indorsements thereon.

As a rule, a drawee bank who has paid a check on which an indorsement has been forged cannot debit the account of a drawer for the amount of said check. An exception to this rule is when the drawer is guilty of negligence which causes the bank to honor such checks. Petitioner in this case has relied solely on the honesty and loyalty of her bookkeeper and never bothered to verify the accuracy of the amounts of the checks she signed the invoices attached thereto. And though she received her bank statements, she didn't carefully examine the same to double-check her payments. Petitioner didn't exercise reasonable diligence which eventually led to the fruition of her bookkeepers fraudulent schemes

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Ust Pathology Report 9 2020Документ1 страницаUst Pathology Report 9 2020Mariam BautistaОценок пока нет

- Criminal LAW: I. Revised Penal Code - Book IДокумент2 страницыCriminal LAW: I. Revised Penal Code - Book IRS SuyosaОценок пока нет

- SettlementAgreementForm FAA DisputesДокумент3 страницыSettlementAgreementForm FAA DisputesJayhze DizonОценок пока нет

- AccentДокумент12 страницAccentMariam BautistaОценок пока нет

- Syllabus For Bar Exam 2019 - Labor LawДокумент3 страницыSyllabus For Bar Exam 2019 - Labor LawVebsie De la CruzОценок пока нет

- Syllabus - Bar Exam 2019 - CIVIL-LAWДокумент4 страницыSyllabus - Bar Exam 2019 - CIVIL-LAWVebsie De la CruzОценок пока нет

- EIKEN Advice For ALTs and StudentsДокумент12 страницEIKEN Advice For ALTs and StudentsMariam BautistaОценок пока нет

- Legal AND Judicial Ethics AND Practical ExercisesДокумент2 страницыLegal AND Judicial Ethics AND Practical ExercisesMariam BautistaОценок пока нет

- Mercantile Law: I. Letters Ofcredit and Trust ReceiptsДокумент4 страницыMercantile Law: I. Letters Ofcredit and Trust ReceiptsMariam BautistaОценок пока нет

- Taxation LawДокумент4 страницыTaxation LawMariam BautistaОценок пока нет

- Topic: State Authority To Punish CrimeДокумент8 страницTopic: State Authority To Punish CrimeMariam BautistaОценок пока нет

- Jirah Rapha Company and Mr. Roderick Iglesia Y TuralloДокумент1 страницаJirah Rapha Company and Mr. Roderick Iglesia Y TuralloMariam BautistaОценок пока нет

- Topic: State Authority To Punish CrimeДокумент8 страницTopic: State Authority To Punish CrimeMariam BautistaОценок пока нет

- Wedding 900 Per Head 2018 (Exclusive)Документ4 страницыWedding 900 Per Head 2018 (Exclusive)Mariam BautistaОценок пока нет

- Deed of AssignmentДокумент2 страницыDeed of AssignmentMariam BautistaОценок пока нет

- Pangalan Tungkulin Mon Tue Wed Fri SatДокумент2 страницыPangalan Tungkulin Mon Tue Wed Fri SatMariam BautistaОценок пока нет

- Australia 2019: 10 Daisy Street Croydon Park, New South Wales 2138, AustraliaДокумент2 страницыAustralia 2019: 10 Daisy Street Croydon Park, New South Wales 2138, AustraliaMariam BautistaОценок пока нет

- Quotation For A Five Kilowatt Solar Grid Tied System: October 15, 2015Документ4 страницыQuotation For A Five Kilowatt Solar Grid Tied System: October 15, 2015Mariam BautistaОценок пока нет

- Mariamb L00004491296Документ2 страницыMariamb L00004491296Mariam BautistaОценок пока нет

- DosДокумент1 страницаDosMariam BautistaОценок пока нет

- Day 1 - Sat 14-Oct Time Place To Do CostДокумент2 страницыDay 1 - Sat 14-Oct Time Place To Do CostMariam BautistaОценок пока нет

- Powers of Administrative Agencies: Tests of Delegation (Applies To The Power To Promulgate Administrative Regulations)Документ28 страницPowers of Administrative Agencies: Tests of Delegation (Applies To The Power To Promulgate Administrative Regulations)Mariam BautistaОценок пока нет

- Waiver of Bank Secrecy Law SampleДокумент3 страницыWaiver of Bank Secrecy Law SampleMariam Bautista50% (2)

- Real Property Taxation ReportДокумент35 страницReal Property Taxation ReportMariam BautistaОценок пока нет

- Bio Research Dr. A Santos Ave. Sucat Paranaque CityДокумент2 страницыBio Research Dr. A Santos Ave. Sucat Paranaque CityMariam BautistaОценок пока нет

- Sworn Declaration: Annex DДокумент1 страницаSworn Declaration: Annex DMariam BautistaОценок пока нет

- Relations Between Husband and WifeДокумент23 страницыRelations Between Husband and WifeMariam BautistaОценок пока нет

- Annex DДокумент2 страницыAnnex DPatrick DazaОценок пока нет

- Shape UpДокумент1 страницаShape UpMariam BautistaОценок пока нет

- Letter of Authorization-CamilleДокумент1 страницаLetter of Authorization-CamilleMariam BautistaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)