Академический Документы

Профессиональный Документы

Культура Документы

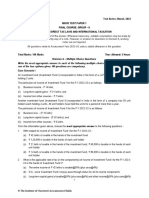

Service Tax Return 3in Excel Format-1

Загружено:

priyaradhiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Service Tax Return 3in Excel Format-1

Загружено:

priyaradhiАвторское право:

Доступные форматы

From ST - 3 (Return under Section 70 of the Fiance Act, 1994) (ORIGINAL / REVISED RETURN) FINANCIAL YEAR For the

period : 1 A Has the assessee opted to operate as Large Taxpayer (Y/N) 1 B If reply to column "1A" is ' of Large Taxpayer Unit (LTU) opted for (name of city) 2 A Name of the assessee 2 B STC No. 2 C Premises code No. 2D Constitution of the assessee: 1. Individual /Proprietary 3.Registered Public Ltd. Company 5. Registered Trust 7. Others [April - September] [October - March] N NA

2.Partnership 4.Registered Private Ltd. Company 6.Society /Co-op. society

Computation of Service Tax (To be filled by a person liable to pay service/Not to be filled by input service distributor) (To be repeated for every

category of taxable service on which service tax is payable by the assessee).

A 1 Name of Taxable Service A 2 Assessee is liable to pay service tax on this taxable service as (i) a service provider; or (ii) a service receiver liable to make payment of service tax B Sub-clause No. of clause (105) of section 65

C 1 Has the assessee availed benefit to any exemption notification (Y / N) C 2 If reply to column "C1" is yes please furnish notification Nos. D If abatement is claimed as per notification no. 1/2006-ST, please furnish Sr. No. in the notification under which such abatement is claimed E 1 Whether provisionally assessed (Y / N) E 2 Prove. Assessment No. (if any)

Value of taxable service, service tax payable and gross amount charged

Month / Quarter (1) ( I ) Service tax payable ( a ) Gross amount received / (paid) in money (i) against service provided (ii) in advance for service to be provided (b) (c) Money equivalent of considerations received / (paid) in a form other than money Value on which service tax is exempt / not payable (i) Amount received against export service (ii) Amount received / (paid ) towards exempted services other than export (iii) Amount received as / (paid to ) pure agent Abatement claimed - Value Taxable value = (a + b) - (C+ d) Service tax rate wise break-up of taxable value = (e) (i) Value on which service tax is payable @ 5% (ii) Value on which service tax is payable @ 8% (iii) Value on which service tax is payable @ 10% (iv) Value on which service tax is payable @ 12% (v) other rate, if any, (please specify) Service tax payable Education cess payable Secondary and higher education cess payable

Oct (2)

Nov (3)

Dec (4)

Jan (5)

Feb (6)

Mar (7)

(d) (e) (f)

(g) (h) (i)

( II ) Taxable amount charged Gross amount for which bills/invoice/challans are issued relating to service provided /to be provided ( j ) (including export of service and exempted service) Money equivalent of other consideration charged, if ( k ) any in a form other than money Amount charged for exported service provided/ to ( l ) be provided Amount charged for exempted service provided/ to be provided (other than export of service given at (1) ( m ) above) ( n ) Amount charged as pure agent ( o ) Amount claimed as abatement ( p ) Net taxable amount charged = (j+k) - (l+m+n+o)

** Assessee liable to pay service tax on quarterly basis may furnish details quarter wise i.e. Apr-Jun, Jul-Sep, Oct-Dec, Jan-Mar # Applicable when service receiver is liable to pay service tax; ^ Not applicable to service receiver liable to pay service tax

4 A. Service Tax education cess and other amounts paid

Month / Quarter (1) (I)

Oct (2)

Nov (3)

Dec (4)

Jan (5)

Feb (6)

Mar (7)

Service tax, education cess, secondary and higher education cess paid

( a ) Service Tax Paid (i) in cash (ii) in CENVAT credit (iii) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (3) of ST Rules (iv) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (4A) of ST Rules -

( b ) Education cess payable (i) in cash (ii) in CENVAT credit (iii) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (3) of ST Rules (iv) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (4A) of ST Rules

( c ) Secondary and higher education cess payable (i) in cash (ii) in CENVAT credit (iii) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (3) of ST Rules (iv) by adjustment of excess amount paid earlier and adjusted in this period under Rule 6 (4A) of ST Rules

( d ) Other amount paid (i) Arrears of revenue paid in cash (ii) Arrears of revenue paid by credit (iii) Arrears of education cess paid in cash (iv) Arrears of education cess paid by credit (v) Arrears of sec & higher edu cess paid in cash (vi) Arrears of sec & higher edu cess paid in credit (vii) Interest paid (viii) Penalty paid (ix) Section 73 A amount paid (x) Any other amount (please specify) ( II ) Details of challans (Vide which service tax education cess secondary and higher education cess and other amount paid in cash) ( a ) Challans Nos. (i) (ii) (iii) (iv) ( b ) Challans Date (i) (ii) (iii) (iv) 4B. -

Source documents details for entries at column 4A (I) (a)(iii) 4A (I) (a)(iv), 4A(I)(b)(iii), 4A (I)(b) (iv), 4A (I) ( c) (iii) 4A (I) ( c) (iv), 4A(I) (d) (i) to (vii) Entry in table 4 A above Month /Quarter Source documents No. / Period Source documents date

Sr.No.

4C.

Details of amount of service tax payable but not paid as on the last day of the period for which return is filed

5 5A

Details of input stage CENVAT credit Whether the assessee providing exempted/non taxable service or exempted goods (2)

(1) ( a ) Whether providing any exempted or nontaxable service (Y/N) ( b ) Whether manufacturing any exempted goods(Y/N) ( c ) If anyone of the above is yes, whether maintaining separate account for receipt or consumption of input service and input goods (refer to rule 6 (2)of CENVAT credit Rule 2004

5B

CENVAT Credit taken and utilized Month / Quarter (1) Oct (2) Nov (3) Dec (4) Jan (5) Feb (6) Mar (7)

( I ) CENVAT Credit of service tax and Central Excise duty ( a ) Opening balance ( b ) Credit taken (i) On inputs (ii) On capital goods (iii) On input services received directly (iv) As received from input service distributor (v) From inter unit transfer by LTU Total Credit taken = ( i+ ii + iii + iv + v ) ( C ) Credit Utilized (i) For payment of service tax (ii) For payment of education cess on taxable service (iii) For payment of excise or any other duty (iv) Towards clearance of input goods and capital goods removed as such (v) Towards inter unit transfer by LTU Total Credit Utilized = ( i+ ii + iii + iv + v ) Closing Balance of CENVAT credit = ( a+b - c ) (d)

( II ) CENVAT Credit of Education and secondary and Higher Education Cess ( a ) Opening Balance Credit of Education and secondary and Higher ( b ) Education Cess taken (i) On inputs (ii) On capital goods (iii) On input services received directly (iv) As received from input service distributor (v) From inter unit transfer by LTU Total Credit of Education and secondary and Higher Education Cess taken = ( i+ii+iii+iv+v ) Credit of Education and secondary and Higher ( c ) Education Cess utilized (i) For payment of education cess and secondary and higher education cess on services (ii) For payment of education cess and secondary and higher education cess on goods (iii) Towards payment of education cess and secondary and higher education cess on clearance of input goods and capital goods removed as such (iv) Towards inter unit transfer by LTU Total Credit of Education and secondary and Higher Education Cess utilized = ( i+ii+iii+iv) Closing Balance of Education and secondary and ( d ) Higher Education Cess = ( a+b - c )

# Relevant only if assessee providing taxable service is also engaged in manufacture and clearance of excisable goods. This would also include excise duty paid on capital goods and inputs removed as waste and scrap, in terms of sub-rule 5A of rule 3 of the CENVAT Credit Rules, 2004 * To be filled only by Large Taxpayer as defined under Rule 2 (ea) of the Central Excise Rules, 2002 and who has opted to operate as LTU. In case LTU has centralized registration for service tax, this information is not applicable in respect of service tax credit.. ** Assessees liable to pay service tax on quarterly basis may give detail quarter wise i.e. Apr-Jun, Jul-Sep, Oct-Dec, and Jan-Mar

e goods. This would also ule 3 of the CENVAT Credit Rules,

as opted to operate as LTU. In

Credit details for Input service distributor Oct (1) (2) Nov (3) Dec (4) Jan (5) Feb (6) Mar (7)

(I) (a) (b) (c)

CENVAT Credit of service tax and Central Excise duty Opening Balance of CENVAT Credit Credit taken (for distribution) on input service Credit Distributed Credit not eligible for distribution (rule 7(b) of CENVAT -

( d ) credit rules 2004) ( e ) Closing balance

( II ) CENVAT Credit of Education and secondary and Higher Education Cess credit Opening Balance of Education and secondary and ( a ) Higher Education Cess credit Credit of Education and secondary and Higher Education Cess taken (for distribution) on input ( b ) service Credit of Education and secondary and Higher ( c ) Education Cess Distributed Credit of Education and secondary and Higher Education Cess not eligible for distribution (rule 7(b) ( d ) of CENVAT credit rules 2004) ( e ) Closing balance -

7 (a)

Self Assessment memorandum

I / We declare that the above particulars are in accordance with the records and books maintained by me/us and are correctly stated. ( b ) I / We have assessed and paid the service tax and/or availed and distributed CENVAT credit correctly as per the provisions of the finance act, 1994 and the rules made thereunder. ( c ) I / We have paid duty within the specified time and in case of delay, I/We have deposit the interest leviable thereon.

(Name & Sign of Assess or authorized sign ) Place: Date: ACKNOWLEDGEMENT I hereby acknowledge the receipt of your ST - 3 return for the period __________________________ Place: Date: (Signature of the Officer of Central Excise & Service Tax) (With Name & Official Seal)

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОценок пока нет

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОт EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОценок пока нет

- st3 FormДокумент12 страницst3 FormAvijit BanerjeeОценок пока нет

- ST RKBДокумент14 страницST RKBanon-849760Оценок пока нет

- Stform 3Документ17 страницStform 3Ramesh SawantОценок пока нет

- (Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial YearДокумент10 страниц(Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial Yearharjeet54Оценок пока нет

- Instruction To Fill Form St3Документ9 страницInstruction To Fill Form St3Dhanush GokulОценок пока нет

- ServiceTaxobjective QuestionsДокумент14 страницServiceTaxobjective QuestionsJitendra VernekarОценок пока нет

- "Form St-3: (Please See The Instructions Carefully Before Filling The Form)Документ8 страниц"Form St-3: (Please See The Instructions Carefully Before Filling The Form)lbajaj_3Оценок пока нет

- (As Defined Under Rule 2 (Ea) of The Central Excise Rules, 2002 Read With Rule 2 (1) (CCCC) of The Service Tax Rules, 1994)Документ18 страниц(As Defined Under Rule 2 (Ea) of The Central Excise Rules, 2002 Read With Rule 2 (1) (CCCC) of The Service Tax Rules, 1994)135276Оценок пока нет

- Form ST-3 (Return Under Section 70 of The Finance Act, 1994)Документ9 страницForm ST-3 (Return Under Section 70 of The Finance Act, 1994)Samir SalunkheОценок пока нет

- Form No. ST 3 - Amended Notification 10 - 2009 - STДокумент14 страницForm No. ST 3 - Amended Notification 10 - 2009 - STJayОценок пока нет

- ST 3Документ5 страницST 3Totala Govindprasad RadheshyamОценок пока нет

- Leelavati Service Tax ReturnДокумент6 страницLeelavati Service Tax Returnphani raja kumarОценок пока нет

- GST Icai 15072023Документ98 страницGST Icai 15072023Selvakumar MuthurajОценок пока нет

- Questionnaire ObjectiveДокумент9 страницQuestionnaire Objectiveprasadzinjurde100% (3)

- Suggested Tax Paper May 2011Документ11 страницSuggested Tax Paper May 2011Sudhir PanigrahiОценок пока нет

- Site Info ClearanceДокумент9 страницSite Info ClearanceAnuppur Amlai RangeОценок пока нет

- Amendments Applicable For Nov 2018 Exam: Income TaxДокумент4 страницыAmendments Applicable For Nov 2018 Exam: Income TaxKrishna DasОценок пока нет

- ST 3 Revised For 2nd QuarterДокумент16 страницST 3 Revised For 2nd QuarterSam SmartОценок пока нет

- Chapter Outline: Individual DeductionsДокумент5 страницChapter Outline: Individual Deductionsnasmoe321Оценок пока нет

- Itr-7 FaqДокумент14 страницItr-7 FaqAshwin KumarОценок пока нет

- CA Final DT Q MTP 1 May 23Документ10 страницCA Final DT Q MTP 1 May 23Mayur JoshiОценок пока нет

- SOD 2020 - Form 1 - FinalДокумент6 страницSOD 2020 - Form 1 - Finalavijit dasОценок пока нет

- Form2FandInstructions 06062006Документ11 страницForm2FandInstructions 06062006Mnaoj PatelОценок пока нет

- Amendments - 23rd August, 2011Документ52 страницыAmendments - 23rd August, 2011Vipul MallickОценок пока нет

- Direct Tax Summary Notes For IPCC JKQK1AK0Документ24 страницыDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaОценок пока нет

- Mock Test Cma Dec 19-1Документ13 страницMock Test Cma Dec 19-1amit jangraОценок пока нет

- Suggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate ExaminationДокумент14 страницSuggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate Examinationseenu pОценок пока нет

- 3 Revision Summary of Income TaxДокумент22 страницы3 Revision Summary of Income TaxJitendra VernekarОценок пока нет

- Stock Exchange Service (A) Date of IntroductionДокумент7 страницStock Exchange Service (A) Date of Introductionarshad89057Оценок пока нет

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsДокумент13 страницFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriОценок пока нет

- Tax Audit Clauses PDFДокумент13 страницTax Audit Clauses PDFSunil KumarОценок пока нет

- Mock Test Series 1 QuestionsДокумент11 страницMock Test Series 1 QuestionsSuzhana The WizardОценок пока нет

- Test Series: March, 2023 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionДокумент10 страницTest Series: March, 2023 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionSagar ShahОценок пока нет

- Indirect Tax AmendmentsДокумент46 страницIndirect Tax AmendmentsCeciro LodhamОценок пока нет

- Itr U EnglishДокумент4 страницыItr U EnglishSHREYASОценок пока нет

- Re: Service Tax-Change in CENVAT Credit Rules 2004Документ7 страницRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ6 страницTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270Оценок пока нет

- P11Документ20 страницP11mistryankusОценок пока нет

- Form 3CD FinalДокумент7 страницForm 3CD FinalMOHANA PRIYA.J 19BCO828Оценок пока нет

- Ca Inter Direct Tax MCQДокумент213 страницCa Inter Direct Tax MCQVikramОценок пока нет

- Works Contract ServicesДокумент13 страницWorks Contract ServicesSreedhar EtrouthuОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ7 страницTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiОценок пока нет

- 14 - Guidance Note - Service TaxДокумент3 страницы14 - Guidance Note - Service Taxgaurav_99961Оценок пока нет

- Income Tax Vol-Ii New PDFДокумент352 страницыIncome Tax Vol-Ii New PDFGaurav Beniwal100% (1)

- Task 04 - QuoteДокумент6 страницTask 04 - Quotesukhwinder17021984Оценок пока нет

- Indirect Tax-Sample QuestionДокумент8 страницIndirect Tax-Sample Questionantonyashin007Оценок пока нет

- Income-Tax Rules, 1962Документ17 страницIncome-Tax Rules, 1962mohd aslamОценок пока нет

- Paper-7 - Applied Direct Taxation: Answer To MTP - Intermediate - Syllabus 2008 - Dec2014 - Set 1Документ21 страницаPaper-7 - Applied Direct Taxation: Answer To MTP - Intermediate - Syllabus 2008 - Dec2014 - Set 1Join Mohd ArbaazОценок пока нет

- 31244mtestpaper Ipcc sr2 p4Документ8 страниц31244mtestpaper Ipcc sr2 p4Sundeep MogantiОценок пока нет

- CSДокумент26 страницCSAnjuElsaОценок пока нет

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Документ9 страницDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007Оценок пока нет

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperДокумент8 страницNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saОценок пока нет

- Cma Tax PaperДокумент760 страницCma Tax Paperritesh shrinewarОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОценок пока нет

- Tds Calculator W.E.F. 1.10.09Документ1 страницаTds Calculator W.E.F. 1.10.09priyaradhiОценок пока нет

- Tally Auto InterestДокумент2 страницыTally Auto InterestpriyaradhiОценок пока нет

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Документ6 страницSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiОценок пока нет

- Project ReportДокумент5 страницProject ReportPriya RadhiОценок пока нет

- Shaligrama StotramДокумент5 страницShaligrama StotrampriyaradhiОценок пока нет

- Pregnancy SlokamДокумент1 страницаPregnancy SlokampriyaradhiОценок пока нет

- Africa StandardsДокумент7 страницAfrica Standardsnujahm1639Оценок пока нет

- Mr. Shev Eltan Poughkeepsie Property and Financial DeedДокумент4 страницыMr. Shev Eltan Poughkeepsie Property and Financial DeedPhilip RussellОценок пока нет

- The Oxford Handbook of The IncasДокумент5 страницThe Oxford Handbook of The IncasClaudiaОценок пока нет

- ch-2..... Chapter - 2 Trade UnionДокумент23 страницыch-2..... Chapter - 2 Trade UnionTurjo IslamОценок пока нет

- Nautical HeroesДокумент36 страницNautical HeroesKevin FunkОценок пока нет

- Pyq Criminal Law Y1 2015Документ2 страницыPyq Criminal Law Y1 2015carnationОценок пока нет

- HGDG-2019 3rd Edition PDFДокумент56 страницHGDG-2019 3rd Edition PDFBoomgard Tribute100% (1)

- Lesson 2.b. Social Structure 19th CenturyДокумент3 страницыLesson 2.b. Social Structure 19th CenturyMJ Dela Cruz67% (3)

- 2021 Nestle Wellness Campus WaiverДокумент1 страница2021 Nestle Wellness Campus WaiverLEGEND TvОценок пока нет

- The ICFAI University, DehradunДокумент11 страницThe ICFAI University, DehradunriyaОценок пока нет

- BMRCL Recruitment 2022 For 144 AE, JE, Section Engineer and Engineering PostsДокумент7 страницBMRCL Recruitment 2022 For 144 AE, JE, Section Engineer and Engineering PostsRajesh K KumarОценок пока нет

- Response of Hot Pepper (Capsicum Annuum L.) To Deficit Irrigation in Bennatsemay Woreda, Southern EthiopiaДокумент7 страницResponse of Hot Pepper (Capsicum Annuum L.) To Deficit Irrigation in Bennatsemay Woreda, Southern EthiopiaPremier PublishersОценок пока нет

- Sindhu Janak V State of Maharashtra SC 2023Документ4 страницыSindhu Janak V State of Maharashtra SC 2023Arun wighmalОценок пока нет

- Charles Dickens..Документ130 страницCharles Dickens..sabriОценок пока нет

- Form 47Документ2 страницыForm 47Dileep KumarОценок пока нет

- Acuña v. CAДокумент3 страницыAcuña v. CAvictoriaОценок пока нет

- Special Stipulations NUTECH UniversityДокумент2 страницыSpecial Stipulations NUTECH UniversityTariqMahmoodОценок пока нет

- Compensation Under Probation of Offender's Act 1958Документ11 страницCompensation Under Probation of Offender's Act 1958ankeshОценок пока нет

- RWDSU Constitution - 2018Документ31 страницаRWDSU Constitution - 2018LaborUnionNews.comОценок пока нет

- Anthropology and Humanism - 2022 - Kefen Budji - Crossing Over An International Student S Experiences and Musings inДокумент9 страницAnthropology and Humanism - 2022 - Kefen Budji - Crossing Over An International Student S Experiences and Musings inJohanna MahabirОценок пока нет

- Examen Parcial - Semana 4 - INV - PRIMER BLOQUE-CULTURA Y ECONOMIA REGIONAL DE EUROPA - (GRUPO1)Документ6 страницExamen Parcial - Semana 4 - INV - PRIMER BLOQUE-CULTURA Y ECONOMIA REGIONAL DE EUROPA - (GRUPO1)mariaОценок пока нет

- Confirmation Letter - Shivam DhakaДокумент2 страницыConfirmation Letter - Shivam DhakaTraining & PlacementsОценок пока нет

- 1139 W Broadway RdTempeCW BrochureДокумент7 страниц1139 W Broadway RdTempeCW BrochureMEGA GLOBALОценок пока нет

- Personal Assistant Hour Notification Form: Month - 20Документ1 страницаPersonal Assistant Hour Notification Form: Month - 20Shahnaz NawazОценок пока нет

- Eden Integrated School Senior High SchoolДокумент3 страницыEden Integrated School Senior High SchoolJamielor Balmediano100% (3)

- History 121: Unit-1-Discussion-QuestionsДокумент2 страницыHistory 121: Unit-1-Discussion-QuestionsJennie CoghlanОценок пока нет

- 2 Interhandel Case (Ferrer) PDFДокумент3 страницы2 Interhandel Case (Ferrer) PDFMatt LedesmaОценок пока нет

- Module 1 Internal Revenue TaxesДокумент11 страницModule 1 Internal Revenue TaxesSophia De GuzmanОценок пока нет

- Fastcalgas Top 50 CylindersДокумент4 страницыFastcalgas Top 50 Cylindersd7csn5fdwpОценок пока нет

- Rodriguez V Gloria Macapagal-Arroyo, Et Al. (G.R. No. 191805, April 16, 2013)Документ8 страницRodriguez V Gloria Macapagal-Arroyo, Et Al. (G.R. No. 191805, April 16, 2013)JM LumaguiОценок пока нет