Академический Документы

Профессиональный Документы

Культура Документы

DLBA 2013 Economic Profile

Загружено:

Long Beach PostАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DLBA 2013 Economic Profile

Загружено:

Long Beach PostАвторское право:

Доступные форматы

DOWNTOWN LONG BEACH

ECONOMIC PROFILE

2013

ECONOMIC PROFILE 2013

TABLE OF CONTENTS

04 04 04 06 08 09 10 12 A VALUE-ADDED BUSINESS ENVIRONMENT THE DOWNTOWN PLAN: INCENTIVIZING DEVELOPMENT MAJOR DEVELOPMENT PROJECTS GETTING AROUND DOWNTOWN DEMOGRAPHIC PROFILE AT-A-GLANCE PSYCHOGRAPHIC OVERVIEW RESIDENTIAL PROFILE HOUSING CHOICES

14 WORKFORCE 16 OFFICE MARKET

18 SHOPPING 20 22 RETAIL OPPORTUNITIES TOURISM AND ATTRACTIONS

DEAR FRIEND:

Welcome to Downtown Long Beach! Our City is conveniently located between Downtown Los Angeles and Orange County and is one of the few American city centers with an ocean view. Downtown Long Beach offers compelling opportunities for major developers, entrepreneurs, unique restaurant concepts, and everything in between. More than 30,000 residents live in Downtown Long Beach, and the population continues to grow. This influx of highly educated Downtown residents with disposable incomes creates a demand for new businessesincluding retail shopping, dining, and professional services. Our residents choose Downtown Long Beach because it is the perfect place to live, work, and play. Beyond the beautiful waterfront views and excellent weather, Downtown Long Beach is ranked among the top nationwide for being one of the most walkable and bike-friendly communities. Dedicated bike lanes in Downtown promote safe road sharing between motorists and cyclists. Additionally, the urban design of Downtown allows residents and visitors to forgo their cars to walk or bike for nearly all errands. The Downtown Community Plan, which the City Council passed last year, will help us enhance the quality of life of our stakeholders. This planning ordinance streamlines permitting processes and encourages investment over the next 25 years. Recognized by the Los Angeles Economic Development Corporation as one of the standout business-friendly cities in Los Angeles County, we continue to do everything possible to make opening a business in Downtown a fair, transparent, and efficient process. A key City partner is the Downtown Long Beach Associates (DLBA). The DLBA serves as a liaison between businesses and the City and provides marketing and promotional assistance to Downtown Long Beach businesses. The DLBA provides other invaluable services like the team of Downtown Safety Guides who patrol the area to provide visitors with directions, dining recommendations, and serve as a second set of eyes and ears to the Long Beach Police Department. Whether it is your first visit or the first visit in a long time, I invite you to discover Downtown Long Beach and everything it has to offer. Sincerely,

The Downtown Long Beach Associates (DLBA) is a nonprofit organization operating on behalf of the residential and commercial property owners and the tenants of the Improvement Districts. It is dedicated to the management, marketing, security, maintenance, advocacy, and economic and community development of Downtown Long Beach. This publication contains the latest data available from the US Census and projections from ESRI. Thank you to the City of Long Beach, the Los Angeles County Assessor, Cushman and Wakefield, Smith Travel Research, the Long Beach Convention and Visitors Bureau, and local representatives from major developments, hotels, and housing units, for providing source material.

Mayor Bob Foster City of Long Beach

ECONOMIC PROFILE 2013

A VALUE-ADDED BUSINESS ENVIRONMENT

PRIME LOCATION

Downtown Long Beach is one of Southern Californias most unique waterfront urban destinations to live, work, and play. As Californias seventh-largest city, Downtown Long Beach is centrally located and a mere 20 minutes from both Los Angeles and central Orange County. Additionally, visitors can easily access Downtown via public transit and explore its many shops, restaurants, and attractions by bike or on foot. Downtown Long Beach offers all the amenities and variety of a major urban center within a clean, safe community and is enhanced by the temperate climate and breathtaking ocean views.

MAJOR DEVELOPMENT PROJECTS

NEW DEVELOPMENTS

The last decade of investment delivered transformational changes to the Downtown skyline. As the national economy rebounds, local planners, developers, and investors are gearing up for the next boom cycle and corresponding property investment opportunities. The new Downtown Plan is setting the course for the next wave of investment and evolution of the Downtown. The accompanying summary of new development projects will deliver up to 1,681 residential units, 740,000 square feet of office space, 400 hotel rooms, 56,370 square feet of retail space, 31 courtrooms, and more than half a million square feet of civic space. Featured projects (renderings to the left) include: 1 Pine Square Adaptive reuse to convert the theater into 69 new residential units, adding to the already existing 142 Pacific Court - Developed by Pine Square Partners. The American Hotel Adaptive reuse as a mixed-use structure to include approximately 3,670 square feet of retail space on the ground floor and 7,000 square feet of creative office space on the second and third floors. Developed by Temple Creative Realty, LLC. Golden Shore Master Plan Multi-phase development plan to include 340,000 square feet of office space, 1,370 residential units, 28,000 square feet of retail space, and 400 hotel rooms over 5.87 acres. Developed by George Medak, Molina Healthcare, and Keesal, Young, and Logan. Governor George Deukmejian Courthouse 545,000-square-foot building with 31 civil and criminal courtrooms, 63,000 square feet of county office space, and 9,200 square feet of retail space. Developed by Long Beach Judicial Partners. Shoreline Gateway Development plan to include 221 residential units and 9,500 square feet of retail space. Developed by AndersonPacific, LLC. Millworks 6th and Pine Project More than 200,000 square feet of commercial office space built to suit for Fortune 1000 company Molina Healthcare. $55 million adaptive reuse of historic Press-Telegram and Meeker-Baker buildings. Developed by 6th and Pine Development, LLC.

BUSINESS IMPROVEMENT DISTRICT

Downtown Long Beach has the added benefit of community-led Business Based and Property Based Improvement Districts, administered by the Downtown Long Beach Associates (DLBA), that ensure Downtown streets are clean, safe, and vibrant. The most visible of these services are the Clean and Safe teams, serving an area frequented daily by thousands of employees, residents, shoppers, and tourists. The DLBAs Clean and Safe teams two of the Downtowns most beloved programs facilitate cleanliness, maintenance, public safety, and ambassadorial services that enhance both physical and experiential aspects of the public realm in Downtown. Attracting New Customers The DLBA utilizes a multi-faceted approach to attracting consumers to Downtown Long Beach. From social media campaigns to traditional print advertising, the DLBA uses a variety of platforms to promote Downtown Long Beach and its live, work, and play atmosphere. Additionally, the DLBA produces more than a dozen annual events that attract tens of thousands of revelers and generate millions in consumer spending. Economic Development Services In addition to attracting business and investment to Downtown, the DLBA also helps existing businesses thrive by constantly improving the political and regulatory climate. The DLBA provides many services, including: Liaison services between businesses and City departments Property owner and brokerage contacts Site selection assistance Business development resources, financial incentives, and other programs. Capital Improvement & Beautification The DLBA works to identify and oversee projects that will enhance the physical environment within Downtown. From storefront activation programs to alleyway beautification grants, these projects are designed to beautify Downtown, enhance public safety, and expand accessibility.

RECENT SUCCESS: 6TH AND PINE PROJECT

Two historic buildings are being given new life as a major office complex for one of the largest employers in Downtown: Molina Healthcare. The 6th and Pine Development Project, managed by Long Beachbased commercial real estate developer Millworks, encompasses a full city block located on Pine Avenue between 6th and 7th Streets that includes the former Press-Telegram and Meeker-Baker buildings. The office space will house approximately 1,000 new employees in more than 200,000 square feet for the managed health care provider and breathe new life into the North Pine neighborhood of the Downtown. The project includes the renovation of both historic buildings and includes the preservation of original design features including the Press-Telegram lobby marble floors and signage, the Meeker-Baker historic faade, and a possible site-wide program to include historic artifacts. The project also had the good fortune to be the first major development to utilize the Downtown Plan. These new zoning regulations, adopted in January 2012, outlined a clear vision for Downtown Long Beach and the building specifications that fit that vision, streamlining the permitting process for developers. Purchased in 2005, the 6th and Pine Development Project had to weather the recession and the elimination of the Redevelopment Agency. Because of their willingness to invest in Downtown, one of Long Beachs largest employers will have the ability to significantly expand and two historic Downtown structures will be restored to their former glory. From a community and economic development perspective, this project is a major accomplishment.

THE DOWNTOWN PLAN: INCENTIVIZING DEVELOPMENT

PLANNING AND ZONING

In January 2012, the Long Beach City Council approved the progressive Downtown Plan, a zoning document that established the permitted land uses, zoning, development, and other design standards for Downtown. The Downtown Plans intention is to ensure that new investment occurs in a manner that is consistent with urban city-building and blends with the character of surrounding neighborhoods, all while streamlining permitting processes and incentivizing investment. Advantages The Downtown Plan and its companion Program Environmental Impact Report (PEIR) provide a number of incentives and advantages compared to other communities, including, but not limited to: The City-initiated certified PEIR can relieve developers of conducting their own full project-level environmental impact reports for new developments. While developers must still perform an initial study, the completion of the PEIR can save developers years of predevelopment time and millions of dollars; Exempting the first 6,000 square feet for all new retail, restaurant, office, hotel, and service uses from off-street parking requirements; Allowing on-premise alcohol sales by right within most of the Downtown Plan geography; and An urbanized code that encourages appropriate-scaled development massing, active ground-floor uses, high quality materials and architecture, the preservation of historic assets, and an embellished public realm designed to encourage active pedestrian activity.

Source: City of Long Beach, Project Representatives

We were fortunate to be the first project to have the benefits of the Downtown Plan. Because of the streamlined regulations and permitting processes, we were able to accelerate the project timeline, expand upon the existing square footage of the historic buildings, and were not limited by previous parking regulations.

Michelle Molina, Millworks Managing Partner

BEVERLY HILLS CENTURY CITY ROSEMEAD 101

LOS ANGELES

ECONOMIC PROFILE 2013

WEST COVINA 10

GETTING AROUND DOWNTOWN

10

BIKE FRIENDLINESS

By opening the nations first bike commuter station, dedicated bike lanes and signals, and hosting the Tour of Long Beach race all benefits found in the Downtown Long Beach was rated in the top 20 most bike-friendly cities in the United States by Bicycling.com.

10 110

60 MONTEBELLO PICO RIVERA 605 HUNTINGTON PARK SOUTH GATE 5

FREEWAY ACCESS

Downtown Long Beach is a short commute to Los Angeles and Orange Counties via the robust Southern California freeway system.

W 7th Street

METRO

Downtown Long Beach is the southern terminus for the Los Angeles Metro Blue Line light rail corridor, which connects Downtown Long Beach to Los Angeles destinations like the Staples Center and Hollywood.

Pacific Avenue

Pine Avenue

venu

LOS ANGELES RIVER

W 6th Street

LYNWOOD

DOWNEY 105 BELLFLOWER NORWALK 91 605 CERRITOS

Alam

710

itos A

Che s Pla tnut ce

Qu e Wa ens y

MAP NOT TO SCALE

Queen Mary

Bike Lanes Passport Freeways Metro Blue Line

Source: Long Beach Transit, Long Beach Airport, City of Long Beach, Biclycling.com, DLBA

W Shoreline Drive

n de ol re G Sho

W 3rd Street W Broadway

E 3rd Street Broadway

COMPTON 91 710

TRANSIT GALLERY

The Promenade

57 FULLERTON

LAKEWOOD LONG BEACH AIRPORT 405

Sh or Dri eline ve

ANAHEIM 5

Performing Arts Center Convention Center Sports Arena Rainbow Lagoon Park

405 110

Palm Beach Park

Catalina Landing The Aquarium of the Pacific Pine Ave Pier Shoreline Aquatic Park Waterfront Esplanade Rainbow Shoreline Village Harbor

GARDEN GROVE

LONG BEACH MARINA

DOWNTOWN LONG BEACH

22 SEAL BEACH 405

22

LONG BEACH AIRPORT

LONG BEACH HARBOR

SANTA ANA

PARKING

There are nearly 15,000 publicly accessible parking spaces in Downtown Long Beach. In recent years, many coin-operated parking meters were replaced with multi-space credit card operated units at The Pike shopping center and along Broadway and 3rd Street.

Downtown Long Beach is only four miles southeast of the Long Beach Airport, which is the west coast hub for JetBlue Airlines. The airport serves more than 3 million commercial passengers annually and boasts a brand new 1,989-space parking structure and 35,000-square-foot passenger concourse expansion, which showcases Long Beach vendors.

HUNTINGTON BEACH

55 405

LONG BEACH TRANSIT

The recently remodeled Long Beach Transit Gallery, located at First Street and Pine Avenue and adjacent to the Blue Line MetroRail stop, plays host to the majority of Long Beach Transits regular bus routes and additional regional bus service. Additionally, Long Beach Transit offers free access to the major attractions in Downtown Long Beach via the Passport.

73

ECONOMIC PROFILE 2013

DEMOGRAPHIC PROFILE AT-A-GLANCE

DOWNTOWN HOUSEHOLDS AVERAGE HOUSEHOLD INCOME AVERAGE HOME VALUE MEDIAN AGE

2000 2011

PSYCHOGRAPHIC OVERVIEW

Psychographic information is used as a complement to a communitys demographic detail and provides greater insight into the personalities and sensibilities of a population to help better comprehend its composition of tastes, lifestyles, proclivities, and behaviors. By combining different categories of people within specific locations, psychoanalytics create a model of diverse lifestyle classifications and produce unique behavioral market segmentation. Based on these trends, it is clear that Downtown residents are becoming more affluent, educated, and cosmopolitan. Below are the fastest growing segments of the Downtown population: 1 12,485 81,810 138,903 $32,048 $40,339 $51,694 $52,268 $49,842 $62,505 Old and Newcomers: These households are typically beginning their careers or are retiring. There are more singles and shared households in these neighborhoods than others. They have above average educational attainment. Their purchases reflect the free lifestyles of singles and renters. They read books and newspapers, watch TV, listen to contemporary music, and go to the movies. Metro Renters: These households are young and educated singles who are beginning their professional careers in large metropolitan cities. This group is younger and more diverse than the U.S. population. They are one of the most educated groups. They tend to buy from Banana Republic, Gap, Nordstrom, and online retailers. These residents exercise regularly and like to travel. They fully utilize amenities offered in cities by visiting museums, going dancing, and attending concerts. Young and Restless: These households are young and over half are single or shared. They are ethnically diverse and live in metropolitan areas. These young professionals live a busy lifestyle and are technologically inclined. They enjoy conveniences and frequently go online to communicate, shop, and keep up with the latest trends.

3-MILE RADIUS

5-MILE RADIUS

UP

30%

2000 2011

$92,866 $161,250 $189,674 $377,592 $471,469 $527,503 2

2000 2011

30.0 28.5 30.2 30.4 31.5 32.8

< $15,000 $15,000 - $24,999 $25,000 - $34,999 $35,000 - $49,999 $50,000 - $74,999 $75,000 - $99,999 $100,000 - $149,999 $150,000 or more

16.16% 21.5% 17% 13.71% 16.3% 13.4% 14.46% 14.1% 12.1% 17.76% 14.6% 14% 12.77% 14.5% 16.3% 12.10% 7.4% 9.1% 6.82% 7.1% 10.1% 6.22% 4.5% 7.9% 3

UP

14%

HOUSEHOLD BY INCOME

UP

11%

Under 18 19-24 25-34

24.10% 26.46% 26.12% 9.00% 10.64% 10.38% 20.43% 18.9% 16.9% 15.79% 14.8% 14.3% 14.69% 12.6% 12.9% 8.04% 9.2% 10.2% 7.96% 7.4% 9.4%

POPULATION BY AGE

35-44 45-54 55-64 65 and over

EDUCATIONAL ATTAINMENT (AGE 25+)

High school diploma or less Some college or Associate degree Bachelors degree or higher

41.77% 47.3% 44.8% 30.98% 29.4% 28.3% 27.24% 23.3% 26.9%

Source: U.S Census, 2011 and ESRI, 2013

10

ECONOMIC PROFILE 2013

11

FUN FACT:

RESIDENTIAL PROFILE

A GREAT PLACE TO CALL HOME

Individuals and families looking for a vibrant urban environment are moving to Downtown Long Beach in increasing numbers. Downtown attractions including the Long Beach Performing Arts Center, Museum of Latin American Art, and Aquarium of the Pacific offer a lively cultural environment while the renaissance of dining centers like The Promenade and Pine Avenue offer craft beer, fine wine, and award-winning restaurants to the cuisine-conscious. Add the high walkability, bikeability, and easy access to the beach and it is easy to see why more and more people are calling Downtown Long Beach home.

AVERAGE HOUSEHOLD INCOME IS WHICH IS A

63% INCREASE

COMPARED TO 2000.

$52,268,

A GROWING POPULATION

More than 5% of Long Beachs population of 462,257 lives in Downtown with a density of 15,650 residents per square mile, which is nearly twice the citywide average. Downtown Long Beachs population has steadily grown by 8% since 2000, compared to less than 1% citywide for the same period, outpacing city population growth. Nearly 29,000 people call Downtown home.

HOUSEHOLD INCOME HOUSEHOLD INCOME DISTRIBUTION DISTRIBUTION

DOWNTOWN LONG BEACH AGE DISTRIBUTION DOWNTOWN LONG BEACH AGE DISTRIBUTION

2010 2010 25.3% 25.3%

WHO LIVES IN DOWNTOWN?

More than 50% are between the ages of 25 and 54. 53% are male, compared to 49% citywide. More than 46% of owner-occupied housing in Downtown cost $300,000 or more, whereas in 2000, only 5% accounted for the same price range. More than 58% have some college education or higher.

Source: U.S. Census, 2011; ESRI, 2012; DLBA

53%

25% 25% 38% 38%

53%

$15,000-$24,999 $15,000-$24,999 16% 16% 13.71% 13.71% $25,000-$34,999 $25,000-$34,999 12.4% 12.4% 14.46% 14.46% $35,000-$49,999 $35,000-$49,999 15.1% 15.1% 17.76% 17.76% $50,000-$74,999 14.9% 14.9% $50,000-$74,999 12.77% 12.77% $75,000-$99,999 $75,000-$99,999 8.5% 8.5% 12.10% 12.10% $100,000-$149,999 $100,000-$149,999 4.9% 4.9% 6.82% 6.82% $150,000$150,000 or more or more 2.9% 2.9% 6.22% 6.22%

of households have incomes of of households have incomes of or more or more

Less than $15,000 Less than $15,000 16.16%16.16%

2011 2011

24.1%24.1%

9%

UNDER 18 UNDER 1819-24

9%

20.43% 20.43% 15.79% 15.79%

2011 2011

55-64 45-54 65+ 55-64 65+

14.69% 14.69% 8.04%8.04% 7.96% 7.96%

19-24 25-34

25-34

35-44

35-44 45-54

OWNER OCCUPIED HOUSING UNITS BY VALUE EDUCATIONAL ATTAINMENT OWNER OCCUPIED HOUSING UNITS BY VALUE EDUCATIONAL ATTAINMENT

POPULATION AGE 25+ AGE 25+ POPULATION

8.41%

23.19%

$75,000 $75,000

31.7% 8.41% 14.78% 31.7% 9.9% 14.78% 30.61% 9.9% 3.3% 30.61% 23.01% 3.3% 2.1% 23.01% 23.19% 2.1%

2000 2000 2011 2011 SOME COLLEGE OR ASSOCIATE DEGREE DEGREE SOME COLLEGE OR ASSOCIATE

BACHELOR'S DEGREE OR HIGHER BACHELOR'S DEGREE OR HIGHER 2000 2000 18% 18% 2011 2011 27.24% 27.24%

2000 2011 2000 2011

26% 26% 30.98% 30.98%

of households have incomes of of households have incomes of or more or more

$50,000 $50,000

Less than $99,000

$100,000Less than $199,999 $99,000

$200,000$100,000$299,999 $199,999

$300,000$200,000$499,999 $299,999

$500,000 $300,000or more $499,999

$500,000 or more

HIGH SCHOOL DIPLOMA OR LESS OR LESS HIGH SCHOOL DIPLOMA 2000 2000 56% 56% 2011 2011 41.78% 41.78%

12

ECONOMIC PROFILE 2013

13

HOUSING CHOICES

HOUSING MARKET

Downtown offers apartments and condos to accommodate a variety of different lifestyles. Amenities such as easy access to transportation, culture, world-class dining, bike-friendly infrastructure, and parks suit the needs of a wide variety of households. From 2000 to 2010, more than 2,000 new residential housing units were built in Downtown Long Beach, which is a 140% increase in housing supply from the 1990s. Moreover, current and future development projects are expected to add hundreds of new units in coming years. Nearly 30,000 residents live in more than 13,800 housing units in Downtown Long Beach, the majority of which are comprised of rental units (77.73%). However, an increasing number of Downtown residents are choosing to buy. Current lease rates reported by rental housing developers in the Downtown start as low as $2.06 per square foot, while the most amenity-rich units fetch north of $2.80 per square foot. Along the waterfront, amenity-rich condo units sell for as much as $351 per square foot.

Source: U.S. Census, 2011; DLBA, Los Angeles County Assessor, Project Representatives

30,000 RESIDENTS

LIVE IN MORE THAN

13,800 HOUSING UNITS

2011

78%

RENT

22%

OWN

Opened Average Price per sq.ft.

2013 SELECTED RESIDENTIAL PRICING

OWNER

AQUA Blu Kress Lofts

Units

534 173 97 82 82 46 51 538 291 104 160

2005 2008 2008 2008 2006 2002 1992 2003 2010 2009 1990

$325.14 $351.40 $209.75 $255.12 $239.37 $269.48 $253.25 $2.38 $2.08 - $2.64 $2.25 - $2.80 $2.06 - $2.69

West Ocean 133 Promenade Walk

Temple Lofts Walker Building

We chose to locate our business on the ground floor of the Camden Harbor View Apartments because it is centrally located within the Downtown community, which is densly populated with dogs and dog owners. It also gives us easy access to customers at the residential properties and hotels as well as the beautiful parks along the waterfront where we take the dogs for adventures.

-Carol Reed Co-owner of Doggie Paws World, a doggie daycare and grooming facility

RENTAL

Camden Harbor View Gallery 421 Promenade Lofts Westerly on 3rd

14

ECONOMIC PROFILE 2013

15

JOB COUNTS BY DISTANCE/DIRECTION ALL WORKERS

WORKFORCE

EMPLOYMENT

Downtown has one of the highest employment densities in Long Beach. It also provides a large share of job opportunities for the residents of nearby cities. More than 37,000 people are employed in Downtown Long Beach. This figure represents more than 22% of all available jobs in the City of Long Beach. More than 24% of the people employed in Downtown are from Long Beach; nearby cities such as Los Angeles, Lakewood, Carson, Bellflower, and Torrance account for an additional 24% of the employed in Downtown. More than 50% of the employed in Downtown travel fewer than 10 miles from their homes, and more than 78% travel fewer than 24 miles from their homes. The majority of Downtown employees (64%) are between the ages of 30 and 54. The next largest age group is comprised of those who are 29 years old or younger (21%). Male workers in Downtown are represented higher than female workers at 56% versus 44%. More than half of Downtown employees have some college experience, while approximately 25% have at least a bachelors degree.

N NW NE

W 5400 9000 SW

1800

SE S

Less than 10 Miles 10 - 24 Miles

25 - 50 Miles Greater than 50 Miles

EMPLOYMENT BY INDUSTRY, DOWNTOWN VS CITY OF LONG BEACH

30% 25% 20% 15% 10% 5% 0%

is hi , ng d an O d n Hu nd tin g Ex c tra tio n Ut ilit ie s on s c tru tio n uf a u ct W rin g sa le Tr ad e Re ta n T il ra de W ar e G as C M an ho le d an

DOWNTOWN CITY OF LONG BEACH

FUN FACT:

DUE TO THE PROXIMITY OF THE PORT OF LONG BEACH, THE TRANSPORTATION AND WAREHOUSING INDUSTRY REPRESENTS THE HIGHEST PERCENTAGE OF JOBS IN DOWNTOWN

u ho

Sources: U.S Census 2011, 2010

26%

5 - 2,520 Jobs/Sq Mile 5 - 2,520 Jobs/Sq Mile Mile 2,521 - 10,068 Jobs/Sq 2,521 - 10,068 Jobs/Sq Mile 10,069 22,646 Jobs/Sq Mile 10,069 - 40,257 22,646 Jobs/Sq Mile 22,647 22,647 - 62,899 40,257 Jobs/Sq Mile 40,258 40,258 - 62,899 Jobs/Sq Mile

1-15 Jobs 1-15 Jobs 16-240 Jobs 16-240 Jobs 241-1,214 Jobs 241-1,214 Jobs 1,215-3,835 Jobs 1,215-3,835 Jobs 3,836-9,362 3,836-9,362 Jobs

gr

ic

tu ul M i

re

,F g,

or

t es u

ry

,F

il

ry ar

in

n ,a

Tr

an

r po

ta

tio

n ni

t, s n n n) or n es ce io ce tio tio pp atio rvic at vi an ra u i m re tra S d e er st ist r i s s s S t S S c i s d e l in fo In in En A al nd Re In od an m d na ic d dm al la n Re tio dm Fo nd A an ci hn A an ta io d a a d t c o c e n , s i t S ic c e ra an uc an Te bl Re d bl ni en ist t n an d Ed Pu e, m Pu in en an pa tio Fin an in at g m e m a t , m r a n d c o a Es rt A age od di ifi C te fC al lu m nt lth En m an ie to xc Re , a o c n e s M ( S e rt He cc l, te A es A em as na ic W io ag rv s n e S a es M of er Pr th O sin g at io n a ur nc e a Le sin g v er ic es p er ris es

16

ECONOMIC PROFILE 2013

17

DOWNTOWN LONG BEACH OFFICE SPACE

L E A S E D Q1/ 2007 - Q4/ 2012

PERCENTAGE LEASED

OFFICE MARKET

Out of the five major employment centers in the city of Long Beach, Downtown accounts for nearly half of the citys total inventory of 9.1 M square feet. Of the 4.2 M square feet of Downtown inventory, Class B buildings account for more than half of the space, while Class A comprises approximately one third of the inventory. As the employment center of the city, Downtown has a leading occupancy rate of 84% for the fourth quarter of 2012. This is a healthier rate than competing markets in the South Bay and other Long Beach sub-markets like the Airport Area, Bixby Knolls / Signal Hill, and 405 / 710 corridor. In calendar year 2012, the overall absorption was also positive for the Downtown, at 47,440 square feet for direct and 77,331 square feet of sublease space. Additionally, rent rates have steadily climbed since the fourth quarter of 2010 for all three office space classes, which indicates a positive recovery of the Downtown office market. Class A buildings have surpassed the rent rates from the fourth quarter of 2008, illustrating a strong demand for premium space and willingness of corporations to pay higher prices for premium office spaces. Overall, the Downtown Office Market is demonstrating healthy growth.

Source: Cushman and Wakefield, 2012

CLASS A

95

TOTAL INVENTORY CLASS B CLASS C

90

85

80

75

70

Q1 Q2 Q3 Q4

2007

Q1 Q2 Q3 Q4

2008

Q1 Q2 Q3 Q4

2009

Q1 Q2 Q3 Q4

2010

Q1 Q2 Q3 Q4

2011

Q1 Q2 Q3 Q4

Source: Cushman and Wakefield, 2012

2012

DOWNTOWN LONG BEACH OFFICE SPACE

RE N T RA T E S Q1/ 2007 - Q4/ 2012

LONG BEACH AREA OFFICE SPACE INVENTORY

CLASS A

3.00

TOTAL INVENTORY CLASS B CLASS C

IN DOLLARS PER SF PER MONTH

2.80 2.60 2.40 2.20 2.00 1.80 1.60 1.40 1.20 1.00 Q1 Q2 Q3 Q4

LONG BEACH AIRPORT AREA

26%

DOWNTOWN LONG BEACH TOTAL OFFICE SPACE CLASS B

46%

DOWNTOWN LONG BEACH

CLASS A

57%

CLASS C

10%

8%

33%

10%

405/710 CORRIDOR BIXBY KNOLLS / SIGNAL HILL EAST LONG BEACH / SEAL BEACH

10%

2007

Q1 Q2 Q3 Q4

2008

Q1 Q2 Q3 Q4

2009

Q1 Q2 Q3 Q4

2010

Q1 Q2 Q3 Q4

2011

Q1 Q2 Q3 Q4

Source: Cushman and Wakefield, 2012

2012

18

ECONOMIC PROFILE 2013

19

SHOPPING

RETAIL SPACE

Compared to other downtowns of similar geographic size and population, Downtown Long Beach contains a relatively impressive supply (1.3 M sq ft) of commercial space built to accommodate ground-floor retail uses. Such retail spaces can be found in a variety of building structures such as stand-alone structures, ground-floor space in mixeduse structures, the adaptive reuse of historic buildings, and space contained in traditional retail centers. Similar to other vibrant downtowns, there are an impressive number of food, beverage, and entertainment establishments that satisfy a wide variety of consumers. Since 2012, there has been a 7% increase in Comparison Shopping, indicating a healthy environment for retail growth.

FOOD / BEVERAGE / ENTERTAINMENT

3% OTHER 2% MEDITERRANEAN 1% SOUTHERN 3% HAMBURGERS 1% DRINKS / JUICE / LEMONADE 26% AMERICAN 2% IRISH 1% INDIAN / PAKISTANI 1% VEGETARIAN

12% MEXICAN / LATIN AMERICAN

CONVENIENCE SHOPPING

12% WOMENS HAIR SALON 24% CONVENIENCE & SUNDRY SHOPS 3% SEAFOOD 4% DESSERT 13% UNISEX HAIR 7% ITALIAN 2% TANNING SALON 1% TAILOR 1% SHOE REPAIR 2% SERVICE STATION 2% PET SHOP 2% OTHER 6% NAIL SALON 6% MENS BARBER 8% HEALTH CLUB 8% DRY CLEANERS 13% DAY SPA 2% JAPANESE FOOD 8% COFFEE / TEA 2% OTHER ASIAN FOOD 9% COCKTAIL LOUNGE 5% BAKERY

5% DELI

5% CHINESE FOOD

TOTAL DOWNTOWN RETAIL

FOOD / BEVERAGE / ENTERTAINMENT

COMPARISON SHOPPING

3% ART GALLERIES / STORES 13% WOMENS APPAREL & ACCESSORIES 2% VIDEO / VIDEO GAME 2% SUPERMARKET & VARIETY STORES 2% SPORTING GOODS 9% CARDS & GIFTS 6% SHOE STORE 2% MUSIC STORE 8% MIXED APPAREL 4% MENS APPAREL 6% LIQUOR / WINE / TOBACCO 5% JEWELRY 3% DISCOUNT DEPARMENT STORE 2% DOLLAR STORE / NOVELTIES 4% DRUGSTORE / PHARMACY 8% ELECTRONICS / CELL PHONES 3% FLORIST / PLANT STORE 5% FURNITURE & HOME ACCESSORIES 8% AUTOMOTIVE 3% BEAUTY SUPPLIES 1% BOOK STORE 1% CANDY SHOP

CONVENIENCE SHOPPING

26%

COMPARISON SHOPPING

36% 38%

20

ECONOMIC PROFILE 2013

21

RETAIL SPENDING POTENTIAL

RETAIL DEMAND WITHIN A 1, 3, AND 5-MILE RADIUS

RETAIL CATEGORY

FURNITURE & HOME FURNISHING STORES ELECTRONICS & APPLIANCE STORES FOOD & BEVERAGE STORES HEALTH & PERSONAL CARE STORES

1-MILE RADIUS

$11,019,326

3-MILE RADIUS

$49,841,745

5-MILE RADIUS

$108,297,908

$8,903,275

$39,687,054

$83,240,970

$69,823,764

$302,918,467

$613,037,898

$13,738,051

$59,520,005

$123,986,640

RETAIL OPPORTUNITIES

RETAIL SPENDING POTENTIAL

The vibrant residential community, emerging development, and thriving business environment position Downtown Long Beach to support significant retail sales numbers. In total, the spending potential within 5 miles of the Downtown exceeds an impressive $2.5 billion annually.

CLOTHING STORES SHOE STORES JEWELRY, LUGGAGE & LEATHER GOODS STORES SPORTING GOODS, HOBBY, BOOK & MUSIC STORES GENERAL MERCHANDISE STORES MISCELLANEOUS STORES FOOD SERVICES & DRINKING PLACES

$15,479,784

$67,340,741

$137,199,096

$1,973,417

$8,555,670

$17,012,693

$1,962,060

$8,723,333

$18,731,534

$4,707,776

$20,862,372

$43,014,679

$38,618,828

$168,017,549

$343,194,410

$6,334,569

$28,321,638

$60,495,005

$56,801,659

$247,714,269

$505,006,359

I am proud to call Downtown Long Beach home to my family and my business. The vibrant community of leaders and families in North Pine made it the perfect place for me to open my store. I am excited to see this neighborhood and my business - growing.

-Rajh Kirch Owner and Creative Director, Sandbox Social Club

FULL-SERVICE RESTAURANTS LIMITED-SERVICE EATING PLACES SPECIAL FOOD SERVICES DRINKING PLACES ALCOHOLIC BEVERAGES

$26,474,613

$115,524,036

$236,500,918

$23,312,084

$101,709,234

$206,852,813

$6,132,011

$26,742,522

$54,260,073

$882,952

$3,738,478

$7,392,554

Source: ESRI and Infogroup 2013

22

ECONOMIC PROFILE 2013

23

FUN FACT:

TOURISM AND ATTRACTIONS

ESTIMATE OF ANNUAL VISITORS TO LONG BEACH =

TWO OF THE MOST NOTABLE LONG BEACH CONVENTIONS ARE AND THE

COMIC CON TED CONFERENCE

6.1 MILLION

MUSEUM OF LATIN AMERICAN ART

Estimated Yearly Attendance: 70,000 Commonly referred to as MoLAA, the Smithsonian affiliate is the only museum in the western United States that exclusively features contemporary Latin American fine art.

DOWNTOWN LONG BEACH HOTEL INVENTORY

LONG BEACH CONVENTION & ENTERTAINMENT CENTER

Estimated Yearly Attendance: 1.61 million

UPSCALE

HOTEL # ROOMS RACK RATES HILTON LONG BEACH 397 $154 - $214 HYATT REGENCY LONG BEACH 528 $289 - $429 WESTIN LONG BEACH 469 $229 - $264 HYATT THE PIKE HOTEL 138 $289 - $329 HOTEL MAYA 195 $220 - $319 RENAISSANCE LONG BEACH HOTEL 374 $189 - $239

TOTAL 2101

BEST WESTERN COURTYARD MARRIOTT HOTEL QUEEN MARY VARDEN BOUTIQUE HOTEL RESIDENCE INN 66 216 315 35 178 $125 - $189 $149 - $199 $127 - $419 $129 - $149 $179 - $199

The Arena seats 13,500 and has 46,000 square feet of exhibit space. Wyland mural: at 116,000 square feet (11,000 m), it is the worlds largest mural. Renovated restaurant, lobby, and arena that includes adjustable curtains and lighting.

CRUISESHIPS & FERRIES

Catalina Express annually carries one million passengers to Catalina Island from its two Long Beach docks, San Pedro, and Dana Point. Carnival Cruise Lines Approximately 390,000 passengers annually embark from the Long Beach Cruise Terminal at the Queen Mary. The Carnival Cruise will add a third ship in 2014 to the Long Beach Cruise Terminal, which will allow the line to carry approximately 550,000 passengers annually.

MID-LEVEL

I. LONG BEACH ARENA

TOTAL

BEACH INN MOTEL CITY CENTER MOTEL GREENLEAF HOTEL INN OF LONG BEACH RODEWAY INN TRAVEL KING MOTOR INN TRAVELODGE VAGABOND INN LONG BEACH

810

25 $ 70 - $ 90 49 $ 70 45 $ 65 51 $ 81 35 $ 95 - $105 15 $ 50 63 $119 - $139 61 $ 65 - $159

II. CONVENTION CENTER

Three dynamic Exhibition Halls with 224,000 square feet of space that can be utilized for all types of conventions, tradeshows, consumer shows, and special events. The Exhibition Halls break down as follows: Exhibition Hall A = 91,000 sq. ft Exhibition Hall B = 57,000 sq. ft Exhibition Hall C = 76,000 sq. ft 34 Meeting Rooms and a Grand Ballroom make the Long Beach Convention & Entertainment Center ideal for all types of special events.

HOTEL INVENTORY:

Total Hotel Inventory =

ECONOMY

TOTAL

344

III. TERRACE THEATER

The Terrace Theater is a full-production theater that seats 3,051 with spaces for wheelchair seating. The Terrace Lobby contains a full-glass front with a view of the Terrace Fountain and ocean views on the east side. The Center Theater boasts 825 seats that are set 13 rows deep in a half-round shape, allowing excellent visibility from any seat.

3,255

ROOMS

ATTENDANCE - ANNUAL EVENTS IN DOWNTOWN

TOYOTA GRAND PRIX OF LONG BEACH LONG BEACH PRIDE FESTIVAL LONG BEACH INTERNATIONAL CITY BANK MARATHON LONG BEACH JAZZ FESTIVAL SUMMER AND MUSIC NEW YEARS EVE ZOMBIE WALK TECATE LIGHT THUNDER THURSDAY LATIN AMERICAN FESTIVAL 172,000 100,000 65,000 20,000 20,000 10,000 10,000 5,000 3,000

DLBA PRODUCED DLBA SPONSORED

THE AQUARIUM OF THE PACIFIC

Estimated Yearly Attendance: 1.5 million The Aquarium of the Pacific is the fourth-largest aquarium in the nation. It displays more than 11,000 animals in more than 50 exhibits that represent the diversity of the Pacific Ocean.

Occupancy (March 2011-March 2012) =

73%

848,860

400,000+

TOTAL

THE QUEEN MARY

Estimated Yearly Attendance: 1.4 million Long considered one of the worlds premiere ocean vessels, the Queen Mary is an Art Deco treasure and one of the most iconic images of Downtown Long Beach. In addition to daily tours and other events, it also features a 307-room hotel.

Estimated Total Room Nights In Downtown Hotels (2012) =

Source: Long Beach Convention and Visitors Bureau, Smith Travel Research

562.436.4259 www.dowtownlongbeach.org

Вам также может понравиться

- DLBA Economic Profile 2014Документ25 страницDLBA Economic Profile 2014Long Beach PostОценок пока нет

- Small-Scale Development: Eight Case Studies of Entrepreneurial ProjectsОт EverandSmall-Scale Development: Eight Case Studies of Entrepreneurial ProjectsОценок пока нет

- Downtown Brooklyn Partnership Strategic Plan Full 07-25-12Документ37 страницDowntown Brooklyn Partnership Strategic Plan Full 07-25-12Norman OderОценок пока нет

- Convention Center Follies: Politics, Power, and Public Investment in American CitiesОт EverandConvention Center Follies: Politics, Power, and Public Investment in American CitiesОценок пока нет

- Downtown Long Beach 2016 Economic ProfileДокумент27 страницDowntown Long Beach 2016 Economic ProfileLong Beach PostОценок пока нет

- The Emergence of Pacific Urban Villages: Urbanization Trends in the Pacific IslandsОт EverandThe Emergence of Pacific Urban Villages: Urbanization Trends in the Pacific IslandsОценок пока нет

- Gatehouse Capital New Orleans WTC ProposalДокумент318 страницGatehouse Capital New Orleans WTC ProposalJLОценок пока нет

- Investment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16От EverandInvestment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16Оценок пока нет

- DC Neighborhood Profiles 2016 highlights thriving retailДокумент124 страницыDC Neighborhood Profiles 2016 highlights thriving retailWashington, DC Economic PartnershipОценок пока нет

- Strategic Plan For The Stockyard, Clark-Fulton, & Brooklyn Centre Community Development Office For 2015-2018Документ12 страницStrategic Plan For The Stockyard, Clark-Fulton, & Brooklyn Centre Community Development Office For 2015-2018Tom RomitoОценок пока нет

- City Foundry, St. Louis - TIF ApplicationДокумент154 страницыCity Foundry, St. Louis - TIF ApplicationnextSTL.comОценок пока нет

- The Journey Is The Reward: Changing Oakland'S Dynamic DistrictsДокумент3 страницыThe Journey Is The Reward: Changing Oakland'S Dynamic DistrictsOaklandCBDs100% (1)

- Troy City Center LLC Proposal ChosenДокумент4 страницыTroy City Center LLC Proposal ChosenalloveralbanyОценок пока нет

- Downtown Clayton Master Plan Update and Retail Strategy - Part 1 of 2Документ74 страницыDowntown Clayton Master Plan Update and Retail Strategy - Part 1 of 2nextSTL.comОценок пока нет

- Norwich Community Development Corporation (NCDC) Annual Report (1/14/14)Документ24 страницыNorwich Community Development Corporation (NCDC) Annual Report (1/14/14)The Bulletin100% (1)

- Detroit 2006Документ143 страницыDetroit 2006Nelson Daza100% (1)

- Research For Case StudyДокумент60 страницResearch For Case StudyApril Kaye LuayonОценок пока нет

- MT Morris: Downtown Revitalization in Rural New York StateДокумент29 страницMT Morris: Downtown Revitalization in Rural New York StateprobrockportОценок пока нет

- ISO 9001:2008 CertifiedДокумент80 страницISO 9001:2008 CertifiedEmerald Rhea Niña RomerosoОценок пока нет

- 706 Market TIF ApplicationДокумент19 страниц706 Market TIF ApplicationShow-Me InstituteОценок пока нет

- 2008-09 Business Improvement District Budget Reports 2 of 2 PDFДокумент8 страниц2008-09 Business Improvement District Budget Reports 2 of 2 PDFRecordTrac - City of OaklandОценок пока нет

- Strategic Plan - Disi Committee MeetingДокумент3 страницыStrategic Plan - Disi Committee MeetingOaklandCBDsОценок пока нет

- NGA Report 2nd EditionДокумент84 страницыNGA Report 2nd EditionnextSTL.comОценок пока нет

- The Loop Area Retail Plan and Development Strategy - Action PlanДокумент22 страницыThe Loop Area Retail Plan and Development Strategy - Action PlannextSTL.comОценок пока нет

- MB Volume 7 Issue 2 Winter 2012Документ60 страницMB Volume 7 Issue 2 Winter 2012City of Miami Beach0% (1)

- Downtown Edmonton ReportДокумент38 страницDowntown Edmonton ReportEmily MertzОценок пока нет

- RFP 17-02 - Lancelot Miami River LLCДокумент75 страницRFP 17-02 - Lancelot Miami River LLCNone None NoneОценок пока нет

- NoMaBID ExecutiveDirectorДокумент2 страницыNoMaBID ExecutiveDirectorAnonymous Feglbx5Оценок пока нет

- Urban Lux Realty GroupДокумент10 страницUrban Lux Realty GroupUrban LuxОценок пока нет

- For Immediate Release: Media Contact: Delaney KempnerДокумент5 страницFor Immediate Release: Media Contact: Delaney Kempnerdavid rockОценок пока нет

- World Trade Center RFQДокумент27 страницWorld Trade Center RFQKatherine SayreОценок пока нет

- LACCДокумент28 страницLACClaОценок пока нет

- Attachment I - Development Vision For GreensburgДокумент3 страницыAttachment I - Development Vision For GreensburgJudy RossОценок пока нет

- Downtowndc Business Improvement DistrictДокумент49 страницDowntowndc Business Improvement Districtsylvia-brown-8017Оценок пока нет

- LWLP Response To RFQДокумент59 страницLWLP Response To RFQHartford Courant100% (1)

- DOA 2011 Annual Report To The City OaklandДокумент7 страницDOA 2011 Annual Report To The City OaklandOaklandCBDsОценок пока нет

- City Manager Kevin Cowper - HighlightsДокумент2 страницыCity Manager Kevin Cowper - HighlightsRickey StokesОценок пока нет

- Development Proposal For 101 Brady Street in Allegan, MichiganДокумент19 страницDevelopment Proposal For 101 Brady Street in Allegan, MichiganWWMTОценок пока нет

- Up, Up and Away: RTR Financial Services Supports Lutheran HealthcareДокумент12 страницUp, Up and Away: RTR Financial Services Supports Lutheran HealthcareelauwitОценок пока нет

- 054 - DPD 2019 Budget StatementДокумент11 страниц054 - DPD 2019 Budget StatementThe Daily LineОценок пока нет

- Project Proposal For The Construction ofДокумент34 страницыProject Proposal For The Construction ofnatty100% (2)

- Writing SampleДокумент20 страницWriting Sampleapi-306690993Оценок пока нет

- Wheaton's Future: Wheaton CBD and Vicinity Sector PlanДокумент6 страницWheaton's Future: Wheaton CBD and Vicinity Sector PlanM-NCPPCОценок пока нет

- Chapter 1 SampleДокумент15 страницChapter 1 SampleAngelica PastidioОценок пока нет

- Brand Building: Strategic Real Estate Marketing Residential Commercial Mixed-UseДокумент32 страницыBrand Building: Strategic Real Estate Marketing Residential Commercial Mixed-UseNamrata SalunkheОценок пока нет

- Regina Downtown PlanДокумент288 страницRegina Downtown Planmies126Оценок пока нет

- Ras Retail RoadmapДокумент68 страницRas Retail RoadmapSektor125 Kencana LokaОценок пока нет

- The Problem and Its Background 1.1: While The Convention CenterДокумент10 страницThe Problem and Its Background 1.1: While The Convention CenterClaireОценок пока нет

- Housing Project Management Development in Bridgeport CT Resume Nancy HadleyДокумент2 страницыHousing Project Management Development in Bridgeport CT Resume Nancy HadleyNancyHadleyОценок пока нет

- HRI Properties World Trade Center ProposalДокумент91 страницаHRI Properties World Trade Center ProposalKatherine Sayre100% (3)

- MPA 640 Public Policy Analysis Cal State University NorthridgeДокумент20 страницMPA 640 Public Policy Analysis Cal State University NorthridgeRaquel Sagun Dela CruzОценок пока нет

- Finalplansw PDFДокумент146 страницFinalplansw PDFOffice of PlanningОценок пока нет

- BING2011 State of The City AddressДокумент12 страницBING2011 State of The City AddressTime Warner Cable NewsОценок пока нет

- Building Market Share: A Path Forward For Economic ExpansionДокумент40 страницBuilding Market Share: A Path Forward For Economic ExpansionBurlington FreePressОценок пока нет

- GGHCDC Self HistoryДокумент10 страницGGHCDC Self Historyres ipsa loquiturОценок пока нет

- MassDevelopment Annual Report 2012Документ32 страницыMassDevelopment Annual Report 2012Devens OnineОценок пока нет

- Ma 2014 Annual Report LRДокумент24 страницыMa 2014 Annual Report LRHuntArchboldОценок пока нет

- MCC Withdrawal Letter July2019Документ2 страницыMCC Withdrawal Letter July2019Kendra DayОценок пока нет

- West Columbia Beautificatino Plan 2010Документ42 страницыWest Columbia Beautificatino Plan 2010api-242227165Оценок пока нет

- Ethics Code Compliant Letter 11.2.2018-1Документ2 страницыEthics Code Compliant Letter 11.2.2018-1Long Beach PostОценок пока нет

- Reply To Petition To Deny - RedactedДокумент112 страницReply To Petition To Deny - RedactedLong Beach PostОценок пока нет

- Robert Fox Endorsement Op-EdДокумент3 страницыRobert Fox Endorsement Op-EdLong Beach PostОценок пока нет

- Open Letter To Long Beach City Council MembersДокумент2 страницыOpen Letter To Long Beach City Council MembersLong Beach PostОценок пока нет

- Garcetti's Letter To The SCAQMD Regarding Tesoro Refinery MergerДокумент2 страницыGarcetti's Letter To The SCAQMD Regarding Tesoro Refinery MergerLong Beach PostОценок пока нет

- LBPD Demographics ReportДокумент6 страницLBPD Demographics ReportLong Beach PostОценок пока нет

- Sunny Zia Response Letter To V. Malauulu Complaint 08.22.19Документ2 страницыSunny Zia Response Letter To V. Malauulu Complaint 08.22.19Long Beach PostОценок пока нет

- An Ethics Complaint Submitted by Board President Vivian Malauulu August 23, 2019Документ4 страницыAn Ethics Complaint Submitted by Board President Vivian Malauulu August 23, 2019Long Beach PostОценок пока нет

- City of Long Beach Elections Official V Board of Supervisors of LA Count...Документ21 страницаCity of Long Beach Elections Official V Board of Supervisors of LA Count...Long Beach PostОценок пока нет

- LB Post Response To OIS Investigations 10-16-18Документ2 страницыLB Post Response To OIS Investigations 10-16-18Long Beach PostОценок пока нет

- OCC Faculty Complaints Against Administration (2008)Документ84 страницыOCC Faculty Complaints Against Administration (2008)Long Beach Post0% (1)

- Terror Plot - Domingo COMPLAINTДокумент31 страницаTerror Plot - Domingo COMPLAINTLong Beach PostОценок пока нет

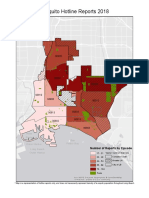

- Mosquito Hotline Reports 2018Документ1 страницаMosquito Hotline Reports 2018Long Beach PostОценок пока нет

- John Bishop CHLB LetterДокумент2 страницыJohn Bishop CHLB LetterLong Beach PostОценок пока нет

- LettertoMemorialCare 6.19.18Документ3 страницыLettertoMemorialCare 6.19.18Long Beach PostОценок пока нет

- Downtown Long Beach Economic Profile 2015Документ25 страницDowntown Long Beach Economic Profile 2015Long Beach PostОценок пока нет

- Dines LetterДокумент2 страницыDines LetterLong Beach PostОценок пока нет

- Long Beach City Auditor's Digital and E-Government Best Practices ReportДокумент30 страницLong Beach City Auditor's Digital and E-Government Best Practices ReportLong Beach PostОценок пока нет

- SCE Multifamily Program 2015Документ2 страницыSCE Multifamily Program 2015Long Beach PostОценок пока нет

- CSU Executive SalariesДокумент2 страницыCSU Executive SalariesSouthern California Public RadioОценок пока нет

- LA District Attorney Letter To Long Beach Community College District Board of TrusteesДокумент2 страницыLA District Attorney Letter To Long Beach Community College District Board of TrusteesLong Beach PostОценок пока нет

- 15-0008 (Sodomy)Документ2 страницы15-0008 (Sodomy)Ed BraytonОценок пока нет

- Agreement For Employment of The Superintendent-President of The Long Beach Community College DistrictДокумент14 страницAgreement For Employment of The Superintendent-President of The Long Beach Community College DistrictLong Beach PostОценок пока нет

- Audit of Vehicle Lien Sales Report HighlightsДокумент65 страницAudit of Vehicle Lien Sales Report HighlightsLong Beach PostОценок пока нет

- The Breakers of Long Beach Second Amended AccusationДокумент9 страницThe Breakers of Long Beach Second Amended AccusationSam GnerreОценок пока нет

- Long Beach Medical Marijuana Ordinance MapДокумент10 страницLong Beach Medical Marijuana Ordinance MapLong Beach PostОценок пока нет

- Memo To Long Beach Mayor and City Council From Airport JetBlue Letter To Airport RE: Customs FacilityДокумент3 страницыMemo To Long Beach Mayor and City Council From Airport JetBlue Letter To Airport RE: Customs FacilityLong Beach PostОценок пока нет

- MEMO: Strategy For The Tidelands Capital Budget and 5-Year Capital PlanДокумент18 страницMEMO: Strategy For The Tidelands Capital Budget and 5-Year Capital PlanLong Beach PostОценок пока нет

- Andrew Burton Resume1Документ2 страницыAndrew Burton Resume1api-113889454Оценок пока нет

- Lesson 2 - Prokaryotic VS Eukaryotic CellsДокумент3 страницыLesson 2 - Prokaryotic VS Eukaryotic CellsEarl Caesar Quiba Pagunsan100% (1)

- Menulis Paper Jurnal Ilmiah - M. Zaini MiftahДокумент44 страницыMenulis Paper Jurnal Ilmiah - M. Zaini MiftahlinearsjournalОценок пока нет

- 1 Practical ResearchhhhhhhhhhДокумент9 страниц1 Practical ResearchhhhhhhhhhKarley GarciaОценок пока нет

- Organizations As Psychic PrisonsДокумент4 страницыOrganizations As Psychic PrisonsAssignmentLab.comОценок пока нет

- Assessing Agricultural Innovation SystemsДокумент106 страницAssessing Agricultural Innovation SystemsAndre RDОценок пока нет

- Technical Assistance NotesДокумент6 страницTechnical Assistance NotesJoNe JeanОценок пока нет

- Student Interest SurveyДокумент7 страницStudent Interest Surveymatt1234aОценок пока нет

- MY TEACHING INTERNSHIP PORTFOLIOДокумент28 страницMY TEACHING INTERNSHIP PORTFOLIOJosielyn Dagondon Machado100% (1)

- Blood Relationship As A Basis of Inheritance Under Islamic Law A Case Study of The Inner and Outer Circles of FamilyДокумент206 страницBlood Relationship As A Basis of Inheritance Under Islamic Law A Case Study of The Inner and Outer Circles of Familyisaac_naseerОценок пока нет

- Performing Drama for Young LearnersДокумент2 страницыPerforming Drama for Young LearnersZafik IkhwanОценок пока нет

- Diwan Bahadur V Nagam AiyaДокумент168 страницDiwan Bahadur V Nagam AiyaAbhilash MalayilОценок пока нет

- Be Form 2 School Work PlanДокумент3 страницыBe Form 2 School Work PlanJOEL DAENОценок пока нет

- Social Justice: Scheduled Castes, Scheduled Tribes, Other Backward Classes, Minorities, and Other Vulnerable GroupsДокумент36 страницSocial Justice: Scheduled Castes, Scheduled Tribes, Other Backward Classes, Minorities, and Other Vulnerable GroupsthegemishereОценок пока нет

- PHD & Master Handbook 1 2020-2021Документ42 страницыPHD & Master Handbook 1 2020-2021awangpaker xxОценок пока нет

- AF - Agri-Crop Production NC II 20151119 PDFДокумент26 страницAF - Agri-Crop Production NC II 20151119 PDFFidel B. Diopita100% (7)

- Teachers Resource Guide PDFДокумент12 страницTeachers Resource Guide PDFmadonnastack0% (1)

- UNIT-4 Performance ManagenmentДокумент17 страницUNIT-4 Performance Managenmentsahoo_pradipkumarОценок пока нет

- Enrolment Action Plan Against COVID-19Документ4 страницыEnrolment Action Plan Against COVID-19DaffodilAbukeОценок пока нет

- Luzande, Mary Christine B ELM-504 - Basic Concepts of Management Ethics and Social ResponsibilityДокумент12 страницLuzande, Mary Christine B ELM-504 - Basic Concepts of Management Ethics and Social ResponsibilityMary Christine BatongbakalОценок пока нет

- Geometer's Sketchpad Unit for GeometryДокумент3 страницыGeometer's Sketchpad Unit for Geometry'Adilin MuhammadОценок пока нет

- Instructional SoftwareДокумент4 страницыInstructional Softwareapi-235491175Оценок пока нет

- Notification DetailedДокумент28 страницNotification DetailedraghuОценок пока нет

- Chapter1 Education and SocietyДокумент13 страницChapter1 Education and SocietyChry Curly RatanakОценок пока нет

- DLL MAPEH Grade9 Quarter1 Arts PalawanДокумент7 страницDLL MAPEH Grade9 Quarter1 Arts PalawanRalphОценок пока нет

- Manual For Project Report and GuidanceДокумент17 страницManual For Project Report and GuidanceJessy CherianОценок пока нет

- Academic Writing Rules and RegsДокумент1 страницаAcademic Writing Rules and RegsEwaОценок пока нет

- Arnaiz-Cesiban-Gerodias-Muyargas-Nogaliza - SOEN 2 Final Requirement PDFДокумент60 страницArnaiz-Cesiban-Gerodias-Muyargas-Nogaliza - SOEN 2 Final Requirement PDFZhanra Therese ArnaizОценок пока нет

- Singapura Journal Final LastДокумент8 страницSingapura Journal Final Lastapi-338954319Оценок пока нет

- The Big Five Personality Traits ExplainedДокумент19 страницThe Big Five Personality Traits Explainedashraul islamОценок пока нет