Академический Документы

Профессиональный Документы

Культура Документы

Inside Investor - Tourism

Загружено:

Telemetric SightАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Inside Investor - Tourism

Загружено:

Telemetric SightАвторское право:

Доступные форматы

SNAPSHOT

Tourism & Hospitality

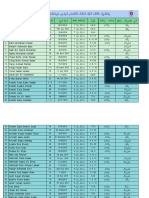

OVERVIEW High arrivals, low yields ...........................110 ANALYSIS OF INVESTMENT OPPORTUNITIES WITH PARTNERS Ambitious goals for the tourism industry.............................................................113 TOP 10 TOURISM AND HOSPITALITY COMPANIES ..................................................115 RATING BY INSIDE INVESTOR A place to visit and invest ........................116

Tourism Malaysia

For the full report, please visit the Inside Investor store:

store.insideinvestor.com

INSIDE MALAYSIA JULY

109

OVERVIEW

TOURISM & HOSPITALITY

Malaysias warm weather, eco-diversity and retail landscape help entice 24.5 million tourist arrivals, who gross about RM59 billion. This makes Malaysia the ninth most travelled destination in the world, but only the 13th highest expenditure by visitors.

A multi-ethnic country blessed with lush rainforests and stunning species of wildlife, Malaysia has a natural advantage for reeling in tourists. Add to the mixture a fascination with shopping centers and experience in halal services, and you start to see the reason for the appeal. Malaysia saw 24.6 million tourist arrivals in 2010, making it the ninth most visited country in the world, the three biggest markets for tourists being China, India as well as the GCC. The industry added RM36.9 billion to gross national income (GNI) in 2009, making it the fifth largest industry in the country after oil, gas and energy, financial services, wholesale and retail and palm oil. Tourism is also the third largest source of income from foreign exchange. Though Malaysias tourism industry is growing at a rate of 12 per cent per annum (2004-2009), placing it beside select few other countries that have maintained double-digit growth, such as Egypt, China and South Africa, the majority of this activity is buoyed by arrivals, not

110

Inside MALAYSIA JULY 2012

Tourism Malaysia

High arrivals, low yields

Since tourism became a significant source of income for Malaysia, the country has launched a number of initiatives to boost the sector.

expenditure yields. The country raked in RM30 billion in 2004 and RM53 billion in 2009, a period that saw a growth of 12 per cent per annum, ranking it 13th worldwide in global tourist receipts, which add up to an average of RM1 billion per week. However, these yields only accounted for 25 per cent of growth in the industry, while arrivals made up 75 per cent. This unbalanced pattern of growth can best be explained by Malaysias lack of attraction towards high-yield, mediumhaul markets due to low flight frequency, the tendency for low-haul tourists to complete high-frequency trips, and use of the country as a transit point. In 2009, only 15 per cent of tourist arrivals in Malaysia accounted for the medium-haul portion of the market much lower than the 43 per cent in Singapore and 36 per cent in Thailand while 78 per cent came from the short-haul market and 7 per cent from long-haul. The solution currently in play is to boost frequencies between Malaysia and those cities where there

Tourism Malaysia

OVERVIEW

TOURISM & HOSPITALITY

is a connectivity gap, such as Beijing, Delhi, Melbourne, Mumbai, Osaka, Seoul, Shanghai, Sydney, Taipei and Tokyo. Local airlines are due to increase capacities and Malaysia Airports Holding Berhad (MAHB) has begun to make concerted efforts to attract foreign airlines to increase flights to Malaysia or set up operations. Since medium-haul market adds an extra 53 per cent yield compared to short-haul tourists, and is a segment which is forecast to grow by eight per cent between 2010 and 2020, the tourism industry stands to gain the most from greater connectivity to medium-haul tourists. A significant contributor to the economy, the tourism industry employs an estimated 14 per cent of the workforce. Unfortunately, however, the industry faces increasing strain from regional markets abroad, such as Singapore, Hong Kong and Macau, where higher incomes draw in Malaysian workers, especially in the hospitality segment. Skills are also drained from the industry due to relatively lower pay: the average income for a Malaysian working in hostels in restaurants averages out at RM1,084 per month, compared to RM2,114 in financial services and RM2,621 in oil and gas, as noted in the Economic Transformation Programme (ETP), Malaysias economic outline to achieve high-income status by 2020. Shopping is already a large contributor to tourism receipts in Singapore (35 per cent) and Hong Kong (57 per cent) and makes up 28 per cent of the market in Malaysia. This relatively lower proportion of the market share is largely due to highly fragmented, stand-alone concentrations of retail areas that have poor connectivity and collaboration between each other. For example, Bukit Bintang in Kuala Lumpur is disconnected from Kuala Lumpur Convention Center (KLCC) due to inadequate pedestrian walkways, which in turn leads to a lack of appeal and vitality. Additional pedestrian walkways and public transportation has been proposed to amend these problems. Pedestrian walkways to be built will connect KLCC to Pavilions Raja Chulan bridge, Pavilion across Jalan Bukit Bintang to Fahrenheit 88 shopping center, Fahrenheit 88 to Lot 10 shopping center, Sungei Wang Plaza to Berjaya Times Squares Imbi bridge, and from Sungei Wang Plaza to Jalan Bukit Bintang-Jalan Pudu intersection. It is hoped that once these areas are linked up that a fashion distinct with enough vibrancy to attract festivals will be created. Outside of KL, additional shopping centers are being developed in Johor Bahru, Sepang and Penang. Iskandar Malaysia, a large-scale property development project in Johor Bahru, will be composed of residential buildings and other private projects such as religious buildings as well as retail. After completion in 2013, it will be open to cater to tourists and day visitors from Singapore and Indonesia. The Sepang project is positioned to attract transit passengers from Kuala Lumpur International Airport (KLIA) and the Low Cost Carrier Terminal (LCCT); in Penang, there is a large volume of Indonesian tourists that can be captured as they make their way up to neighbouring Thailand. Cruise line travel is a globally growing segment, one in which half of passengers are high-yield tourists. In Southeast Asia, Singapore is currently leading in the industry because of lacking cruise will be vamped up in Langkawi and Penang by developing premium shopping centers and promoting the development of appealing tourism concepts, such as entertainment zones, cable car services and golf courses. Penang is also slated to develop two new convention centers to attract MICE tourists. When compared to regional peers Singapore and Thailand, Malaysia has precious few five-star hotels. Of Malaysias hotel industry, five per cent are in the five-star mix, while 13 per cent are represented in this category in Singapore and 14 per cent in Thailand. Investment tax allowances will be extended to include four- and five-star hotels with foreign ownership in order to attract more funds to upgrade and refurbish hotel assets. In addition, starting from 2013, four- and five-star hotels will have to charge a minimum room rate. It is hoped that this will encourage hoteliers to work to match service levels with pricing. Hopping on the bandwagon after regional leader Singapore debuted its Marina Bay Sands and Resorts World Sentosa, Malaysia has plotted out developmental plans in the integrated resorts (IR) segment. After the opening of Resorts World Sentosa in February 2010, tourism arrivals doubled, which includes a 46 per cent increase from Malaysian tourists, as noted in the ETP. The family-related travel industry in the region largely caters to the burgeoning middle-class populations of India, China and the Middle East, regions that make up the vast majority of Malaysias tourists. As these central strata of society move up the economic ladder, they will continue to contribute more to global tourism, now only representing 13 per cent of global departures yet 48 per cent of the global population. The Malaysia Tourism Transformation Plan has been set up to push the goal to achieve 36 million tourists by 2020, from 24.6 million in 2010, and generate up to RM150 billion in annual revenue, from RM56.5 billion in 2010, which indicates that the plan is eyeing a higher average spending of the individual tourist in the future.

Inside MALAYSIA JULY 2012

Investment tax allowances will be extended by the Malaysian government to include four- and fivestar hotels with foreign ownership in order to attract more funds to upgrade and refurbish hotel assets.

terminal infrastructure elsewhere. According to the Business Times, a local business newspaper, tourism logistics

111

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Crime and Punishment Vocabulary 93092Документ2 страницыCrime and Punishment Vocabulary 93092Rebeca Alfonso Alabarta50% (4)

- Aarushi VerdictДокумент273 страницыAarushi VerdictOutlookMagazine88% (8)

- Project Driven & Non Project Driven OrganizationsДокумент19 страницProject Driven & Non Project Driven OrganizationsEkhlas Ghani100% (2)

- CH 1 QuizДокумент19 страницCH 1 QuizLisa Marie SmeltzerОценок пока нет

- Design of Swimming Pool PDFДокумент21 страницаDesign of Swimming Pool PDFjanithbogahawatta67% (3)

- "If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsДокумент21 страница"If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsIsadora Mandarino OteroОценок пока нет

- April 20 2011Документ48 страницApril 20 2011Telemetric SightОценок пока нет

- Baker Canoe Kayak Presentation 2010Документ30 страницBaker Canoe Kayak Presentation 2010Telemetric SightОценок пока нет

- Johor State Office Space RentalДокумент2 страницыJohor State Office Space RentalTelemetric SightОценок пока нет

- Calculating Net Present Value and IRR Using ExcelДокумент2 страницыCalculating Net Present Value and IRR Using ExcelTelemetric SightОценок пока нет

- PEST Analysis: Downloaded From The Times 100 EditionДокумент1 страницаPEST Analysis: Downloaded From The Times 100 EditionTelemetric SightОценок пока нет

- Megatrend in Asia-PacificДокумент25 страницMegatrend in Asia-PacificTelemetric SightОценок пока нет

- Business Victoria Marketing Plan TemplateДокумент32 страницыBusiness Victoria Marketing Plan TemplateAlphonse Raj DavidОценок пока нет

- A Mobile Disaster Management System Using The Android TechnologyДокумент10 страницA Mobile Disaster Management System Using The Android TechnologyTelemetric SightОценок пока нет

- Kemajuan Ekonomi: Kemajuan Ekonomi Inisiatif 1malaysia Transformasi Politik Penglibatan Kepimpinan GlobalДокумент3 страницыKemajuan Ekonomi: Kemajuan Ekonomi Inisiatif 1malaysia Transformasi Politik Penglibatan Kepimpinan GlobalTelemetric SightОценок пока нет

- How Much of My Pension Can I Spend? (After Tax and Increasing With Inflation)Документ22 страницыHow Much of My Pension Can I Spend? (After Tax and Increasing With Inflation)Telemetric SightОценок пока нет

- How Many More Years Must I Work To Have $1 Million at Retirement?Документ3 страницыHow Many More Years Must I Work To Have $1 Million at Retirement?Telemetric SightОценок пока нет

- Publisiti-Promosi - 1Документ1 страницаPublisiti-Promosi - 1Telemetric SightОценок пока нет

- D3.2.2 Anwar Nakeeb Food Based 6-17-09Документ17 страницD3.2.2 Anwar Nakeeb Food Based 6-17-09Telemetric SightОценок пока нет

- Knight Frank H 206Документ12 страницKnight Frank H 206Telemetric SightОценок пока нет

- IAB ReportДокумент198 страницIAB ReportMrutunjay PatraОценок пока нет

- Break Even Point Analysis-Definition, Explanation Formula and CalculationДокумент5 страницBreak Even Point Analysis-Definition, Explanation Formula and CalculationTelemetric Sight100% (2)

- Mahkota Melaka HotelДокумент4 страницыMahkota Melaka HotelTelemetric SightОценок пока нет

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Документ2 страницыRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYОценок пока нет

- Abrigo Vs Flores DigestДокумент4 страницыAbrigo Vs Flores DigestKatrina GraceОценок пока нет

- Nuclear Power Plants PDFДокумент64 страницыNuclear Power Plants PDFmvlxlxОценок пока нет

- How Beauty Standards Came To BeДокумент3 страницыHow Beauty Standards Came To Beapi-537797933Оценок пока нет

- QuickRecharge - Ae Is Launched by Paynet - OneДокумент2 страницыQuickRecharge - Ae Is Launched by Paynet - OnePR.comОценок пока нет

- (Bloom's Modern Critical Views) (2000)Документ267 страниц(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- Loan AgreementДокумент6 страницLoan AgreementSachin ShastriОценок пока нет

- Biology 31a2011 (Female)Документ6 страницBiology 31a2011 (Female)Hira SikanderОценок пока нет

- 05 Vision IAS CSP21 Test 5Q HIS AM ACДокумент17 страниц05 Vision IAS CSP21 Test 5Q HIS AM ACAvanishОценок пока нет

- "Working Capital Management": Master of CommerceДокумент4 страницы"Working Capital Management": Master of Commercekunal bankheleОценок пока нет

- Shell - StakeholdersДокумент4 страницыShell - StakeholdersSalman AhmedОценок пока нет

- Susan Rose's Legal Threat To Myself and The Save Ardmore CoalitionДокумент2 страницыSusan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDouglas MuthОценок пока нет

- Philippine Politics and Governance: Lesson 6: Executive DepartmentДокумент24 страницыPhilippine Politics and Governance: Lesson 6: Executive DepartmentAndrea IbañezОценок пока нет

- Eicher HR PoliciesДокумент23 страницыEicher HR PoliciesNakul100% (2)

- HelpДокумент5 страницHelpMd Tushar Abdullah 024 AОценок пока нет

- See 2013Документ38 страницSee 2013Ankur BarsainyaОценок пока нет

- Estatement - 2022 05 19Документ3 страницыEstatement - 2022 05 19tanjaОценок пока нет

- An Introduction: by Rajiv SrivastavaДокумент17 страницAn Introduction: by Rajiv SrivastavaM M PanditОценок пока нет

- MAKAUT CIVIL Syllabus SEM 8Документ9 страницMAKAUT CIVIL Syllabus SEM 8u9830120786Оценок пока нет

- Day Wise ScheduleДокумент4 страницыDay Wise ScheduleadiОценок пока нет

- Open Quruan 2023 ListДокумент6 страницOpen Quruan 2023 ListMohamed LaamirОценок пока нет

- Financial Amendment Form: 1 General InformationДокумент3 страницыFinancial Amendment Form: 1 General InformationRandolph QuilingОценок пока нет

- Organizational Behavior: Chapter 6: Understanding Work TeamДокумент6 страницOrganizational Behavior: Chapter 6: Understanding Work TeamCatherineОценок пока нет