Академический Документы

Профессиональный Документы

Культура Документы

11 55

Загружено:

René MorelИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

11 55

Загружено:

René MorelАвторское право:

Доступные форматы

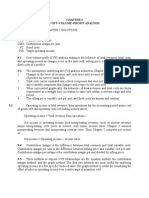

Managerial Accounting Chapter 11

CHAPTER 11: CASE STUDY 11-55

Comprehensive Variance Analysis

Used to Explain Operational Results

Rene Morel

Embry-Riddle Aeronautical University Online

MBAA 517

Instructor: Dr. Ana Machuca

Managerial Accounting Chapter 11

Aunt Mollys Old Fashioned Cookies bakes cookies for retail stores. The companys best-selling

cookie is chocolate nut supreme, which is marketed as a gourmet cookie and regularly sells for

$8.00 per pound. The standard cost per pound of chocolate nut supreme, based on Aunt

Mollys normal monthly production of 400,000 pounds, is as follows:

Cost Item

Quantity

Standard

Unit Cost

Direct Materials:

Cookie Mix

Milk Chocolate

Almonds

10 oz.

5 oz.

1 oz.

0.02 per oz.

0.15 per oz.

0.50 per oz.

$

$

$

$

0.20

0.75

0.50

1.45

Mixing

1 min

14.40 per hr.

0.24

Baking

2 min

18.00 per hr.

$

$

0.60

0.84

Variable Overhead

3 min

Total standard cost per pound

32.40 per hr.

$

$

1.62

3.91

Total Cost

Direct labor

Aunt Mollys management accountant, Karen Blair, prepares monthly budget reports based on

these standard costs. Aprils contribution report, which compares budgeted and actual

performance, is shown in the following schedule.

Contribution Report for April

Units (in pounds)

Revenue

Direct material

Direct labor

Variable overhead

Total variable costs

Contribution margin

Static

Budget

Actual

Variance

400,000

450,000

50,000

$ 3,200,000.00

$ 580,000.00

$ 336,000.00

$ 648,000.00

$ 1,564,000.00

$ 1,636,000.00

$ 3,555,000.00

$ 865,000.00

$ 348,000.00

$ 750,000.00

$ 1,963,000.00

$ 1,592,000.00

$

$

$

$

$

$

355,000.00

285,000.00

12,000.00

102,000.00

399,000.00

44,000.00

Managerial Accounting Chapter 11

Justine Madison, president of the company, is disappointed with the results. Despite a sizable

increase in the number of cookies sold, the products expected contribution to the overall

profitability of the firm decreased. Madison has asked Blair to identify the reason why the

contribution margin decreased. Blair has gathered the following information to help in her

analysis of the decrease.

Usage Report for February

Cost Item

Direct Materials:

Cookie Mix

Milk Chocolate

Almonds

Direct Labor:

Mixing

Baking

Variable Overhead

Total Variable Costs

Quantity

4,650,000

2,660,000

480,000

450,000

800,000

Actual Cost

$

$

$

93,000.00

532,000.00

240,000.00

$ 108,000.00

$ 240,000.00

$ 750,000.00

$ 1,963,000.00

Required:

1. Prepare a new contribution report for April in which:

The static budget column in the contribution report is replaced with a flexible budget

column.

The variances in the contribution report are recomputed as the difference between the

flexible budget and actual columns.

First, I performed a Contribution report for 400,000 and then for 450,000 pounds.

Managerial Accounting Chapter 11

April Contribution Report

Quantity

Standard

Standard Cost

Actual

Actual

Cost

Actual Total

Cost

Revenue

400,000

$8.00

$3,200,000.00

450,000

$7.90

$3,555,000.00

Units (in pounds)

400,000

Direct Materials:

Cookie Mix

Milk Chocolate

Almonds

4,000,000

2,000,000

400,000

$0.02

$0.15

$0.50

$80,000.00

$300,000.00

$200,000.00

$580,000.00

4,650,000

2,660,000

480,000

$0.02

$0.20

$0.50

$93,000.00

$532,000.00

$240,000.00

$865,000.00

Direct labor

Mixing

Baking

400,000

800,000

$0.24

$0.30

$96,000.00

$240,000.00

$336,000.00

450,000

800,000

$0.24

$0.30

$108,000.00

$240,000.00

$348,000.00

Variable

Overhead

400,000

$1.62

$648,000.00

$648,000.00

$1,564,000.00

450000

$1.67

$750,000.00

$750,000.00

$1,963,000.00

Contribution

Margin

450,000

$1,636,000.00

$1,592,000.00

Managerial Accounting Chapter 11

April Contribution Report

Quantity

Standard

Standard Cost

Actual

Actual

Cost

Actual Total

Cost

Revenue

450,000

$8.00

$3,600,000.00

450,000

$7.90

$3,555,000.00

Units (in pounds)

450,000

Direct Materials:

Cookie Mix

Milk Chocolate

Almonds

4,500,000

2,250,000

450,000

$0.02

$0.15

$0.50

$90,000.00

$337,500.00

$225,000.00

$652,500.00

4,650,000

2,660,000

480,000

$0.02

$0.20

$0.50

$93,000.00

$532,000.00

$240,000.00

$865,000.00

Direct labor

Mixing

Baking

450,000

900,000

$0.24

$0.30

$108,000.00

$270,000.00

$378,000.00

450,000

800,000

$0.24

$0.30

$108,000.00

$240,000.00

$348,000.00

Variable

Overhead

450,000

$1.62

$729,000.00

$729,000.00

$1,759,500.00

450000

$1.67

$750,000.00

$750,000.00

$1,963,000.00

Contribution Margin

450,000

$1,840,500.00

$1,592,000.00

2. What is the total contribution margin in the flexible budget column of the new report

prepared for requirement (1)?

For 400,000 pounds: $1,636,000.00

For 450,000 pounds: $1,840,500.00

3. Explain (i.e., interpret) the meaning of the total contribution margin in the flexible

budget column of the new report prepared for requirement (1).

The use of a Flexible budget is very good in means of representing everything as a standard

cost. It is a measure of controlling variable costs and measuring towards a standard. If the

results for the actual budget where as the flexible budget, the contribution margin should have

been more.

Managerial Accounting Chapter 11

4. What is the total variance between the total variance between the flexible budget

contribution margin and the actual contribution margin in the new report prepared for

requirement (1)? Explain this total contribution margin variance by computing the

following variances. (Assume that all materials are used in the month of purchase.)

a. Direct-material price variance.

Direct materials:

Cookie Mix: Flexible=$0.02, Actual=$0.02, 4,650,000 x ($0.00)=$0.00

Milk Chocolate: Flexible=$0.15, Actual=$0.20, 2,660,000 x ($0.05) = $133,000 U

Almonds: Flexible=$0.50, Actual=$0.50, 480,000 x ($0.00)=$0.00

Total: $133,000.00 U

b. Direct-material quantity variance.

Direct Materials:

Cookie Mix

Milk Chocolate

Almonds

4,500,000

2,250,000

450,000

$0.02

$0.15

$0.50

$90,000.00

$337,500.00

$225,000.00

$652,500.00

4,650,000

2,660,000

480,000

$0.02

$0.20

$0.50

$93,000.00

$532,000.00

$240,000.00

$865,000.00

150,000 x ($0.02) = $3,000.00

410,000 x ($0.15) = $61,500.00

30,000 x ($0.50) = $15,000.00

Total variance: $79,500.00

Or, $865,000-$652,500.00=$79,500.00

c. Direct-labor rate variance.

The direct-labor rate is equal to zero.

d. Direct-labor efficiency variance.

Direct labor

Mixing

Baking

450,000

900,000

$0.24

$0.30

$108,000.00

$270,000.00

$378,000.00

$378,000-$348,000=$30,000.00 Favorable

450,000

800,000

$0.24

$0.30

$108,000.00

$240,000.00

$348,000.00

Managerial Accounting Chapter 11

e. Variable-overhead spending variance.

$750,000-($1,250,000/60x$32.40hr)=$75,000.00 Unfavorable

f. Variable-overhead efficiency variance.

$32.40 x [($1,250,000/60) (450,000lbsx3min/60)] = $54,000.00 Favorable

g. Sales-price variance.

Revenue

450,000

$8.00

$3,600,000.00

450,000

$7.90

$3,555,000.00

$0.10x450,000=$45,000.00 Unfavorable

5. a. Explain the problem that might arise in using direct-labor hours as the basis for

applying overhead.

It seems that direct labor is not a good indicator to calculate overhead. Direct labor does not

seem to be the cost driver for the overhead. One is not dependent on the other.

b. How might activity-based costing (ABC) solve the problems described in requirement

5a?

ABC might be a better solution to find out the real cost drivers for the overhead. By studying

the activities involved in driving the overhead cost, the company can better understand what is

driving overhead.

Вам также может понравиться

- Hilton 9E Global Edition Solutions Manual Chapter17Документ40 страницHilton 9E Global Edition Solutions Manual Chapter17jenmarielle33% (3)

- Case 11-55Документ3 страницыCase 11-55HETTYОценок пока нет

- Hilton 9E Global Edition Solutions Manual Chapter03Документ58 страницHilton 9E Global Edition Solutions Manual Chapter03Bea71% (7)

- Chap 016Документ50 страницChap 016palak3280% (5)

- Managerial Accounting Chapter 17, 8th Edition HiltonДокумент20 страницManagerial Accounting Chapter 17, 8th Edition HiltonMuhammed GhazanfarОценок пока нет

- Cost Accounting Job Costing Case StudiesДокумент5 страницCost Accounting Job Costing Case StudiesSugata SОценок пока нет

- Management Accounting Chapter 9Документ57 страницManagement Accounting Chapter 9Shaili SharmaОценок пока нет

- Profitability of Products and Relative ProfitabilityДокумент5 страницProfitability of Products and Relative Profitabilityshaun3187Оценок пока нет

- Hilton CH 4 Select SolutionsДокумент20 страницHilton CH 4 Select Solutionsintan100% (1)

- Tugas Variable Costing and The Measurement of ESG and Quality Costs (Irga Ayudias Tantri - 120301214100011)Документ2 страницыTugas Variable Costing and The Measurement of ESG and Quality Costs (Irga Ayudias Tantri - 120301214100011)irga ayudias0% (1)

- Solution Manual12Документ46 страницSolution Manual12wansurОценок пока нет

- Chap 015Документ40 страницChap 015palak32100% (2)

- Hilton CH 6 Select SolutionsДокумент19 страницHilton CH 6 Select SolutionsRaymondSinegar100% (1)

- Week13 SolutionsДокумент14 страницWeek13 SolutionsRian RorresОценок пока нет

- Chap 008Документ44 страницыChap 008palak32100% (6)

- Ch.12 FOH Carter.14thДокумент40 страницCh.12 FOH Carter.14thMuhammad Aijaz KhanОценок пока нет

- Hilton 9E Global Edition Solutions Manual Chapter03Документ58 страницHilton 9E Global Edition Solutions Manual Chapter03Varshitha Gokari100% (2)

- Hilton Chapter 08 SolutionsДокумент65 страницHilton Chapter 08 SolutionsKaustubh Agnihotri75% (8)

- Chapter 2 Selected Answers PDFДокумент16 страницChapter 2 Selected Answers PDFsadiaОценок пока нет

- Chap 012Документ45 страницChap 012palak32100% (6)

- Tugas Chapter 12Документ8 страницTugas Chapter 12irga ayudiasОценок пока нет

- Tugas Chapter 14Документ7 страницTugas Chapter 14irga ayudiasОценок пока нет

- Chapter 12 SolutionsДокумент29 страницChapter 12 SolutionsAnik Kumar MallickОценок пока нет

- Work in process and cost of goods manufactured analysisДокумент2 страницыWork in process and cost of goods manufactured analysisPrilly ManembuОценок пока нет

- PR CHP 5 - Ex 5-1 - Kelompok 1Документ2 страницыPR CHP 5 - Ex 5-1 - Kelompok 1Lucky esteritaОценок пока нет

- Chapter 02 - Basic Cost Management Concepts and Accounting for Mass Customization OperationsДокумент16 страницChapter 02 - Basic Cost Management Concepts and Accounting for Mass Customization OperationsJohsyutОценок пока нет

- Hilton Chapter 9 SolutionsДокумент11 страницHilton Chapter 9 SolutionsRaghavОценок пока нет

- Practical BEP QuestionsДокумент16 страницPractical BEP QuestionsSanyam GoelОценок пока нет

- Hilton CH 9 Select SolutionsДокумент18 страницHilton CH 9 Select Solutionsprasanna50% (2)

- 9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Документ4 страницы9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Christy Angkouw0% (1)

- Chap 007Документ65 страницChap 007palak3267% (6)

- Standard Costing Managerial Control ToolДокумент20 страницStandard Costing Managerial Control ToolEnrique Miguel Gonzalez Collado100% (1)

- 9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem) PDFДокумент32 страницы9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem) PDFAnisa Vrenozi67% (3)

- XLSXДокумент28 страницXLSXnaura syahdaОценок пока нет

- Divisi Kompresor Tidak Boleh Menjual Kompresor $50Документ6 страницDivisi Kompresor Tidak Boleh Menjual Kompresor $50irga ayudiasОценок пока нет

- Calculating Cost of Goods Sold and Net IncomeДокумент12 страницCalculating Cost of Goods Sold and Net IncomeUmair AliОценок пока нет

- Bab 8 Costing by Product and Joint ProductДокумент4 страницыBab 8 Costing by Product and Joint ProductBudy_Arto_6600Оценок пока нет

- Chap 005Документ85 страницChap 005redspyderxОценок пока нет

- Hilton 9E Global Edition Solutions Manual Chapter01Документ16 страницHilton 9E Global Edition Solutions Manual Chapter01Bea100% (4)

- Chapter 11 Solution - Cost AccountingДокумент8 страницChapter 11 Solution - Cost AccountingJoy TОценок пока нет

- Hilton MAcc Ch14 SolutionДокумент5 страницHilton MAcc Ch14 SolutionDini Rayhana Prasetyaningtyas33% (3)

- Monthly Global Point Current Affairs September 2021Документ151 страницаMonthly Global Point Current Affairs September 2021MeowMeow100% (1)

- MBA 504 Ch5 SolutionsДокумент12 страницMBA 504 Ch5 SolutionspheeyonaОценок пока нет

- CVP Analysis: Cost-Volume-Profit Relationships ExplainedДокумент3 страницыCVP Analysis: Cost-Volume-Profit Relationships Explainedcamd12900% (1)

- Acct 260 Chapter 11Документ38 страницAcct 260 Chapter 11John Guy100% (1)

- Wiley - Chapter 9: Inventories: Additional Valuation IssuesДокумент20 страницWiley - Chapter 9: Inventories: Additional Valuation IssuesIvan BliminseОценок пока нет

- Chapter 17 Allocation of Support Activity Costs and Joint CostsДокумент43 страницыChapter 17 Allocation of Support Activity Costs and Joint CostsMISRET 2018 IEI JSC100% (1)

- ch12 PDFДокумент9 страницch12 PDFEmma Mariz GarciaОценок пока нет

- Hilton CH 5 Select SolutionsДокумент42 страницыHilton CH 5 Select SolutionsVivek Yadav79% (14)

- Patricia Eklund's participative budgeting proceduresДокумент11 страницPatricia Eklund's participative budgeting proceduresirga ayudiasОценок пока нет

- Standard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceДокумент3 страницыStandard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceRené MorelОценок пока нет

- Variances Spring 2023 RevisedДокумент16 страницVariances Spring 2023 Revisedzoyashaikh20Оценок пока нет

- 420C14Документ38 страниц420C14Suhail100% (1)

- f5 Short Notes MHAДокумент25 страницf5 Short Notes MHAKlaus MIKEОценок пока нет

- Managerial Lesson 7 Slides UpdatedДокумент11 страницManagerial Lesson 7 Slides UpdatedThuraОценок пока нет

- Basic Sales Mix The General Manager of LoДокумент7 страницBasic Sales Mix The General Manager of LoAndres MontenegroОценок пока нет

- CVP-analysis ExcercisesДокумент31 страницаCVP-analysis Excercisesგიორგი კაციაშვილიОценок пока нет

- Hubba Brownies Calaoagan Dackel, Gattaran, Cagayan 09068447153 Summary of Day 1 Operation V. Financial PlanДокумент3 страницыHubba Brownies Calaoagan Dackel, Gattaran, Cagayan 09068447153 Summary of Day 1 Operation V. Financial PlanRoan Eam TanОценок пока нет

- 2.1 Discuss Principle of Costing 2.2 Compute Cost of ProductionДокумент5 страниц2.1 Discuss Principle of Costing 2.2 Compute Cost of ProductionHazel Karen Caguingin0% (1)

- Joint Product and By-Product Costing: Measuring, Monitoring, and Motivating PerformanceДокумент24 страницыJoint Product and By-Product Costing: Measuring, Monitoring, and Motivating PerformancearunprasadvrОценок пока нет

- Solution Manual09Документ69 страницSolution Manual09ULank 'zulhan Darwis' Chullenk100% (1)

- Activity 6.2Документ1 страницаActivity 6.2René MorelОценок пока нет

- Standard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceДокумент3 страницыStandard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceRené MorelОценок пока нет

- At Least Two of Your Classmates in The Forum.: Flexible BudgetsДокумент1 страницаAt Least Two of Your Classmates in The Forum.: Flexible BudgetsRené MorelОценок пока нет

- Master Budget for Electronics Company Automated SystemДокумент7 страницMaster Budget for Electronics Company Automated SystemRené Morel0% (1)

- 16 58Документ3 страницы16 58René MorelОценок пока нет

- 9 45Документ10 страниц9 45René MorelОценок пока нет

- QMS PrinciplesДокумент5 страницQMS PrinciplesShankar AsrОценок пока нет

- Module 5 NotesДокумент20 страницModule 5 NotesHarshith AgarwalОценок пока нет

- Nike's Winning Ways-Hill and Jones 8e Case StudyДокумент16 страницNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- CF Wacc Project 2211092Документ34 страницыCF Wacc Project 2211092Dipty NarnoliОценок пока нет

- Understanding consumer perception, brand loyalty & promotionДокумент8 страницUnderstanding consumer perception, brand loyalty & promotionSaranya SaranОценок пока нет

- The Role of Business ResearchДокумент23 страницыThe Role of Business ResearchWaqas Ali BabarОценок пока нет

- Get Surrounded With Bright Minds: Entourage © 2011Документ40 страницGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiОценок пока нет

- LIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SДокумент1 страницаLIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SMohammad ShuaibОценок пока нет

- Claim Form For InsuranceДокумент3 страницыClaim Form For InsuranceSai PradeepОценок пока нет

- SC upholds conviction for forgery under NILДокумент3 страницыSC upholds conviction for forgery under NILKobe Lawrence VeneracionОценок пока нет

- PEA144Документ4 страницыPEA144coffeepathОценок пока нет

- 1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Документ8 страниц1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Mirza KapalОценок пока нет

- Updated Case Westover ElectricalДокумент8 страницUpdated Case Westover ElectricalRalph Adrian MielОценок пока нет

- Fin 416 Exam 2 Spring 2012Документ4 страницыFin 416 Exam 2 Spring 2012fakeone23Оценок пока нет

- The Builder's Project Manager - Eli Jairus Madrid PDFДокумент20 страницThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridОценок пока нет

- Finance TestДокумент3 страницыFinance TestMandeep SinghОценок пока нет

- GodrejДокумент4 страницыGodrejdeepaksikriОценок пока нет

- My Project Report On Reliance FreshДокумент67 страницMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

- Employee Training at Hyundai Motor IndiaДокумент105 страницEmployee Training at Hyundai Motor IndiaRajesh Kumar J50% (12)

- English For Hotel-1-1Документ17 страницEnglish For Hotel-1-1AQilla ZaraОценок пока нет

- 1Документ10 страниц1himanshu guptaОценок пока нет

- Internship PresentationДокумент3 страницыInternship Presentationapi-242871239Оценок пока нет

- TENAZAS Vs R Villegas TaxiДокумент2 страницыTENAZAS Vs R Villegas TaxiJanet Tal-udan100% (2)

- H4 Swing SetupДокумент19 страницH4 Swing SetupEric Woon Kim ThakОценок пока нет

- Hire PurchaseДокумент16 страницHire PurchaseNaseer Sap0% (1)

- Financial Statement of A CompanyДокумент49 страницFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Corpo Bar QsДокумент37 страницCorpo Bar QsDee LM100% (1)

- Balance ScorecardДокумент11 страницBalance ScorecardParandeep ChawlaОценок пока нет

- Kasut You DistributionДокумент9 страницKasut You DistributionNo Buddy100% (1)

- SHS Entrepreneurship Week 2Документ12 страницSHS Entrepreneurship Week 2RUSSEL AQUINO50% (2)