Академический Документы

Профессиональный Документы

Культура Документы

Money and Banking Rutgers

Загружено:

rithvikr09Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Money and Banking Rutgers

Загружено:

rithvikr09Авторское право:

Доступные форматы

62-220-365 Money and Banking

Fall 2007

Instructor: Dr. Richard Anderson Email: richarda@andromeda.rutgers.edu rta2101@Columbia.edu Text: Mishkin, Frederick; Money, Banking and Financial Markets Addison Wesley; 8 edition , 2006; ISBN 0-321-42177-9 Course Outline I. An Overview of the Financial System Structure of Financial Markets Debt and Equity Markets Primary and Secondary Markets Exchanges and Over-the-Counter Markets Money and Capital Markets World Stock Markets Foreign Stock Market Indexes Chapters 1, 2 II. Money Meaning of Money Functions of Money Evolution of the Payments System The Federal Reserves Monetary Aggregates Chapter 3 III. Interest Rates Measuring Interest Rates Present Value Yield to Maturity Other Measures of Interest Rates Application: The Bond Page Bond Prices and Interest Rates Maturity and the Volatility of Bond Returns: Interest-Rate Risk The Distinction between Real and Nominal Interest Rates Chapter 4 IV. The Determination Interest Rates Theory of Asset Demand Expected Rate of Return and Risk Diversification Supply and Demand in the Bond Market Changes in Equilibrium Interest Rates Application: Changes in the Equilibrium Interest Rate Due to Expected Inflation or Business Cycle Expansions

Chapter 5 V. The Risk and Term Structure of Interest Rates Risk Structure of Interest Rates Application: The inverted yield curve Term Structure of Interest Rates Chapter 6 Midterm Exam VI. Banking and the Management of Financial Institutions The Bank Balance Sheet Balance Sheet Ratios Managing Interest-Rate Risk Gap and Duration Analysis Chapter 9 VII. Banking Industry: Structure and Competition The Evolution of the Banking Industry Bank Legislation since the Depression Chapter 10, 11 VIII. Financial Derivatives Options Financial Futures Swaps Application: Hedging with Financial Futures Organization of Trading in Financial Futures Markets Application: Hedging with Futures Options Interest-Rate Swaps Web Chapter available on Blackboard IX. Central Banks and the Federal Reserve System Formal Structure of the Federal Reserve System Board of Governors of the Federal Reserve System Federal Open Market Committee (FOMC) Chapter 12 X. Multiple Deposit Creation and the Money Supply Process The Feds Balance Sheet Federal Reserve Open Market Operations The Monetary Base The Money Supply Model and the Money Multiplier Chapter 13, 14 XI. Tools and Conduct of Monetary Policy

Open Market Operations Discount Ratey Reserve Requirements Goals of Monetary Policy Central Bank Strategy: Use of Targets The Taylor Rule, NAIRU, and the Philips Curve Chapter 15 Optional: The Foreign Exchange Market The International Financial System Foreign Exchange Market Exchange Rates in the Long Run Theory of Purchasing Power Parity Factors That Affect Rates in the Long Run Exchange Rates in the Short Run Interest Parity Condition Explaining Changes in Exchange Rates Chapter 17 Final Exam

EVALUATION: Midterm 50% Final Exam 50% GRADING CRITERIA: A AB+ B BC+ C CD 93-100 90-92 88-89 83-87 80-86 78-79 73-77 70-73 60-69

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- "Working Capital Management": Master of CommerceДокумент4 страницы"Working Capital Management": Master of Commercekunal bankheleОценок пока нет

- Shell - StakeholdersДокумент4 страницыShell - StakeholdersSalman AhmedОценок пока нет

- DocumentДокумент2 страницыDocumentHP- JK7Оценок пока нет

- Gujarat Technological UniversityДокумент5 страницGujarat Technological Universityvenkat naiduОценок пока нет

- Distribution Logistics Report 2H 2020Документ21 страницаDistribution Logistics Report 2H 2020IleanaОценок пока нет

- General Concepts and Principles of ObligationsДокумент61 страницаGeneral Concepts and Principles of ObligationsJoAiza DiazОценок пока нет

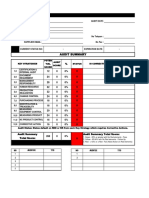

- Form Audit QAV 1&2 Supplier 2020 PDFДокумент1 страницаForm Audit QAV 1&2 Supplier 2020 PDFovanОценок пока нет

- Variable Costing Case Part A SolutionДокумент3 страницыVariable Costing Case Part A SolutionG, BОценок пока нет

- D Matei About The Castra in Dacia and THДокумент22 страницыD Matei About The Castra in Dacia and THBritta BurkhardtОценок пока нет

- Weight Watchers Business Plan 2019Документ71 страницаWeight Watchers Business Plan 2019mhetfield100% (1)

- CompTIA Network+Документ3 страницыCompTIA Network+homsom100% (1)

- See 2013Документ38 страницSee 2013Ankur BarsainyaОценок пока нет

- 14CFR, ICAO, EASA, PCAR, ATA Parts (Summary)Документ11 страниц14CFR, ICAO, EASA, PCAR, ATA Parts (Summary)therosefatherОценок пока нет

- Juegos 360 RGHДокумент20 страницJuegos 360 RGHAndres ParedesОценок пока нет

- Contemporary World Reflection PaperДокумент8 страницContemporary World Reflection PaperNyna Claire GangeОценок пока нет

- Cuthites: Cuthites in Jewish LiteratureДокумент2 страницыCuthites: Cuthites in Jewish LiteratureErdincОценок пока нет

- Shipping - Documents - Lpg01Документ30 страницShipping - Documents - Lpg01Romandon RomandonОценок пока нет

- HumanitiesprojДокумент7 страницHumanitiesprojapi-216896471Оценок пока нет

- eLTE5.0 DBS3900 Product Description (3GPP)Документ37 страницeLTE5.0 DBS3900 Product Description (3GPP)Wisut MorthaiОценок пока нет

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiДокумент3 страницы.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLisleОценок пока нет

- Garrido Vs TuasonДокумент1 страницаGarrido Vs Tuasoncmv mendozaОценок пока нет

- SiswaДокумент5 страницSiswaNurkholis MajidОценок пока нет

- DepEd Red Cross 3 4 Seater Detached PoWs BoQsДокумент42 страницыDepEd Red Cross 3 4 Seater Detached PoWs BoQsRamil S. ArtatesОценок пока нет

- EvaluationДокумент4 страницыEvaluationArjay Gabriel DudoОценок пока нет

- GDPR Whitepaper FormsДокумент13 страницGDPR Whitepaper FormsRui Cruz100% (6)

- List of Departed Soul For Daily PrayerДокумент12 страницList of Departed Soul For Daily PrayermoreОценок пока нет

- GHMC Results, 2009Документ149 страницGHMC Results, 2009UrsTruly kotiОценок пока нет

- Resume-Pam NiehoffДокумент2 страницыResume-Pam Niehoffapi-253710681Оценок пока нет

- Consolidation Physical Fitness Test FormДокумент5 страницConsolidation Physical Fitness Test Formvenus velonza100% (1)

- Upcoming Book of Hotel LeelaДокумент295 страницUpcoming Book of Hotel LeelaAshok Kr MurmuОценок пока нет