Академический Документы

Профессиональный Документы

Культура Документы

Socially Responsible Investing: The Green Attitudes and Grey Choices of Brazilian Students

Загружено:

Alex BarbosaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Socially Responsible Investing: The Green Attitudes and Grey Choices of Brazilian Students

Загружено:

Alex BarbosaАвторское право:

Доступные форматы

Proceedings of the 2nd International Conference on Environmental Pollution and Remediation Montreal, Quebec, Canada, 28-30 August 2012

Paper No. 257

Socially Responsible Investing: the Green Attitudes and Grey Choices of Brazilian Students

Daniel Jos Cardoso da Silva,

Federal University of Alagoas - Faculty of Economics and Business Av Lourival Mota Melo, s / n, bl. 16, 1st Floor, Board of Martins - Maceio Alagoas Brasil danieljcsilva@gmail.com

Luiz Carlos Marques dos Anjos,

Federal University of Alagoas - Faculty of Economics and Business Av Lourival Mota Melo, s / n, bl. 16, 1st Floor, Board of Martins - Maceio Alagoas Brasil luiz@consultorcontabil.com

Adhemar Ranciaro Neto,

Federal University of Alagoas - Faculty of Economics and Business Av Lourival Mota Melo, s / n, bl. 16, 1st Floor, Board of Martins - Maceio Alagoas Brasil adhranneto@gmail.com

Luiz Carlos Miranda,

Federal University of Pernambuco - Center of applied social sciences Av. Moraes Rego, 1235 - University City, Recife - Pernambuco Brasil lc-miranda@uol.com.br

Aldemar de Arajo Santos,

Federal University of Pernambuco - Center of applied social sciences Av. Moraes Rego, 1235 - University City, Recife - Pernambuco Brasil aldemar.santos@ufpe.br

Abstract - This article was inspired by research Vyvyan et al (2007) who tried to better understand the disparity between the positive attitudes towards socially responsible investment (SRI) and the level of investment in SRI, examining both the attitudes and SRI investment choices are made. Both studies worked with the hypothesis: those who are more committed to principles of environmental sustainability are more likely to invest in SRI. We surveyed 351 students and teachers from various states and regions of Brazil. Respondents were asked about their beliefs in the practice of corporate governance and sustainable development. They were then simulated three investment scenarios involving two fictitious companies, one adopting governance practices and sustainable development and the other with no commitment to these practices. At first almost all respondents reported caring and concern for their decisions, corporate governance and socially and environmentally responsible companies. What is noticeable is that there was a change in the choices of respondents contradicting the "green attitudes. Keywords: Socially Responsible Investing, the Green Attitudes, Grey Choices, Brazilian Students

1. Introduction

This article was inspired by research Vyvyan et al (2007) who tried to better understand the disparity between the positive attitudes towards socially responsible investment (SRI) and the level of investment in SRI, examining both the attitudes and SRI investment choices are made. Both studies worked with the

257-1

hypothesis: those who are more committed to principles of environmental sustainability are more likely to invest in SRI. To test this 318 people from two large Queensland organisations are surveyed in relation to their investment attitudes and preferences, by Australians researchers. In this survey of Brazilian students surveyed were called sciences of business: administration, accounting and economics of various grade levels. Vyvyan et al (2007) thought that there are significant differences in investment attitudes with environmentalists placing more importance on SRI investment criteria. However, there was no significant difference between environmentalists and non-environmentalists in terms of utility scores from an investment selection experiment with the environmentalists placing higher importance on financial performance criteria than SRI criteria, making choices similar to those with the lowest level of environmental activism. Stayed the question: Will students have the same behavior of professional investors?

2. Methodology

We surveyed 351 students and teachers from various states and regions of Brazil, for example, Pernambuco, Paraiba, Alagoas, Minas Gerais. We used an electronic questionnaire tool "Google Docs", available at: https://docs.google.com/spreadsheet/viewform?formkey=dHFfTlhUdFp2WHlvYWxFdjB2NFZLOWc6M A. The research took place in the period 19/03/2012 to 13/04/2012. Respondents were asked about their beliefs in the practice of corporate governance and sustainable development. They were then simulated three investment scenarios involving two fictitious companies, one adopting governance practices and sustainable development and the other with no commitment to these practices. The results are presented in the following sections of this research using descriptive statistics. For the analyzes we used the SPSS statistical software in its version number 20.

3. Description of the Sample Surveyed

Table 1 presents a description of the sample surveyed. The predominant profile of the respondents are young up to 25 years old (58.49%), college students (68.4%), female (53.6%) and accounting students (51.6%).

Table 1: Descriptive statistics Age <25yrs >26-30yrs >30-40yrs >40-50yrs >50yrs Total Gender Male Female Total Frequency 205 57 53 29 7 351 Frequency 163 188 351 Percent 58,4 16,2 15,1 8,3 2,0 100,0 Percent 46,4 53,6 100,0 Valid Percent 58,4 16,2 15,1 8,3 2,0 100,0 Valid Percent 46,4 53,6 100,0 Cumulative Percent 46,4 100,0 Cumulative Percent 58,4 74,6 89,7 98,0 100,0

257-2

Education Student in higher education Undergraduate qualification Postgraduate qualification Master Science Ph.D. / Doctor Total Main_Training_Area Administration Accounting Economy Other areas Total

Frequency 240 47 33 24 7 351 Frequency 117 181 23 30 351

Percent 68,4 13,4 9,4 6,8 2,0 100,0 Percent 33,3 51,6 6,6 8,5 100,0

Valid Percent 68,4 13,4 9,4 6,8 2,0 100,0

Cumulative Percent 68,4 81,8 91,2 98,0 100,0

Valid Percent Cumulative Percent 33,3 51,6 6,6 8,5 100,0 33,3 84,9 91,5 100,0

4. The Green Attitudes

Three questions were asked to evaluate the stated beliefs (green attitudes) of respondents. The first was: Do you consider important to be informed about issues related to corporate sustainability? The overwhelming majority (95.4%) said yes. The second question was: Do you think that sustainable companies create shareholder value over the long term because they are better prepared to face economic risks, social and environmental? Again the majority of respondents (89.5%) said yes. Finally the third question was: If you were an investor, issues of corporate sustainability and corporate governance would be taken into account when making investment decisions in a given institution? Also the previous question, the vast majority (89.5%) said they would do.

5. The Grey Choices

Table 2 shows how respondents behaved in front of three simulated scenarios in relation to an investment. In the first scenario they had the option to invest in a company that adopted corporate governance practices and was committed to environmental responsibility, since the other company had no commitment to these beliefs. The return on investment would be the same. In the second scenario the company without compromising environmental and governance offered a return 50% higher than the other company. In the third scenario the return on investment would be 100% that the company's "sustainable". What is noticeable is that there was a change in the choices of respondents contradicting the "green attitude". Analyzing the behavior of respondents by age was the biggest change in young people up to 25 years in which 29% changed their choice from the first to the third scenario, although there have been changes in all ages, except among those with more than 50 years not changed their minds. By gender, there was the highest among men change (29%). For education, Master Sciences (33%) and Undergraduate qualification (26%) had change of greater than college students (25%). And looking at the main training area students and professors of economics (39%) were the most radically changed their choice.

4. Conclusion

Based on the results observed, it can be concluded that education, nor gender were decisive in changing choices because the results end up being very similar. But the experience brought by the age seems to help maintain more consistent choices. Also, apparently made quite a difference was the main training area, and economists more sensitive with respect to the return on investment.

257-3

Table 2 - Behavior of respondents on the scenarios First investment scenario Option 1 Age <25yrs >26-30yrs >30-40yrs >40-50yrs >50yrs Total Gender Total Education student in higher education Undergraduate qualification Postgraduate qualification Master Science Ph.D. / Doctor Total Main Training Area Accounting Economy Other areas Total 178 23 28 346 3 0 2 5 155 17 25 297 26 6 5 54 134 14 24 261 47 9 6 90 Administration 117 0 100 17 89 28 Male Female 202 57 53 27 7 346 160 186 346 237 47 31 24 7 346 Option 2 3 0 0 2 0 5 3 2 5 3 0 2 0 0 5 Second investment scenario Option 1 Option 2 169 51 45 25 7 297 129 168 297 204 44 26 18 5 297 36 6 8 4 0 54 34 20 54 36 3 7 6 2 54 Third investment scenario Option 1 144 46 42 22 7 261 113 148 261 178 35 26 16 6 261 Option 2 61 11 11 7 0 90 50 40 90 62 12 7 8 1 90

Although the majority of respondents to maintain their initial choice, the most important conclusion of this work is that there is still much to do in relation to environmental education, especially among the young students of business science. Furthermore, the observed lack of congruency between attitudes and choices in relation to environmental criteria may have implications for the growth of SRI funds, Vyvyan et al (2007) have also warned of this in his study.

References

Vyvyan, V., Ng, C and Brimble, M. (2007). Fluoride Socially Responsible Investing: the green attitudes and grey choices of Australian investors. Corporate governance, Volume 15 Number 2 March 2007., 370-381.

257-4

Вам также может понравиться

- Importance of Quantitative Research Across FieldsДокумент2 страницыImportance of Quantitative Research Across FieldsWilson100% (2)

- Lesson Plan-Conditional ClausesДокумент6 страницLesson Plan-Conditional ClausesMonik Ionela50% (2)

- Learning Resource Action PlanДокумент2 страницыLearning Resource Action PlanTiny100% (17)

- Cengage Reading 2013Документ12 страницCengage Reading 2013Carmen Antonia Mendoza BarretoОценок пока нет

- Dissertation Examples Open UniversityДокумент6 страницDissertation Examples Open UniversityOnlinePaperWriterFargo100% (1)

- Polytechnic University of The Philippines Research PaperДокумент7 страницPolytechnic University of The Philippines Research Paperh03ch3b4Оценок пока нет

- Thesis On Education For Sustainable DevelopmentДокумент8 страницThesis On Education For Sustainable DevelopmentJody Sullivan100% (1)

- Quantitative Research Paper in EducationДокумент5 страницQuantitative Research Paper in Educationafmdcwfdz100% (1)

- Factors Affecting Environmental Sustainability Habits of University StudentsДокумент24 страницыFactors Affecting Environmental Sustainability Habits of University StudentsgbendiniОценок пока нет

- Vocational Education Students' Perception On Ethics Study - Evidence From Accounting StudentsДокумент12 страницVocational Education Students' Perception On Ethics Study - Evidence From Accounting StudentsGlobal Research and Development ServicesОценок пока нет

- RRLДокумент5 страницRRLCherryl Mariano GonzalesОценок пока нет

- Factors Affecting Career DecisionsДокумент31 страницаFactors Affecting Career DecisionsClaudine de CastroОценок пока нет

- Importance of Quantitative Research Across FieldsДокумент6 страницImportance of Quantitative Research Across FieldsJap Caranza LagunillaОценок пока нет

- Dissertation 2013Документ4 страницыDissertation 2013BuyResumePaperSingapore100% (1)

- MSDM PlacementДокумент12 страницMSDM PlacementMeryana Santya ParamitaОценок пока нет

- Out of Sight, Out of Mind: The Value of Political Connections in Social NetworksДокумент56 страницOut of Sight, Out of Mind: The Value of Political Connections in Social NetworksMuhammad Irka Irfa DОценок пока нет

- SaveДокумент16 страницSaveJames Patrick UrquizaОценок пока нет

- What is the role of knowledge & managerial incentives as an anti-catalyst in reducing carbon emissions and how do we fight it?Документ9 страницWhat is the role of knowledge & managerial incentives as an anti-catalyst in reducing carbon emissions and how do we fight it?dipti.paryaniОценок пока нет

- UI Greenmetric Guideline 2015Документ22 страницыUI Greenmetric Guideline 2015DennerAndradeОценок пока нет

- Six Growing Trends in Corporate Sustainability 2013Документ36 страницSix Growing Trends in Corporate Sustainability 2013Vincent Black100% (1)

- Cesifo1 wp7395Документ39 страницCesifo1 wp7395Adriana SouzaОценок пока нет

- Sample Shorter Data Analysis Report With CommentsДокумент8 страницSample Shorter Data Analysis Report With CommentsleejingpОценок пока нет

- Tugas Artikel MetpenДокумент9 страницTugas Artikel Metpen33Asmaul HusnaОценок пока нет

- Factors Influencing Legal Management Students' Degree ChoicesДокумент29 страницFactors Influencing Legal Management Students' Degree ChoicesLiezel CarandangОценок пока нет

- MBA Students' Attitudes Towards CSRДокумент23 страницыMBA Students' Attitudes Towards CSRAlok JainОценок пока нет

- Iastate ThesisДокумент5 страницIastate Thesisdonnacastrotopeka100% (2)

- Nyu Poly ThesisДокумент7 страницNyu Poly ThesisKaren Gomez100% (1)

- Sustainable Development Goals and Businesses As Active Change AgeДокумент5 страницSustainable Development Goals and Businesses As Active Change AgeBazilОценок пока нет

- Reviews of Related Literature and StudiesДокумент10 страницReviews of Related Literature and StudiesTricia Mae FernandezОценок пока нет

- Thesis On Factors Influencing Career ChoiceДокумент7 страницThesis On Factors Influencing Career Choicecandacedaiglelafayette100% (2)

- AbstractДокумент8 страницAbstractVanessa VerestОценок пока нет

- Factors Influencing Life Insurance ChoiceДокумент199 страницFactors Influencing Life Insurance ChoiceVenkat GVОценок пока нет

- EDULEARN 2021 Attitudes Towards The Choice of A Professional Career Montes & FrancoДокумент6 страницEDULEARN 2021 Attitudes Towards The Choice of A Professional Career Montes & FrancoIvan MontesОценок пока нет

- Sustainable Operations Research Based Assignment OnДокумент11 страницSustainable Operations Research Based Assignment Onssvarma09Оценок пока нет

- Key challenges in attracting and retaining workforce in service sectorДокумент7 страницKey challenges in attracting and retaining workforce in service sectorHappy Bells by Sonia KotakОценок пока нет

- Research Chapter 33333333333333333333Документ6 страницResearch Chapter 33333333333333333333Musefa DelwatoОценок пока нет

- Phase 3 ReportДокумент15 страницPhase 3 ReportHamza TariqОценок пока нет

- Thesis PerformanceДокумент5 страницThesis Performancegof1mytamev2100% (2)

- Effect Career ChoiceДокумент8 страницEffect Career ChoiceGerald mangulabnanОценок пока нет

- Student Participation in Collegiate Organizations - Expanding The BoundariesДокумент8 страницStudent Participation in Collegiate Organizations - Expanding The BoundariesMarinel VillaneraОценок пока нет

- Why MFIs Go GreenДокумент25 страницWhy MFIs Go GreenNejra HadziahmetovicОценок пока нет

- The Truth About Class Size Reduction: Problems, Examples, and AlternativesДокумент9 страницThe Truth About Class Size Reduction: Problems, Examples, and AlternativesEducation Policy CenterОценок пока нет

- Research Paper On Factors Affecting Academic PerformanceДокумент4 страницыResearch Paper On Factors Affecting Academic Performanceoiotxmrhf100% (1)

- Theoretical Framework and Factors Affecting Accounting EnrollmentДокумент6 страницTheoretical Framework and Factors Affecting Accounting EnrollmentCykee Hanna Quizo LumongsodОценок пока нет

- Chapter 1THE FACTORS AFFECTING THE CAREER DECISION OF GRADE 11 GAS STUDENTS IN SAINT VINCENT COLLEGE OF CABUYAOДокумент7 страницChapter 1THE FACTORS AFFECTING THE CAREER DECISION OF GRADE 11 GAS STUDENTS IN SAINT VINCENT COLLEGE OF CABUYAOJusdtrou Añeperbos100% (1)

- Valdez 2019Документ23 страницыValdez 2019anonimo anonimoОценок пока нет

- Sample of Thesis About Student SatisfactionДокумент5 страницSample of Thesis About Student Satisfactionxxsfomwff100% (2)

- GlobeScan Seven Unlocks HSL April 2021Документ10 страницGlobeScan Seven Unlocks HSL April 2021ComunicarSe-ArchivoОценок пока нет

- ART.2 WhydoMFIsgogreen ALLET 2012-04Документ24 страницыART.2 WhydoMFIsgogreen ALLET 2012-04Sitah SamОценок пока нет

- PriorExposure EntrepreneurialEducation Text FinalversionДокумент32 страницыPriorExposure EntrepreneurialEducation Text FinalversionJonnaОценок пока нет

- Academic Major Study July 242017Документ11 страницAcademic Major Study July 242017Hagi GintingОценок пока нет

- Kingston University Dissertation ExtensionДокумент7 страницKingston University Dissertation ExtensionCheapestPaperWritingServiceUK100% (1)

- ttДокумент8 страницttKiều Trần Nguyễn DiễmОценок пока нет

- The New Corporate Social Responsibility: Graeme - Auld@yale - EduДокумент39 страницThe New Corporate Social Responsibility: Graeme - Auld@yale - EdudvbadvarОценок пока нет

- Factors Influencing Career Choice and Curriculum Exit PlansДокумент32 страницыFactors Influencing Career Choice and Curriculum Exit PlansHihuhiОценок пока нет

- Final RationaleДокумент36 страницFinal Rationaleraymart copiarОценок пока нет

- Final Dissertation ProjectДокумент8 страницFinal Dissertation ProjectWriteMyPhilosophyPaperSingapore100% (1)

- J Management Studies - 2022 - Markman - Will Your Study Make The World A Better PlaceДокумент7 страницJ Management Studies - 2022 - Markman - Will Your Study Make The World A Better Placedjhx5vv2s8Оценок пока нет

- The Benefits of Florida'S Test-Based Promotion System: CSL LДокумент20 страницThe Benefits of Florida'S Test-Based Promotion System: CSL LUploader_LLBBОценок пока нет

- Facebook and Stress Impact Accounting Student GradesДокумент15 страницFacebook and Stress Impact Accounting Student GradesWanda Nur fitriaОценок пока нет

- The Social Dimensions of Corporate Sustainability: An Integrative Framework Including COVID-19 InsightsДокумент29 страницThe Social Dimensions of Corporate Sustainability: An Integrative Framework Including COVID-19 Insightskarunesh_343Оценок пока нет

- Sustainability 12 08747 v2Документ29 страницSustainability 12 08747 v2sita deliyana FirmialyОценок пока нет

- Sustainability in Business: A Financial Economics AnalysisОт EverandSustainability in Business: A Financial Economics AnalysisОценок пока нет

- 2017.02.09 BSSE CatalogueДокумент12 страниц2017.02.09 BSSE CatalogueAnonymous BBs1xxk96VОценок пока нет

- DP Unit Planner Style 1Документ5 страницDP Unit Planner Style 1Marrian JОценок пока нет

- Head Start Corrective Action PlanДокумент37 страницHead Start Corrective Action PlanCourier JournalОценок пока нет

- Concept and Elements in FPKДокумент27 страницConcept and Elements in FPKSiti ZayaniОценок пока нет

- Individual Performance Commitment & Review Form (Ipcrf) : Irene B. Aranilla Sst-I Quezon JUNE 2019-2020Документ18 страницIndividual Performance Commitment & Review Form (Ipcrf) : Irene B. Aranilla Sst-I Quezon JUNE 2019-2020Irene Balane AranillaОценок пока нет

- L2 - English Lesson FormatДокумент21 страницаL2 - English Lesson FormatMajdoline Sadeddine0% (1)

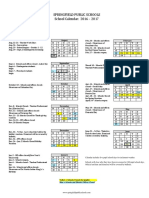

- Asd-W School Calendar 2016-2017 ColoredДокумент1 страницаAsd-W School Calendar 2016-2017 Coloredapi-336438079Оценок пока нет

- Lesson Plan 23 MarchДокумент5 страницLesson Plan 23 Marchapi-284820888Оценок пока нет

- District Project Office Sarva Shiksha Abhiyan, Sambalpur: AdvertisementДокумент4 страницыDistrict Project Office Sarva Shiksha Abhiyan, Sambalpur: AdvertisementRupali PanigrahiОценок пока нет

- Udl Team 6 Lesson PlanДокумент3 страницыUdl Team 6 Lesson Planapi-254028740Оценок пока нет

- Curriculum MapДокумент5 страницCurriculum Mapapi-293923979Оценок пока нет

- Episode 3 AnswerДокумент4 страницыEpisode 3 Answerblessy sampayanОценок пока нет

- Magic School Bus Valentine's Lesson PlanДокумент2 страницыMagic School Bus Valentine's Lesson PlanLauren NixonОценок пока нет

- Effectiveness of Traditional LearningДокумент3 страницыEffectiveness of Traditional LearningSeth Harvey Lim GamboaОценок пока нет

- BibliographyДокумент2 страницыBibliographyapi-217963894Оценок пока нет

- Perimeter and Area of RectanglesДокумент2 страницыPerimeter and Area of RectanglesKaisha MedinaОценок пока нет

- They Say I SayДокумент3 страницыThey Say I Sayapi-240595359Оценок пока нет

- pr2 Research Notes and SummariesДокумент6 страницpr2 Research Notes and Summariesapi-320171936Оценок пока нет

- Quality Education - How To Ensure It in Bangladesh.Документ4 страницыQuality Education - How To Ensure It in Bangladesh.Moon AhmedОценок пока нет

- Christmas Homework: READING BOOK: Animal Farm, by George OrwellДокумент2 страницыChristmas Homework: READING BOOK: Animal Farm, by George OrwellGalina KorostelevaОценок пока нет

- Clinical Field Experience BДокумент4 страницыClinical Field Experience BRaymond BartonОценок пока нет

- School Year Calendar 2016-2017 Final 3-7-16 1Документ1 страницаSchool Year Calendar 2016-2017 Final 3-7-16 1api-352924230Оценок пока нет

- KWF Position Paper On EO210Документ5 страницKWF Position Paper On EO210Rb GutierrezОценок пока нет

- Parent Welcome Letter1.Telicia - 2Документ6 страницParent Welcome Letter1.Telicia - 2tevil9555Оценок пока нет

- Activity 2.3 AnswersДокумент2 страницыActivity 2.3 AnswershamidahrazakОценок пока нет

- DAILY LESSON LOG OF M11GM - Ie-F-2 (Week Six - Day One) : Answer KeyДокумент3 страницыDAILY LESSON LOG OF M11GM - Ie-F-2 (Week Six - Day One) : Answer KeyEdelmar BenosaОценок пока нет

- SEO-Optimized title for English lesson on Philippine folktalesДокумент6 страницSEO-Optimized title for English lesson on Philippine folktalesJollyGay Tautoan LadoresОценок пока нет