Академический Документы

Профессиональный Документы

Культура Документы

Hindustan Sanitaryware Industries IC

Загружено:

Angel BrokingАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hindustan Sanitaryware Industries IC

Загружено:

Angel BrokingАвторское право:

Доступные форматы

Initiating coverage | Ceramic Products July 18, 2013

Hindustan Sanitaryware Industries

Traction in sanitaryware industry to be key driver

Hindustan Sanitaryware Industries Ltd (HSIL) is the largest manufacturer of sanitaryware (40% market share) and the second largest manufacturer (22% market share) of glass containers in India. With increased awareness for improving sanitation coverage coupled with current low penetration and changing lifestyles of people, the sanitaryware industry is poised to witness steady traction. HSIL, with its recently expanded capacity in sanitaryware and strong brand recall is well placed to benefit from the robust growth expected in the industry. Moreover, no further expansion in the low-RoCE glassware division is likely to improve the return ratios going forward. We initiate coverage on HSIL and recommend Buy with a target price of `117 valuing the business on SOTP basis for FY2015E.

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Ceramic Products 574 840 1.0 154 / 83 70,965 2 19,396 6,038 HSNT.BO HSI.IN

`87 `117

12 Months

Investment rationale

Extended capacity to compliment rising demand: Due to increasing awareness about improving sanitation, low penetration and changing lifestyles of people, the sanitaryware industry is witnessing traction. HSILs greenfield project will expand its sanitaryware capacity by 1.2mp (million pieces) and faucetware capacity by 2.5mp by FY2015E, which in turn will help the company to cater to the rising demand in the market. Leading position with positive brand recall to provide edge: HSIL holds a leading position in the sanitaryware industry (organized segment) with ~40% market share. Well-known brands like QUEO Hindware Art, Hindware Italian, Hindware, Raasi, and Benevalve, enable HSIL to cater to varied segments of the market. Glassware division - unlikely to be a drag going forward: The companys glassware division which has constituted ~60% of the capital employed has generated RoCE in the range of 6-10% historically. On the other hand, the sanitaryware division has a track record of RoCE above 18%. Going ahead, we expect no further investments in the low-RoCE glassware division which will aid in improving the overall return ratios. Outlook and valuation: We expect HSIL to register a CAGR of 15.8% in its top-line over FY2013-15E to `2,363 on the back of robust growth in the sanitaryware industry coupled with stable growth in the glass industry. The EBITDA and net profit are expected to post a CAGR of 16.3% and 14.8% respectively over FY2013-15E. Valuing the business on SOTP basis, assigning the glassware division a target EV/invested capital of 0.5x and assigning the sanitaryware division a target PE of 7x, we arrive at an estimated market capitalization of `770cr in FY2015E which provides 34.2% upside from the current levels. Hence, we initiate coverage on HSIL and recommend Buy with a target price of `117 valuing the business on SOTP basis for FY2015E.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 51.6 12.3 19.2 17.0

Abs.(%) Sensex HSIL

3m (0.5)

1yr 17.1

3yr 12.3

(19.0) (38.5) (23.8)

Key financials

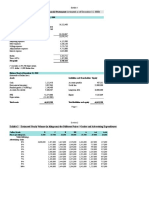

FY2014E FY2015E Net sales (` cr) 2,042 2,363 OPM (%) 14.6 14.8 PAT (` cr) 81 109 EPS (`) 12.3 16.5 ROIC (%) 9.0 10.4 P/E (x) 7.1 5.3 P/BV (x) 0.5 0.5 EV/ EBITDA (x) 5.0 4.4

Twinkle Gosar

Source: Company, Angel Research

Tel: 022- 3935 7800 Ext: 6848 Gosar.twinkle@angelbroking.com

Please refer to important disclosures at the end of this report

HSIL | Initiating Coverage

Investment rationale

Changing lifestyles boost prospects of sanitaryware industry

Owing to changing lifestyles of people, the role of sanitary products has advanced from being a necessity to a status statement thus increasing the proportion of spending on these basic amenities. Growth in disposable incomes of people has been a vital factor supporting the improving lifestyles of people. Indias sanitation coverage is only ~40%, which is among the lowest in the world, thus increasing the risk of health hazards and epidemics. With increasing awareness towards improving public health, the sanitaryware segment is expected to witness high attention. In addition, with requirement of personal space and privacy gaining an inevitable place, nuclear family structure is gaining prominence, thereby increasing demand for sanitary products.

Leading position with strong brand recall to provide edge

HSIL holds a leading position in the sanitaryware industry (organized segment) with a market share of ~40%. The company caters to various segments of the market through its well known sanitaryware brands like QUEO (for super premium segment), Hindware Art and Hindware Italian (for the premium segment), Hindware (for medium/ standard segment) and Raasi and Benevalve (for the lowend segment).

Enhanced capacity to compliment rising demand

HSIL has undertaken brownfield expansion in FY2012 for its sanitaryware division owing to higher capacity utilisation of ~110% (inclusive of traded goods). The company is well placed to cater to rising demand in the market with its increased capacities in the sanitaryware (79% ie 0.7mp) and faucetware (capacity increased 10-fold, ie by 0.2mp) segments. HSIL has greenfield expansion plans for sanitaryware (1.2mp) and faucetware (2.5mp) in Gujarat and Rajasthan respectively, slated to be operational post FY2014. Outsourcing the manufacture of faucets until recent past had limited HSILs scope in increasing sales volumes. Hence, enhanced in-house production of faucets now is expected to ensure consistent supply and enable the company in meeting rising market demand going forward.

Exhibit 1: Facility and capacity details

Division Sanitaryware Faucetware

Source: Company

Facility Bahadurgarh (Haryana) Bibinagar (Andhra Pradesh) Bhiwadi (Rajshthan)

Brown-Field 79% (0.7 mp) 10x (0.2 mp)

Total Capacity 1.5 mp 2.0 mp 0.5 mp

Green-Field 1.2 mp- Gujarat 2.5 mp

July 18, 2013

HSIL | Initiating Coverage

Glassware division- unlikely to be a drag going forward

The sanitaryware and glassware segments operate on different business dynamics and do not have any synergies. Historically, the glassware division which has constituted ~60% of the capital employed, has generated RoCE in the range of 610%. On the other hand, the sanitaryware division has generated relatively much higher RoCE (18-27%). We expect no further expansion plans in the low-RoCE glassware division and this will likely improve the return ratios. Considering the vast difference in the profitabilities of the two divisions and lack of any synergy between them, we believe the two divisions will be separated sooner or later which will provide fair valuations to both the entities.

Exhibit 2: RoCE and constitution in capital employed

Particulars (%) Glassware Division Return on capital employed Constitution of capital employed Sanitaryware Division Return on capital employed Constitution of capital employed

Source: Company, Angel Research

FY2009 8.7 67.3

FY2010 8.8 52.6

FY2011 14.8 55.5

FY2012 9.7 63.9

FY2013 5.9 61.7

27.3 26.0

29.2 38.7

24.2 43.5

19.7 35.6

18.2 37.9

At a macro level, the glassware industry is facing over-capacity. This has reduced pricing power for players in the industry, thus leading to lower profitabilities for them. Consequently, small players are exiting due to cost ineffectiveness. We believe this will lead to equilibrium in the industry in the near future. The production capacity of the glassware division has been expanded by 42%, ie from 475TPD (tonnes per day) in FY2012 to 1,650 TPD now, thereby enabling the company to avail to economies of scale. HSIL has no further investment plans in this segment. The stable existing demand and the soon-approaching equilibrium in the glassware industry will facilitate HSIL to operate at optimal levels.

July 18, 2013

HSIL | Initiating Coverage

Financials

Exhibit 3: Key assumptions

Key Assumptions Net sales (` cr) Sanitaryware Sales (` cr) Volume Growth (%) Value Growth (%) Glassware Sales (` cr) Volume Growth (%) Value Growth (%) Others Sales (` cr) Value Growth (%)

Source: Company, Angel Research

FY2012 1,446 607 9.6 13.0 710 17.8 11.9 129 173.8

FY2013E 1,762 747 6.1 16.0 826 (10.7) 30.4 189 46.5

FY2014E 2,042 895 8.0 11.0 920 8.7 2.5 227 20.0

FY2015E 2,363 1,064 6.7 11.5 1,031 7.1 4.5 268 18.0

Top-line to post 15.8% CAGR over FY2013-15E

Traction in the sanitaryware industry coupled with recent expansion in capacity are expected to drive HSILs top-line at a CAGR of 15.8% over FY2013-15E. The companys top-line is estimated to be at `2,363cr in FY2015E.

Exhibit 4: Net Sales on an upward trend

2,500 33.5 2,000 1,500 1,000 18.2 30.6 36.2 20.4 15.9 15.7 40 35 30

Exhibit 5: Segmental sales trend

1,200

(` cr)

( ` cr)

(%)

20 15

600 400

1,096

1,463

1,762

2,042

2,363

146

189

227

367

490

607

747

616

804

5 0

FY2009 FY2010 FY2011 FY2012 FY2013 FY2014E FY2015E Net sales (LHS) Net sales growth (RHS)

FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E Others FY2015E Sanitaryware division Glassware division

Source: Company, Angel Research

Source: Company, Angel Research

The contribution of the sanitaryware division to total revenues is expected to increase from 42% in FY2013 to 45% in FY2015E due to increased capacities coupled with robust growth in demand. The glassware divisions contribution is subsequently expected to decline from 47% to 44% in FY2015E.

EBITDA to post a 16.3% CAGR over FY2013-15E

On the back of robust top-line growth, the companys EBITDA is expected to rise from `259cr in FY2013 to `350cr in FY2015E. The EBITDA margin is expected to remain stable at ~14.7% in FY2014E and FY2015E. Increase in total raw material cost is expected to be offset by lower other manufacturing expenses (considering the economies of scale once the new capacity is operational at optimal level).

July 18, 2013

895

268

18

67

200

313 296 7

500

1,064

10

419

538

710

826

25

800

920

1,031

1,000

HSIL | Initiating Coverage

Exhibit 6: EBITDA margins to normalise

400 350 300 250 16.5 13.9 19.0 17.1 14.7 14.8 14.6 16 12 20

Exhibit 7: Segmental EBIT margins

25.0 19.4 20.0 15.0 16.9 21.1 20.1 18.2 14.9 14.8

( ` cr)

(%)

(%)

200 150 100 50 0 FY2009 FY2010 FY2011 EBITDA (LHS) FY2012 FY2013 FY2014E FY2015E EBITDA margin (RHS) 85 133 208 250 259 299 350 0 8 4

15.0 10.0 10.7 5.0 0.0 FY2009 FY2010 FY2011 11.1

15.3

8.6

8.0

8.0

FY2012 FY2013E FY2014E FY2015E Glassware division

Sanitaryware division

Source: Company, Angel Research

Source: Company, Angel Research

The EBIT margin of the sanitaryware division, at ~14.7% for FY2014E and FY2015E, is relatively higher than that of the glassware division at 8.0% for the same period.

Net profit to post a 14.8% CAGR over FY2013-15E

Decent top-line growth and operational efficiency are to aid reported net profit to post a CAGR of 15.6% from `82cr in FY2013 to `109cr in FY2015E. After adjusting for extraordinary income of `24cr in FY2013E, the adjusted PAT is expected to grow at a CAGR of 35.9% over FY2013-15E. The net profit margin (adjusted) is expected to rise from 3.3% in FY2013 to 4.6% in FY2015E. The increase is mainly due to the adjustment of extraordinary income in FY2013 and reduced interest cost in FY2015E, owing to repayments during the year. HSILs debt-equity ratio is comfortably placed at 0.8x FY2015E, keeping interest cost at manageable levels.

Exhibit 8: Reduced interest expense to boost bottom-line

120 100 80 6.4 7.2 4.0 3.3 4.6 8 7 6 5

(` cr)

40 20 0 79 FY2011 94 FY2012 PAT (LHS)

Source: Company, Angel Research

3 2 59 FY2013 81 FY2014E 109 FY2015E 1 0

PAT margin (RHS)

July 18, 2013

(%)

60

HSIL | Initiating Coverage

Outlook and Valuation

We have allocated the entire debt to the glassware division, with it being a capital intensive business. With the target EV/Invested capital at 0.5x (lower than the peer Hindustan National Glass trading which is currently trading at 1.0x EV/Invested capital), the value for the glassware division amounts to `119cr. For the sanitaryware division, based on a target PE of 7x (still lower than its peer Cera Sanitarywares target PE of 12.0x for FY2015E), we arrive at a value of `652cr for this division. Thus, on a SOTP basis, the expected market capitalization of the overall business comes in at `770cr for FY2015E, which provides 34.2% upside from the current levels.

Exhibit 9: SOTP Valuation

Particulars (` cr) Glassware division Debt Capital employed Target EV/Invested capital Expected MCAP (A) Sanitaryware division EBIT PAT Cera's target PE Target PE Expected MCAP (B) Expected Total MCAP (A+B) Current MCAP Upside

Source: Angel Research

FY2015E 1,008 1,245 0.5 119

133 93 12.0 7.0 652 770 574 34.2%

Exhibit 10: One-year forward PE

275 250 225 200 175 150 125 100 75 50 25 0

(` )

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jan-09

Jan-10

Jan-11

Jan-12

Price

Source: Company, Angel Research

4x

9x

14 x

19 x

July 18, 2013

Jan-13

Jul-13

HSIL | Initiating Coverage

HSILs top-line is expected to grow at a CAGR of 15.8% over FY2013-15E to `2,363cr in FY2015E on the back of robust growth in the sanitaryware industry coupled with stable growth in the glass industry. Subsequently, the EBITDA and net profit are to grow at 16.3% and 14.8% CAGR over the same period. The EBITDA margin is expected to remain stable at ~14.7% in FY2014E and FY2015E. The stock is trading at an attractive PE multiple of 5.2x for FY2015E earnings compared to its peer Cera Sanitarywares PE multiple of 10.0x. Hence, we initiate coverage on HSIL and recommend Buy with a target price of `117, based on SOTP valuation for FY2015E earnings.

Competition

HSIL is the market leader in sanitaryware products with ~40% market share, followed by Roca Parryware (~26% share) and Cera Sanitaryware (~22% share). In the faucetware segment, Jaguar is the leader with a market share of 45-50%. In the container glass business, HSIL has a 22% market share, after HNGs leading market share of ~50%.

Exhibit 11: Sanitaryware divisions peer comparison

Sales (` cr) HSIL FY2014E FY2015E CSL FY2014E FY2015E

Source: Angel Research

EBIT Margin (%) 14.8 14.8 12.5 11.7

897 1,065 631 797

Exhibit 12: Peer comparison

Sales (` cr) HSIL FY2014E FY2015E CSL FY2014E FY2015E 631 797 14.5 13.7 54 42.6 26.5 65 51.1 25.3 11.9 10.0 2.8 2.3 7.0 5.9 2,042 2,363 14.6 14.8 81 12.3 9.0 7.1 5.3 0.5 0.5 5.0 4.4 109 16.5 10.4 OPM (%) PAT (` cr) EPS (`) ROE (%) P/E (x) P/BV (x) EV/EBITDA (x)

Source: Company, Angel Research

July 18, 2013

HSIL | Initiating Coverage

Risk factors

Unorganized sanitaryware manufacturers pose a threat since they enjoy the benefit of nil excise duty and sales tax. Hence, their products are ~70% cheaper than the organized sectors products. The increase in excise duty from 8% to 12% has made products from organized players more expensive. Low-cost imports from China. Any drastic changes in government policy related to housing construction and imports among others, is bound to impact the industry. Raw material cost- Any increase in the price of brass, the main raw material for faucets, may dent EBITDA margin. Rise in the cost of raw materials such as soda ash and that of power & fuel could dent operational margins. Any slowdown in the housing segment will cease growth, as in India the major demand for sanitaryware is fresh demand. HSIL has significant amount of debt on its books comprising ECB worth US$111mn. Rupee depreciation would increase the interest cost and repayment quantum of the loan and hence will negatively affect the bottomline of the company.

Exhibit 13: Sensitivity analysis

Change in Rupee (%) (5) (3) 0 3 5 10

Source: Angel Research

EBITDA margin (%) 15.3 15.2 15.0 14.9 14.8 14.6

Adj PAT (` cr) 119 117 114 111 109 104

July 18, 2013

HSIL | Initiating Coverage

The company

HSIL is a leading sanitaryware manufacturer in India (40% market share) and the second largest manufacturer of container glass (22% market share). The company operates through its two divisions- 1) sanitaryware division (45% of total revenue) and 2) glassware division (45%).

Exhibit 14: Segmental details

HSIL

Building Products (45%)

Container Glass (45%)

Others (10%)

Sanitaryware (69%) Faucetware (19%) Ohers (12%)

Vent- Extractor fans EVOK stores Garden PolymersPET bottles

Source: Company

Exhibit 15: Sanitary wares segmental contribution

Exhibit 16: Industrial contribution in Glassware division

Food 12%

Standard basicHindware 46%

Super PremiumQueo, PremiumHindware Italian, Hindware Art 52%

Pharma 12%

Beverages 18% Low end- Raasi 2%

Liquor 58%

Source: Company

Source: Company

Moreover, the clientele base for both the segments is huge, diversified and constitutes known and elite organizations.

Exhibit 17: Strong clientele

Building Products Segment The 3C Company, Ansal Group, DLF, Emaar MGF, Godrej Properties, Indiabulls, Jaypee, Larsen & Toubro, M2K, Mahindra Lifespace, Mariott, NBCC Oberoi, Parsvnath, Tata Projects etc

Source: Company

Container Glass Segment Abbott, Apex, Pfizer GSK, Dr Reddy, Reckitt Beckinser HUL, United Spirits, United Breweries Pepsico India, Nestle India Carlsberg India, Radico Khaitan

July 18, 2013

HSIL | Initiating Coverage

Other factors

Product launches: HSIL is putting in continuous efforts to innovate and come up with new product launches in both the divisions. It has recently launched 25 new products in the sanitaryware division, 2 series of Benelave faucets, 6 kitchen appliances and 2 varieties of tiles. Strong distribution network: HSIL is well placed to benefit from its strong distribution network of 15,000 retailers, above 2,000 dealers, above 1,600 institutional clients (1,235 for Sanitaryware division and 490 for Glassware division), 25 Hindware Boutiques, 458 Hindware shop-in-shop, and 18 service centres across India. Strategic associations: HSIL has allied with Vent for extractor fans, and with QUEO, a UK based subsidiary of Barwood, for sanitaryware products. HSIL has also acquired 100% equity in M/s Garden Polymers Pvt Ltd for `87cr in FY2012. The acquired company is a leading supplier to premier customers in the liquor, pharma and FMCG industries. It is engaged in the business of manufacturing PET bottles, caps and closures, having plants at Dharwad (Karnataka) and Selaqui (Uttarakhand). The acquisition is expected to provide synergy to the container glass business since both the companies cater to similar set of customers, thereby strengthening HSILs position in the packaging industry.

July 18, 2013

10

HSIL | Initiating Coverage

Sanitaryware industry

The Indian sanitaryware industry, estimated to be at `1,500cr-1,800cr, contributes to ~8% of the worlds sanitaryware production. The industry has a sustained growth rate of ~15% per annum due to increasing housing demand, purchasing power and consciousness towards hygiene. However, the premium segment has registered a growth rate of ~20-25%, indicating favorable transition in the Indian sanitaryware industry. India is emerging as the second largest sanitaryware market in the world and is expected to witness robust growth owing to the following:

Low penetration in Indian sanitation coverage

Considering Indias dense population, its sanitation coverage is only ~40%, which is considered to be among the lowest in the world, thus increasing the risk of health hazards and epidemics. The concept of making a clean and hygienic toilet is growing rapidly in rural areas, where a toilet did not even exist a few years ago. With increasing awareness towards improving public health, the sanitaryware segment is expected to witness high attention.

Changing lifestyle and rising awareness about health and fitness

Owing to the changing lifestyle of people, the role of sanitary products has advanced from being a necessity to a status statement thus impacting the spending structure of individuals and increasing the proportion of spending on these basic amenities. Growth in per capita income, leading to a simultaneous increase in the disposable incomes of people, has been a vital factor supporting the changing lifestyle of people. In addition, with requirement of personal space and privacy gaining an inevitable place, nuclear family structure is gaining prominence, thereby increasing demand for sanitary products. This trend is expected to continue, thus providing sustainable demand visibility for sanitaryware products. Lastly, with aesthetics gaining significant importance, HSILs initiatives to provide better designs and quality are bound to perk up its top-line.

Immense fresh demand on back of construction sectors growth

In India, the construction sector is growing at a robust pace because of rapid urbanization. For the sanitaryware industry, ~93% of the demand is fresh demand. Only 7% is derived from the replacement segment, which arises out of renovations and refurnishing. In developed economies, 20% is fresh demand, while 80% demand is from the replacement segment. Considering the above facts, the Indian construction sector is bound to contribute a strong growth for the sanitaryware industry and eventually for HSIL.

Wide exports horizon

Indian sanitaryware products are very competitive because of their low production costs and hence, exports from India are increasing with every passing day. Seven foreign brands including H&R Johnson, Roca and Kohler have established their operations in India.

July 18, 2013

11

HSIL | Initiating Coverage

Container glass industry

The Indian packaging industry is currently worth US$550bn, of which glass containers constitute 12% with a market size of ~`4,000cr. The glass industry is currently growing at a CAGR of 11% and is expected to reach US$21.6bn by 2015.

Exhibit 18: Packaging industry composition

Others 17% Caps and Closures 6% Metal Cans 8% Glass 12%

Printed Cartons 17% Flexible Packaging 22%

Rigid Plastics 18%

Source: Company

Low per capita consumption: The per capita consumption of glass is as low as

1.5Kg in India, compared to 89.0Kg in South Korea, 63.9Kg in France, 50.3Kg in Spain, 27.5Kg in the US and UK, 10.2Kg in Japan and 5.9Kg in China. This suggests scope for per capita consumption of glass to increase in the domestic market which would be a positive for HSIL and other players in the industry. Strong entry barriers: The glass industry is quite capital intensive, thereby reducing the threat from new entrants. Moreover, the industry had been gradually advancing on the path of automation, thereon further increasing the cost of developing the facility. Considering the above factors, glass industry displays strong entry barriers, thereby providing a shield to the existing big players. Over-capacity: The glass industry as of now is already witnessing over-capacity. Recently many small glass plants (with furnace capacity below 400TPD) have been shutting down since their production cost has been relatively higher than manufacturers with large furnace capacities. However, the over-capacity in the industry is to soon reach equilibrium with the recent and ongoing shutdowns. Growth in user industries: The container glass industry serves varied user industries like liquor, pharma, food and beverages, etc. Growth in the container glass industry is expected to be driven by rising demand from the user industries with - a) the liquor industry growing at 14-15% b) Pharma industry growing at 15-17% and c) Food and Beverages industry growing at 9%.

July 18, 2013

12

HSIL | Initiating Coverage

Profit and loss statement

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Total operating income % chg Net Raw Material % chg Power & Fuel Cost % chg Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation & Amort. EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of Net Sales) PBT (reported) Tax (% of PBT) PAT (reported) Extraordinary Exp./(Inc.) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg

FY2011 1,170 74 1,096 1,096

36.2

FY2012 1,567 104 1,463 1,463

33.5

FY2013 1,903 141 1,762 1,762

20.4

FY2014E 2,206 163 2,042 2,042

15.9

FY2015E 2,552 189 2,363 2,363

15.7

328

37.9

474

44.6

543

14.5

628 15.6 468 15.9 150 15.9 211 15.9 287 17.1 1,743 299 15.4 14.6 112 187 12.9 9.2 71 6 0.3 122 41 33.5 81 81 38.1 4.0 12.3 12.3 38.1

728 16.0 541 15.7 173 15.7 244 15.7 326 13.6 2,012 350 17.2 14.8 122 229 22.1 9.7 72 7 0.3 163 55 33.5 109 109 33.8 4.6 16.5 16.5 33.8

201

20.5

277

37.6

404

45.9

98

28.8

119

21.4

129 8.6 182

14.6

123

51.5

159

29.1

138

10.3

184

33.5

245 32.9 1,503 259 3.7 14.7 93 166 (10.3) 9.4 69 4 0.2 124 42 33.5 82 (24) 59 (37.3) 3.3 8.9 8.9 (37.3)

888 208

56.5

1,213 250

20.3

19.0 55 152

84.8

17.1 65 185

21.4

13.9 36 4 0.3 119 40 33.6 79 0 79

81.5

12.6 42 5 0.3 148 54 36.7 94 94

18.4

7.2 12.0 12.0

81.5

6.4 14.2 14.2

18.4

July 18, 2013

13

HSIL | Initiating Coverage

Balance sheet

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves & Surplus Shareholders Funds Total Loans Long term Provision Other long term liabilities Net Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Long term loans and advances Other non-current assets Current Assets Cash Loans & Advances Inventory Debtor Other current assets Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 1,098 286 808 30 3 36 38 6 454 21 46 222 164 0 270 184 1,105 1,548 351 1,139 333 58 11 62 7 667 73 43 306 244 1 425 242 1,853 1,953 444 1,509 58 11 53 2 937 82 58 407 389 1 478 459 2,092 2,192 556 1,636 46 11 53 2 991 55 61 465 408 1 554 437 2,185 2,388 678 1,711 37 11 53 2 1,146 44 71 557 473 1 664 482 2,296 13 659 672 345 3 12 73 1,105 13 954 967 791 3 13 78 1,853 13 1,013 1,026 933 4 14 114 2,092 13 1,064 1,077 976 4 14 114 2,185 13 1,142 1,155 1,008 4 14 114 2,296 FY2011 FY2012 FY2013 FY2014E FY2015E

July 18, 2013

14

HSIL | Initiating Coverage

Cash flow statement

Y/E March (` cr) Profit Before Tax Depreciation Other Income Change in WC Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/Dec. In Investments Other Income Cash Flow from Investing Issue of Equity/Preference Inc./(Dec.) in Debt Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) In Cash Opening Cash balance Closing cash balance FY2011 119 55 (4) 39 (40) 170 (89) (62) 4 (148) 2 (114) (17) 102 (26) (3) 25 21 FY2012 148 65 (5) (6) (54) 147 (755) 1 5 (749) 0 452 (20) 222 654 52 21 73 FY2013 124 93 (4) (232) (42) (60) (67) 9 4 (54) 0 180 0 (58) 123 9 73 82 FY2014E 122 112 (6) (4) (41) 183 (227) 0 6 (221) 0 42 (31) 12 (27) 82 55 FY2015E 163 122 (7) (56) (55) 167 (187) 0 7 (180) 0 32 (31) 2 (11) 55 44

July 18, 2013

15

HSIL | Initiating Coverage

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Net sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset TO (Gross Block) Inventory / Net sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to Equity Net debt to EBITDA Int. Coverage (EBIT/ Int.)

FY2011 7.2 4.3 0.9 2.9 0.8 4.2 0.8 12.0 12.0 20.4 2.5 101.7 13.9 0.7 1.1 10.0 7.0 0.4 11.2 13.8 15.0 11.8 1.0 64 51 91 61 0.4 1.4 4.2

FY2012 6.1 3.6 0.6 3.5 0.9 5.1 0.7 14.2 14.2 24.0 3.0 146.5 12.6 0.6 1.1 8.5 3.4 0.7 12.3 10.0 13.4 9.7 0.9 66 53 93 61 0.7 2.8 4.4

FY2013 9.8 3.8 0.6 3.5 0.8 5.5 0.7 8.9 8.9 23.0 4.0 155.4 9.4 0.7 0.9 5.7 4.9 0.8 6.3 7.9 8.5 5.7 0.9 49 53 93 78 0.8 3.2 2.4

FY2014E 7.1 3.0 0.5 5.3 0.7 5.0 0.7 12.3 12.3 29.2 4.0 163.0 9.2 0.7 1.0 6.0 4.9 0.8 7.0 8.6 9.0 7.5 0.9 47 53 93 68 0.8 3.0 2.6

FY2015E 5.3 2.5 0.5 5.3 0.6 4.4 0.7 16.5 16.5 34.9 4.0 174.9 9.7 0.7 1.1 6.9 4.8 0.8 8.7 10.0 10.4 9.4 1.0 47 53 93 68 0.8 2.7 3.2

July 18, 2013

16

HSIL | Initiating Coverage

Advisory Team Tel: (91) (022) 39500777

E-mail: advisory@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

HSIL No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 18, 2013

17

HSIL | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team Fundamental: Sarabjit Kour Nangra Vaibhav Agrawal Bhavesh Chauhan Viral Shah Sharan Lillaney V Srinivasan Yaresh Kothari Ankita Somani Sourabh Taparia Bhupali Gursale Vinay Rachh Amit Patil Twinkle Gosar Tejashwini Kumari Akshay Narang Harshal Patkar Technicals: Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Derivatives: Siddarth Bhamre Institutional Sales Team: Mayuresh Joshi Meenakshi Chavan Gaurang Tisani Akshay Shah Production Team: Tejas Vahalia Dilip Patel Research Editor Production Incharge tejas.vahalia@angelbroking.com dilipm.patel@angelbroking.com VP - Institutional Sales Dealer Dealer Sr. Executive mayuresh.joshi@angelbroking.com meenakshis.chavan@angelbroking.com gaurangp.tisani@angelbroking.com akshayr.shah@angelbroking.com Head - Derivatives siddarth.bhamre@angelbroking.com Sr. Technical Analyst Technical Analyst Technical Analyst shardul.kulkarni@angelbroking.com sameet.chavan@angelbroking.com sacchitanand.uttekar@angelbroking.com VP-Research, Pharmaceutical VP-Research, Banking Sr. Analyst (Metals & Mining) Sr. Analyst (Infrastructure) Analyst (Mid-cap) Analyst (Cement, FMCG) Analyst (Automobile) Analyst (IT, Telecom) Analyst (Banking) Economist Research Associate Research Associate Research Associate Research Associate Research Associate Research Associate sarabjit@angelbroking.com vaibhav.agrawal@angelbroking.com bhaveshu.chauhan@angelbroking.com viralk.shah@angelbroking.com sharanb.lillaney@angelbroking.com v.srinivasan@angelbroking.com yareshb.kothari@angelbroking.com ankita.somani@angelbroking.com sourabh.taparia@angelbroking.com bhupali.gursale@angelbroking.com vinay.rachh@angelbroking.com amit.patil@angelbroking.com gosar.twinkle@angelbroking.com tejashwini.kumari@angelbroking.com akshay.narang@angelbroking.com harshal.patkar@angelbroking.com

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 / NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

July 18, 2013

18

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Preqin Latin America Report 2021Документ35 страницPreqin Latin America Report 2021Carlos ArangoОценок пока нет

- Special Technical Report On NCDEX Oct SoyabeanДокумент2 страницыSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingОценок пока нет

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Документ4 страницыDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingОценок пока нет

- WPIInflation August2013Документ5 страницWPIInflation August2013Angel BrokingОценок пока нет

- Technical & Derivative Analysis Weekly-14092013Документ6 страницTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Market Outlook: Dealer's DiaryДокумент13 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Daily Agri Tech Report September 16 2013Документ2 страницыDaily Agri Tech Report September 16 2013Angel BrokingОценок пока нет

- Metal and Energy Tech Report November 12Документ2 страницыMetal and Energy Tech Report November 12Angel BrokingОценок пока нет

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertДокумент4 страницыRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingОценок пока нет

- Oilseeds and Edible Oil UpdateДокумент9 страницOilseeds and Edible Oil UpdateAngel BrokingОценок пока нет

- Daily Agri Report September 16 2013Документ9 страницDaily Agri Report September 16 2013Angel BrokingОценок пока нет

- Daily Metals and Energy Report September 16 2013Документ6 страницDaily Metals and Energy Report September 16 2013Angel BrokingОценок пока нет

- Derivatives Report 16 Sept 2013Документ3 страницыDerivatives Report 16 Sept 2013Angel BrokingОценок пока нет

- International Commodities Evening Update September 16 2013Документ3 страницыInternational Commodities Evening Update September 16 2013Angel BrokingОценок пока нет

- Daily Agri Tech Report September 14 2013Документ2 страницыDaily Agri Tech Report September 14 2013Angel BrokingОценок пока нет

- Currency Daily Report September 16 2013Документ4 страницыCurrency Daily Report September 16 2013Angel BrokingОценок пока нет

- Commodities Weekly Outlook 16-09-13 To 20-09-13Документ6 страницCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingОценок пока нет

- Derivatives Report 8th JanДокумент3 страницыDerivatives Report 8th JanAngel BrokingОценок пока нет

- Commodities Weekly Tracker 16th Sept 2013Документ23 страницыCommodities Weekly Tracker 16th Sept 2013Angel BrokingОценок пока нет

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressДокумент1 страницаPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingОценок пока нет

- IIP CPIDataReleaseДокумент5 страницIIP CPIDataReleaseAngel BrokingОценок пока нет

- Technical Report 13.09.2013Документ4 страницыTechnical Report 13.09.2013Angel BrokingОценок пока нет

- Sugar Update Sepetmber 2013Документ7 страницSugar Update Sepetmber 2013Angel BrokingОценок пока нет

- Market Outlook 13-09-2013Документ12 страницMarket Outlook 13-09-2013Angel BrokingОценок пока нет

- TechMahindra CompanyUpdateДокумент4 страницыTechMahindra CompanyUpdateAngel BrokingОценок пока нет

- Metal and Energy Tech Report Sept 13Документ2 страницыMetal and Energy Tech Report Sept 13Angel BrokingОценок пока нет

- MetalSectorUpdate September2013Документ10 страницMetalSectorUpdate September2013Angel BrokingОценок пока нет

- MarketStrategy September2013Документ4 страницыMarketStrategy September2013Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateДокумент6 страницTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingОценок пока нет

- Daily Agri Tech Report September 06 2013Документ2 страницыDaily Agri Tech Report September 06 2013Angel BrokingОценок пока нет

- EAE0516 - 2022 - Slides 15Документ25 страницEAE0516 - 2022 - Slides 15Nicholas WhittakerОценок пока нет

- New Jeevan Anand (915) : Mr. YesДокумент5 страницNew Jeevan Anand (915) : Mr. YesPankaj YadavОценок пока нет

- A Project Report On TaxationДокумент71 страницаA Project Report On TaxationHveeeeОценок пока нет

- Grade 7 Practice: Calculating Percent Changes and DiscountsДокумент3 страницыGrade 7 Practice: Calculating Percent Changes and DiscountsRizky HermawanОценок пока нет

- Engineering Economics HandoutДокумент6 страницEngineering Economics HandoutRomeoОценок пока нет

- Mobile Money International Sdn Bhd Company ProfileДокумент1 страницаMobile Money International Sdn Bhd Company ProfileLee Chee SoonОценок пока нет

- Brexit Implications On CM FXДокумент6 страницBrexit Implications On CM FXAyobami EkundayoОценок пока нет

- Final Exam/2: Multiple ChoiceДокумент4 страницыFinal Exam/2: Multiple ChoiceJing SongОценок пока нет

- Pedro Santos' Transportation Business General Journal For The Month of JulyДокумент8 страницPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლОценок пока нет

- Doa TradeДокумент17 страницDoa TradeEduardo WitonoОценок пока нет

- Power Notes: BudgetingДокумент46 страницPower Notes: BudgetingfrostyangelОценок пока нет

- Indian Institute of Banking & Finance: Certificate Course in Digital BankingДокумент6 страницIndian Institute of Banking & Finance: Certificate Course in Digital BankingKay Aar Vee RajaОценок пока нет

- Bcoc 136Документ2 страницыBcoc 136Suraj JaiswalОценок пока нет

- HW On Receivables B PDFДокумент12 страницHW On Receivables B PDFJessica Mikah Lim AgbayaniОценок пока нет

- FM by Sir KarimДокумент2 страницыFM by Sir KarimWeng CagapeОценок пока нет

- Van Den Berghs LTD V ClarkДокумент6 страницVan Den Berghs LTD V ClarkShivanjani KumarОценок пока нет

- Exhibits and Student TemplateДокумент7 страницExhibits and Student Templatesatish.evОценок пока нет

- Vault GuideДокумент414 страницVault Guidethum_liangОценок пока нет

- Intercompany transactions elimination for consolidated financial statementsДокумент13 страницIntercompany transactions elimination for consolidated financial statementsicadeliciafebОценок пока нет

- Adjusting Entries Prob 3 4Документ4 страницыAdjusting Entries Prob 3 4Jasmine ActaОценок пока нет

- Taxes Are Obsolete by Beardsley Ruml, Former FED ChairmanДокумент5 страницTaxes Are Obsolete by Beardsley Ruml, Former FED ChairmanPatrick O'SheaОценок пока нет

- EF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Документ30 страницEF2A1 HDT Budget Upto Direct Taxes PCB4 1629376359978Mamta Patel100% (1)

- 1234449Документ19 страниц1234449Jade MarkОценок пока нет

- GST Session 38Документ20 страницGST Session 38manjulaОценок пока нет

- Calculate employee wagesДокумент29 страницCalculate employee wagesPrashanth IyerОценок пока нет

- A Generation of Sociopaths - Reference MaterialДокумент30 страницA Generation of Sociopaths - Reference MaterialWei LeeОценок пока нет

- DMGT104 Financial Accounting PDFДокумент317 страницDMGT104 Financial Accounting PDFNani100% (1)

- Admission of A PartnerДокумент21 страницаAdmission of A PartnerHarmohandeep singhОценок пока нет

- DepartmentalizationДокумент19 страницDepartmentalizationmbmsabithОценок пока нет