Академический Документы

Профессиональный Документы

Культура Документы

Summary of The History of Interest Rates

Загружено:

Jan Ebenezer MorionesИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Summary of The History of Interest Rates

Загружено:

Jan Ebenezer MorionesАвторское право:

Доступные форматы

Summary of the History of Interest Rates

As civilization emerged, a gradual need for a legal system became apparent. Much of the earliest recorded laws concerned the issue of credit and the price thereof interest. A chap named Hammurabi, King of the first dynasty of Babylon, authored the earliest known formal laws around 1800 B.C. within which we find the first recorded attempt to regulate interest rates. Hammurabi established a ceiling or maximum rate of interest that a moneylender might charge a borrower. On loans of grain, which were repayable in kind, the maximum rate of interest was limited to 33 1/3% per annum. On loans of silver, the maximum legal rate was established at 20% although some records have revealed a few rare instances when the rate of interest charged was as high as 25%. Although interest rates of 20-25% in Babylon may appear excessively high, in India comparable rates of interest were quite similar. The legal limitation on interest rates during the 24th century B.C. in India was established at 24%, according to the Laws of Manu. Nonetheless, every loan in Babylon, according to the laws of Hammurabi, had to be witnessed by a public official and recorded in a written contract. The penalty for charging more than the legal rate through any means was quite severe the debt was simply cancelled. Collateral could be pledged in the form of land or some possession. A debtor could also pledge his wife, children or slaves. In extreme cases, the debtor could even pledge his person but the law forbids personal slavery of a debtor beyond three years. The Law of Hammurabi remained unchanged for most of the next 1200 years. It is quite obvious that interest rates had often been charged well in excess of 33 1/3% during previous periods. Unfair practices also existed and many of these were addressed by Hammurabi. For example, creditors were forbidden from calling a loan made to a farmer prior to harvest. If the crop failed due to weather conditions, all interest on the loan would be cancelled for that year. In the case of houses, due to the scarcity of wood, a door could be used as collateral and was considered to be separate from a house. Architects were held responsible for defects in construction and could be put to death if the building collapsed and killed the occupant. One who is unfamiliar with archaeology might suspect the ability to trace the price of gold, commodities or interest rates back thousands of years. Nevertheless, contracts etched into clay tablets have been uncovered recording all aspects of mans early social and economic behavior several thousand years before Christ. Many loans took the form of a bearer note or bill, which the creditor could then sell, to another party. Some loans were subject to call while others bore a fixed rate of interest and a fixed maturity. Records of international loans from one nation to another have also survived in clay tablets involving the Babylonians, Assyrians, Elamites, Hittites and Syrians. The Egyptians were more of a state run economy highly authoritarian in nature leaving few records of interest and credit.

Вам также может понравиться

- Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItОт EverandRunning on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItРейтинг: 3.5 из 5 звезд3.5/5 (22)

- Cowen - The New Monetary EconomcsДокумент25 страницCowen - The New Monetary EconomcsjpkoningОценок пока нет

- Financial Reckoning Day: Memes, Manias, Booms & Busts ... Investing In the 21st CenturyОт EverandFinancial Reckoning Day: Memes, Manias, Booms & Busts ... Investing In the 21st CenturyОценок пока нет

- Fixing America: Breaking the Stranglehold of Corporate Rule, Big Media, and the Religious RightОт EverandFixing America: Breaking the Stranglehold of Corporate Rule, Big Media, and the Religious RightРейтинг: 2 из 5 звезд2/5 (1)

- The Cost of Capitalism: Understanding Market Mayhem and Stabilizing our Economic FutureОт EverandThe Cost of Capitalism: Understanding Market Mayhem and Stabilizing our Economic FutureРейтинг: 3.5 из 5 звезд3.5/5 (3)

- History of the United States Democracy: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyОт EverandHistory of the United States Democracy: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyОценок пока нет

- Greed, Inc.: Why Corporations Rule the World and How We Let It HappenОт EverandGreed, Inc.: Why Corporations Rule the World and How We Let It HappenОценок пока нет

- The American Indians: Their History, Condition and Prospects, from Original Notes and ManuscriptsОт EverandThe American Indians: Their History, Condition and Prospects, from Original Notes and ManuscriptsОценок пока нет

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsОт EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsОценок пока нет

- What the bible really says about Money and Giving: It's Not What You Think!От EverandWhat the bible really says about Money and Giving: It's Not What You Think!Оценок пока нет

- Macroeconomics and Development: Roberto Frenkel and the Economics of Latin AmericaОт EverandMacroeconomics and Development: Roberto Frenkel and the Economics of Latin AmericaОценок пока нет

- Panic on Wall Street: A History of America's Financial DisastersОт EverandPanic on Wall Street: A History of America's Financial DisastersОценок пока нет

- Entering the Brazilian Market: A guide for LEAN ConsultantsОт EverandEntering the Brazilian Market: A guide for LEAN ConsultantsОценок пока нет

- Ricardo's Law: House Prices and the Great Tax Clawback ScamОт EverandRicardo's Law: House Prices and the Great Tax Clawback ScamРейтинг: 5 из 5 звезд5/5 (1)

- The Wall Street Journal Guide to the End of Wall Street as We Know It: What You Need to Know About the Greatest Financial Crisis of Our Time—and How to Survive ItОт EverandThe Wall Street Journal Guide to the End of Wall Street as We Know It: What You Need to Know About the Greatest Financial Crisis of Our Time—and How to Survive ItОценок пока нет

- Essentials of Economic Theory: As Applied to Modern Problems of Industry and Public PolicyОт EverandEssentials of Economic Theory: As Applied to Modern Problems of Industry and Public PolicyОценок пока нет

- Student Loan Forgiveness or Ten Years to Life?: A Responsible Visual Guide to Your Federal Student Loan Repayment OptionsОт EverandStudent Loan Forgiveness or Ten Years to Life?: A Responsible Visual Guide to Your Federal Student Loan Repayment OptionsОценок пока нет

- When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary SupremacyОт EverandWhen Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary SupremacyРейтинг: 4 из 5 звезд4/5 (2)

- Lombard Street: A Description of the Money MarketОт EverandLombard Street: A Description of the Money MarketРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Readings in Distributed Artificial IntelligenceОт EverandReadings in Distributed Artificial IntelligenceAlan H. BondОценок пока нет

- Manias, Panics and Crashes SynopsisДокумент2 страницыManias, Panics and Crashes SynopsisvideodekhaОценок пока нет

- A History of Interest Rates, 4th Edition (Homer & Sylla)Документ7 страницA History of Interest Rates, 4th Edition (Homer & Sylla)Vincent Lau0% (1)

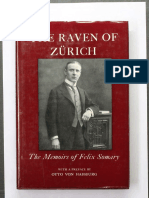

- The Raven of Zurich The Memoirs of Felix Somary Compressed PDFДокумент167 страницThe Raven of Zurich The Memoirs of Felix Somary Compressed PDFDavid100% (2)

- (New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFДокумент331 страница(New Thinking in Political Economy Series) Richard M. Salsman - The Political Economy of Public Debt - Three Centuries of Theory and Evidence-Edward Elgar Pub (2017) PDFioannaОценок пока нет

- Tobin - Commercial Banks As Creators of MoneyДокумент12 страницTobin - Commercial Banks As Creators of MoneyJung ZorndikeОценок пока нет

- Interpersonal Comparison of Utility - RobbinsДокумент8 страницInterpersonal Comparison of Utility - RobbinsarterioОценок пока нет

- American Economic Review-Top 20 ArticlesДокумент8 страницAmerican Economic Review-Top 20 ArticlesClub de Finanzas Economía-UCV100% (1)

- CranstonRoss (2002) - PrinciplesOfBankingLaw 257p.Документ257 страницCranstonRoss (2002) - PrinciplesOfBankingLaw 257p.Tran Chau Quang LuanОценок пока нет

- Maistre and HobbesДокумент23 страницыMaistre and HobbesJosé Manuel Meneses RamírezОценок пока нет

- Lords of Finance: The Bankers Who Broke The World - Liaquat AhamedДокумент4 страницыLords of Finance: The Bankers Who Broke The World - Liaquat AhamedxagedebyОценок пока нет

- The Boom of 2021Документ4 страницыThe Boom of 2021Jeff McGinnОценок пока нет

- GELDERLOOS Peter - The Failure of Nonviolence (2017, Left Bank Books)Документ282 страницыGELDERLOOS Peter - The Failure of Nonviolence (2017, Left Bank Books)Luna Rossa100% (2)

- Frank H. Knight-Intelligence and Democratic Action-Harvard University Press (1960)Документ184 страницыFrank H. Knight-Intelligence and Democratic Action-Harvard University Press (1960)Guilherme MachadoОценок пока нет

- The Ascent of Money Part 1 To 5Документ47 страницThe Ascent of Money Part 1 To 5Vivek Srivastava0% (1)

- Permanence: 17th June 2013Документ5 страницPermanence: 17th June 2013tony caputi100% (1)

- Mearsheimer - Better To Be Godzilla Than BambiДокумент2 страницыMearsheimer - Better To Be Godzilla Than BambiFilipe MSОценок пока нет

- Progress & Poverty by Henry GeorgeДокумент39 страницProgress & Poverty by Henry Georgegouki76Оценок пока нет

- Interview With Gary GortonДокумент16 страницInterview With Gary GortonHossein KazemiОценок пока нет

- The Tyranny of PrintersДокумент539 страницThe Tyranny of PrintersYana Adamovic100% (2)

- "Are Economists Basically Immoral?" and Other Essays On Economics, Ethics, and ReligionДокумент466 страниц"Are Economists Basically Immoral?" and Other Essays On Economics, Ethics, and ReligionafiqjenobaОценок пока нет

- CellДокумент1 страницаCellJan Ebenezer MorionesОценок пока нет

- Opamp 1321344Документ2 страницыOpamp 1321344Jan Ebenezer MorionesОценок пока нет

- 12 Lecture PresentationДокумент97 страниц12 Lecture Presentationdrsaleemraza2004Оценок пока нет

- Knowledge Check: Operational Amplifier: Aol AcmДокумент2 страницыKnowledge Check: Operational Amplifier: Aol AcmJan Ebenezer MorionesОценок пока нет

- Gas Law NotesДокумент6 страницGas Law NotesLloydDagsilОценок пока нет

- CHM11-3Lecture Unit #1 PDFДокумент57 страницCHM11-3Lecture Unit #1 PDFJan Ebenezer MorionesОценок пока нет

- Comm 3xitДокумент707 страницComm 3xitJan Ebenezer Moriones100% (1)

- Balancing Equations: Practice ProblemsДокумент10 страницBalancing Equations: Practice ProblemsJan Ebenezer MorionesОценок пока нет

- Comm Exit 3q 2014-2015 Batch2Документ2 страницыComm Exit 3q 2014-2015 Batch2Jan Ebenezer MorionesОценок пока нет

- Come X Review Valient SДокумент6 страницCome X Review Valient SJan Ebenezer MorionesОценок пока нет

- Multiview Orthographic ProjectionДокумент8 страницMultiview Orthographic ProjectionJan Ebenezer MorionesОценок пока нет

- 12 Lecture PresentationДокумент97 страниц12 Lecture Presentationdrsaleemraza2004Оценок пока нет

- 1st QTR Sy 13-14 Comm Exit Take 1Документ10 страниц1st QTR Sy 13-14 Comm Exit Take 1Jan Ebenezer MorionesОценок пока нет

- 20 Transmission LinesДокумент2 страницы20 Transmission LinesJan Ebenezer MorionesОценок пока нет

- OSPFДокумент2 страницыOSPFAris CarrascoОценок пока нет

- Communication Exit ReviewДокумент25 страницCommunication Exit ReviewJan Ebenezer MorionesОценок пока нет

- PacklikeaproДокумент6 страницPacklikeaproJan Ebenezer MorionesОценок пока нет

- Number LeafДокумент1 страницаNumber LeafJan Ebenezer MorionesОценок пока нет

- Ece114 0Документ5 страницEce114 0Jan Ebenezer MorionesОценок пока нет

- 03 Iywp 2010Документ4 страницы03 Iywp 2010Jan Ebenezer MorionesОценок пока нет

- Tro 2013Документ13 страницTro 2013Jan Ebenezer MorionesОценок пока нет

- Cisco 4 - Chapter 1Документ6 страницCisco 4 - Chapter 1Jan Ebenezer MorionesОценок пока нет

- Eigrp Protocol HeaderДокумент1 страницаEigrp Protocol Headeropexxx100% (2)

- Proto PrintДокумент1 страницаProto PrintJan Ebenezer MorionesОценок пока нет

- Public Class Form1Документ4 страницыPublic Class Form1Jan Ebenezer MorionesОценок пока нет

- Empirical ET ModelsДокумент6 страницEmpirical ET ModelsJan Ebenezer MorionesОценок пока нет

- E404Документ4 страницыE404Jan Ebenezer MorionesОценок пока нет

- Laplace Transform by Engr. VergaraДокумент88 страницLaplace Transform by Engr. VergaraSharmaine TanОценок пока нет

- E 305Документ5 страницE 305Jan Ebenezer MorionesОценок пока нет

- HKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorДокумент2 страницыHKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorWeR1 Consultants Pte LtdОценок пока нет

- Employee Selection - Structure ExerciseДокумент10 страницEmployee Selection - Structure ExerciseKaushik HazarikaОценок пока нет

- Multifinance Outlook 2023-Update1.1-1 - RemovedДокумент5 страницMultifinance Outlook 2023-Update1.1-1 - Removedsyabeh qokaОценок пока нет

- CHAP - 02 - Financial Statements of BankДокумент81 страницаCHAP - 02 - Financial Statements of BankKaОценок пока нет

- EMV OverviewДокумент51 страницаEMV OverviewManish ChofflaОценок пока нет

- Amortization Calculator - Wikipedia, The Free EncyclopediaДокумент3 страницыAmortization Calculator - Wikipedia, The Free Encyclopediaapi-3712367Оценок пока нет

- Business Plan RetailДокумент6 страницBusiness Plan RetailaminshekoftiОценок пока нет

- Depositary ReceiptsДокумент40 страницDepositary Receiptsapeksha_6065320560% (1)

- Nominal & Effective Interest RatesДокумент18 страницNominal & Effective Interest RatesMUHAMMAD QASIMОценок пока нет

- Lease Accounting: Professor, I.M TiwariДокумент20 страницLease Accounting: Professor, I.M TiwariEr Swati NagalОценок пока нет

- TVM Complete TemplateДокумент17 страницTVM Complete TemplateAlok RajОценок пока нет

- NJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13Документ2 страницыNJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13RutgersCPEОценок пока нет

- Delegates Schedule of FeesДокумент1 страницаDelegates Schedule of FeesAngelo Mark Ordoña PorgatorioОценок пока нет

- PNB1017 Above 2 CroreДокумент27 страницPNB1017 Above 2 CroreDesikanОценок пока нет

- Conceptual Framework of E-BankingДокумент7 страницConceptual Framework of E-Bankingaifyalam0% (1)

- Twenty4: How To Ace Four of The Toughest Job Interview QuestionsДокумент2 страницыTwenty4: How To Ace Four of The Toughest Job Interview QuestionsAlliant Credit UnionОценок пока нет

- Quiz - CashДокумент4 страницыQuiz - CashJustin ManaogОценок пока нет

- Purchase Invoice: Pt. Cipta Graha SejahteraДокумент4 страницыPurchase Invoice: Pt. Cipta Graha Sejahterayasmina khoirun nisaОценок пока нет

- Digital Lending For SMEsДокумент5 страницDigital Lending For SMEsSatwika PutraОценок пока нет

- Banks Cannot Own PropertyДокумент1 страницаBanks Cannot Own Propertythenjhomebuyer50% (2)

- 8 Money HacksДокумент5 страниц8 Money Hacksmr.sharma1192% (13)

- Basic Accounting Concepts and Case StudiesДокумент114 страницBasic Accounting Concepts and Case Studiesgajiniece429Оценок пока нет

- Qo M Pass White PaperДокумент40 страницQo M Pass White Papersaurav.iseОценок пока нет

- Nathaniel Pyron Sues SF Coinbase For Fraud & Conspiracy. Alleges Coinbase Software Algorithm Manipulation by Employees and Contractors.Документ52 страницыNathaniel Pyron Sues SF Coinbase For Fraud & Conspiracy. Alleges Coinbase Software Algorithm Manipulation by Employees and Contractors.Nathaniel PyronОценок пока нет

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Документ9 страницMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruОценок пока нет

- MeДокумент64 страницыMemuhaba AdegeОценок пока нет

- Kartik Vivek Johar Bank StatementДокумент13 страницKartik Vivek Johar Bank Statementjaxefa7669Оценок пока нет

- Examiners Report F9 June 19Документ12 страницExaminers Report F9 June 19Sakeef SajidОценок пока нет

- Economics 2 XiiДокумент17 страницEconomics 2 Xiiapi-3703686Оценок пока нет

- CBSE Class 11 Accountancy Question Paper SA 1 2012 (2) - 0 PDFДокумент6 страницCBSE Class 11 Accountancy Question Paper SA 1 2012 (2) - 0 PDFsivsyadavОценок пока нет