Академический Документы

Профессиональный Документы

Культура Документы

Junior Certificate Business Studies For Households and Enterprises by Matt Hynes

Загружено:

Czar E-BraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Junior Certificate Business Studies For Households and Enterprises by Matt Hynes

Загружено:

Czar E-BraАвторское право:

Доступные форматы

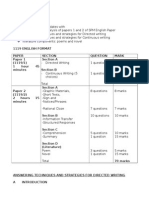

JC Business TM Contents for textbook and workbook Chapter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Textbook 1 2 5 7 9 11 12 13 13 14 No exercises 16 No exercises 16 18 19 20 20 21 23 24 No exercises 26 26 27 29 30 32 32 32 34 35 36 38 38 No exercises 40 No exercises 71 80 84 Workbook 182

182 183 185 186 189 192 230 230 232 233 234 234 238 246 249 252 256 258 260 263 264 267 267 269 275 276 277 283 287 287 290 295 297 302 305 310 317 324 325 329

Communications Communications in Action Introduction to Record Keeping Household Accounts Income Expenditure The Budget The Good Consumer Protecting the Consumer Making a complaint Money and Banking I Money and Banking II Money and Banking III Bank Accounts Personal Borrowing Insurance Premium Calculation and Estimating Compensation Economic Framework Budgeting - the National Budget Foreign Trade Forms of Ownership Private Limited Company Chain of Production People at Work Being an Employer Industrial Relations Finance for Business Preparation of a Business Plan Business Loan Applications Banking for Business Business Insurance Delivery Systems Marketing Financial Recording and Filing Business Documents I Business Documents II Recording Credit Transactions Continuous Balancing Ledgers and Statements Analysed Cash Books I Analysed Cash Books II Monitoring Overheads General Journal

42 43 44 45 46 47 48 49 50 51 52 53 54 55

Combined Books of First Entry and Ledger Questions Control Accounts Trading Account Profit and Loss Account Profit and Loss Appropriation Account Balance Sheet Adjustments to Final Accounts Final Accounts and Balance Sheet with Adjustments Assessing a Business Club Accounts Club Accounts with Adjustments Farm Accounts Service Firms Information Technology

91 109 109 111 114 118 127 132 148 152 161 166 173 177

331 333 334 336 337 338 339 341 342 346 347 348 348 348

Junior Certificate

Business Studies

for Households and Enterprises

TEXTBOOK TEACHERS MANUAL

Matt Hynes

Matt Hynes 2005 ISBN 1-84131-703-9 Folens Publishers, Hibernian Industrial Estate, Greenhills Road, Tallaght, Dublin 24. Editor: Fiona Dunne Design and Layout: Compuscript Produced in Ireland by Folens Publishers All rights reserved. The publisher reserves the right to change, without notice, at any time the specification of this product.

FOLENS

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 1 Communications

1.

Factors Destination Cost Speed Record Explanation Is communication within Ireland or worldwide? How do the different methods compare on price? How urgent is the information to be communicated? Is it necessary to keep the information?

2. Internal communication

Method Notice board Meetings Explanation A space that employees will look at to keep them up-to-date with what is happening Bring employees together to discuss topics face-to-face

External communication

Method Letters Newspapers Explanation Written communication from one person to another sent in the post Written communication printed on local or national newspapers

3. Oral communication

Method Telephone Meetings Explanation Use of landline or wire-free device to contact someone else Bring employees together to discuss topics face-to-face

Written communication

Method Letters Notice board Explanation Written communication from one person to another sent by post A space that employees will look at to keep them up-to-date with what is happening

Visual communication

Method Charts Television Explanation Used to provide detailed information in lines or easy-to-understand pictures Used to show people actually communicating in real-life situations

4. See chart at bottom of p4 in the textbook.

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 2 Communications in Action

Letter Writing The answers to letters should follow the nine-point plan. Its good discipline for the students to put in the numbers beside the text when doing the exercises, to ensure that they complete the letter fully. The address of the sender and date of the letter can also be placed on the lefthand side of the page. 1.

1. Top View Road, Sligo. (087) 4325676. Ms News Agent, Corner Grove, Sligo. Dear Ms News Agent, I wish to enquire about a new magazine called Predict Your Future. Can you obtain this magazine for me? How much will it cost? How many issues are there? Please let me know as soon as possible. Yours sincerely,

2. 3.

4. 5. 6.

7. 8. 9.

Patrick Kerns.

2.

1. Harmony Street, Carlow. (086) 85341245. Edge Music Store, Piano Row, Waterford. Dear Mr Edge, I wish to order a new CD called How to Make A Snowman Melt. When can you have it in stock? Please phone or text me when its in. Yours faithfully,

2. 3.

4. 5. 6. 7. 8. 9.

Nora Jones.

Junior Certificate Business Studies Textbook Teachers Manual

3.

1. Students Union, St. Marks Community School, Celbridge, Co. Kildare.

2. 3. Finbar Keenan, Main Street, Maynooth, Co. Kildare. Dear Finbar, I was delighted to hear that you are coming to our school in September. As you will be in Second Year, I would like to set out the ten subjects you will study. Six subjects are compulsory: For the other four you can choose from:

4. 5. 6.

7. 8. 9.

Please contact me if you want details about these subjects. Yours faithfully,

Monica Grey. President Students Union.

Report Writing The answers to reports should follow the nine-point plan. Its good discipline for the students to put in the numbers beside the text when doing the exercises, to ensure that they complete the report fully. 4.

1. Siobhn Gallagher, Class 1, Vocational School, Letterkenny, Co. Donegal. Best Value In Mobile Phone Credit

2. 3. 4.

Class 1, Vocational School, Letterkenny, Co. Donegal. I was asked by you to prepare a report on where the best value in mobile phone credit can be obtained. I checked out all the providers. My findings are set out below. Providers Price per call per minute Price per text I recommend O2 cent cent Vodafone cent cent Meteor cent cent

5. 6.

7. 8. 9.

I am available to discuss my findings if required.

Siobhn Gallagher. Mobile Phone Consultant.

Junior Certificate Business Studies Textbook Teachers Manual

5.

1. Ilona Donnelly, Class D, Mercy Convent. Best Fast-Food Outlets in

2. 3. 4. 5.

Class D, Mercy Convent. I was asked by you to prepare a report on the best fast-food outlets in . I visited all the outlets and sampled the food. My findings are set out below. The providers are rated out of 10. Providers Price Quality Service I recommend Mighty Sams. Mighty Sams 7 8 9 Mini Macks 6 8 7 Burger Queen 9 5 8

6.

7. 8. 9.

I am available to discuss my findings if required.

Ilona Donnelly. Fast Food Consultant.

6.

1. Mire McGrath, Class A, Ard Scoile. Main Sources of Income for Students in Class A

2. 3. 4. 5. 6. 7. 8. 9.

I was asked by you to prepare a report on the main sources of income for students in Class A. I surveyed all twenty-six students. My findings are set out below. Income Percentage of income earned The main source is pocket money. I am available to discuss my findings if required. Pocket money 60% Part-time Work 30% Other 10%

Mire McGrath. Financial Consultant.

7. Notice is given that a meeting of the Business Studies Students Club will take place in Room 5 at 12.30 pm on Monday 3 October 2005. All members please attend. 8. AGM Agenda for the Business Studies Student Club. 1. Minutes of previous meeting 2. Matters arising from the minutes 3. Correspondence received by club officers 4. Treasurers report 5. Club tour to AIB headquarters 6. Membership fees 7. Any Other Business for the next meeting

4

Junior Certificate Business Studies Textbook Teachers Manual

Charts and Graphs 9. Bar chart showing sales of shoes for period 20002005.

10.

Line graph showing rate of inflation for period 19992004.

11.

Pie chart showing breakdown of sales for the four seasons 2005.

Chapter 3 Introduction to Record Keeping

The solutions to exercises 1 to 5 show the accounts balanced. You may wish your students to do likewise depending on their progress. 1.

Date 2005 1/1 6/1 Prize money Pocket money Details Total 100 10 110 11/1 Balance b/d 75 Date 2005 8/1 10/1 10/1 Sports gear Lunch Balance c/d Details Total 30 5 75 110

Junior Certificate Business Studies Textbook Teachers Manual

2.

Date 2005 1/2 4/2 Pocket money Sale of books Details Total 12 55 Date 2005 6/2 8/2 10/2 10/2 67 11/2 Balance b/d 37 New books Video Magazines Balance c/d Details Total 20 4 6 37 67

3.

Date 2006 1/3 4/3 6/3 13/3 Interest Wages Pocket money Balance b/d Details Total 28 32 8 68 22 Date 2006 8/3 12/3 12/3 School books Sweets Balance c/d Details Total 40 6 22 68

4.

Date 2007 1/1 5/1 7/1 Parents Pocket money Interest Details Total 100 12 38 150 10/1 Balance b/d 28 Date 2007 2/1 3/1 9/1 9/1 School books Lunch Magazine Balance c/d Details Total 90 8 24 28 150

5.

Date 2008 1/4 4/4 10/4 Aunt Parents Wages Details Total 20 80 45 145 19/4 Balance b/d 5 Date 2008 6/4 8/4 18/4 18/4 Hair styles Music lessons School tour Balance c/d Details Total 5 75 60 5 145

6.

Date 2008 1/5 9/5 13/5 Birthday Sale of CD Uncle Details Total 75 30 10 115 14/5 Balance b/d 37 Date 2008 2/5 5/5 13/5 13/5 CD Magazine Clothes Balance c/d Details Total 18 15 45 37 115

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 4 Household Accounts

1.

Analysed Cash Book Date 2005 1/3 3/3 Balance b/d Wages Details Total 200 600 Date 2005 5/3 6/3 7/3 8/3 Groceries Fuel Petrol Electricity Details Total 120 220 40 80 145 60 665 12/3 Balance c/d 800 13/3 Balance b/d 135 135 800 265 300 145 60 100 80 HK 120 L&H 220 40 Other

10/3 Groceries 12/3 Window clean

2.

Analysed Cash Book Date 2005 1/4 6/4 Balance b/d Wages Details Total 500 850 Date 2005 2/4 4/4 5/4 8/4 Groceries Petrol Electricity Car service Details Total 300 45 100 155 185 35 820 13/4 Balance c/d 1,350 14/4 Balance b/d 530 530 1,350 485 200 185 35 135 155 HK 300 45 100 Car Other

11/4 Groceries 13/4 School books

3.

Analysed Cash Book Date Details Total Cash 180 120 650 Total Date Bank 320 2007 2/2 6/2 7/2 9/2 Car service Groceries Insurance Petrol 3 4 85 12/2 Balance c/d 300 13/3 Balance b/d 215 970 315 215 300 2 25 320 100 655 315 970 100 310 110 320 1 60 150 Details Ch. Total Total no. Cash Bank 85 HK Car Mortgage

2007 1/2 3/2 4/2 Balance b/d Child Benefit Wages

60 150

85

25 320

10/2 Mortgage 12/2 Meat bill

Junior Certificate Business Studies Textbook Teachers Manual

4.

Date 2007 1/3 3/3 12/3 Balance b/d Child Benefit Wages Details Total Cash 50 120 450 Analysed Cash Book Total Date Details Ch. Total Total Bank no. Cash Bank 230 2007 4/3 5/3 6/3 8/3 Heating oil Milk bill Groceries Hair cut 3 4 5 82 12/3 Balance c/d 170 13/3 Balance b/d 88 680 81 88 170 1 2 82 50 31 100 599 81 680 120 81 380 38 HK 38 82 50 31 100 480 Per L&H 380

10/3 Doctor 12/3 Electricity

5.

Date 2008 1/4 5/4 6/4 Balance b/d Child Benefit Wages Details Total Cash 100 120 500 Analysed Cash Book Total Date Details Ch. Total Total Bank no. Cash Bank 2008 1/4 7/4 8/4 9/4 Balance b/d Groceries Mortgage Insurance 1 2 3 4 55 150 13/4 14/4 Balance c/d 220 Balance b/d 70 625 1,125 13/4 Balance c/d 14/4 Balance b/d 70 220 1,125 625 160 355 95 355 380 65 75 65 75 55 510 250 HK 95 355 380 Mort- Other gage

11/4 Milk bill 12/4 Electricity 13/4 School fees

6.

Date 2008 1/6 2/6 8/6 Balance b/d Child Benefit Wages Details Total Total Cash Bank 320 120 860 Analysed Cash Book Date Details Ch. Total Total no. Cash Bank 2008 1/6 3/6 5/6 6/6 10/6 12/6 12/6 13/6 Balance c/d 440 Balance b/d 320 45 905 13/6 Balance b/d 12/6 Balance b/d Groceries Insurance Electricity Milk bill Holiday Balance c/d 1 2 3 4 80 320 440 905 45 80 500 55 50 50 130 55 50 50 550 55 250 HK 80 500 L&H Other

Junior Certificate Business Studies Textbook Teachers Manual

7.

Date 2008 1/2 2/2 3/2 10/2 Balance Wages Bank C Child Benefit 100 80 Details Total Total Cash Bank 40 120 850 Analysed Cash Book Date Details Ch. Total Total L& School Other no. Cash Bank H 2008 3/2 4/2 5/2 6/2 7/2 11/2 Cash C Groceries School uniform Electricity Petrol Central Heating Balance c/d 3 88 12/8 220 13/8 Balance b/d 312 970 175 132 220 1 2 38 440 440 795 545 175 970 150 88 50 150 105 105 38 150 100 50

Chapter 5 Income

1. (a) Toms gross wage = 400 (40 hours @ 10. Basic = 400. No overtime.) (b) Annes gross wage = 648 (40 hours @ 12. Basic = 480 + overtime 168.) (c) Jims gross wage = 624 (40 hours @ 8. Basic = 320 + overtime 304.) 2. (a) Pats gross wage (b) Irenes gross wage 3.

Deductions Statutory Non-statutory Difference

= 531 (38 hours @ 9. Basic = 342 + overtime 135 + 54.) = 440 (38 hours @ 8. Basic = 304 + overtime 120 + 16.)

Explanation Example Income Tax, PRSI Pension, Savings, VHI, Union Fee

Compulsory payments by employees to the government taken from the gross wage Voluntary amounts taken from an employees gross wage at the request of the employee Statutory payments are compulsory whereas non statutory are voluntary

4.

Employee (a) Shelia (b) Paul (c) Breda (d) Conor

Gross Wage 320 320 450 500

Tax before deducting tax credit 64 64 90 100

Tax Credit 25 35 50 60

Tax Due 39 29 40 40

5. Employee Gross Wage Tax before deducting tax credit Tax Credit Tax Due

(a) Martin (b) Louise 350 650 70 273 50 65 20 208

PRSI 17.50 32.50

Net Wage 312.50 409.50

Junior Certificate Business Studies Textbook Teachers Manual

6. (a) Gerard

Gross pay First 21,586 @ 20% Remainder @ 42% Tax before deducting tax credits Less tax credits Tax due Add PRSI due 30,000 21,586 8,414 Tax Due 4,317.20 3,533.88 7,858.64 1,592 6,259.08 1,500 7,759.08 Total Deductions

Net pay = Gross pay less deductions: 30,000 7,759.08 = 22,240.92

(b) Monica

Gross pay First 21,586 @ 20% Remainder @ 42% Tax before deducting tax credits Less tax credits Tax due Add PRSI due 42,000 21,586 20,414 Tax Due 4,317.20 8,573.88 12,891.08 2,400 10,491.08 2,100 12,591.08 Total Deductions

Net pay = Gross pay less deductions: 42,000 12,591.08 = 29,408.92

(c) Adrian

Gross pay First 21,586 @ 20% Remainder @ 42% Tax before deducting tax credits Less tax credits Tax due Add PRSI due 55,000 21,586 33,414 Tax Due 4,317.20 14,033.88 18,351.08 2,700 15,651.08 2,750 18,401.08 Total Deductions

Net pay = Gross pay less deductions: 55,000 18,401.08 = 36,598.92

(d) Josephine

Gross pay First 21,586 @ 20% Remainder @ 42% Tax before deducting tax credits Less tax credits Tax due Add PRSI due 37,000 21,586 15,414 Tax Due 4,317.20 6,473.08 10,791.08 1,850 8,941.08 1,850 10,791.08 Total Deductions

Net pay = Gross pay less deductions: 37,000 10,623.08 = 26,208.92

10

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 6 Expenditure

1. Our income is limited = We have not got enough income to buy all the things we would like to buy. 2. The financial cost = The actual price of the item purchased. The opportunity cost = What is given up when you decide to purchase one item instead of another. 3. (a) The financial cost is 30. (b) The opportunity cost of buying the shirt is not being able to go to the football match. 4. (i) Make a list and stick to it. (ii) Only bring enough money with you to buy necessities. 5.

Type of Expenditure Fixed Irregular Discretionary Examples House insurance, mortgage Electricity, telephone Birthday presents, entertainment

6. Capital expenditure is spending on things that will last for more than one year e.g. cars, houses. Current expenditure is spending on things that are used up within one year e.g. petrol for the car, groceries. 7.

Number of units used (i) 636 (ii) 622 (iii) 714 (iv) 1,052 (8,516 7,880) (9,202 8,580) (5,493 4,779) (3,393 2,341) Cost of electricity 44.52 43.54 49.98 73.64

8.

Cost of electricity (i) 44.52 (ii) 43.54 (iii) 49.98 (iv) 73.64 Standing charge 9 9 9 9 VAT@ 13.5% 7.23 (13.5% of 53.52) 7.09 7.96 11.16 Total Cost 60.75 59.63 66.94 93.8

9.

Lynch Units used Cost Standing charge VAT Total cost 723 68.69 9 10.49 88.18 King 737 70.02 9 10.67 89.87 King Highest Bill

11

Junior Certificate Business Studies Textbook Teachers Manual

10. Households usually receive a telephone bill every two months for a landline and once a month for a mobile phone bill.

Butler Number of calls Cost Rental charge VAT Total cost 1,432 71.60 40.00 23.44 135.04 Lennon 689 34.45 40.00 15.64 90.09

Chapter 7 The Budget

1. (a)

Employee Monica Oliver Pat Monthly wage 780 920 535 5% Increase 39 46 26.75 Future Income 819.00 966.00 561.75

(b)

Saver Pat Mike Kate Mary Deposit 1,230 740 335 1,940 3% Interest 36.90 22.20 10.10 58.20

2.

Expenditure Mortgage Housekeeping Telephone Car Tax Present Cost 260 140 90 290 3% Increase 7.80 4.20 2.70 8.70 Future Cost 267.80 144.20 92.70 298.70

3. People save because: (i) They want to earn interest; (ii) They want to go on a holiday; (iii) They want to buy a car; (iv) They want to have money in case of an emergency. It is important to plan savings because otherwise the money will be unwisely spent before one thinks about it.

12

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 8 The Good Consumer

1.

1. Handlebar Street, Roscommon. (086) 8732258.

2. 3. KM Cycles Ltd, Main Street, Longford.

4. Dear Mr. Martin, 5/6. I wish to order one of the new racing bicycles which you advertised on Shannonside Northern Sound on 15/4/2006 at a price of 140. 7. Can you ring me if one is available? 8. 9. Yours faithfully,

Mary Farrell.

Chapter 9 Protecting the Consumer

1. Consumers need protection because of: (i) Unsafe goods; (ii) Overcharging by retailers; (iii) Misleading advertisements. 2. (a) Laura is entitled to a full refund or replacement shoes. She does not have to accept a credit note. (b) Pat is entitled to a replacement suit unless he was clearly warned in advance by the drycleaner that the suit might shrink. (c) Sheila is entitled to have her engine repaired or replaced and also any damage repaired. (d) Maura can refuse to take the ham in case it is out-of-date. 3. Sign 1: This sign is legal because the shop does not have to sell on credit. Sign 2: This sign is not legal because the shop has to refund money if the good sold is faulty. Sign 3: This sign is not legal because the shop has to refund money if the good sold is faulty. 4. (a) The Small Claims Court helps consumers who cannot get a retailer to make good any loss due to faulty goods, but who do not want to go to the District Court or employ a solicitor. The largest amount they can claim is 1,270. The Office of the Ombudsman can help consumers who have difficulty getting satisfaction from government bodies and departments. (b) Trade Associations are made up of members of similar types of business to protect their interests and provide them with assistance when required, e.g. Irish Travel Agents Association. The Office of the Director of Consumer Affairs is responsible for enforcing the Consumer Information Act 1978. It educates consumers on their rights. 5. (a) The Consumer Association of Ireland. (b) Consumer Choice Magazine.

13

Junior Certificate Business Studies Textbook Teachers Manual

6.

(i) (ii) (iii) (iv) (v)

Goods should be of merchantable quality; Good should be fit for their purpose; Goods should be as described; Goods should correspond to sample shown; The suppliers of services must be qualified.

Chapter 10 Making a complaint

1. Consumers complain because: the seller gives misleading information; they are unhappy with the quality of goods or service; they are overcharged; goods are not as ordered. 2. The steps a consumer should take when a product is unsatisfactory will depend on the problem. If it is a normal good then the consumer should: Identify the problem; obtain proof of purchase; contact the seller and ask for a refund or replacement; put the complaint in writing; contact the sellers trade association if available; bring the seller to the Small Claims Court. 3. (a)

1. 6 Bridge Street, Granard, Longford. 8/9/2006 Ms Susan Tarpey, Manager, S&S Arkin Ltd, Dublin Road, Longford. Dear Ms Tarpey, I am writing to you concerning a new colour television set SAMO Model P107, which I bought in your shop on 7/9/2006. The sound does not work. I require a replacement or a refund of my money 399. Please let me know your response by return of post. Yours faithfully,

2. 3.

4. 5. 6. 7.

8. 9.

Tom Murphy.

(b) Mr Murphy could contact the sellers trade association or contact the registrar of the Small Claims Court.

14

Junior Certificate Business Studies Textbook Teachers Manual

4. (a)

1. 16 Castle Street, Ennis, Co. Clare. 15/4/2006 Mr. Frank Clarke, Manager, The Bike Shop Ltd, Nenagh Road, Limerick. Dear Mr Clarke, I am writing about a new bicycle Model RB 25, which I bought in your shop on 11/4/2006. Within a few days the bicycle has given me trouble. The chain slips off every time I meet a hill. I am very disappointed with it. I require a replacement or a refund of my money 179. Please let me know your response by return of post. Yours faithfully,

2. 3.

4. 5. 6. 7. 8. 9.

Peter Cooney.

(b) Mr Cooney could contact the local media or the registrar of the Small Claims Court. 5. (a)

1. Rioscarraig, Ardara, Co. Donegal. 3/3/2006 The Sales Manager, Allbrite Ltd, Church Street, Letterkenny, Co. Donegal. Dear Sir/Madam, I am writing to you concerning a new, fitted aluminium patio door from your firm. I enclose a copy of the contract. After a month, it did not seal properly and allowed in the wind and rain. Spots of rust have developed on it. I'm very dissatisfied with the door and demand an immediate replacement or a full refund of my money 698. Please let me know your response by return of post. Yours faithfully,

2. 3.

4. 5. 6. 7.

8. 9.

Maeve O'Sullivan.

(b) The Sale of Goods and Supply of Services Act 1980. The goods were not fit for the purpose and the fitter was not properly qualified. (c) The receipt; credit card statement; the door itself, copy of contract signed by Allbrite Ltd.

15

Junior Certificate Business Studies Textbook Teachers Manual

6. A credit note is a document given by a seller to a customer that states that the amount owing or paid has been reduced. It is only acceptable if the customer agrees to it. This is usually when there is nothing wrong with the goods but the customer changes his/her mind on the colour etc.

Chapter 11 Money and Banking I

There are no exercises in the textbook.

Chapter 12 Money and Banking II

1.

Method Cheque Bank draft Standing order Direct debit Credit transfer Cost Expensive Most expensive Fixed charge Fixed charge Least expensive Safety Could be forged 100% safe 100% safe 100% safe 100% safe Record Yes in stub Yes in a receipt Yes in statement Yes in statement Yes in statement

2. A standing order is an instruction by a bank current account holder to pay a fixed sum of money on a fixed date to a named person/organisation. A direct debit is where a named person/organisation obtains permission from a current account holder to take a varying amount out of their account on a date to be decided by the person/organisation. 3. (a) 75 (b) 600 (c) 1,197 4. (a) 78.81 (b) 702 (c) 1,481.19 5. (a) 40 (b) 160 (c) 100 (d) 144 (e) 288 (f) 319.20

Chapter 13 Money and Banking III

There are no exercises in the textbook.

Chapter 14 Bank Accounts

1.

Date 2005 1/4 5/4 30/4 Balance b/d Wages Wages Details Total Date 2005 Cash Insurance Groceries Car repairs Cash Balance c/d ATM 7 8 9 ATM Details Cheque/ATM Total 100 600 250 200 200 1,000 2,350

Bank A/C 950 8/4 600 800 15/4 19/4 23/4 28/4 30/4 2,350

1/5

Balance b/d

1,000

16

Junior Certificate Business Studies Textbook Teachers Manual

2.

Date 2006 1/5 8/5 31/5 Balance b/d Wages Wages Details Total 1,200 950 950 Date 2006 Bank A/C 11/5 13/5 22/5 26/5 29/6 31/5 3,100 1/6 Balance b/d 1,600 Cash Milk bill Grocery bill Mortgage Cash Balance c/d ATM 4 5 6 ATM 200 230 170 600 300 1,600 3,100 Details Cheque/ATM Total

3.

Date 2006 31/5 Balance b/d CT Details Total 210 700 Date 2006 Bank A/C SO DD Interest/charges Balance c/d 910 1/6 Balance b/d 125 480 200 105 125 910 Details Total

Bank Reconciliation Statement as on 31/5/2006 Balance as per Bank Statement 1,925 Add lodgements not credited 1,100 3,025 Less cheques not cashed 2,900 Balance as per Updated Bank Account 125 4. (a) The statement was issued on 30 March 2006. (b) Michael Lynch had money in his bank account. (c) People do not cash cheques in the order they are issued. Some people keep them for up to six months. (d) Current account fees could include: cost of standing orders; cost of direct debits; cheque book. (e) A direct debit differs from a standing order in the following ways: The amounts can vary in direct debits but are fixed in standing orders; the date the money is taken from the account is decided by the receiver when a direct debit is used and by the account holder when a standing order is used.

17

Junior Certificate Business Studies Textbook Teachers Manual

(f)

Date 2006 31/3 Balance b/d CT Details Total Date Details Total Fees Balance c/d 783 1/6 Balance b/d 777 6 777 783 2006 Updated Bank A/C 683 100

Bank Reconciliation Statement as 31/5/2006 Balance as per Bank Statement 497 Add lodgements not credited 355 852 Less cheques not cashed 75 Balance as per Updated Bank Account 777

Chapter 15 Personal Borrowing

1. The lender will require the following information: Name and address of applicant; where the person is employed; the amount earned; the amount required; the purpose of the loan; security available. 2. Renting is suitable for obtaining something that is only needed on a once-off basis. It is cheaper than most other methods in that you only have to pay for it when you need it. 3. (a) Hire purchase has two stages. The first stage involves a person hiring the item by making a number of instalments. The second stage involves the person taking ownership of the item by paying a final instalment. (b) Hire purchase can be used for obtaining cars; furniture; household equipment such as washing machines, refrigerators, TVs etc. 4. (a) Cost 600 (b) Cost 1,255 (c) Cost 780 (d) Cost 1,330

5. Two rights of the borrower are: To be shown the APR; To know the cash price. Two responsibilities of the borrower are: To provide true and accurate information about him/herself; To repay the amount owing on time. 6. It is important to budget for the cost of borrowing because if a person does not allow for the cost of repaying a loan, then that person may not be able to repay the amount owing on time.

18

Junior Certificate Business Studies Textbook Teachers Manual

7. (a) The extra cost of buying the cooker by Easy Pay is 487.10. (b) The ESB might offer this form of repayment because borrowers can make their repayments when they are paying their electricity bills. The cost is spread over five years. (c) Yes, the Lee household will keep within their budget by saving 6 per week because they only need to repay 40.87 per two months and they are saving 48 per two months. (d) A five-year loan of 739 at 15% flat rate would cost them 1,293.25 in total. They should take the ESB Easy Pay offer and save 67.15. 8.

Options Option 1 Bank Loan Option 2 Hire Purchase Option 3 Bank Loan Cost of each option workings 9,000 + interest 2,970 = 11,970 500 + instalments 9,720 = 10,220 9,000 + interest 2,700 = 11,700

Option 3 is the best value.

Chapter 16 Insurance

1. People need insurance because they are afraid of risks occurring which would make them worse off and they may not be able to recover from these losses, e.g. fire burning down their house, car crashing into someone else. 2. Insurance operates as follows. People who fear possible losses can share these fears with others by paying premiums to an insurer, who in turn agrees to pay compensations should these losses occur. 3. (a) Ann Smyth might purchase any or all of the following: Flat and contents insurance; motor insurance; health insurance; salary protection insurance; travel insurance. (b) The Mulligan family might purchase any or all of the following: House and contents insurance; motor insurance; health insurance; boat insurance; travel insurance. 4. (a) With insurance there is only a possibility that some loss will occur, but with life assurance there is a certainty that the loss will occur. Insurance is purchased on an annual basis whereas life assurance has to be purchased for a number of years. (b) With whole life assurance the insurer will pay out when the insured dies but with endowment assurance the insurer will pay out on death or the insured reaching a certain age, whichever comes first. 5. Car insurance is required by law because a motorist is driving on public roads, which are built by the government, and may injure another party (third party). 6. One starts with finding out what cover is required. A proposal form is then completed. On being accepted, a premium is paid and an insurance policy or certificate is given by the insurer to the insured. 7. The two principles of insurance that apply to purchasing insurance are: Insurable Interest you can only insure something that you benefit from or from whose loss you will suffer. Utmost Good Faith when completing an insurance proposal form all questions must be answered truthfully and accurately.

19

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 17 Premium Calculation and Estimating Compensation

1. Patrick Kiernan

Basic Premium Add loadings Working abroad Dangerous hobby Basic plus loadings Less loadings Non-smoker Total Premium 60 1,140 100 100 200 1,200 1,000

2. Geraldine Lally

Basic Premium Add loadings Medical condition Living abroad Dangerous hobby Basic plus loadings Less loadings Non-drinker Non-smoker Total Premium 87 87 174 1,566 180 180 180 540 1,740 1,200

3. Inform the Garda and the insurer of the loss; obtain estimates for the loss; complete a claims form; an insurance assessor estimates damage; compensation is paid if necessary. 4. (a) (i) Shane should complete a claims form. (ii) 7,900 (8,000 100). (b) (i) Annual Cost= 146 (Building 100 + Contents 36 + Loading premium 10). (ii) Renewal date the date when the premium is due for payment. Proposal form A form completed by the person seeking insurance. Loading An additional premium charged when the risk is higher. Premium The fee paid by the insured to the insurer when purchasing insurance. (iii) Yes because: (a) The broker is independent of any insurance company, (b) The broker is arranging better cover than the agent. (iv) An insurance agent sells the policies of only one insurance company. An insurance broker on the other hand, being independent, can select from a number of insurance companies.

Chapter 18 Economic Framework

1. People have to make choices because their income is limited, but they want to obtain the most satisfaction possible from their available income. 2. Choices made by student: Reasons for choices included: 3. (a) The financial cost is 20 (b) The opportunity cost is a CD and a football

20

Junior Certificate Business Studies Textbook Teachers Manual

4. (a) The four factors of production are: Land anything provided by nature used in the production of goods/services. Labour the human effort used in the production of goods/services. Capital money and man-made goods used in the production of goods/services. Enterprise the taking of a risk in bringing the other factors together for a profit. (b) Combinations of these factors are needed because no factor can operate on its own, e.g. land without labour will produce nothing. 5. (a) The purpose of an economic system is to decide: What goods and services will be produced; how production will take place; who will receive the goods and services produced; how fast the economy will grow. (b) Ireland has a mixed economy. 6. (a) Economic growth is 40% (b) Economic growth is 2.27% (c) Economic growth is 1.79% 7. (a) Rate of inflation is 8% (b) Rate of inflation is 4% (d) Rate of inflation is 1%

Chapter 19 Budgeting The National Budget

1. Certain services require a level of investment that only the government can provide. Some services are non profit-making and will therefore not be provided by the private sector. Certain services are too important to leave to private individuals e.g. an Garda Sochna, the Army. 2. The main services provided by the government are education; healthcare; transport; postal services; electricity. 3. National government lays down guidelines on how the country as a whole should be run it is responsible for trains, electricity, postal services etc. Local government is responsible for services and decisions on a county or big town-basis. It is responsible for local roads, water, housing, sewage etc. 4. The government provides services through government departments e.g. Department of Education and Science; Department of Health and Children; semi state bodies e.g. An Post, ESB; local government agencies e.g. County Councils and Urban Councils. 5.

Income Income Tax VAT Customs and excise duty Corporation tax Capital tax EU and other receipts Deficit

National Budget

millions 3,500 2,800 2,100 350 150 3,200 770 12,870 Expenditure Social welfare National debt Security Education Health Agriculture Other millions 3,500 2,900 880 1,400 1,550 340 2,300 12,870

21

Junior Certificate Business Studies Textbook Teachers Manual

6.

Income Income Tax VAT Customs duties Capital tax EU receipts

National Budget

millions 3,100 2,750 2,900 240 3,800 12,790 Expenditure Education Agriculture Health Social welfare Security Surplus millions 1,550 570 1,950 2,800 670 5,250 12,790

(a) The biggest source of income is EU receipts, the biggest source of expenditure is Social Welfare. (b) The percentage of total expenditure spent on social welfare is 37.14%. (c) Capital tax is 1.88% of total income. (d) Revised National Budget

Income Income Tax VAT Customs duties Capital tax EU receipts millions 3,100 2,475 2,900 240 3,800 12,515 Expenditure Education Agriculture Health Social welfare Security Surplus millions 1,627.50 602.49 2,047.50 3,220 703.50 4,314.01 12,515

7. (a)

Income Income Tax EU and other receipts VAT Customs and excise Corporation tax Capital tax Other receipts Deficit

National Budget 2001

millions 3,200 2,100 2,100 1,900 500 100 1,000 500 11,400 11,400 Expenditure Security Social welfare Education Health Agriculture Debit services Miscellaneous millions 800 3,000 1,368 1,400 400 2,432 2,000

(b) This budget was a deficit of 500m. (i) The main source of government income was income tax. (ii) The percentage spent on education was 12%. (iii) Garda, Army. (c) Increase corporation tax by 150m. Reason: the employees are paying too much tax and the businesses are paying too little. Decrease Miscellaneous by 350m. Reason: savings could be found in each department to ensure that there would be a balanced budget.

22

Junior Certificate Business Studies Textbook Teachers Manual

(d) Total expenditure would be up by 570 (5% of 11,400) to 11,970. Total income would be down by 210 (10% of VAT 2,100) to 10,690. The overall budget deficit would be 1,280m. (e) An increase in the level of unemployment would increase the social welfare payments and decrease the income tax receipts.

Chapter 20 Foreign Trade

1. Ireland engages in foreign trade for the following reasons: The Irish market is too small; creation of more employment by selling to larger markets; Ireland does not possess certain raw materials; Irish people like to have a greater choice of goods. 2.

(a) Cars Germany (b) Newspapers England (c) Oil USA (d) Coal Poland (e) Shoes Italy (f) Bananas Israel

3.

(a) Butter England (b) Cattle Egypt (c) Computer parts USA (d) Irish Water Spain (e) CDs Japan

4. Enterprise Ireland. It provides information about foreign markets and introduces Irish businesses to foreign buyers. 5.

Amount in millions a b c d e f 15 70 25 30 120 10 Surplus/Deficit Surplus Surplus Deficit Deficit Surplus Deficit

6. Balance of trade is a surplus of 100m. (400m300m). 7. (a) Balance of trade deficit is 20m. Balance of payments deficit is 230m. (b) Balance of trade surplus is 140m. Balance of payments is in balance, i.e. receipts are equal to expenditure. 8. (a and b)

EU Country Belgium Denmark France Hungary Italy Poland Danish French Hungarian Italian Polish Language Flemish/French Euro Krone Euro Forint Euro Zloty Currency

23

Junior Certificate Business Studies Textbook Teachers Manual

9. (a and b)

Country Currency UK Pound Sterling Sweden Krona Denmark Krone

Note: any of the ten new countries would also be correct answers. 10. (a) 280 (1 = 1.56 is equal to 1 = 0.64. 0.64 450 = 280) (b) 703.13 (1 = 1.56 is equal to 1 = 0.64. 450 0.64 = 703.125) 11. (a) 122,400 (d) 820.90 (b) 5 (e) $65,000 (c) 694.44

Chapter 21 Forms of Ownership

1.

Form of Ownership Sole Trader Characteristic 1 Characteristic 2 One person puts up the One person makes all investment the decisions Owed by between 1 and 50 shareholders Control over who can buy the shares Characteristic 3 One person takes all the profit or suffers all the loss Must have the word limited after its name

Private Limited Company Co-operative

Owed by eight or more Each member has only Each member has an members one vote equal say in the running of the co-operative Owned by the government Government makes top management appointments Profits are reinvested or taken by the government

State-owned business

2.

Form of Ownership Advantage 1 Sole Trader Easy to set up Private Limited Company Co-operative Limited liability Limited liability Advantage 2 Takes all the profits Disadvantage 1 Unlimited liability Disadvantage 2 Lacks continuity Costly to set up Often too small to develop

Can have up to 50 A lot of legalities shareholders when setting up Together everyone One vote per achieves more member success (TEAMS) Provides employment

State-owned business

Provides extra revenue if profitable

Losses have to be Too dependent on borne by the tax government for payer capital

3.

Form of Ownership Sole Trader Private Limited Company Co-operatives State-owned business 1 150 8 plus Government Ownership Liability Unlimited Limited Limited Unlimited Profitability Owner takes all Shared between shareholders Shared between members Reinvested or taken by government

24

Junior Certificate Business Studies Textbook Teachers Manual

4. (a)

(b) State ownership has been used in Ireland because no one invests in non profit-making businesses. Employment had to be created. Co-operatives were used to process the milk produced by farmers. Some workers formed co-operatives, to give themselves employment when their businesses closed down. 5. (a) (b) (c) (d) A state-owned or semi-state company is a business owned by the government. A sole trader is a business owned and run by one person. A co-operative is a business owned and controlled by the workers or members. A private limited company is a business owned by between 1 and 50 people and managed by a board of directors. (e) The owners of a private limited company have limited liability and are called shareholders.

6. (a) (a) Sentences written out correctly: (a) The VHI provides insurance for people's health. (b) RTE provides a television service for the country. (c) Bord Filte promotes the tourist industry in Ireland. (d) An Post delivers letters every morning. (e) Aer Lingus provides an air transport service. (f) The ESB provides power for light and heat. (g) The ACC Bank provides finance for farmers. (h) Iarnrd ireann runs the railways in Ireland. (i) Bord na Mna provides turf and briquettes. (j) Telecom ireann provides telephone and fax services. Note: Bord Filte, Telecom ireann and ACC have changed since this Q7 was asked in 1995. Bord Filte is now Filte Ireland and Telecom and ACC are no longer state-owned companies. (b) FS provides training for unemployed people. Bus ireann provides a national road transport service.

Chapter 22 Private Limited Company

There are no exercises in the textbook.

25

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 23 Chain of Production

1. (a) The channels of distribution are the means by which goods and services are passed from the producers to the final consumers. (b) 1. Manufacturer Consumer Example: Shipbuilding 2. Manufacturer Retailer Consumer Example: Groceries (e.g. Tesco) 3. Manufacturer Wholesaler Retailer Consumer Example: Bread, Milk 2. For the manufacturer, the wholesaler pays cash immediately and stores the goods. For the retailer, the wholesaler provides a variety of goods and sells in small quantities. 3. To sell goods and services in convenient locations; to sell wide variety of goods; to provide advice for consumers. 4. In-store banking; growth in international retailers; greater use of technology e.g. bar code scanners; buying and selling via the internet. 5. Unit shops: independent shops convenient to customers. Voluntary groups: independent shops which come together to buy in bulk. Shopping centres: one-stop shopping areas containing a wide variety of shops with car parking. Vending machines: use of machines to provide 24-hour sale of selected goods. Multiple shops: shops, owned by one owner, with a similar look and design. 6. (a) Sentences written out correctly: Primary Production is where raw materials are produced. Secondary Production is where raw materials are turned into finished goods. The Services Industry is where teachers, nurses and hairdressers are employed. The Wholesaler is a person who buys in bulk (large amounts) from the Manufacturer. A Department Store is one shop divided into many sections. A Shopping Centre is a covered area where there are many shops. A Chain Store is a retailer with branches around the country. A Vending Machine is a slot machine where you can buy cans of orange. A Travel Agency is a shop that sells airline tickets. A Newsagent is a shop that sells newspapers. (b) Supermarkets sell groceries on a self-service basis. Greengrocers sell fruit and vegetables.

Chapter 24 People at Work

1. Three rights: An employee is entitled to receive a minimum wage; have a safe and healthy workplace; be treated in an equal way. Three responsibilities: An employee is responsible for doing an honest days work; protecting their employers property; providing honest information when applying for a job.

26

Junior Certificate Business Studies Textbook Teachers Manual

2. Two reasons for unemployment include businesses downsizing and increase in numbers doing part-time work. 3.

Products used in Ireland Motor cars Clothes Petrol Coal No Yes No No Yes/No

4. Two rewards of being self-employed include: Making ones own decisions; keeping all the profit made. Two risks of being self-employed include: Losing everything if the business fails; using up all ones savings to start up business. 5.

6. (a and b)

Department Finance Production Marketing Work Recording income and expenditure Designing and making goods Researching the market; advertising and selling goods Skills required Bookkeeping, accuracy Creative, engineering Good communication skills

Chapter 25 Being an Employer

1. Three rights of employers include: Set up a business; select suitable staff; dismiss dishonest staff. Three responsibilities of an employer include: Provide safe working conditions; pay the agreed wage; keep proper employment records. 2. The procedure for employing staff includes: Finding out what staff is required; Preparing job descriptions; Advertising the job; Short-listing applicants; Interviewing and appointing applicants.

27

Junior Certificate Business Studies Textbook Teachers Manual

3. Caretaker required for St Veronicas College, Cork Qualifications: Experience: Hours of work: Rate of pay: Holidays: FS certificate in caretaker studies Four years 48-hour week, flexi-work 25 per hour 34 days per year

Apply to Chairperson, BOM, St Veronicas College, Cork Closing date for applications 25 August 2008 St Veronicas College is an equal opportunities employer 4. Basic week 40 hours @ 8 = Overtime 9 hours @ 12 = Gross wage 5. Basic wage Overtime Gross wage 6. Basic wage Bonus Gross wage 7. Basic wage Commission Gross wage 8. Basic wage Commission Gross wage 9. Gross income 43,000 First 29,400 Remainder 13,600 Gross tax due Less tax credits (1,580 + 1,270) Actual tax due PRSI Calculation 7.5% of 43,000 @ 20% @ 42% 10 rolls @ 7 per roll 5 rolls @ 8 per roll 70 40 110 125 2,100 2,225 250 70.50 15 320.50 335.50 5,880 5,712 11,592 2,850 8,742 3,225 320 108 428 150 120 400 270 670

40 hours @ 10 10 hours @ 15 per hour 6 hours @ 20 per hour

6 policies @ 350

250 copies @ 1 47 copies @ 1.50

Net Wage: Gross Wage (43,000) PAYE (8,742) PRSI (3,225) = 31,033

28

Junior Certificate Business Studies Textbook Teachers Manual

10. Gross income 63,000 First 29,400 Remainder 33,600 Gross tax due Less tax credits (1,580 + 1,270) Actual tax due PRSI: Calculation 7.5% of 63,000

@ 20% @ 42%

5,880 14,114 19,992 2,850 17,140 4,725

Net Wage Gross Wage (63,000) PAYE (17,140) PRSI (4,725) = 41,135 11. Gross income 62,000 First 29,400 Remainder 32,600 Gross tax due Less tax credits (1,580 + 1,270) Actual tax due PRSI: Calculation 7.5% of 62,000 @ 20% @ 42% 5,880 13,440 19,320 2,850 16,470 4,650

Net Wage: Gross Wage (62,000) PAYE (16,470) PRSI (4,650) BUPA (600) Union Fee (1,350) = 38,930

Chapter 26 Industrial Relations

1. Good industrial relations are important because disputes over wages, working conditions etc., can be settled without a strike taking place. 2. Trade unions: Negotiate wage increases for their members; Protect their members against unfair dismissal; Represent their members in discussions with employers and government on matters such as taxation and employment. 3.

Union Type Craft Union White Collar Union Industrial Union General Union Explanation Represents workers who have served an apprenticeship Represents workers who have professional qualification Represents workers who work in the same industry Represents workers who are not in any of the other three unions Example NUJ ASTI INO SIPTU

4. Industrial disputes arise when:

Working conditions are dangerous; Pay should be increased because of extra work done.

5. Industrial disputes can be settled by: Workers discussing the problem with their supervisor; The shop steward discussing the problem with the manager; An acceptable third party bringing the two sides in dispute together.

29

Junior Certificate Business Studies Textbook Teachers Manual

6. (a) (i) Line graph showing number of strikes for the period 19901994

(ii) 44.2 strikes. (iii) 1992 and 1994. (b) (i) Breach of agreement on the employment of temporary staff. (ii) Department of Agriculture and members of the CPSU. (iii) Ban on overtime, refusal to perform duties of higher grades, ban on telephone and public enquiries. (iv) Both sides going to conciliation or arbitration. 7. (a) Strikes take place because: Workers are seeking higher wages; Poor working conditions; Demarcation disputes over who does what work. (b) (i) Suspension by An Post of staff at its Dublin mail centre in Clondalkin. (ii) An Post and the CWU (postal workers). (iii) Reinstatement of suspended staff and the restoration of the postal service. An Post wanted the union to deliver work changes that had already been paid for. (iv) Members of the public who could not get any post; charities, e.g. Concern, who would not get donations that were sent in the post. (v) The Labour Relations Commission (LRC).

Chapter 27 Finance for Business

1. It is important to distinguish between short-, medium- and long-term needs because each one has a different time period and will require a different type of finance. E.g. a long-term need would require a source of finance to be paid back after at least five years.

30

Junior Certificate Business Studies Textbook Teachers Manual

2.

Short-Term Source Creditors Expenses due Bank overdraft Explanation This is where a business buys goods from a supplier and pays for them at a later date. This where certain expenses are incurred and paid for later, e.g. electricity and telephone. This where a person has a current account and has permission from the bank to take out more money than is in the account.

3.

External Source Hire Purchase Explanation This is a source of finance where the business that requires the three vans, pays a number of instalments and becomes the eventual owner when the last instalment is paid. This is a source of finance where the business that wants the use but not ownership of the three vans, pays a finance company for the use of them.

Leasing

4.

Long-Term Source Reserves Grants Long-term loan Explanation This an internal source of finance that is available to a profitable business that has set some of its profit aside for use at a later stage. This is an external source of finance, which is obtained from the EU or government, to start or expand a business, if certain conditions are met. This is an external source of finance that is obtained from a financial institution for the purchase of land, buildings and machinery. The business must be creditworthy, be able to repay the loan and have security.

5. Killoe, Co. Longford. Title: Suitable Sources of Finance for Kennedy Ltd. Date:___________________ Kennedy Ltd, College Park, Longford. I was asked by you to advise on suitable sources of finance for your business. As your needs are both long and medium term, I advise the following: Extension of the factory should be financed by investing extra capital in the business and using up the available reserves. The purchase of suitable equipment should be financed by a four-year bank loan. I am available to discuss this report if necessary. Thomas Mahon. Financial Consultant.

31

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 28 Preparation of a Business Plan

1. (i) (ii) (iii) (iv) (v) The business background giving details of the owners and a history of the business; A description of the product or service; Market research details of customers and competitors; How the product or service will be promoted; The sources of finance that will be used, both internal and external. = 122,000 = 86,000 36,000

2. Total cost of project (60,000 + 30,000 + 18,000 + 14,000) Less Finance Available (56,000 + 30,000) Finance Required:

3. Total cost of project (80,000 + 40,000 + 60,000 + 20,000 + 10,000) = 210,000 Less Finance Available (62,500 + 35,000) = 97,500 Finance Required: 112,500

Chapter 29 Business Loan Applications

1. The business history; purpose of the loan; amount of the loan; time period of the loan; proof of ability to repay the loan; details of security available in case the loan is not paid back. 2. Total cost of project (150,000 + 140,000) Less finance available (80,000 + 50,000) Loan required: = 290,000 = 130,000 160,000

Chapter 30 Banking for Business

1.

Service Money transmission Lending Night-safe facilities Paypath International services Explanation This involves moving money from one business to another e.g. cheques, credit transfers etc Banks provide loans for different periods as well as overdrafts Banks provide a safe place to keep business money overnight Banks will transfer money to an employees account Banks will make payments to foreign businesses on behalf of their account holders

2. A private limited company must provide memorandum of association; articles of association; written agreement of directors to open an account; signatures of persons permitted to sign cheques.

32

Junior Certificate Business Studies Textbook Teachers Manual

3. The directors of the company, having completed an application form and provided necessary details, open the account; Money is lodged to the account using lodgement slips, credit transfers, standing orders etc; Payments are made from the account by way of cheques signed by authorised people, by standing orders, direct debits, credit transfers etc; The account is checked against the bank statement. 4.

Date 2005 31/7 Balance b/d Credit transfer Standing order Direct debit Bank charges 3,000 2,400 4,500 350 Details

Adjusted Bank Account

Debit Credit Balance 17,000 20,000 17,600 13,100 12,750

Bank Reconciliation Statement as on 31/7/2005 Balance as per bank statement Add lodgements not credited Less cheques not yet presented (4,600 + 6,000) Balance as per adjusted bank account 5.

Date 2007 31/5 Balance b/d Credit transfer Details

12,750 10,600 23,350 10,600 12,750

Adjusted Bank Account

Total 12,900 2,400 15,300 Balance b/d 13,960 Date 2007 31/5 Standing order Bank charges Balance c/d Details Total 1,300 40 13,960 15,300

Bank Reconciliation Statement as on 31/5/2007 Balance as per bank statement Add lodgements not credited Less cheques not yet presented (1,300 + 600 + 1,450) Balance as per adjusted bank account 6.

Date 2007 31/3 Balance b/d Credit transfer Details

9,810 7,500 17,310 3,350 13,960

Adjusted bank account

Total 16,740 2,780 19,520 Balance b/d 17,630 Date 2007 31/3 Direct debit Bank charges Balance c/d Details Total 1,790 100 17,630 19,520

33

Junior Certificate Business Studies Textbook Teachers Manual

Bank Reconciliation Statement as on 31/3/2007 Balance as per bank statement Add lodgements not credited Less cheques not yet presented (950 + 4,360 + 3,550) Balance as per adjusted bank account 7. (a)

Date 2004 1/5 3/5 31/5 Balance b/d Lodgement Lodgement Details Total 1,500 3,500 12,400

14,890 11,600 26,490 17,630

8,860

Bank Account

Date 2004 7/5 10/5 14/5 19/5 27/5 31/5 17,400 Martin Ltd Bruton Ltd Cash withdrawal Kenny Ltd Harney Ltd Balance c/d 1 2 ATM 3 4 Details Ch. no./ATM Total 1,700 4,500 600 2,780 1,900 5,920 17,400

1/6

Balance b/d

5,920

(b)

Date 2004 31/5 Balance b/d Credit transfer Details

Adjusted Bank Account

Total 5,920 10,000 15,920 12,345 Date 2004 Direct debit Bank fees Balance c/d Details Total 3,400 175 12,345 15,920

(c) Bank Reconciliation Statement as on 31/5/2004 Balance as per bank statement Add lodgements not credited Less cheques not yet presented (4,500 + 1,900) Balance as per adjusted bank account 6,345 12,400 18,745 6,400 12,345

Chapter 31 Business Insurance

1.

Types of Insurance Third party motor insurance Theft insurance Cash in transit Employers liability Product liability Explanation Required by law in case damage is caused by its motor vehicles In case goods or equipment is stolen In case money is stolen on the way to the bank In case workers get injured at work In case consumers get injured using the product

34

Junior Certificate Business Studies Textbook Teachers Manual

2. (a) Hayes Ltd is required by law to have third party motor insurance, and to pay its share of PRSI. (b) Hayes Ltd should also take out: Fire insurance in case fire causes damage to furniture, premises or equipment; Theft insurance in case furniture or equipment is stolen; Employers liability in case any of its five workers are injured at work. (c) Hayes Ltd may be unable to insure against losses due to bad management or furniture going out of date. (d) Hayes Ltd should have adequate insurance so that all possible risks are insured for the correct amounts. (e) Hayes Ltd should consult an insurance broker because the broker will be independent and experienced.

Chapter 32 Delivery Systems

1. An efficient delivery system is important in the chain of distribution because: Raw materials have to be transported to manufacturers; Finished goods have to be transported to retailers; Workers have to be transported to their places of work; Consumers have to be transported to the retailers. 2. Cost the cost of transport adds to the cost of the goods so it must be as low as possible. Reliability the system must be punctual and meet deadlines. Speed speed is very important for delivery of many goods e.g. fish, fruit etc. Convenience the system should be available as and when required. 3. Road transport is very popular and is suitable for fast deliveries of non-bulky goods. Air transport is very quick and is suitable for transporting people and high-value non-bulky goods. 4.

Delivery System Road Rail Sea Air Speed Fast over short distances Very fast Slow Very fast Cost Expensive Cheaper than road Cheaper than air Very expensive Reliability Very reliable Very reliable Dependent on weather Dependent on weather Good transported Non-bulky Bulky Bulky Non-bulky

5. Dublin Port Tunnel, which allows trucks to bypass Dublin city on the way to Dublin Port. 6. A business can transport goods as and when it needs to and is not tied to timetables. It can also advertise its goods on the side of its trucks. 7. (a) 178 km (b) 206 km (c) 188 km (d) 164 km 8. (a) 325 km (b) 326 km 9. (a) 10.14 am (b) 11.30 am 10. (a) 5.55 am (b) 5.36 am

35

Junior Certificate Business Studies Textbook Teachers Manual

11. (a) Cost of diesel: 168 = 6.72 litres @ 0.60 = 4.03 25 Driver wages: 100 Annual costs: 1,500 + 600 + 1,100 320 Total costs: 114.03 = 10

(b) Cost of diesel: 168 = 6.72 litres @ 0.60 = 4.03 25 Driver wages: 120 Annual costs: 1,350 + 750 + 1,200 = 11 300 Total costs: 135.03 12. (a) Cost of diesel: 472 = 18.88 litres @ 0.60 = 11.33 25 Driver wages: 11@ 8 + 11 @ 3 = 121 Annual costs: 900 + 520 + 3,000 295 Total costs: 147.31 (b) 1.46%. 13. Cost of diesel: 460 = 28,75 litres @ 0.60 = 17.25 16 Driver wages: 98 Annual costs: 580 + 1,500 + 750 283 Total costs: 125.25 = 10 = 14.98

Chapter 33 Marketing

1. Market means the exchange of goods or services for payment. Examples include: market for labour; transport; money; education. 2. Carrying out market research; Production of a product or service; Deciding on a place to sell the product or service; Deciding on the price at which to sell the product or service; Deciding on how to promote the product or service; Carry out further market research to get customer feedback. 3.

Product/Service Target Market

Farmers Journal Business people Farmers

Conrad Hotel

Sky Sports Business Studies Books Sports Junior Certificate Students

Doc Martens boots Teenagers

36

Junior Certificate Business Studies Textbook Teachers Manual

4. Sample layout

Four Ps Product Price Promotion Place Product chosen: school bag Available in ten colours and five sizes Range from 12.50 to 28.60 Send fliers to schools. Television advertisements in August Available in all sports and school bookshops

5. Market research is important because it provides details of customers and competitors. This helps identify the target market. 6. A business would first use desk research, which involves studying existing information on the market. It would then use field studies to get additional information that is not available from desk research. This involves using questionnaires, interviews etc. 7. A business advertises to inform customers about its products or services, to persuade customers to buy only its products or services and also to highlight the difference between its products or services and those of its competitors. 8. Who is the target market; The type of product or service; The cost. 9. Be careful with the number of words used because that determines the price of newspaper advertisements. Example: Dont dry up, Quench your thirst with Irish Rain. Available NOW in retail stores nationwide! 10. To launch a new Finance and Consumer TV Show. Example: Youve seen the rest Now watch the best Get it all off your chest With the new Finance and Consumer test. 11. Students to suggest answer. 12.

Product/Service Media Smarties Television Swimwear Colour magazine Festival Posters Circus Fliers Bank Radio

13. Students to suggest answers. 14. Must have, Cant live without it, Be ahead of the pack.

37

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 34 Financial Recording and Filing

1. To know how much you have; To know how much you owe; To know how much you are owed; To know if you are making a profit or a loss. 2. Complete documents; Record data in Books of First Entry; Post data to the Ledger; Extract a Trial Balance; Prepare Final Accounts and Balance Sheet. 3. Double entry bookkeeping is the recording of the giving and the receiving aspects of a transaction. 4. Debtors Ledger is used to record the names of people who owe the business money. Creditors Ledger is used to record the names of people to whom the business owes money. General Ledger is used to record all transactions that cannot be recorded in the Debtors or Creditors Ledgers.

Chapter 35 Business Documents I

1. Effective purchasing means purchasing the right quantity and quality of goods at the right price and time. 2. Letter, phone or e-mail. 3. Quality; price; method of payment; delivery; discounts. 4.

Providers Hardware Stores Ltd, Cavan. (049) 23246. VAT Reg. No. 6311141H _______________________ The Sales Department, Crown Paints Ltd, Dublin. Dear Sir/Madam, Please send me the best terms and conditions under which you can supply me with the following: 50 10 litre drums of white emulsion; 30 5 litre tins of cream paint; 60 5 litre tins of white ceiling paint; 15 1 litre tins of brown gloss paint for exterior use. Yours faithfully, _____________________________ Purchasing Manager.

38

Junior Certificate Business Studies Textbook Teachers Manual

5.

All Sports Ltd, Cork Rd., Dublin. (01) 7734218. VAT Reg. No. 4812641S ________________________ Connolly Sportswear Manufacturers Ltd, Tuam Rd., Galway. Dear Sir/Madam, Please send me the best terms and conditions under which you can supply me with the following: 4 Sets of Leitrim Jerseys (Senior size); 60 Hurling Helmets varying sizes; 30 Tracksuits with Leitrim crest; 120 Hurleys varying sizes. Yours faithfully, _______________________ Purchasing Manager.

6. C 556.20 7.

(A = 565.25

B = 580.30

C = 556.20)

Term CWO Ex Works Trade Discount 30% 5% in 10 days otherwise net Subject to VAT @21%

Explanation Cash must be sent with the order Price does not include delivery. If goods have to be delivered they will cost more Retailers will receive a 30% reduction in the price to encourage them to sell the goods If payment is made within 10 days of receiving the goods a further reduction of 5% will be given, otherwise the normal price applies Value Added Tax at 21% has to be added to the price of the goods

8. A business can check the credit ratings of a customer by: Checking the existing records to see if the customer paid up in the past; Asking for a bank reference to see if the bank would recommend the customer; Asking for a trade reference to see if another business would recommend the customer. 9. (a) Gross Profit 200 10. (a) 20% 11. (a) 50 12. 25% (b) 16.67% (b) 40% (b) Mark up % = 50%. Margin % = 33 13 %

Chapter 36 Business Documents II

There are no exercises in the textbook.

39

Junior Certificate Business Studies Textbook Teachers Manual

Chapter 37 Recording Credit Transactions

1.

Sales Book (p1) Date 2006 11/10 13/10 15/10 Coyne Ltd Hynes Ltd Lyons Ltd 54 55 56 DL DL DL Details Inv. no. F Net 32,000 28,000 16,000 76,000 Debtors Ledger Date 2006 11/10 Sales SB Details F Total Date Details F Total 2006 Coyne Ltd A/C 36,320 Hynes Ltd A/C 13/10 Sales SB 31,780 Lyons Ltd A/C 15/10 Sales SB 18,160 General Ledger Sales A/C 15/10 Vat A/C 15/10 Credit sales SB 10,260 Total debtors SB 76,000 VAT 4,320 3,780 2,160 10,260 Total 36,320 31,780 18,160 86,260

Trial Balance as on 15/10/2006 Coyne Ltd Hynes Ltd Lyons Ltd Sales VAT 86,260 36,320 31,780 18,160 76,000 10,260 86,260

2.

Sales Book (p1) Date 2006 17/4 18/4 20/4 Foley Ltd Roley Ltd Poley Ltd 34 35 36 DL DL DL Details Inv. no. F Net 11,000 19,000 52,000 82,000 VAT 1,485 2,565 7,020 11,070 Total 12,485 21,565 59,020 93,070

40

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2006 17/4 Sales SB Details F Total Date Details F Total 2006 Foley Ltd A/C 12,485 Roley Ltd A/C 18/4 Sales SB 21,565 Poley Ltd A/C 20/4 Sales SB 59,020 General Ledger Sales A/C 20/4 VAT A/C 20/4 Credit sales SB 11,070 Total debtors SB 82,000

Trial Balance as on 20/4/2006 Foley Ltd Roley Ltd Poley Ltd Sales VAT 93,070 12,485 21,565 59,020 82,000 11,070 93,070

3.

Sales Book (p1) Date 2007 12/5 14/5 15/5 Mark Ltd Dark Ltd Park Ltd 67 68 69 DL DL DL Details Inv. no. F Net 27,000 10,400 38,400 75,800 VAT 3,645 1,404 5,184 10,233 Total 30,645 11,804 43,584 86,033

41

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2007 12/5 Sales SB Details F Total Date Details F Total 2007 Mark Ltd A/C 30,645 Dark Ltd A/C 14/5 Sales SB 11,804 Park Ltd A/C 15/5 Sales SB 43,584 General Ledger Sales A/C 15/5 VAT A/C 15/5 Credit sales SB 10,233 Total debtors SB 75,800

Trial Balance as on 15/5/2007 Mark Ltd Dark Ltd Park Ltd Sales VAT 86,033 30,645 11,804 43,584 75,800 10,233 86,033

4.

Sales Book (p1) Date 2007 23/9 24/9 26/9 Brown Ltd White Ltd Green Ltd 45 46 47 DL DL DL Details Inv. no. F Net 21,000 50,000 16,000 87,000 VAT 4,410 10,500 3,360 18,270 Total 25,410 60,500 19,360 105,270

42

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2007 23/9 Sales SB Details F Total Date Details F Total 2007 Brown Ltd A/C 25,410 White Ltd A/C 24/9 Sales SB 60,500 Green Ltd A/C 26/9 Sales SB 19,360 General Ledger Sales A/C 26/9 VAT A/C 26/9 Credit sales SB 18,270 Total debtors SB 87,000

Trial Balance as on 26/9/2007 Brown Ltd White Ltd Green Ltd Sales VAT 105,270 25,410 60,500 19,360 87,000 18,270 105,270

5.

Purchases Book (p1) Date 2007 3/4 5/4 8/4 PM Ltd ET Ltd AA Ltd 4 2 1 CL CL CL Details Inv. no. F Net 18,000 8,000 12,000 38,000 VAT 3,780 1,680 2,520 7,980 Total 21,780 9,680 14,520 45,980

43

Junior Certificate Business Studies Textbook Teachers Manual

Creditors Ledger Date 2007 Details F Total Date Details F Total Purchases PB 21,780 2007 PM Ltd A/C 3/4 ET Ltd A/C 5/4 AA Ltd A/C 8/4 General Ledger Purchases A/C 8/4 Total creditors PB 38,000 VAT A/C 8/4 Credit purchases PB 7,890 Purchases PB 14,520 Purchases PB 9,680

Trial Balance as on 8/4/2007 PM Ltd ET Ltd AA Ltd Purchases VAT 38,000 7,890 45,790 45,790 21,780 9,680 14,520

6.

Purchases Book (p1) Date 2007 17/9 19/9 23/9 BC Ltd MP Ltd CC Ltd 7 5 3 CL CL CL Details Inv. no. F Net 36,000 4,000 54,000 94,000 VAT 7,560 840 11,340 19,740 Total 43,560 4,840 65,340 113,740

44

Junior Certificate Business Studies Textbook Teachers Manual

Creditors Ledger Date 2007 Details F Total Date Details F Total Purchases PB 43,560 2007 BC Ltd A/C 17/9 MP Ltd A/C 19/9 CC Ltd A/C 23/9 General Ledger Purchases A/C 23/9 Total purchases PB 94,000 VAT A/C 23/9 Credit purchases PB 19,740 Purchases PB 65,340 Purchases PB 4,840

Trial Balance as on 23/9/2007 BC Ltd MP Ltd CC Ltd Purchases VAT 94,000 19,740 113,740 113,740 43,560 4,840 65,340

7.

Purchases Book (p1) Date 2007 29/5 30/5 31/5 PP Ltd DJ Ltd FI Ltd 9 8 7 CL CL CL Details Inv. no. F Net 64,000 48,000 96,000 208,000 VAT 8,640 6,480 12,960 28,080 Total 72,640 54,480 108,960 236,080

45

Junior Certificate Business Studies Textbook Teachers Manual

Creditors Ledger Date 2007 Details F Total Date Details F Total Purchases PB 72,640 2007 PP Ltd A/C 29/5 DJ Ltd A/C 30/5 FI Ltd A/C 31/5 General Ledger Purchases A/C 31/5 Total creditors PB 208,000 VAT A/C 31/5 Credit purchases PB 28,080 Purchases PB 108,960 Purchases PB 54,480

Trial Balance as on 31/5/2007 PP Ltd DJ Ltd FI Ltd Purchases VAT 208,000 28,080 236,080 236,080 72,640 54,480 108,960

8.

Purchases Book (p1) Date 2007 14/7 16/7 18/7 PJ Ltd SM Ltd JC 7 2 4 CL CL CL Details Inv. no. F Net 16,000 44,000 36,000 96,000 VAT 2,160 5,940 4,860 12,960 Total 18,160 49,940 40,860 108,960

46

Junior Certificate Business Studies Textbook Teachers Manual

Creditors Ledger Date 2007 Details F Total Date Details F Total Purchases PB 18,160 2007 PJ Ltd A/C 14/7 SM Ltd A/C 16/7 JC Ltd A/C 18/7 General Ledger Purchases A/C 18/7 Total creditors PB 96,000 VAT A/C 18/7 Credit purchases PB 12,960 Purchases PB 40,860 Purchases PB 49,940

Trial Balance as on 18/7/2007 PJ Ltd SM Ltd JC Ltd Purchases VAT 96,000 12,960 108,960 108,960 18,160 49,940 40,860

9.

Sales Returns Book (p1) Date 2006 20/4 23/4 Bun Ltd Gun Ltd 67 68 DL DL Details Credit note no. F Net 1,300 600 1,900 VAT 273 126 399 Total 1,573 726 2,299

47

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2006 Details F Total Date Details F Total Sales returns SRB 1,573 2006 Bun Ltd A/C 20/4 Gun Ltd A/C 23/4 General Ledger Sales Returns A/C 20/4 Total debtors SRB 1,900 VAT A/C 20/4 Sales returns SRB 399 Sales returns SRB 726

Trial Balance as on 20/4/2007 Bun Ltd Gun Ltd Sales returns VAT 1,900 399 2,299 2,299 1,573 726

10.

Sales Returns Book (p1) Date 2006 12/1 14/1 Bob Ltd Rob Ltd 45 46 DL DL Details Credit note no. F Net 3,000 1,600 4,600 VAT 405 216 621 Total 3,405 1,816 5,221

48

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2006 Details F Total Date Details F Total Sales returns SRB 3,405 2006 Bob Ltd A/C 12/1 Rob Ltd A/C 14/1 General Ledger Sales Returns A/C 14/1 Total debtors SRB 4,600 VAT A/C 14/1 Sales returns SRB 621 Sales returns SRB 1,816

Trial Balance as on 14/1/2006 Bob Ltd Rob Ltd Sales returns VAT 4,600 621 5,221 5,221 3,405 1,816

11.

Sales Returns Book (p1) Date 2006 24/9 26/9 Joe Ltd Coe Ltd 78 79 DL DL Details Credit note no. F Net 2,400 5,600 8,000 VAT 324 756 1,080 Total 2,724 6,356 9,080

Debtors Ledger Date 2006 Details F Total Date Details F Total Sales returns SRB 2,724 2006 Joe Ltd A/C 24/9 Coe Ltd A/C 26/9 General Ledger Sales Returns A/C 26/9 Total debtors SRB 8,000 VAT A/C 26/9 Sales returns SRB 1,080 Sales returns SRB 6,356

49

Junior Certificate Business Studies Textbook Teachers Manual

Trial Balance as on 26/9/2006 Joe Ltd Coe Ltd Sales returns VAT 8,000 1,080 9,080 9,080 2,724 6,356

12.

Purchases Returns Book (p1) Date 2007 7/3 8/3 Mike Ltd Alma Ltd 56 12 CL CL Details Credit note no. F Net 3,600 1,400 5,000 VAT 486 189 675 Total 4,086 1,589 5,675

Creditors Ledger Date 2007 7/3 Purchases returns PRB Details F Total Date Details F Total 2007 Mike Ltd A/C 4,086 Alma Ltd A/C 8/3 Purchases returns PRB 1,589

Purchases Returns A/C 8/3 VAT A/C 8/3 Purchases returns PRB 675 Total creditors PRB 5,000

Trial Balance as on 8/3/2007 Mike Ltd Alma Ltd Purchases returns VAT 5,675 4,086 1,589 5,000 675 5,675

50

Junior Certificate Business Studies Textbook Teachers Manual

13.

Purchases Returns Book (p1) Date 2007 23/1 25/1 Vicki Ltd Steve Ltd 34 5 CL CL Details Credit note no. F Net 2,800 800 3,600 VAT 378 108 486 Total 3,178 908 4,086

Creditors Ledger Date 2007 23/1 Purchases returns PRB Details F Total Date Details F Total 2007 Vickie Ltd A/C 3,178 Steve Ltd A/C 25/1 Purchases returns PRB 908 General Ledger Purchases Returns A/C 25/1 VAT A/C 25/1 Purchases returns PRB 486 Total creditors PRB 3,600

Trial Balance as on 25/1/2007 Vickie Ltd Steve Ltd Purchase returns VAT 4,086 3,178 908 3,600 486 4,086

14.

Purchases Returns Book (p1) Date 2007 16/2 18/2 Vera Ltd Jack Ltd 14 67 CL CL Details Credit note no. F Net 3,400 2,800 6,200 VAT 714 588 1,302 Total 4,114 3,388 7,502

51

Junior Certificate Business Studies Textbook Teachers Manual

Creditors Ledger Date 2007 16/2 Purchases returns PRB Details F Total Date Details F Total 2007 Vera Ltd A/C 4,114 Jack Ltd A/C 18/2 Purchases returns PRB 3,388 General Ledger Purchases Returns A/C 18/2 VAT A/C 18/2 Purchase returns PRB 1,302 Total creditors PRB 6,200

Trial Balance as on 18/2/2007 Vera Ltd Jack Ltd Purchase returns VAT 7,502 4,114 3,388 6,200 1,302 7,502

15.

Sales Book (p1) Date 2008 3/4 5/4 Smyth Ltd Smart Ltd 43 44 DL DL Details Invoice no. F Net 20,000 15,500 35,500 VAT 4,200 3,255 7,455 Total 24,200 18,755 42,955

Sales Returns Book (p1) Date 2008 8/4 9/4 Smyth Ltd Smart Ltd 12 13 DL DL Details Credit note no. F Net 4,500 3,200 7,700 VAT 945 672 1,617 Total 5,445 3,872 9,317

52

Junior Certificate Business Studies Textbook Teachers Manual

Debtors Ledger Date 2008 3/4 Sales SB Details F Total Date Details F Total Sales returns Balance c/d SRB 5,445 18,755 24,200 2008 Smyth Ltd A/C 24,200 24,200 10/4 5/4 Balance b/d Sales SB 18,755 Smart Ltd A/C 18,755 18,755 10/2 Balance b/d 14,883 General Ledger Sales A/C 9/4 Sales Returns A/C 9/4 Total debtors SRB 7,700 VAT A/C 9/4 9/4 Sales returns Balance c/d SRB 1,617 5,838 7,455 10/4 Balance b/d 7,455 5,838 9/4 Credit sales SB 7,455 Total debtors SB 35,500 9/4 9/4 Sales returns Balance c/d SRB 3,872 14,883 18,755 8/4 9/4

Trial Balance as on 9/4/2008 Smyth Ltd Smart Ltd Sales Sales returns VAT 41,338 7,700 5,838 41,338 18,755 14,883 35,500

16.

Sales Book (p1) Date 2008 13/2 14/2 Harry Ltd Helen Ltd 67 68 DL DL Details Invoice no. F Net 35,000 24,000 59,000 VAT 4,725 3,240 7,965 Total 39,725 27,240 66,965

53

Junior Certificate Business Studies Textbook Teachers Manual

Sales Returns Book (p1) Date 2008 16/2 18/2 Harry Ltd Helen Ltd 56 57 DL DL Details Credit note no. F Net 6,000 2,400 8,400 VAT 810 324 1,134 Total 6,810 2,724 9,534

Debtors Ledger Date 2008 13/2 Sales SB Details F Total Date Details F Total Sales returns Balance c/d SRB 6,810 32,915 39,725 2008 Harry Ltd A/C 39,725 39,725 19/2 14/2 Balance b/d Sales SB 32,915 Helen Ltd A/C 27,240 27,240 19/2 Balance b/d 24,516 General Ledger Sales A/C 18/2 Sales Returns A/C 18/2 Total debtors SRB 8,400 VAT A/C 18/2 18/2 Sales returns Balance c/d SRB 1,134 6,831 7,965 19/2 Balance b/d 7,965 6,831 18/2 Credit sales SB 7,965 Total debtors SB 59,000 18/2 Sales returns Balance c/d SRB 2,724 24,516 27,240 16/2 18/2

Trial Balance as on 18/2/2008 Harry Ltd Helen Ltd Sales Sales returns VAT 65,831 8,400 6,831 65,831 32,915 24,516 59,000

54

Junior Certificate Business Studies Textbook Teachers Manual

17.

Sales Book (p1) Date 2008 25/6 26/6 Glass Ltd Task Ltd 78 79 DL DL Details Invoice no. F Net 45,000 78,000 123,000 VAT 9,450 16,380 25,830 Total 54,450 94,380 148,830

Sales Returns Book (p1) Date 2008 27/6 Glass Ltd 32 DL Details Credit note no. F Net 7,600 VAT 1,596 Total 9,196

Debtors Ledger Date 2008 25/6 Sales SB Details F Total Date Details F Total Sales returns Balance c/d SRB 9,196 45,254 54,450 2008 Glass Ltd A/C 54,450 54,450 28/6 26/6 Balance b/d Sales SB 45,254 Task Ltd A/C 94,380 General Ledger Sales A/C 27/6 Sales Returns A/C 27/6 Total debtors SRB 7,600 VAT A/C 27/6 27/6 Sales returns Balance c/d SRB 1,596 24,234 25,830 28/6 Balance b/d 25,830 24,234 27/6 Credit sales SB 25,830 Total debtors SB 123,000 27/6 27/6

Trial Balance as on 27/6/2008 Glass Ltd Task Ltd Sales Sales returns VAT 147,234 7,600 24,234 147,234 45,254 94,380 123,000

55

Junior Certificate Business Studies Textbook Teachers Manual

18.

Purchases Book (p1) Date 2006 10/4 12/4 Dinny Ltd Tesie Ltd 32 56 CL CL Details Invoice no. F Net 39,400 76,900 116,300 Purchases Returns Book (p1) Date 2006 14/4 16/4 Dinny Ltd Tesie Ltd 21 89 CL CL Details Credit note no. F Net 6,400 3,500 9,900 Creditors Ledger Date 2006 14/4 16/4 Purchase returns Balance c/d PRB Details F Total Date Details F Total Purchases PB 47,674 47,674 Balance b/d Purchases PB 39,930 93,049 93,049 Balance b/d 88,814 2006 Dinny Ltd A/C 7,744 39,930 47,674 17/4 Tesie Ltd A/C 16/4 16/4 Purchases returns Balance c/d PRB 4,235 88,814 93,049 17/4 General Ledger Purchases A/C 16/4 Total creditors PB 116,300 Purchase Returns A/C 16/4 VAT A/C 16/4 Credit purchases PB 24,423 24,423 17/4 Balance b/d 22,344 Trial Balance as on 16/4/2008 Dinny Ltd Tesie Ltd Purchases Purchases returns VAT 22,344 138,644

56

VAT 8,274 16,149 24,423

Total 47,674 93,049 140,723

VAT 1,344 735 2,079

Total 7,744 4,235 11,979

10/4

12/4

Total creditor

PRB

9,900

16/4 16/4

Purchases ret. Balance c/d

2,079 22,344 24,423

39,930 88,814 116,300 9,900 138,644

Junior Certificate Business Studies Textbook Teachers Manual

19.