Академический Документы

Профессиональный Документы

Культура Документы

Chapter 16

Загружено:

Rahila RafiqАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 16

Загружено:

Rahila RafiqАвторское право:

Доступные форматы

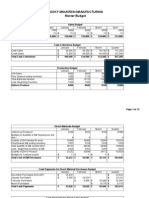

COST ACCOUNTING 9TH EDITION

Chapter 16

Page 80

COST ACCOUNTING 9TH EDITION

CHAPTER 16 EXERCISES

Problem 16-1 1

_______________Co Cash Disbursement Budget For the Month June $ 54% 46% 38,000 15% of sale 51,300 (2,000) $342000 * $20 49,300 6,840,000 6,927,300

June Payments May Payments wages and Salaries Marketing exp Less: Dep CGS Total Cash Disbursement 2 _______________Co Cash Collection Budget For the Month May April Collection April Collection March Collection Total Cash Receipt 3 _______________Co Purchase Budget For the Month July Production reqd for july Add: end inv for july Inv needed Less: op Inv Purchase Required Problem 16-2 1

$ 60% 25% 9% 97% 211,266 90,750 31,860 333,876

Units 11,400

130% of Aug

15,860 27,260

130% of july

(15,600) 11,660

_______________Co Cash Collection Budget For the Month July 80% 18% 98%

$ 548,800 108,000 656,800

July Collection June Collection Total Cash Receipt

Cash Collection For Sep from Aug Sale

126,000

Chapter 16

Page 81

COST ACCOUNTING 9TH EDITION

3 4 Aug Ending Inv=25% next month Sale _______________Co Purchase Budget For the Month June CGS Add: end inv for july Inv needed Less: op Inv Purchase Required Problem 16-4 _______________Co Cash Budget For the Month of Sep Op Cash Bal Add: Expected Cash Receipts cash Sales ON ACCOUNT Current Month Sales Aug month Sale July Sales Total cash available Less: Expected Cash Payements cash Purchases Payment to ON ACCOUNT expanses Paid Total Financing Required _______________Co Cash Budget For the Month of OCT Op Cash Bal Add: Expected Cash Receipts cash Sales ON ACCOUNT Current Month Sales Sep month Sale Aug Sales Total cash available Less: Expected Cash Payements cash Purchases 38750 48000 10000 96,750 149,750 20000 92000 46500 158,500 (8,750) 25% of june sale 80% of sales 25% of july sale 100,000

Units 480,000 175,000 655,000 (150,000) 505,000

$ 13,000

40,000

$ (8,750)

60,000 47500 31000 12000 90,500 141,750 20000

Chapter 16

Page 82

COST ACCOUNTING 9TH EDITION

Payment to ON ACCOUNT expanses Paid Total Expected cash Balance After Payments Sep A/P opening 10000 purchases 100000 ending (12,000) disct (6,000) Payments 92000 OCT A/P 12000 80000 (9,000) 3,000 86000 86000 10000 116,000 25,750

Chapter 16

Page 83

COST ACCOUNTING 9TH EDITION

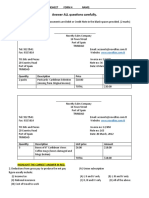

CHAPTER 16 EXERCISES

Exercise 16.1 Salvey Company Budgeted Cash Receipts for April $ Feburary Sales( 40000 x 12%)= March Sales (70000x97% x 60%) March Sales (70000x x 25%) Total= 4800 407404.7 17500 429704.7

Exercise 16.2 1 Budgeted Cash Collections in May May Sales(150000 x 20%) April Sales(180000 x 50%) March Sales( 100000 x 25%) Total Cash Collections 2

30000 90000 25000 145000

Balance of Accounts Receivable on April 30th April Receivable(180000 x 80%) 1440000 March Receivable(100000 x 30%) 30000 Less Bad Debts (100000 x 5%) -5000 Receivalbes on April 30th 1465000 Balance of Accounts Receivable on May 31st May Receivable(150000 x 80%) April Receivable(180000 x 30%) Less Bad Debts (180000 x 5%) Receivalbes on April 30th

1200000 54000 -9000 1245000

Exercise 16.3 Marketing, General, and Admn Expenses Fixed (71000-40000) Variable (700000*15%)-(700000*1%) Cost of Goods Sold(700000*70%) Increase in Inventory during the month Estimated June cash disbursement

$ 31000 98000 129000 490000 10000 629000

Exercise 16.4 Production requriement of Par in July July Sale Requirement= Closing Stock requried= Total Stock needed= Opening Stock= Units to be produced Units of Tee required for production of par in july= Purchase requirment of Tee 30000 3000 33000 3000 30000 30000*3= 90000

Chapter 16

Page 84

COST ACCOUNTING 9TH EDITION

Production requirement in july= Closing inventory required= Total Inventory required= Less available opening Stock Units to be purchaes Cost of July Purchases 87000*5= 90000 11000 101000 14000 87000 435000 Dollars

Production requriement of Par in June June Sale Requirement= Closing Stock requried= Total Stock needed= Opening Stock= Units to be produced Units of Tee required for production of par in july= Purchase requirment of Tee Production requirement in june= Closing inventory required= Total Inventory required= Less available opening Stock Units to be purchaes Cost of July Purchases 138000*5= 50000 3000 53000 5000 48000 48000*3= 144000

144000 14000 158000 20000 138000 690000 Dollars

Cash required in July for purchase of Tee Payment of June Purchases= 690000*98%*1/3 Payment of July Purchases=435000*98%*2/3 Total Cash required

225400 284200 509600

Exercise 16.5 Crockett Company Cash Budget For the Month of July Opening Balance Exepected Receipts Current Receivalbe Last Month Receivable Total Cash Available Expected Payments Income Tax Payment of Payables 5000 20000 14700

34700 39700 1600

Chapter 16

Page 85

COST ACCOUNTING 9TH EDITION

Current payable Last Month Payable Marketing & Admn Expenses Dividneds Total Expected Payments Balance after payments Fianacing required Desired Closing Balance 3750 7500 11250 10000 15000 36250 3450 1550 5000

Exercise 16.12

Direct Materials Direct Laobur Supervision Indirect materials Property tax Maintenance Power Insurance Depreciation

Flexible Budget at 100% Capacity Fixed Variable Total cost Cost Cost 20000 20000 11250 11250 500 0 500 250 1500 1750 300 0 300 600 1000 1600 200 100 300 175 0 175 1600 0 1600

Direct Materials Direct Laobur Supervision Indirect materials Property tax Maintenance Power Insurance Depreciation Exercise 16.13

Flexible Budget at 192% Capacity Variable Total Cost Fixed Cost 18400 18400 10350 10350 500 0 500 250 1380 1630 300 0 300 600 920 1520 200 92 292 175 0 175 1600 0 1600

The Birch Company Assembly department Flexible Budget for one month 60% Capcity 2280 1920 2856 17280 670 441 2160 345 23752 75% Capacity 2850 2400 3570 21600 670 552 2700 432 29524

Units 3800 Direct Labour Hours 3200 Direct Material Direct Labour Fixed Factor Overhead Supplies Indrect labour Other Charges Total

Chapter 16

Page 86

COST ACCOUNTING 9TH EDITION

Cost per Unit 10.42 10.36

Exercise 16.14 Albanese Inc. Flexible Budget for one month 60% of N.C 1440 960 2880 6048 960 240 1008 432 11568 8.03

Units Direct labour Hours

80% of N.C 1920 1280 3840 8064 960 320 1344 576 15104 7.87

Normal Capacilty (N.C) 2400 1600 4800 10080 960 400 1680 720 18640 7.77

Direct Material Direct Labour Fixed Factor Overhead Supplies Indrect labour Other Charges Total manufacturing Cost Manufacturing cost per unit

Chapter 16

Page 87

Вам также может понравиться

- Business Plan TemplateДокумент9 страницBusiness Plan TemplatePalo Alto Software93% (61)

- Hillyard Master BudgetДокумент4 страницыHillyard Master Budgetyuikokhj75% (4)

- Petition For Issuance of Letter of AdministrationДокумент4 страницыPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaОценок пока нет

- Notes PDFДокумент80 страницNotes PDFRahila Rafiq100% (5)

- Car Loan FormДокумент5 страницCar Loan FormDrumaraОценок пока нет

- Contracts Undercredit Transaction S - Lecture NotesДокумент85 страницContracts Undercredit Transaction S - Lecture NotesJanetGraceDalisayFabreroОценок пока нет

- Case 08-29 Cravat Sales CompanyДокумент5 страницCase 08-29 Cravat Sales Companysubash1111@gmail.comОценок пока нет

- Assignment Fiscal Policy in The PhilippinesДокумент16 страницAssignment Fiscal Policy in The PhilippinesOliver SantosОценок пока нет

- Sample IB Economics Internal Assessment Commentary - MacroДокумент3 страницыSample IB Economics Internal Assessment Commentary - MacroUday SethiОценок пока нет

- PROBLEMДокумент3 страницыPROBLEMSam VОценок пока нет

- Profit Planning, Activity-Based Budgeting and E-Budgeting: Mcgraw-Hill/IrwinДокумент78 страницProfit Planning, Activity-Based Budgeting and E-Budgeting: Mcgraw-Hill/IrwinSi HarisОценок пока нет

- Accounting Excel Budget ProjectДокумент8 страницAccounting Excel Budget Projectapi-242531880Оценок пока нет

- Acct 2020 Excel Budget Problem FinalДокумент12 страницAcct 2020 Excel Budget Problem Finalapi-301816205Оценок пока нет

- Tori Kallerud Chapter 9 HWДокумент12 страницTori Kallerud Chapter 9 HWapi-325347697Оценок пока нет

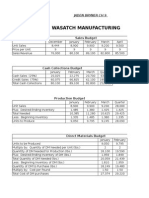

- Wasatch Manufacturing Master BudgetДокумент6 страницWasatch Manufacturing Master Budgetapi-255137286Оценок пока нет

- Chapter 15Документ7 страницChapter 15Rahila RafiqОценок пока нет

- Master Budget Assignment CH 9Документ4 страницыMaster Budget Assignment CH 9api-240741436Оценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-278341046Оценок пока нет

- EportfolioДокумент8 страницEportfolioapi-220792970Оценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-249190933Оценок пока нет

- p9-60 PsimasinghДокумент8 страницp9-60 Psimasinghapi-241811190Оценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-242429455Оценок пока нет

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Оценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Оценок пока нет

- Accounting Chapter 9 Eportfolio ExcelДокумент12 страницAccounting Chapter 9 Eportfolio Excelapi-273030710Оценок пока нет

- Acct 2020 Excel Budget Problem Student Template 1 AutosavedДокумент10 страницAcct 2020 Excel Budget Problem Student Template 1 Autosavedapi-273073964Оценок пока нет

- 1 PhototecДокумент3 страницы1 Phototecalice horanОценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-242720692Оценок пока нет

- Excell Budget Assignment-Master BudgetДокумент6 страницExcell Budget Assignment-Master Budgetapi-213470756Оценок пока нет

- Final Project Master Budget by Amit ShankarДокумент9 страницFinal Project Master Budget by Amit Shankarapi-242858911Оценок пока нет

- Cost Accounting 9 EditionДокумент11 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Carolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1Документ8 страницCarolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1api-284502690Оценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент5 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265Оценок пока нет

- FinalaccountingprojectДокумент14 страницFinalaccountingprojectapi-242856546Оценок пока нет

- 1 PhototecДокумент3 страницы1 PhototecKaishe RamosОценок пока нет

- Book 1Документ2 страницыBook 1tuanОценок пока нет

- Wasatch ManufacturingДокумент12 страницWasatch Manufacturingapi-301899907Оценок пока нет

- Sales and Distribution of Britannia Industriesltd..Документ17 страницSales and Distribution of Britannia Industriesltd..Praveen RajanОценок пока нет

- Acct 2020 Excel Budget ProblemДокумент4 страницыAcct 2020 Excel Budget Problemapi-241815288Оценок пока нет

- CH 10 BudgetingДокумент83 страницыCH 10 BudgetingShannon BánañasОценок пока нет

- Budgeting - Planning: A325 Discussion - March 19, 2012Документ8 страницBudgeting - Planning: A325 Discussion - March 19, 2012alfaОценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент10 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Master BudgetingДокумент11 страницMaster BudgetingsulavnepalОценок пока нет

- Excel HomeworkДокумент9 страницExcel Homeworkapi-248528639Оценок пока нет

- Chapter 9 Excel Budget AssignmentДокумент4 страницыChapter 9 Excel Budget Assignmentapi-261038165Оценок пока нет

- Cash Sales 1821500 2305850 Credit Sales 3407200 4521000 Returns From Customers 21,300 48,550 Cost of Goods Sold 4452320 5422640Документ10 страницCash Sales 1821500 2305850 Credit Sales 3407200 4521000 Returns From Customers 21,300 48,550 Cost of Goods Sold 4452320 5422640rohitdhallОценок пока нет

- Class 4 QuestionsДокумент24 страницыClass 4 QuestionsKeylia SeniorkklooОценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент4 страницыWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-240678692Оценок пока нет

- BudgetingДокумент74 страницыBudgetingRevathi AnandОценок пока нет

- Management AccountingДокумент12 страницManagement AccountingKathlyn Ann MasilОценок пока нет

- Answer in BudgetingДокумент9 страницAnswer in BudgetingkheymiОценок пока нет

- Acct 2020 Emily RufenerДокумент4 страницыAcct 2020 Emily Rufenerapi-284746082Оценок пока нет

- Taparick 20140830Документ31 страницаTaparick 20140830Prakash Philip ZachariaОценок пока нет

- 5Документ3 страницы5RenОценок пока нет

- BudgetingДокумент130 страницBudgetingRevathi AnandОценок пока нет

- Operations ManagementДокумент5 страницOperations ManagementskripsianyaОценок пока нет

- Marking Scheme: Section AДокумент8 страницMarking Scheme: Section Aaegean123Оценок пока нет

- Material BudgetДокумент37 страницMaterial BudgetRahul SardaОценок пока нет

- April May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total RevenueДокумент18 страницApril May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total Revenueyonna anggrelinaОценок пока нет

- CH 3 Cost Accounting Matz 7edДокумент27 страницCH 3 Cost Accounting Matz 7edZainab Abizer Merchant50% (8)

- BTNC3 - Nhom 8Документ7 страницBTNC3 - Nhom 8Lê LinhhОценок пока нет

- ch9 Final EditionДокумент6 страницch9 Final Editionapi-291516969Оценок пока нет

- FinMan HomeworkДокумент6 страницFinMan HomeworkMaria Kathreena Andrea AdevaОценок пока нет

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryОт EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Historia Del Mondonguito A La ItalianaДокумент7 страницHistoria Del Mondonguito A La ItalianaJuan OrocoОценок пока нет

- Chapter 21Документ4 страницыChapter 21Rahila RafiqОценок пока нет

- Chapter 20 NotesДокумент17 страницChapter 20 NotesRahila RafiqОценок пока нет

- Chapter 17 NotesДокумент8 страницChapter 17 NotesRahila RafiqОценок пока нет

- Chapter 20Документ5 страницChapter 20Rahila RafiqОценок пока нет

- Chapter 17Документ6 страницChapter 17Rahila RafiqОценок пока нет

- Chapter 12Документ7 страницChapter 12Rahila RafiqОценок пока нет

- Chapter 12 NotesДокумент18 страницChapter 12 NotesRahila RafiqОценок пока нет

- Chapter 8 CorrectedДокумент10 страницChapter 8 CorrectedRahila RafiqОценок пока нет

- Chapter 11Документ3 страницыChapter 11Rahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент5 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент19 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Cost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSДокумент16 страницCost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSRahila Rafiq0% (1)

- Chapter 1Документ28 страницChapter 1Rahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент11 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Notes Receivable - Measurement and Determination of Interest ExpenseДокумент6 страницNotes Receivable - Measurement and Determination of Interest ExpenseMiles SantosОценок пока нет

- BPD AssignmentДокумент2 страницыBPD AssignmentSoniya ShahuОценок пока нет

- Bangladesh-India DTAA PDFДокумент7 страницBangladesh-India DTAA PDFmajumdar.sayanОценок пока нет

- Australian Unity Rebate FormДокумент2 страницыAustralian Unity Rebate FormpmarteeneОценок пока нет

- PaymentReceipt 22330358715495Документ3 страницыPaymentReceipt 22330358715495nurgazymazhОценок пока нет

- International Finance - Questions Exercises 2023Документ5 страницInternational Finance - Questions Exercises 2023quynhnannieОценок пока нет

- Quiz 2Документ9 страницQuiz 2yuvita prasadОценок пока нет

- Economic Roundtable ReleaseДокумент1 страницаEconomic Roundtable Releaseapi-25991145Оценок пока нет

- FAR 4204 (Receivables)Документ10 страницFAR 4204 (Receivables)Maximus100% (1)

- Quiz 9Документ3 страницыQuiz 9朱潇妤100% (1)

- Accounts PayableДокумент29 страницAccounts PayableDiane RoallosОценок пока нет

- This Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Документ4 страницыThis Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Ruhul AminОценок пока нет

- Travel Hunt Mail - 01 Night 02 Days Yercaud Tour Package - Travel HuntДокумент2 страницыTravel Hunt Mail - 01 Night 02 Days Yercaud Tour Package - Travel HuntsalesОценок пока нет

- FINANCIAL RISK MANAGEMENT TEST 1 AnswersДокумент2 страницыFINANCIAL RISK MANAGEMENT TEST 1 AnswersLang TranОценок пока нет

- Sanction Letter MitaBrickДокумент15 страницSanction Letter MitaBricktarique2009Оценок пока нет

- WineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKERДокумент25 страницWineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKERBrad DempseyОценок пока нет

- CBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City MarketДокумент5 страницCBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City Marketvl coderОценок пока нет

- TEST-24: VisionДокумент64 страницыTEST-24: VisionSanket Basu RoyОценок пока нет

- Property Law II - ContentsДокумент12 страницProperty Law II - Contentsdanyal860Оценок пока нет

- 1BS0 01 Que 20211123Документ24 страницы1BS0 01 Que 20211123Omar BОценок пока нет

- Mid AFA-II 2020Документ2 страницыMid AFA-II 2020CRAZY SportsОценок пока нет

- Schedule and FormulasДокумент55 страницSchedule and FormulasRodmae VersonОценок пока нет

- I Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdДокумент2 страницыI Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdMuhammad Dennis AnzarryОценок пока нет