Академический Документы

Профессиональный Документы

Культура Документы

Bondholders Would Lose More Than $1 Trillion If Yields Spike - BIS - Reuters

Загружено:

Tan SoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bondholders Would Lose More Than $1 Trillion If Yields Spike - BIS - Reuters

Загружено:

Tan SoАвторское право:

Доступные форматы

Bondholders would lose more than $1 trillion if yields spike - BIS | Reuters

EDITION: U.S.

Register

Sign In

Search News & Quotes

Home

Business

Markets

World

Politics

Tech

Opinion

Breakingviews

Money

Life

Pictures

Video

ARTICLE

COMMENTS(2)

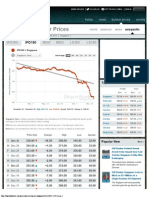

Bondholders would lose more than $1 trillion if yields spike - BIS

Recommend 24 people recommend this. Sign Up to see what your friends recommend. Tweet 1

By Alan Wheatley, Global Economics Correspondent

LONDON, June 23 | Sun Jun 23, 2013 10:00am EDT

(Reuters) - Bondholders in the United States alone would lose more than $1 trillion if yields leap, showing how urgent it is for governments to put their finances in order, the Bank for International Settlements said on Sunday.

The Basel-based BIS lambasted firms and households as well as the public sector for not making good use of the time bought by ultra-loose monetary policy, which it said had ended up creating new financial strains and delaying rather than encouraging necessary economic adjustments. The BIS, a grouping of central banks, was one of the few organisations to foresee the global financial crisis that erupted in 2008. Since then, government bond yields have sunk as investors seek a traditionally safe place to park funds, regulators tell banks to hold more bonds and central banks buy bonds as a means of pumping money into vulnerable economies. The BIS said in its annual report that a rise in bond yields of 3 percentage points across the maturity spectrum would inflict losses on U.S. bond

Login or register Follow Reuters

Latest from My Wire

Share

Share this Email Print Related News

Bernanke bond announcement 'inappropriately timed:' Fed's Bullard

Fri, Jun 21 2013

Bernanke says Fed likely to reduce bond buying this year

Wed, Jun 19 2013

Wall St. drops after Bernanke hints at slowing stimulus

Wed, Jun 19 2013

investors - excluding the Federal Reserve - of more than $1 trillion, or 8 percent of U.S. gross domestic product. The potential loss of value in government debt as a share of GDP is at a

IMF urges repeal of 'ill-designed' U.S. cuts

Fri, Jun 14 2013

RSS

YouTube

record high for most advanced economies, ranging from about 15 percent to 35 percent in France, Italy, Japan and Britain.

RECOMMENDED VIDEO

Kaeser is new king of Siemens (1:46)

"As foreign and domestic banks would be among those experiencing the losses, interest rate increases pose risks to the stability of the financial system if not executed with great care," the BIS said. "Clear central bank communication well in advance of any moves to tighten will be critical in this regard."

Bank of Japan stands pat, leaves door open for market calming steps

Tue, Jun 11 2013

Analysis & Opinion Bernanke should be international man of mystery

Squatters right, says student

http://www.reuters.com/article/2013/06/23/economy-global-bis-idUSL3N0EW3EZ20130623[5/08/2013 6:09:11 a.m.]

Bondholders would lose more than $1 trillion if yields spike - BIS | Reuters

toilet designer

Underlining the BIS's warning, U.S. bond prices slumped after Fed Chairman Ben Bernanke said on Wednesday that the U.S. central bank expected to reduce its pace of bond buying, now $85 billion a month, and cease purchases completely by mid-2014 if the economy continues to improve.

Miley Cyrus talks image change and controversy

Bernanke sets major challenges for his successor

Related Topics

The best Nokia Lumia ever? See what else everyone is

(Nokia Blog)

The BIS acknowledged that bond yields were unlikely to rise 3 percentage points overnight. But it noted that big moves can happen quickly: in 1994 yields in many advanced economies rose by about 2 percentage points in the course of a year.

Currencies Bonds News Bonds Markets

A Singapore strategy

(HSBC Global Connections) [?]

h JUST GET ON WITH IT

FINANCIAL COMMENTARIES AND GUIDES

Test-drive our CFD trading platform, without registering your details. (IG Markets) Test-drive our CFD trading platform, without registering your details. (IG Markets) Test-drive our CFD trading platform, without registering your details. (IG Markets) Test-drive our CFD trading platform, without registering your details. (IG Markets) Test-drive our CFD trading platform, without registering your details. (IG Markets)

Brushing aside the contention that austerity is counterproductive, the BIS said countries must redouble their efforts to make their debt manageable because growth alone will not do the job. "Over indebtedness is one of the major barriers on the path to growth after a financial crisis. Borrowing more year after year is not the cure," the report said. The fiscal adjustments required in rich countries are especially sizeable when projected increases in age-related spending are taken into account. Indeed, the adjustments are so large that governments are likely instead to water down entitlements such as pensions, the report said. Not only has the debt of households, firms and governments increased as a share of GDP in most countries since 2007, but debt-service ratios are now higher in most rich countries than the 19952007 average - despite low interest rates. The country with the highest debt ratio is Sweden. And governments have balked at labour and product market reforms, despite overwhelming evidence that making it cheaper to lay off workers and reducing the barriers to competition in sectors such as retailing would deliver a big boost to growth. Expecting monetary policy to solve these problems is a recipe for failure, the BIS said.

READ

Stephen Cecchetti, the BIS's chief economist, said central banks could not do more without compounding the risks they have already created. "It is others that need to act, speeding up the hard but essential reform and repair work to unlock productivity and employment growth. Continuing to wait will not make things any easier, particularly as public support and patience erode," he said on a conference call.

CURRENCIES Recommend BONDS NEWS BONDS MARKETS

1 2 3 4 5

White House holds high-level meeting over security threat

03 Aug 2013

U.S. grand jury probing contractor that vetted Snowden: WSJ

03 Aug 2013

U.S. expected to say accused Fort Hood shooter carefully planned attack

12:13am EDT

24 people recommend this. Sign Up to see what your friends recommend. Link this Share this Digg this Email Reprints

Restaurant chain says salad linked to virus no longer served

03 Aug 2013

Tweet this

Thousands rally to support embattled Tunisia government

03 Aug 2013

We welcome comments that advance the story through relevant opinion, anecdotes, links and data. If you see a comment that you believe is irrelevant or inappropriate, you can flag it to our editors by using the report abuse links. Views expressed in the comments do not represent those of Reuters. For more information on our comment policy, see http://blogs.reuters.com/fulldisclosure/2010/09/27/toward-a-more-thoughtful-conversation-on-stories/

Comments (2)

birder wrote:

Snowden leaves Moscow airport, gets refugee status in Russia

DISCUSSED

228 197

And the Fed stands to loose the most having bought the most. Serves them right.

Jun 23, 201310:51am EDT--Report as abuse

Obama to propose grand bargain on corporate tax rate, infrastructure

huckel wrote: The FED did wonders in helping the economy recover from a disaster. Mr Bernake has got the timing right to start pulling out of the buying program. But it will mean that there will be a new time of volatility

http://www.reuters.com/article/2013/06/23/economy-global-bis-idUSL3N0EW3EZ20130623[5/08/2013 6:09:11 a.m.]

Bondholders would lose more than $1 trillion if yields spike - BIS | Reuters

132

Threat to U.S. embassies appears al Qaeda-linked: lawmaker

ahead as the economy learns to walk again on it own 2 feet. Thank you Mr Bernake for helping us cross this difficult time.

Jun 23, 201311:18pm EDT--Report as abuse

This discussion is now closed. We welcome comments on our articles for a limited period after their publication.

SPONSORED LINKS

See All Comments

Reuters.com Legal Support & Contact Account Information Connect with Reuters About

EDITION: U.S.

Back to top

Business

Markets

World

Politics

Technology

Opinion

Money

Pictures

Videos

Site Index

Bankruptcy Law Support Register

California Legal

New York Legal

Securities Law

Corrections Sign In Facebook Terms of Use LinkedIn RSS Podcast AdChoices Newsletters Copyright Mobile

Twitter Privacy Policy

Advertise With Us

Thomsonreuters.com About Thomson Reuters Our Flagship financial information platform incorporating Reuters Insider An ultra-low latency infrastructure for electronic trading and data distribution A connected approach to governance, risk and compliance Our next generation legal research platform Our global tax workstation Investor Relations Careers Contact Us

Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.com, video, mobile, and interactive television platforms. Thomson Reuters journalists are subject to an Editorial Handbook which requires fair presentation and disclosure of relevant interests. NYSE and AMEX quotes delayed by at least 20 minutes. Nasdaq delayed by at least 15 minutes. For a complete list of exchanges and delays, please click here.

http://www.reuters.com/article/2013/06/23/economy-global-bis-idUSL3N0EW3EZ20130623[5/08/2013 6:09:11 a.m.]

Вам также может понравиться

- Q2 2020 Letter BaupostДокумент16 страницQ2 2020 Letter BaupostLseeyouОценок пока нет

- Cast Study - GM MotorsДокумент9 страницCast Study - GM MotorsAbdullahIsmailОценок пока нет

- America for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA SovereigntyОт EverandAmerica for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA SovereigntyРейтинг: 4 из 5 звезд4/5 (4)

- Rights and ObligationsДокумент5 страницRights and ObligationsAmace Placement KanchipuramОценок пока нет

- List of Standard Reports in Oracle EBSДокумент17 страницList of Standard Reports in Oracle EBSJilani Shaik100% (1)

- Goldilocks-All Bout GoldilocksДокумент13 страницGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- Aquaculture Feasibility StudyДокумент59 страницAquaculture Feasibility StudyTan SoОценок пока нет

- SocGen End of The Super Cycle 7-20-2011Документ5 страницSocGen End of The Super Cycle 7-20-2011Red911TОценок пока нет

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsОт EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsОценок пока нет

- Homework: Working Capital Management 2021coardbulji: ActivityДокумент3 страницыHomework: Working Capital Management 2021coardbulji: ActivityMa Teresa B. CerezoОценок пока нет

- P5-1A Dan P5-2AДокумент6 страницP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- In The NewsДокумент6 страницIn The Newsapi-244981307Оценок пока нет

- Cityam 2011-09-30Документ48 страницCityam 2011-09-30City A.M.Оценок пока нет

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeДокумент1 553 страницыEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassОценок пока нет

- Financial News Articles - COMPLETE ARCHIVEДокумент319 страницFinancial News Articles - COMPLETE ARCHIVEKeith KnightОценок пока нет

- Economic Downturn Guide 1Документ32 страницыEconomic Downturn Guide 1Corina HerreraОценок пока нет

- The "Wall Street Greed Tax"Документ3 страницыThe "Wall Street Greed Tax"ValuEngine.comОценок пока нет

- 1NC Foster R2Документ14 страниц1NC Foster R2Saje BushОценок пока нет

- 2009-10-26 GF&Co - TBTF (Too Bought To Function)Документ7 страниц2009-10-26 GF&Co - TBTF (Too Bought To Function)Joshua RosnerОценок пока нет

- Coronavirus: Fear Returns To Stock MarketsДокумент47 страницCoronavirus: Fear Returns To Stock MarketsFloramae PasculadoОценок пока нет

- The King Report: M. Ramsey King Securities, IncДокумент3 страницыThe King Report: M. Ramsey King Securities, InctheFranc23Оценок пока нет

- El Panorama Reciente de La Crisis y El FEDДокумент3 страницыEl Panorama Reciente de La Crisis y El FEDriemmaОценок пока нет

- Global Market Outlook July 2011Документ8 страницGlobal Market Outlook July 2011IceCap Asset ManagementОценок пока нет

- Ayushi ProjectДокумент15 страницAyushi ProjectgopalsfzОценок пока нет

- Issue 31 Citigroup CEO Vikram Pandit Suggests New Way To Gauge RiskДокумент6 страницIssue 31 Citigroup CEO Vikram Pandit Suggests New Way To Gauge RiskrajuandramaОценок пока нет

- Mark Kleinman: Warning: Slow Growth AheadДокумент31 страницаMark Kleinman: Warning: Slow Growth AheadCity A.M.Оценок пока нет

- 7-12-11 Too Big To FailДокумент3 страницы7-12-11 Too Big To FailThe Gold SpeculatorОценок пока нет

- Tong Hop 1Документ11 страницTong Hop 1fastman01Оценок пока нет

- Key Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures VideoДокумент23 страницыKey Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures Videosujeet1077Оценок пока нет

- Rising Bond Yields. This Is Just The Start: Dhara RanasingheДокумент7 страницRising Bond Yields. This Is Just The Start: Dhara Ranasinghesolo66Оценок пока нет

- January 19, 2013 - February 1, 2013: Maryland Tax Credit Bill Aims To Spur Commercial DevelopmentДокумент4 страницыJanuary 19, 2013 - February 1, 2013: Maryland Tax Credit Bill Aims To Spur Commercial DevelopmentAnonymous Feglbx5Оценок пока нет

- GreyOwl Q4 LetterДокумент6 страницGreyOwl Q4 LetterMarko AleksicОценок пока нет

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Документ5 страницMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatОценок пока нет

- 2008 PTSD VS The Ghosts of The 1970SДокумент7 страниц2008 PTSD VS The Ghosts of The 1970SnanuWe SlaОценок пока нет

- Current and Likely Future Impact of Coronavirus Outbreak On The U.S Stock MarketДокумент12 страницCurrent and Likely Future Impact of Coronavirus Outbreak On The U.S Stock MarketMahnum TahirОценок пока нет

- The Pensford Letter - 3.12.12Документ5 страницThe Pensford Letter - 3.12.12Pensford FinancialОценок пока нет

- Powell 20200519 AДокумент8 страницPowell 20200519 Ajack venitraОценок пока нет

- Calm Before Another Global Market Storm Cooper ' and Given Just HowДокумент12 страницCalm Before Another Global Market Storm Cooper ' and Given Just HowAlbert L. PeiaОценок пока нет

- WWW - Treasury.gov Connect Blog Documents FinancialCrisis5Yr vFINALДокумент25 страницWWW - Treasury.gov Connect Blog Documents FinancialCrisis5Yr vFINALMichael LindenbergerОценок пока нет

- Stock Market Crash of 2008Документ4 страницыStock Market Crash of 2008Azzia Morante LopezОценок пока нет

- Morning News Notes: 2010-12-14Документ2 страницыMorning News Notes: 2010-12-14glerner133926Оценок пока нет

- A Truly Magical Finale For Potter and Co: Our Thumbs UpДокумент24 страницыA Truly Magical Finale For Potter and Co: Our Thumbs UpCity A.M.Оценок пока нет

- Euro Defeat Leaves Villas-Boas On Brink: Chelsea Lose in NaplesДокумент36 страницEuro Defeat Leaves Villas-Boas On Brink: Chelsea Lose in NaplesCity A.M.Оценок пока нет

- The Pensford Letter - 1.28.13Документ6 страницThe Pensford Letter - 1.28.13Pensford FinancialОценок пока нет

- KCMJune 10Документ3 страницыKCMJune 10amit.chokshi2353Оценок пока нет

- How Long Is The Subprime TunnelДокумент6 страницHow Long Is The Subprime TunnelAlampilli BaburajОценок пока нет

- David Einhorn NYT-Easy Money - Hard TruthsДокумент2 страницыDavid Einhorn NYT-Easy Money - Hard TruthstekesburОценок пока нет

- Newsletter March 2015 FinalДокумент9 страницNewsletter March 2015 FinalavishathakkarОценок пока нет

- Big Business and Bad GovernmentДокумент12 страницBig Business and Bad GovernmentJamaal MorganОценок пока нет

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Документ17 страницThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenОценок пока нет

- The Monarch Report 6-18-2012Документ4 страницыThe Monarch Report 6-18-2012monarchadvisorygroupОценок пока нет

- The Global Outlook Isn't Bad. But When Will It Be Good?Документ6 страницThe Global Outlook Isn't Bad. But When Will It Be Good?api-227433089Оценок пока нет

- March 292010 PostsДокумент12 страницMarch 292010 PostsAlbert L. PeiaОценок пока нет

- Markets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSДокумент48 страницMarkets Hit As Euro Hopes Fade: FSA: Beef Up EU Rules After RBSCity A.M.Оценок пока нет

- Print ArticleДокумент2 страницыPrint ArticleJinwoo KimОценок пока нет

- The Paralympics Are Coming To London: Year To Go PreviewДокумент32 страницыThe Paralympics Are Coming To London: Year To Go PreviewCity A.M.Оценок пока нет

- Ben Bernanke Testimony B-F Congress 4-3-08Документ7 страницBen Bernanke Testimony B-F Congress 4-3-08TNT1842Оценок пока нет

- Moody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)Документ136 страницMoody's: Regional Banks On Review For Downgrade (AP) Consumer Confidence Dims (Reuters)Albert L. PeiaОценок пока нет

- The Big Mac IndexДокумент2 страницыThe Big Mac IndexParilla13Оценок пока нет

- Climbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Документ3 страницыClimbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Anonymous Feglbx5Оценок пока нет

- U.S. Jobless Claims Fall To Lowest in Four and Half YearsДокумент6 страницU.S. Jobless Claims Fall To Lowest in Four and Half YearsChristian SalazarОценок пока нет

- Koo Read+ +dec+14+2010+ +Roller+Coaster+Ride+for+Bond+MarketДокумент10 страницKoo Read+ +dec+14+2010+ +Roller+Coaster+Ride+for+Bond+Marketavicohen85Оценок пока нет

- Fiscal Economical Analysis Based On Pandemic COVID-19: Avijit RoyДокумент6 страницFiscal Economical Analysis Based On Pandemic COVID-19: Avijit RoyAvijit Pratap RoyОценок пока нет

- How The West Fell Out of Love With Economic Growth - The EconomistДокумент8 страницHow The West Fell Out of Love With Economic Growth - The EconomistDito InculoОценок пока нет

- Water TimerДокумент13 страницWater TimerTan SoОценок пока нет

- Goldman Sachs Denies S'Pore Stock Dump - KINIBIZДокумент2 страницыGoldman Sachs Denies S'Pore Stock Dump - KINIBIZTan SoОценок пока нет

- Ultrasound Shown To Be Potentially Safe, Effective Way To Kill Bacteria - ScienceDailyДокумент7 страницUltrasound Shown To Be Potentially Safe, Effective Way To Kill Bacteria - ScienceDailyTan SoОценок пока нет

- Tax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetДокумент2 страницыTax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetTan SoОценок пока нет

- cl650 Chiller ManualДокумент4 страницыcl650 Chiller ManualTan So0% (1)

- The Stock Market Just Experienced The Most Seismic Shift From Growth To Value Since Lehman Brothers, Says Nomura - MarketWatch PDFДокумент6 страницThe Stock Market Just Experienced The Most Seismic Shift From Growth To Value Since Lehman Brothers, Says Nomura - MarketWatch PDFTan SoОценок пока нет

- Fish and Aquaculture: Executive SummaryДокумент10 страницFish and Aquaculture: Executive SummaryTan SoОценок пока нет

- Philips 170s4 Monitor Power Board PDFДокумент4 страницыPhilips 170s4 Monitor Power Board PDFTan SoОценок пока нет

- QN902x Hardware Application Note v0.7 PDFДокумент25 страницQN902x Hardware Application Note v0.7 PDFTan So100% (1)

- Air-Con For B2, C Class in TTSHДокумент4 страницыAir-Con For B2, C Class in TTSHTan SoОценок пока нет

- Singapore Latest Bunker Prices Ship & Bunker PDFДокумент2 страницыSingapore Latest Bunker Prices Ship & Bunker PDFTan SoОценок пока нет

- Billionaires Dumping Stocks, Economist Knows WhyДокумент4 страницыBillionaires Dumping Stocks, Economist Knows WhyTan SoОценок пока нет

- TEA1533AP (170B4 - 170C4 - 170N4 - 170S4 - 170X4) Service Notes - Power & Inverter SchematicsДокумент9 страницTEA1533AP (170B4 - 170C4 - 170N4 - 170S4 - 170X4) Service Notes - Power & Inverter SchematicsAntonio MacedoОценок пока нет

- Nuclear in Singapore Malaysian Nuclear Society (MNS)Документ2 страницыNuclear in Singapore Malaysian Nuclear Society (MNS)Tan SoОценок пока нет

- Five Banks Account For 96% of $250 Trillion in Outstanding US Derivative Exposure - Global ResearchДокумент4 страницыFive Banks Account For 96% of $250 Trillion in Outstanding US Derivative Exposure - Global ResearchTan SoОценок пока нет

- Social Progress Index 2014 Report (Main Pages)Документ3 страницыSocial Progress Index 2014 Report (Main Pages)Tan SoОценок пока нет

- CPF Life Payout SammyBoy ForumДокумент4 страницыCPF Life Payout SammyBoy ForumTan SoОценок пока нет

- "Shadow Banking" The Performance of Active U.S. Regulators Nerves - Stock Market TodayДокумент4 страницы"Shadow Banking" The Performance of Active U.S. Regulators Nerves - Stock Market TodayTan SoОценок пока нет

- Pimco Bond Guru Bill Gross Bets On TIPS and Loses - BusinessweekДокумент4 страницыPimco Bond Guru Bill Gross Bets On TIPS and Loses - BusinessweekTan SoОценок пока нет

- The 441 TRILLION Dollar Interest Rate Derivatives Time BombДокумент5 страницThe 441 TRILLION Dollar Interest Rate Derivatives Time BombTan SoОценок пока нет

- A Cruel, Cruel Summer For U.S. Credit Funds - ReutersДокумент5 страницA Cruel, Cruel Summer For U.S. Credit Funds - ReutersTan SoОценок пока нет

- 'Shadow Banking' Still Thrives, System Hits $67 TrillionДокумент4 страницы'Shadow Banking' Still Thrives, System Hits $67 TrillionTan SoОценок пока нет

- Some Key StatisticsДокумент25 страницSome Key StatisticsTan SoОценок пока нет

- Weather and Rheumatism - Arthritis - FibromyalgiaДокумент2 страницыWeather and Rheumatism - Arthritis - FibromyalgiaTan So100% (1)

- Aquarium InsulationДокумент1 страницаAquarium InsulationTan SoОценок пока нет

- Microsoft Word - 50-3100RДокумент2 страницыMicrosoft Word - 50-3100RTan SoОценок пока нет

- Fuji Ceramics CorporationДокумент2 страницыFuji Ceramics CorporationTan SoОценок пока нет

- Lesson No.1 Investment and Portfolio ManagementДокумент36 страницLesson No.1 Investment and Portfolio ManagementBangalisan, Jocelyn S.Оценок пока нет

- Summary List of QP NOS As On 23rd August 11 Sep 2017Документ96 страницSummary List of QP NOS As On 23rd August 11 Sep 2017Pavan Kumar NarendraОценок пока нет

- Indian Aluminium IndustryДокумент6 страницIndian Aluminium IndustryAmrisha VermaОценок пока нет

- Decision Areas in Financial ManagementДокумент15 страницDecision Areas in Financial ManagementSana Moid100% (3)

- Form 1040-ES: Purpose of This PackageДокумент12 страницForm 1040-ES: Purpose of This PackageBill ChenОценок пока нет

- Tci Freight NL01AA2959 261354914 31.12.2020Документ1 страницаTci Freight NL01AA2959 261354914 31.12.2020Doita Dutta ChoudhuryОценок пока нет

- (PPT) Performance of Systematic Investment Plan On Selected Mutual Funds - SynopsisДокумент9 страниц(PPT) Performance of Systematic Investment Plan On Selected Mutual Funds - SynopsiskhayyumОценок пока нет

- TB Chapter 01Документ28 страницTB Chapter 01josephnikolaiОценок пока нет

- FIP Assignment # 2Документ11 страницFIP Assignment # 2talhashafqaatОценок пока нет

- Credit Risk PlusДокумент14 страницCredit Risk PlusAliceОценок пока нет

- Annexa Prime Trading CoursesДокумент11 страницAnnexa Prime Trading CoursesFatima FX100% (1)

- Personal Finance: Prelim Quiz 1 15/15Документ6 страницPersonal Finance: Prelim Quiz 1 15/15Baduday SicatОценок пока нет

- Important Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesДокумент1 страницаImportant Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDaljeet SinghОценок пока нет

- Class NotesДокумент24 страницыClass NotesRajat tiwariОценок пока нет

- Review 105 - Day 4 Theory of AccountsДокумент13 страницReview 105 - Day 4 Theory of Accountschristine anglaОценок пока нет

- CE Lecture# 03Документ22 страницыCE Lecture# 03ATTA100% (1)

- FileДокумент1 страницаFileArs HadОценок пока нет

- COVID-19 Outbreak: Impact On Sri Lanka and RecommendationsДокумент19 страницCOVID-19 Outbreak: Impact On Sri Lanka and RecommendationsMohamed FayazОценок пока нет

- LESSON5Документ5 страницLESSON5Ira Charisse BurlaosОценок пока нет

- Econet Wireless Annual Report 2013Документ139 страницEconet Wireless Annual Report 2013bobbyr01norОценок пока нет

- Metadvantageplus BrochureДокумент6 страницMetadvantageplus BrochureyatinthoratscrbОценок пока нет

- Mega KPI BundleДокумент11 страницMega KPI Bundlepepito.supermarket.baliОценок пока нет

- Ketan Parekh ScamДокумент2 страницыKetan Parekh Scamrehan husainОценок пока нет

- A131 Tutorial 1 QДокумент9 страницA131 Tutorial 1 QJu RaizahОценок пока нет