Академический Документы

Профессиональный Документы

Культура Документы

What Is A Financial Agreement

Загружено:

gadgit7Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What Is A Financial Agreement

Загружено:

gadgit7Авторское право:

Доступные форматы

What is a Binding Financial Agreement?

In Australian law, a Binding Financial Agreement (BFA) is a written contract, which complies with Part VIIIA or Part VIIIAB of the Family Law Act 1975 (the Act). Financial agreements allow couples to set out how they will divide assets and liabilities such as houses, shares, money, cars, personal property and debt etc, in the event of a relationship breakdown. Since the amendments to the Family Law Act (March 2009) all couples regardless of gender or marital or de facto status can enjoy the protection and certainty that financial agreements provide. This means that you can use a financial agreement if: You are plan to get married and wish to set out the financial arrangements of your union Pre Nuptial Agreement. If you decide to put an agreement in place after the wedding this is called a Post Nuptial Agreement. You are living together (heterosexual or same sex couple) Cohabitation Agreement. You can also put an agreement in place BEFORE you move in together. You are separating and wish to formalise the property settlement Separation Agreement.

Why use a Financial Agreement?

Primarily Financial Agreements were introduced as a non-combative method of allowing couples to decide between themselves how property should be divided, thus freeing up the Family Court system. When a BFA is correctly executed and put in place, it prevents either party making an application to the Family Court for the division of assets in a property settlement. There are a number of advantages to using Financial Agreements. You can: Avoid potentially divisive issues that could arise if you ever separate. Specify ground rules for buying and owning property.

Coordinate and support your estate plans, to be sure that family property passes as you wish. Avoids costly litigation following a relationship breakdown.

RP Emery and Associates provide low cost Financial Agreement Templates that will allow you to put an agreement in place without spending a fortune. We also offer the fixed price Review Service so you can obtain your Certificate of Advice to make your FA binding. For more information see www.financialagreements.com.au

Can anybody use Financial Agreements?

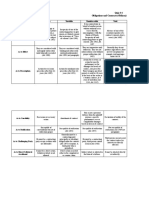

Making your own FA works best when you are prepared to talk to your partner openly and amicably about your arrangements. We like to refer to our system as The Peaceful Path to Settlement its about the couple working together to decide what they want to do so that they can minimise conflict, emotional and financial stress. Agreements for De facto Couples and Same Sex Couples __Pre De Facto 90UB _____De Facto/Cohabitation Agreement 90UC _________De Facto Separation Agreement 90UD Agreements for Married Couples __Prenup / Pre Nuptial Agreement 90B ____Post Nuptial Agreement 90C _______Separation Agreement 90C __________Divorce Agreement 90D

Financial Agreements Common Names

The term Financial Agreement is an umbrella term to describe an agreement more commonly know as either a pre nuptial (pre nup, prenup, prenuptial, prenuptual) agreement, a cohabitation agreement, a defacto agreement, a post nuptial agreement, a

marriage agreement, or a separation agreement. Each of these agreements are more accurately known as financial agreements under the appropriate section of the Family law Act 1975.

RP Emery and Associates 2013

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Nicolas V RomuloДокумент7 страницNicolas V RomuloJohn Basil ManuelОценок пока нет

- From Empire To Commonwealth: Simeon Dörr, English, Q2Документ35 страницFrom Empire To Commonwealth: Simeon Dörr, English, Q2S DОценок пока нет

- Amendment Procedure in USAДокумент22 страницыAmendment Procedure in USAVibhuti SharmaОценок пока нет

- AZMI Arifin Perak Disturbances 1871-75: British Colonialism, The Chinese Secret Societies and The Malay RulersДокумент26 страницAZMI Arifin Perak Disturbances 1871-75: British Colonialism, The Chinese Secret Societies and The Malay RulersMohamad Fazwan Bin Mohd NasirОценок пока нет

- Study Material Cum Question Bank Jaipur FinalДокумент301 страницаStudy Material Cum Question Bank Jaipur FinalAnuj DadhichОценок пока нет

- Adil Najam - Trade & EnvironmentДокумент278 страницAdil Najam - Trade & EnvironmentJack BagelzОценок пока нет

- Gobinda Khanal Final Thesis DoalosДокумент135 страницGobinda Khanal Final Thesis DoalosLeulОценок пока нет

- The American War of IndependenceДокумент45 страницThe American War of IndependenceSrikanth PeriОценок пока нет

- Case Digest IV Delegation of PowersДокумент16 страницCase Digest IV Delegation of PowersHazel ManuelОценок пока нет

- Liner ConferencesДокумент96 страницLiner ConferencesKate GrobnickОценок пока нет

- India and International LawДокумент4 страницыIndia and International LawganeshОценок пока нет

- Trends and Determinants of Investment - UNCTAD 1998Документ445 страницTrends and Determinants of Investment - UNCTAD 1998Bui Thu HaОценок пока нет

- Contagious: S.NO Karaka Description - Significations (7 Bhava) Primary Cusps Supporting Cusps Planets LinkedДокумент1 страницаContagious: S.NO Karaka Description - Significations (7 Bhava) Primary Cusps Supporting Cusps Planets LinkedramachariОценок пока нет

- Alberto, Jenner S. Quiz # 4 Bsa Ii Obligations and Contracts (Oblicon)Документ2 страницыAlberto, Jenner S. Quiz # 4 Bsa Ii Obligations and Contracts (Oblicon)Jen NerОценок пока нет

- The Myth of Migration 2008 - Hein de Haas PDFДокумент19 страницThe Myth of Migration 2008 - Hein de Haas PDFMaurício Mühlmann ErthalОценок пока нет

- Employment AgreementДокумент4 страницыEmployment AgreementRocketLawyer80% (5)

- (The European Union Series) Neill Nugent (Auth.) - The Government and Politics of The European Union-Macmillan Education UK (1999) PDFДокумент590 страниц(The European Union Series) Neill Nugent (Auth.) - The Government and Politics of The European Union-Macmillan Education UK (1999) PDFklemiОценок пока нет

- A World of RegionsДокумент2 страницыA World of RegionsMikael Dominik AbadОценок пока нет

- Kyoto ProtocolДокумент4 страницыKyoto ProtocolShraddha BahiratОценок пока нет

- Silver Chain Group Limited National Non Nursing Enterprise Agreement 2017 PDFДокумент56 страницSilver Chain Group Limited National Non Nursing Enterprise Agreement 2017 PDFshnauserОценок пока нет

- The Napoleonic WarsДокумент226 страницThe Napoleonic WarsDori Bear100% (23)

- Chapter 19 - Age of Napoleon and The Triumph of RomanticismДокумент18 страницChapter 19 - Age of Napoleon and The Triumph of RomanticismPaigegabriellex3Оценок пока нет

- Union of Filipro Va Nestle DigestДокумент2 страницыUnion of Filipro Va Nestle DigestGoodyОценок пока нет

- Use of Force in International LawДокумент25 страницUse of Force in International LawRaGa JoThiОценок пока нет

- 6 Europoean Union Studies TE 2020Документ48 страниц6 Europoean Union Studies TE 2020Gamer HDОценок пока нет

- Start of RevolutionДокумент12 страницStart of RevolutionAiden PatsОценок пока нет

- Writings of Samuel Adams, VOL 4 1778-1802 Ed. Harry Alonzo Cushing 1904Документ464 страницыWritings of Samuel Adams, VOL 4 1778-1802 Ed. Harry Alonzo Cushing 1904Waterwind100% (2)

- Mintra Form 2Документ17 страницMintra Form 2Jose Luis QuispeОценок пока нет

- Sources of International Space Law - Jaku and FreelandДокумент19 страницSources of International Space Law - Jaku and FreelandIsha SenОценок пока нет

- History Assignment Part TwoДокумент2 страницыHistory Assignment Part TwoCj MwaleОценок пока нет