Академический Документы

Профессиональный Документы

Культура Документы

PO2013-35 Socialized Housing Special Account - Final Version

Загружено:

Bryan Cesar V. AsiaticoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PO2013-35 Socialized Housing Special Account - Final Version

Загружено:

Bryan Cesar V. AsiaticoАвторское право:

Доступные форматы

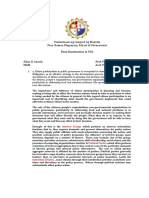

Approved on 3rd and Final Reading on June 24, 2013

Republic of the Philippines Quezon City CITY COUNCIL

PROPOSED ORDINANCE NO. 2013-35 (amended version)

AN ORDINANCE CREATING A SPECIAL ACCOUNT OUT OF THE PROCEEDS COLLECTED UNDER THE QUEZON CITY HOUSING PROGRAMS SUCH AS THE COMMUNITY MORTGAGE PROGRAM (CMP), DIRECT SALE OF CITY GOVERNMENT REAL PROPERTIES, SOCIALIZED HOUSING TAX (SHT), INCOME FROM THE NATIONAL GOVERNMENT CENTER EASTSIDE AND WESTSIDE DEVELOPMENT PROJECTS AND REAL PROPERTY TAX GENERATED FROM OTHER NEWLY ACQUIRED AND REDISTRIBUTED REAL PROPERTIES, ALL TO BE DEPOSITED IN A SPECIAL ACCOUNT TO BE KNOWN AS THE SOCIALIZED HOUSING SPECIAL ACCOUNT OF QUEZON CITY.

Introduced by Councilor ALEXIS R. HERRERA

WHEREAS, the Quezon City Government has made housing and resettlement a priority program and its implementation entails a huge amount of money; WHEREAS, under the Community Mortgage Program, the Quezon City Government derives revenues in the form of origination fees from the Socialized Housing Finance Corporation (SHFC) to accommodate priority socialized housing projects identified by the city; WHEREAS, as part of the Citys on-site development, the Quezon City Government acquires public lands through the Community Mortgage Program for socialized housing projects and redistribute them, while Quezon City-owned lands are offered through direct sale; WHEREAS, pursuant to the provisions of RA 7279 and the Department of Finance Local Finance Circular No. 1-97, 10 April 1997, the Quezon City Government is collecting the Socialized Housing Tax (SHT) in order to generate much needed funds for the Socialized Housing and Resettlement Program of the City Government; WHEREAS, the Socialized Housing Tax (SHT) under Ordinance No. SP-2095, S-2011 imposed an additional one-half (0.5%) percent tax on assessed value of all lands in urban areas in excess of P100,000.00 for five years. Twenty six (26%) percent of real property taxpayers in Quezon City are affected and subject to the Socialized Housing Tax (SHT); WHEREAS, Republic Act No. 9207 declared certain portions of the National Government Center site open for disposition to bona fide residents and local government or community facilities occupying the same for socio-economic, civic and religious purposes, amending Proclamation No. 1826, Series of 1979; WHEREAS, all real properties acquired by the City through the localized community mortgage program and disposed portions of the National Government Center, Housing and Development Projects which may have been distributed to qualified beneficiaries are subject to real property tax; WHEREAS, the real property tax accruing from these new acquisitions, not previously taxed, shall be regarded as special real property tax which will be a new source of income for the City and shall be deposited in the Special Account; WHEREAS, the special real property taxes of the newly acquired real properties shall be collected based on the assessed value of the real property net of the Special Education Fund

Approved on 3rd and Final Reading on June 24, 2013

and the 30% Barangay Share which are ordinarily collected jointly with the regular real property basic tax; WHEREAS, Ordinance No. SP-1973, S-2009 appropriated annually the amount of Eighteen Million Five Hundred Eighty Five Thousand (P18,585,000.00) Pesos for the approval of the Community Development Project of the National Government-Eastside Projects; WHEREAS, there is a need to safeguard the use of the said funds and see to it that the same shall be used exclusively for the Socialized Housing Program of the City Government; NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF QUEZON CITY, IN SESSION ASSEMBLED: SECTION 1. That a Special Account shall be created to be known as the Socialized Housing Special Account of Quezon City wherein the proceeds collected under the Quezon City housing programs such as the Community Mortgage Program (CMP), Direct Sale of City Government real properties, Socialized Housing Tax (SHT), income from the National Government Center Eastside and Westside development projects and real property tax generated from other newly acquired and redistributed real properties are to be deposited or credited. SECTION 2. No money from the Socialized Housing Special Account of Quezon City shall be disbursed without the approval of the Quezon City Local Housing Board. SECTION 3. This special account shall be reserved exclusively for the development and improvement of socialized housing projects of the City. SECTION 4. The Local Housing Board of Quezon City shall issue the implementing rules, regulation and guidelines for the proper implementation of this Ordinance, within a period of thirty (30) days from the approval hereof. SECTION 5. Any provision of Ordinances, Rules and Regulations inconsistent herewith are hereby repealed, amended or modified accordingly. SECTION 6. This Ordinance shall take effect immediately upon its approval.

Submitted by:

ALEXIS R HERRERA Councilor, First District

Вам также может понравиться

- F2848 - Power of Attorney and Declaration of Representative - InstructionsДокумент6 страницF2848 - Power of Attorney and Declaration of Representative - InstructionsAutochthon Gazette100% (3)

- Estmt - 2022 07 12Документ6 страницEstmt - 2022 07 12Pablo GutierrezОценок пока нет

- Ferrer, JR V. Herbert Bautista (G.R. No. 210551 June 30, 2015)Документ2 страницыFerrer, JR V. Herbert Bautista (G.R. No. 210551 June 30, 2015)SALMAN JOHAYRОценок пока нет

- How Is The CreationДокумент4 страницыHow Is The Creationeinel dcОценок пока нет

- Philippine Power & Development Co. franchise tax caseДокумент16 страницPhilippine Power & Development Co. franchise tax caseLou StellarОценок пока нет

- Tax Ation San Beda College of LAW - ALABANGДокумент52 страницыTax Ation San Beda College of LAW - ALABANGYour Public ProfileОценок пока нет

- Lala2017 Audit ReportДокумент146 страницLala2017 Audit ReportEm SanОценок пока нет

- Local Funds Management and UtilizationДокумент89 страницLocal Funds Management and UtilizationJennylyn Favila Magdadaro100% (7)

- INCIDENT REPORT FORM - Quezon City PDFДокумент2 страницыINCIDENT REPORT FORM - Quezon City PDFBryan Cesar V. AsiaticoОценок пока нет

- Local Fiscal AdministrationДокумент18 страницLocal Fiscal AdministrationLander Dean S. ALCORANOОценок пока нет

- LASON Notes on Local Government Tax PowersДокумент42 страницыLASON Notes on Local Government Tax PowersDon So HiongОценок пока нет

- Barangay Budget ExecutionДокумент6 страницBarangay Budget Executionlinden_07100% (1)

- Unit 9 Lesson 2 Decentralization and Local GovernanceДокумент25 страницUnit 9 Lesson 2 Decentralization and Local GovernancePatrixia Miclat0% (1)

- Alvarez Vs GuingonaДокумент3 страницыAlvarez Vs GuingonaKukaiSitonОценок пока нет

- Budget ProcessДокумент6 страницBudget Processjd_prgrin_coОценок пока нет

- Sample Appropriation OrdinanceДокумент2 страницыSample Appropriation OrdinanceMaria Fiona Duran MerquitaОценок пока нет

- LGU Budget Process GuideДокумент7 страницLGU Budget Process GuideKaren Santos100% (1)

- PO21CC - Anti Trafficking Ordinance - QC - ECPATДокумент17 страницPO21CC - Anti Trafficking Ordinance - QC - ECPATBryan Cesar V. AsiaticoОценок пока нет

- Local Housing Board (LHB) Model Ordinance No. 3Документ8 страницLocal Housing Board (LHB) Model Ordinance No. 3Alvin Claridades100% (2)

- Proposed Seoul ItineraryДокумент6 страницProposed Seoul ItineraryBryan Cesar V. AsiaticoОценок пока нет

- Ferrer v. Mayor Bautista (Digest)Документ3 страницыFerrer v. Mayor Bautista (Digest)Chimney sweep100% (2)

- Ferrer V Bautista DigestsДокумент3 страницыFerrer V Bautista Digestspinkblush717100% (1)

- Financing Philippine Local GovernmentsДокумент15 страницFinancing Philippine Local Governmentsjennivabe94% (34)

- San Juan City's Socialized Housing Tax CollectionДокумент10 страницSan Juan City's Socialized Housing Tax CollectionTaxation LawОценок пока нет

- Appropriation Ordinance No.Документ4 страницыAppropriation Ordinance No.Clarisse Marion DenilaОценок пока нет

- Local Finance Circular GuidelinesДокумент21 страницаLocal Finance Circular GuidelinesAh MhiОценок пока нет

- 4th Regional & Urban DevelopmentДокумент7 страниц4th Regional & Urban DevelopmentGhotna ChatterjeeОценок пока нет

- Republic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoДокумент18 страницRepublic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoMaryan MokamadОценок пока нет

- Pharma RefДокумент3 страницыPharma RefJanileah InfanteОценок пока нет

- Taxation QuestionsДокумент63 страницыTaxation QuestionsPrince EG DltgОценок пока нет

- PresentatiomДокумент33 страницыPresentatiomdarakravi12Оценок пока нет

- Budget Related Policies and Rates Schedules for 2011/2012Документ171 страницаBudget Related Policies and Rates Schedules for 2011/2012r_mukuyuОценок пока нет

- Quezon City, Section 3 of Which ProvidesДокумент2 страницыQuezon City, Section 3 of Which ProvidesMary AnneОценок пока нет

- Balayan2017 Audit ReportДокумент143 страницыBalayan2017 Audit ReportEnrico TabiaОценок пока нет

- The Peoples BudgetДокумент14 страницThe Peoples BudgetActionNewsJaxОценок пока нет

- On The Garbage Fee - UNCONSTITUTIONALДокумент2 страницыOn The Garbage Fee - UNCONSTITUTIONALLoОценок пока нет

- Final Consolidated Fiscal Policy - Dec 2014 PDFДокумент17 страницFinal Consolidated Fiscal Policy - Dec 2014 PDFRecordTrac - City of OaklandОценок пока нет

- Provincial Gazette Provinsiale Koerant: Free State Province Provinsie VrystaatДокумент5 страницProvincial Gazette Provinsiale Koerant: Free State Province Provinsie VrystaatThandi85Оценок пока нет

- Reclassification of Agricultural Lands Under Local Government CodeДокумент7 страницReclassification of Agricultural Lands Under Local Government CodeMark AlanОценок пока нет

- Development and Management of The BudgetДокумент5 страницDevelopment and Management of The Budgetpathanfor786Оценок пока нет

- O-2018-07 Birchwood PILOT (FINAL - Revised) PDFДокумент4 страницыO-2018-07 Birchwood PILOT (FINAL - Revised) PDFCranford1Оценок пока нет

- COA Circular 92-382 Local Government FundsДокумент13 страницCOA Circular 92-382 Local Government FundsDenni Dominic Martinez LeponОценок пока нет

- Ltom Book 1: Chapter 1: Fiscal Organization Chapter AssessmentДокумент1 страницаLtom Book 1: Chapter 1: Fiscal Organization Chapter AssessmentMarivic EspiaОценок пока нет

- Community Improvement District For Bowllagio (Maize 54 Development)Документ35 страницCommunity Improvement District For Bowllagio (Maize 54 Development)Bob WeeksОценок пока нет

- Plainview Grocery Store CID and TIF in Wichita, KansasДокумент15 страницPlainview Grocery Store CID and TIF in Wichita, KansasBob WeeksОценок пока нет

- Gazette 22 of 27 May 2011Документ10 страницGazette 22 of 27 May 2011Thandi85Оценок пока нет

- State Govt Scheme Improves Slum ConditionsДокумент6 страницState Govt Scheme Improves Slum Conditionsanju sureshОценок пока нет

- PO - Quarry Operators Guidelines Ordinance - Mco - Sept1Документ4 страницыPO - Quarry Operators Guidelines Ordinance - Mco - Sept1Mai MomayОценок пока нет

- Ferrer Vs Bautista (Mayor of QC)Документ6 страницFerrer Vs Bautista (Mayor of QC)Marlowe Cris MenceroОценок пока нет

- Note On Issuance of Muni BondsДокумент9 страницNote On Issuance of Muni BondsParvesh BansalОценок пока нет

- Reviewing Local Revenue CodesДокумент78 страницReviewing Local Revenue CodesMaria Florida ParaanОценок пока нет

- Notes to Financial Statements of Malabon CityДокумент28 страницNotes to Financial Statements of Malabon CityJuan Uriel CruzОценок пока нет

- Financing Philippine Local Governments: Presented By: Amora Rossel M. PascuaДокумент15 страницFinancing Philippine Local Governments: Presented By: Amora Rossel M. PascuaAmora Rossel PascuaОценок пока нет

- Foster/Edens TIF Redevelopment PlanДокумент60 страницFoster/Edens TIF Redevelopment PlanDNAinfo ChicagoОценок пока нет

- Final Mock ExamДокумент57 страницFinal Mock ExamShellanie MurroОценок пока нет

- Plan de Desarrollo Municipal: Provincia Antonio Quijarro, Primera Sección UyuniДокумент153 страницыPlan de Desarrollo Municipal: Provincia Antonio Quijarro, Primera Sección UyunikarlaОценок пока нет

- Jawaharlal Nehru National Urban Renewal Mission: Towards Better Cities..Документ13 страницJawaharlal Nehru National Urban Renewal Mission: Towards Better Cities..kishore2285Оценок пока нет

- RMC 1-80Документ1 167 страницRMC 1-80Ramon Augusto Melad LacambraОценок пока нет

- South Side Community Benefit District PlanДокумент42 страницыSouth Side Community Benefit District PlanAnonymous arnc2g2NОценок пока нет

- Shelter CodeДокумент30 страницShelter CodeJin SiclonОценок пока нет

- Taxation Ordinances ValidityДокумент4 страницыTaxation Ordinances ValidityMaria Fiona Duran MerquitaОценок пока нет

- City Government of Quezon CityДокумент1 страницаCity Government of Quezon CityTorrecampo YvetteОценок пока нет

- Memo96 005Документ5 страницMemo96 005rahmaОценок пока нет

- Vigan City Executive Summary 2020Документ5 страницVigan City Executive Summary 2020Loriane ArcainaОценок пока нет

- GR#152774 Prov. of Batangas v. RomuloДокумент21 страницаGR#152774 Prov. of Batangas v. RomuloJane IcarroОценок пока нет

- TaclobanCity2017 Audit Report PDFДокумент170 страницTaclobanCity2017 Audit Report PDFJulPadayaoОценок пока нет

- White Plains GSTДокумент7 страницWhite Plains GSTBryan Cesar V. AsiaticoОценок пока нет

- QC Councilors Appeal to Preserve 'Del Monte Avenue' NameДокумент2 страницыQC Councilors Appeal to Preserve 'Del Monte Avenue' NameBryan Cesar V. AsiaticoОценок пока нет

- Test False + False - Reagent Correlations Result Specific Gravity PH ProteinДокумент2 страницыTest False + False - Reagent Correlations Result Specific Gravity PH ProteinBryan Cesar V. AsiaticoОценок пока нет

- Gad Vawc Report Form 2016 PDFДокумент1 страницаGad Vawc Report Form 2016 PDFBryan Cesar V. AsiaticoОценок пока нет

- CKC Discussion 291 Mass Testing of Barangay FrontlinersДокумент2 страницыCKC Discussion 291 Mass Testing of Barangay FrontlinersBryan Cesar V. AsiaticoОценок пока нет

- Enrico de Leus Froilan San JuanДокумент16 страницEnrico de Leus Froilan San JuanBryan Cesar V. AsiaticoОценок пока нет

- PO21CC - MECQ Social Distancing On EstablishmentsДокумент3 страницыPO21CC - MECQ Social Distancing On EstablishmentsBryan Cesar V. AsiaticoОценок пока нет

- LMPJ - Gender and Development Legislations 2020Документ9 страницLMPJ - Gender and Development Legislations 2020Bryan Cesar V. AsiaticoОценок пока нет

- Schengen Visa Application Form EnglishДокумент4 страницыSchengen Visa Application Form EnglishHatem FallouhОценок пока нет

- PO21CC - MECQ Social Distancing On EstablishmentsДокумент3 страницыPO21CC - MECQ Social Distancing On EstablishmentsBryan Cesar V. AsiaticoОценок пока нет

- PO21CC-316 Covid Blended Learning OrdinanceДокумент3 страницыPO21CC-316 Covid Blended Learning OrdinanceBryan Cesar V. AsiaticoОценок пока нет

- Group Assignment No. 1 - Case Problem For Forms of Legal Argument 2Документ2 страницыGroup Assignment No. 1 - Case Problem For Forms of Legal Argument 2Bryan Cesar V. AsiaticoОценок пока нет

- PR21CC - Closure of CemeteriesДокумент2 страницыPR21CC - Closure of CemeteriesBryan Cesar V. AsiaticoОценок пока нет

- Bernabe E. Training DesignДокумент4 страницыBernabe E. Training DesignBryan Cesar V. AsiaticoОценок пока нет

- Po21cc - Lifting of Anti-Hoarding OrdinanceДокумент2 страницыPo21cc - Lifting of Anti-Hoarding OrdinanceBryan Cesar V. AsiaticoОценок пока нет

- Po21cc - Mandatory Use of Face ShieldsДокумент3 страницыPo21cc - Mandatory Use of Face ShieldsBryan Cesar V. AsiaticoОценок пока нет

- Acknowledgement: Given This June - , 2019 at Quezon CityДокумент1 страницаAcknowledgement: Given This June - , 2019 at Quezon CityBryan Cesar V. AsiaticoОценок пока нет

- Po21cc - Mandatory Use of Face ShieldsДокумент3 страницыPo21cc - Mandatory Use of Face ShieldsBryan Cesar V. AsiaticoОценок пока нет

- Draft Covid LearningOrdinanceДокумент2 страницыDraft Covid LearningOrdinanceBryan Cesar V. AsiaticoОценок пока нет

- PR21CC - Liga NG Barangay Kagawad PDFДокумент1 страницаPR21CC - Liga NG Barangay Kagawad PDFBryan Cesar V. AsiaticoОценок пока нет

- PR21CC - ANNUAL INVESTMENT PLAN - SupplementalДокумент1 страницаPR21CC - ANNUAL INVESTMENT PLAN - SupplementalBryan Cesar V. AsiaticoОценок пока нет

- Allan D. Azurin Final-Examination-in-PGAДокумент8 страницAllan D. Azurin Final-Examination-in-PGABryan Cesar V. AsiaticoОценок пока нет

- Suspension and Cancellation of Membership Application Form: CompetitionДокумент1 страницаSuspension and Cancellation of Membership Application Form: CompetitionBryan Cesar V. AsiaticoОценок пока нет

- Ethical Issues in Working With Children and Families: Gerald P. Koocher, PH.D., ABPPДокумент50 страницEthical Issues in Working With Children and Families: Gerald P. Koocher, PH.D., ABPPBryan Cesar V. AsiaticoОценок пока нет

- Information Sheet PDFДокумент1 страницаInformation Sheet PDFBryan Cesar V. AsiaticoОценок пока нет

- Final Version Face ShieldДокумент6 страницFinal Version Face ShieldBryan Cesar V. AsiaticoОценок пока нет

- PO21CC - MECQ Social Distancing On EstablishmentsДокумент3 страницыPO21CC - MECQ Social Distancing On EstablishmentsBryan Cesar V. AsiaticoОценок пока нет

- Vat RuleДокумент105 страницVat Ruleshankar k.c.Оценок пока нет

- CASA Statement 1666917842767Документ32 страницыCASA Statement 1666917842767samsunga332029Оценок пока нет

- Tally Accounting Book by Ca MD ImranДокумент6 страницTally Accounting Book by Ca MD ImranMd ImranОценок пока нет

- BSNLДокумент1 страницаBSNLRamki KvlОценок пока нет

- Decision Tree for Philippine Tax Withholding SystemsДокумент1 страницаDecision Tree for Philippine Tax Withholding SystemsLoudie Ann MarcosОценок пока нет

- Nova Pulse Ivf Clinic PVT LTDДокумент2 страницыNova Pulse Ivf Clinic PVT LTDHarinathОценок пока нет

- Swiggy order details for YashaswinisДокумент2 страницыSwiggy order details for YashaswinisnichubharathОценок пока нет

- Akansha ChourasiaДокумент1 страницаAkansha Chourasiaakanksha skyОценок пока нет

- NR PropertiesДокумент30 страницNR PropertiesHari Harul VullangiОценок пока нет

- Personnel Digest: Updated Benefits for Class I EmployeesДокумент462 страницыPersonnel Digest: Updated Benefits for Class I Employeesballubalraj100% (4)

- PWC Tanzania Tax Datacard 2011 20121170527Документ6 страницPWC Tanzania Tax Datacard 2011 20121170527Zimbo KigoОценок пока нет

- RR 10-02Документ2 страницыRR 10-02saintkarri100% (1)

- Sony TV repair invoiceДокумент4 страницыSony TV repair invoiceMahesh ReddyОценок пока нет

- Jeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Документ4 страницыJeremyybardolazacabillo: Page1of4 016palentintostbrgypansol 9 0 0 9 - 0 7 6 4 - 4 9 Calambalaguna 4 0 2 7Jeremy CabilloОценок пока нет

- 23 March 2022 One PlusДокумент1 страница23 March 2022 One PlusVikas VermaОценок пока нет

- My - Bill - 16 Feb, 2023 - 15 Mar 2023, 2023Документ10 страницMy - Bill - 16 Feb, 2023 - 15 Mar 2023, 2023RJIO NAGPURОценок пока нет

- KTM Duke 250 Abs 2017 GST 0Документ1 страницаKTM Duke 250 Abs 2017 GST 0zaim nur hakimОценок пока нет

- Account Closure Form: Customer DetailsДокумент3 страницыAccount Closure Form: Customer DetailsAyan AcharyaОценок пока нет

- Hindustan Petroleum Corporation Limited: Price ListДокумент10 страницHindustan Petroleum Corporation Limited: Price ListVizag Roads33% (3)

- CIR Vs PNBДокумент9 страницCIR Vs PNBDenise Michaela YapОценок пока нет

- Newsletter 336Документ8 страницNewsletter 336Henry CitizenОценок пока нет

- Instructions For Form 8962Документ20 страницInstructions For Form 8962HОценок пока нет

- Evershed Kroll White Consulting Ledgers Upto 19.02.24Документ22 страницыEvershed Kroll White Consulting Ledgers Upto 19.02.24MILINDSWОценок пока нет

- Far.119 Income TaxДокумент4 страницыFar.119 Income Taxjhon tupagОценок пока нет

- DT Summary Book For Maynov 2020 PDFДокумент416 страницDT Summary Book For Maynov 2020 PDFajay guptaОценок пока нет

- How To Access and Understand Your PayslipДокумент9 страницHow To Access and Understand Your PayslipbucalaeteclaudialoredanaОценок пока нет