Академический Документы

Профессиональный Документы

Культура Документы

Highlights o P Bhatt

Загружено:

lavishjatinОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Highlights o P Bhatt

Загружено:

lavishjatinАвторское право:

Доступные форматы

Highlights Deposits have been particularly hard hit, with its share in total bank deposits coming down

n from 18.72 per cent in March 2004 to 15.21 per cent by December 2005. ROLE OF CEO "The key to successful leadership today is influence, not authority." The first thing he did was to stop the roll-out of core banking solutions in SBI branches. But we needed some 700 modifications before the project restarted and, TCS rose to the occasion splendidly In the past five months, he has opened 955 branches more than six branches a day on an average The process of liberalization and globalization of the Indian economy had already begun, bringing with it both opportunities and threats-State Bank of India having the largest network of branches in the country and a strong IT platform already in place, Mr. Bhatt felt that the Bank was at the threshold of its "golden period". With his deep knowledge of the market, both domestic and international, his close grasp of IT related issues, his hands-on approach to execution, and his proven ability to plan and strategize

First priority of Sh. OP BHATT as CHAIRMAN has been to increase SBI's market share Super Circle of Excellence Staff also being given targets to bring in new business. For the year to 31 December 2006, its advances grew at 26.86 per cent while deposit growth was 11.17 per cent His policy was to target higher market share, but not at the cost of bank's strength, soundness and profitability Deposits were growing on a higher base compared to advances. So, a 5 per cent growth in deposits was higher as compared to a 10 per cent growth in advances in terms of absolute numbers A new ad campaign recently adopted by him to change the bank's brand image Yields are lower in corporate lending. So, he decides why not give more loan to buy homes rather than to corporate? It is a business strategy. But as a leading public sector

bank, there are some obligations. Sbi is the nation's bank and will be doing a disservice if it does not meet these obligations. Bank has to put money in large projects like ultra mega power projects, but only after due diligence. He decided that the number of Managing Directors may go up from two to four. This will make the management of the bank's operations slightly easier. If the RBI holding was brought down from 55 per cent to 51 per cent, will have more elbowroom to raise money. So that we will also be able to raise money through the subsidiaries According to him Sbi will acquire banks overseas only if they are sizeable. Banks worth $3 million or $5 million does not make business sense. He would not grow market share at the cost of profitability. It does not make sense to have a few branches overseas. Rather he is more interested in consolidating Banks operations rather than acquiring a few more branches Document called the 'State Of The Nation' became the basis for transforming SBI. It was communicated to SBI's 14,000-odd branch managers across India and unions The top management realized that to achieve the transformation they sought, getting the grassroots level employees on board was extremely important. So a massive internal communication initiative called Parivartan was launched. They launched it across the country and covered all the employees in 120 days. The initiative was aimed at obtaining the support and acceptance of employees for the change initiatives undertaken by the bank, and explaining to them why change was necessary So what he did was send out a questionnaire to banks 200,000 employees asking them to craft a vision, mission and a value statement for the bank. He got 141,000 responses. With his officres he distilled that and came up with a simple vision: My SBI. My Customer First. My SBI First In Customer Satisfaction The end of 2008 saw banks across the world, including private sector banks in India, struggling due to recession and stalling their expansion plans. India's leading bank State Bank of India (SBI), on the other hand, was drawing up plans to further strengthen its position besides coming out with the announcement that it would recruit 20,000 clerical staff. The bank attributed its good performance despite a turbulent phase in the industry, to the various initiatives that it had taken since 2006, including 'Project Parivartan' According to SBI, the initiative that was launched in July 2007 was a huge success and was instrumental in bringing about the attitudinal change in the workforce that was required to compete in a very competitive environment

The prescription was innovation, but the challenge centered on getting 200,000 workers stretched across 10,000 branches to take their medicine. Communicating the need for change and shaking this huge corporate behemoth from its lethargy became the critical task ahead of Bhatt. State Bank, in which the government has a 60 percent interest, was languishing in inertia. The people werent performing poorly as individuals; they just werent aligned along a common set of objectivesno goals, no vision, no commitment. In January 2008, we became number one in India in terms of market cap, overtaking ICICI Bank State Bank is now the countrys 5th largest company in terms of market cap, from 14th in 2006.And internationally; theyve entered the Fortune Global 500. Customer service is also improving. In 2007, we were rated the best bank in India in terms of customer service, brand loyalty, and branch strength. In the past year, weve also raised $4 billion through rights issues$1.5 billion from the public and $2.5 billion from the government. The income from lending has been higher than the industry average. One of the major drivers of profit growth is the treasury operation. The annual treasury income trebled to Rs 3,745 crore (Rs 1,231 crore). Also bank have a 32% growth in fee income, which came from across the spectrum. Bank is engaged in issuing letter of credit, guarantees, loan processing, gold banking, brokerages etc. An over 30% growth in fee income for a bank of SBIs size is significant The SBI bad loans remained under control. The gross NPA ratio improved to 2.84% as on March 31, 2009 from 3.04% a year ago and net NPA at 1.76% compared to 1,78%. If you omit NPAs from State Bank of Saurashtra (Rs 206 crore), NPAs from Dabhol (Rs 1,615 crore) and NPAs on account of international business (Rs 954 crore), SBIs asset quality is quite good Changing business realities, Bhatt explains, are behind his reshuffling exercise. Indeed, big corporations were the banks major borrowers but now SBIs exposure to these companies is Rs35,000 crore while its mortgage portfolio is Rs42,000 crore. Things are not static and the relative importance of business groups is changing. With the economy becoming more and more complex, risk management is the most important job in any bank

Bhatt claims, are showing. Our home loan portfolio has grown 27% this year, higher than the competition. Similarly, the auto loan portfolios growth has been 30% Merger of associate banks with SBI to build scale. - State Bank-Indore & State BankSaurashtra 3.4 million apply for 11,000 clerical vacancies in SBI! Business Line Banks agricultural loans stood at Rs36,922 crore in June, growing more than 30% year-on-year. During the year 2007-08, Rural Business Group of the Bank comprising rural and semi urban branches, accounting for about 70% of the branch network of the Bank grew by Rs.298.07 billion in deposit representing a growth of 22.8% and Rs.187.34 billion in advances representing a growth of 23.4%. This was against a growth of Rs.163.67 billion in deposit and Rs.176.84 billion in the advances in the previous year. As on 31.03.2008, the Bank had a network of 84 overseas offices spread over 32 countries covering all time zones. Net Profit from Banks overseas operations (including subsidiaries and joint ventures with more than 50% shareholding) registered a growth of 84% during the fiscal year mainly driven by significant growth of 48% in Net Customer Credit. The Bank has participated to the extent of USD 3.04 billion in 31 Merger and Acquisition deals aggregating USD 22.56 billion in 2007-08 as against participation to the extent of US $ 1.07 billion in 13 deals aggregating US $ 5.37 billion during the previous year The bank has managed to increase the share of international advances in the total business to 16% at the end of Mar09, from 10% at the end of Mar06. Fee Income grew by 45% to 18.6bn which proved to be a positive surprise and also it earned smart treasury gains of Rs7.1bn. Bottom-Line grew by 42% on the back of higher growth in balance sheet, Fee Income, treasury gains and reversal of provision on equity book. It is a straight fourth consecutive quarter of ~40% growth in PAT.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

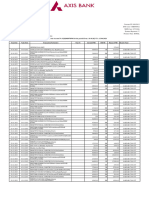

- Bank StatementДокумент5 страницBank Statementtaxlawconsultant022Оценок пока нет

- Electronic Payment System in Nepal: Group 5Документ19 страницElectronic Payment System in Nepal: Group 5Anuska JayswalОценок пока нет

- Current AccountДокумент1 страницаCurrent AccountLegal DivisionОценок пока нет

- 3 Jan To 12 Jan 23Документ2 страницы3 Jan To 12 Jan 23GouravОценок пока нет

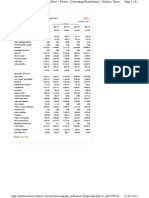

- HTTP WWW - MoneycontrolДокумент1 страницаHTTP WWW - MoneycontrolPavan PoliОценок пока нет

- SAP DPMS MobileДокумент1 страницаSAP DPMS MobileVinod PanchalОценок пока нет

- iSave-IPruMF FAQsДокумент6 страницiSave-IPruMF FAQsMayur KhichiОценок пока нет

- Fca 2017 54 PDFДокумент167 страницFca 2017 54 PDFasalihovicОценок пока нет

- HDFC Bank - Wire Transfer DetailsДокумент2 страницыHDFC Bank - Wire Transfer Detailsanon_193130758Оценок пока нет

- CH11Документ31 страницаCH11Marwa HassanОценок пока нет

- Debit CardДокумент8 страницDebit CardnaazkinzaОценок пока нет

- The Differences Between Japanese and Chinese Banking SystemДокумент5 страницThe Differences Between Japanese and Chinese Banking SystemwainhuiОценок пока нет

- Annexure Regulatory Framework For Cross Border MergerДокумент2 страницыAnnexure Regulatory Framework For Cross Border MergerAVIN TIWARIОценок пока нет

- Dintle StatementДокумент3 страницыDintle StatementMANDLAОценок пока нет

- Deposit Sources of FundsДокумент6 страницDeposit Sources of FundsSakib Chowdhury0% (1)

- Reserve Bank of India: An Analysis of Banking Vis A Vis GlobalizationДокумент11 страницReserve Bank of India: An Analysis of Banking Vis A Vis Globalizationarko banerjeeОценок пока нет

- T3TSL - Syndicated Loans - R11.1Документ238 страницT3TSL - Syndicated Loans - R11.1sivanandini100% (1)

- AP BUILDING PHONE BILL Oct 23Документ1 страницаAP BUILDING PHONE BILL Oct 23jfallon1969Оценок пока нет

- New Approaches To SME Finance Using Bank Account Information (Big Data)Документ19 страницNew Approaches To SME Finance Using Bank Account Information (Big Data)ADBI EventsОценок пока нет

- Class 8: Chapter 15 - Simple Interest and Compound Interest - Exercise 15AДокумент13 страницClass 8: Chapter 15 - Simple Interest and Compound Interest - Exercise 15AManu ThakurОценок пока нет

- Madura Chapter 6 PDFДокумент13 страницMadura Chapter 6 PDFRizaldy Aji MuzakkyОценок пока нет

- Mr. AnshulДокумент2 страницыMr. AnshulAnshul SharmaОценок пока нет

- Isb540 - HiwalahДокумент16 страницIsb540 - HiwalahMahyuddin Khalid100% (1)

- Pdic 20 QuestionsДокумент6 страницPdic 20 Questionsjeams vidalОценок пока нет

- Mathematics of Investments: Simple Interest and Simple DiscountДокумент43 страницыMathematics of Investments: Simple Interest and Simple DiscountremelynОценок пока нет

- Daily FX Update: Eur Limited Above 1.40 As Draghi Lays Out PlansДокумент3 страницыDaily FX Update: Eur Limited Above 1.40 As Draghi Lays Out Planspathanfor786Оценок пока нет

- Audit of Cash - Exercise 1 (Solution)Документ10 страницAudit of Cash - Exercise 1 (Solution)Aby ReedОценок пока нет

- Vijayawada To Bangalore: Abhibus TicketДокумент1 страницаVijayawada To Bangalore: Abhibus Ticketmydearbhava1Оценок пока нет

- Working Capital Policy and ManagementДокумент64 страницыWorking Capital Policy and ManagementUy SamuelОценок пока нет

- 123Документ12 страниц123pattembunnyОценок пока нет