Академический Документы

Профессиональный Документы

Культура Документы

Awesome

Загружено:

Amit BanerjeeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Awesome

Загружено:

Amit BanerjeeАвторское право:

Доступные форматы

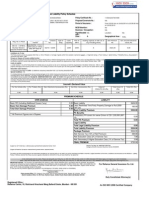

HDFC ERGO General Insurance Company Limited

Certificate of Insurance cum Policy Schedule

Policy No. 2311200006847813000

Private Car Package Policy

MRS SUPRIYA BANERJEE Insured Name Correspondence 41 RISHI BANKIM ROAD BEHALA KOLKATAKOLKATA, WEST BENGAL, 700034 Address

2311 Policy 14/05/2012 Mrs Holder declare has be False that no claimTOJOAPU If2311200006847812000 declaration 20 Agent Agent Tel Supriya Name found No. Code : :AARVI 91-8080015616 Banerjee incorrect, :200936320702 GENERAL benefits INSUR under t

RTO Registration Address

KOLKATA 41 RISHI BANKIM ROAD BEHALA KOLKATAKOLKATA, WEST BENGAL, 700034

Mobile

9830347525

Phone

E Mail

30/04/2013 00:01hrs

tojoapu@yahoo.com To Date & Time 29/04/2014 Midnight

Registration No. WB-02-T-9418 Policy Issuance Date Seats

5 18/04/2013

Period of Insurance From Date & Time Make

MARUTI

Model - Variant

WAGON R DUO-LX

Engine No

F10AN4140404

Chassis No

MASEED81500316877

Mfg Yr

2005

Body Type

STATION WAGON

CC

1061

Insured's Declared Value (IDV)

The Vehicle (`)

94,766

For Trailer (`)

0

Non Electrical Acc. (`)

0

Electrical Acc. (`)

0

CNG/LPG Kit (`)

0

Total IDV (`)

94,766

Named Persons & Nominee (IMT-15) Nominee (Owner Driver) Own Damage Premium (a)

Basic Own Damage: 2022

Appointee Premium Details (`) Liability Premium (b)

Basic Third Party Liability: LL to Paid Driver (IMT-28) PA Cover for Owner Driver of ` 200000 Third Party Liability for CNG/LPG Kit 1110 50 100 60

Total Basic Premium

2022

Less: others Less: No Claim Bonus (20%) Total - Less

71 390 461 Net Liability Premium (b) Total Package Premium (a+b) Service Tax (Including Education Cess & Higher Education Cess, wherever applicable) 1320 2881 356

Net Own Damage Premium (a)

1561

Total Premium

3237

Geographical Area

India

Compulsory Deductible (IMT-22)

Dated : 11/04/2013

` 1000.00

Voluntary Deductible (IMT-22A)

` 0.00

Payment Details: Cheque No. 350861

Drawn on UCO Bank

Previous Policy No. 2311200006847812000 Valid from 30/04/2012 to 29/04/2013, of HDFC ERGO GENERAL INSURANCE CO.LTD. No Claim Bonus 0 % Policy Holder declare that no claim has been made in the previous year policy. If declaration found incorrect, benefits under the present policy in respect of own damage section will stand forfeited.

List Of Endorsements Endt No Description Effective Date End Date Premium (In ` )

LIMITATIONS AS TO USE: The Policy covers use of the vehicle for any purpose other than: a) Hire or Reward b) Carriage of goods (other than samples or personal luggage) c) Organized racing d) Pace making e ) Speed testing f) Reliability Trials g ) Any purpose in connection with Motor Trade. Persons or Class of Persons entitled to drive: Any person including the insured, provided that a person driving holds an effective driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding an effective learner's license may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Limits of Liability 1. Under Section II-1 (i) of the policy - Death of or bodily injury - Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. 2. Under Section II - 1(ii) of the policy -Damage to Third Party Property` 750000 3. P. A. Cover under Section III for Owner - Driver(CSI): ` 200000 Terms, Conditions & Exclusions: As per the Indian Motor Tariff. A personal copy of the same is available free of cost on request & the same is also available at our website. I / We hereby certify that the policy to which the certificate relates as well as the certificate of insurance are issued in accordance with the provision of chapter X, XI of M. V.Act 1988. "The stamp duty of ` 0.50 paid b y Demand Draft, vide Receipt/Challan no 5270 dated 14/05/2012 a s prescribed in Government Notification Revenue and Forest Department No Mudrank 2004/4125/CR 690/M-1, dated 31/12/2004". Service Tax Registration No.: AABCH0738EST004. IMPORTANT NOTICE: The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made b y the Company b y reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 i s recoverable from the Insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY". Disclaimer: The Policy shall be void from inception if the premium cheque is not realized. In the event of misrepresentation, fraud or non-disclosure of material fact, the Company reserves the right to cancel the Policy from inception.

Policy Issuing Office: Mumbai

For HDFC ERGO General Insurance Company Ltd.

Agent Name :AARVI GENERAL INSURANCE SERVICES Agent Code :200936320702 Tel No. : 91-8080015616

Duly Constituted Attorney

Registered Off.: Ramon House, H.T.Parekh Marg, 169, Backbay Reclamation, Mumbai 400 020, India. Toll-Free No.1800-2-700-700 Fax 91 22 66383699 care@hdfcergo.com www.hdfcergo.com Corporate Off.: 6th Floor, Leela Business Park, Andheri-Kurla Road, Andheri(E), Mumbai 400 059.

Frequently Asked Questions (FAQs) - MOTOR INSURANCE

WHAT ARE THE MAJOR COVERS OF THE POLICY? Loss or Damage to the Insured Vehicle caused due to: a) Fire, explosion, self ignition or lightning. b) Burglary, housebreaking or theft c) All act of God perils like earthquake, flood, cyclone etc d) Accidental external means, terrorism, riot and strike Liability to Third Parties: Provides cover for any legal liability arising out of the use of the vehicle for: a) Accidental death / injury to any third party b) Any damage to property owned by third party Personal Accident Cover: The policy provides for mandatory Personal Accident cover for owner driver and optional cover for passengers covering accidental death and permanent total disability.

WHAT ARE THE MAJOR EXCLUSIONS IN THE POLICY? a) General aging, wear & tear, mechanical or electrical breakdown, failure, depreciation, any consequential loss b) Damage by a person driving without a valid license c) Damage by a person driving under the influence of liquor or drugs d) Loss/damage attributable to war, mutiny, nuclear risks e) Damage to tyres and tubes, unless damaged during an accident f) Usage on hire & reward (applicable for all classes expect public commercial vehicles) 1. DETAILS TO KEEP HANDY WHILE REGISTERING A CLAIM a) Policy No. b) Registration details / RC copy c) Drivers details at the time of accident including driving license number d) FIR on a case to case basis e) Repair estimate 2. HOW DO I FILE A CLAIM? For Accidental Damage to Insured Vehicle (Own Damage Claims): a) Call our customer care Toll-free 1800-2-700-700 if the vehicle meets with an accident b) Provide your policy number for reference and register the claim c) If your vehicle can be driven, take it to the nearest dealer / garage d) Get a repair estimate,fill up the claim form and attach a copy of the registration Certificate driving license ofthe person driving at thetimeof the accident e) If the garage is within our network, you could avail of cashless claim facility. Pay for non accident related repairs, depreciation and deductible. We would settle the rest. f) If the garage is outside our network, you would have to get the claim reimbursed subsequently. g) Sign the repairers satisfaction voucher and drive off! 4. CLAIMS DOCUMENTS: IN CASE OF LOSS DUE TO THEFT a) Duly filled and signed claim form & discharge voucher ( after loss settlement ) b) Original Registration Certificate (RC) c) Original policy copy d) Copy of FIR lodged at the nearest police station e) All original keys & vehicle invoice copy f) No trace report confirming that the stolen vehicle is not traceable g) Loss or damage to bonnet side parts, mudguard, bumpers, lamps, tyres, tubes, headlights, paint work (applicable for all commercial vehicles; unless opted additionally) h) Loss or damage resulting from overturning arising out of operation as a tool (applicable for mobile cranes, drilling rigs, mobile plants, navvies, shovels, grabs, rippers unless opted for additionally) i) Loss of or damage to accessories by burglary housebreaking or theft unless the vehicle is stolen at the same time (applicable to all commercial vehicles & two wheelers)

WHAT DO I DO IN CASE OF A CLAIM? 3. CLAIMS DOCUMENTS - IN CASE OF ACCIDENTAL DAMAGE TO INSURED VEHICLE a) Duly filled and signed claim form & satisfaction voucher b) Registration Certificate (RC) c) Driving license of the person driving at the time of the accident d) Policy copy , original repair estimate, repair invoice e) Payment receipt for non-cashless claims f) Original repair invoice for cashless claims g) AML documents for amount more than 1 lac (PAN card, 2 passport size photo, residence proof). h) Form 35 & original NOC from financer incase of total loss where payment is made to insured. i) A copy of police FIR/panchnama is required for TP injury/death/property damage Additional documents required for commercial vehicles: a) Spot survey b) Load challan c) Fitness certificate d) Route permit

g) Original NOC from financer incase of hypothecation / HPA h) Intimation to RTO for theft of vehicle i) Duly signed RTO transfer papers (Form 26, 28,29,30,35) j) RC extract with stolen remark from the concerned RTO after the loss k) AML documents for amount more than 1 lac (PAN card, 2 passport size photo, residence proof). l) Deed of subrogation cum indemnity on judicial stamp paper. HOW DO I MAKE CHANGES IN MY POLICY (ENDORSEMENTS)? 2. For addition of electrical and non electrical accessories/CNG & LPG Kit: a) Request letter for the change b) Policy copy c) Invoice copy (mandatory where value of accessory exceeds ` 20,000/-) d) Endorsed Registration Certificate Copy (For CNG/LPG kit) e) Cheque for additional premium Call us for additional premium details & send relevant documents copy to our corporate office 4.Changes / Correction in Policy Holder's Name / Correspondence Address / Contact Numbers / E-mail id / any other changes: E mail us at : care@hdfcergo.com OR Call Toll-free: 1800 2 700 700 / 1800 226 226 OR Fax your request at: 022 6638 3669 HOW TO CONTACT US? Call Toll-free Fax E-Mail Write to us at : : : : 1800 2 700 700 / 1800 226 226 022 6638 3669 care@hdfcergo.com HDFC ERGO General Insurance Company Limited 6th floor, Leela Business Park, Andheri Kurla Road, Andheri(East), Mumbai - 400 059 Track your claims online whenever the need arises Raise service request / complaints & set renewal reminders Information about branches, garages and hospitals

1. Changes related to registration of vehicle or vehicle details like: a) Correction in registration number/ location / address b) Correction in vehicle make & model / cubic capacity / seating capacity/ engine & chassis number / year of manufacture Documents Required: a) Request letter for the change b) Policy copy c) Registration Certificate copy 3. Documents required to change financier details (Hypothecation/Lease/Hire-Purchase) a) Request letter for the change b) Policy copy c) Endorsed Registration Certificate copy d) NOC from financier (not mandatory for deletion if RC is endorsed) HOW DO I RENEW MY POLICY? a) Visit www.hdfcergo.com to renew instantly online. b) SMS ""RENEW <POLICY NO> "" to 9999 700700 c) Visit our nearest branch / your agent d) Send a copy of the renewal notice along with premium cheque to our branch office / Corporate office e) Call our toll free number 1800 2 700 700 / 1800 226 226.

Manage Your Portfolio @ hdfcergo.com / Smartphones*

View your policy details Link multiple policies of yourself and your loved ones Change your personal details on the go

* supports smart phones based on Blackberry, iPhone, Android & Symbian platforms

This document is a summary of the benefits offered. The information mentioned above is illustrative and not exhaustive. Information must be read in conjunction with the policy wordings. In case of any conflict between this document and the policy wordings, the terms and conditions mentioned in the policy wordings shall prevail.

Вам также может понравиться

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОт EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОценок пока нет

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyОт EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyОценок пока нет

- Bike InsuranceДокумент2 страницыBike InsuranceAnil Kumar56% (41)

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Документ4 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Ameer SyedОценок пока нет

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000Документ2 страницыHDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000Satish BojjawarОценок пока нет

- 2312100150128200000Документ2 страницы2312100150128200000sachinkulsh_1Оценок пока нет

- 2312100095928100000Документ2 страницы2312100095928100000Kavin Prakash100% (2)

- Suman Joshi - 2319200460984200000Документ1 страницаSuman Joshi - 2319200460984200000Harsh Sahrawat100% (3)

- S M Asloob.Документ2 страницыS M Asloob.saikripa1210% (1)

- Motorised-Two Wheelers Liability Only Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleДокумент3 страницыMotorised-Two Wheelers Liability Only Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleJagateeswaran KanagarajОценок пока нет

- Gccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy ScheduleДокумент51 страницаGccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy Schedulejpeg143Оценок пока нет

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleДокумент3 страницыReliance Private Car Vehicle Certificate Cum Policy ScheduleMatthew Smith100% (5)

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleДокумент3 страницыMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleSelva KumarОценок пока нет

- INSURANCEДокумент3 страницыINSURANCEmurali9026100% (1)

- 1799 InsuranceДокумент1 страница1799 InsuranceDeepak SudhakaranОценок пока нет

- Surendrakumarmishra SulДокумент1 страницаSurendrakumarmishra SulRavi Kumar33% (3)

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleДокумент3 страницыMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy Schedulekrishna_1238Оценок пока нет

- New Bajaj Policies PDFДокумент11 страницNew Bajaj Policies PDFexcel.syed0% (1)

- NgrgnddaДокумент15 страницNgrgnddajustinsitohjsОценок пока нет

- Document InsuranceДокумент23 страницыDocument InsurancePriti PathakОценок пока нет

- Auto Insurance: What You Need and Why You Need ItДокумент44 страницыAuto Insurance: What You Need and Why You Need ItHimanshu KhuranaОценок пока нет

- Vehicle Insurance Policy FormatДокумент4 страницыVehicle Insurance Policy Formatarunavonline_947835049% (59)

- Motor Write Up - ShortДокумент3 страницыMotor Write Up - ShortqwertyОценок пока нет

- XCD InsuranceДокумент3 страницыXCD Insuranceabhiin4Оценок пока нет

- Private Car Policy Schedule EmailДокумент3 страницыPrivate Car Policy Schedule EmailSeetha ChimakurthiОценок пока нет

- mh43x8786 Xylo E6Документ4 страницыmh43x8786 Xylo E6Asif ShaikhОценок пока нет

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeДокумент3 страницыIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- Reliance Car InsuranceДокумент4 страницыReliance Car InsuranceMatthew Smith67% (9)

- Chandrasenan Shine Done Aug 2014Документ12 страницChandrasenan Shine Done Aug 2014chinnuОценок пока нет

- 31 2015 2338Документ2 страницы31 2015 2338VenkatachalamОценок пока нет

- Can Insorance SampleДокумент19 страницCan Insorance Samplepradeep singh karkiОценок пока нет

- Certificate Cum Policy Schedule: Cubic Capacity / Year of ManfДокумент1 страницаCertificate Cum Policy Schedule: Cubic Capacity / Year of ManfVimalMalviyaОценок пока нет

- RA3550Документ1 страницаRA3550Patel DipenОценок пока нет

- B0512753 V3383925 00000 00000 00001 00130976 FPV Schedule ScheduleДокумент1 страницаB0512753 V3383925 00000 00000 00001 00130976 FPV Schedule ScheduleshakilОценок пока нет

- Basic Own DamageДокумент3 страницыBasic Own DamageHarsh PriyaОценок пока нет

- 4 24 20145 07 53PM PDFДокумент2 страницы4 24 20145 07 53PM PDFpawarkamal5Оценок пока нет

- Bike Insurance PDFДокумент2 страницыBike Insurance PDFChaudharyShubhamSachan46% (85)

- Sunrise Logisticks - 1Документ2 страницыSunrise Logisticks - 1niren4u1567100% (2)

- Innova Ranbir PDFДокумент2 страницыInnova Ranbir PDFNarinder KaurОценок пока нет

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Документ3 страницыIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- InsuranceДокумент1 страницаInsuranceOmkar TrivediОценок пока нет

- Bike PolicyДокумент2 страницыBike PolicyAdhwareshBharadwaj100% (2)

- MillingДокумент2 страницыMillingMohamedFasil100% (1)

- Icici LombardДокумент1 страницаIcici LombardTony Jacob33% (3)

- Sareen C K Bike InsuranceДокумент1 страницаSareen C K Bike InsurancesareenckОценок пока нет

- Dublicate InsuranceДокумент4 страницыDublicate InsuranceAbubakarsiddiq FruitwalaОценок пока нет

- Polo 30017392506500000Документ1 страницаPolo 30017392506500000niren4u1567Оценок пока нет

- Car Insurance RenewalДокумент2 страницыCar Insurance Renewalpavnishsharma33% (3)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeДокумент3 страницыIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vОценок пока нет

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Документ3 страницыIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017SureshОценок пока нет

- Two Insurance Copy ITДокумент1 страницаTwo Insurance Copy ITbaranimba5Оценок пока нет

- Shashi Kant Policy PDFДокумент1 страницаShashi Kant Policy PDFJamie Jordan100% (1)

- Pramod KumarДокумент1 страницаPramod KumarSumit RajОценок пока нет

- The Insured: Policy No: Policy Type: Issue Date: OccupationДокумент2 страницыThe Insured: Policy No: Policy Type: Issue Date: OccupationMukesh ManwaniОценок пока нет

- InsuranceДокумент2 страницыInsuranceMIKE4U4Оценок пока нет

- Motor Vehicle InsuranceДокумент2 страницыMotor Vehicle InsuranceMrignayani SinghОценок пока нет

- Tata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyДокумент2 страницыTata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyRapoluSivaОценок пока нет

- Harpriti PolicyДокумент1 страницаHarpriti PolicyIASkanhaОценок пока нет

- CDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsОт EverandCDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsОценок пока нет

- CDL Study Guide: Complete manual from A to Z on everything you need to know to pass the commercial driver's license examОт EverandCDL Study Guide: Complete manual from A to Z on everything you need to know to pass the commercial driver's license examОценок пока нет

- Week 9 11 Intro To WorldДокумент15 страницWeek 9 11 Intro To WorldDrea TheanaОценок пока нет

- Electronic Ticket For 1gjtsx Departure Date 20-05-2022Документ3 страницыElectronic Ticket For 1gjtsx Departure Date 20-05-2022Vikas BalyanОценок пока нет

- 2 Multi-Realty Vs Makati TuscanyДокумент21 страница2 Multi-Realty Vs Makati TuscanyLaura MangantulaoОценок пока нет

- Types and Concept of IncomeДокумент5 страницTypes and Concept of IncomeMariecris MartinezОценок пока нет

- LAW Revision Question 3Документ4 страницыLAW Revision Question 3Nur Aishah RaziОценок пока нет

- Rent Agreement Format MakaanIQДокумент2 страницыRent Agreement Format MakaanIQShikha AroraОценок пока нет

- Rosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrДокумент5 страницRosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrEliza Den DevilleresОценок пока нет

- Business and Company Law AnswerДокумент13 страницBusiness and Company Law AnswerCheng Yuet JoeОценок пока нет

- Article 62 of The Limitation ActДокумент1 страницаArticle 62 of The Limitation ActGirish KallaОценок пока нет

- ISLAMIC MISREPRESENTATION - Draft CheckedДокумент19 страницISLAMIC MISREPRESENTATION - Draft CheckedNajmi NasirОценок пока нет

- VOLIITSPart IДокумент271 страницаVOLIITSPart IrkprasadОценок пока нет

- Office of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposerДокумент5 страницOffice of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposermarjОценок пока нет

- Adelfa V CAДокумент3 страницыAdelfa V CAEd Karell GamboaОценок пока нет

- Avdanced Accounting Dayag 2 - Solution Chapter 16 Part 2Документ3 страницыAvdanced Accounting Dayag 2 - Solution Chapter 16 Part 2Patricia Adora AlcalaОценок пока нет

- CTA CasesДокумент177 страницCTA CasesJade Palace TribezОценок пока нет

- Nicoleta Medrea - English For Law and Public Administration.Документ57 страницNicoleta Medrea - English For Law and Public Administration.gramadorin-10% (1)

- PIL PresentationДокумент7 страницPIL PresentationPrashant GuptaОценок пока нет

- Sample Compromise AgreementДокумент3 страницыSample Compromise AgreementBa NognogОценок пока нет

- The Oecd Principles of Corporate GovernanceДокумент8 страницThe Oecd Principles of Corporate GovernanceNazifaОценок пока нет

- DOX440 Gun Setup Chart Rev 062019Документ4 страницыDOX440 Gun Setup Chart Rev 062019trọng nguyễn vănОценок пока нет

- International Protection of HRДокумент706 страницInternational Protection of HRAlvaro PazОценок пока нет

- Preserving The Gains of Ramadan10 Deeds To Be Continued After RamadanДокумент2 страницыPreserving The Gains of Ramadan10 Deeds To Be Continued After RamadantakwaniaОценок пока нет

- Second Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)Документ59 страницSecond Semester of Three Year LL.B. Examination, January 2011 CONTRACT - II (Course - I)18651 SYEDA AFSHANОценок пока нет

- Metode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumДокумент24 страницыMetode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumAfrian F NovalОценок пока нет

- National Seminar A ReportДокумент45 страницNational Seminar A ReportSudhir Kumar SinghОценок пока нет

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookДокумент26 страниц(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroОценок пока нет

- Form - 28Документ2 страницыForm - 28Manoj GuruОценок пока нет

- Airworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Документ2 страницыAirworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)sagarОценок пока нет

- FINAL-Telephone Directory-2019Документ107 страницFINAL-Telephone Directory-2019Rizwan TahirОценок пока нет

- In Modern BondageДокумент221 страницаIn Modern BondageetishomeОценок пока нет