Академический Документы

Профессиональный Документы

Культура Документы

Bolton Chen Wang (2009) (Presentation PPT. A Unified Theory of Tobin's Q, Corporate Investment, Financing, and Risk Management)

Загружено:

as111320034667Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bolton Chen Wang (2009) (Presentation PPT. A Unified Theory of Tobin's Q, Corporate Investment, Financing, and Risk Management)

Загружено:

as111320034667Авторское право:

Доступные форматы

A unified theory of Tobins q,

corporate investment, financing,

and risk management

Patrick Bolton, Columbia, CEPR, and NBER

Hui Chen, MIT

Neng Wang, Columbia and NBER

!!"#$%&'!%(!)*+$,-.$*-

/012&%3

!"#$#%"$&!!'"%(")#*

+,)'-!!"#.

/!012)'3!)4!5#62*(72#(

+8$%').

!"#$#%"$&!!'"%(")#*

+,)'-!!"#.

,)#("#/0#(!,&$"1!

23#$1"%!!"#$#%"#/!4!506/"#/

+7**0(!8'"%"#/.!

9!:;0)'3!)<!=#>0*(10#(

+?$%').

!"#$#%"$&!!'"%(")#*

+,)'-!!"#.

,)#("#/0#(!,&$"1!

23#$1"%!!"#$#%"#/!4!506/"#/

+7**0(!8'"%"#/.!

9:"*!-$-0'

;!9:0)'3!)<!=#>0*(10#(

+?$%').

The Economist, Nov. 22-28, 2008

Model Design

constant investment opportunity (with a benchmark q

theory)

constant nancing opportunity

the interaction

Model Sketch: Physical

Production

capital accumulation:

dK

t

= (I

t

K

t

)dt

output:

dY

t

= K

t

(dt + dZ

t

)

cost of investing:

(I

t

+ G(I

t

, K

t

)) dt.

adjustment cost G(I, K) = g(I/K)K, where

g(i) =

2

i

2

.

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Dynamics for cash W: dW

t

= change in cash =

CF from operations (production)

+ CF from investing (i.e. (r ) W

t

dt)

+ CF from nancing

payout

Precautionary motive for holding cash

Cost of holding cash:

Can pay out cash to investors at any time: 1 for 1

Model Sketch

Option to liquidate

collect lK from capital and W from cash account

Option to issue external equity

xed cost

variable cost

Credit line

credit limit: cK

interest rate: r +

Model Sketch

Option to liquidate

collect lK from capital and W from cash account

Option to issue external equity

xed cost

variable cost

Credit line

credit limit: cK

interest rate: r +

Model Sketch

Option to liquidate

collect lK from capital and W from cash account

Option to issue external equity

xed cost

variable cost

Credit line

credit limit: cK

interest rate: r +

Four (optimally divided) regions

payout region

cash region (w > 0)

credit region (w < 0)

equity nancing (liquidation) region

Solution sketch

Firm value maximization: P(K, W)

Homogeneity: P(K, W) = p(w) K where w = W/K

Economics: stochastic balanced capital accumulation

with nancial frictions

Solution sketch

Firm value maximization: P(K, W)

Homogeneity: P(K, W) = p(w) K where w = W/K

Economics: stochastic balanced capital accumulation

with nancial frictions

Solution sketch

Firm value maximization: P(K, W)

Homogeneity: P(K, W) = p(w) K where w = W/K

Economics: stochastic balanced capital accumulation

with nancial frictions

Solution Sketch

Investment rst-order condition:

marginal cost of production =

P

K

(K, W)

P

W

(K, W)

marginal value of liquidity (marginal cost of funds):

P

W

(K, W) = p

(w)

Value and Investment

rm value-capital ratio p(w):

rp(w) = (i(w) ) (p (w) wp

(w))

+((r )w + i(w) g(i(w))) p

(w)

+

2

2

p

(w) .

investment-capital ratio:

i(w) =

1

p(w)

p

(w)

w 1

.

Average and marginal q

Optimal composition of the balance sheet: W and K

Average q:

q

a

(w) =

P(K, W) W

K

= p(w) w

Marginal q:

q

m

(w) =

dP(K, W)

dK

= q

a

(w) (p

(w) 1) w

Average and marginal q

Optimal composition of the balance sheet: W and K

Average q:

q

a

(w) =

P(K, W) W

K

= p(w) w

Marginal q:

q

m

(w) =

dP(K, W)

dK

= q

a

(w) (p

(w) 1) w

Average and marginal q

Optimal composition of the balance sheet: W and K

Average q:

q

a

(w) =

P(K, W) W

K

= p(w) w

Marginal q:

q

m

(w) =

dP(K, W)

dK

= q

a

(w) (p

(w) 1) w

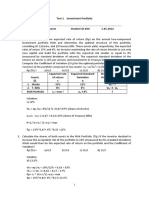

Parameter Values

risk-free rate r = 6%

mean productivity shock (risk-neutral) = 18%

volatility of productivity shock = 9%

rate of depreciation = 10.07%

adjustment cost = 1.5

liquidation value l = 0.9

cash-carrying cost = 1%

proportional nancing cost = 6%

xed nancing cost = 1%

Benchmark: i

FB

= 15.1% and q

FB

= 1.23.

Liquidation

0 0.05 0.1 0.15 0.2 0.25

0.8

1

1.2

1.4

1.6

w

A. rm value-capital ratio: p(w)

rst-best

liquidation

l +w

0 0.05 0.1 0.15 0.2 0.25

5

10

15

20

25

30

B. marginal value of cash: p

(w)

0 0.05 0.1 0.15 0.2 0.25

!0.8

!0.6

!0.4

!0.2

0

0.2

cash-capital ratio: w = W/K

C. investment-capital ratio: i(w)

rst-best

liquidation

0 0.05 0.1 0.15 0.2 0.25

0

5

10

15

20

D. investment-cash sensitivity: i

(w)

cash-capital ratio: w = W/K

Optimal Financing

0 0.05 0.1 0.15 0.2

1

1.1

1.2

1.3

1.4

m( = 1%)

w( = 1%)

w( = 0)

A. rm value-capital ratio: p(w)

= 1%

= 0

0 0.05 0.1 0.15 0.2

1

1.2

1.4

1.6

1.8

B. marginal value of cash: p

(w)

= 1%

= 0

0 0.05 0.1 0.15 0.2

!0.3

!0.2

!0.1

0

0.1

0.2

cash-capital ratio: w = W/K

C. investment-capital ratio: i(w)

= 1%

= 0

0 0.05 0.1 0.15 0.2

0

2

4

6

8

10

12

cash-capital ratio: w = W/K

D. investment-cash sensitivity: i

(w)

= 1%

= 0

Dynamic hedging

0 0.05 0.1 0.15 0.2

!10

!8

!6

!4

!2

0

A. hedge ratio: (w)

costly margin

frictionless

0 0.05 0.1 0.15 0.2

!0.4

!0.2

0

0.2

B. investment-capital ratio: i(w)

frictionless

costly margin

no hedging

0 0.05 0.1 0.15 0.2

1.1

1.2

1.3

1.4

cash-capital ratio: w = W/K

C. rm value-capital ratio: p(w)

frictionless

costly margin

no hedging

0 0.05 0.1 0.15 0.2

1

1.5

2

2.5

3

cash-capital ratio: w = W/K

D. marginal value of cash: p

(w)

frictionless

costly margin

no hedging

Risk & return

Conditional :

(w) =

m

p

(w)

q

a

(w) + w

,

Idiosyncratic volatility and beta

0 0.2 0.4 0.6 0.8

1

1.2

1.4

1.6

1.8

2

A. rm value-capital ratio: p(w)

idio vol: 5%

idio vol: 15%

idio vol: 30%

0 0.2 0.4 0.6 0.8

1

1.1

1.2

1.3

1.4

1.5

1.6

1.7

B. marginal value of cash: p

(w)

idio vol: 5%

idio vol: 15%

idio vol: 30%

0 0.2 0.4 0.6 0.8

!0.3

!0.2

!0.1

0

0.1

0.2

cash-capital ratio: w = W/K

C. investment-capital ratio: i(w)

idio vol: 5%

idio vol: 15%

idio vol: 30%

0 0.2 0.4 0.6 0.8

0.6

0.8

1

1.2

1.4

1.6

1.8

cash-capital ratio: w = W/K

D. conditional beta: (w)/

FB

idio vol: 5%

idio vol: 15%

idio vol: 30%

Credit line

!0.2 !0.1 0 0.1 0.2

0.9

1.1

1.3

1.5

m(c = 0.2)

w(c = 0.2)

m(c = 0)

w(c = 0)

A. rm value-capital ratio: p(w)

c = 0.2

c = 0

!0.2 !0.1 0 0.1 0.2

1

1.2

1.4

1.6

1.8

B. marginal value of cash: p

(w)

c = 0.2

c = 0

!0.2 !0.1 0 0.1 0.2

!0.25

!0.15

!0.05

0.05

0.15

cash-capital ratio: w = W/K

C. investment-capital ratio: i(w)

c = 0.2

c = 0

!0.2 !0.1 0 0.1 0.2

0

3

6

9

12

cash-capital ratio: w = W/K

D. investment-cash sensitivity: i

(w)

c = 0.2

c = 0

Investment and q

!0.2 !0.1 0 0.1 0.2

1.14

1.16

1.18

1.2

1.22

1.24

1.26

1.28

1.3

cash-capital ratio: w = W/K

A. average q and marginal q

q

a

(c = 0.2)

q

m

(c = 0.2)

q

a

(c = 0)

q

m

(c = 0)

q

FB

!0.2 !0.1 0 0.1

0.8

0.9

1

1.1

1.2

1.3

cash-capital ratio: w = W/K

B. investment and q

q

q

a

q

m

q

m

/p

i

!0.2 !0.1 0 0.1

!0.1

!0.05

0

0.05

0.1

0.15

i

Main Results

Investment rst-order equation

marginal cost of investing =

marginal q

marginal cost of nancing

nancing: no target cash level, target leverage;

nancing regions:

payout

cash

credit

equity nancing (or liquidation)

Main Results

Investment rst-order equation

marginal cost of investing =

marginal q

marginal cost of nancing

nancing: no target cash level, target leverage;

nancing regions:

payout

cash

credit

equity nancing (or liquidation)

Main Results (continued)

risk management: cash, hedging, and asset sales

rm value and risk/return: idiosyncratic and

systematic risks

methodology: tractable dynamic economic framework

Вам также может понравиться

- Corporate Finance Formula SheetДокумент4 страницыCorporate Finance Formula Sheetogsunny100% (3)

- Letter - Offer of Earnest MoneyДокумент2 страницыLetter - Offer of Earnest MoneyIpe Closa100% (1)

- VASP Tutorial DielectricsRPA PDFДокумент51 страницаVASP Tutorial DielectricsRPA PDFndsramОценок пока нет

- Chapter 7 Portfolio TheoryДокумент44 страницыChapter 7 Portfolio Theorysharktale2828100% (1)

- CMA CMA2 BookOnline SU11 OutlineДокумент22 страницыCMA CMA2 BookOnline SU11 OutlineM AyazОценок пока нет

- Moody's Report 2005Документ52 страницыMoody's Report 2005as111320034667Оценок пока нет

- Corporate Finance Formula SheetДокумент5 страницCorporate Finance Formula SheetChan Jun LiangОценок пока нет

- Water TechnologyДокумент68 страницWater Technologyahmed100% (1)

- Business History of Latin AmericaДокумент257 страницBusiness History of Latin AmericaDaniel Alejandro Alzate100% (2)

- BudgetingДокумент5 страницBudgetingKevin James Sedurifa Oledan100% (1)

- DC Soccer Cost-Benefit Analysis FINALДокумент406 страницDC Soccer Cost-Benefit Analysis FINALBenjamin FreedОценок пока нет

- FAO Statistics Book PDFДокумент307 страницFAO Statistics Book PDFknaumanОценок пока нет

- Star Wars-Scarcity, Incentives, and Markets: Part 1 - Key Terms - Fill in The Blanks With OneДокумент5 страницStar Wars-Scarcity, Incentives, and Markets: Part 1 - Key Terms - Fill in The Blanks With OneOlufemi AderintoОценок пока нет

- Principles of Managerial Finance Chapter 10Документ13 страницPrinciples of Managerial Finance Chapter 10vireu100% (3)

- VASP Tutorial AtomsMoleculesBulk PDFДокумент62 страницыVASP Tutorial AtomsMoleculesBulk PDFndsramОценок пока нет

- Calculate Band Structure Using VASPДокумент5 страницCalculate Band Structure Using VASPatash10Оценок пока нет

- Electronic Structure VASP NickelДокумент9 страницElectronic Structure VASP NickelRajasekarakumar Vadapoo100% (2)

- Ongaku Drinks+menu+low+resДокумент11 страницOngaku Drinks+menu+low+resKhoa ĐăngОценок пока нет

- How To Answer Multiple Choice Questions Like A ProДокумент5 страницHow To Answer Multiple Choice Questions Like A ProJoy FondevillaОценок пока нет

- International S1 2019Документ218 страницInternational S1 2019Eva ZhengОценок пока нет

- Take Home Final Exam1Документ4 страницыTake Home Final Exam1Sindura RamakrishnanОценок пока нет

- Manajemen Keuangan RangkumanДокумент6 страницManajemen Keuangan RangkumanDanty Christina SitalaksmiОценок пока нет

- Session 5 - Cost of CapitalДокумент49 страницSession 5 - Cost of CapitalMuhammad HanafiОценок пока нет

- FINA2222 Formula SheetДокумент6 страницFINA2222 Formula SheetDaksh ParasharОценок пока нет

- Chapter 8: Cost of CapitalДокумент12 страницChapter 8: Cost of CapitalSeekander AhmedОценок пока нет

- Topic04 WACCДокумент28 страницTopic04 WACCGaukhar RyskulovaОценок пока нет

- Cost of Capital FMДокумент45 страницCost of Capital FMVinay VinnuОценок пока нет

- ECMC49F Midterm Solution 2Документ13 страницECMC49F Midterm Solution 2Wissal RiyaniОценок пока нет

- How To FinanceДокумент20 страницHow To FinanceChristian EstebanОценок пока нет

- Chap 4: Comparing Net Present Value, Decision Trees, and Real OptionsДокумент51 страницаChap 4: Comparing Net Present Value, Decision Trees, and Real OptionsPrabhpuneet PandherОценок пока нет

- Lecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALДокумент49 страницLecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALANH VÕ TỪОценок пока нет

- Pln-Cmams - Cost of CapitalДокумент26 страницPln-Cmams - Cost of Capitaldwi suhartantoОценок пока нет

- Risk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPMДокумент49 страницRisk and Rates of Return: Stand-Alone Risk Portfolio Risk Risk & Return: CAPMNazmus Sakib RahatОценок пока нет

- CH19Документ8 страницCH19Lyana Del Arroyo OliveraОценок пока нет

- External Capital Rationing Internal Capital RationingДокумент10 страницExternal Capital Rationing Internal Capital RationingSiva SubramaniamОценок пока нет

- Review Notes FinalДокумент12 страницReview Notes FinalJoseph AbalosОценок пока нет

- Risk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskДокумент12 страницRisk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskrajjoОценок пока нет

- Lecture Organization: OCF Scenario Analysis Cost AnalysisДокумент21 страницаLecture Organization: OCF Scenario Analysis Cost AnalysisCindy SU YuОценок пока нет

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskДокумент41 страницаThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSheikh OsamaОценок пока нет

- Chapter 19 Financing and ValuationДокумент8 страницChapter 19 Financing and ValuationLovely MendozaОценок пока нет

- FM FormulasДокумент9 страницFM FormulasrafishogunОценок пока нет

- The Weighted Average Cost of Capital and Company Valuation: Fundamentals of Corporate FinanceДокумент30 страницThe Weighted Average Cost of Capital and Company Valuation: Fundamentals of Corporate FinancedewimachfudОценок пока нет

- Assignment 1 Kelompok 3Документ15 страницAssignment 1 Kelompok 3iyanОценок пока нет

- Chapter 2 - Capital Budgeting Under RiskДокумент8 страницChapter 2 - Capital Budgeting Under RiskAndualem ZenebeОценок пока нет

- Rate of Return Payoff Investment: + 1+discount 0Документ10 страницRate of Return Payoff Investment: + 1+discount 0Jair Azevedo JúniorОценок пока нет

- 395 Midterm 1 Cheat SheetДокумент2 страницы395 Midterm 1 Cheat Sheetchrisjames20036Оценок пока нет

- Cost of CapitalДокумент16 страницCost of CapitalSirshajit SanfuiОценок пока нет

- WaccДокумент33 страницыWaccTammy YahОценок пока нет

- Test 1 INV Portfolio - 5 - May - 2022Документ2 страницыTest 1 INV Portfolio - 5 - May - 2022zakaria kerboubОценок пока нет

- The Cost of Capital: Answers To End-Of-Chapter QuestionsДокумент13 страницThe Cost of Capital: Answers To End-Of-Chapter QuestionsRissa VillarinОценок пока нет

- The Cost of Capital: Answers To End-Of-Chapter QuestionsДокумент21 страницаThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausОценок пока нет

- CH 01 BenningaДокумент40 страницCH 01 BenningargfieldsОценок пока нет

- 4 - Cost of CapitalДокумент10 страниц4 - Cost of Capitalramit_madan7372Оценок пока нет

- Chap 11Документ45 страницChap 11SEATQMОценок пока нет

- Corporate Finance Sam en VattingДокумент11 страницCorporate Finance Sam en VattingVincent van MeeuwenОценок пока нет

- 3rd Presentation 2020Документ51 страница3rd Presentation 2020Camila Arango PérezОценок пока нет

- Capital Allocation Across RiskyДокумент23 страницыCapital Allocation Across RiskyVaidyanathan RavichandranОценок пока нет

- Answers To Practice Questions: Capital Budgeting and RiskДокумент8 страницAnswers To Practice Questions: Capital Budgeting and Risksharktale2828Оценок пока нет

- Corporate Finance Tutorial 5 - SolutionsДокумент8 страницCorporate Finance Tutorial 5 - Solutionsandy033003Оценок пока нет

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Документ6 страницGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpОценок пока нет

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Документ6 страницGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioОценок пока нет

- Tugas GSLC Corp Finance Session 16Документ6 страницTugas GSLC Corp Finance Session 16Javier Noel ClaudioОценок пока нет

- 2201AFE VW Week 9 Return, Risk and The SMLДокумент50 страниц2201AFE VW Week 9 Return, Risk and The SMLVut BayОценок пока нет

- PC10 - Investment CriteriaДокумент15 страницPC10 - Investment CriteriaSyed InshanuzzamanОценок пока нет

- Risk and Return-Chapter 4Документ24 страницыRisk and Return-Chapter 4Arif JubaerОценок пока нет

- WACCДокумент16 страницWACCMahmoud HassaanОценок пока нет

- RWJ 08Документ38 страницRWJ 08Kunal PuriОценок пока нет

- Cecchetti, Mohanty and Zampolli The Real Effects of DebtДокумент34 страницыCecchetti, Mohanty and Zampolli The Real Effects of Debtas111320034667Оценок пока нет

- Mental Accounting and Loss AversionДокумент46 страницMental Accounting and Loss Aversionas111320034667Оценок пока нет

- Banks Non-Interest Income and Systemic RiskДокумент40 страницBanks Non-Interest Income and Systemic Riskas111320034667Оценок пока нет

- Debt and Growth: Is There A Magic Threshold?: Andrea Pescatori, Damiano Sandri, and John SimonДокумент19 страницDebt and Growth: Is There A Magic Threshold?: Andrea Pescatori, Damiano Sandri, and John Simonas111320034667Оценок пока нет

- The Impact of High and Growing Government Debt On Economic GrowthДокумент42 страницыThe Impact of High and Growing Government Debt On Economic GrowthSonxScrbd77Оценок пока нет

- Debt and Growth: Is There A Magic Threshold?: Andrea Pescatori, Damiano Sandri, and John SimonДокумент19 страницDebt and Growth: Is There A Magic Threshold?: Andrea Pescatori, Damiano Sandri, and John Simonas111320034667Оценок пока нет

- Growth in Time DebtДокумент6 страницGrowth in Time DebtAli BrelandОценок пока нет

- Qiu Mahagaonkar (2009) (Testing The Modigliani-Miller Theorem Directly in The Lab. A General Equilibrium Approach)Документ33 страницыQiu Mahagaonkar (2009) (Testing The Modigliani-Miller Theorem Directly in The Lab. A General Equilibrium Approach)as111320034667Оценок пока нет

- Jensen Meckling (1994) (The Nature of Man)Документ39 страницJensen Meckling (1994) (The Nature of Man)as111320034667Оценок пока нет

- Currency HedgingДокумент33 страницыCurrency Hedgingas111320034667Оценок пока нет

- Dopke Townsend (Dynamic Mechanism Design With Hidden Income and Hidden Actions)Документ51 страницаDopke Townsend (Dynamic Mechanism Design With Hidden Income and Hidden Actions)as111320034667Оценок пока нет

- Morkoetter Westerfeld (200) (Rating Model Arbitrage in CDO Markets. An Empirical Analysis)Документ25 страницMorkoetter Westerfeld (200) (Rating Model Arbitrage in CDO Markets. An Empirical Analysis)as111320034667Оценок пока нет

- Zhou 2006 (Principal Agent Analysis in Continuous Time)Документ39 страницZhou 2006 (Principal Agent Analysis in Continuous Time)as111320034667Оценок пока нет

- Williams (2006) (On Dynamic Principal Agenta Problems in COntinuous Time)Документ35 страницWilliams (2006) (On Dynamic Principal Agenta Problems in COntinuous Time)as111320034667Оценок пока нет

- Statistical Methods in Credit Risk ModelingДокумент156 страницStatistical Methods in Credit Risk ModelingTin Lun Elvin HoОценок пока нет

- Sunstein Thaler (2003) (Libertarian Paternalism Is Not An Oxymoron)Документ45 страницSunstein Thaler (2003) (Libertarian Paternalism Is Not An Oxymoron)as111320034667Оценок пока нет

- Rubinstein (History of Modigliani-Miller Theorem)Документ7 страницRubinstein (History of Modigliani-Miller Theorem)as111320034667Оценок пока нет

- Platt (2009) (The Private Equity Myth)Документ19 страницPlatt (2009) (The Private Equity Myth)as111320034667Оценок пока нет

- Zhang (FInancing Policy I)Документ20 страницZhang (FInancing Policy I)as111320034667Оценок пока нет

- Acharya Bharath Srinivasan (2004) (Understanding Recovery Rates)Документ60 страницAcharya Bharath Srinivasan (2004) (Understanding Recovery Rates)Lamies BorjesОценок пока нет

- Plantin Sapra Shin (2005) (Marking To Market, Liquidity and Financial Stability)Документ33 страницыPlantin Sapra Shin (2005) (Marking To Market, Liquidity and Financial Stability)as111320034667Оценок пока нет

- Qi (2010) (Valuation Methologies and Emerging Markets)Документ18 страницQi (2010) (Valuation Methologies and Emerging Markets)as111320034667Оценок пока нет

- Benmelech Dlugosz (2008) (The Alchemy of Credit Ratings)Документ40 страницBenmelech Dlugosz (2008) (The Alchemy of Credit Ratings)as111320034667Оценок пока нет

- Frank Goyal (2002) (Testing The Pecking Order Theory of Capital Structure)Документ32 страницыFrank Goyal (2002) (Testing The Pecking Order Theory of Capital Structure)as111320034667Оценок пока нет

- Altman, Onorato (2003) (An Integrated Pricing Model For Defaultable Loans and Bonds)Документ21 страницаAltman, Onorato (2003) (An Integrated Pricing Model For Defaultable Loans and Bonds)as111320034667Оценок пока нет

- Dullmann Trapp (2004) (Systematic Risk in Recovery Rates)Документ52 страницыDullmann Trapp (2004) (Systematic Risk in Recovery Rates)as111320034667Оценок пока нет

- Dullmann Trapp (2004) (Systematic Risk in Recovery Rates)Документ52 страницыDullmann Trapp (2004) (Systematic Risk in Recovery Rates)as111320034667Оценок пока нет

- Barnhill, Maxwell (2002) (Modeling Correlated Market and Credit Risk in Fixed Income Portfolios)Документ28 страницBarnhill, Maxwell (2002) (Modeling Correlated Market and Credit Risk in Fixed Income Portfolios)as111320034667Оценок пока нет

- A Research Report ON "Perception of Consumer Towards Online Food Delivery App"Документ43 страницыA Research Report ON "Perception of Consumer Towards Online Food Delivery App"DEEPAKОценок пока нет

- The Struggling Spanish Economy: Guide Words Possible Source Main IdeaДокумент4 страницыThe Struggling Spanish Economy: Guide Words Possible Source Main IdeaMayeОценок пока нет

- Financial Times Europe August 222020Документ46 страницFinancial Times Europe August 222020HoangОценок пока нет

- MBM38202954 06 150925Документ4 страницыMBM38202954 06 150925Serkan SekerciОценок пока нет

- The Effect of Revenue of Small and Medium Enterprise in Naawan During PandemicДокумент9 страницThe Effect of Revenue of Small and Medium Enterprise in Naawan During PandemicJeffer Sol E. CortadoОценок пока нет

- Class 12 Project EcoДокумент18 страницClass 12 Project EcoKunal GuptaОценок пока нет

- 5.1 FindingsДокумент9 страниц5.1 FindingsSaif Ahmed Khan RezvyОценок пока нет

- Project Report On: Submitted byДокумент47 страницProject Report On: Submitted byManoj ParabОценок пока нет

- State Wise Installed Capacity As On 30.06.2019Документ2 страницыState Wise Installed Capacity As On 30.06.2019Bhom Singh NokhaОценок пока нет

- ЖасминДокумент10 страницЖасминjasmin nurmamatovaОценок пока нет

- Efektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Документ11 страницEfektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Didit Prasojo secondОценок пока нет

- Quotation List E D C: Series No. Model No. Unit Price (Usd) Unit Price (Usd) Unit Price (Usd)Документ4 страницыQuotation List E D C: Series No. Model No. Unit Price (Usd) Unit Price (Usd) Unit Price (Usd)Lucian StroeОценок пока нет

- Paramount InvoiceДокумент4 страницыParamount InvoiceDipak KotkarОценок пока нет

- Chinese Soft Power Rise and Implications For A Small State by CharuniДокумент3 страницыChinese Soft Power Rise and Implications For A Small State by CharuniRaphael Sitor NdourОценок пока нет

- Municipality Province Quezon Calabarzon Philippines Manila LucenaДокумент6 страницMunicipality Province Quezon Calabarzon Philippines Manila LucenaJensen Ryan LimОценок пока нет

- Springer - The Anarchist Roots of Geography Towards Spatial EmancipationДокумент8 страницSpringer - The Anarchist Roots of Geography Towards Spatial EmancipationRobertОценок пока нет

- Mobilink PresentationДокумент4 страницыMobilink PresentationAalam KhaliliОценок пока нет

- Qualified Contestable Customers - January 2022 DataДокумент59 страницQualified Contestable Customers - January 2022 DataDr. MustafaAliОценок пока нет

- 2015 - Civil Services Mentor - MayДокумент145 страниц2015 - Civil Services Mentor - MayVishnu RoyОценок пока нет

- Prac.U1 3.ML - Pre.list - ReadingДокумент4 страницыPrac.U1 3.ML - Pre.list - ReadingDịp Dịp67% (3)

- General AwarenessДокумент137 страницGeneral AwarenessswamyОценок пока нет

- Information Age JoshuaДокумент4 страницыInformation Age JoshuaClaren daleОценок пока нет

- Tugas ToeflДокумент3 страницыTugas ToeflIkaa NurОценок пока нет

- Comp Data2312 PDFДокумент338 страницComp Data2312 PDFkunalОценок пока нет