Академический Документы

Профессиональный Документы

Культура Документы

Chi So Nha Quan Tri Mua Hang 7 2013 en

Загружено:

haiquanngИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chi So Nha Quan Tri Mua Hang 7 2013 en

Загружено:

haiquanngАвторское право:

Доступные форматы

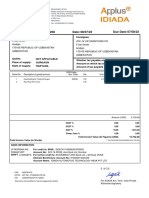

HSBC Purchasing Managers Index 2013

Embargoed until: 1 August 2013

HSBC Vietnam Manufacturing PMI

Slower deterioration of operating conditions signalled during July

Key findings: PMI remains below 50.0 no-change mark for third successive month Output and new orders fall, but at slower rates Employment levels unchanged

Vietnams manufacturing sector continued to contract during July, albeit at a slower pace as output and new orders fell at weaker rates and employment was unmoved. Margins remained under pressure as output charges continued to fall, but input prices rose at an accelerated pace. The headline seasonally adjusted Purchasing Managers Index (PMI) a composite indicator designed to provide a singlefigure snapshot of operating conditions in the manufacturing economy registered 48.5 in July. That was an improvement on Junes 46.4 but, by remaining below the 50.0 no-change mark, signalled a third successive monthly contraction of the manufacturing sector. Output and new orders both continued to fall during the latest survey period, albeit at slower rates. Modest falls in these key variables were said to reflect soft underlying market conditions, with clients purchasing power reported to have weakened. Latest data implied that the net decline in new orders was partly driven by a decline in new business from abroad. New export orders fell for a second successive month and at the fastest rate since the start of the year. China was noted in particular as a source of demand weakness during the latest survey period. With new orders continuing to fall, panellists were able to make further inroads into their work outstanding. The latest decline was the joint second fastest in the survey history as companies were able to take advantage of slow demand and clear existing contracts. Excess production was also used to build inventories during July, with stocks of finished goods rising to the sharpest degree since June 2012. Inventories have now grown for two months in a row. On the employment front, Vietnamese manufacturers left staffing levels unchanged during July following two months of contraction. While some panellists added to payroll numbers to help bolster production, others responded to reduced new order volumes by cutting staffing levels. Output charges were cut further in July, the fourth month in succession that a net reduction in average tariffs has been observed. Discounts were reported to reflect intensifying market competition and efforts to stimulate sales. There was some evidence that output prices were being reduced to help clear excess inventory at plants. In contrast, input prices continued to rise. Inflation has now been registered for seven months in a row, with a limited supply of inputs reported to have pushed up prices. There was also evidence that a stronger US dollar had raised import costs. Average delivery times continued to improve despite evidence of vendors struggling to source inputs. Companies reported that reduced purchasing activity had eased the pressure on suppliers during the latest survey period.

HSBC Vietnam Purchasing Managers Index (PMI) HSBC Vietnam Purchasing Managers Index (PMI)

50 = no change on previous month

55

Increasing rate of growth

50

HSBC Vietnam Purchasing Managers Index

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

40

The HSBC Vietnam Manufacturing Purchasing Managers Index (PMI) is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. The indicator is derived from individual diffusion indices which measure changes in output, new orders, employment, suppliers delivery times and stocks of goods purchased. A reading of the PMI below 50.0 indicates that the manufacturing economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change. The greater the divergence from 50.0, the greater the rate of change signalled by the index. Purchasing Managers Index and PMI are trade marks of Markit Economics Limited, HSBC use the above marks under licence. Markit and the Markit logo are registered trade marks of Markit Group Limited.

HSBC Vietnam Manufacturing PMI

Output Index

Q. Please compare your production/output this month with the situation one month ago.

50 = no change on previous month

60 55 50 45 40

Increasing rate of growth

% L o w er

% H ig h er

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

The seasonally adjusted Output Index remained below the 50.0 no-change mark in July to indicate a further contraction of manufacturing output, the third in successive months. The degree to which output fell was solid, despite easing since June, with panellists again linking the latest contraction to ongoing weakness in their new order books.

New Orders Index

Q. Please compare the level of new orders received (Vietnam and export) this month with the situation one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

40

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

The seasonally adjusted New Orders Index posted below the crucial 50.0 no-change mark during July, extending the current period of decline to three months. That said, Julys fall in new business was modest and considerably weaker than in June. Panellists reported that client demand was lower, with purchasing power squeezed amid evidence of soft underlying market conditions.

New Export Orders Index

Q. Please compare the level of new export orders received this month with the situation of one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

40

% S am e

Julys survey indicated further weakness in new export orders, with latest data showing a second consecutive monthly decline. Moreover, a fall in the seasonally adjusted New Export Orders Index to a six-month low indicated an accelerated pace of contraction. Panellists reported that new export orders had fallen in line with softer global demand, with China mentioned as a particular source of demand weakness.

Backlogs of Work Index

Q. Please compare the level of outstanding business in your company this month with the situation one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

40

% S am e

Vietnamese manufacturers were again able to make inroads into their work outstanding during July. The respective seasonally adjusted Backlogs of Work Index has posted readings below the 50.0 no-change mark for 16 months in succession, and the latest decline was the joint-second sharpest in the series history. Insufficient demand was reported to have enabled manufacturers to clear backlogs of work. All Intellectual Property Rights owned by Markit Economics Limited

1 August 2013

Stocks of Finished Goods Index

Q. Please compare your stocks of finished goods (in units) this month with the situation one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

40

% S am e

A second successive monthly increase in inventories of finished goods was signalled during the latest survey period. Moreover, the seasonally adjusted Stocks of Finished Goods Index indicated a solid rate of growth that was the sharpest since June 2012. Panellists reported that slow sales had led to an excess of production at their plants and a subsequent increase in warehouse inventories.

Employment Index

Q. Please compare the level of employment at your unit with the situation one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

The seasonally adjusted Employment Index registered exactly at the 50.0 neutral mark during July to indicate no change in staffing volumes since the previous survey period. Stagnation was an improvement on two months of consecutive contraction. Where growth of employment was recorded, panellists took on extra staff to service production needs. Any falls in staff numbers were linked to reduced new order volumes.

Output Prices Index

Q. Please compare the average price that you charge per unit of output (volume weighted) this month with the situation one month ago.

50 = no change on previous month

70 65 60 55 50 45 40 35

Apr '11 Jul Oct Jan '12 Apr Jul Oct

Increasing rate of growth

% L o w er

% H ig h er

Increasing rate of contraction Jan'13 Apr Jul

% S am e

Output charges continued to decline during July, extending the current deflationary period to four months. Exactly14% of the survey panel indicated a decline in output prices since the previous survey period, with a number offering discounts in response to market competition and efforts to stimulate sales. There were some reports of a desire to shift excess inventory of warehouse stocks.

Input Prices Index

Q. Please compare the average price of your purchases (volume weighted) this month with the situation one month ago.

50 = no change on previous month

85 80 75 70 65 60 55 50 45 40

Increasing rate of inflation

% L o w er

% H ig h er

Increasing rate of deflation Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

The seasonally adjusted Input Prices Index signalled continued inflation of input prices during July. Latest data marked the seventh successive month that input prices have increased, and the latest rise was solid and the sharpest for three months. Panellists blamed limited supply amongst vendors for inflation, while others reported that a stronger US dollar raised the price of imported goods. Higher transport costs were also reported.

1 August 2013

Suppliers Delivery Times Index

Q. Please compare your suppliers delivery times (volume weighted) this month with the situation one month ago.

50 = no change on previous month

55

Faster deliveries

% S lo w er

% F aster

50

45

Slower deliveries Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

Average supplier delivery times shortened for a fourth month in succession during July, but again at only a modest pace. Panellists reported that weaker demand for inputs had led to a net gain in average lead times, although the rate of improvement was restricted by reports of scarce supply at vendors.

Quantity of Purchases Index

Q. Please compare the quantity of items purchased (in units) this month with the situation one month ago.

50 = no change on previous month

55 50 45 40 35

Increasing rate of growth

% L o w er

% H ig h er

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

% S am e

The seasonally adjusted Quantity of Purchases Index remained below the 50.0 no-change mark for a third month in succession during July to indicate a further reduction in purchasing activity. Panellists reported that buying had been reduced in line with ongoing falls in production and new order volumes. The degree to which input buying fell in the latest survey period was solid, though weaker than recorded during June.

Stocks of Purchases Index

Q. Please compare your stocks of purchases (in units) with the situation one month ago.

50 = no change on previous month

55

Increasing rate of growth

% L o w er

% H ig h er

50

45

Increasing rate of contraction Apr '11 Jul Oct Jan '12 Apr Jul Oct Jan'13 Apr Jul

40

% S am e

With purchasing activity being reduced further in July, inventories of inputs held by Vietnamese manufacturers continued to decline. However, with the seasonally adjusted Stocks of Purchases Index registering slightly below the 50.0 no-change mark, the degree to which inventories were reduced was only marginal.

Notes on the Data and Method of Presentation

The Purchasing Managers Index is based on data compiled from monthly replies to questionnaires sent to purchasing executives in around 400 manufacturing companies. The panel is stratified geographically and by Standard Industrial Classification (SIC) group, based on industry contribution to Vietnam GDP . Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the Report shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the diffusion index. This index is the sum of the positive responses plus a half of those responding the same. The Purchasing Managers Index (PMI) is a composite index based on five of the individual indexes with the following weights derived from the Chartered Institute of Purchasing & Supplys survey of the UK economy: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times index inverted so that it moves in a comparable direction. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease. Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

Warning

The intellectual property rights to the HSBC Vietnam Manufacturing PMI provided herein is owned by Markit Group Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markits prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (data) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Markit, PMI and Purchasing Managers' Index are all trademarks owned by The Markit Group.

All Intellectual Property Rights owned by Markit Economics Limited

Вам также может понравиться

- Not F OR Redistribution: HSBC Vietnam Manufacturing PMIДокумент4 страницыNot F OR Redistribution: HSBC Vietnam Manufacturing PMIThanh XuânОценок пока нет

- China Factories Report Steepening Downturn in MarchДокумент2 страницыChina Factories Report Steepening Downturn in MarchDhananjaya HathurusingheОценок пока нет

- WF WeeklyEconomicFinancialCommentary 01102014Документ9 страницWF WeeklyEconomicFinancialCommentary 01102014Javier EscribaОценок пока нет

- PMI, Inflation and IIP AnalysisДокумент17 страницPMI, Inflation and IIP Analysissanjay josephОценок пока нет

- Vietnam - Lets Go Vietnam 08.05.2012Документ9 страницVietnam - Lets Go Vietnam 08.05.2012Duc Tri NguyenОценок пока нет

- MarrkitcompGlobal Economy 12-01-05Документ3 страницыMarrkitcompGlobal Economy 12-01-05cwarren2004Оценок пока нет

- FinLight Research - Market Perspectives Jan 2014Документ55 страницFinLight Research - Market Perspectives Jan 2014tingitingiОценок пока нет

- Wells Fargo Securities Macro Report 01-05-2015Документ9 страницWells Fargo Securities Macro Report 01-05-2015Michael Anthony BallОценок пока нет

- PMI Report 1302 Puerto RcioДокумент3 страницыPMI Report 1302 Puerto RcioMonitoreoEconomicoPRОценок пока нет

- KoreaДокумент2 страницыKoreaDavid4564654Оценок пока нет

- Some August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012Документ5 страницSome August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012api-162199694Оценок пока нет

- Pmi Dec 2013 Report FinalДокумент2 страницыPmi Dec 2013 Report FinaleconomicdelusionОценок пока нет

- Week of October 10, 2022Документ13 страницWeek of October 10, 2022Steve PattrickОценок пока нет

- Bos 0915Документ2 страницыBos 0915William HarrisОценок пока нет

- WF Weekly Econ 04-10-131Документ9 страницWF Weekly Econ 04-10-131BlackHat InvestmentsОценок пока нет

- Psi September 2013 Final Report PDFДокумент2 страницыPsi September 2013 Final Report PDFLauren FrazierОценок пока нет

- DailyFT - Be Empowered China Factory Growth Slows in November, Weakens Quarterly Outlook PrintДокумент2 страницыDailyFT - Be Empowered China Factory Growth Slows in November, Weakens Quarterly Outlook PrintSanath DissanayakeОценок пока нет

- June Psi ReportДокумент2 страницыJune Psi ReportDavid SmithОценок пока нет

- PMI July 2015Документ8 страницPMI July 2015Swedbank AB (publ)Оценок пока нет

- HsbcpmidecДокумент2 страницыHsbcpmidecChrisBeckerОценок пока нет

- TaiwanДокумент2 страницыTaiwanDavid4564654Оценок пока нет

- PMI January 2015Документ8 страницPMI January 2015Swedbank AB (publ)Оценок пока нет

- Task 4Документ8 страницTask 4Anooja SajeevОценок пока нет

- PMI - August 2014Документ8 страницPMI - August 2014Swedbank AB (publ)Оценок пока нет

- Economic Report - 07 December 2012Документ9 страницEconomic Report - 07 December 2012Angel BrokingОценок пока нет

- View Press ReleaseДокумент4 страницыView Press ReleaseLuke Campbell-SmithОценок пока нет

- Growth in Logistics N SCMДокумент3 страницыGrowth in Logistics N SCMPradeep PrabhuОценок пока нет

- Dashboard - US Manufacturing Spring 2013Документ7 страницDashboard - US Manufacturing Spring 2013gpierre7833Оценок пока нет

- PMI - September 2014Документ8 страницPMI - September 2014Swedbank AB (publ)Оценок пока нет

- Market Perspectives - Feb 2014Документ73 страницыMarket Perspectives - Feb 2014tingitingiОценок пока нет

- PMI China October 2021Документ4 страницыPMI China October 2021Arie HendriyanaОценок пока нет

- China Economy Manufacturing Regains Momentum As The Outlook ImprovesДокумент1 страницаChina Economy Manufacturing Regains Momentum As The Outlook ImprovesmetkarchetanОценок пока нет

- Texas Fed Manufacturing Survey - May 2015Документ4 страницыTexas Fed Manufacturing Survey - May 2015Bob PriceОценок пока нет

- Report On Jobs: UK Labour MarketДокумент8 страницReport On Jobs: UK Labour MarkethelenproctorОценок пока нет

- ISM, Income, Consumption, Construction DataДокумент1 страницаISM, Income, Consumption, Construction DatamonzennОценок пока нет

- Q2 News 6Документ2 страницыQ2 News 6Kaizer James CaguioaОценок пока нет

- Er 20130620 Bull Acci Q 22013Документ5 страницEr 20130620 Bull Acci Q 22013David SmithОценок пока нет

- HSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseДокумент3 страницыHSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseRonitsinghthakur SinghОценок пока нет

- PMI Services January 2014Документ8 страницPMI Services January 2014Swedbank AB (publ)Оценок пока нет

- Terranova Calendar Jan 2014Документ7 страницTerranova Calendar Jan 2014B_U_C_KОценок пока нет

- Pmi May13 FinalДокумент2 страницыPmi May13 FinalBelinda WinkelmanОценок пока нет

- Psi Jan 13 Report Final PDFДокумент2 страницыPsi Jan 13 Report Final PDFBelinda WinkelmanОценок пока нет

- Ficc Times HTML HTML: The Week Gone by and The Week AheadДокумент7 страницFicc Times HTML HTML: The Week Gone by and The Week AheadBindiya CardozОценок пока нет

- India's Manufacturing PMI Sinks To An 8-Month Low of 55.5 in OctДокумент2 страницыIndia's Manufacturing PMI Sinks To An 8-Month Low of 55.5 in Octz_k_j_vОценок пока нет

- Dec 2011Документ8 страницDec 2011jeremy56Оценок пока нет

- PMI USA010424Документ2 страницыPMI USA010424Marcelo PàivaОценок пока нет

- Aig Pci August 2013Документ2 страницыAig Pci August 2013leithvanonselenОценок пока нет

- Evropská Ekonomika (V AJ)Документ7 страницEvropská Ekonomika (V AJ)Ivana LeváОценок пока нет

- Terranova Calendar Dec 2013Документ5 страницTerranova Calendar Dec 2013B_U_C_KОценок пока нет

- Psi Oct11 ReportДокумент2 страницыPsi Oct11 Reportdavid_llewellyn_smithОценок пока нет

- Weekly Economic Commentary 11-3-11Документ7 страницWeekly Economic Commentary 11-3-11monarchadvisorygroupОценок пока нет

- Purchasing Managers' Index - August 2013Документ8 страницPurchasing Managers' Index - August 2013Swedbank AB (publ)Оценок пока нет

- Er 20111006 Bull PhatdragonДокумент1 страницаEr 20111006 Bull Phatdragondavid_llewellyn9140Оценок пока нет

- PMI October 2013Документ8 страницPMI October 2013Swedbank AB (publ)Оценок пока нет

- ISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessДокумент9 страницISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessHåkan RolfОценок пока нет

- Psi Final Report April 13Документ2 страницыPsi Final Report April 13Belinda WinkelmanОценок пока нет

- Mar 06 28 12Документ3 страницыMar 06 28 12Anonymous Feglbx5Оценок пока нет

- Mumbai: Driven by Rise in New Businesses, Services Sector Growth Picked Up Momentum in AprilДокумент3 страницыMumbai: Driven by Rise in New Businesses, Services Sector Growth Picked Up Momentum in ApriliesmcrcОценок пока нет

- 2015 0622 Hale Stewart Us Equity and Economic Review For The Week of June 15 19 Better News But Still A Touch SlogДокумент11 страниц2015 0622 Hale Stewart Us Equity and Economic Review For The Week of June 15 19 Better News But Still A Touch SlogcasefortrilsОценок пока нет

- Vietnam Banking Survey 2013 - enДокумент0 страницVietnam Banking Survey 2013 - enhaiquanngОценок пока нет

- SA23 Commercial Banking AmericasДокумент4 страницыSA23 Commercial Banking AmericashaiquanngОценок пока нет

- Customer Service Excellence Standard Key ElementsДокумент17 страницCustomer Service Excellence Standard Key Elementshaiquanng50% (2)

- Complaints Procedure Flow ChartДокумент4 страницыComplaints Procedure Flow CharthaiquanngОценок пока нет

- NSM2361 Small Business TemplateДокумент10 страницNSM2361 Small Business TemplatehaiquanngОценок пока нет

- HSBC Vietnam Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseДокумент3 страницыHSBC Vietnam Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleasehaiquanngОценок пока нет

- CSU 070215 Customer Care PolicyДокумент19 страницCSU 070215 Customer Care PolicyhaiquanngОценок пока нет

- Check NegotiationДокумент1 страницаCheck NegotiationhaiquanngОценок пока нет

- Event Management Plan - GDC ToolkitДокумент36 страницEvent Management Plan - GDC Toolkitmunyeki80% (5)

- Chi So Nha Quan Tri Mua Hang 5 2013 enДокумент3 страницыChi So Nha Quan Tri Mua Hang 5 2013 enhaiquanngОценок пока нет

- HSBC Vietnam Pmi Dec 2012 enДокумент3 страницыHSBC Vietnam Pmi Dec 2012 enhaiquanngОценок пока нет

- VNI Monthly Report Mar 2013Документ4 страницыVNI Monthly Report Mar 2013haiquanngОценок пока нет

- HSBC Increase Stake in Bao Viet enДокумент3 страницыHSBC Increase Stake in Bao Viet enhaiquanngОценок пока нет

- HSBC Vietnam Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseДокумент3 страницыHSBC Vietnam Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleasehaiquanngОценок пока нет

- June Banking Reform in Vietnam PDFДокумент7 страницJune Banking Reform in Vietnam PDFTung BlackiadoОценок пока нет

- Crisis CommДокумент12 страницCrisis Commsiva_koti10Оценок пока нет

- Epi Module 04 Tag508Документ77 страницEpi Module 04 Tag508haiquanngОценок пока нет

- VOF Q1 2013 Report FinalДокумент12 страницVOF Q1 2013 Report FinalhaiquanngОценок пока нет

- Questionnaire Design: Developing A Questionnaire So You Get The Information You Want!Документ43 страницыQuestionnaire Design: Developing A Questionnaire So You Get The Information You Want!haiquanngОценок пока нет

- Questionnaire Design: Developing A Questionnaire So You Get The Information You Want!Документ43 страницыQuestionnaire Design: Developing A Questionnaire So You Get The Information You Want!haiquanngОценок пока нет

- The Cambodia, Laos & Myanmar: Business ForecastДокумент4 страницыThe Cambodia, Laos & Myanmar: Business ForecasthaiquanngОценок пока нет

- Epi Module 04 Tag508Документ77 страницEpi Module 04 Tag508haiquanngОценок пока нет

- How To Design A QuestionnaireДокумент3 страницыHow To Design A QuestionnaireMithun SahaОценок пока нет

- Business PlanДокумент12 страницBusiness PlanAli Abdurrahman SungkarОценок пока нет

- Strategic Plan TemplateДокумент25 страницStrategic Plan Templateblazivica999Оценок пока нет

- Bizguide Business Plan TemplateДокумент28 страницBizguide Business Plan TemplatehaiquanngОценок пока нет

- Annual Business Plan TemplateДокумент3 страницыAnnual Business Plan TemplatehaiquanngОценок пока нет

- Bizguide Business Plan TemplateДокумент28 страницBizguide Business Plan TemplatehaiquanngОценок пока нет

- Annual Business Plan TemplateДокумент3 страницыAnnual Business Plan TemplatehaiquanngОценок пока нет

- SunstarДокумент189 страницSunstarSarvesh Chandra SaxenaОценок пока нет

- Assignment For Lecture 9: Supply Chain Management: I MultichoiceДокумент8 страницAssignment For Lecture 9: Supply Chain Management: I MultichoiceThi Khanh Linh PhamОценок пока нет

- CH 4Документ31 страницаCH 4ferasbarakat100% (2)

- Top Companies in Vapi GujaratДокумент9 страницTop Companies in Vapi GujaratNimesh C VarmaОценок пока нет

- Annual Report: Petrochina Company LimitedДокумент276 страницAnnual Report: Petrochina Company LimitedDư Trần HưngОценок пока нет

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyДокумент8 страницImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksОценок пока нет

- Proposed Purified Water Station Business Plan: Dr. Gladys G. Rosales MA ELTДокумент8 страницProposed Purified Water Station Business Plan: Dr. Gladys G. Rosales MA ELTJorim Sumangid100% (1)

- 264354822072023INDEL4SB22220720231808Документ9 страниц264354822072023INDEL4SB22220720231808tsmlaserdelhiОценок пока нет

- MarketingStrategyChapter07-2 4Документ60 страницMarketingStrategyChapter07-2 4deepak boraОценок пока нет

- Indian Securities Market ReviewДокумент221 страницаIndian Securities Market ReviewSunil Suppannavar100% (1)

- Micro Credit PresentationДокумент33 страницыMicro Credit PresentationHassan AzizОценок пока нет

- C39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESДокумент11 страницC39SN FINANCIAL DERIVATIVES- TUTORIAL-OPTION PAYOFFS AND STRATEGIESKhairina IshakОценок пока нет

- As and Guidance NotesДокумент94 страницыAs and Guidance NotesSivasankariОценок пока нет

- 2001 Parker Hannifin Annual ReportДокумент46 страниц2001 Parker Hannifin Annual ReportBill M.Оценок пока нет

- ABC PracticeДокумент5 страницABC PracticeAbhijit AshОценок пока нет

- 5 Essential Business Strategy ToolsДокумент30 страниц5 Essential Business Strategy ToolsrlwersalОценок пока нет

- E-Business Adaptation and Financial Performance of Merchandising Business in General Santos CityДокумент9 страницE-Business Adaptation and Financial Performance of Merchandising Business in General Santos CityTesia MandaloОценок пока нет

- ACG 6305 Chapter 1Документ17 страницACG 6305 Chapter 1Rudy Joseph Michaud IIОценок пока нет

- BOI - New LetterДокумент5 страницBOI - New Lettersandip_banerjeeОценок пока нет

- Orange Book 2nd Edition 2011 AddendumДокумент4 страницыOrange Book 2nd Edition 2011 AddendumAlex JeavonsОценок пока нет

- Assignment 1AДокумент5 страницAssignment 1Agreatguy_070% (1)

- Portfoli o Management: A Project OnДокумент48 страницPortfoli o Management: A Project OnChinmoy DasОценок пока нет

- SELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESДокумент19 страницSELLING SKILLS: CUSTOMER-CENTRIC STRATEGIESNatsu DeAcnologiaОценок пока нет

- 7C'S of Effective CommunicationДокумент2 страницы7C'S of Effective CommunicationOsama AhmedОценок пока нет

- IINP222300238 JSC JV Homologation - 220714 - 110521Документ1 страницаIINP222300238 JSC JV Homologation - 220714 - 110521Gayrat KarimovОценок пока нет

- Kalamba Games - 51% Majority Stake Investment Opportunity - July23Документ17 страницKalamba Games - 51% Majority Stake Investment Opportunity - July23Calvin LimОценок пока нет

- Cost Estimation ProcurementДокумент21 страницаCost Estimation ProcurementEng-Ahmed BaasaayОценок пока нет

- CostSheetДокумент6 страницCostSheetsudhansu prasadОценок пока нет

- Human Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofДокумент44 страницыHuman Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDHARMENDER YADAVОценок пока нет

- Diploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementДокумент2 страницыDiploma, Anna University-UG, PG., HSC & SSLC: Ba5008 Banking Financial Services ManagementSruthi KunnasseryОценок пока нет