Академический Документы

Профессиональный Документы

Культура Документы

Seminar On Business Valuation (Property Related) Ism

Загружено:

rokiahhassanИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Seminar On Business Valuation (Property Related) Ism

Загружено:

rokiahhassanАвторское право:

Доступные форматы

Af.

(jrJ

VAWJff10fJ Cfr:offNj relATED)

:

G (? 1LBtfr

Mp- {jf1){lbE cu

MY. CittONI1

Np- t. &{10

'2l (;ctDgtf2 ;;2005

1\1:

Lvtlvlj->LlF &ott {OUNt!<t' ewg

BUSINESS VALUATION

INTERNATIONAL VALUATION

STANDARDS COMMITTEE

A.

B.

I. INTRODUCTION

What is being appraised?

Definitions of Value.

"Fair Market Value" usually the standard of value in the United States of America. It is well defined. "Market

Value", as defined in real property and by IVSC, is the same as Fair Market Value in business appraisal.

Fair market value is considered to represent a value at which awilling buyer and a willing

seller, both beinQ informed of the relevant facts about the business, could reasonably conduct

a transaction, neither person acting under the compulsion to do so.

Although not stated in the definition, it assumes: 1) a cash value; 2) both parties can perform (buyer

has financing and seller has clear title and can deliver); 3) a reasonable time for exposure in the

market; and 4) normal contacts will be signed.

Unusual factors must be explained if not valued.

C. Who Performs Business Valuations

Chartered Financial Analyst (CFA) of the Institute of Chartered Financial Analysts

Accredited Senior Appraiser (ASA) of American Society of Appraisers in Business Valuation

Certified Business Appraiser (CBA) of the Institute of Business Appraisers

Accredited in Business Valuation (ABV) of the American Institute of Certified Public Accountants.

Chartered Business Valuator (CBV) of the Canadian Institute of Chartered Business Valuators.

II. BUSINESS APPRAISAL

STANDARDS

A. International Valuation Standards - 2003, Guidance Note 6.

B. Uniform Standards of Professional Appraisal Practice (USPAP)

Standards 9 and 10 as well as the Preamble

- Standard 9: In developing a business appraisal, an appraiser must be

aware of, understand and correctly employ those recognized methods

and techniques that are necessary to produce a credible appraisal.

- Standard 10: In reporting the results of a business appraisal, an

appraiser must communicate each analysis, opinion and conclusion in a

manner that is not misleading.

C. American Society of Appraisers Business Valuation Standards

D. Institute of Business Appraisers Business Valuation Standards

III. BUSINESS APPRAISAL

ETHICS - IVS-SixthEdition

This is an extract of IVS. Please use entire IVS.

3.3 A Valuer is a person who possesses the

necessary qualifications, abilities, and

experience to execute a valuation.

The Valuer shall be a person of good repute

who:

- Has an appropriate degree

- Has suitable experience

- Understands recognized methods and techniques

IVS Ethics - Cant.

- Is a member of a recognized national professional

valuation body

- Pursues professional learning

- Follows this Code of Conduct

Ethics:

- Honesty

- Integrity

- Conduct

- Conflicts of interest

~ Confidentiality

- Impartiality

IVS Ethics - Cont.

Competence

- Acceptance of Instructions

-Outside Assistance

- Efficiency and Diligence

Disclosure

Reporting of Values

IV. BUSINESS VALUATION

THEORY

A. The value of a business arises from:

- Assets, either Tangible or Intangible; and

- Cash Flow (different definitions of income)

B. The Phases of Business Value

- Orderly Liquidation is often the least value if the

owner has ability to sell the assets

- As cash flow increases, the value of the business

increases from the liquidating value of tangible assets

to the going concern value of tangible assets

- As cash flow increases further, the value of the

business increases to include the value of specific,

identifiable and non-identifiable intangible assets

VALUE=!(INCOME,ASSETS)

Relationship of Value, Income and Assets

Income Level Value

Liquidation Value

9 8

Goodwill

7

Value in Use

6 5 4 3

Company Value

........

....

2

........

........

.....

........

1

........

10

9

8

V

7

a

6

I

5

U 4

e

3

2

1

........

....

0

....

0

Income

c. The Three Basic Approaches

to Value

1. Cost

- Is a balance sheet focused approach (also called Adjusted

Balance Sheet)

- Based on the premise that a prudent buyer will pay no more for a

property than it would cost to replace with a substitute property

with the same utility -- the principal of substitution

- Concept: Value all the assets of a company, subtract the

liabilities, to arrive at the value of FMV stockholders' equity

- Value of each asset may be derived by using any of the three

approaches for valuing those individual assets

- Assets and company may be valued as a going concern or in a

liquidation scenario

COST APPROACH

FAIR MARKET VALUE BALANCE

SHEET

CURRENT ASSETS

WORKING

CAPITAL

FIXED ASSETS

ASSETS

CURRENT

LIABILITIES

LONG TERM DEBT

LIABILITIES + EQUITY

C.

2.

a)

b)

c)

d)

e)

The Three Basic.Approaches

to Value - Continued

Market

Again, principle of substitution.

Comparison between subject property and similar

properties which have recently sold. Normally either

publicly traded shares of similar companies or

acquisitions of similar companies.

May be either balance sheet or income statement

focused

Value the equity or invested capital of a company

through comparison with the pricing of investment in

companies (often as traded in the stock market)

Generally, is a going concern assumption, not

Iiquidation

C. The Three Basic Approaches

to Value - Continued

3. Income

- Based on theory that the value of any asset is the

present value of expected future benefits to be

derived by the ownership of that asset

- Income statement focused

- Value the equity or invested capital of a company by

deriving the present value of the expected flow of

future economic .benefits

- Generally, is a going concern assumption, not

liquidation

- Generally, may take two forms

Discounted cash flow

Capitalization of cash flow

D. Basic Variables Affecting Value

1. Economic conditions

2. Industry Conditions

3. Business Background and Conditions

Earnings history of the firm

Future earning capacity

Balance sheet

Qualitative factors

4. Risk Assessment

Risk free rates of return

General equity risk

Industry specific risk

Company specific risk

a}

b}

c}

d}

e}

f}

g}

h}

5. Revenue Ruling 59-60

The nature of the business and history of the enterprise

The economic outlook in general and condition and outlook of

the specific industry in particular

The book value of the stock and the financial condition of the

business

The earnings capacity of the company

The dividend-paying capacity

Whether or not the enterprise has goodwill or other intangible

value

Sales of stock and the size of the block to be valued

The market prices of stocks of corporations engaged in the

same or similar lines of business whose stocks are actively

traded in a free and open market, either on an exchange or

over-the-counter

v. STEPS OF AN APPRAISAL

A. Engagement Letter

- Define Assignment

- What is the Written Output

- Due Date

- Fee Arrangement

B. Gather Information

- Subject Company Data

- Economic Data

- Industry Data

- Market Data, Le., Transactions in other companies

C. Analyze Information

- Industry/Economic

- Company Qualitative and Quantitative Analys!s

- Market Data

D.

E

.

Do Valuation Approaches, Reconciliation and Conclusion

Write the report documenting what you have done

VI. DATA GATHERING

A. Economic Data and Analysis

B. Industry Data and Analysis

C. Company Data

D. The On Site Interview

E. Market Data

VII. FINANCIAL STATEMENT

ANALYSIS

A. What is the goal of financial analysis?

- Identify unusual items

- Identify what happened and why it happened

- Identify trends and what caused them

- Identify how the company departs from the

industry norm and why

- Comparison with comparable companies to

assist in selection of appropriate valuation

multiples

VII. FINANCIAL STATEMENT

ANALYSIS - Continued

B. Trend Analysis Over Time - Goal is to identify positive or

negative trends, review past growth or see what is "normal" for

the subject company

1. Five Year Spreadsheet, including latest twelve months

- Income Statement

- Balance Sheet

2. Common Size Spreadsheet

3. Trend of Financial Ratios

- Liquidity and Leverage Ratios

- Profitability and Turnover Ratios

- Return on equity, i.e., Income/Equity

Components of ROE = Profitability x Turnover x Leverage

ROE =Income/Sales x Sales/Assets x Assets/Equity

VII. FINANCIAL STATEMENT

ANALYSIS - Continued

C. Comparative Industry Analysis

- Sources of Comparative Data

Robert Morris Associates (RMA) Annual Statement Studies

Performance Analysis Reports (PAR) prepared by trade

association

Other industry data compiled by trade associations or trade

periodicals

Similar publicly traded companies

- Balance sheet and income statement common size

compansons

- Comparative financial ratios

VIII. ASSET BASED VALUATION

APPROACHES

A. When are they most appropriate

- Start-up operation; no track record as a going concern

- Holding company, for example, owning primarily securities

(publicly traded or closely held) or real properties

- Asset-heavy businesses where the sale of the company would

involve specific assets

- Company contemplating liquidation

B. Book value - equity as stated on the financial

statements

- Advantage - Simple, widely understood

- Disadvantages - The value of assets and liabilities stated at

historical, depreciated cost may bear no resemblance to current

economic value

C. Adjusted Book Value

1. Purpose - To replace cost of assets and liabilities with current

economic value

2. Typical balance sheet adjustments

- Non-operating assets and liabilities such as excess cash and securities,

excess investment property and related obligations

- Uncollectible receivables

- LIFO or current replacement cost inventory adjustments

- Marketable securities

- Unmarketable securities

- Accelerated depreciation

- Real property per appraisal

- Machinery & equipment per appraisal

- Intangible assets like goodwill, non-compete agreement

- terms on debt

- Contingencies such as lawsuit or pension obligations

- Deferred taxes

D. Liquidation Value

1. Orderly or forced liquidation

2. Consult management, auctioneer, P&M

appraiser, and/or real estate appraiser

concerning appropriate liquidating discounts

3. Consider liquidation costs

- Auctioneer's fees and commissions

- Continued fixed cost and administrative costs during

liquidation period

- Legal, accounting and other professional fees

- Taxes payable by the corporation

E. Market Based Asset

Approaches

1. Price/book value - where do similar companies

stocks sell relative to book value

2. Price/adjusted book value

- Conceptually the best asset approach

- Most applicable when assets consist primarily of:

Inventory - LIFO adjustments to market data

Real Property - Publicly traded Real Estate Investment Trusts

(REITs) for market data

Securities - Publicly traded investment companies

- Advantages - Uses adjusted company data and market data

- Disadvantages - Difficult or impossible to get adjusted asset data

for similar companies. Cannot make valid comparisons.

IX. ADJUSTMENTS TO INCOME

GOAL: REACH NORMALIZED OPERATING INCOME

A.Non-operating Items - Remove effect on income

statement of non-operating assets. Examples include:

- Excess real property - adjust for rental income, property taxes,

depreciation, debt service

- Excess cash and securities - adjust for interest income,gain

(loss) on securities

B. Varying Accounting Treatments

- LIFO/FIFO inventory

- Depreciation (tax lives vs. economic lives)

- Capital versus operating lease

- Pension Accounting

c. Non-recurring Items

1. Gain (loss) on sale of assets

2. Bad debts

3. Professional fees

4. Unusual production costs - labor or materials

5. Start-up costs

6. Discontinued operations

7. Unusual revenues - price or volume

D. Discretionary Items

1. Owner's compensation - Salary &

Bonus & "Toys"

2. Indirect owner's compensation -

Pension, profit sharing, commissions,

director's fees

3. Transactions with related parties, for

example, leases for real property or

equipment

4. Unusual perquisites

IX. ADJUSTMENTS - Continued

E. New Circumstances change expected

Income

- Acquisition

- Divestiture

F. Invested Capital (Debt Free) Methods

x. CAPITALIZATION OF

INCOME

A. Variations of "Income"

- Net income after income tax

- Income before income tax (EBT)

- Operating inco-me or earnings before interest and

taxes (EBIT)

- Earnings before interest, taxes, depreciation and

amortization (EBITDA)

- Cash flow =Net income plus non-cash charges such

as depreciation and amortization

-lnvestedCapital methods

- Which measure is most appropriate will depend on

the specific situation

x. CAPITALIZATIONOF

INCOME - Continued

B. Goal is to identify long term estimate of

current operating earning power

- Start with the adjusted income statement

already developed

- Compare this to adjusted budget for next year

or management's longer term forecast(s)

- Based on the adjusted historical and

budgeted future, arrive at your best estimate

of long term earning power

C. Capitalization Rate

A rate to translate income (or expected income) into

value

Definition: Capitalization rate =required rate of return.

(discount rate) minus expected long term growth

Capitalization Rate =Required Rate of Return - Growth

(For All Non-Zero Growth Rates)

Capitalization Rate =Required Rate of Return

Only If Growth Rate is Zero

Value =Expected Income/Capitalization Rate

VaIue = ____

Required Rate of Return less Growth Rate

C. Capitalization Rate -Cont.

2. Required Rate of Return - One of the most important and most

subjective aspects of business appraisal

Goal is to measure the RISK that the mrnected income will not be achieved

- Operating risk

- Industry/Economic Conditions

- Company Characteristics

Stability of Product Demand

Substitute Products

Competition

Manufacturing problems

Labor

Stability of supplies

Management/key people

- Financial Risk

Fixed charge coverage, leverage

Adequacy of working capital

Access to long term capital - debt or equity

C. Capitalization Rate - Cant.

Methods of developing the required rate of

return

- "Build up" method

Risk-free rate (long term government securities)

Equity Risk Premium

Specific risk premium for subject company

(most important but no hard guidelines)

- Market method - what rates are other people. using

who are actively buying and selling. Great

conceptually, but the data is seldom available

C. Capitalization Rate - Cont.

Growth Rate - based on past history and management's

budget. Final decision based on judgment of appraiser

- Assumes growth in perpetuity so conservative rate is necessary

- Common range of long term growth is 4Jb to 1QOJb

- Example of typical capitalization rate for closely held company

Value = Expected Pretax Income

Required Rate of Return Less Growth Rate

Value = Expected Pretax Income/(25

%

- 50/0)

Value = Expected Pretax Income/20o/0

D. Excess Earnings Method

Blending an asset-based and an income-based valuation

methods

- Conceptual Basis - Goodwill (value above adjusted net asset

value) exists for a company only if the expected income exceeds

the return required on the adjusted tangible net assets

- Step by Step Method

Determine adjusted tangible net asset value

Determine required rate of return on adjusted tangible net assets

Determine aggregate dollar return required

Compare required return to expected income

If expected earnings exceed required rate, capitalize "excess"

earnings at a relatively high rate to determine goodwill

Total value of company = adjusted tangible net asset value plus

goodwill

D. Excess Earnings Method

Adjusted tangible net asset value

Expected pretax income

$ 1,000,000

250,000

Required pretax return on tangible net assets = 180/0

Capitalization'rate on excess earnings = 300/0

Expected Return

Less Required Tangible Return

($1,000,000 x 1 8 ~ )

"Excess Earnings"

Capitalization rate on excess

Goodwill

Value Conclusion

Tangible net assets

Goodwill

Total Value

-

-

250,000

180,000

70,000

30%

$ 233,000

$1,000,000

233,000

$1,233,000

XI. DISCOUNTED FUTURE

RETURNS

A. Conceptually the most accurate way to value

any investment

- Defined as the present value of future expected

benefits/returns

- Present value of future returns, discounted at a

required rate of return

- Can assume either returns in perpetuity or some

terminal value. Identical concept to pricing a bond

- Differs from "Capitalization" method in that return is

estimated in each of multiple future periods rather

than using a single measure of income

c. Projecting Future Returns

- Long term forecast based on adjusted historical results &management's budget

- Best measure of return is free cash flow (available for dividends/distributions)

Net Income

Plus Non-cash expenses such as depreciation, amortization, deferred taxes

Minus Capital expenditures

Minus Debt principal payments

Plus/Minus Working capital needs (deficiency or excess)

- Year by year forecast plus terminal value, five to ten year forecast common

FCF = Free Cash Flow

r = Required Rate of Return

Value = FCF

1

+ . FCF

2

(1 +r)1 (1 +r)2

+ + FCFn

(1 +r)n

- Required rate of return is determined as previously discussed. Differing levels of

risk are associated with differing levels of income.

D. Terminal Value

Constant growth (capitalization equation)

Terminal Value = FCFn+1

r-g

No growth (annuity in perpetuity)

Terminal Value = FCF

n

+

1

r

XII. MARKET DATA

APPROACHES

A. Conceptual Basis - Principle of substitution

B. Get "market" multiples for similar companies that have

recently sold or whose shares are actively traded. Multiple

based on:

- Current earnings and/or cash flow

- Historical average earnings and/or cash flow

- Projected future earnings and/or cash flow

- Revenues - key on comparative profit margins

- Volume (revenue)

- Equity or adjusted equity - key on comparative return on equity

C. Make qualitative and quantitative comparisons between

subject company and market data. Assess comparative growth

and risk characteristics. Should pricing mUltiples for subject

company be above, below or similar to the market norms?

XII. MARKET DATA

APPROACHES

D. Sources of Market Data

- Similar publicly traded companies

- Similar acquired companies

- Industry rules of thumb

- Make sure the comparisons are accurate, Le., make the same

adjustments to the market data that were made to the subject

company

E. Summary

- Do proper company analysis and adjustments

- Adjust data of comparables, if appropriate

- Determine appropriate norms for market multiples

- Determine how the company's multiples should differ from the

market norms

XIII.OTHER CONSIDERATIONS

A. Buy/Sell Agreements

B. History of Past Transactions or Offers to Buy

C. Discounts for Minority Interest (or Lack of

Control) and Lack of Marketability

D. Premium for Control

E. Special Attributes of Control

F. Control or Minority Assignment can largely

dictate appraisal methodology

G. Special rights or privileges, i.e., put options,

preferred stock conversion or redemption

features .

XIV. DISCOUNT FOR LACK

OF MARKETABILITY

A. Lack of Marketability Discount:

- What is the impact of law on transfer?

- Facts and circumstance dominate, as usual.

B. Studies:

- Restricted Stock Studies

- IPO Studies

- PV Type Calculations

C. Fair market value of minority shares in a closely

held company would be, on average, 350/0 to 45k

less than the value of minority shares in a similar

company whose shares were actively traded in the

stock market.

DLOM - Qualitative Factors

11. Robert Moroney wrote a second article (Taxes -- The Tax

Magazine, May 1977, Why 2 5 ~ Discount for NonmarketabHity in

One Valuation, 100

%

in Another?)

a) Are dividends being paid?

b) Is management friendly? Honest?

c) How fast is the subject company growing?

d) Degree of control?

e) Is the industry in a favorable competitive s tuation?

f) In there interest in the industry in buying companies?

g) Prevailing mood of the investing public?

h) What is the financial and business risk in the subject company?

i) What are the particular restrictions on transfer of interests?

xv. LACK OF CONTROL

DISCOUNT

(MINORITY INTEREST DISCOUNT)

A. Theory. It is commonly accepted in the field of

business valuation that the per share value of a

controlling interest is worth more than the per share

value of a minority interest. Control is a valuable asset.

With it the investor has the right to control the Board of

Directors which in turn can determine salaries, benefits,

dividends, the sale of assets, the direction of the

company, liquidation, etc. These rights have value and

investors are willing to recognize that value by paying a

higher price for a controlling block of stock than they

would for a minority block of stock.

DLOC - Qualitative Factors

1. What are the disadvantages of lack of control?

2. How much cash does a shareholder get on an

annual basis?

3. How is management runni.ng the company -- good.

for all, or good for one?

. 4. How fast is the subject company growing?

5. What is the financial and business risk in the subject

company?

6. What is the impact of state law on lack of control?

7. Facts and circumstance dominate, as usual.

DLOC - Quantification

B. The opposite of a control premium is a minority interest

discount.

C. Quantification. In the public marketplace the value of control is

quantified when one company offers to buy all (or a majority of)

the shares of another -- a "tender offer".

D. Calculation. In recognition of the value of control the buyer

typically makes a bid for the stock at a price that exceeds the

marketprice existing at the time. This excess is called the

"tender offer premium" and is believed to be an objective

estimate of the value of control.

- Control Premium Example: if a tender offer of $28 is made fora publicly

traded company that is trading at $20 per share, the value of a

controlling interest is $28, the value of a minority interest is $20 and the

premium for control is 40

%

- The related minority discount' (DLOC) is 29%.

XVI. CONTROL PREMIUM

XVII. LACK OF VOTE

DISCOUNT

A. What is the impact of a lack of a vote?

B. What is the impact of law on lack of control (vote)?

C. Facts and circumstance dominate, as usual.

Quantification: Riding & Jog, "Price Effects of Dual Class

Shares", January/February 1986 issue, Financial

Analysts Journal noted that the average premium for

voting shares traded on the Toronto Stock Exchange

(Canada's largest) was 7% over restricted voting shares

in the same companies, which translates into a discount

equivalent of about 6.5k (i.e., 1.07x 0.935 =1.00).

Houlihan, Lokey, Howard &Zukin found a discount

range of 2k to 40/0 for non-voting common stock.

XVIII. VALUATION

CONCLUSION

A. Briefly review all source documents to see if any

important factors were missed

B. Re-read the appraisal assignment

C. Summarize and compare the conclusions of the

various approaches

D. Recheck methods that give extreme values

E. Determine the relevance of the various approaches

for the particular assignment

F. Arrive at a single point estimate, by either

quantitative or qualitative techniques. Better to

round than to imply a false sense of precision

G. Check the final conclusion against adjusted income

or adjusted equity. Does the answer make sense?

XIX. SMALL BUSINESSES --

SPECIAL FACTORS

A. Market Approach

- Data Bases

- Rules of Thumb

- Multiple of Owners' Discretionary Cash

B. Income Approach

- Replacement compensation for the labor of the owner

is a key consideration

C. Transactions

- What is typically sold

- What is not typically sold

Graduation day

e

INTERNATIONAL

VALUATION STANDARDS

COMMITTEE

BUSINESS VALUATION

By

Gregory A. Gilbert, CFA, FASA, CBA

of

Corporate Valuations, Inc.

Kuala Lumpur, Malaysia

October 21, 2003

BUSINESS VALUATION

This handout is largely stated in tenns of corporations. Many techniques work

equally well with partnerships or sole proprietorships.

I. INTRODUCTION 1

II. BUSINESS APPRAISAL STANDARDS 2

III. BUSINESS APPRAISAL ETHICS. 3

IV. BUSINESS VALUATION THEORY 5

V. STEPS OF AN APPRAISAL 7

VI. DATA GATHERING 8

VII. FINANCIAL STATEMENT ANALYSIS 11

VIII. ASSET BASED VALUATION APPROACHES 12

IX. ADJUSTMENTS TO INCOME GOAL: REACH NORMALIZED OPERATING INCOME 14

XIV. DISCOUNT FOR LACK OF MARKETABILITY

XIX. SMALL BUSINESSES SPECIAL FACTORS

XV. LACK OF CONTROL (MINORITY INTEREST) DISCOUNT

XIII. OTHER CONSIDERATIONS IN DETERMINING FAIR MARKET VALUE

15

18

19

20

21

23

25

26

27

28

Pagei IVSC

X. CAPITALIZATION OF INCOME

XI. DISCOUNTED FUTURE RETURNS

XII. MARKET DATA APPROACHES

XVIII. VALUATION CONCLUSION

XVI. CONTROL PREMIUM

XVII. LACK OF VOTE DISCOUNT

Corporate Valuations, Inc.

I. INTRODUCTION

A. What is being appraised?

1. Stock in a Corporation

a) Common or Preferred Stock

b) Controlling or Minority Interest

2. Partnership Interest - General Partner or Limited Partner

3. Sole Proprietorship

B. Definitions of Value.

1. "Fair Market Value" usually the standard of value in the United States of America.

Well defined. "Market Value", as defined in real property and by NSC, in real

estate appraisal is the same thing as Fair Market Value in business appraisal.

a) Fair market value is considered to represent a value at which a willing buyer

and a willing seller, both being informed of the relevant facts about the

business, could reasonably conduct a transaction, neither person acting

under the compulsion.to do so.

b) Although not stated in the definition, it normally assumes: a cash or cash

equivalent value; both parties can perform (the buyer has financing and the

seller has clear title and can deliver the interest); a reasonable time for

exposure in the market; and that normal contacts will be signed.

c) Unusual factors must be explained. Such factors may be governmental

restrictions like environmental contamination, non-compliance with

Americans with Disabilities Act, or other rules and regulations.

2. Other value definitions. Often even less well defined. Two examples:

a) "Investment Value" is the value of a business to a particular owner.

b) "Intrinsic Value" usually means a long term quasi-market value - what the

value "should be" if the market had no fluctuations.

c) Particular legal jurisdictions have special value definitions.

C. Who Performs Business Valuations

1. Business Valuation Specialists - What To Look For

a) Chartered Financial Analyst (CFA) of the Institute of Chartered Financial

Analysts

b) Accredited Senior Appraiser (ASA) of American Society of Appraisers in

Business Valuation

c) Certified Business Appraiser (CBA) of the Institute of Business Appraisers

d) Accredited in Business Valuation (ABV) of the American Institute of

Certified Public Accountants.

e) Chartered Business Valuator (CBV) of the Canadian Institute of Chartered

Business Valuers.

f) Experience

g) Reputation (References)

Corporate Valuations, Inc. IVSC Page 1

II. BUSINESS APPRAISAL STANDARDS

A. International Valuation Standards - 2003, Guidance Note 6. Copy attached.

B. Uniform Standards of Professional Appraisal Practice (USPAP) Standards 9 and 10 as well

as the Preamble

1. Standard 9

a) In developing a business appraisal, an appraiser must be aware of,

understand and correctly employ those recognized methods and techniques

that are necessary to produce a credible appraisal.

2. Standard 10

a) In reporting the results of a business appraisal, an appraiser must

communicate each analysis, opinion and conclusion in a manner that is not

misleading.

C. American Society of Appraisers Business Valuation Standards

D. Institute of Business Appraisers Business Valuation Standards

Corporate Valuations, Inc. IVSC Page 2

III. BUSINESS APPRAISAL ETHICS

A. American Society of Appraisers Code of Ethics (as an example).

1. Primary duty and responsibility.

a) Obligation to determine and describe the kind of value.

b) Obligation to be accurate.

c) Obligation to avoid a false value.

d) Obligation to attain competency and to practice ethically.

2. Obligations to the client.

a) Confidential character of appraisal assignment.

b) Obligation to give competent service.

c) In testimony may not suppress facts, data or opinions.

d) Must document appraisals in report or work files.

e) Only with consent mayan appraiser have more than one client for an

appraisal.

) It is good practice to have a written contract with a client.

3. Appraisal Methods and Practices.

a) The kind of value reached must be described.

b) Methods must be appropriate to the appraisal.

c) Fractional appraisals must be so labeled.

d) Hypothetical appraisals must be so labeled.

e) Contingent and limiting conditions must be stated.

4. Unethical practices.

a) Contingent fees.

b) Percentage fees.

c) Appraisals in which the appraiser has an undisclosed interest.

d) Advocacy.

e) Unsigned appraisal reports. Appraisal reports wherein there was dissent by

an appraiser that was not registered in the report.

) Unconsidered opinions.

g) Misuse of membership designations.

5. Appraisal reports must contain:

a) Description of the property under appraisal.

b) Statement ofthe objectives of the appraisal report.

(1) What is the goal of the appraisal.

(2) Meaning attached to the specific kind of value.

(3) Date ofthe appraisal.

Corporate Valuations, Inc. IVSC Page 3

(4) When appropriate, an analysis of the highest and best use of the

property.

c) Statement of contingent and limiting conditions.

d) Description and explanation in the appraisal report of the appraisal

methodes) used.

e) Statement ofthe appraiser's disinterestedness.

) Signatures to appraisal reports and inclusion of dissenting opinions.

B. USPAP ethics are in the Preamble

C. Institute of Business Appraisers' Code of Ethics

Corporate Valuations, Inc. IVSC Page 4

IV. BUSINESS VALUATION THEORY

A. The value of a business arises from:

1. Assets, either Tangible or Intangible; and

2. Cash Flow (different definitions of income)

B. The Phases of Business Value

1. Orderly Liquidation is often the least value if the owner has ability to sell the assets

2. As cash flow increases, the value of the business increases from the liquidating

value of tangible assets to the going concern value of tangible assets

3. As cash flow increases further, the value of the business increases to include the

value of specific, identifiable intangible assets

C. The Three Basic Approaches to Value Used in the Appraisal Profession

1. Cost

a) Is a balance sheet focused approach (also called Adjusted Balance Sheet)

b) Based on the premise that a prudent buyer will pay no more for a property

than it would cost to replace with a substitute property with the same utility

-- the principal of substitution

c) Value all the assets of a company, subtract the liabilities, to arrive at the

value ofthe stockholders' equity

d) Value of each asset may be derived by using any of the three approaches for

valuing those individual assets

e) Assets and company may be valued as a going concern or ina liquidation

scenario - either orderly liquidation or forced liquidation

2. Market

a) Again,principle of substitution.

b) Comparison between subject property and similar properties which have

recently sold. Normally either publicly traded similar companies or

acquisitions of similar companies.

c) May be either balance sheet or income statement focused

d) Value the equity or invested capital of a company through comparison with

the pricing of investment in companies (often as traded in the stock market)

e) Generally, is a going concern assumption, not liquidation

3. Income

a) Based on theory that the value of any asset is the present value of expected

future benefits to be derived by the ownership of that asset

b) Income statement focused

c) Value the equity or invested capital of a company by deriving the present

value of the expected flow of future economic benefits

d) Generally, is a going concern assumption, not liquidation

e) Generally, may take two forms

Corporate Valuations, Inc. IVSC PageS

(1) Discounted cash flow

(2) Capitalization of cash flow

D. Basic Variables Affecting Value

1. Economic conditions

a) General

b) Specific

2. Industry Conditions

3. Business Background and Conditions

a) Earnings history of the firm

b) Future earning capacity

c) Balance sheet

d) Qualitative factors

4. Risk Assessment

a) Risk free rates of return

b) General equity risk

c) Industry specific risk

d) Company specific risk

5. Revenue Ruling 59-60

a) The nature of the business and history ofthe enterprise

b) The economic outlook in general and condition and outlook of the specific

industry in particular

c) The book value of the stock and the financial condition of the business

d) The earnings capacity of the company

e) The dividend-paying capacity

f) Whether or not the enterprise has goodwill or other intangible value

g) Sales of stock and the size of the block to be valued

h) The market prices of stocks of corporations engaged in the same or similar

lines of business whose stocks are actively traded in a free and open market,

either on an exchange or over-the-counter

Corporate Valuations, Inc. IVSC Page 6

v. STEPS OF AN APPRAISAL

A. Engagement Letter

1. Define Assignment

a) What is to be valued

b) Appraisal Date

c) Purpose of Appraisal

d) Who is the client

2. What is the Appraisal Output

a) Verbal Opinion or Letter

b) Short Report

c) Detailed Report

3. Due Date

4. Fee Arrangement

B. Gather Information

1. Subject Company Data

a) Financial Statements

b) Other Documents

c) Inspect facilities and interview key people

2. Economic Data

3. Industry Data

4. Market Data, Le., Transactions in other companies

C. Analyze Information

1. Industry/Economic

2. Company Qualitative and Quantitative Analysis

3. Market Data

D. Do Valuation Approaches, ReconciHation and Conclusion

E. Write the report documenting what you have done

Corporate Valuations, Inc. IVSC Page?

VI. DATA GATHERING

A. Economic Data and Analysis

1. General economic trends that might affect demand

2. Specific economic data in market or region served

3. Allows appraiser to make informed judgment about the risks facing a company

4. Determine how important general economic conditions are to the subject company

B. Industry Data and Analysis

1. Risk oriented

2. The life cycle ofthe industry

3. Competition

4. Growth rate and future expectations

5. New technology

6. Sources of information

a) Standard & Poor's Industry Survey

b) Value Line

c) Trade Journals

d) Trade Associations

e) Business Publications

7. Determine how important industry conditions are to the subject company

C. Company Data

Financials for 5 fiscal years audited

Income tax returns, same 5 fiscal years

Interim financials

Detailed depreciation schedule

Budgets or forecasts

Product and Market Data

Marketing literature, Brochures, etc., price lists

Locations where company operates

Product specifications

Lists of patents, copyrights, trademarks

Customer list and suppliers' list

Profits by divisionlbranch

List of major competitors and their locations

List of trade associations

Survey of geographic market

Distribution Agreements

Organization chart

Brief resume on key personnel

Employment agreements; Covenant not to compete

Union contracts

Compensation schedule for owners

Schedule of life insurance policies on key personnel

Pension and profit sharing plans and employee handbook

For corporation: Articles of Incorporation, Bylaws and Minutes

Corporate Valuations, Inc. IVSC Page 8

List of stockholders and/or partners

Any details on prior stock sales

Buy/sell agreements, options, etc.

Shareholder and Board Minutes

Major contracts

Copies of previous appraisals

D. The On Site Interview

1. Main purpose is to assess risk

2. Review Pertinent Documents First

3. Prepare a list of questions

4. Topics to discuss with management

Operations

Financial performance

Key personnel

Plans for future

Competitive environment - Where does the company fit into competitive

scheme

5. Persons to interview might include

Client

Client's attorney

Companypresident

Company chief financial officer

Members of company board of directors

Company's accountant

Company's attorney

Company's banker

6. Areas of questions might include

History and operations of company

Capitalization and ownership of company

Economic and industry factors affecting company

Facilities (location)

Management and employees

Competition and how the company competes

Customer base (backlogs)

Supplier base

Contingent liabilities and assets

Past transactions in interests in the company ownership

Future plans and products (services)

Government regulations

Seasonality and cyclicality

Products and services of company offered and to be offered and sales

breakdown

Company's present and future debt loads

Other information of which the appraiser may not be aware

E. Market Data

1. Similar Publicly Traded Companies - Separated by Standard Industrial

Classification (SIC) number

a) Standard & Poor's

b) Computer data bases

Corporate Valuations, Inc. IVSC Page 9

c) Moody's

d) Ask management

e) Identify and get annual report

2. Similar companies which have merged or been acquired (can be either public or

private)

a) Ask Management

b) Merger & Acquisitions Magazine

c) Merger & Acquisition Sourcebook

d) Merrill Lynch Mergerstat Review

e) Trade Associations, Periodicals and Newsletters

Corporate Valuations, Inc. IVSC Page 10

VII. FINANCIAL STATEMENT ANALY S I S ~

A. What is the goal of financial analysis?

1. Identify unusual items

2. Identify what happened and why it happened

3. Identify trends and what caused them

4. Identify how the company departs from the industry norm and why

5. Comparison with comparable companies to assist in selection of appropriate

valuation multiples

B. Trend Analysis Over Time - Goal is to identify positive or negative trends, review past

growth or see what is "normal" for the subject company

1. Five Year Spreadsheet, including latest twelve months

a) Income Statement

Volume

Sales

Gross Margin

SG&A Details

Interest Expense

Other Income

Tax Rate

b) Balance Sheet

c) Sources & Uses Statement, ifrelevant

2. Common Size Spreadsheet

a) Best to combine with aggregate dollars

3. Trend of Financial Ratios

a) Liquidity Ratios

b) Leverage Ratios

c) Profitability Ratios

d) Turnover Ratios

e) The most important ratio is the return on equity, i.e., IncomelEquity

Components of ROE = Profitability x Turnover x Leverage

ROE = Income/Sales x Sales/Assets x AssetslEquity

C. Comparative Industry Analysis

1. Sources of Comparative Data

a) Robert Morris Associates (RMA) Annual Statement Studies

b) Performance Analysis Reports (PAR) prepared by trade association

c) Other industry data compiled by trade associations or trade periodicals

d) Similar publicly traded companies

2. Balance sheet and income statement common size comparisons

3. Comparative financial ratios

Corporate Valuations, Inc. IVSC Page 11

VIII. ASSET BASED VALUATION APPROACHES

A. When are they most appropriate

1. operation; no track record as a going concern

2. Holding company, for example, owning primarily securities (publicly traded or

closely held) or real properties

3. Asset heavy businesses (for example, heavy machinery and equipment) where the

sale of the company would involve specific assets

4. Company contemplating liquidation

B. Book value equity as stated on the financial statements

1. Advantage Simple, widely understood

2. Disadvantages The value of assets and liabilities stated at cost may bear no

resemblance to current economic value

C. Adjusted Book Value

1. Purpose To replace cost of assets and liabilities with current economic value

2. Typical balance sheet adjustments

a) Separate non-operating assets and liabilities such as excess cash and

securities, excess investment property and related obligations

b) Uncollectible receivables

c) LIFO or current replacement cost inventory adjustments

d) Marketable securities

e) Unmarketable securities

t) Accelerated depreciation

g) Real property per appraisal

h) Machinery & equipment per appraisal

i) Intangible assets like goodwill, agreement

j) Advantageous terms on debt

k) Contingencies such as lawsuit or pension obligations

1) Deferred taxes

D. LiquidationValue

1. Orderly or forced liquidation

2. Consult management, auctioneer, M&E appraiser, real estate appraiser concerning

appropriate liquidating discounts

3. Consider liquidation costs

a) Auctioneer's fees and commissions

b) Continued fixed cost and administrative costs during liquidation period

c) Legal, accounting and other professional fees

d) Taxes payable by the corporation

E. Market Based Asset Approaches

Corporate Valuations, Inc. IVSC Page 12

1. Pricelbook value - where do similar companies stocks sell relative to book value

2. Price/adjusted book value

a) Conceptually the best asset approach

b) Most applicable when assets consist primarily of:

(1) Inventory LIFO adjustments to market data

(2) Real Property - Publicly traded Real Estate Investment Trusts

(REITs) for market data

(3) Securities - Publiclytraded investment companies

c) Advantages - Uses both adjusted company data and market data

d) Disadvantages - Difficult or impossible to get adjusted asset data of similar

companies. Cannot make valid comparisons.

Corporate Valuations, Inc. IVSC Page 13

IX. ADJUSTMENTS TO INCOME

GOAL: REACH NORMALIZED OPERATING INCOME

A. Non-operating Items - Remove effect on income statement of non-operating assets.

Examples include:

1. E X c ~ s s real property - adjust for rental income, property taxes, depreciation, debt

servIce

2. Excess cash and securities - adjust for interest income, gain (loss) on securities

B. Varying Accounting Treatments

1. LIFO/FIFO inventory

2. Depreciation

3. Capital versus operating lease

4. Pension Accounting

C. Non-recurring Items

1. Gain (loss) on sale of assets

2. Bad debts

3. Professional fees

4. Unusual production costs - labor or materials

5. Start-up costs

6. Discontinued operations

7. Unusual revenues - price or volume

D. Discretionary Items

1. Owner's compensation - Salary & Bonus

2. Indirect owner's compensation - Pension, profit sharing, commissions, director's

fees

3. Transactions with related parties, for example, leases for real property or equipment

4. Unusual perquisites

E. New Circumstances

1. Acquisition

2. Divestiture

F. Invested Capital (Debt Free) Methods

Corporate Valuations, Inc. IVSC Page 14

x. CAPITALIZATION OF INCOME

A. Variations of "Income"

1. Net income after income tax

2. Income before income tax

3. Operating income or earnings before interest and taxes (EBIT)

4. Earnings before interest, taxes and depreciation

5. Cash flow = Net income plus depreciation/amortization

6. Invested Capital methods

7. Which measure is most appropriate will depend on the specific situation

B. Goal is to identify a long term best estimate of current earning power

1. Start with the adjusted income statement already developed

2. Compare this to adjusted budget for next year or management's long term forecast

3. Based on the adjusted historical and budgeted future, arrive at a best estimate of

long term earning power

C. Capitalization Rate - A rate for translating income (or expected income) into value

1. Definition: Capitalization rate = required rate of return (discount rate) minus

expected long term growth

Capitalization Rate = Required Rate of Return - Growth

For All Non-Zero Growth Rates

Capitalization Rate = Required Rate of Return

Only If Growth Rate is Zero

Value =Expected Income/Capitalization Rate

Value = Expected Income

Required Rate of Return less Growth Rate

2. Required Rate of Return - One of the most important and most subjective aspects of

business appraisal

a) Goal is to measure the RISK that the expected income will not be achieved

(1) Operating risk

Industry/Economic Conditions

Company Characteristics

Stability ofProduct Demand

Substitute Products

Competition

Manufacturing problems

Labor

Stability of supplies

Managementlkey people

(2) Financial Risk

Corporate Valuations, Inc. IVSC Page 15

Fixed charge coverage

Adequacy of working capital

Access to long term capital - debt or equity

b) Methods of developing the required rate of return

(1) "Build up" method

Risk-free rate (long term government securities)

Equity Risk Premium

Specific risk premium for subject company

(most important but no hard guidelines)

(2) Market method - what rates are other people using who are actively

buying and selling. Great conceptually, but the data is seldom

available

(3) Common range of required rates of return for pretax income is 15%-

50%. Many will be in the 20% to 30% range.

(4) Growth Rate - based on past history and management's budget.

Final decision based on judgment of appraiser

(a) Assumes growth in perpetuity so conservative rate is

necessary

(b) Common range oflong term growth is 4% to 10%

(c) Example of typical capitalization rate for closely held

company

Value = Expected Pretax Income

Required Rate of Return Less Growth Rate

Value = Expected Pretax Income/(25% - 5%)

Value = Expected Pretax Income/20%

D. Excess Earnings Method - blending an asset-based and an income-based valuation methods

1. Conceptual Basis - Pay goodwill (value above adjusted net asset value) for a

company only if the expected income exceeds the return required on the adjusted

tangible net assets acquired

2. Step by Step Method

a) Determine adjusted tangible net asset value

b) Determine required rate of return on tangible net assets purchased

c) Determine aggregate dollar return required

d) Compare required return to expected income

e) If expected earnings exceed required rate, capitalize "excess" earnings at a

relatively high rate to determine goodwill

f) Total value of company = adjusted tangible net asset value plus goodwill

3. Example

Common pretax rates of return on tangible net assets is 15% to 20%. Common

pretax capitalization rates for excess assets are 20% to 50%.

Corporate Valuations, Inc. IVSC Page 16

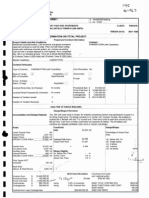

Adjusted tangible net asset value

Expected pretax income

Required pretax return on tangible net assets

Capitalization rate on excess earnings

=

=

$ 1,000,000

250,000

18%

30%

Expected Return =

Less Required Tangible Return ($1,000,000 x 18%)=

"Excess Earnings" =

Capitalization rate on excess

Goodwill =

250,000

180,000

70,000

30%

$ 233,000

E.

Value Conclusion

Tangible net assets

Goodwill

Total Value

Owners' Discretionary Cash Methods

=

$1,000,000

233,000

$1,233,000

Corporate Valuations, Inc. IVSC Page 17

XI. DISCOUNTED FUTURE RETURNS

A. Conceptually the most accurate way to value any investment

1. Defined as the present value of future expected benefits

2. Present value of future returns, discounted at a required rate ofreturn

3. Can assume either returns in perpetuity or some terminal value. Identical concept to

pricing a bond

B. Differs from "Capitalization" method in that return is estimated in each of multiple future

periods rather than using a single measure of income

C. Projecting Future Returns

1. Long term forecast based on adjusted historical results & management's budget

2. Optimal measure of return is free cash flow which could be used to pay

dividends/distributions. Considers all sources and uses of cash such as:

Net Income

Non-cash expenses such as depreciation,

amortization, deferred taxes

Capital expenditures

Debt principal payments

Working capital needs (deficiency or excess)

3. Year by year forecast plus terminal value

a) Five to ten year forecast is common

FCF =Free Cash Flow

r = Required Rate of Return

Value = FCF1- + FCFl +...... + FCF

n

(l +r) 11+r) 11+r)n

b) Required rate of return is determined as previously discussed. Differing

levels of risk are associated with differing levels of income. Use of

optimistic, best estimate and pessimistic forecasts entails differing discount

rates.

D. Terminal Value

1. Constant growth (capitalization equation)

Terminal Value = FCF

n

+1

r-g

2. No growth (annuity in perpetuity)

Terminal Value =

Corporate Valuations, Inc.

FCF

n

+1

r -

IVSC Page 18

XII. MARKET DATA APPROACHES

A. Conceptual Basis - Principle of substitution

B. Determine "market" multiples for similar companies that have recently sold or whose

shares are actively traded. Multiple based on:

1. Current earnings and/or cash flow

2. Historical average earnings and/or cash flow

3. Projected future earnings and/or cash flow

4. Revenues - key on comparative profit margins

5. Volume

6. Equity or adjusted equity - key on comparative return on equity

C. Must make qualitative and quantitative comparisons between subject company and market

data. Assess comparative growth prospects and risk characteristics. Should the pricing

multiples for subject company be above, below or similar to the market norms?

D. Sources of Market Data

1. Similar publicly traded companies

2. Similar acquired companies

3. Industry rules ofthumb

4. Make sure the comparisons are accurate, i.e., make the same adjustments to the

market data that were made to the subject company

E. Summary

1. Do proper company analysis and adjustments

2. Adjust data of comparables, if appropriate

3. Determine appropriate norms for market multiples

4. Determine how the company's multiples should differ from the market norms

Corporate Valuations, Inc. IVSC Page 19

XIII. OTHER CONSIDERATIONS IN DETERMINING FAIR

MARKET VALUE

A. Buy/Sell Agreements

B. History of Past Transactions or Offers to Buy

C. Discounts for Minority Interest (or Lack of Control) and Lack of Marketability

D. Premium for Control

E. Special Attributes of Control

F. Control or Minority Assignment can largely dictate appraisal methodology

G. Special rights or privileges, i.e., put options, preferred stock conversion or redemption

features

Corporate Valuations, Inc. Ivse Page 20

XIV. DISCOUNT FOR LACK OF MARKETABILITY

A. Lack of Marketability Discount:

1. What is the impact of state law on transfer?

2. Facts and circumstance dominate, as usual.

B. Studies:

1. Institutional Investor Study done by the S.E.C. on purchases of restricted stocks by

institutions found a wide range of discounts, with 35% appearing asa typical level

barring unusual circumstances.

2. Robert E. Moroney, Taxes, March, 1973, examined discounts paid by funds

investing in restricted securities.

3. J. Michael Maher, Taxes, September, 1976, examined discounts paid by funds

investing in restricted securities.

4. Thomas A. Solberg, Journal of Taxation, September, 1979, examined 15 court

cases in which restricted securities were valued. The median discount in his study

was 38.9%.

5. John D. Emory, "The Value of Marketability As TIlustrated In Initial Public

Offerings Of Common Stock," Business Valuation Review, December, 1986,

examined 21 initial public offerings (IPOs) that took place between January 1, 1985

and June 30, 1985. Mr. Emory found that the median discount from the public

offer price was 43% for the transactions taking place within five months ofthe IPO.

Mr. Emory has updated his article several times, with the results as noted below:

Study

1985 - 1986

1987 - 1989

1989 - 1990

1990 - 1992

1992 - 1993

1994 - 1995

1995 - 1997

1997 ~ 2 0 0 0

1980 - 2000 Recap

Median Discount

43%

45%

40%

40%

44%

45%

42%

54%

47%

The usefulness of the data from these IPO studies is more questionable than that

from the restricted stock studies, primarily for two reasons. One is that the pre-IPO

private transactions do not always occur at arms' length fair market value prices.

The second is that the. IPO prices do not necessarily represent fair market value

either. Often, public market trading subsequent to the IPO suggests that the market

"values" the shares differently than the IPO price which was determined by the

investment banker takiI;J.g the company public. However, the data still is of interest.

6. In an effort to correct some of the problems with the IPO studies, Mary Ann Lerch,

writing in the BVR, June 2000 issue, "Measuring Lack of Marketability Discounts

for IPO Pricing ~ The Graphic Approach IPO Data: November 1995 ~ April 1997",

noted that after correction for biases, her data showed.that the.discount for lack of

marketability remained in the 20% to 30% range.

7. Writing in the December 2000 BVR, "Marketability Discounts and Risk in

Transactions Prior to Initial Public Offerings", Philip Saunders, Jr. indicated that

the Emory studies were sound, and that the minimum discount was "around 25%"

Corporate Valuations, Inc. IVSC Page 21

plus an additional discount of 15 to 20 basis points for every day until the public

offering. He estimated that an offering that was five months off would justify a

discount of 50% to 55%.

8. John J. Kania, in the March 2001 BVR, "Evolution of the Discount for Lackof

Marketability", reviewed various studies on lack of marketability, and argued that

discounts had actually decreased to about 20%, with 14% appropriate after

consideration ofthe "information cost discount".

9. Various authors have attempted to use regression analyses to analytically reach

improved estimates of the discount for lack of marketability. All of the studies

suffer from problems, in our view, that removes them from consideration.

10. Summary: Based on these studies and discussions presented above, we believe a

reasonable average discount for lack of marketability is 35% to 45% for minority

shareholdings when the beginning value assumes the liquidity of the public market.

All other things being equal, the fair market value of minority shares in a closely

held company would be, on average, 35% to 45% less than the value of minority

shares in a similar company whose shares were actively traded on an exchange or

over the counter. The difference can be either thought of as a discount to the value

of the closely held interests or a premium for the liquidity afforded by the public

market.

The magnitude of the discount for lack of marketability applicable to a specific

investment is affected by many factors. One of the factors is an overlapping issue;

the less control a specific investment has over management of the entity, the less

marketable that interest is. Of particular importance regarding marketability

discounts for closely held interests is the issue of when a sale of those interests

might be possible, or other form of realization of the value of the interests. Such

realization could be provided by liquidation of the entity, sale of the entity, sale of

the particular interest because of put rights or buy/sell provisions, or an IPO of the

entity. This impacts the discount for lack of marketability because it impacts the

time the investment is likely to be held prior to the receipt of any return on the

investment. Tied to this impact is that of the entity's dividend or distribution policy

and history. If dividends or distributions are expected, the discount for lack of

marketability would be reduced because the investor would be receiving some

return on a regular basis, quarterly for example, and not have to wait for sale or

liquidation for the total return on the investment. Generally to a lesser extent, the

nature and history of the entity, its financial condition and its outlook impact the

marketability of investments in that entity. If the entity appears stable and the

outlook appears favorable, an investor may assign less importance to the issue of

immediate liquidity because the eventual return at time of sale would appear more

certain and, perhaps, higher. Clearly, restrictions on the transferability of an

investment would decrease its marketability.

11. Robert Moroney wrote a second article (Taxes -- The Tax Magazine, May 1977,

Why 25% Discount for Nonmarketability in One Valuation, 100% in Another?) on

the discount for lack of marketability in which he noted the factors that affect the

size of the discount. These factors can be classified into a relatively few categories:

a) Are dividends being paid?

b) Is management friendly? Honest?

c) How fast is the subject company growing?

d) Degree of control?

e) Is the industry in a favorable competitive situation?

t) In there interest in the industry in buying companies?

g) Prevailing mood ofthe investing public?

h) What is the financial and business risk in the subject company?

i) What are the particular restrictions on transfer of int.erests?

Corporate Valuations, Inc. IVSC Page 22

xv. LACK OF CONTROL (MINORITY INTEREST)

DISCOUNT

A. Theory. It is commonly accepted in the field of business valuation that the per share value

of a controlling interest is worth more than the per share value of a minority interest.

Control is a valuable asset. With it the investor has the right to control the Board of

Directors which in turn can determine salaries, benefits, dividends, the sale of assets, the

direction of the company, liquidation, etc. These rights have value and investors are

willing to recognize that value by paying a higher price for a controlling block of stock

than they would for a minority block of stock.

1. What are the disadvantages of lack of control?

2. How much cash does a shareholder get on an annual basis?

3. How is management running the company -- good for all, or good for one?

4. How fast is the subject company growing?

5. What is the financial and business risk in the subject company?

6. What is the impact of state law on lack of control?

7. Facts and circumstance dominate, as usual.

B. The opposite of a control premium is a minority interest discount.

C. Quantification. In the public marketplace the value of control is quantified when one

company offers to buy all (or a majority of) the shares of another -- a "tender offer".

D. Calculation. In recognition of the value of control the buyer typically makes a bid for the

stock at a price that exceeds the market price existing at the time. This excess is called the

"tender offer premium" and is believed to be an objective estimate ofthe value of control.

1. Control Premium Example: if a tender offer of $28 is made for a publicly traded

company that is trading at $20 per share, the value of a controlling interest is $28,

the value of a minority interest is $20 and the premium for control is 40%.

2. Control premiums in the public stock market are normally inversely related to the

level of the public market in general. When the stock market is high based on

underlying fundamentals such as earnings, control premiums tend to decline.

Conversely, control premiums tend to be higher when the stock market is

conservatively valued. This implies that the long term value of a company based on

its underlying economic fundamentals is not as volatile as the stock price, as the

latter can change markedly over relatively short periods.

3. Data Sources.

a) Mergerstat Review, published annually Merrill Lynch Business Advisory

Services Division.

b) Houlihan, Lokey, Howard & Zukin, Inc. (HLHZ) control premium study

published quarterly.

(1) The HLHZ premiums are consistently above those suggested by the

Merrill Lynch data because of differences in the method of

computing the "premium". Merrill Lynch's pre-tender price is

rigidly defined as the price five business days prior to the formal

tender offer announcement. Because of inside information, the stock

price has often already crept up by this time in anticipation of the

announcement. The control premiums thus computed are biased

Corporate Valuations, Inc. IVSC Page 23

downward. HLHZ takes a more subjective approach in determining

the pre-tender price.

4. Minority Discount Example. In the example previously cited, the control premium

of 40% would be synonymous with a minority interest discount of 28.6%, i.e.,

($20/$28 = 0.714 and 1.0-0.714=0.286).

E. 50:50 interests.

F. Swing vote interests.

Corporate Valuations, Inc. IVSC Page 24

XVI. CONTROL PREMIUM

A. What are the advantages of control?

B. How fast is the subject company growing?

C. Is the industry in a favorable competitive situation?

D. In there interest in the industry in buying companies?

E. What is the financial and business risk in the subject company?

F. What is the impact oflaw on control?

Corporate Valuations, Inc. IVSC Page 25

XVII. LACK OF VOTE DISCOUNT

A. What is the impact of a lack of a vote?

B. What is the impact oflaw on lack of control (vote)?

C. Facts and circumstance dominate, as usual.

D. Quantification: An article titled "Price Effects of Dual Class Shares" by Riding & Jog,

published in the January/February 1986 issue of the Financial Analysts Journal noted that

the average premium for voting shares traded on the Toronto Stock Exchange (Canada's

largest) was 7% over restricted voting shares in the same companies, which translates into

a discount equivalent of about 6.5% (i.e., 1.07 x 0.935 =1.00).

E. A later study of voting and non-voting common stock and the value differential,

undertaken by Houlihan, Lokey, Howard & Zukin found a discount range of 2% to 4% for

non-voting common stock.

Corporate Valuations, Inc. IVSC Page 26

XVIII. VALUATION CONCLUSION

A. Briefly review all source documents to see if any important factors were missed

B. Re-read the appraisal assignment

C. Summarize and compare the conclusions of the various approaches

D. Recheck methods which give extreme values

E. Determine the relevance of the various approaches for the particular assignment

F. Arrive at a single point estimate, by either quantitative or qualitative techniques. Better to

round than to imply a false sense of preciseness

G. Check the final conclusion against adjusted income or adjusted equity. Does the answer

make sense?

Corporate Valuations, Inc. IVSC Page 27

XIX. SMALL BUSINESSES -- SPECIAL FACTORS

A. Market Approach

1. Data Bases

a) Business Brokers

b) IBA Data Base

c) BizComps Data Base

d) Be careful to know what is considered in the value reported in the data base

2. Rules of Thumb

a) Business Brokers

b) Desmond Books

c) Be careful to know what is considered in the value reported in the rule of

thumb and what causes the rule to vary between businesses.

3. Multiple of Owners' Discretionary Cash

a) Pretax Income plus

b) Owners salary, distributions, perqs, expense allowances over cost, etc. plus

c) Interest Payments plus

d) Depreciation and amortization plus

e) Non-necessary, non-economic expenses

B. Income Approach

1. Replacement compensation for the labor of the owner is a key consideration

C. Transactions --What is Typically Sold (and what is not sold)

1. What is typically sold

a) Inventory

b) Equipment, Fixtures

c) Real Estate (owned or leased)

d) Goodwill

2. What is not typically sold

a) Cash

b) Accounts Receivable

c) Account Payable and other Debt or Liabilities

Corporate Valuations, Inc. IVSC Page 28

CORPORATE VALUATIONS, INC.

6645 NE 78

fJl

Court, Suite C-6

(503) 235-7777 FAX # (503) 235-3624

Portland, Oregon 97218 USA

email ggilbert@corpval.com

GREGORY A. GILBERT, CFA, FASA, CBA

Occupation

Areas of

Specialization

Expert Witness

Education

Professional

Designations

Instruction

Experience

Offices

President, Corporate Valuations

Principal, VALPOINT, Inc.

Valuation of business interests including closely held corporations, publicly traded corporations,

partnerships and sole proprietorships; intangibles; and damages to business interests.

Idaho Maine Oregon Texas Washington [Federal, State, Tax, Property Tax and Bankruptcy Courts].

Directory of Experts, The Best Lawyers in America, 1990-1993.

Tax Court Cases: Beaver Bolt, Inc. v. Commissioner, T.e. Memo 1995-549.

Estate of Joseph W. Giselman, deceased, Harry W. Giselman, personal representative,

v Commissioner, T.C. Memo 1988-391

Bachelor of Arts in Economics, 196;4, Yale University.

Master of Science in Business, 1966, M.LT.

CFA - Chartered Financial Analyst.

FASA - Fellow, American Society of Appraisers

ASA - Accredited Senior Appraiser.

CBA - Certified Business Appraiser.

At various times has headed development/teaching/grading of Courses, Seminars and Exams for American

Society of Appraisers, and have regularly taught courses BV-201, BV-202, BV-203 and BV-204. Taught

courses and seminars on Business Valuation through colleges, universities, appraisal, legal, accounting and

other professional groups, in the USA and abroad.

1983-Present: President, Corporate Valuations.

1991-Present: Principal, VALPOINT, Inc.

1978-1983: Vice President and Associate Director of Research, Willamette Management Assoc.

1976-1977: Furman, Selz, Mager, Dietz and Birney, NYSE, providing research to institutions.

1966-1976: Monness, Williams & Sidel, a NYSE member firm providing research to institutions.

2003-2006: Member, Nominating and Awards Committee, American Society of Appraisers.

1993-2006: Co-USA-Member, International Valuation Standards Committee.

2003-2004: Member, International Relations Committee, American Society of Appraisers.

1990-2004: Member, Editorial Review Board, Business Valuation Review

2001-2003: Past Chair, Business Valuation Committee, American Society of Appraisers.

1997-2002: Member, Admission & Membership Committee, American Society of Appraisers.

2000-2002: Member, Strengths Weaknesses Opportunities Threats Profession Consolidation Committee

1999-2002: Co-Founder, Director and President, Center for Advanced Valuation Studies.

1999-2001: Chairman, Business Valuation Committee, American Society of Appraisers.

1993-200I: Chairman, International Valuation Confederation, American Society of Appraisers.

1998-2001: Member, Business Valuation Profession Task Force

1997-2001: Member, Business Valuation e.L.A.R.E.N.C.E. Task Force

1998-2000: Education Commission, Valuation 2000

Corporate Valuations, Inc. IVSC Page 29

Member

Gregory A. Gilbert - Continued

Offices Continued

1997-1999: Vice Chairman, Business Valuation Committee, American Society of Appraisers.

1997-1999: Member, Uniform Standards ofProfessional Appraisal Practice Issues Resource Panel.

1997-1998: Chairman, Admission & Membership Committee, American Society of Appraisers.

1994-1996: Member, Appraiser Qualifications Board, The Appraisal Foundation.

1993-1993: Vice Chairman, Business ValuationCommittee, American Society of Appraisers.

1993-1993: Chairman, Education Committee, American Society of Appraisers.

1991-1993: Education Committee, American Society ofAppraisers.

1987-1993: Business Valuation Committee, American Society of Appraisers.

1992-1993: Regional Governor, Institute of Business Appraisers.

1992-1993: Chairman, International Development Committee, Am. Society of Appraisers.

1989-1992: Chairman, Education Committee for Business Valuation, Am. Society of Appraisers.

1991-1992: Chairman, Advanced Seminar Committee, Am. Society of Appraisers.

1990-1991: Chairman, Regional and Chapter Seminar Committee, Am. Society of Appraisers.

1986-1990: Northwest Regional Governor, American Society of Appraisers.

1987-1990: Budget & Finance Committee, American Society of Appraisers.

1989-1990: Treasurer, Political Action Committee, American Society of Appraisers.

1984-1986: President, Portland Chapter, American Society of Appraisers.

1983-1984: Vice President, Portland Chapter, American Society of Appraisers.

American Society of Appraisers - Business Valuation; Association of Investment Management and Research;

The Institute of Chartered Financial Analysts; Portland Society ofFinancial Analysts; Financial Analysts

Federation; ESOP Association; Institute of Business Appraisers.

Published

9-30-2003

"Price/Sales Ratios", Business Valuation News (6/86).

Leveraged ESOP Valuation", Business Valuation News (9/85).

"Business Appraisal- Who, Why & When", Daily Journal of Commerce (4/84).

"Discount Rates and Capitalization Rates--Where Are We?", Business Valuation Review, (9/90).

"Valuing The Business", Advising Oregon Businesses, 1991 and 1995, OR State Bar Continuing Legal Ed.

"Discounted Future Benefit Method--An Income Approach", Handbook ofBusiness Valuation,

Wiley 1992.

Corporate Valuations, Inc. IVSC Page 30

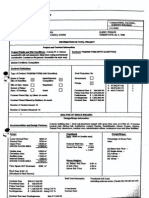

CASE STUDY

May 21, 2003

Appraisal of Runckel Distribution, Service & Supply, Inc.

Sample Case Data and Brief Explanation of Appraisal

Description of Assignment

Pursuant to a request by Mr. Gerald Runckel, we reached an opinion of the fair market value of a 30%

interest in Runckel Distribution, Service & Supply, Inc. (''the Company") as of April 30, 2003. The

purpose of the appraisal is to .assist with Christopher Runckel's sale of stock to Blake Runckel. No other

purpose is intended or should be inferred.

Sources of Information

Greg Gilbert and Pat Jordan of Corporate Valuations inspected the offices and facilities of Runckel

Distribution, Service & Supply, Inc. on May 12, 2003. Management interview held at the same time as

the inspection, as well as telephone conversations, management provided descriptions as to general and

specific information related to the Company. A list of documents reviewed is contained in the full report.

Scope of Assignment

There are numerous factors that should be considered in determining the value of a business or business

interest. Among these are the previously described factors outlined by the Internal Revenue Service in