Академический Документы

Профессиональный Документы

Культура Документы

Depository System of Shareholding - How To Open A Demat Account

Загружено:

Krishna GОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Depository System of Shareholding - How To Open A Demat Account

Загружено:

Krishna GАвторское право:

Доступные форматы

THE DEPOSITORY SYSTEM OF SHAREHOLDING: HOW TO OPEN A DEMAT ACCOUNT

Share certificates abolished from stock exchanges 1. Shares in the form of paper certificates cannot be traded on Indian stock exchanges for the last several years. Trading is now in demat (i.e. dematerialised) form only. Hence, investors who hold paper certificates have to open an account with a Depository. Such account is in electronic mode. The paper certificates have thus been dematerialised, i.e. changed into demat accounts. Also, if you want to apply for any IPO (initial public offer) of shares, you need to have an account with a depository because IPO allotment is now only in demat form. Depository Participants (DPs) 2. India has two competing depositories, viz; the National Securities Depository Ltd (NSDL) and Central Depository Services Ltd (CDSL). The investor does not deal directly with the Depository but only with its agents who are called Depository Participants (DPs). The DPs are spread over many cities/towns across the country. The DPs operate within the framework of the particular Depository as regards systems to be followed. Banks as DPs vs. Brokers as DPs 3. Some banks also operate as DPs but most of the DPs are stockbrokers. It needs to be understood that there are three distinct activities: (a) Buying and selling of shares has necessarily to be done through a stockbroker. (b) Payments involve the bank with which the investor has an account; and

(c) The recording of share transactions in the demat account has to be done by the DP. Hence, if your broker is also a DP, it simplifies the task somewhat in most cases. Opening a depository account 4. For opening an account with a DP, you will have to fill up an Account Opening Form and also sign an Agreement Form with the DP. Such agreement has to be on Stamp Paper. You will have to provide proof of your identity and also proof of address. Such proof can be any of the following: PAN card, Voter Identity Card, Passport, Ration card, Driving license, Electricity Bill, Landline Telephone bill, etc. The SEBI made the requirement of having a PAN Card mandatory for opening a demat account. In the case of joint holders, each joint holder is required to have a PAN card. Nomination Facility is also available in the depository system. This is to enable the nominee to receive the securities after the death of the holder of the demat account. The system of charges 6. Most DPs charge for account opening, account maintenance and transactions. These charges vary among the DPs. The SEBI rules prohibit the DPs from levying charges in case an investor closes his Demat Account with one DP and transfers to another DP. To an extent, the DPs compete among themselves. So do the two depositories. When you want to sell or buy shares, you have to place an order with your broker. The payments for purchases/sales of shares are made or received through the stock broker. You have also to instruct your DP so that he can make the necessary entries in your demat account. The DP will send you periodic statements of your share holdings and transactions.

5.

7.

8.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 09 Chapter 3Документ41 страница09 Chapter 3Krishna GОценок пока нет

- Chrysalis Formats RajaДокумент36 страницChrysalis Formats RajaKrishna GОценок пока нет

- Closing Date of Receipt of Application: 14.10.2009Документ8 страницClosing Date of Receipt of Application: 14.10.2009Krishna GОценок пока нет

- Chapter 2: Basic CLI CommandsДокумент27 страницChapter 2: Basic CLI CommandsKrishna GОценок пока нет

- Ut-300R2 Adsl2/2+Modem: Utstarcom, IncДокумент85 страницUt-300R2 Adsl2/2+Modem: Utstarcom, IncKrishna GОценок пока нет

- IGNOU FEG-01 Solved Assignment 2013Документ10 страницIGNOU FEG-01 Solved Assignment 2013Biswajit Behera100% (1)

- MLLNДокумент45 страницMLLNKrishna GОценок пока нет

- BcoftДокумент8 страницBcoftKrishna GОценок пока нет

- Visakhapatnam Map RGCLДокумент1 страницаVisakhapatnam Map RGCLKrishna GОценок пока нет

- Bharat Sanchar Nigam Limited HR Management System Madhuravada Summary and Monthwise Details of 2nd PRC IDA ArrearДокумент6 страницBharat Sanchar Nigam Limited HR Management System Madhuravada Summary and Monthwise Details of 2nd PRC IDA ArrearKrishna GОценок пока нет

- 149ONU 404i Data SheetДокумент2 страницы149ONU 404i Data SheetKrishna GОценок пока нет

- FTTH DolphinДокумент8 страницFTTH DolphinKrishna GОценок пока нет

- H3C EPON OLT Operation ManualДокумент86 страницH3C EPON OLT Operation ManualKrishna GОценок пока нет

- No Outside Recruitment at Proposed DGM and MT Level As Sufficient Number of Required Talents Available in BSNLДокумент2 страницыNo Outside Recruitment at Proposed DGM and MT Level As Sufficient Number of Required Talents Available in BSNLKrishna GОценок пока нет

- FTTH ProductsДокумент1 страницаFTTH ProductsKrishna GОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Afghanistan Law Bibliography 3rd EdДокумент28 страницAfghanistan Law Bibliography 3rd EdTim MathewsОценок пока нет

- Why-Most Investors Are Mostly Wrong Most of The TimeДокумент3 страницыWhy-Most Investors Are Mostly Wrong Most of The TimeBharat SahniОценок пока нет

- TesisДокумент388 страницTesisHadazaОценок пока нет

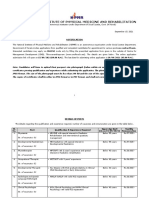

- NIPMR Notification v3Документ3 страницыNIPMR Notification v3maneeshaОценок пока нет

- They Cried MonsterДокумент13 страницThey Cried MonstermassuroОценок пока нет

- MATH 7S eIIaДокумент8 страницMATH 7S eIIaELLA MAE DUBLASОценок пока нет

- AC2104 - Seminar 5Документ3 страницыAC2104 - Seminar 5Rachel LiuОценок пока нет

- Republic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestДокумент3 страницыRepublic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestCamelle EscaroОценок пока нет

- Catalog Vacuum Circuit Breakers 3ah47 enДокумент36 страницCatalog Vacuum Circuit Breakers 3ah47 enbajricaОценок пока нет

- God As CreatorДокумент2 страницыGod As CreatorNeil MayorОценок пока нет

- What Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsДокумент149 страницWhat Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsCometa Halley100% (1)

- ch09 (POM)Документ35 страницch09 (POM)jayvee cahambingОценок пока нет

- PSychoyos Semiotica LibreДокумент68 страницPSychoyos Semiotica Librebu1969Оценок пока нет

- The Palatability, and Potential Toxicity of Australian Weeds To GoatsДокумент163 страницыThe Palatability, and Potential Toxicity of Australian Weeds To Goatsalshokairsaad513Оценок пока нет

- Supply Chain Analytics For DummiesДокумент69 страницSupply Chain Analytics For DummiesUday Kiran100% (7)

- Native Americans - Clothing & Head DressesДокумент28 страницNative Americans - Clothing & Head DressesThe 18th Century Material Culture Resource Center100% (15)

- Catibayan Reflection AR VRДокумент6 страницCatibayan Reflection AR VRSheina Marie BariОценок пока нет

- 2nd Exam 201460 UpdatedДокумент12 страниц2nd Exam 201460 UpdatedAlbert LuchyniОценок пока нет

- Secant Method - Derivation: A. Bracketing MethodsДокумент5 страницSecant Method - Derivation: A. Bracketing MethodsStephen Dela CruzОценок пока нет

- Chapter 2Документ16 страницChapter 2nannaОценок пока нет

- Diverse Narrative Structures in Contemporary Picturebooks: Opportunities For Children's Meaning-MakingДокумент11 страницDiverse Narrative Structures in Contemporary Picturebooks: Opportunities For Children's Meaning-MakingBlanca HernándezОценок пока нет

- Unsworth - Re-Branding The City - Changing The Images of PlacesДокумент45 страницUnsworth - Re-Branding The City - Changing The Images of PlacesNatalia Ney100% (2)

- ( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageДокумент14 страниц( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDamon Culbert0% (1)

- Faust Part Two - Johann Wolfgang Von GoetheДокумент401 страницаFaust Part Two - Johann Wolfgang Von GoetherharsianiОценок пока нет

- Timothy Ajani, "Syntax and People: How Amos Tutuola's English Was Shaped by His People"Документ20 страницTimothy Ajani, "Syntax and People: How Amos Tutuola's English Was Shaped by His People"PACОценок пока нет

- Cambridge English First Fce From 2015 Reading and Use of English Part 7Документ5 страницCambridge English First Fce From 2015 Reading and Use of English Part 7JunanОценок пока нет

- Shostakovich: Symphony No. 13Документ16 страницShostakovich: Symphony No. 13Bol DigОценок пока нет

- Chapter 5Документ24 страницыChapter 5Tadi SaiОценок пока нет

- Medical Surgical Nursing Nclex Questions 5Документ18 страницMedical Surgical Nursing Nclex Questions 5dee_day_8Оценок пока нет

- Thermal (TE-411,412,413,414,511)Документ25 страницThermal (TE-411,412,413,414,511)nved01Оценок пока нет