Академический Документы

Профессиональный Документы

Культура Документы

The Wall Street Journal

Загружено:

Pako MogotsiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Wall Street Journal

Загружено:

Pako MogotsiАвторское право:

Доступные форматы

DJIA 15135.84 0.

98%

Nasdaq 3479.38 1.04%

Stoxx Eur 600 288.31 g 1.31%

FTSE 100 6375.52 g 0.72%

DAX 7806.00 g 2.36%

CAC 40 3753.85 g 1.46%

Euro 1.2833 g 0.66%

Pound 1.4910 g 1.08%

Interpreting Fedspeak

OFF THE WALL 31

EUROPE EDITION

VOL. XXXI NO. 111 MONDAY, JULY 8, 2013

$1.75 (C/V) - KES 250 - NAI 375 -

1.70

WSJ.com

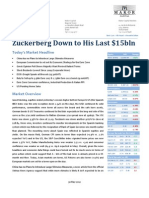

New Finance Questions For Euro Zone

BY MATTHEW DALTON AND MATINA STEVIS BRUSSELSEuro-zone officials are preparing to confront one of the next big tests in the regions debt crisis: finding yet more financing for Portugal, Greece and Cyprus on top of more than 200 billion ($256 billion) the bloc already has devoted to bail out its weakest members. Euro-zone tensions have flared up in recent weeks after several months of relative calm, with a political crisis exploding last week in Portugal, tricky negotiations coming to a head over releasing more aid money for Greece and mounting evidence that the Cypriot economic program is veering off track. Those events add new urgency to a meeting Monday of finance ministers from the 17 euro-zone nations in Brussels. But some of those concerns eased over the weekend. Portuguese Prime Minister Pedro Passos Coelho appeared to have settled the weeklong crisis after making a cabinet reshuffle and securing a joint political commitment by the two governing parties to stay united. And officials reported progress in the Greek talks, including advances in discussions over public-sector payroll cuts Athens had promised as part of its bailout. That opens up the likelihood the ministers will unlock at least part of the next aid slice of at least 4.8 billion for the country. Resolving these questions now will be punted into what could be a tempestuous autumn. Talks will heat up after German elections in Septem-

Wimbledon: Andy Murray Ends a 77-Year Wait

ber, when analysts expect Chancellor Angela Merkel, a decisive figure in the eurozone debate who is expected to win re-election, will have more latitude to take tough decisions. Election campaigns could also get under way in Portugal. And Greece will come under question since the country wont, as things stand, have 12 months of forward financing needed to get the necessary support of the International Monetary Fund for further releases of rescue funds. And Cyprus is widely expected to need more money. These issues could be in play as the U.S. Federal RePlease turn to page 3

Portugals remixed government starts over........ 3 Simon Nixon: How Berlin is steering the EU.......................... 4

Inside

BY MATT JARZEMSKY

U.S. Earnings Season Will Test Confidence

After Fridays strongerthan-expected U.S. jobs report, investors are more convinced than ever that the Federal Reserves bond-buying program will be scaled back as soon as September. If that happens, the stock market will lose fuel that helped power the Dow Jones Industrial Average to a new high in May. Investors hoping that U.S. companies will come to the rescue are likely to be disappointed. Earnings season kicks off Monday afternoon in New York with aluminum giant Alcoa Inc., while banks J.P. Morgan Chase & Co. and Wells Fargo & Co. report second-quarter results Friday morning. By the end of the

High-end smartphone makers face flood of cheaper devices Business ................ 15 U.S. authorities probe cause of deadly Asiana Airlines crash U.S. News ............... 6 Egypts post-Morsi reality check Opinion................... 14

month, dozens of corporate Americas bellwethers will have signaled whether the U.S. economy is growing fast enough to justify stock prices that are within striking distance of their all-time highs. Companies in the Standard & Poors 500-stock index are expected to report a meager 0.6% rise in quarterly earnings from a year earlier, according to analyst forecasts complied by FactSet. That would be the smallest growth since the third quarter of 2012, when profits fell. In this years first quarter, earnings at S&P 500 companies grew 3.5%, and Please turn to page 22

Associated Press

Alcoa no longer sets the tone for earnings................... 15 Heard: U.S. jobs data work over bond buyers.................... 32

Andy Murray became the first British man to win Wimbledon since 1936 with a 6-4, 7-5, 6-4 victory over Novak Djokovic in Sundays Wimbledon final. The applause was possibly the loudest and longest in Wimbledon history. The last four or five years, its been very, very tough, very stressful, a lot of pressure, Murray said after the match. Articles on page 30

2 | Monday, July 8, 2013

AM

IM

UK

SW FR

IT SP

TK BR

PL

IS

AE

GR

THE WALL STREET JOURNAL.

PAGE TWO

Whats News

Associated Press

PUUUUUUUL!: A judge watches the leather ring held by two competitors with their middle fingers at the Alps Finger Wrestling championships in the southern German town of Mittenwald on Sunday.

Business & Finance

n Retailers are becoming more stringent about monitoring safety at the factories they source from in Bangladesh, pre-empting a pact that hasnt come into full effect. Separately, Cambodia was supposed to be an industry model, but problems remain at least decade after a U.N.-backed program was launched to manage it. 3, 9 n The vagaries of the aluminum market mean Alcoa, always the first to report earnings, isnt the industrial bellwether of yore. 15 n One aspect of the Volcker rule a curb on participation in bankrun investments by directors and employeeshas left confusion among lenders, staff and clients. 15 n Mexicos antitrust regulator could soon issue a last call for

beer makers sales exclusivity agreements with corner stores and restaurants, clearing a path for craft brewers and other players to crash a lucrative party. 18 n Three years ago, a Greek lawyer-turned-tycoon, was riding high, as his investment fund had just snapped up Olympic Air. Today, however, he has become a symbol of Greeces travails. 19 n China is launching an investigation of Swiss packaging company Tetra Pak International, the latest in a growing roster of foreign firms under scrutiny for antimonopoly practices in China. 20 n The Chinese government is adopting a tough line with Europe in talks to resolve a multibilliondollar trade dispute over solarpanel equipment, leaving the two sides with significant differences after weeks of negotiations. 20

n A mortgage-focused hedgefund investor closed his fund and handed money back to investors last month after he concluded that mortgage bonds and other investments were on thin ice. 20 n The Dutch central bank has told lenders to build up a bigger capital cushion for potential losses on real-estate loans, its latest move to protect banks from the countrys property slump. 22 n Banks discretion in judging the riskiness of their assets can lead to overstatements of their capital ratios of as much as 20%, a report by global regulators says. 22 n The U.K. government could be left with a big hole in its public finances and Swiss banks could lose millions of pounds paid in advance after a tax agreement apparently failed to raise anywhere near the money expected. 23

n The price of oil from some OPEC members has fallen, highlighting the prospect of a deepening rift between countries that are most affected and those that are largely unscathed. 24 n HSBC is leaving retail banking and wealth management in South Korea, its latest move to rid itself of inefficient businesses. 24

n Canadian authorities confirmed five deaths and said about 40 people remained missing after a runaway train carrying crude oil derailed, causing an explosion that destroyed dozens of buildings in a Quebec town. 7 n Activists on both sides of Egypts widening political divide protested in the capital, a day after opponents of ousted President Mohammed Morsi failed to settle on a new prime minister. 8 n A female former Afghan lawmakers path from traveling the world to hiding in a shelter shows just how far the country has to go in improving the treatment of women. 8 n North and South Korea agreed to take initial steps toward reopening their joint industrial zone, a rare consensus after months of fractious relations. 9

World-Wide

n The leader of the junior partner in Portugals ruling coalition has been named deputy prime minister and point man in the countrys dealings with the countrys international bailout creditors. 3 n The U.K. deported radical cleric Abu Qatada to Jordan to face terrorism charges, concluding a frustrating saga for British authorities who have battled to eject him. 4

ONLINE TODAY

Readers Choices WSJ Technology Crisis in Egypt Question of the Day Which of these luxury European houses is your favorite?

Vote online today at europe.wsj.com

1. Opinion: After the Coup in Cairo 2. Permits to Allow Concealed Guns Soar 3. Cargo Bikes: The New Station Wagon 4. Two Dead in San Francisco Plane Crash 5. Opinion: Part-Time America 6. Airline Fees Climb 7. Two Former Popes Set for Sainthood 8. Egypt Retreats From ElBaradei 9. Job Gains Show Staying Power 10.Blast From Train Hits Quebec Town

Samsung Electronics business keeps on delivering, but investors just arent buying it.

Heard on the Streets Aaron Back comments on smartphone profits.

SUBSCRIBE TODAY

CALL +44 (0) 20 3426 1313 VISIT wsjeuropesubs.com/wsje

THE WALL STREET JOURNAL EUROPE (ISSN 0921-99) 222 Grays Inn Road, London, WC1X 8HB FOR ISSUES RELATED TO SERVICE: CALL +44 (0) 20 3426 1313 EMAIL subs.wsje@dowjones.com WEB service.wsje.com

Previous Results Have your fears been allayed by the ECB and BOE giving guidance on keeping interest rates low?

Yes. Good for my equities and my mortgage. 29% No. A sugar rush that wont help my savings 38% Too early to tell 33%

Follow our continuing coverage on events in Egypt europe.wsj.com

Advertising Sales worldwide through Dow Jones International. Frankfurt: 49 69 29725 390; London: +44 20 7573 4060; Paris: 331 40 17 17 01. Printed in Belgium by Concentra Media N.V. Printed in Germany by Dogan Media Group / Hrriyet A.S. Branch Germany. Printed in Switzerland by Zehnder Print AG Wil. Printed in the United Kingdom by Newsprinters (Broxbourne) Limited, Great Cambridge Road, Waltham Cross, EN8 8DY. Printed in Italy by Telestampa Centro Italia s.r.l. Printed in Spain by Bermont S.A. Printed in Israel by Jerusalem Post Group. Printed in Turkey by IHLAS GAZETECLK A.S. Printed in Poland by Polskapresse Printing Division. Registered as a newspaper at the Post Office. Trademarks appearing herein are used under license from Dow Jones & Co. 2013 Dow Jones & Company. All rights reserved. Editeur responsable. Tracy Corrigan M-17936-2003. Registered address: Avenue Cortenbergh 60, 1040 Brussels, Belgium

THE WALL STREET JOURNAL.

Monday, July 8, 2013 | 3

WORLD NEWS

Retailers WorkTogetheronSafetyMatters

BY CHRISTINA PASSARIELLO PARISRetailers are becoming more stringent about monitoring safety at the factories they use in Bangladesh, pre-empting a safety pact that wont come into full effect until the fall. A sense of urgency has permeated retailers in the wake of a factory building collapse that killed more than 1,100 workers in April, illuminating the lack of oversight in one of the worlds largest garment manufacturers. Retailers such as Hennes & Mauritz AB, Zara parent Inditex SA and British retailer Primark, part of Associated British Foods PLC, scrambled to come up with an industrywide safety pact, which begins to take effect on Monday. Yet many are also taking matters into their own hands and working with their competitors, duplicating some of the functions of the safety pact. The newfound cooperation underscores the pressure on retailers to adapt how they do business in Bangladesh. Retailers are rushing to conduct their own building-safety checks, even before the same buildings are checked by the pacts chief inspector. Last month, British retailers Tesco PLC and Primark said they discovered structural problems at the Liberty Fashion Wears Ltd. factory in Savar, near the crumbled Rana Plaza. The four-story building doesnt have enough steel support for its weight, the retailers said, and tory must be inspected by next April, one year after the Rana Plaza collapse. The five-year accord is designed to raise fire- and building-safety standards in Bangladesh. Seventy retailersnearly all Europeanhave signed the legally binding pact since mid-May, pledging to help finance repairs at sites that dont meet their standards and to not contract work at factories that the group deems unsafe. Inditex, PVH Corp., the owner of Calvin Klein and Tommy Hilfiger, and British mail-order retailer N Brown Group PLC are heading the initiative on behalf of the retailers. Trade union groups and the International Labour Organization are also participating. Major U.S. retailers including Wal-Mart Stores Inc. and Gap Inc. are pursuing a competing program that would establish a $50 million safety fund, according to a person familiar with the proposal. It could be announced as soon as mid-July, according to the person. The European group, which will operate as a foundation based in Amsterdam, has just begun to recruit its two key positionschief safety inspector and executive director. The safety inspector will coordinate building-safety assessments of all of the factories in which the retailer signatories manufacture. Suzanne Kapner contributed to this article.

Bloomberg News

Workers embroider T-shirts with logos on the production line of a garment factory in Gazipur, Bangladesh, in May. it is at risk of collapsing like its neighbor. Tesco and Primark then teamed up with other retailers producing at the factory, including Carrefour SA and Debenhams PLC. And two weeks ago, retailers including Tesco and Carrefour wrote a letter to the factory owner, cosigned by the trade unions, demanding that he close the site until more inspections and repairs are done, according to the retailers. They insisted that the factory keep paying wages during the shutdown, and they committed to completing their orders there once the factory is safe again. Attempts to contact the factory owner were unsuccessful. Retailers are also sharing supplier listsinformation that they used to guard for competitive reasons. Many retailers use the same factories, so they believe they can exact change by coordinating efforts. Over the summer, a group of 70 retailers participating in the safety pact will establish a master list of the factories covered by it. Members estimate it could cover 1,500 to 2,000 of Bangladeshs 5,000 factories. According to the pact, each fac-

Garment trade in Cambodia is under pressure ......................................... 9

Continued from first page serve, which has helped buoy the regions debt markets with its own stimulus efforts that have sent dollars speeding around the world, might be slowing or stopping its asset purchases come autumn. Both factors could produce turmoil in the sovereign debt markets, creating problems for Portugal in particular. The spike in borrowing costs in recent weeks has cast doubt over whether Western Europes poorest nation will be able to exit its bailout program without fresh aid in mid-2014. Lisbon successfully tapped the market for long-term borrowing earlier in May, bolstering hopes it would be able to continue funding itself from the private sector next year. Portugal paid 5.8% for its May bond issue, a price it can pay as a one-off, but not sustain over a longer period of time. Portuguese and euro-zone officials are wary of discussing the prospect that Portugal will need a second bailout. Two European Union officials stressed that any additional aid needed by Portugal would become clear early next year, and would be modest compared to the original 78-billion bailout. It could be a precautionary credit line that would disburse aid to a member state to be used as needed rather than disbursed regularly based on a fully-fledged bailout plan. Portugal will need 14 billion in 2013 and 15 billion in 2014 just to repay maturing debt, according to a document from the so-called troika of official creditorsthe European Central Bank, European Commission and IMF. The bailout plan foresees the government raising 16.3 billion in market financing for 2014, a diffi-

New Finance Questions Confront Euro Zone

Euro-zone ofcials will need to decide how they will nd more nancing for Greece, Portugal and Cyprus. All three bailout countries face challenges that could increase their need for funding.

Treating the Wounded

ShuffleAids VicePremier InPortugal

BY PATRICIA KOWSMANN LISBONPaulo Portas, leader of the junior partner in Portugals ruling coalition, has emerged from a weeklong political crisis that ended in a cabinet shuffle by being named deputy prime minister and point man in the countrys dealings with international bailout lenders. But analysts say Mr. Portas still might not have greater maneuvering room than previous Portuguese officials to wrest more growth-oriented terms from the creditorsthe European Union, the International Monetary Fund and the European Central Bank. Thus resolution of Portugals latest political crisis is more likely to be a patch-over of problems accumulating in one of the euro zones most-fragile economies, rather than a long-term solution, analysts say. Mr. Portas heads the Democratic and Social Center Party, and last week he resigned as foreign minister to protest the appointment of a finance minister he felt would stick closely to the austerity favored by international creditors. On Saturday, Mr. Passos Coelho, of the Social Democratic Party, announced a cabinet shuffle that gives greater visibility to Mr. Portas, who in effect will coordinate economic policies. Tactically, Mr. Portass gambit has paid off. Indeed, this might be no bad thing if it helps shore up the government and improve the politics of economic reform in Portugal, said Nicholas Spiro, managing director at Spiro Sovereign Strategy, in London.

GREECE

PORTUGAL

CYPRUS

247.5 billion

78

10

Bailout ends: December 2014 Possible Pitfalls: Privatization revenues and tax receipts fall short; another debt structuring is needed this fall

Source: European Commission (bailout size and date)

June 2014 Borrowing in the bond market becomes too expensive, requiring more bailout cash

March 2015 Restructuring of the biggest Cypriot bank stalls or fails; recession is deeper than expected

The Wall Street Journal

cult task if investors remain concerned a political revolt in Lisbon against the bailout could jeopardize the countrys bailout financing. In Greece, the government, the euro zone and the International Monetary Fund have yet to finalize a deal on payroll cuts, which will affect 12,500 government workers, ahead of Mondays meeting in Brussels, officials in Athens said Sunday. I hope we will conclude tomorrow morning before the Eurogroup meeting, Poul Thomsen, IMF mission chief in Athens, told reporters. Stopping funding would only worsen the situation in Greece, where recovery is necessary to avoid

[debt relief] even sooner than core Europe would like, economists at the Royal Bank of Scotland wrote last week. October looms as the date when Greeces international creditors will start to tackle the question of debt relief, part of a pledge made earlier this year to bring Greeces debt well under 110% of GDP by 2022. The IMF has been pushing for this for some time, but has maintained it wont forgive any of its own loans to Greece, citing its status as a preferred creditor. But several eurozone countries, including Germany, Finland and Austria, are arguing that the fund should take losses as

well, officials say. Doubts are rising across Europe about Cypruss 10-billion bailout plan, which was negotiated just months ago. The Cypriot economy is in free fall, while the Bank of Cyprus, the countrys largest bank, is still stuck in a restructuring process Not even the most basic preconditions for getting the bank out of resolution has been achieved, said a senior euro-zone official. That includes appointing an auditor to evaluate the banks books and determine how much losses its large depositors will have to suffer, the official said. Stelios Bouras contributed to this article

4 | Monday, July 8, 2013

THE WALL STREET JOURNAL.

EUROPE NEWS

A Reluctant Hegemon Steps to Forefront

[ Agenda ]

BY SIMON NIXON It was a busy few days in Berlin last week. On Wednesday, Chancellor Angela Merkel hosted 20 European heads of government at a jobs summit, convened to discuss solutions to the euro zones youth unemployment crisis. On Thursday, her finance minister, Wolfgang Schuble, hosted his Spanish counterpart as he handed over an 800 million ($1.03 billion) loan from stateowned lender KfW, to ICO, the Spanish development bank. And throughout the week, telephone lines between the German capital and Lisbon ran red hot as Berlin successfully persuaded the junior party in Portugals ruling coalition not to bring down the government. So much for Germany being Europes reluctant hegemon. Critics say Germany has failed to exercise the leadership in Europe that it has a responsibility to provide by virtue of its economic superiority, held back largely for reasons of history, culture and political parochialism. Instead, they argue, Germany has forced countries on the euro zones periphery to bear the full cost of the regions debt crisis, causing social misery and a deep recession that threaten to destroy the currency bloc, rather than offer the solidarity and burdensharing needed to allow Europe to exit the crisis. It is arguable whether Germany has ever been as reluctant as claimed; Germany has been the dominant force in shaping the Continents affairs for over 30 years, even if it has exerted its influence less noisily than, say, the French or British. And even during the current crisis, German leadership has been more effective than its critics recognize. But the events of the past week highlight an increasing German assertiveness, combined with a change in the way it is choosing to exercise its power.

Chancellor Angela Merkel addressed a news conference after a summit on youth unemployment on Wednesday in Berlin. Sure, one shouldnt read too much into what were essentially publicity stunts to bolster Ms. Merkels image ahead of Septembers national elections. The jobs summit provided photo opportunities but delivered no new policies, while the loan to Spain was too small to ease the funding challenges faced by its small and midsize businesses. But the fact that Ms. Merkel felt the need to hold a jobs summit or extend bilateral loans to Spain is revealing. It shows the extent to which Berlin has been stung by accusations that its single-minded pursuit of austerity is responsible for the economic and social crises in the periphery. Ms. Merkel felt compelled to do something because her opponents were threatening to turn eurozone unemployment and SME funding into an election issue. Domestic and international political pressure is forcing Berlin to accept greater responsibility. Crucially, Germanys willingness to publicly accept this responsibility also marks a shift in Berlins European strategy away from the supranational community method centered on the European Commission toward bilateral and intergovernmental initiatives that allow Berlin a far greater degree of control. Indeed, one of the most striking changes in Berlins handling of the crisis over the past two years is the extent to which suspicion of the commission has hardened into deep mistrust. For example, Berlin was furious at the commissions decision in June to offer France an extra two years to meet its deficit target before a delay had been even formally requested and without upfront conditionsa decision that some German officials fear undermined reformers in the French government. Suspicion of the Brussels bureaucracy and its tendency to yield to national interests is the main reason why Berlin opposes handing the commission responsibility for the euro zones planned Single Supervisory Authority, which will decide the fate of failed banks in the new banking union. To some in Berlin, the commission, particularly under its current leadership, is weak, power hungry and ineffective. Bilateral deals and intergovernmental arrangements offer greater scope to act decisively, while also presenting fewer legal and political obstacles, either in the shape of Germanys own Constitutional Court or in the need to seek Europe-wide ratification of treaty changes. German ministers and officials still believe in pooling sovereignty, but many are wary of yielding sovereignty to institutions that they cant control and that may be used as a vehicle for the mutualization of European debts. Of course, some argue this German reluctance to allow the mutualization of euro-zone debts is proof that Berlin wont face up to its responsibilities as Europes hegemon. But that ignores an important truth: most crisis countries have already received substantial debt relief as a result of the generous loan extensions and interest-free periods provided under bailout programs.

Germanys critics focus only on the nominal value of outstanding debt, which may be very high relative to gross domestic product. But they ignore the substantial reductions in the so-called net present value of debts, the actual amount countries must repay over the coming decades measured in todays money. This is a much more relevant figure when assessing long-term solvency. Berlin has played its part in easing debt burdens, but has done so in a way that has allowed it to keep control of the process to protect its own taxpayers and ensure that crisis countries pursue reforms. That may have frustrated those who wanted something for nothing, but it was politically and economically the only sensible way to proceed. Berlins critics are on stronger ground when they argue that Germany could do more to boost the European economy with its domestic policies. With government debt standing at 90% of GDPa level that would in normal times be considered eyewateringly higheven the leftwing Green party says the priority must be to pay down debt. But Germany could still be doing more to frame regulatory and tax policies to unlock its vast domestic savings surplus to fund private-sector-led investment. That would be in Germanys interest too. The country owes much of its success over the past decade to an export boom driven by soaring demand in emerging markets and a decade of wage restraint at home. But the economy is expected to grow by just 0.3% in 2013 and its competitiveness risks being eroded as a result of a decade of underinvestment in infrastructure, housing, education and new sources of energy. To maintain the long-term health of its economy, Germany needs to spend an additional 80 billion a year on infrastructure, according to a recent report by the Berlin-based think tank DIW Berlin. After all, the only thing worse for Europe than a reluctant hegemon is an economically weakened one.

BY CASSELL BRYAN-LOW AND PETER EVANS

U.K. Deports Radical Cleric for Trial in Jordan

man, had spent several years in jail in Britain, but wasnt charged with a crime in a U.K. court. British authorities first tried to deport Mr. Qatada in 2001 and then detained him in 2002 under antiterrorism laws that at the time allowed suspected terrorists to be jailed without charge. Since then, he has been in and out of jail and has repeatedly been under stiff bail conditions. He had won repeated appeals in British and European courts to block his extradition by arguing he would face unfair trial if returned to Jordan because he would be at risk of torture and evidence obtained by torture could be used against him. The path was cleared for his departure after Britain and Jordan in June ratified a treaty on torture intended to address his human-rights concerns. The preacher, who is in his 50s, then indicated he would voluntarily return to Jordan.

Agence France-Presse/Getty Images

LONDONThe U.K. deported radical cleric Abu Qatada to Jordan to face terrorism charges, concluding a frustrating saga for British authorities who have battled to eject him for more than 10 years. On Sunday, Mr. Qatada pleaded not guilty to terrorism charges in a Jordanian court, his lawyer told the Associated Press. The lawyer, Tayseer Thiab, said Mr. Qatada told military prosecutors that he is not guilty of terrorism and rejected the charges against him. The U.K.s struggles underscore the challenge for Western governments in balancing human rights in the fight against terrorism. Since 2001, successive British governments have sought to extradite Mr. Qatada, who U.S. and European antiterrorism officials have called a key al Qaeda operative who

Muslim cleric Abu Qatada boards a Jordan-bound plane near London on Sunday. posed a serious risk to national security. A Palestinian from Jordan, Mr. Qatada has been sentenced in absentia by Jordan in 1999 to life imprisonment for involvement in terrorist acts and faces trial. Mr. Qatada, whose real name is Omar Mahmoud Mohammed Oth-

Mr. Qatada left the U.K. early Sunday and arrived in Jordan, where he was taken to court. In nearly two hours of questioning, prosecutors charged Mr. Qatada with conspiring to carry out terror attacks in Jordan twicein 1999 for a foiled plot against the American school in Amman and in 2000 for allegedly targeting Israeli and American tourists and Western diplomats during New Year celebrations, AP reported. Mr. Qatada was ordered detained for 15 days pending further questioning, AP reported one of the prosecutors as saying. Mr. Thiab said he would try to free his client on bail Monday. In the U.K., Prime Minister David Cameron said he was delighted Mr. Qatada had been deported. This dangerous man has now been removed from our shores to face the courts in his own country, said British Home Secretary Theresa May.

Reuters

THE WALL STREET JOURNAL.

Monday, July 8, 2013 | 5

6 | Monday, July 8, 2013

THE WALL STREET JOURNAL.

U.S. NEWS

Investigators Search for Clues to Crash

BY ANDY PASZTOR The Asiana Airlines pilots whose Boeing 777 crashed Saturday while landing at San Francisco International Airport were following a routine visual approach and didnt radio any onboard problems or declare an emergency before impact, according to preliminary reports of the disaster that killed two people and sent more than 100 to the hospital. Investigators will focus on why the twin-engine jetlinerarriving on an overnight flight from Seoul with 307 people aboard and descending in good weatherslammed down hard on a portion of the airport hundreds of feet before the runways normal touchdown point, according to industry and U.S. government safety experts. Early on, the probe is likely to delve into everything from possible engine problems to pilot mistakes to mechanical issues. Deborah Hersman, chairman of the U.S.s National Transportation Safety Board, told reporters before departing Washington for San Francisco with a team of investigators that they will look at everything but that it was too early to speculate about the cause. We have not determined what the focus of this investigation is yet, she said. One issue likely to come under early review is the overall experience and hand-flying skills of the pilots, who couldnt use an instrumentlanding system as a backstop. Those navigation devices for the runway werent operating Saturday because of work under way to improve the strip. Since late June, all pilots landing at the San Francisco airport have been warned that the approach aids are temporarily turned off. While visual approaches typically dont require any assistance from instrument-landing systems, safety experts said some airlines prefer to have pilots rely on them as an additional safeguard under nearly all circumstances. As part of their effort to dissect the sequence of events, U.S. and South Korean investigators also are expected to examine if pilot fatigue or flight-control problems contributed to the accident, and whether air-traffic-control instructions may have been a factor. The aircraft should have been flying roughly 100 or 150 feet above the airports surface, experts said, when its tires or tail apparently smacked into a stretch of the sea wall and the jet began breaking apart. Large

Agence France-Presse/Getty Images

The Asiana Airlines Boeing 777 plane as seen after it crashed while landing at San Francisco International Airport on Saturday. Two people were killed. pieces of the tail section and scrape marks were visible near the sea wall, and both left and right portions of the landing gear were found hundreds of yards away from the main wreckage. Passenger Eugene Anthony Rah, a hip-hop concert producer who was on his 173rd flight from Seoul to San Francisco on Asiana Airlines, said he knew as he looked out the window on the approach to the runway that something was wrong. The altitude was too low over San Francisco Bay, he said, and then he heard an unusual engine noise, like revving. I thought [the pilot] was trying to get more power, to gain elevation. Despite the Asiana jets losing both left and right landing gears, its rear bulkhead, portions of the wings, and at least one engine, early reports indicated that the crew and airport emergency officials acted quickly to evacuate most passengers. They slid down emergency slides or otherwise managed to leave the plane, before an intense fire melted its aluminum skin and left a giant gash replacing what had been the top half of the middle of the fuselage. Witnesses said they saw puffs of smoke, apparently from the main wheels or tail hitting the ground, bethough they stressed other issues also are being assessed and it is too early to prioritize investigative directions. The fuel question is relevant because the safety board and Boeing Co. in previous years spent a lot of major accident involving a Boeing 777 in passenger service. Ice accumulation starved both engines of a British Airways 777 from fuel on final approach to Londons Heathrow International Airport, forcing the crew to crash-land just short of the runway. Nobody was injured in that accident, but it prompted major changes in operating procedures and a redesign of fuel systems aboard the 777. Fallout from the accident also prompted regulators to take a fresh look at eliminating such hazards on future models built by Boeing and other manufacturers. That British Airways jet was powered by Rolls-Royce PLC engines, while the Asiana jet was powered by engines manufactured by the Pratt &Whitney unit of United Technologies Corp. According to safety experts, one of the first items on the safety boards to-do list is likely to be determining whether the engines were putting out thrust immediately before impact.

One issue likely to come under early review is the overall experience and hand-flying skills of the pilots, as an instrument-landing system was unavailable.

fore the plane was engulfed in flames; some parts of the jet were later found in the San Francisco Bay, which circles the beginning of the runway. Passengers were seen jumping down emergency inflatable slides to the tarmac. Fuel flow to the engines is one area that already has attracted the attention of investigators and outside safety experts, according to people familiar with the matter, time and money looking into the previously unknown phenomenon of ice accumulating inside fuel lines when jets make long-distance flights between continents. In rare instances, chunks of ice can break loose and block the fuel supply to enginesan especially dangerous result when pilots expect to spool up the engines just before touchdown. That is what happened in January 2008, which was the only other

Two Chinese Students Perish in Asiana Disaster

BY JAMES T. AREDDY SHANGHAIThe two 16-year-old Chinese girls killed in Saturdays airplane crash in San Francisco planned to spend their summer break practicing English in California under an exchange program. Students, bankers, technology workers and others from China represented almost half of the 291 passengers aboard Asiana Airlines Flight 214 from Seoul when it landed hard in San Francisco, skidded off the runway and eventually caught fire. Chinas Ministry of Education said in a statement that 70 of those aboard were Chinese high-school and middle-school students and their teachers, joining of a wave of precollege exchange programs in the U.S. that analysts say are fast becoming a rite of passage for the countrys education-minded and increasingly wealthy middle class. Among them, according to a statement from Asiana that was also carried on leading Chinese state media, were Wang Linjia and Ye Mengyuan. Last month, the two friends had finished their first year of high school at Jiangshan Middle School in Zhejiang province, according to their postings on the Internet. They were on their way to a 15day summer camp in the San Francisco area organized by Jiangshan, according to a government spokesman in the town where the school is located. Ms. Wang and Ms. Ye were traveling with 28 other students and four teachers, according to personnel at the school and local government. The exchange program is dubbed a cultural immersion course but mainly is meant to expose young Chinese to English, according to people familiar with the program. Jiangshans seven-year-old study-abroad program switched to the U.S. last year from London, when the Summer Olympic Games there made it difficult to organize, according to a student at the school. Parents gathered Sunday at Jiangshan, a prestigious institution in Chinas industrial heartland that has produced leading Chinese scientists. The plane carried at least 60 students plus teachers from Jiangshan as well as similar groups from two Chinese schools in northern Shanxi Province who were also headed to U.S. study programs. Family members and administrators at the school Sunday said by phone they had little information but the mood was grim. Shortly before Ms. Wang and Ms. Ye were publicly identified Sunday evening, the local government where the school is located distributed a photo showing two parents collapsed over a desk distraught after speaking with officials in San Francisco. In the U.S.-China relationship, student-exchange programs represent a source of bilateral harmony. China already is the largest source of foreign university students in the U.S., and is increasingly dispatching younger groups to study English and play basketball. Almost 200,000 Chinese students studied in the U.S. on visas in the 2011-2012 academic year, the fifth straight year of 20%-plus growth, according to the Institute of International Education. Only about one-tenth that number of Americans

study in China, though a program unveiled in 2009 by U.S. President Barack Obama, and supported with China-funded scholarships, aims to boost the numbers. While Chinese long have sought spots in U.S. colleges, educators say Chinese increasingly are enrolling high school and even primary school students in English, culture and sports programs. They are starting at a younger age, said Alice Sun, founder of a Beijing consultancy called Ivy Labs. This year, she placed a 10-year-old Chinese student in a U.S. boarding school, for instance. The crash was a top story of Sundays Chinese news broadcasts, which included a scrolling list of survivor names as Chinese parents clamored for word about their children.

THE WALL STREET JOURNAL.

Monday, July 8, 2013 | 7

WORLD NEWS

Trade Talks Could Raise Heat on China

[ The Outlook ]

BY WILLIAM MAULDIN The U.S. is launching broad trade talks with Europe this week and preparing for the next stage of negotiations with select AsiaPacific nations, part of the Obama administrations effort to find new fuel for economic growth. U.S. trade experts and business leaders say they expect the deals will also put pressure on the only major economy absent from the negotiating tables: China. China has to decide whether to conform and adapt to the norms of international trade or continue to be an outlier, said Michael Wessel, member of the U.S.-China Economic and Security Review Commission, a U.S. government agency created to monitor the trade and economic relationship between the two countries. It puts pressure on them to do bilateral deals that might provide them with important access to key markets. European Union officials arrived in Washington to start talks Monday aimed at eliminating remaining tariffs on exports and imports, recognizing each others industry standards and granting easier market access for businesses across the Atlantic. The two sides are looking to clinch deals that would open up their government contracting to foreign companies and allow for freer trade in goods and services. Such methods of lowering trade barriers are a tougher sell in many emerging-market economies such as China. Europe and the United States are not just going to wait for Chinatheyre going to move forward, said Myron Brilliant, executive vice president for international affairs at the U.S. Chamber of Commerce. Proponents of a U.S.-EU trade pact concede, however, that it would take years to negotiate and implement, suggesting that any impact on China would also be far off. This is going to be a difficult negotiation, said Mickey Kantor, the former U.S. trade representative who led talks to form the World Trade Organization. It may take longer than anyone expects. And China could benefit from a trade deal that boosted growth and likely importsin its two largest export markets. The U.S. and EU imported goods worth $808 billion from China last year. But watching the U.S. and Europe hammer out a deal also could lead China to work harder on its bilateral trade and investment talks with Washington, U.S. officials hope. The Obama administration is also preparing this week for the next round of talks for the TransPacific Partnership, or TPP, which includes Japan and many marketoriented economies in Asia and Latin America, but not China. A free-trade pact among these countries could have a more direct effect on China than the U.S.-EU trade pact. Yukon Huang, former World Bank chief for China and a senior associate at the Carnegie Endowment for International Peace, said it is very likely the TPP would actually discourage or make it difficult for parts to be shipped to and from Asian

Talking Points

Bilateral trade in goods between the U.S. and European Union was larger than their bilateral trade with China in 2012 TOTAL TRADE IN GOODS, IN BILLIONS

$700 billion 600 500 400 300 200 100 0 2008 09 10 11 12 2008 09 10 11 12 2008 09 10 11 12

but trade in goods with China is growing faster. Change since 2008 in total trade

U.S.China EUChina

U.S.EU

U.S.China:

EUChina

30% 20 10 0 10 20 30 2008 09 10 11 12

U.SEU

Note: EUChina trade gures were converted from euros to dollars using the rate on Dec. 31 of each year. Sources: U.S. Commerce Dept., European Commission

The Wall Street Journal

countries outside the group, jeopardizing Chinas role as the final assembly point for phones and gadgets whose parts come from other countries. Another sensitive point for China: the Trans-Pacific Partnership talks are looking at limiting the role of state-owned enterprises. Still, depending on how the Trans-Pacific Partnership rules are structured, the countries in the group could end up boosting trade in products that are partly produced in China, said Mr. Wessel of the U.S.-China Economic and Security Review Commission. Western leaders say the goal of the two sets of trade negotiations isnt to isolate or contain China. Our efforts in these negotiations are not aimed at any one country, but at developing high standards and new

disciplines that strengthen the international trading system and create a level playing field on which our workers and firms can compete, said U.S. Trade Representative Michael Froman. In recent weeks Beijing officials have softened their once-critical tone on the trans-Pacific trade talks, saying they would weigh the advantages and disadvantages of joining. China Daily, the Chinese governments flagship Englishlanguage newspaper, last week cited officials growing increasingly positive about the possibility of entering the talks. The Chinese embassy in Washington didnt immediately reply to a request for comment on the issue. Chinas new leadership appears to be looking at domestic economic reforms, and some trade

experts say the chances are good that they will look favorably on expanding international economic ties and allowing more foreign investment. American businesses want to see fewer barriers to investment in China and greater market access, including in services and new areas such as cloud computing, said John Frisbie, president of the U.S.-China Business Council. Mr. Froman said in an interview that his office is engaging very actively with China, adding that his office is excellent at multitasking among various trade initiatives. Meantime, Chinas breakneck pace of economic expansion is slowing, making it possible that Beijing could look to trade deals with the U.S. as a way to way to re-energize growth.

Five Confirmed Dead in Quebec Railway Disaster

LAC MEGANTIC, QuebecCanadian authorities on Sunday confirmed five deaths and said about 40 people remained missing after a runaway train carrying crude oil derailed and caught fire early Saturday, causing an explosion that destroyed dozens of buildings in this small town. By Caroline Van Hasselt, Carolyn King and Tom Fowler A police spokesman on Sunday said several investigations were under way. Because deaths were involved, Quebec police will conduct a criminal investigation into the incident, and the spokesman told the media at a noon briefing that they cannot rule out foul play. Teams from the train operator and the Transportation Safety Board of Canada have been on the scene since early Saturday, but the fire has limited access to the site. Earlier, local media had reported as many as 60 residents missing and up to 30 buildings destroyed. The scale of the explosion and evacuation rank the accident as one of the most dramatic rail incidents in North America in recent years. The train, operated by Montreal Maine & Atlantic Railway Inc., a unit of privately held Rail World Inc., of Rosemont, Ill., derailed early Saturday morning in Lac Megantic, Quebec. Oil has leaked into the towns namesake lake and a nearby river. A company spokesman said the train had been stopped and secured outside town just before midnight. Its crew was off the train when it started moving again, for unknown reasons, eventually traveling almost 11 kilometers before derailing in Lac Megantic, the company said. Numerous cars have derailed, said Canadas Transportation Safety Board, which has deployed a team of investigators. TSB officials said they were focusing their initial probe on the train, its brakes and the track. The derailment is the latest in a string of railroad mishaps involving crude oil shipments in Canada and the U.S., amid a boom in North American crude production and crude shipments by rail. So far, though, recent derailments have resulted in only minor spills, typically far from urban centers. Recent derailments have raised scrutiny of the North American railroad industrys safety record in carrying crude. A spokeswoman for the provincial police force, the Surete du Quebec, Aurelie Guindon, said about 1,000 residents have been evacuated. Another 1,000 have been evacuated from a nearby town because of worry over air quality, authorities said at a news conference in the late afternoon. The Canadian Broadcasting Corp. aired video of flames and black smoke billowing above the town as emergency-services vehicles jammed a road leading into the municipality. CBC also posted raw video footage, taken by residents in the early hours of the morning, of buildings ablaze and residents running for cover through the towns streets. A large blast woke Bernard Deners at around 1:30 a.m. Mr. Deners, who lives about a half mile from the blast scene, said the air was scorching hot outside his home when he went outside to investigate. Flames leapt high in the air. More explosions rattled the town hours later. It was terrible, just terrible, he said. The entire town, a close-knit lakeside community, came out onto the streets. We think there are many people dead, many, but we just dont know, the 58-year-old said. Mr. Deners said everybody in town knows someone who is missing. Local hotels were fully booked with residents seeking temporary shelter and emergency officials. Jean St.-Pierre was working at the Hotel Oriental when he heard the first blast and rushed to the window. He raced to his car and drove to the scene, but was turned back by more explosions. It was like hell, there was fire everywhere and explosions, he said. Mr. St.-Pierre fears the worst.

A firefighter works at the scene of the Quebec train derailment on Sunday.

Guests who witnessed the explosion up close said a bar at the center of town was full of people outside enjoying a drink when the first explosion struck nearby. Its like a nightmare, he said. The police have blocked off a large no-go zone around the site of the derailment. Lac Megantic, a town of about 6,000, is located about 250 kilometers east of Montreal in Quebecs Eastern Townships. Joe McGonigle, Maine-based vice president at Montreal Maine & Atlantic, said the train had been stopped outside of town for a crew change, and that there was no crew on the train at the time that it somehow started to roll again. The trains engineer had inspected the train at just before midnight and all was secure. However, sometime after that, the train started to move, eventually traveling nearly 11 kilometers, and part of it derailed and several cars exploded, he said. The train was released, we dont know how, he said. All safety measures were in place, and the train was secure, he said. Rail World said late Saturday that the derailment happened at about 1:15 a.m. Saturday. The train involved had 72 carloads of crude and five locomotive units. The company said railway personnel were able to pull 13 carloads intact from the site at the rear of the train. David George-Cosh and Alistair MacDonald contributed to this article.

Reuters

8 | Monday, July 8, 2013

THE WALL STREET JOURNAL.

WORLD NEWS: ASIA

Afghan Women Fear Erosion of Rights

BY MARGHERITA STANCATI KABULA plaque from President Hamid Karzai sits on Noor Zia Atmars desk, congratulating her for her achievements as a lawmaker. The desk is in a shelter for abused women. Ms. Atmarwho served in Afghanistans first Parliament after the Talibans downfallhas nowhere else to live these days after escaping an abusive husband and a family that disowned her after she divorced him. The tale of Ms. Atmarwho helped pass Afghanistans landmark legislation protecting womens rightsshows just how far the country has to go in improving the treatment of women. The laws themselves, including one aimed at ending violence against women, are increasingly coming under threat as U.S.-led international forces pull out and conservative politicians reassert themselves. The achievements of the past 12 years are really in danger, cautions prominent lawmaker and womens rights campaigner Shukria Barakzai. They want to push women in the corner. Ms. Atmar returned to Afghanistan from exile in Pakistan within weeks after the U.S.-led invasion ousted the Taliban regime. She was determined to make the most of new opportunities in her home country. She started working at a local radio station as an on-air presenter in the eastern city of Jalalabad, but then quit to run in the 2005 parliamentary elections. She ran her campaign on a shoestring budget, selling a gold necklace to pay for her election posters. She won, helped by a constitutional provision that reserves a third of elected seats in the lower house of Parliament for women. In 2010, as her term was ending, Ms. Atmar married Toryalai Malakzai, who ran a small construc-

Noor Zia Atmar, who helped pass legislation protecting womens rights, at her shelter in Kabul on a recent afternoon. tion company and was helping her with her re-election campaign. He told me he liked women politicians, Ms. Atmar recalled on a recent afternoon. But then he started behaving like a villain from Bollywood movies. Ms. Atmar, who once toured world capitals as a symbol of female empowerment in the new Afghanistan, became confined to her home after losing her re-election bid in the fall that year. The rare times she went out, she had to wear a fullbody burqa, something she had never done before. Once a passionate public speaker, she was barred from using her phone. She was asked to remove her husbands shoes, and if I refused, he would beat me up, recalls Ms. Atmar, a youthful 40-year-old whose lightly made-up face was framed by a loose head scarf. After a few months, her husband attacked her with a kitchen knife, says Ms. Atmar, revealing a small white scar on her neck. That is when she says she escaped his home. Mr. Malakzai couldnt be reached to comment. Ms. Atmars older brother Zmaray confirmed that she has been disowned by her relatives. People in Jalalabad are very traditional, he explained. These days, Ms. Atmars movements are limited to daily commutes between her shelter and her office a hidden corner of a government ministrywhere she works as an adviser. It is unclear how long she can stay in the shelter, as the very existence of these shelters has become controversial. Conservative lawmakers say the law on the elimination of violence against womenlegislation that Ms. Atmar lobbied for in Parliament and that was passed by presidential decree in 2009runs against Islam. They point to the laws provisions authorizing shelters for abused women and girls. Mawlavi Abdul Rahman Rah-

mani, a bearded mullah who sits in the lower house of Parliament, says these shelters are little more than brothels.What kind of woman escapes her husbands home and goes to a shelter? he said in an interview. It is against the rules of Islam, he said. This echoes the position of the Taliban. Islam has clear instructions: A woman cant go outside her house without the permission of her husband or of her guardian, said Zabihullah Mujahid, a spokesman for the Taliban. He described shelters as a conspiracy to Westernize society. In May, male lawmakers removed quotas for women in provincial and district councils. That decision by the lower house of Parliament was reversed by the upper house in June. Now lawmakers will try to reconcile their differences. The women of Afghanistan are still suffering from the same kind of mentality we have seen in the past, says Fawzia Koofi, who chairs the Parliaments women commission. Efforts to revive peace talks with the Taliban, who last month opened a political office in Qatar, have intensified fears that progress on rights may backslide. If you are having a dialogue between the Afghan government and the Taliban, you are actually having a dialogue between a group that hates womens rights and a group that couldnt care less about womens rights, says Heather Barr, Afghanistan researcher at Human Rights Watch. The government says it is committed to upholding womens rights at the negotiating table should talks move forward. The progress that has taken place in the past 10 years has to be maintained, says Adela Raz, a spokeswoman for the president. Ehsanullah Amiri and Habib Khan Totakhil contributed to this article.

Candidate Put Forward for Egyptian Prime Minister

CAIROLeaders of the hard-line Islamist Nour Party and secular party leaders have agreed after marathon negotiations to put Ziad Bahaa-Eldin, a London-trained economist, forward as candidate for prime minister, officials from Mr. Bahaa-Eldins Social Democratic Party said. By Tamer El-Ghobashy, Matt Bradley and Charles Levinson They agreed to put Mohamed ElBaradei, leader of an umbrella grouping of political parties called the National Salvation Front, up for one of multiple vice-president posts, the party officials said. Mr. ElBaradei had been tapped as prime minister on Saturday, but his swearing-in was canceled at the last minute after the Nour Party raised objections. Military-appointed interim President Adly Mansour still has to formally name both men to their positions, and both men have to accept. The coalition of parties backing Messrs. Bahaa-Eldin and ElBaradei and the military are keen to keep the Nour Partys support for the interim government to give it a broader base of support that includes secular and Islamist political parties, analysts and coalition party officials say. Mr. Bahaa-Eldin, a founding member of the liberal, secular Social Democratic Party, which was formed after Egypts revolution in 2011, has yet to say whether he will accept the position. Party leaders were meeting late Sunday night to decide what to do, according to Fareed Zahran, one of the partys founders. Mr. Bahaa-Eldins last public post was as head of a government financial regulatory body. He resigned that post shortly after Egypts 18day uprising in 2011 when the military tapped a former Mubarak crony to be prime minister. Though he never publicly said so, many prorevolutionary forces in Egypt hailed the resignation as a show of support. In the capital on Sunday, activists on both sides of Egypts widening political divide staged protests. In Cairos Nasr City neighborhood, ousted President Mohammed Morsis mostly Islamist supporters maintained their vigil, demanding that the deposed president be reinstated. At what has become the staging ground of their movement, Rabaa Mosque, thousands crowded around a stage and chanted in unison with rally leaders. Anti-Morsi protesters trickled in to Cairos Tahrir Square throughout the afternoon, and opposition lead-

Margherita Stancati/The Wall Street Journal

Mohamed ElBaradei, left, with interim President Adly Mansour on Saturday. ers said they were planning for larger protests to begin that evening. Leaders from the Tamarod campaign, the anti-Morsi signaturegathering campaign that started the movement to oust the president two months ago, urged Egyptians on Saturday to remain in city squares throughout the country on Sunday to confirm that this is not a coup. As the sun began to set, significant crowds from both camps began to assemble rapidly at their respective demonstrations. At Tahrir, crowds cheered as military helicopters flew over the square. Outside the Republican Guard Club, where Mr. Morsi was last known to be held, a smaller sit-in closed down Salah Salem Streeta major boulevard normally teeming with traffic to and from suburbs and Cairo International Airport. Supporters erected cinder-block and barbed-wire barriers to block the flow of traffic. Directly across from the clubs entrance, they set up a stage, where speakers encouraged the crowd to chant and sing.

The protesters were separated from a heavy presence of soldiers protecting the club by barbed wire. Imamssenior religious figures lined the barrier on the protesters side to prevent anyone from getting too close. The soldiers stood impassively as some in the crowd taunted them with chants insulting Defense Secretary Gen. Abdel Fattah Al Sisi. Late Saturday, a spokesman for the office of Mr. Mansour said Mr. ElBaradei, a leader of the secular groups who opposed ousted President Morsi, hadnt been appointed prime minister. The official state news agency had earlier reported that Mr. ElBaradei would be sworn in Saturday, sparking criticism from Mr. Morsis Islamist supporters. Mr. ElBaradei was sick in bed on Sunday, according to opposition leaders close to the negotiations about who would be the next premier. Mr. ElBaradei had been scheduled to be on NBCs Meet the Press Sunday morning, but canceled, citing laryngitis and a fever and said he was under doctors orders not to do television interviews, according to host David Gregory. According to Mr. Gregory, Mr. ElBaradei told him that he still expected to be named the leader of Egypt as early as Sunday but said the country is falling apart.

Agence France-Presse/Getty Images

THE WALL STREET JOURNAL.

Monday, July 8, 2013 | 9

WORLD NEWS

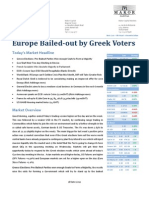

Garment Trade In Cambodia Under Pressure

BY KATE OKEEFFE PHNOM PENH, CambodiaThis small Southeast Asian country was supposed to become a model for the world apparel industry, with tough factory monitoring and strong worker protections. But a dozen years after the United Nations International Labour Organization launched a program to manage Cambodias booming garment tradethe first of its kind in the worldlabor activists say many factories still suffer from problems that triggered calls for more oversight in the first place, including the abuse of workers rights. Accidents at two Cambodian factories in May, including one that left two people dead when part of a shoemaking factory collapsed, highlight what activists say are continuing unsafe conditions. Cambodias opposition party has made better working conditions one of its big campaign issues in the national election set for July 28, calling for the monthly minimum wage for workers to rise to $150, almost double the current level, and for working hours to be limited to eight hours a day. The countrys struggle to transform its garment industry offers lessons for Bangladesh, where more than 1,100 people were killed in the April collapse of a garment-factory building. Since then, retailers from H&M to Wal-Mart Stores Inc. have pledged to tighten factory monitoring there. The ILO, meanwhile, is considering launching a factorymonitoring program in Bangladesh, incorporating lessons from its Cambodian project, said Deputy Director General Sandra Polaski. But Cambodias experience speaks to the difficulty in radically transforming working conditions. The core problem is the way the supply chain is structured, which exploits the most vulnerable people, the workers, says Sanjiv Pandita, executive director of the Asia Monitor Resource Center, a nongovernmental organization focusing on Asia labor issues. Labor activists say the government, factories, brands and even some unions keep labor costs down for their own economic benefit. Workersoften extremely poor and uneducatedhave little leverage. There is a lot of injustice in Cambodia even after years of work to improve factories, said Lao Bunna, a 43-year-old who works in one of the heavily guarded garment complexes that line the chaotic

roads into Phnom Penh, the capital. Workers at Ms. Laos factory often feel faint because there are few windows and poor air circulation, she said. Her boss told her and other employees that they would be fired if they refused to work overtime, she added. She has declined to join a union, saying she fears retaliation from factory owners. Her complaints point to gaps between reality and Cambodian law which prohibits laborers from being asked to put in excessive overtime or work in overheated factories, and protects their right to unionizes and the voluntary ILO program that is meant to monitor adherence to those laws. Officials at the factory declined to comment on these issues. Cambodias Secretary of State of the Ministry of Labor Oum Mean said the country doesnt have problems with garment factories because it has appropriate legislation in place to police them. If the factories do not follow the labor law, we will punish them, he said. He also said that competitive labor costs in Cambodia can attract investors to the country, which in turn improves the lives of Cambodians. Cambodia exploded onto the global garment scene in the 1990s. Development specialists saw the sector as a major growth opportunity for the country, which had only recently emerged from the genocidal Khmer Rouge regime, which according to some estimates left 1.7 million people dead during the late 1970s. Taking advantage of cheap labor, factories sprouted up in Phnom Penh residential areas as well as on farmland and rice paddies on the outskirts. There are 462 export factories now, said Ken Loo, secretary general of the Garment Manufacturers Association in Cambodia. That is up from 185 exporting factories in 2001, he said, citing his earliest records. But the rapid growth was accompanied by complaints of sweatshop conditions. As activists called for a solution, U.S. officials negotiated a 1999 trade deal with Cambodia. Washington offered to expand access to the American marketwhich had quotas on garment importsif Cambodian firms improved labor standards. The ILO launched a local body, known today as Better Factories Cambodia, to monitor progress. Better Factories Cambodia was a powerful force in educating factories, their business partners and the

Associated Press

A rescue officer tries to clear people from the wreckage of a factory that collapsed south of Phnom Penh in May.

U.N.-backed overseer Better Factories Cambodia has loosened its auditing standards.

AUDITING AND REPORTING PRACTICES Auditors make both announced and unannounced factory visits Public summary reports detail specic factories progress by issue Public summary reports list names of specic factories Individual factory reports publicly available Worker representatives briefed on individual factory reports PRE 2005

twice each year

Better Factories?

Factories have high levels of noncompliance in many areas, according to Better Factories' April 2013 report.

REGULATION Limit overtime work Ensure reasonable temperature in factory Provide sufcient medical staff Pay employees child-care costs Provide soap and water near toilets FACTORIES FOUND NONCOMPLIANT 96% dont comply 68% 66% 61% 52%

The Wall Street Journal

POST 2005

once a year or less

YES

NO

Sources: Stanford Law School & Worker Rights Consortium (audits); Better Factories Cambodia (compliance)

public on labor issues, say union leaders and activists. Conditions at many factories have improved since the program got underway, they say. The program has helped hold factories to paying at least the minimum wage and has served as a neutral intermediary in Cambodia, said Jill Tucker, Better Factories Cambodias chief technical adviser. The program is funded by international buyers and Cambodias government and garment association, as well as by foreign governments including the U.S. But the U.N. program lost some teeth in 2005, with the expiration of the 1970s-era Multi-Fibre Arrangement, which set quotas for apparel imports into rich countries. The end of quotas removed important leverage the U.S. used to pressure factories to change. As factory owners worried about losing guaranteed access to U.S. markets, they pressed the ILO on another frontasking Better Factories to stop naming manufacturers in their public reports, according to Ms. Polaski. Negative assessments,

they reasoned, could kill their business in a more competitive global trade environment. The program agreeda move Ms. Polaski called a bad decision that eroded its progress in the country. The program now submits confidential reports to the factories, whose business partners have the option to buy them. It also publishes public summaries of its assessments that dont name the factories. The ILO is now pushing for greater transparency in all of its monitoring programs around the world, Ms. Polaski said, including in Cambodia and in any potential venture in Bangladesh. Mr. Loo of the manufacturers association said the factories werent powerful enough to have forced the program into making the change and said the ILOs present method of reporting is much better than naming and shaming. The long-term effectiveness of the Better Factories initiative has come under fire by a pair of recent reportsan August 2012 evaluation by Cambodias Community Legal

Education Centre and the Netherlands-based Clean Clothes Campaign, and a February 2013 report by Stanford Law School and the U.S.-based Worker Rights Consortium. Among the continuing problems they identified were excessively low wages, a shortage of independent unions and abuse of workers rights to participate in unions and claim benefits. Meanwhile, employers are increasingly signing workers to shortterm contracts lasting three or six months, which critics say let them easily terminate workers if they join unions or seek bonuses or maternity leave benefits. An April 2013 Better Factories Cambodia report said that 90% of the newly-registered factories it assessed say all of their workers are on short-term contracts. Better Factories Cambodias Ms. Tucker concedes her programs influence has been waning but says it hopes new strategies, including increased transparency, will help. Sun Narin and Patrick Barta contributed to this article.

Korean Governments Thaw in Talks to Reopen Joint Industrial Park

BY KANGA KONG SEOULNorth and South Korea agreed early Sunday to take initial steps toward reopening their joint industrial zone, a rare modest consensus between the sides after months of fractious relations. South Korean owners of businesses with manufacturing facilities at the Kaesong Industrial Complex will visit the park from Wednesday to conduct maintenance checks on equipment that has been idle since April. They will be allowed to return with raw materials, finished products and equipment, with their safety guaranteed by the North, a joint statement said. Representatives from each side will meet again on Wednesday at the park to discuss ways to reopen the facility and prevent another sudden closure. Until April, the Kaesong complex was the sole example of inter-Korean economic cooperation. Home to facilities for 123 South Korean small manufacturers, around 53,000 North Korea workers provided cheap labor for the companies and a steady source of foreign currency for the Pyongyang regime. But as relations between the Koreas deteriorated following the Norths nuclear bomb test in February and subsequent military drills in the South, North Korea on April 9 pulled all of its nationals from the plant for the first time since it opened in 2004. It specifically cited its displeasure with the portrayal of the park in the South as a cash cow for the Pyongyang regime. About $90 million in annual wages were paid directly to the Norths government for work done at the facility. North Korea initially rebuffed of-

fers of dialogue over the complex from the South and pulled out of recent high-level talks over inter-Korean cooperation. But last week it accepted a proposal for low-level talks about Kaesong for Saturday. It also restored a communications line between the sides that allows coordination of South Korean traffic heading to and from the plant, which lies a few kilometers inside North Korea.

10 | Monday, July 8, 2013

THE WALL STREET JOURNAL.

IN DEPTH

Bloomberg News

Eight years after his forced resignation from AIG, Maurice Hank Greenberg is staging an improbable comeback. In 2011, Mr. Greenberg appeared on Bloomberg TV, above.

At 88, Former AIG Boss Is Building a New Empire

BY LESLIE SCISM

Greenbergs Fast-Growing Insurance Conglomerate Is Collecting Billions in Premiums All Over the Globe

ately, Maurice Hank Greenberg, former chief executive of American International Group Inc., has been traveling the world, with stops in Shanghai, Istanbul, Manila and other far-flung locales. The 88-year-old hasnt been sightseeing. Eight years after his forced resignation from AIGwhich he turned from an obscure property-casualty player into a global financial powerhouseMr. Greenberg is staging an improbable comeback. Hes quietly building a fast-growing insurance conglomerate, called Starr Cos., thats collecting billions in premiums all over the globe. Sipping herbal tea in his Park Avenue offices decorated with paintings, sculptures and photographs of him with world leaders, Mr. Greenberg said he has no thought of retiring. I am doing what I do best, he said. I like building things. His reign at AIG famously ended amid a giant accounting scandal. And today his rebranding efforts are complicated by one final obstacle from the past: a trial on civilfraud charges alleging he used accounting shenanigans to portray an unduly rosy picture of AIGs results. Late last month, the New York Court of Appeals denied an effort by Mr. Greenbergs lawyer, prominent trial attorney David Mr. Greenberg has long denied he did Boies, to win dismissal of the civil-fraud anything wrong, and maintains that Mr. charges that stuck from the original suit Spitzer never should have brought the case brought by New Yorks then-Attorney Genbecause, among other things, AIGs earnings eral Eliot Spitzer in 2005. restatement from the affair shaved off just The ruling followed a 3% of shareholders equity, federal judges approval of an amount he considers a $115 million pact to settle immaterial. The U.S. A New Plan class-action shareholders Chamber of Commerce Starr's property-casualty litigation against Mr. filed a friend-of-the-court premiums have grown rapidly. Greenberg and other forbrief in the state case call100% mer AIG executives that ing for its dismissal, and 2012: 80% covers the same accountpoliticians who lent suping issues. In 2009, Mr. port include former gover75 Greenberg agreed to pay nors Mario Cuomo and Cumulative growth $15 million to resolve SeGeorge Pataki, who cosince 2008 curities and Exchange wrote an opinion piece in 50 Commission allegations reThe Wall Street Journal in lated to AIGs accounting May. 25 methods; he admitted no Meanwhile, Mr. Greenwrongdoing. berg prevailed on a matter In the latest ruling, the affecting Starrs sizable 0 states highest court said AIG holdings: A federal 2008 '09 '10 '11 '12 the attorney generals ofclaims court judge ruled Source: Starr The Wall Street Journal fice, which had abandoned on June 26 that an entity its effort to seek monetary he heads could proceed damages from Mr. Greenberg in the wake of with a lawsuit against the U.S. government the class-action settlement, could try the over alleged unconstitutional elements of civil fraud matters and seek other relief AIGs bailout during the 2008 financial crisuch as a ban on serving as an officer of a sis. The government says it did nothing public company. wrong. Starr was AIGs largest shareholder until the government takeover. In identifying causes of the 2008 markets meltdown, the governments Financial Crisis Inquiry Commission cited stunning instances of governance breakdowns and irresponsibility that included AIG senior managements ignorance of the terms and risks of the companys huge exposure to mortgage bonds. No one expected the feisty Mr. Greenberg to disappear when he left AIG. With a commanding presence, he had dominated the insurance industry for decades, and was one of the most powerful executives in the broader financial-services world. He was an often-brusque, hard-charging boss known for boundless energyand impatience with managers, analysts and others who didnt live up to his standards. Of his reputation as a tough boss, Mr. Greenberg said: I wouldnt ask anybody to do anything I wouldnt do. Because Mr. Greenbergs new venture is privately held and has ample capital, the New York ruling is unlikely to have immediate consequences for the firm, insurance experts say. He doesnt intend to take his Starr public, so a potential ban on serving as a public officer would be moot. No matter the legal outcome, the road ahead is likely to be tough. Competition is

THE WALL STREET JOURNAL.

Monday, July 8, 2013 | 11

IN DEPTH