Академический Документы

Профессиональный Документы

Культура Документы

Problems - Income Taxation

Загружено:

pedrosagucioИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Problems - Income Taxation

Загружено:

pedrosagucioАвторское право:

Доступные форматы

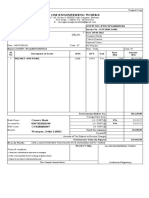

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY INTEGRATION BATCH 2012-2013 BUSINESS LAW AND TAXATION

TAXATION INCOME TAXATION PROBLEMS TAX ON INDIVIDUAL

D.S. FIGUEROA

1. In 2012, Brad P., legally separated from wife, Angel, had gross compensation income of P 620,000; Angel, on the other hand, had P 810,000. Brad was granted by the court custody of one child while Angel will have custody over three of their four children. a. b. c. d. e. f. g. h. The basic personal exemption of Brad is The additional exemption of Brad is His net compensation income/ taxable income is The basic personal exemption of Angel is The additional exemption of Angel is Her net compensation income/ taxable income is Brads tax due is Angels tax due is

2. Mr. Brendan F., married, ha the following data for the taxable year 2012: Gross Income, Philippines Gross Income, United States Expenses, Philippines Expenses, United States 557,588 413,143 388,475 325,143

a. If the taxpayer is a resident citizen, his taxable income is b. If the taxpayer is a citizen of the Philippines, with residence in the United States, the taxable income is c. If the taxpayer is a non-resident alien engaged in business in the Philippines, allows full reciprocity on personal exemption, the taxable income is d. If the taxpayer is a non-resident alien not engaged in business, taxable income is 3. Ellen B., single with two legally adopted sons, is a resident citizen employed as chief accountant in a government office. Below are data related to her income for 2012: Gross Compensation Income Premium payment on health insurance Lotto Winnings Bribes, kickback, under the table transactions a. b. c. d. 252,000 2,400 35,000 98,000

Her total personal exemptions is Total deductions and exemptions are Her taxable income Tax due for the year is 1 of 4

SOURCES: INCOME TAXATION & TRANSFER AND BUSINESS TAXATION, BALLADA. Questions modified and exemplified to illustrate pertinent provisions of the Tax Code.

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY INTEGRATION BATCH 2012-2013 BUSINESS LAW AND TAXATION

4. Linda F., a non-resident alien, is employed by a petroleum contractor. She is married and has three children. She paid premiums for her familys hospitalization insurance for 12,000. Her gross compensation income in 201 is 1,350,000. a. b. c. d. e. Her basic personal exemption is ____________ Additional exemption is __________________ Premium payments allowed is _____________ Taxable income is _______________________ Tax due is _____________________________

5. Ashley J., a non-resident alien, not engaged in business is a single parent, with one child. She also supports her nieces. She has the following information for 2012: Gross Income Royalties from a patented invention Deductions a. b. c. d. e. 2,100,523 261,450 1, 046,972

Taxable income is _____________ Final Taxes on royalties ____________ Total personal exemptions __________________ Tax due on taxable income __________________ Total taxes payable ______________________

PASSIVE INCOME: Identify the tax base and tax due applicable 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. Interest income from local currency deposit of a resident alien, 25,000 Interest from long term deposits by a resident citizen having 5 years maturity, 50,000 Interest income from FCDS of a resident alien, 25,000 Royalties from an invention by a resident alien, P150,000 Sweepstakes winnings of a resident alien, 100,000,000 Royalties as a musical composer received by a non-resident citizen 200,000 Bingo Winnings of a non-resident citizen, 50,000 Prizes in an amateur singing contest by a resident citizen, 8,000 Prizes in an amateur dance contest by a resident alien, 18,000 Cash dividend from domestic corporation of a nonresident citizen, 100,000 Cash dividend from domestic corporation of a nonresident alien ETB, 100,000 Cash dividend from domestic corporation of a nonresident alien NETB 100,000 Property dividend by a non resident alien ETB, 50,000 Interest from BDO Bank deposit under FCDS of a non-resident citizen, 300,000 Informers reward of a resident citizen, amount of inventory appropriated is 25,000,000 Stock dividend of a resident citizen from domestic corporation, 100,000 Stock dividend of a resident alien which increased his shareholdings from 10%-12%, 100,000 Share in the income of a partner, a resident citizen from business partnership, 75,000 2 of 4 SOURCES: INCOME TAXATION & TRANSFER AND BUSINESS TAXATION, BALLADA. Questions modified and exemplified to illustrate pertinent provisions of the Tax Code.

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY INTEGRATION BATCH 2012-2013 BUSINESS LAW AND TAXATION

TAX ON CORPORATIONS 1. Dynasty Corporation just completed its third year of operations. It has the following financial information for the taxable year 2013, its third year. Philippines P1, 250,000 945, 000 China P800, 000 540,000

Gross Income Deductions a. b. c. d.

Assuming the taxpayer is domestic corporation, the taxable income and tax due is Assuming the taxpayer is a resident foreign corporation, the taxable income and tax due is Assuming the taxpayer is a nonresident foreign corporation, the taxable income and tax due is Assuming the taxpayer is a n international carrier whose gross Philippine billings and expenses are the amounts stated in Philippines, tax due is e. Assuming the taxpayer is a nonresident owner of aircrafts and its gross rentals and expenses are those stated in China, tax due is f. Assuming the taxpayer is a nonresident owner of vessels and its gross rentals and expenses are those stated in Philippines, tax due is g. Assuming the taxpayer is a proprietary educational institution, its income from tuition fees and expenses are those stated in Philippines, and income in unrelated business and expenses are those in China, tax due is h. Assuming the taxpayer is a proprietary educational institution, its income from tuition fees and expenses are those stated in China, and income in unrelated business and expenses are those in Philippines, tax due is 2. Variety Corporation, a resident foreign corporation was on its sixth year of operations. The following data pertain to its operations in the Philippines for the years 2012 and 2013: 2012 P620, 000 530, 000 2013 P720, 000 612, 000

Gross income Business expenses a. b. c. d. e.

Normal income tax for 2012 Income tax due for 2012 MCIT for 2013 Income tax due for 2013 Assuming the taxpayer is a nonresident foreign corporation, tax due for 2013 is

3 of 4 SOURCES: INCOME TAXATION & TRANSFER AND BUSINESS TAXATION, BALLADA. Questions modified and exemplified to illustrate pertinent provisions of the Tax Code.

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY INTEGRATION BATCH 2012-2013 BUSINESS LAW AND TAXATION

TAX ON PARTNERSHIP AND PARTNERS 1. DRRK and Co., a GPP is engaged in auditing, tax and assurance services. Partners share in the net profits are equally distributed. For the year 2012, the following data where gathered:

Gross Income of the GPP Allowable Itemized Deductions of the GPP Gross Income of Partner D, business Allowable Itemized deduction of Partner D, business Gross Income of Partner D, business Allowable Itemized deductions of Partner D, business a. b. c. d. e. f. g.

P4, 000,000 2, 000, 000 500, 000 125, 000 300, 000 115, 000

Distributable Income of the GPP using itemized deduction Taxable income of Partner D Taxable income of Partner K Assuming the taxpayer is a business partnership, using I.D., the tax due of DRRK and Co. is Assuming the taxpayer is a business partnership ,using I.D, taxable income of Partner D Assuming the taxpayer is a business partnership , using OSD, taxable income of Partner K Assuming the taxpayer is a business partnership , final taxes due of the partnership is

ESTATES AND TRUST 1. Lady Morgana created two irrevocable trusts naming her favorite granddaughter, Alyssa, now 18 years old as beneficiary of both trust. It is provided in the trust that starting the year 2012, when Alyssa turns 18, she is to receive 25% of the net income of both trusts to her education. Below are additional information: Trust 1 Trust2 Gross Income P600, 000 P900, 000 Deductions before distribution 180,000 280,000 a. b. c. d. Taxable Income of Trust1 is Taxable Income of Trust2 is Consolidated tax due is Share of each trust on the consolidated tax due is

4 of 4 SOURCES: INCOME TAXATION & TRANSFER AND BUSINESS TAXATION, BALLADA. Questions modified and exemplified to illustrate pertinent provisions of the Tax Code.

Вам также может понравиться

- Income Taxation: Rex B. Banggawan, Cpa, MbaДокумент17 страницIncome Taxation: Rex B. Banggawan, Cpa, Mbadeeznuts100% (1)

- Chapter 3 Introduction To Taxation: Chapter Overview and ObjectivesДокумент34 страницыChapter 3 Introduction To Taxation: Chapter Overview and ObjectivesNoeme Lansang100% (1)

- HQ04 - Final Income TaxationДокумент5 страницHQ04 - Final Income TaxationJimmyChaoОценок пока нет

- 2 Corporation-RevisedДокумент8 страниц2 Corporation-RevisedSamantha Nicole Hoy100% (2)

- HQ02 - Taxes, Tax Laws and Tax AdministrationДокумент10 страницHQ02 - Taxes, Tax Laws and Tax AdministrationJimmyChaoОценок пока нет

- Income TaxationДокумент28 страницIncome TaxationJessa Gay Cartagena TorresОценок пока нет

- General Principles of Income TaxationДокумент11 страницGeneral Principles of Income TaxationKenncy100% (1)

- Quiz 4 - Gross IncomeДокумент6 страницQuiz 4 - Gross IncomeVanessa Grace100% (1)

- Acco 2033 Income TaxationДокумент284 страницыAcco 2033 Income TaxationRita Daniela100% (1)

- Business Taxation and VAT GuideДокумент50 страницBusiness Taxation and VAT GuideAllyson VillalobosОценок пока нет

- Chapt-7 Dealings in PropДокумент14 страницChapt-7 Dealings in Prophumnarvios0% (1)

- Compensation IncomeДокумент18 страницCompensation IncomeMoon KimОценок пока нет

- Chapter 8 - Deductions From Gross IncomeДокумент36 страницChapter 8 - Deductions From Gross IncomejohnОценок пока нет

- Finals Quiz 1 Dealings in Properties Answer KeyДокумент6 страницFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- Module No 6 - Intro To Regular Income TaxДокумент4 страницыModule No 6 - Intro To Regular Income TaxLysss EpssssОценок пока нет

- ACC311 Income Taxation 6 7 PDFДокумент124 страницыACC311 Income Taxation 6 7 PDFZen OrtegaОценок пока нет

- Income TaxationДокумент6 страницIncome TaxationLove Lee Hallarsis Fabicon86% (7)

- TaxДокумент3 страницыTaxArven FrancoОценок пока нет

- Chapter 10 Compensation IncomeДокумент65 страницChapter 10 Compensation IncomeAnna Janinah100% (6)

- Income-Tax-Assignment No. 3 SolutionДокумент18 страницIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoОценок пока нет

- Income Tax For Corporation PDFДокумент7 страницIncome Tax For Corporation PDFNadi HoodОценок пока нет

- Taxation On PartnershipДокумент28 страницTaxation On PartnershipVal Pineda100% (1)

- CHAPTER 14 Regular Income Tax IndividualДокумент28 страницCHAPTER 14 Regular Income Tax IndividualAvada Kedavra100% (1)

- Income Taxation CHAPTER 6Документ14 страницIncome Taxation CHAPTER 6Mark67% (3)

- Inclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Документ18 страницInclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Mylene Santiago100% (1)

- Income Tax TestbankanssssДокумент17 страницIncome Tax TestbankanssssAirille Carlos67% (3)

- FBT Calculation GuideДокумент8 страницFBT Calculation GuideJuan Frivaldo100% (2)

- Introduction To Income TaxationДокумент52 страницыIntroduction To Income TaxationMonica Monica33% (3)

- CPAR Fringe Benefit TaxДокумент5 страницCPAR Fringe Benefit TaxNikki75% (4)

- Chapter 6 Introduction To The Value Added TaxДокумент27 страницChapter 6 Introduction To The Value Added TaxJoanna Louisa GabawanОценок пока нет

- AC 3103 MOCK EXAM TIPSДокумент14 страницAC 3103 MOCK EXAM TIPSChristine NionesОценок пока нет

- DYBSATax213 - Income Taxation (MODULE 1-14)Документ51 страницаDYBSATax213 - Income Taxation (MODULE 1-14)MARK ANGELO PANGILINANОценок пока нет

- CH 5 Final Income TaxationДокумент19 страницCH 5 Final Income TaxationGabriel Trinidad SonielОценок пока нет

- TAXATIONДокумент20 страницTAXATIONItchigo Korusaki33% (3)

- Answer Midterm - Docx 1Документ8 страницAnswer Midterm - Docx 1Yolly DiazОценок пока нет

- Compensation Income Part 1Документ7 страницCompensation Income Part 1Jean Diane JoveloОценок пока нет

- Final Income TaxationДокумент4 страницыFinal Income TaxationJean Diane Jovelo100% (1)

- Income Taxation Banggawan - Chapter 1Документ5 страницIncome Taxation Banggawan - Chapter 1Frances Garrovillas100% (13)

- VAT rules on sale of goods and propertiesДокумент55 страницVAT rules on sale of goods and propertiesKarlo PalerОценок пока нет

- Exclusion From Gross IncomeДокумент8 страницExclusion From Gross IncomeRonna Mae DungogОценок пока нет

- CPA Review Center Income Tax TheoriesДокумент4 страницыCPA Review Center Income Tax TheoriesJennifer Arcadio100% (1)

- HQ01 - General Principles of TaxationДокумент12 страницHQ01 - General Principles of TaxationAl Joshua Ü Pidlaoan86% (7)

- Chapter 3 Inclusions in The Gross Income PDFДокумент11 страницChapter 3 Inclusions in The Gross Income PDFkimberly tenebro100% (1)

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseДокумент9 страницBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahОценок пока нет

- Law and Joint Obligations ModifiedДокумент34 страницыLaw and Joint Obligations ModifiedAllanah AncotОценок пока нет

- Capital Gains Tax Quiz AnswersДокумент2 страницыCapital Gains Tax Quiz AnswersJimbo Manalastas50% (2)

- Tax Deduction PrinciplesДокумент13 страницTax Deduction PrinciplesGIRLОценок пока нет

- Income Taxation - Part 3 PartnershipДокумент35 страницIncome Taxation - Part 3 PartnershipJenny Malabrigo, MBAОценок пока нет

- Introduction To Regular Income TaxДокумент25 страницIntroduction To Regular Income TaxShelley TabadaОценок пока нет

- Final Withholding Tax FWT and CapitalДокумент40 страницFinal Withholding Tax FWT and CapitalEdna PostreОценок пока нет

- Q5 Items of Gross IncomeДокумент10 страницQ5 Items of Gross IncomeNhaj0% (2)

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDДокумент40 страницIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- Chapter 10 Tabag - Serrano NotesДокумент5 страницChapter 10 Tabag - Serrano NotesNatalie SerranoОценок пока нет

- Up Portia SororityДокумент12 страницUp Portia Sororitycmv mendoza0% (1)

- Taxation - PB - 19thДокумент9 страницTaxation - PB - 19thKenneth Bryan Tegerero TegioОценок пока нет

- Taxation Law Review Final ExaminationsДокумент4 страницыTaxation Law Review Final ExaminationsRufino Gerard MorenoОценок пока нет

- Taxation Law Review Final ExamДокумент5 страницTaxation Law Review Final ExamJasperAllenBarrientosОценок пока нет

- PWC Print ElimsДокумент6 страницPWC Print ElimsClyde RamosОценок пока нет

- Cpa Review School of The Philippines ManilaДокумент5 страницCpa Review School of The Philippines ManilaSamuel Cedrick AbalosОценок пока нет

- Income Tax Semifinals ExamДокумент5 страницIncome Tax Semifinals ExamFeelingerang MAYoraОценок пока нет

- Om Engineering Works: Tax InvoiceДокумент1 страницаOm Engineering Works: Tax InvoiceSrishti GaurОценок пока нет

- Solutions To Homework Assignments: Chapter 10: Property Received Amount ExplanationДокумент10 страницSolutions To Homework Assignments: Chapter 10: Property Received Amount ExplanationErikОценок пока нет

- Income Tax Department: Challan ReceiptДокумент1 страницаIncome Tax Department: Challan ReceiptnrajeswarijobworksОценок пока нет

- FBR MCqsДокумент9 страницFBR MCqsNaveed Khan75% (8)

- CTG: Capital Gains Tax Rules for Real Property SalesДокумент11 страницCTG: Capital Gains Tax Rules for Real Property SalesMylene SantiagoОценок пока нет

- Template Slip Gaji - V2.1 - enДокумент35 страницTemplate Slip Gaji - V2.1 - enHk ThОценок пока нет

- X Western Vs Cir Case Digest OkДокумент2 страницыX Western Vs Cir Case Digest OkIvan Montealegre ConchasОценок пока нет

- 4562 Lecture 7 Problem SetДокумент6 страниц4562 Lecture 7 Problem SetJared BergerОценок пока нет

- Complete Procedures of Documenting and Registering A Philippine Real Estate SaleДокумент2 страницыComplete Procedures of Documenting and Registering A Philippine Real Estate SaleRey Jan N. VillavicencioОценок пока нет

- Plagiarism - ReportДокумент5 страницPlagiarism - ReportabbishekОценок пока нет

- Accounting Past Paper 2Документ2 страницыAccounting Past Paper 2Noshair AliОценок пока нет

- PAL Exempt from 20% Final Withholding TaxДокумент1 страницаPAL Exempt from 20% Final Withholding TaxBrylle Garnet DanielОценок пока нет

- General Mathematics and Statistics (6401)Документ14 страницGeneral Mathematics and Statistics (6401)Chemo PhobiaОценок пока нет

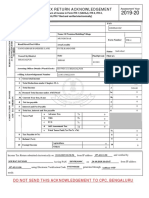

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRida ShaikhОценок пока нет

- Print For Perfect OneДокумент1 страницаPrint For Perfect OnenmbmОценок пока нет

- Service Description: Internet Access ServiceДокумент1 страницаService Description: Internet Access Servicehari om gautamОценок пока нет

- BIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements BelowДокумент6 страницBIR Form Quarterly Tax Returns: INSTRUCTION: Refer To Chapter 14 of Your Book in Answering The Requirements Belowdianne caballeroОценок пока нет

- CIR V General FoodsДокумент2 страницыCIR V General FoodsNelsonPolinarLaurdenОценок пока нет

- ChandanДокумент2 страницыChandanchandan kumarОценок пока нет

- Indian Income Tax Return Acknowledgement for AY 2019-20Документ1 страницаIndian Income Tax Return Acknowledgement for AY 2019-20Sourav KumarОценок пока нет

- Employer Identification Number (EIN) Application / RegistrationДокумент3 страницыEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Od 329907974006428100Документ1 страницаOd 329907974006428100mdkalim092Оценок пока нет

- Summary of Turn Over: Bureau of Internal Revenue (Bir)Документ7 страницSummary of Turn Over: Bureau of Internal Revenue (Bir)MichaelОценок пока нет

- 2020 Health Savings Account 224911187 Form 1099 SA & InstructionsДокумент2 страницы2020 Health Savings Account 224911187 Form 1099 SA & InstructionsBlake BrewerОценок пока нет

- 2022 Bir Tax CalendarДокумент40 страниц2022 Bir Tax CalendarRose Ann FrancoОценок пока нет

- CIR V American RubberДокумент2 страницыCIR V American RubberKath Leen0% (1)

- Arguments in Favor of The QBI Deduction IncludeДокумент2 страницыArguments in Favor of The QBI Deduction IncludeDrifta Jnr MukaniОценок пока нет

- F 211Документ2 страницыF 211Bogdan PraščevićОценок пока нет

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceДокумент2 страницыSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaОценок пока нет

- Go Go International-3Документ2 страницыGo Go International-3sahil.goelОценок пока нет