Академический Документы

Профессиональный Документы

Культура Документы

Taxation: Difference

Загружено:

Zed AbantasИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Taxation: Difference

Загружено:

Zed AbantasАвторское право:

Доступные форматы

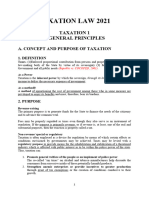

Taxation

- inherent power of a sovereign state which imposes a levy, a burden upon

persons, property and rights for purposes of raising revenue to defray the expenses of the government. A mode of raising revenue for public purposes Life and strength of the government

Inherent: a necessary attribute and a consequence of sovereignty Necessity: the basis of the right of the government to compel all persons, natural or juridical, who has income, wealth, property and rights within its territorial boundaries to contribute. Constitutional provisions: only limits the power of tax, but not remove/grant it; a legislative function. Inherent powers of the government: taxation, police power, eminent domain. Difference: Taxation- legislative; revenue collected for public purpose; cannot impair obligations of contracts; subject to constitutional limitations; can be delegated to President Police power- executive; amount collected for operation and existence of agency; can impair obligations of contracts; free from constitutional limitations but limited to public demand and due process; can be delegated to local government units Eminent Domain- judicial; power to take private property for public use upon payment of just compensation; property must be expropriated first through court proceedings; can be delegated to local government units; can override constitutional impairment provision because the welfare of the State is superior to any private contract; limited by public purpose and just compensation Purposes and Objectives: Revenue- collecting funds from taxpayers to fund operations for public welfare and protection Regulation- to regulate tobacco, alcoholic products, luxury products (Sin products) Promotion of General Welfare- tool of police power to promote general welfare Encourage Economic Growth- tax incentives or exemptions attract investments Reduction of Social Inequity- system of taxation to prevent undue concentration of wealth Protectionism- tax imposed to protect local industries from foreign industries Incidental Purposes- tool in International Relations: discriminatory duty (equalize foreign discrimination against local products), countervailing duty (to offset subsidies from exporting countries to their exporters to protect local industries), marking duty (to imported articles with improper classifications),

dumping duties (tax on imported goods with prices lower than their market value to protect local industries). Basis of Taxation: Doctrine of Attribute of Sovereignty- taxing power is a right to every independent government; burden to those who enjoyed the privileges of the government; of protection and welfare Lifeblood Doctrine- tax is essential because the government cannot exist and operate without it General Welfare Doctrine- tax is the strongest because it involves the power to destroy; can prohibit certain activities inimical to the public good Theories of Taxation: Necessity Theory- It is a power predicated upon necessity. Benefits Protection Theory- States power to tax is grounded on the reciprocal duties of support and protection; symbiotic relationship. Personal Liability Theory- a tax is personal to the taxpayer. (On corporations: piercing the corporate veil doctrine) Nature of Taxation: Inherent power of the State A Legislative function Intended for purposes of raising revenue Revenue collected is exclusively for public purpose Cannot be applied to heads of State, ambassadors, and its diplomatic corps or staff Strongest power of the Government subject only to its inherent and constitutional limitations

Points to Ponder: a. Taxation recognizes superiority of contracts- the power to tax recognizes obligations imposed by contracts as guaranteed by Article 3 Section 10 of the 1987 Constitution. This does not apply when the State exercises its police power in disregarding or impairing the obligation of contracts. b. The legislature has unlimited scope to everything to be taxed where there are no constitutional restrictions. c. The power to tax includes the power to destroy but when it is unjust the court can strike it down for the power to tax cannot override constitutional proscriptions.

d. The power to destroy should be exercised with great caution to minimize injury to the proprietary rights of the taxpayer. The tax collector must not kill the hen that lays the golden eggs. e. The power to tax carries with it the power to exempt which only Congress is authorized to exercise. f. The power to tax can be delegated to the President of the Philippines under certain conditions and its delegation to local governments. g. Only the Congress can exercise the power of taxation and cannot be delegated because it involves discretion on: 1. The power to select the object and subject to be taxed 2. The determination of the purposes of tax collection 3. The fixing of the amount and the rates to be imposed 4. The formulation of the coverage of the tax laws What can be delegated is the ministerial and advisory powers like property valuation, assessment and collection. Delegated power cannot be delegated. BIR, delegated by Tax Code, cannot delegate its power further. Can be delegated to PRESIDENT (must be within the frame of national development; tarrif rates, import and export quotas, etc.) or the LOCAL GOVERNMENT (Counselors only, to safeguard their self-sufficiency)

INHERENT LIMITATIONS: It must be exercised for purposes of raising revenue Revenue collected must be used for public purpose Applicable within territorial jurisdiction Legislative in character and may not be delegated Subject to international comity or agreement Provides safeguards on double taxation Not unjust, excessive, oppressive or confiscatory Allows exemption of government agencies or instrumentalities

DOUBLE TAXATION: act of the sovereign to tax twice the same property of the same taxpayer for the same purpose during the same year by the same authorities. KINDS: direct duplicate (requirements for tax uniformity: classification must be based on substantial distinctions, must be germane to the purpose of the law, must apply to future conditions identical to present, applicable to all taxpayers who belong to the same class. Direct duplicate is illegal); indirect duplicate taxation ( two different taxing authorities represented by two different local government units; or a local government unit and the national government.); domestic double (imposed by local and national government); international double (different taxing jurisdictions). Remedies to prevent double taxation are: 1. Adoption of a reciprocal exemption 2. Allowance of Tax Deduction 3. Allowance of a Tax Credit Double taxation does NOT apply when: 1. 2. 3. 4. Reciprocity clause is applied Tax credits are allowed and applied Tax benefit agreement with foreign countries Tax paid in another taxing authority are allowed as a deduction for same taxable property

Вам также может понравиться

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxОт EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxОценок пока нет

- General Principles: Power of TaxationДокумент21 страницаGeneral Principles: Power of TaxationCarl MurphyОценок пока нет

- Chapter 1 TaxationДокумент13 страницChapter 1 TaxationGlomarie Gonayon100% (1)

- General Principles of TaxationДокумент5 страницGeneral Principles of TaxationClaude Peña100% (1)

- BBE Lawyers Notes Taxation LawДокумент215 страницBBE Lawyers Notes Taxation LawYoo PawОценок пока нет

- TaxationДокумент82 страницыTaxationCherry Ann LayuganОценок пока нет

- TaxationДокумент17 страницTaxationyawi diskatersОценок пока нет

- FundamentalДокумент11 страницFundamentalWilfredo VillaflorОценок пока нет

- Module 1 Lecture TAXationДокумент7 страницModule 1 Lecture TAXationJagi KimОценок пока нет

- Shabu Batak TaxationДокумент41 страницаShabu Batak TaxationJOSHUA M. ESCOTOОценок пока нет

- Taxation LawДокумент106 страницTaxation Lawjohnanthony201Оценок пока нет

- Income Taxation ReviewerДокумент17 страницIncome Taxation ReviewerRena Mae BalmesОценок пока нет

- Illustrations of Lifeblood TheoryДокумент11 страницIllustrations of Lifeblood TheoryDarwin Ilustre BacayОценок пока нет

- Tax Principles ExplainedДокумент273 страницыTax Principles ExplaineditsmenatoyОценок пока нет

- General Principles of Taxation ExplainedДокумент12 страницGeneral Principles of Taxation ExplainedMatt Marqueses PanganibanОценок пока нет

- Chapter 1 Income TaxationДокумент7 страницChapter 1 Income TaxationAihla Michelle Berido100% (1)

- Taxation Virgilio D. Reyes 2 PDFДокумент194 страницыTaxation Virgilio D. Reyes 2 PDF?????Оценок пока нет

- Income Tax - Principles (Pat)Документ44 страницыIncome Tax - Principles (Pat)Jeacy Mae GallegoОценок пока нет

- Principles of TaxationДокумент32 страницыPrinciples of TaxationTyra Joyce Revadavia100% (1)

- Taxation - Defined - August 22, 2013Документ93 страницыTaxation - Defined - August 22, 2013Asdqwe ZaqwsxОценок пока нет

- 2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Документ20 страниц2018 UDM Tax Law Review Part 1 - Lecture 1 Complete (July 02)Simeon SuanОценок пока нет

- Business and Real Estate Taxation LimitationsДокумент39 страницBusiness and Real Estate Taxation LimitationsAron John SanielОценок пока нет

- Principles of Taxation-ReviewerДокумент36 страницPrinciples of Taxation-ReviewerNikki Coleen SantinОценок пока нет

- Mike's Tax Law Reviewer (Compressed)Документ23 страницыMike's Tax Law Reviewer (Compressed)Miguel Anas Jr.Оценок пока нет

- Taxation NotesДокумент91 страницаTaxation NotesRoma JayОценок пока нет

- Basic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)Документ6 страницBasic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)dsndcwnnfnhОценок пока нет

- Principles of TaxationДокумент32 страницыPrinciples of TaxationAndrea WaganОценок пока нет

- Definition and Concept of TaxationДокумент11 страницDefinition and Concept of TaxationJackie Calayag100% (4)

- 01-Principles of Taxation (Part 2)Документ25 страниц01-Principles of Taxation (Part 2)Deanne Lorraine V. GuintoОценок пока нет

- Neral Principles of Taxation PDFДокумент10 страницNeral Principles of Taxation PDFKaren Joy MagsayoОценок пока нет

- Income Taxation Principles ExplainedДокумент40 страницIncome Taxation Principles ExplainedJessaОценок пока нет

- Principles of TaxationДокумент13 страницPrinciples of TaxationHazel OrtegaОценок пока нет

- General Principle TaxationДокумент2 страницыGeneral Principle Taxationnodnel salonОценок пока нет

- PRINCIPLES OF TAXATION POWERДокумент8 страницPRINCIPLES OF TAXATION POWERMay AbiaОценок пока нет

- Dean Elvena - Jurisdiction To Inherent LimitationsДокумент3 страницыDean Elvena - Jurisdiction To Inherent LimitationsRik GarciaОценок пока нет

- Chapter 1 TaxationДокумент6 страницChapter 1 TaxationCharlotte CañeteОценок пока нет

- TaxationДокумент18 страницTaxationMatthew MadriagaОценок пока нет

- Tax TVДокумент151 страницаTax TVAngel MarieОценок пока нет

- Condensed Reviewer for Taxation PrinciplesДокумент4 страницыCondensed Reviewer for Taxation PrinciplesClaire Anne SulamОценок пока нет

- Philippine Tax PrinciplesДокумент25 страницPhilippine Tax PrinciplesEuli Mae SomeraОценок пока нет

- Chapter 1 IntaxДокумент7 страницChapter 1 IntaxrarerawrolesОценок пока нет

- Taxation Law ReviewerДокумент62 страницыTaxation Law ReviewerAdelaine Faith Zerna96% (23)

- Reviewer in TaxationДокумент19 страницReviewer in TaxationMarco ComboyaОценок пока нет

- Taxation I ReviewДокумент62 страницыTaxation I ReviewSK Tim RichardОценок пока нет

- Understanding Taxation FundamentalsДокумент32 страницыUnderstanding Taxation FundamentalsJames GuiruelaОценок пока нет

- General PrincipleДокумент23 страницыGeneral PrincipleRai DОценок пока нет

- Tax 311 Topic PDFДокумент22 страницыTax 311 Topic PDFAnnie Mae YnotОценок пока нет

- Lecture On General Principles of TaxationДокумент75 страницLecture On General Principles of TaxationJayen100% (1)

- Bintaxa ReadingsДокумент9 страницBintaxa ReadingsAlex GonzalesОценок пока нет

- Reviewer in TaxationДокумент9 страницReviewer in TaxationMerlyn M. Casibang Jr.Оценок пока нет

- Taxation Law 1 ReviewerДокумент11 страницTaxation Law 1 ReviewerCyril Dave LimОценок пока нет

- NT - Introduction To Taxation 1227 - Income TaxДокумент8 страницNT - Introduction To Taxation 1227 - Income TaxElizah PorcadoОценок пока нет

- Taxation Explained: Powers, Principles & TheoriesДокумент26 страницTaxation Explained: Powers, Principles & TheoriesJabeth IbarraОценок пока нет

- Principles of Income TaxationДокумент29 страницPrinciples of Income TaxationAriane Grace Hiteroza MargajayОценок пока нет

- Gen. Principles and Income TaxДокумент46 страницGen. Principles and Income TaxLeidi Kyohei NakaharaОценок пока нет

- Tax 1 FinalsДокумент16 страницTax 1 FinalsDenise DuriasОценок пока нет

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemОт EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemОценок пока нет

- Hamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemОт EverandHamilton's Economic Policies: Works & Speeches of the Founder of American Financial SystemОценок пока нет

- Petition for Bail in Drug CaseДокумент3 страницыPetition for Bail in Drug CaseZed AbantasОценок пока нет

- Sample Legal Opinion in UniversityДокумент1 страницаSample Legal Opinion in UniversityZed AbantasОценок пока нет

- Certification of Election Registration BoardДокумент1 страницаCertification of Election Registration BoardZed AbantasОценок пока нет

- Trampled SALEДокумент1 страницаTrampled SALEZed AbantasОценок пока нет

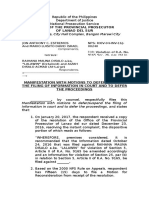

- Manifestation and Motion To SuspendДокумент2 страницыManifestation and Motion To SuspendZed AbantasОценок пока нет

- Memo Inspection SampleДокумент1 страницаMemo Inspection SampleZed AbantasОценок пока нет

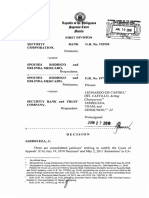

- G.R. No. 168964 Full TextДокумент5 страницG.R. No. 168964 Full TextZed AbantasОценок пока нет

- Sample Annual Report 2016 (SUC)Документ5 страницSample Annual Report 2016 (SUC)Zed AbantasОценок пока нет

- The Three Priorities From The Local Government CodДокумент2 страницыThe Three Priorities From The Local Government CodZed AbantasОценок пока нет

- Identification of StrategiesДокумент4 страницыIdentification of StrategiesZed AbantasОценок пока нет

- School Lab Report SummaryДокумент2 страницыSchool Lab Report SummaryZed AbantasОценок пока нет

- Peace Building PresentationДокумент20 страницPeace Building PresentationZed AbantasОценок пока нет

- Resume Format For Graduating Students: How To Fill Up The FormДокумент4 страницыResume Format For Graduating Students: How To Fill Up The FormZed AbantasОценок пока нет

- Fixing A Cannot Browse ProblemДокумент1 страницаFixing A Cannot Browse ProblemZed AbantasОценок пока нет

- Basic Concepts of CommunismДокумент1 страницаBasic Concepts of CommunismZed AbantasОценок пока нет

- Civil Law Review IДокумент26 страницCivil Law Review IZed AbantasОценок пока нет

- Sample ApplicationДокумент1 страницаSample ApplicationZed AbantasОценок пока нет

- Batang ManggagawaДокумент1 страницаBatang ManggagawaZed AbantasОценок пока нет

- Criminal Law CasesДокумент90 страницCriminal Law CasesZed AbantasОценок пока нет

- Criminal Law CasesДокумент90 страницCriminal Law CasesZed AbantasОценок пока нет

- Remedial Law Memory AidДокумент38 страницRemedial Law Memory AidIm In TroubleОценок пока нет

- PM CaseДокумент2 страницыPM CaseZed AbantasОценок пока нет

- Cases in Remedial LawДокумент1 страницаCases in Remedial LawZed AbantasОценок пока нет

- Labor ReviewДокумент1 страницаLabor ReviewZed AbantasОценок пока нет

- Remedial Law Memory AidДокумент38 страницRemedial Law Memory AidIm In TroubleОценок пока нет

- Regional Trial Courts of Misamis Oriental (RTCS) - Hearing Starts at 8:30amДокумент2 страницыRegional Trial Courts of Misamis Oriental (RTCS) - Hearing Starts at 8:30amZed AbantasОценок пока нет

- Reflection PaperДокумент2 страницыReflection PaperZed Abantas100% (1)

- Labor CasesДокумент43 страницыLabor CasesZed AbantasОценок пока нет

- Dawn of Time LyricsДокумент2 страницыDawn of Time LyricsZed AbantasОценок пока нет

- Memorandum SampleДокумент25 страницMemorandum SampleganiboyОценок пока нет

- China Bank Vs CAДокумент2 страницыChina Bank Vs CAVanya Klarika NuqueОценок пока нет

- General Principles of TaxationДокумент36 страницGeneral Principles of Taxationnicole5anne5ddddddОценок пока нет

- Maso V Leopard CaseДокумент5 страницMaso V Leopard CaseShantar KnytОценок пока нет

- Industrial Management vs. NLRCДокумент5 страницIndustrial Management vs. NLRCSherwin Anoba CabutijaОценок пока нет

- Essentials of a Valid ContractДокумент7 страницEssentials of a Valid Contract2016031 ASWIN S PRADEEPОценок пока нет

- Javier v. CA 199 SCRA 824Документ4 страницыJavier v. CA 199 SCRA 824Marge OstanОценок пока нет

- Section-1 (Instructions To Bidders) SBD - 1Документ11 страницSection-1 (Instructions To Bidders) SBD - 1sujeОценок пока нет

- Tfii'Llbiupptnes I Upreme Court:Fflanila: L/Epubltt ofДокумент21 страницаTfii'Llbiupptnes I Upreme Court:Fflanila: L/Epubltt ofJanMikhailPanerioОценок пока нет

- Human Rights - Abuse of RightsДокумент8 страницHuman Rights - Abuse of RightsMika BanzuelaОценок пока нет

- Promoter Functions, Rights, Duties and LiabilitiesДокумент5 страницPromoter Functions, Rights, Duties and LiabilitiesAbhinav Palsikar100% (1)

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Документ20 страницScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderОценок пока нет

- Antonio T. Carrascoso, Jr. Camus & Delgado: 448 Philippine Reports AnnotatedДокумент3 страницыAntonio T. Carrascoso, Jr. Camus & Delgado: 448 Philippine Reports AnnotatedHilleary VillenaОценок пока нет

- Board of Liquidators V KalawДокумент2 страницыBoard of Liquidators V Kalawpretzvinluan100% (3)

- Cordia ComplaintДокумент107 страницCordia ComplaintKyle CollierОценок пока нет

- Law of Agency (Autosaved)Документ36 страницLaw of Agency (Autosaved)Nurul Ain AisyaОценок пока нет

- Obligations Digests, Civil Law ReviewДокумент112 страницObligations Digests, Civil Law ReviewMadzGabiolaОценок пока нет

- FPIC Common Carrier Through PipelinesДокумент2 страницыFPIC Common Carrier Through PipelinesTheodore Dolar100% (2)

- Civ Pro Case Digest R57Документ45 страницCiv Pro Case Digest R57kristel jane caldozaОценок пока нет

- Ceniza Bar Notes 2022Документ38 страницCeniza Bar Notes 2022Fasa Mufa100% (1)

- Memory Aid - Persons and Family Relations San Beda LawДокумент26 страницMemory Aid - Persons and Family Relations San Beda LawMARIA KATHRINA BENITEZОценок пока нет

- Tan Vs HosanaДокумент2 страницыTan Vs HosanaAnonymous 5MiN6I78I067% (3)

- Standard Water Connection GuideДокумент44 страницыStandard Water Connection GuideAqua CFDОценок пока нет

- Institutional Arbitration Trend in India vs Ad Hoc ArbitrationДокумент11 страницInstitutional Arbitration Trend in India vs Ad Hoc ArbitrationAvtar singhОценок пока нет

- Succession - Atty. Uribe Codal Provisions & Case Doctrines Tricia Cruz Dlsu-LawДокумент29 страницSuccession - Atty. Uribe Codal Provisions & Case Doctrines Tricia Cruz Dlsu-LawJerome MoradaОценок пока нет

- Appellant's Opening Brief: NCOPM v. Brown Et AlДокумент64 страницыAppellant's Opening Brief: NCOPM v. Brown Et Alrick siegel100% (1)

- Oriental Tin Can Labor Union v. Sec. of LaborДокумент3 страницыOriental Tin Can Labor Union v. Sec. of Laboralexis_bea100% (2)

- Legal Separation CasesДокумент52 страницыLegal Separation CasesCrnc NavidadОценок пока нет

- A Passion For Justice: Lord Denning, Christianity and The LawДокумент20 страницA Passion For Justice: Lord Denning, Christianity and The LawCacia PimentelОценок пока нет

- Conciliation Proceedings Under The Arbitration Conciliation ActДокумент5 страницConciliation Proceedings Under The Arbitration Conciliation ActGarima AgrawalОценок пока нет