Академический Документы

Профессиональный Документы

Культура Документы

Phat Dragon (23 August 2013)

Загружено:

leithvanonselenИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Phat Dragon (23 August 2013)

Загружено:

leithvanonselenАвторское право:

Доступные форматы

Phat dragon

23 August 2013

# 177

a weekly chronicle of the Chinese economy

The flash estimate of the HSBC manufacturing PMI for August

shocked most observers by rising to 50.1 from 47.7 in July. This release follows the promising official data for the month of July that Phat Dragon covered in recent editions of this chronicle. In reviewing the previous release of this survey, Phat Dragon noted that the forward looking aspects of the detail improved, despite the decline in the headline reading, with the fall away in finished goods inventories a development of some moment. Even so, the new orders to inventories ratio was still well below unity, which tempered expectations of a major improvement. So the favourable direction of change was not a surprise it was the scale of the gain that was not anticipated.

54 52 50 48 46 44 42 40 65 60 55 50 45 40 35

Manufacturing: stocks and orders

index

Finished goods inventories

index

Sources: CEIC, Markit * Seasonally adjusted by Westpac Economics.

NBS*

HSBC

New Orders

In this regard it is worth noting that the large bounce in the

private survey merely brings it into line with the official PMI produced by the NBS. The official survey had consistently indicated that orders were firmer and inventories were less excessive than the state of play as described by the respondents to the HSBC survey. The starkly different perceptions of the finished goods inventory position in the two surveys was a major point of frustration from an analytical point of view. Indeed, as Phat Dragons main interest in the various monthly business surveys is in the information they provide on the state of the inventory cycle, when they are so far out of accord with each other, their combined and individual utility both decline significantly.

54 52 50 48 46 44 42 40 65 60 55 50 45 40 35

Jan-05

Jan-07

Jan-09

Jan-11

Jan-13

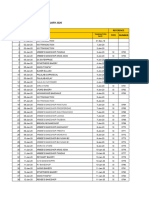

Steel inventory cycle: April 12 to Jun 13

60 45 30 15 0

Oct2012 Aug2012

inventories Jul%yr 2012

May2012 Apr2012 Mar2013 Sep2012 Apr2013 Dec2012 May2013 Jun2013

-15 -30 0 3 6 9

Jan2013

The PMI surveys are just two of the many sources that Phat

Sales %yr

Dragon draws upon to assess the state of the inventory cycle in manufacturing. Various industry associations provide valuable additional information, and there is also an official series on industrial inventories by sector to ponder. Phat Dragons favourite measures come from the industry associations of the bellwether steel and heavy machinery sectors. The situation in steel moved favourably in the most recent update, with the growth of sales accelerating and the growth in inventories decelerating: an ideal situation for a short term bounce in production. In heavy machinery, conditions are not as obviously favourable, but the state of play in yellow goods is much improved on this time a year ago. Looking specifically at excavators, Phat Dragon estimates that finished units on hand were equivalent to 1.71 months of current absorption rates as of June, down from 1.84 months a year ago. Furthermore, with sales accelerating to 8.0%yr in the month of July, when output and inventory information are made available, it is extremely likely that the inventory to sales ratio will improve further.

12

15

Supply demand imbalance in excavators

3 2 1 10 0 -1 -2

Inventories falling

Months of sales

Inventories rising Months of sales Number of machines

units

30 20

First half of the calendar year specified.

Sources: CEIC, Westpac Economics. Year to June gap between sales and production plus net imports, scaled by average monthly sales in equivalent period.

0 -10 -20

-3 2006 2007 2008 2009 2010 2011 2012 2013

Chinese industrial inventories

75 60 45 30 15 0 -15

Sources: CEIC, Westpac Economics. 3mma.

Phat Dragon has noted previously that within heavy industry,

basic materials producers are running leaner inventory positions than downstream machinery sectors. This is in large part due to the relative strength of the construction and equipment investment cycles, with the latter a clear laggard at present. This divergence is also evident within the basic materials space, most visibly in the outperformance of long versus flat steel products. Other sectoral developments worthy of mention are the downward trend in the growth of inventories in nonferrous metals smelting, rubber and plastics, paper making and metal fabrication. Sectors moving the other way include autos, furniture, textiles and ICT. The outward orientation of these latter three industries is consistent with the decline in the new export orders reading in the flash PMI, which was the lone major sub-index to go against the grain in the August update.

Westpac Institutional Banking Group Economic Research

%yr IT and telco Total Ferrous metals Rubber and plastic Textiles

%yr

75 60 45 30 15 0 -15 -30

-30 Jan-04

Jul-05

Jan-07

Jul-08

Jan-10

Jul-11

Jan-13

Stats of the week: China is home to 56 officially

recognized ethnic groups, 10 of whom have more than 5 million members.

economics@westpac.com.au www.westpac.com.au

Past performance is not a reliable indicator of future performance. The forecasts given above are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The results ultimately achieved may differ substantially from these forecasts.

Disclaimer

Things you should know: Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you. If you are located in Australia, this material and access to this website is provided to you solely for your own use and in your own capacity as a wholesale client of Westpac Institutional Bank being a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (Westpac). If you are located outside of Australia, this material and access to this website is provided to you as outlined below. This material and this website contain general commentary only and does not constitute investment advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision. This information has been prepared without taking account of your objectives, financial situation or needs. This material and this website may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure the information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of the information, or otherwise endorses it in any way. Except where contrary to law, Westpac and its related entities intend by this notice to exclude liability for the information. The information is subject to change without notice and none of Westpac or its related entities is under any obligation to update the information or correct any inaccuracy which may become apparent at a later date. The information contained in this material and this website does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter a legally binding contract. Past performance is not a reliable indicator of future performance. The forecasts given in this material and this website are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts. Transactions involving carbon give rise to substantial risk (including regulatory risk) and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision. This information has been prepared without taking account of your objectives, financial situation or needs. Statements setting out a concise description of the characteristics of carbon units, Australian carbon credit units and eligible international emissions units (respectively) are available at www.cleanenergyregulator.gov.au as mentioned in section 202 of the Clean Energy Act 2011, section 162 of the Carbon Credits (Carbon Farming Initiative) Act 2011 and section 61 of the Australian National Registry of Emissions Units Act 2011. You should consider each such statement in deciding whether to acquire, or to continue to hold, any carbon unit, Australian carbon credit unit or eligible international emissions unit. Additional information if you are located outside of Australia New Zealand: The current disclosure statement for the New Zealand division of Westpac Banking Corporation ABN 33 007 457 141 or Westpac New Zealand Limited can be obtained at the internet address www.westpac.co.nz. Westpac Institutional Bank products and services are provided by either Westpac Banking Corporation ABN 33 007 457 141 incorporated in Australia (New Zealand division) or Westpac New Zealand Limited. For further information please refer to the Product Disclosure Statement (available from your Relationship Manager) for any product for which a Product Disclosure Statement is required, or applicable customer agreement. Download the Westpac NZ QFE Group Financial Advisers Act 2008 Disclosure Statement at www.westpac.co.nz. China, Hong Kong, Singapore and India: Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore. Westpac Hong Kong Branch holds a banking license and is subject to supervision by the Hong Kong Monetary Authority. Westpac Hong Kong branch also holds a license issued by the Hong Kong Securities and Futures Commission (SFC) for Type 1 and Type 4 regulated activity. Westpac Shanghai and Beijing Branches hold banking licenses and are subject to supervision by the China Banking Regulatory Commission (CBRC). Westpac Mumbai Branch holds a banking license from Reserve Bank of India (RBI) and subject to regulation and supervision by the RBI. U.K.: Westpac Banking Corporation is registered in England as a branch (branch number BR000106), and is authorised and regulated by the Australian Prudential Regulatory Authority in Australia. WBC is authorised in the United Kingdom by the Prudential Regulation Authority. WBC is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority in the United Kingdom. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. This material and this website and any information contained therein is directed at a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services Act 2000 (Financial Promotion) Order 2005 or (b) high net worth entities, and other persons to whom it may otherwise be lawfully communicated, falling within Article 49(1) of the Order (all such persons together being referred to as relevant persons). The investments to which this material and this website relates are only available to and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such investments will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely upon this material and this website or any of its contents. In the same way, the information contained in this material and this website is intended for eligible counterparties and professional clients as defined by the rules of the Financial Services Authority and is not intended for retail clients. With this in mind, Westpac expressly prohibits you from passing on the information in this material and this website to any third party. In particular this material and this website, website content and, in each case, any copies thereof may not be taken, transmitted or distributed, directly or indirectly into any restricted jurisdiction. U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (CFTC) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. Westpac Capital Markets, LLC (WCM), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (the Exchange Act) and member of the Financial Industry Regulatory Authority (FINRA).

Disclaimer

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. All disclaimers set out with respect to Westpac apply equally to WCM. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments. The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates. For the purposes of Regulation AC only: Each analyst whose name appears in this report certifies that (1) the views expressed in this report accurately reflect the personal views of the analyst about any and all of the subject companies and their securities and (2) no part of the compensation of the analyst was, is, or will be, directly or indirectly related to the specific views or recommendations in this report. For XYLO Foreign Exchange clients: This information is provided to you solely for your own use and is not to be distributed to any third parties. XYLO Foreign Exchange is a division of Westpac Banking Corporation ABN 33 007 457 141 and Australian credit licence 233714. Information is current as at date shown on the publication. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. XYLO Foreign Exchanges combined Financial Services Guide and Product Disclosure Statement can be obtained by calling XYLO Foreign Exchange on 1300 995 639, or by emailing customercare@XYLO.com.au. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Past performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- RP Data Property Pulse (11 October 2013)Документ1 страницаRP Data Property Pulse (11 October 2013)leithvanonselenОценок пока нет

- Phat Dragons Weekly Chronicle of The Chinese Economy (19 Sept 2013)Документ3 страницыPhat Dragons Weekly Chronicle of The Chinese Economy (19 Sept 2013)leithvanonselenОценок пока нет

- Westpac Red Book (September 2013)Документ28 страницWestpac Red Book (September 2013)leithvanonselenОценок пока нет

- Wilson HTM Valuation Dashboard (17 Sept 2013)Документ20 страницWilson HTM Valuation Dashboard (17 Sept 2013)leithvanonselenОценок пока нет

- HSBC China Flash PMI (23 Sept 2013)Документ3 страницыHSBC China Flash PMI (23 Sept 2013)leithvanonselenОценок пока нет

- ANZ Property Industry Confidence Survey December 2013Документ7 страницANZ Property Industry Confidence Survey December 2013leithvanonselenОценок пока нет

- Wilson HTM - ShortAndStocky (20130916)Документ22 страницыWilson HTM - ShortAndStocky (20130916)leithvanonselenОценок пока нет

- RP Data Weekend Market Summary WE 13 Sept 2013Документ2 страницыRP Data Weekend Market Summary WE 13 Sept 2013Australian Property ForumОценок пока нет

- Aig Pci August 2013Документ2 страницыAig Pci August 2013leithvanonselenОценок пока нет

- Media Release - The Vote Housing Special-1Документ3 страницыMedia Release - The Vote Housing Special-1leithvanonselenОценок пока нет

- HIA Dwelling Approvals (10 September 2013)Документ5 страницHIA Dwelling Approvals (10 September 2013)leithvanonselenОценок пока нет

- Saul Eslake - Henry George Dinner Sep 2013 (Slides)Документ13 страницSaul Eslake - Henry George Dinner Sep 2013 (Slides)leithvanonselenОценок пока нет

- Phat Dragon Weekly Chronicle of The Chinese Economy (6 September 2013)Документ3 страницыPhat Dragon Weekly Chronicle of The Chinese Economy (6 September 2013)leithvanonselenОценок пока нет

- Phat Dragons Weekly Chronicle of The Chinese Economy (28 August 2013)Документ3 страницыPhat Dragons Weekly Chronicle of The Chinese Economy (28 August 2013)leithvanonselenОценок пока нет

- ANZ - Retail Sales Vs Online Sales (August 2013)Документ4 страницыANZ - Retail Sales Vs Online Sales (August 2013)leithvanonselenОценок пока нет

- NZ PC On Aucklands MUL (March 2013)Документ23 страницыNZ PC On Aucklands MUL (March 2013)leithvanonselenОценок пока нет

- Westpac - Where Have The FHBs Gone (August 2013)Документ6 страницWestpac - Where Have The FHBs Gone (August 2013)leithvanonselenОценок пока нет

- HIA - Housing Activity During Business Cycles (August 2013)Документ8 страницHIA - Housing Activity During Business Cycles (August 2013)leithvanonselenОценок пока нет

- RP Data - Steady Decline in Home Ownership (8 August 2013)Документ1 страницаRP Data - Steady Decline in Home Ownership (8 August 2013)leithvanonselenОценок пока нет

- Weekend Market Summary Week Ending 2013 August 25 PDFДокумент2 страницыWeekend Market Summary Week Ending 2013 August 25 PDFLauren FrazierОценок пока нет

- Westpac - Fed Doves Might Have Last Word (August 2013)Документ4 страницыWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenОценок пока нет

- RP Data - Brisbane & Adelaide Housing (15 August 2013)Документ1 страницаRP Data - Brisbane & Adelaide Housing (15 August 2013)leithvanonselenОценок пока нет

- RP Data - Rising Sales To Benefit Agents (August 2013)Документ1 страницаRP Data - Rising Sales To Benefit Agents (August 2013)leithvanonselenОценок пока нет

- RBA Statement of Monetary Policy (August 2013)Документ62 страницыRBA Statement of Monetary Policy (August 2013)leithvanonselenОценок пока нет

- Genworth Streets Ahead Report (July 2013)Документ8 страницGenworth Streets Ahead Report (July 2013)leithvanonselenОценок пока нет

- RP Data Home Values Results (July 2013)Документ4 страницыRP Data Home Values Results (July 2013)leithvanonselenОценок пока нет

- ME Bank Household Financial Comfort Report (July 2013)Документ32 страницыME Bank Household Financial Comfort Report (July 2013)leithvanonselenОценок пока нет

- Shale - The New World (ANZ Research - August 2013)Документ18 страницShale - The New World (ANZ Research - August 2013)leithvanonselenОценок пока нет

- Age Bias in The Australian Welfare State (ANU 2013)Документ16 страницAge Bias in The Australian Welfare State (ANU 2013)leithvanonselenОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- StatementsДокумент1 страницаStatementsAnthony EvansОценок пока нет

- Assignment 2 Fin632 Amal Mobaraki 441212274Документ4 страницыAssignment 2 Fin632 Amal Mobaraki 441212274Amal MobarakiОценок пока нет

- Audit Class Notes EvidenceДокумент15 страницAudit Class Notes EvidencePrince Wayne SibandaОценок пока нет

- Sandeep Jain 13 Years Business AnalystДокумент4 страницыSandeep Jain 13 Years Business AnalystMona JainОценок пока нет

- Namaste India 2020Документ228 страницNamaste India 2020Ravi BabuОценок пока нет

- IAS 37 by Zubair SaleemДокумент23 страницыIAS 37 by Zubair Saleemnaeem.akhtar.askОценок пока нет

- IT Certificate 2020-21 BajajДокумент1 страницаIT Certificate 2020-21 BajajPushpendra SinghОценок пока нет

- What Is Stock ExchangeДокумент16 страницWhat Is Stock ExchangeNeha_18Оценок пока нет

- Audit in A An It or Cis Environment Module 3Документ20 страницAudit in A An It or Cis Environment Module 3Arwin SomoОценок пока нет

- Part 2 Chapter 1Документ4 страницыPart 2 Chapter 1Keay ParadoОценок пока нет

- Basic Accounting QuestionnaireДокумент5 страницBasic Accounting Questionnaireangeline bulacanОценок пока нет

- Ems p1 8 Question Paper Final 2023Документ6 страницEms p1 8 Question Paper Final 2023Abdul AhadОценок пока нет

- DEMAT Account Closure Request FormДокумент1 страницаDEMAT Account Closure Request FormManmohan RathiОценок пока нет

- 5-10 Fa1Документ10 страниц5-10 Fa1Shahab ShafiОценок пока нет

- Management Financial ServicesДокумент11 страницManagement Financial ServicesTanmeet kourОценок пока нет

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Документ21 страницаAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Stella SabaoanОценок пока нет

- Advac 2 Prelims 1 - PALACIOДокумент4 страницыAdvac 2 Prelims 1 - PALACIOPinky DaisiesОценок пока нет

- Snacks BillДокумент2 страницыSnacks BillSiva ShankarОценок пока нет

- LVL - Subsidiary Sales & Purchases 2020Документ34 страницыLVL - Subsidiary Sales & Purchases 2020rheamaenarciso613Оценок пока нет

- Cpar NegoДокумент20 страницCpar NegoChristian Blanza Lleva67% (3)

- PDFДокумент7 страницPDFwww_hari786Оценок пока нет

- FAR 3 Sample QuestionsДокумент2 страницыFAR 3 Sample Questionsfrancis dungcaОценок пока нет

- Method For Evaluation GoodwillДокумент17 страницMethod For Evaluation Goodwillraj chhina0% (1)

- Zero EMI Book ReviewДокумент28 страницZero EMI Book ReviewRaj GajeraОценок пока нет

- Bus Math11 Slo QTR2-WK 1 - 2Документ5 страницBus Math11 Slo QTR2-WK 1 - 2Alma Dimaranan-Acuña100% (1)

- Purchasing Process Exercise 3.1, 3.2 & 3.3Документ3 страницыPurchasing Process Exercise 3.1, 3.2 & 3.3Kathlyn TajadaОценок пока нет

- 1819 IB124 Summer Exam PaperДокумент6 страниц1819 IB124 Summer Exam PaperHarry TaylorОценок пока нет

- Banking Awareness January Set 1: by Dr. Gaurav GargДокумент18 страницBanking Awareness January Set 1: by Dr. Gaurav GargGh-ccfОценок пока нет

- Jeevan AmritДокумент11 страницJeevan Amritapi-3800339100% (1)

- Tugas Auditing II - TGL 30 Jan 2021Документ2 страницыTugas Auditing II - TGL 30 Jan 2021Fara DinaОценок пока нет