Академический Документы

Профессиональный Документы

Культура Документы

Assessment Year Indian Income Tax Return Sahaj

Загружено:

allipraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assessment Year Indian Income Tax Return Sahaj

Загружено:

allipraАвторское право:

Доступные форматы

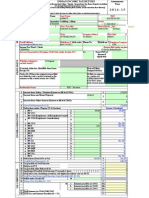

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year

2012-13

First Name THOMAS Flat / Door / Building KUNTHARAYIL Road / Street CHUNGATHARA POST Town/City/District MALAPPURAM Email Address thomaskvarghese1@gmail.com Income Tax Ward / Circle WARD-3 TIRUR Whether original or revised return? If revised, enter Original Ack no / Date If u/s 139(9)-defective return , enter Original Ack No If u/s 139(9)-defective return , enter Notice No Residential Status RES - Resident Area / Locallity NR.GOVT.CHC State 16-KERALA Pin Code 679334 Middle Name Last Name KUNTHARAYIL VARGHESE Status I - Individual Date of birth (DD/MM/YYYY) 25/05/1963 Sex (Select) M-Male PAN ABNPV2007Q

PERSONAL INFORMATION

FILING STATUS

Mobile no (Std code) Phone No Employer Category (if in 9447275724 04931 230035 employment) OTH Return filed under section [Pl see Form Instruction] 17-Revised 139(5) R-Revised 443195810300712 Date 30/07/2012

If u/s 139(9)defective return , enter Notice Date Tax Payable Tax Status 1 2 3 4 100,000 0 0 0 0 4,946 0 0 0 0 0 0 0 0 104,946 6 7 8 9 10 25,046 0 13 14 15 1,216,321 -109,476 0 1,106,845 System Calculated 100,000 0 0 0 0 4,946 0 0 0 0 0 0 0 0 104,946 1,001,899 152,570 4,577 157,147

1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 INCOME & DEDUCTIONS Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2+3) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c(i) c(i) 80 CCD (Employers Contribution) 80 CCD (Employees / Self Employed 5c(ii) c(ii) Contribution) 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 Balance Tax Payable (10 11 12) 13 14 Total Interest u/s 234A 234B 234C 15 Total Tax and Interest Payable (13 + 14)

TAX COMPUTATION

132,101 0 132,101

23

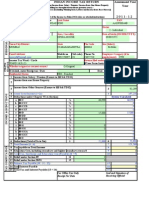

Details of Tax Deducted at Source from SALARY [As per FORM 16 issued by Employer(s)] Tax Deduction Name of the Account Number SI.No Employer (TAN) of the Employer (3) (1) (2) CHNM00049A MANAGER, 1 2 MAR 3

Income charg eable under the head Salaries (4) 1,001,899

Total tax Deducted (5) 132,100

(Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)] Tax Deduction Account Number (TAN) of the Deductor (2) Amount out of (6) claimed for this year (7)

SI.No

Name of the Deductor

Unique TDS Certificate No.

Deducted Year

Total tax Deducted

(1) 1 2 3 4

(3)

(4)

(5)

(6)

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Credit into Govt Account (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The taxes paid figures below will get filled up when the Schedules linked to them are filled. a Advance Tax (from item 25) b TDS (Total from item 23 + item 24) 16a 16b 0 132,100 17 18 19 132,100 1 0

No 21 Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details 679009102 Savings MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only VERIFICATION THOMAS son/daughter of VARGHESE KUNTHARAYIL I, VARGHESE solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2012-13 Place Date 30/07/2012 Sign here -> CHUNGATHARA ABNPV2007Q PAN 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP

REFUND

17 18 19 20

0 c Self Assessment Tax (item 25) 16c Total Taxes Paid (16a+16b+16c) Tax Payable (15-17) (if 15 is greater than 17) Refund (17-15) if 17 is greater than 15 57050751772 Enter your Bank Account number

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Details of donations entitled for deduction under section 80G (PLEASE READ NOTE BELOW) Schedule 80G Donations entitled for 100% deduction without qualifying limit A Name of donee 1 2 3 4 Total 80GA 0 Adress City or Town or District State Code PinCode PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0

Donations entitled for 50% deduction without qualifying limit Name of Address City or Town or State Code donee District 1 2 3 4 Total 80GB :

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations entitled for 100% deduction subject to qualifying limit Name of Address City Or Town Or State Code donee District 1 2 3 4 Total 80GC :

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations entitled for 50% deduction subject to qualifying limit Name of Address City Or Town Or State Code donee District 1 2 3 4 Total 80GD

PinCode

PAN of Donee Amount of Eligible donation Amount of Donation 0 0 0 0 0 0

Donations (A + B + C + D)

NOTE : (IN CASE OF DONEE FUNDS SETUP BY GOVERNMENT AS DESCRIBED IN SECTION 80G(2), PLEASE USE PAN AS "GGGGG0000G".

Validate data before generating XML No of entries Amount TDS on Salary 1 TDS on Interest 0 Tax Payments 0

132100 0 0

VERIFICATION Full Name Son/daughter of Place Date PAN

THOMAS KUNTHARAYIL VARGHESE VARGHESE CHUNGATHARA 30/07/2012 ABNPV2007Q

1. Validate against each schedule the

count of no of entries.

3. In case this count does not match to

the entered number of entries, you may recheck the schedules, refer to instructions for filling up tables, and ensure that all entries are valid and completely entered.

2. This is required to confirm that the 4. Once this sheet is validated, you

total no of entries entered per schedule is valid and being generated in the final XML may click on Save XML to generate the XML file

If the no of entries are 0 In a schedule, there are mandatory fields For a row to be valid, these must be filled in. Also, do not skip blank rows

IL VARGHESE

Вам также может понравиться

- Income TaxДокумент6 страницIncome TaxKuldeep HoodaОценок пока нет

- 2012 Itr1 Pr21Документ5 страниц2012 Itr1 Pr21MRLogan123Оценок пока нет

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Документ3 страницыSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarОценок пока нет

- IT Return 2011 2012Документ3 страницыIT Return 2011 2012swapnil6121986Оценок пока нет

- Assessment Year Sahaj Indian Income Tax ReturnДокумент7 страницAssessment Year Sahaj Indian Income Tax Returnrajshri58Оценок пока нет

- ITR Form 1Документ7 страницITR Form 1gj29hereОценок пока нет

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateДокумент3 страницыAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinОценок пока нет

- Indian Income Tax Return Assessment Year SahajДокумент7 страницIndian Income Tax Return Assessment Year SahajSubrata BiswasОценок пока нет

- 2013 Itr1 PR11Документ9 страниц2013 Itr1 PR11Akshay Kumar SahooОценок пока нет

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamДокумент11 страницITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranОценок пока нет

- Gross Total Income (1+2+3) 4: System CalculatedДокумент8 страницGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamОценок пока нет

- Gross Total Income (1+2c) 4: Import Previous VersionДокумент4 страницыGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailОценок пока нет

- Gross Total Income (1+2c) 4: System CalculatedДокумент3 страницыGross Total Income (1+2c) 4: System CalculatedDHARAMSONIОценок пока нет

- 2011 ITR1 r2Документ3 страницы2011 ITR1 r2Zafar IqbalОценок пока нет

- 2015 Itr1 PR3Документ18 страниц2015 Itr1 PR3shubham sharmaОценок пока нет

- Assessment Year Indian Income Tax Return: I - IndividualДокумент6 страницAssessment Year Indian Income Tax Return: I - IndividualManjunath YvОценок пока нет

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Документ22 страницыSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaОценок пока нет

- Form ITR-1Документ3 страницыForm ITR-1Rajeev PuthuparambilОценок пока нет

- Enter Necessary Data For Income Tax CalculationДокумент15 страницEnter Necessary Data For Income Tax Calculationsa_mishraОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент12 страницITR-3 Indian Income Tax Return: Part A-GENmehtakvijayОценок пока нет

- V. N. Hari,: Sudhakar & Kumar AssociatesДокумент28 страницV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaОценок пока нет

- ITR-2 Indian Income Tax Return: Part A-GENДокумент10 страницITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalОценок пока нет

- Assessment Year Sahaj Indian Income Tax ReturnДокумент1 страницаAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaОценок пока нет

- 2011 - ITR2 - r6Документ33 страницы2011 - ITR2 - r6Bathina Srinivasa RaoОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент8 страницITR-3 Indian Income Tax Return: Part A-GENRahul SharmaОценок пока нет

- ITR-2 Indian Income Tax Return: Part A-GENДокумент12 страницITR-2 Indian Income Tax Return: Part A-GENMankamesachinОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент7 страницITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeОценок пока нет

- Indian Numbering SystemДокумент8 страницIndian Numbering SystemelangomduОценок пока нет

- Form 16, Tax Deduction at Source... Income Tax of IndiaДокумент2 страницыForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент7 страницITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Оценок пока нет

- 1701 Bir FormДокумент12 страниц1701 Bir Formbertlaxina0% (1)

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearДокумент7 страницItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraОценок пока нет

- Form 16 Word FormatДокумент4 страницыForm 16 Word FormatVenkee SaiОценок пока нет

- Bir Form 1701Документ12 страницBir Form 1701miles1280Оценок пока нет

- Form 16Документ4 страницыForm 16Aruna Kadge JhaОценок пока нет

- Tax Applicable (Tick One) 2 8 1Документ7 страницTax Applicable (Tick One) 2 8 1Gaurav BajajОценок пока нет

- ITR-3 Indian Income Tax Return: Part A-GENДокумент7 страницITR-3 Indian Income Tax Return: Part A-GENAvani GadaОценок пока нет

- Bir Forms PDFДокумент4 страницыBir Forms PDFgaryОценок пока нет

- Summary of Tax Deducted at Source: TotalДокумент2 страницыSummary of Tax Deducted at Source: Totaladithya604Оценок пока нет

- 82255BIR Form 1701Документ12 страниц82255BIR Form 1701Leowell John G. RapaconОценок пока нет

- Itr 2Документ9 страницItr 2Arvind PaulОценок пока нет

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtДокумент6 страницIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiОценок пока нет

- 2016 Itr4 PR3Документ165 страниц2016 Itr4 PR3TejasОценок пока нет

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryОт EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОт EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryОт EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryОценок пока нет

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОт EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- 11 12 ReportДокумент2 страницы11 12 ReportallipraОценок пока нет

- AnalДокумент1 страницаAnalallipraОценок пока нет

- Types: BusinessДокумент2 страницыTypes: BusinessallipraОценок пока нет

- Mes Mampad College: Internal Mark ListДокумент44 страницыMes Mampad College: Internal Mark ListallipraОценок пока нет

- SwamiДокумент2 страницыSwamiallipraОценок пока нет

- The Boston Globe - March 14, 2019Документ40 страницThe Boston Globe - March 14, 2019Deepak NopanyОценок пока нет

- Laguna State Polytechnic University: Course Sem/AyДокумент7 страницLaguna State Polytechnic University: Course Sem/AyShaine Cariz Montiero SalamatОценок пока нет

- Blessing ShopДокумент3 страницыBlessing ShopTony KayalaОценок пока нет

- Examining Attorney Refusal - No 87884420Документ7 страницExamining Attorney Refusal - No 87884420jmollodОценок пока нет

- DeKalb County, GA, Technical Zoning MemoДокумент2 страницыDeKalb County, GA, Technical Zoning MemoGet the Cell Out - Atlanta ChapterОценок пока нет

- Dune Universe Reading OrderДокумент4 страницыDune Universe Reading OrderCarter RewopОценок пока нет

- SIM7500 - SIM7600 Series - Jamming Detection - Application Note - V3.00Документ8 страницSIM7500 - SIM7600 Series - Jamming Detection - Application Note - V3.00AlbertoGonzálezОценок пока нет

- Asking About and Giving DirectionsДокумент4 страницыAsking About and Giving DirectionsCsatlós TímeaОценок пока нет

- Movie Critics Assignment - Little WomenДокумент16 страницMovie Critics Assignment - Little Womenclara anglnaОценок пока нет

- Deep Delusions, Bitter TruthДокумент44 страницыDeep Delusions, Bitter Truthcirqueminime100% (2)

- RAMOS, LOUWELLA 2 BN International Health Information Regulatory BodiesДокумент2 страницыRAMOS, LOUWELLA 2 BN International Health Information Regulatory BodiesLouwella RamosОценок пока нет

- Zero Hour: How Lawyers Are Responding To The Climate Emergency Ahead of November's COP26 ShowdownДокумент40 страницZero Hour: How Lawyers Are Responding To The Climate Emergency Ahead of November's COP26 ShowdownRabia BegumОценок пока нет

- NEOM Minor Works - ITT-19112023Документ9 страницNEOM Minor Works - ITT-1911202301095902062ahmedОценок пока нет

- Opm Part A Volume 1 EngДокумент368 страницOpm Part A Volume 1 EngLego EdrisaОценок пока нет

- SUMMARIESДокумент71 страницаSUMMARIESstarhorsesОценок пока нет

- Prelims 2022 Question With Answer Key - A SeriesДокумент36 страницPrelims 2022 Question With Answer Key - A SeriesKarthi KannanОценок пока нет

- Principles of Accounts SbaДокумент21 страницаPrinciples of Accounts SbaOrane CassanovaОценок пока нет

- Quantitative Assessment of Sustainable Development and Growth in Sub-Saharan AfricaДокумент168 страницQuantitative Assessment of Sustainable Development and Growth in Sub-Saharan AfricaCharles Jude IsonОценок пока нет

- Furniture of The Olden Time (1917) PDFДокумент508 страницFurniture of The Olden Time (1917) PDFpatatitoОценок пока нет

- Capability StatementДокумент1 страницаCapability StatementAditya PaiОценок пока нет

- Quality Circles and Teams-Tqm NotesДокумент8 страницQuality Circles and Teams-Tqm NotesStanley Cheruiyot100% (1)

- Internship Outcome/issues Analysis 3.1: Challenged Faced in The WorkplaceДокумент4 страницыInternship Outcome/issues Analysis 3.1: Challenged Faced in The WorkplaceAhmed HossainОценок пока нет

- Sundance UFOДокумент13 страницSundance UFOAnandaОценок пока нет

- Lesson 2 - Contract of EmploymentДокумент34 страницыLesson 2 - Contract of EmploymentPoopОценок пока нет

- "Job Evaluation"Документ68 страниц"Job Evaluation"Anusha Reddy100% (2)

- Tourism Class 1Документ23 страницыTourism Class 1gowthami mОценок пока нет

- Chapter 1 - Twelfth Night - Why Shakespeare (Revised)Документ13 страницChapter 1 - Twelfth Night - Why Shakespeare (Revised)hudhoud.93Оценок пока нет

- Pop SP PDFДокумент93 страницыPop SP PDFkkkОценок пока нет

- Bingham InstructionsДокумент44 страницыBingham InstructionsDzung Tran33% (3)

- Quality Throughout History: Quality Across All CulturesДокумент5 страницQuality Throughout History: Quality Across All CulturesAldemer Laron BoretaОценок пока нет