Академический Документы

Профессиональный Документы

Культура Документы

JKSW - Icmd 2009 (B11)

Загружено:

IshidaUryuuОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

JKSW - Icmd 2009 (B11)

Загружено:

IshidaUryuuАвторское право:

Доступные форматы

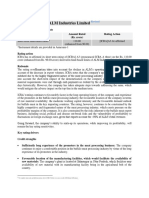

PTJakartaKyoeiSteelWorksTbk.

Business

Steel

CompanyStatus

PMDN

Underwriter

PTMashillJayaSecurities

Shareholder

2000

PTDivisiMultiSejati

PTMatahariDiptanusa

Public

2001

36.60% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

34.73% TheeNingKhong

Public

2005

PTDevisiMultiSejahtera

PTMatahariDiptanusa

TheeNingKhong

Public

2006

36.67% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

33.33% Public

2002

36.67% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

33.33% Public

2007

30.56% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

39.44% Public

2003

36.67% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

33.33% Public

2008

30.56% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

39.44% Public

2004

36.67% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

33.33% Public

36.67%

28.67%

1.33%

33.33%

2009

30.56% PTDevisiMultiSejahtera

28.67% PTMatahariDiptanusa

1.33% TheeNingKhong

39.44% Public

30.56%

28.67%

1.33%

39.44%

Management & Number of Employees

Board of Commissioners

Board of Directors

Number of Employees

2000 President Commissioner

Commissioners

Thee Ning Khong

The Wai Ping Rebecca, Ridwan Usman

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Gunadi Sularko

318

2001 President Commissioner

Commissioners

Thee Ning Khong

Ridwan Usman

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Gunadi Sularko

200

2002 President Commissioner

Commissioners

Thee Ning Khong

Sartomo

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Gunadi Sularko

200

2003 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

200

2004 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

198

2005 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

198

2006 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

198

2007 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

201

2008 President Commissioner

Commissioners

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Directors

Directors

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

192

2009 President Commissioner

Commissioner

Thee Ning Khong

Drs. Fuad Djafar

President Director

Vice President Director

Director

Muhammad Djauhari, MBA

The Kwen Ie

Harry Lasmono Hartawan

174

1998

1999

2000

Total Assets

Current Assets

of which

Cash on hand and in banks

Cash and cash equivalents

Short-term investment

Trade receivables

Inventories

Trade receivable from affiliates

Advances

Non-current Assets

of which

Fixed Asset Net

Deffered Tax Assets-Net

Investments

Other Assets

408,710

218,363

377,953

101,501

310,187

90,296

2,160

659

362

Liabilities

Current Liabilities

of which

Bank loans

Bank borrowings

Short-term debts

Taxes payable

Trade payables

Accrued expenses

Current maturities of

long-term debt

Long-term Liabilities

of which

Bank borrowings

Non-Current Liabilities

Minority Interests in Subsidiaries

(million rupiah)

2001

2002

2003

2004

2005

383,165

154,482

538,583

254,119

376,676

117,430

309,187

117,632

289,447

110,097

470

649

729

636

440

71,290

64,710

85,891

14,336

84,539

4,990

129,970

23,609

224,623

27,354

91,763

24,120

97,870

9,493

82,256

19,494

184,010

200,249

97,309

99,246

284,464

259,246

191,555

179,350

91,222

100,116

87,935

83,616

48,871

52,428

6,336

76,202

122,583

129,436

48,125

39,324

1,695

1,662

1,240

1,257

536,989

497,622

558,046

526,888

699,528

692,584

852,544

808,215

901,684

885,413

701,558

685,230

675,505

659,125

648,612

25,717

384,752

397,892

391,262

375,452

636,548

568,543

588,226

37,414

39,122

22,186

66,706

29,598

224,583

105,000

278,585

196,908

51,956

66,931

9,346

68,625

753

125

23,554

953

39,366

31,158

6,944

44,329

16,271

16,328

16,380

622,895

Shareholders' Equity

Paid-up capital

Paid-up capital

in excess of par value

Revaluation of fixed assets

Retained earnings (accumulated loss)

(128,279)

75,000

(180,093)

75,000

(389,342)

75,000

(469,379)

75,000

(363,101)

75,000

(324,882)

75,000

(366,318)

75,000

(359,165)

75,000

7,500

38

(210,817)

4,846

38

(259,978)

4,846

38

(469,226)

4,846

38

(549,263)

4,846

38

(442,985)

4,846

38

(404,767)

4,846

38

(446,202)

4,846

38

(439,049)

Net Sales

Cost of Good Sold

Gross Profit

Operating Expenses

Operating Profit

Other Income (Expenses)

Profit (Loss) before Taxes

Profit (Loss) after Taxes

148,724

92,693

56,031

31,250

24,781

(202,686)

(177,905)

(177,905)

51,063

48,794

2,269

3,691

(1,422)

(43,916)

(45,338)

(45,200)

17,439

22,001

(4,562)

18,804

(23,366)

(225,200)

(248,567)

(209,248)

30,476

34,713

(4,237)

2,854

(7,090)

(73,193)

(80,283)

(80,038)

189,413

185,545

3,868

3,864

4

33,997

34,002

23,516

105,893

111,053

(5,160)

4,395

(9,555)

10,706

54,719

38,219

87,332

73,228

14,104

12,792

1,312

(20,784)

(10,247)

(41,435)

110,185

93,282

16,902

6,737

10,166

(11,592)

25,211

10,622

Per Share Data (Rp)

Earnings (Loss) per Share

Equity per Share

Dividend per Share

Closing Price

(1,186)

(855)

500

(301)

(1,201)

275

(1,395)

(2,596)

70

(534)

(3,129)

25

157

(2,421)

n.a

15

255

(2,166)

n.a

40

(276)

(2,442)

n.a

65

71

(2,394)

n.a

65

(0.42)

(0.58)

-

(0.91)

(0.23)

-

(0.05)

(0.03)

-

(0.05)

(0.01)

-

0.10

(0.01)

n.a

n.a

0.16

(0.02)

n.a

n.a

(0.24)

(0.03)

n.a

n.a

0.92

(0.03)

n.a

n.a

0.44

n.a.

1.31

0.38

0.17

n.a.

1.43

0.36

(43.53)

n.a.

0.19

n.a.

1.48

0.04

n.a.

n.a.

3.40

0.14

(11.96)

(25.10)

0.13

n.a.

2.26

n.a.

n.a.

n.a.

4.41

0.06

(67.46)

(53.74)

0.19

n.a.

2.23

n.a.

n.a.

n.a.

1.47

0.08

(20.89)

(17.05)

0.29

n.a.

1.67

0.02

n.a.

0.12

6.78

0.35

4.37

6.48

0.17

n.a.

1.86

n.a

n.a.

0.36

4.60

0.28

10.15

11.76

0.18

n.a.

2.18

0.16

1.50

n.a.

7.71

0.28

(13.40)

(11.31)

4.28

n.a.

2.24

0.15

9.23

0.10

4.79

0.38

3.67

2.96

1998

1999

(7.53)

40.39

(65.67)

(74.59)

2000

(17.93)

116.19

(65.85)

362.94

2001

23.53

20.56

74.76

(61.75)

2003

(30.06)

(10.53)

(44.09)

62.52

2004

(17.92)

12.75

(17.53)

(208.41)

Financial Ratios

PER (x)

PBV (x)

Dividend Payout (%)

Dividend Yield (%)

Current Ratio (x)

Debt to Equity (x)

Leverage Ratio (x)

Gross Profit Margin (x)

Operating Profit Margin (x)

Net Profit Margin (x)

Inventory Turnover (x)

Total Assets Turnover (x)

ROI (%)

ROE (%)

1

2

3

4

Growth (%)

Indicators

Total Asset

Share Holder's Equity

Net Sales/Revenue

Net Provit

2002

40.56

(22.64)

521.52

(129.38)

2005

(6.38)

(1.95)

26.17

(125.64)

SUMMARY OF FINANCIAL STATEMENT

PT. Jakarta Kyoei Steel Works Limited (JKSW)

2006

(millionrupiah)

2007

2008

TotalAssets

CurrentAssets

ofwhich

Cashandcashequivalents

Tradereceivables

Inventories

NonCurrentAssets

ofwhich

FixedAssetsNet

DefferedTaxAssets

OtherAssets

263,493

103,196

290,140

146,127

300,345

150,710

594

84,609

10,125

160,297

803

115,011

29,056

144,013

386

100,504

48,468

149,635

47,523

19,694

1,232

47,315

16,901

1,244

47,167

29,010

1,293

Liabilities

CurrentLiabilities

ofwhich

TaxesPayable

Tradepayables

Accruedexpenses

NonCurrentLiabilities

617,095

12,967

678,743

65,086

718,864

67,265

713

10,268

900

604,128

239

62,591

1,169

613,657

70

65,696

426

651,599

Shareholders'Equity

Paidupcapital

Paidupcapital

inexcessofparvalue

Revolutionoffixedassets

Retainedearnings(accumulatedloss)

(353,602)

75,000

(388,604)

75,000

(418,519)

75,000

4,846

38

(433,486)

4,846

38

(468,488)

4,846

n.a

(498,365)

NetSales

CostofGoodsSold

GrossProfit(Loss)

OperatingExpenses

OperatingProfit(Loss)

OtherIncome(Expenses)

Profit(Loss)beforeTaxes

Profit(Loss)afterTaxes

125,853

107,664

18,189

10,066

8,123

17,070

25,194

5,563

131,285

121,966

9,319

33,280

(23,961)

(8,248)

(32,209)

(35,002)

190,057

169,586

20,471

26,768

(6,297)

(35,728)

(42,025)

(29,916)

37

(2,357)

n.a

145

(233)

(2,591)

n.a

240

(199)

(2,790)

n.a

85

FinancialRatios

PER(x)

PBV(x)

DividendPayout(%)

DividendYield(%)

3.91

(0.06)

n.a

n.a

(1.03)

(0.09)

n.a

n.a

(0.43)

(0.03)

n.a

n.a

CurrentRatio(x)

DebttoEquity(x)

LeverageRatio(x)

GrossProfitMargin(x)

OperatingProfitMargin(x)

NetProfitMargin(x)

InventoryTurnover(x)

TotalAssetsTurnover(x)

ROI(%)

ROE(%)

7.96

n.a.

2.34

0.14

6.45

0.04

10.63

0.48

2.11

1.57

2.25

n.a.

2.34

0.07

n.a

n.a

4.20

0.45

(12.06)

(9.01)

2.24

n.a.

2.39

0.11

n.a

n.a

3.50

0.63

(9.96)

(7.15)

PerShareData(Rp)

Earnings(Loss)perShare

EquityperShare

DividendperShare

ClosingPrice

PER=0.51x;PBV=0.03x(June2009)

FinancialYear:December31

PublicAccountant:S.Mannan,Sofwan,Adnan&Co.(2007);

Achmad,Rasyid,Hisbullah&Jerry(2008)

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Tobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаTobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- Myrx - Icmd 2009 (B04)Документ4 страницыMyrx - Icmd 2009 (B04)IshidaUryuuОценок пока нет

- PT Ever Shine Tex TBK.: Summary of Financial StatementДокумент2 страницыPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuОценок пока нет

- Adhesive company rankings by total assets and net profits 2011-2012Документ1 страницаAdhesive company rankings by total assets and net profits 2011-2012IshidaUryuuОценок пока нет

- PT Kabelindo Murni TBK.: Summary of Financial StatementДокумент2 страницыPT Kabelindo Murni TBK.: Summary of Financial StatementIshidaUryuuОценок пока нет

- Directory 2011Документ88 страницDirectory 2011Davit Pratama Putra KusdiatОценок пока нет

- Stone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаStone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- Cement Company Asset & Profit Rankings 2011-2012Документ1 страницаCement Company Asset & Profit Rankings 2011-2012IshidaUryuuОценок пока нет

- JPRS - Icmd 2009 (B11)Документ4 страницыJPRS - Icmd 2009 (B11)IshidaUryuuОценок пока нет

- PT Nusantara Inti Corpora Tbk Financial Performance 1988-2011Документ2 страницыPT Nusantara Inti Corpora Tbk Financial Performance 1988-2011IshidaUryuuОценок пока нет

- Indr - Icmd 2009 (B04)Документ4 страницыIndr - Icmd 2009 (B04)IshidaUryuuОценок пока нет

- PT Chandra Asri Petrochemical TBKДокумент2 страницыPT Chandra Asri Petrochemical TBKIshidaUryuuОценок пока нет

- Bima PDFДокумент2 страницыBima PDFIshidaUryuuОценок пока нет

- Cable Companies Net Profit & Asset Rankings 2011-2012Документ1 страницаCable Companies Net Profit & Asset Rankings 2011-2012IshidaUryuuОценок пока нет

- Construction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаConstruction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- Automotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаAutomotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- YpasДокумент2 страницыYpasIshidaUryuuОценок пока нет

- Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Документ1 страницаRanking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuОценок пока нет

- Animal FeedДокумент1 страницаAnimal FeedIshidaUryuuОценок пока нет

- AaliДокумент2 страницыAaliSeprinaldiОценок пока нет

- Agriculture PDFДокумент1 страницаAgriculture PDFIshidaUryuuОценок пока нет

- YpasДокумент2 страницыYpasIshidaUryuuОценок пока нет

- Adhesive company rankings by total assets and net profits 2011-2012Документ1 страницаAdhesive company rankings by total assets and net profits 2011-2012IshidaUryuuОценок пока нет

- PT Unitex Tbk Financial Performance and Shareholder SummaryДокумент2 страницыPT Unitex Tbk Financial Performance and Shareholder SummaryIshidaUryuuОценок пока нет

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementДокумент2 страницыPT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuОценок пока нет

- AbbaДокумент2 страницыAbbaIshidaUryuuОценок пока нет

- UnvrДокумент2 страницыUnvrIshidaUryuuОценок пока нет

- VoksДокумент2 страницыVoksIshidaUryuuОценок пока нет

- PT Kalbe Farma TBK.: Summary of Financial StatementДокумент2 страницыPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Titan Q3FY22Документ12 страницTitan Q3FY22Ranjan PrakashОценок пока нет

- Donam Corporate FinanceДокумент9 страницDonam Corporate FinanceMAGOMU DAN DAVIDОценок пока нет

- Corporate Actions - Dividends, Bonus, Splits, Buyback EtcДокумент37 страницCorporate Actions - Dividends, Bonus, Splits, Buyback Etcagrawal.minОценок пока нет

- ExercisesДокумент5 страницExercisesSandip GhoshОценок пока нет

- Partnership Agreement TemplateДокумент12 страницPartnership Agreement TemplateNaymul AlamОценок пока нет

- Nestle Income Statement & Balance SheetДокумент10 страницNestle Income Statement & Balance SheetDristi SinghОценок пока нет

- Feu Sec Form 17 A - 2013-2014Документ273 страницыFeu Sec Form 17 A - 2013-2014allanrnmanalotoОценок пока нет

- Financial Accounting and Reporting Review Questions - Week 2Документ15 страницFinancial Accounting and Reporting Review Questions - Week 2Fery AnnОценок пока нет

- Salary Slip FormatДокумент8 страницSalary Slip Formatshrija nairОценок пока нет

- Fundamental & Technical Analysis of Indian Automobile IndustryДокумент72 страницыFundamental & Technical Analysis of Indian Automobile IndustryAMAL RAJОценок пока нет

- TVI Express PresentationДокумент70 страницTVI Express PresentationNito Fonacier II100% (1)

- Financial Statement Analysis On APEX and Bata Shoe CompanyДокумент12 страницFinancial Statement Analysis On APEX and Bata Shoe CompanyLabiba Farah 190042118Оценок пока нет

- Strat Cost PAA1Документ12 страницStrat Cost PAA1Katrina Jesrene DatoyОценок пока нет

- Financial Analysis AssignmentДокумент5 страницFinancial Analysis AssignmentSaifiОценок пока нет

- MAA Textile SME Rating ReportДокумент8 страницMAA Textile SME Rating ReportMd. Nazrul Islam BhuiyanОценок пока нет

- Invest Like Koon Yew Yin - Learn How A Philanthropist Amasses A Huge Fortune From Investments in Malaysia Stock Market PDFДокумент277 страницInvest Like Koon Yew Yin - Learn How A Philanthropist Amasses A Huge Fortune From Investments in Malaysia Stock Market PDFJJОценок пока нет

- Bustax Chap 3 QuizДокумент3 страницыBustax Chap 3 QuizTeam Mindanao100% (1)

- ALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating ActionДокумент6 страницALM Industries Limited: Summary of Rated Instruments Instruments Amount Rated (Rs. Crore) Rating Actionsgr_kansagraОценок пока нет

- CE1401 EstimationandQuantitySurveyingДокумент28 страницCE1401 EstimationandQuantitySurveyingTarak A Positive100% (5)

- You Recently Graduated From College and Your Job Search LedДокумент2 страницыYou Recently Graduated From College and Your Job Search LedAmit PandeyОценок пока нет

- CA IPCC Branch AccountsДокумент19 страницCA IPCC Branch AccountsAkash Gupta75% (4)

- Wells Fargo Expresssend Remittance Transfer RecordДокумент1 страницаWells Fargo Expresssend Remittance Transfer RecordCarlos Eduardo Najera Farias100% (1)

- Financial Accounting - M1 NotesДокумент15 страницFinancial Accounting - M1 NotesSana BajpaiОценок пока нет

- Practice Question On Group AccountsДокумент12 страницPractice Question On Group Accountsemerald75% (4)

- Fsa 2014 18 PDFДокумент242 страницыFsa 2014 18 PDFTuu TueОценок пока нет

- Performance Measurement II Differential Analysis: The Key To Decision Making - Part IДокумент53 страницыPerformance Measurement II Differential Analysis: The Key To Decision Making - Part IWai Ying LaiОценок пока нет

- Cognizant Payslip for Feb 2023Документ1 страницаCognizant Payslip for Feb 2023B G B S KumarОценок пока нет

- Test Bank Chap 009Документ19 страницTest Bank Chap 009BẢO CHÂU GIAОценок пока нет

- Accounting Conservatism and Cost of Equity Capital Evidence From IndonesiaДокумент9 страницAccounting Conservatism and Cost of Equity Capital Evidence From IndonesiaMstefОценок пока нет

- Form PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Документ4 страницыForm PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Joy100% (1)