Академический Документы

Профессиональный Документы

Культура Документы

Impact of US Judicial Interpretations in Global Credit Risk

Загружено:

Eduardo PetazzeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Impact of US Judicial Interpretations in Global Credit Risk

Загружено:

Eduardo PetazzeАвторское право:

Доступные форматы

Impact of US Judicial Interpretations in Global Credit Risk

Eduardo Petazze The recent decision by U.S. courts regarding interpretation of the equal treatment clause (pari passu), and additionally, the imposition on financial agents -in charge of distributing the payments from the debtor- for the retention of amounts sufficient to meet to treatment parity clauses, are having and continue to have a significant effect on increasing the risk premium of international financial institutions and countries with high debt exposure. The odds that the U.S. Supreme Court agrees to analyze the sentence, and, in any case, to reverse the decisions of the lower courts is very low. The Argentina, is pushing for a new law, protective measures in favor of the bondholders under foreign jurisdiction, both for holdouts and to performance bonds. Possible new sovereign debt crisis could significantly reduce the degrees of freedom of any country to offer -with some probability of success- a restructuring of its debt, including reductions, time extensions, adjustment of interest rates, etc.. Indeed, the interpretation of American law (even if the case of Argentina was not a precedent), protects the rights of the creditor against the claims of a debtor (including sovereign) to decide to restructure its debt. In that sense, the creditors will not be compelled to accept the proposed swaps. Additionally, sovereign debtor is required to produce a negative pledge, as is demonstrating its inability to improve an offer or afford the payment due on the agreed conditions. Because they are inevitable sovereign debt crisis occur from time to time, the international community should work on two essential aspects to prevent or mitigate systemic effects A set of rules, issued under the auspices of an international body to establish the mechanisms for self-declaration of "bankruptcy" of a sovereign issuer, and the rights and obligations of unsecured creditors, up to that statement. Such kind of rules may be referenced by each country in its future debt issues A limitation, as recommended by the Deutsche Bundesbank, to limit tenure (for computing capital adequacy) of sovereign-debt by financial institutions. The analysis of the impact of the proposal of the Bundesbank should be done with haste, ensuring that a possible implementation of such a limitation does not end up creating a problem of liquidity in debt securities issued or ability of new funding for the public deficit. It is not advisable to await the decision of the Supreme Court or speculate that the international impact of the case against Argentina end up being limited.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

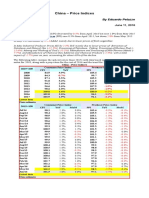

- China - Price IndicesДокумент1 страницаChina - Price IndicesEduardo PetazzeОценок пока нет

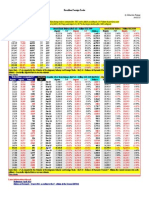

- WTI Spot PriceДокумент4 страницыWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Документ1 страницаMéxico, PBI 2015Eduardo PetazzeОценок пока нет

- Brazilian Foreign TradeДокумент1 страницаBrazilian Foreign TradeEduardo PetazzeОценок пока нет

- Retail Sales in The UKДокумент1 страницаRetail Sales in The UKEduardo PetazzeОценок пока нет

- U.S. New Residential ConstructionДокумент1 страницаU.S. New Residential ConstructionEduardo PetazzeОценок пока нет

- Euro Area - Industrial Production IndexДокумент1 страницаEuro Area - Industrial Production IndexEduardo PetazzeОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Actsc 612 A31Документ14 страницActsc 612 A31R Nurul QAОценок пока нет

- Mahatma Gandhi University Mba SyllabusДокумент188 страницMahatma Gandhi University Mba SyllabusTony JacobОценок пока нет

- Mastering R For Quantitative Finance - Sample ChapterДокумент40 страницMastering R For Quantitative Finance - Sample ChapterPackt Publishing100% (1)

- Chapter-14 Accounting For Not For Profit Organization PDFДокумент6 страницChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BОценок пока нет

- Introduction To Income TaxДокумент215 страницIntroduction To Income Taxvikashkumar657Оценок пока нет

- PERMATA ILTIZAM SDN BHD-SME ScoreДокумент8 страницPERMATA ILTIZAM SDN BHD-SME ScoreFazlisha ShaharizanОценок пока нет

- Patti B Saris Financial Disclosure Report For 2010Документ64 страницыPatti B Saris Financial Disclosure Report For 2010Judicial Watch, Inc.Оценок пока нет

- Kukreja Institute of Hotel Management and Catering Technology Internal Examination Paper 2012 M.M. - 100 Front Office, B.H.M. 1 SEM TIME-3 HrsДокумент1 страницаKukreja Institute of Hotel Management and Catering Technology Internal Examination Paper 2012 M.M. - 100 Front Office, B.H.M. 1 SEM TIME-3 HrsSumit PratapОценок пока нет

- E Filing Income Tax Return OnlineДокумент53 страницыE Filing Income Tax Return OnlineMd MisbahОценок пока нет

- Spes Form 5 - Placement Report Cum Gsis - Dec2016Документ1 страницаSpes Form 5 - Placement Report Cum Gsis - Dec2016Joel AndalesОценок пока нет

- SaharaДокумент14 страницSaharaSunnyVermaОценок пока нет

- List of Contents: Rayalaseema Hypo Hi-StrengthДокумент57 страницList of Contents: Rayalaseema Hypo Hi-StrengthShams SОценок пока нет

- Balance Sheet of Indian Oil Corporation PDFДокумент5 страницBalance Sheet of Indian Oil Corporation PDFManpreet Kaur SekhonОценок пока нет

- Residency ReportДокумент83 страницыResidency ReportaromamanОценок пока нет

- Fund Flow StatementДокумент17 страницFund Flow StatementPrithikaОценок пока нет

- HSBC V PB TrustДокумент3 страницыHSBC V PB Trustrgtan3Оценок пока нет

- Law of InsuranceДокумент7 страницLaw of InsuranceJack Dowson100% (1)

- Climate Resilience - World Resources InstituteДокумент13 страницClimate Resilience - World Resources Institutegilberto777Оценок пока нет

- UnpaidDividend 2009 2010Документ49 страницUnpaidDividend 2009 2010harsh bangurОценок пока нет

- Lilac Flour Mills - FinalДокумент9 страницLilac Flour Mills - Finalrahulchohan2108Оценок пока нет

- Cheques: Features of A ChequeДокумент12 страницCheques: Features of A ChequebushrajaleelОценок пока нет

- All Fiori ApplicationДокумент49 страницAll Fiori ApplicationRehan KhanОценок пока нет

- PDFДокумент4 страницыPDFAhmad SulaimanОценок пока нет

- Henry vs. Structured Investments Co.Документ9 страницHenry vs. Structured Investments Co.pbsneedtoknowОценок пока нет

- 3 Departmental AccountsДокумент13 страниц3 Departmental AccountsJayesh VyasОценок пока нет

- Midterm Test No2 - JIB60 1Документ1 страницаMidterm Test No2 - JIB60 1k60.2112520041Оценок пока нет

- Abhishek ReportДокумент67 страницAbhishek ReportAbhishek KarОценок пока нет

- Project Report On Cash Management of State Bank of SikkimДокумент39 страницProject Report On Cash Management of State Bank of Sikkimdeivaram50% (10)

- Fincial Statement AnalysisДокумент41 страницаFincial Statement AnalysisAziz MoizОценок пока нет

- Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Документ111 страницHorngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Sally MillerОценок пока нет