Академический Документы

Профессиональный Документы

Культура Документы

Executive Summary Ravi

Загружено:

Aditya VermaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Executive Summary Ravi

Загружено:

Aditya VermaАвторское право:

Доступные форматы

EXECUTIVE SUMMARY Investment in mutual funds gives you exposure to equity and debt markets.

These funds are marketed as a safe haven or as smart investment vehicles for novice investors. The middle-class Indian investor who plays hot tips for a quick buck at the bourses is the stuff of legends. The middle-class Indian investor who runs out of luck and loses not only his money but his peace of mind too is somewhat less famous by choice. Mutual funds, on the other hand, sell us middling miracles. Consequently proof enough for a research on Mutual Funds, which has exacting returns.

Every investor requires a healthy return on his/her investments. But since the market is very volatile and due to lack of expertise they may fail to do so. So a study of these mutual funds will help one to equip with unwarranted knowledge about the elements that help trade between risk and return thereby improving effectiveness. A meticulous study on the scalability at which the mutual funds operate along with diagnosis of the market conditions would endure managing the investment portfolio efficiently. Investment is a sensitive concept, any investor whether professional or individual needs to be very careful while investing and getting decent return. Stock markets which gives good returns in the long run does also has huge amount of risk, it is challenging task for professionals to get the expected rate of return from their investments. Individual investors who invest their hard earned money in equities burn their fingers due to lack of conceptual knowledge. Some investors who are risk averse go for Mutual Funds. So, it is very important to check whether Mutual Funds yield the expected returns to the investors, it is obvious as this pint of that a question strikes to our mind as to why only some Mutual Funds give good returns than other Mutual Fund Companies. The point is what makes the successful Mutual Fund Companies to give comparatively. There may be many factors which contribute for yielding returns.

So in the above context the first point seems to be more appropriate answer to the questions to why only some Mutual Fund Companies give higher returns. The Study was conducted to compare the performance of Diversified Equity Funds Return with their Benchmarks, SENSEX and Nifty.

The rise in the level of capital market has manifested the importance Mutual Funds as investment medium. Mutual Funds are now are becoming a preferred investment destination for the investors as fund houses offer not only the expertise in managing funds but also a host of other services.

Total Assets Under Management (AUM) in India as of today is around $100b. Volatile markets and year end accounting considerations have shaved 6% off in March, but much of that money should flow back in April. The next five years will see the Indian Asset Management business grow at least 33% annually says a study by McKinsey.

Investors money inflow to mutual funds has sidelined for the time being but the overall long term fundamental outlook on the economy remains intact. To lower the impact of volatility one can stay invested in diversified equity funds over a longer period of time through the route of Systematic Investment Plan. The following are many factors which may have contributed higher returns. 1. Less fees and expenses. 2. Conservative (less risk fund Manager) 3. Use of hedging techniques 4. Fund managers prediction or forecasting of securities movement ability.

Вам также может понравиться

- Bhavesh Sawant Bhuvan DalviДокумент8 страницBhavesh Sawant Bhuvan DalviBhuvan DalviОценок пока нет

- Mutual FundsДокумент37 страницMutual FundsGokul KrishnanОценок пока нет

- Mutual Fund ProjectДокумент70 страницMutual Fund ProjectPranali ahirraoОценок пока нет

- Comparative Analysis of ICICI and SBI Mutual FundДокумент21 страницаComparative Analysis of ICICI and SBI Mutual FundNitish KharatОценок пока нет

- Study of Mutual FundДокумент106 страницStudy of Mutual Fundmadhumaddy20096958Оценок пока нет

- Theoretical Framework Mutual Fund DefinedДокумент14 страницTheoretical Framework Mutual Fund Definedsheeba chigurupatiОценок пока нет

- Introduction of Mutual FundДокумент17 страницIntroduction of Mutual FundParas Upreti100% (1)

- SBI Mutual FundДокумент88 страницSBI Mutual FundSubramanya Dg100% (1)

- Mutual FundsДокумент50 страницMutual FundsrajeshОценок пока нет

- A Study On Mutual Funds in IndiaДокумент40 страницA Study On Mutual Funds in IndiaYaseer ArafathОценок пока нет

- An Empirical Study of Factors Affecting Sales of Mutual Funds Companies in IndiaДокумент289 страницAn Empirical Study of Factors Affecting Sales of Mutual Funds Companies in Indiashradha srivastavaОценок пока нет

- A Study On Risk and Return of Selected Mutual Funds Through Integrated Enterprises (India) LTDДокумент68 страницA Study On Risk and Return of Selected Mutual Funds Through Integrated Enterprises (India) LTDMakkuMadhaiyanОценок пока нет

- Comparative Study On MF and FDДокумент6 страницComparative Study On MF and FDamrita thakur100% (1)

- Pratik BBДокумент74 страницыPratik BBPratik PadmanabhanОценок пока нет

- A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanДокумент19 страницA Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanVandita KhudiaОценок пока нет

- India Infoline (Awarness About The Mutual Fund)Документ95 страницIndia Infoline (Awarness About The Mutual Fund)c_nptl50% (2)

- RamanДокумент50 страницRamanAlisha SharmaОценок пока нет

- Mutual FundsДокумент16 страницMutual Fundsvirenshah_9846Оценок пока нет

- Mutual FundsДокумент3 страницыMutual Fundssaurabh dixitОценок пока нет

- Questionnaire On Mutual FundsДокумент5 страницQuestionnaire On Mutual Fundsriteshjindal19875008Оценок пока нет

- A Study On Different Mutual Funds Providers in IndiaДокумент121 страницаA Study On Different Mutual Funds Providers in IndiaRajesh BathulaОценок пока нет

- Mutual Fund: An Attractive Investment OptionДокумент117 страницMutual Fund: An Attractive Investment OptionMohammad FaizanОценок пока нет

- Introduction To Investment Management: Bond, Real Estate, Mortgages EtcДокумент25 страницIntroduction To Investment Management: Bond, Real Estate, Mortgages EtcRavi GuptaОценок пока нет

- Investment Avenue Research PaperДокумент3 страницыInvestment Avenue Research Paperdeepika gawas100% (1)

- Mutual Fund Research PaperДокумент22 страницыMutual Fund Research Paperphani100% (1)

- Mutual Fund ProjectДокумент35 страницMutual Fund ProjectKripal SinghОценок пока нет

- Perception of People Towards Investment and VariousДокумент20 страницPerception of People Towards Investment and Variouscgs005Оценок пока нет

- A Project On Portfolio Management in Mutual Funds: Submitted BY Aarnesh Karamchandani PGДокумент87 страницA Project On Portfolio Management in Mutual Funds: Submitted BY Aarnesh Karamchandani PGDawarОценок пока нет

- Chapter-I: A Comparative Study of HDFC and ICICI Mutual FundДокумент52 страницыChapter-I: A Comparative Study of HDFC and ICICI Mutual FundSarva ShivaОценок пока нет

- Comparative Analysis of Mutual Funds - Kotak SecuritiesДокумент6 страницComparative Analysis of Mutual Funds - Kotak SecuritiesVasavi DaramОценок пока нет

- Uti - Investor's-Attitude-Towards-Uti-Mutual-FundsДокумент132 страницыUti - Investor's-Attitude-Towards-Uti-Mutual-Fundstrushna19Оценок пока нет

- Religare Mutual Fund ProjectДокумент44 страницыReligare Mutual Fund Projectsks4986100% (1)

- Project On MFДокумент43 страницыProject On MFAbhi Rajendraprasad100% (1)

- A Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesДокумент67 страницA Study On Mutual Fund: Comparison Between Equity Diversification and Sector Specific SchemesChethan.sОценок пока нет

- Mutual Fund InvstДокумент109 страницMutual Fund Invstdhwaniganger24Оценок пока нет

- A Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)Документ30 страницA Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)DowlathAhmedОценок пока нет

- Comparative Analysis of Mutual FundsДокумент27 страницComparative Analysis of Mutual FundsTajinder Pal Saini100% (7)

- Risk and Return Analysis of Mutual FundДокумент12 страницRisk and Return Analysis of Mutual FundMounika Ch100% (1)

- Comparison Between Some Debt Equity & Mutual FundsДокумент20 страницComparison Between Some Debt Equity & Mutual FundsJayesh PatelОценок пока нет

- Nitish SharmaДокумент59 страницNitish SharmaannnnmmmmmОценок пока нет

- Mutual FundДокумент28 страницMutual FundAnwar khanОценок пока нет

- Aditya Birla Mutual FundДокумент66 страницAditya Birla Mutual FundRohit Mittal0% (1)

- Mutual Fund Distribution ChannelsДокумент15 страницMutual Fund Distribution Channelsdurgeshnandan600240% (5)

- Project ReportДокумент57 страницProject ReportPAWAR0015Оценок пока нет

- Blackbook Project On Mutual FundsДокумент88 страницBlackbook Project On Mutual Fundssun1986Оценок пока нет

- A Study On Investor Preferences Towards Various Mutual FundsДокумент122 страницыA Study On Investor Preferences Towards Various Mutual FundsAnkit Agarwal60% (5)

- A Project Report On Mutual Fund As An Investment Avenue at NJ India InvestДокумент16 страницA Project Report On Mutual Fund As An Investment Avenue at NJ India InvestYogesh AroraОценок пока нет

- Akib BlackbookДокумент78 страницAkib BlackbookaditiОценок пока нет

- A Project Report ON ''A Study On Consumer Preference and Brand Loyalty Towards Ritika Securities"Документ34 страницыA Project Report ON ''A Study On Consumer Preference and Brand Loyalty Towards Ritika Securities"Gaurav SonkeshariyaОценок пока нет

- Investment in Mutual FundДокумент20 страницInvestment in Mutual FundAshish SrivastavaОценок пока нет

- Mutual Fund Project PrintДокумент79 страницMutual Fund Project PrintNirbhay KumarОценок пока нет

- A Study On Investors Perception Towards Investment in Mutual FundsДокумент56 страницA Study On Investors Perception Towards Investment in Mutual FundsVishwas DeveeraОценок пока нет

- Behavioral Study On Investor's Towards Mutual Funds With Special Reference To Bangalore InvestorsДокумент11 страницBehavioral Study On Investor's Towards Mutual Funds With Special Reference To Bangalore InvestorsAnonymous lAfk9gNPОценок пока нет

- Gamification in Consumer Research A Clear and Concise ReferenceОт EverandGamification in Consumer Research A Clear and Concise ReferenceОценок пока нет

- Capital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueОт EverandCapital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueОценок пока нет

- AIS SAP Course IntroДокумент3 страницыAIS SAP Course IntroAditya VermaОценок пока нет

- Carlsberg CGSRДокумент9 страницCarlsberg CGSRAditya VermaОценок пока нет

- Ioc Risk Management Policy For Hedging Oil InventoriesДокумент10 страницIoc Risk Management Policy For Hedging Oil InventoriesAditya VermaОценок пока нет

- 4 Exploratory Research Design-Secondary DataДокумент30 страниц4 Exploratory Research Design-Secondary DataAditya VermaОценок пока нет

- Business ProposalДокумент2 страницыBusiness ProposalAditya VermaОценок пока нет

- Innovation Intelligence Study 4 enДокумент176 страницInnovation Intelligence Study 4 enAditya VermaОценок пока нет

- Ented LaДокумент3 страницыEnted LaAditya VermaОценок пока нет

- Bloomberg Sample QuestionsДокумент7 страницBloomberg Sample QuestionsAditya Verma100% (1)

- Rahul Bhatia EntДокумент8 страницRahul Bhatia EntAditya VermaОценок пока нет

- 07 Constraint Management - KrajewskiДокумент38 страниц07 Constraint Management - KrajewskiAditya VermaОценок пока нет

- CRM Software Open Source CRM ERP EBINeutrinoR1 EnglishДокумент20 страницCRM Software Open Source CRM ERP EBINeutrinoR1 EnglishAditya VermaОценок пока нет

- Lecture - MIS-I: - Introduction To IS - Definitions of IS Etc. - IS OutputsДокумент26 страницLecture - MIS-I: - Introduction To IS - Definitions of IS Etc. - IS OutputsAditya VermaОценок пока нет

- Name: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateДокумент8 страницName: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateRegina PutriОценок пока нет

- Embedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)Документ46 страницEmbedding Neoliberalism: The Evolution of A Hegemonic Paradigm (By Philip Cerny, From The Journal of International Trade and Diplomacy 2 (1), Spring 2008: 1-46)skasnerОценок пока нет

- NewpricenotesДокумент192 страницыNewpricenotesSanthosh Shankar50% (2)

- Marginal CostingДокумент14 страницMarginal CostingbrightyОценок пока нет

- Specialty Toys Case ProblemДокумент5 страницSpecialty Toys Case ProblemHope Trinity EnriquezОценок пока нет

- Sales Promotion of Reliance GSM ServicesjituДокумент61 страницаSales Promotion of Reliance GSM ServicesjituDutikrushna SahuОценок пока нет

- Level of Application and Effectiveness of General TheoriesДокумент32 страницыLevel of Application and Effectiveness of General TheoriesNormi Anne TuazonОценок пока нет

- Implied Conditions Under Sale of Goods ActДокумент10 страницImplied Conditions Under Sale of Goods ActAlbiОценок пока нет

- Cambria Tail Risk ETF: Strategy Overview Fund DetailsДокумент2 страницыCambria Tail Risk ETF: Strategy Overview Fund Detailscena1987Оценок пока нет

- Equity Research Summer ProjectДокумент66 страницEquity Research Summer Projectpajhaveri4009Оценок пока нет

- Texto en Ingles Finanzas CorporativasДокумент2 страницыTexto en Ingles Finanzas CorporativasyercaОценок пока нет

- Managerial Economics: PCTI Limited - A Unique Name For Quality EducationДокумент98 страницManagerial Economics: PCTI Limited - A Unique Name For Quality EducationRobert AyalaОценок пока нет

- Unit 1: Financial ManagementДокумент20 страницUnit 1: Financial ManagementDisha SareenОценок пока нет

- Business Model H&MДокумент1 страницаBusiness Model H&MlavanyaОценок пока нет

- Digital MarketingДокумент23 страницыDigital MarketingKonarkRawatОценок пока нет

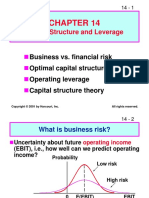

- Struktur Modal Dan LeverageДокумент47 страницStruktur Modal Dan LeverageArish AZSОценок пока нет

- 2021 Global Islamic Fintech Report 2021Документ56 страниц2021 Global Islamic Fintech Report 2021Slamet PrayitnoОценок пока нет

- Website Disclaimers Item Location Text: For Assistance, Email Us atДокумент1 страницаWebsite Disclaimers Item Location Text: For Assistance, Email Us atSabelo VeziОценок пока нет

- Acc 311 - Week1 - 1-3 MyAccountingLab Homework-Chapters 1 and 2Документ14 страницAcc 311 - Week1 - 1-3 MyAccountingLab Homework-Chapters 1 and 2Lilian LОценок пока нет

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingДокумент10 страницAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaОценок пока нет

- Pengaruh Brand Image Dan Kualitas Layanan TerhadapДокумент11 страницPengaruh Brand Image Dan Kualitas Layanan TerhadapNur SakinahОценок пока нет

- 2023 HSC Business StudiesДокумент22 страницы2023 HSC Business StudiesSreemoye ChakrabortyОценок пока нет

- SFM Theory Important Questions Notes by @divyesh - VaghelaДокумент27 страницSFM Theory Important Questions Notes by @divyesh - Vaghelasneh.officialworkОценок пока нет

- Economics Chapter 12Документ10 страницEconomics Chapter 12silenthitman7100% (1)

- Soal Kuis The Howell CorporationДокумент4 страницыSoal Kuis The Howell CorporationTeukuFirhanОценок пока нет

- FTCXSXSXSP - Seminar 8 - AnswersДокумент4 страницыFTCXSXSXSP - Seminar 8 - AnswersLewis FergusonОценок пока нет

- Primary MarketДокумент23 страницыPrimary MarketSneha KansalОценок пока нет

- Baring Bank and NickДокумент11 страницBaring Bank and NickMirindra RobijaonaОценок пока нет

- Foreign Exchange ManagementДокумент11 страницForeign Exchange ManagementVinit MehtaОценок пока нет

- Ritik Pandey Black Book NewДокумент73 страницыRitik Pandey Black Book NewShivam MishraОценок пока нет