Академический Документы

Профессиональный Документы

Культура Документы

Futures

Загружено:

avneesh_munjal8777Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Futures

Загружено:

avneesh_munjal8777Авторское право:

Доступные форматы

Presenting Futures

One of the most exotic terms in trading is Futures. The common man has stopped worrying about understanding these concepts as he feels it is not meant for his understanding. However let me make an attempt to explain

Lets say theres is a farmer who cultivates wheat

And a bread manufacturer who needs wheat as an input for making bread

The farmer thinks that the price of wheat which is currently trading at Rs. 100

could fall to Rs. 90 in 3

months.

The bread manufacturer on

the other hand feels that the price of wheat on the other

hand might become Rs. 120

in 3 months.

In such a case both get together and sign a contract which says that at the end of 3 months the farmer

would sell wheat to the bread

manufacturer at Rs. 110. Thus the farmer is protected against possible fall in prices

And the bread manufacturer is protected against the price of his input going up beyond Rs. 110

Such a contract is called a Futures contract because it is a contract that has to be executed at some future date

Thus Futures Trading is nothing

but having a point of view about the direction of the future price of a commodity/stocks/currency. And when two parties have opposite views about future price movements they obviously are open to sign a mutually beneficial deal like the farmer and the bread manufacturer did in our example

Now, lets say that after 3 months the price of wheat reaches Rs 120 In this case the farmer will have to sell for Rs.110 as per the contract and undertake a opportunity loss of Rs. 10 as his call that prices would go down was not correct.

The bread manufacturer on the other hand would be happy to receive wheat at Rs 110 due to the Futures Contract at a time when the prevailing market price is Rs 120. Thus he clearly makes a profit of Rs 10 because his expectation on price movement turned out to be correct.

However at the end of the period both parties achieve their goals of protecting their interests. While there may be an opportunity loss of the farmer but still he lands up making a profit of Rs. 10. At least he would have been at peace for the period of 3 months since he remained protected against any price fall or loss

The bread manufacturer on the other hand gets wheat at Rs 110 and makes a clear gain of Rs 10. He can now plan his manufacture more profitably than his competitors who would by in the market at the spot price of Rs 120 Since his call was right about the price movement, he landed up making the gain of Rs 10 due to the futures contract.

Thus in a sense both parties landed up meeting their business objectives and the futures contract helped them plan their business well by protecting their interests against unpleasant price fluctuations.

I hope I have been able to explain to you the so called exotic product which as you can see is a very logical protection tool for a buyer and seller of the Futures Contract having different views about price movements and both being keen to reduce their losses. Thus at the end one gains more and one gains less but both are happy that they could plan their business well

Hope this story succeeded in clarifying the concept of Futures

Please give us your feedback at professor@tataamc.com

Вам также может понравиться

- Future Markets, Put and Option Contracts, Derivative Markets and MechanismДокумент8 страницFuture Markets, Put and Option Contracts, Derivative Markets and Mechanismamarsinha1987Оценок пока нет

- In This Kaya Sila Gumagamit NG Future Market Kasi To Manage Their Exposure Sa Risk NG Pagbabago NG PresyoДокумент3 страницыIn This Kaya Sila Gumagamit NG Future Market Kasi To Manage Their Exposure Sa Risk NG Pagbabago NG PresyoShaina Kaye De GuzmanОценок пока нет

- Derivatives: A Derivative Is A Financial Instrument Whose Value Depends On or The Value of An Underlying AssetДокумент9 страницDerivatives: A Derivative Is A Financial Instrument Whose Value Depends On or The Value of An Underlying AssetArpit GuptaОценок пока нет

- 5,000 Kgs of Grain To The Buyer in June at A Price of $4 Per KGДокумент3 страницы5,000 Kgs of Grain To The Buyer in June at A Price of $4 Per KGMr. Sharath Harady BBA - IADCAОценок пока нет

- CH - 1 - 2 Financial EngeeringДокумент6 страницCH - 1 - 2 Financial EngeeringUbraj NeupaneОценок пока нет

- HedgingДокумент3 страницыHedgingMrzeeshanОценок пока нет

- Derivatives RediffДокумент5 страницDerivatives Redifffernandesroshandaniel4962Оценок пока нет

- DerivativesДокумент5 страницDerivativesAishwarya TripathiОценок пока нет

- Futures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsОт EverandFutures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsРейтинг: 1 из 5 звезд1/5 (1)

- DM - IntroductionДокумент88 страницDM - IntroductionSagar PatilОценок пока нет

- Derivatives Notes1Документ23 страницыDerivatives Notes1Sumeet JeswaniОценок пока нет

- Derivatives ExamplesДокумент10 страницDerivatives ExamplesshaRUKHОценок пока нет

- All You Wanted To Know About DerivativesДокумент3 страницыAll You Wanted To Know About DerivativesnehabelsareОценок пока нет

- Equity Shares 5Документ4 страницыEquity Shares 5Sci UpscОценок пока нет

- CC CC C C CCCCC CC: CCCCCCCCCCCCCCCCCCCCCCCCCCC C C C CC C CC CДокумент10 страницCC CC C C CCCCC CC: CCCCCCCCCCCCCCCCCCCCCCCCCCC C C C CC C CC CberatjusufiОценок пока нет

- Option Derivative:: Project Assignment On Financial Derivatives & Market Submitted by Rohan Gholam Roll No - 222Документ65 страницOption Derivative:: Project Assignment On Financial Derivatives & Market Submitted by Rohan Gholam Roll No - 222Rohan GholamОценок пока нет

- What Are Derivatives?..Документ53 страницыWhat Are Derivatives?..553199Оценок пока нет

- Derivatives PpsДокумент18 страницDerivatives Ppsmaakabhawan26Оценок пока нет

- Bai As-Salam and Istisna'Документ26 страницBai As-Salam and Istisna'Angela MaymayОценок пока нет

- Futures Contract Trading TipsДокумент14 страницFutures Contract Trading TipsK Subramani100% (1)

- Derivatives: The Important Categories of DerivativesДокумент10 страницDerivatives: The Important Categories of DerivativesShweta AgrawalОценок пока нет

- Futures Futures Options: How and When To ChooseДокумент41 страницаFutures Futures Options: How and When To ChooseMary WeldonОценок пока нет

- MAF 680 Chapter 7 - Futures Derivatives (New)Документ89 страницMAF 680 Chapter 7 - Futures Derivatives (New)Pablo EkskobaОценок пока нет

- Chapter 11: Derivatives: Required Material Are As Following: Book's 11 Edition Futures, Forwards & OptionsДокумент31 страницаChapter 11: Derivatives: Required Material Are As Following: Book's 11 Edition Futures, Forwards & OptionsMarwa HassanОценок пока нет

- Currency HedgingДокумент2 страницыCurrency Hedgingpranav7ranjithОценок пока нет

- Hedge (Finance)Документ7 страницHedge (Finance)deepakОценок пока нет

- CommodityMarkets 1Документ57 страницCommodityMarkets 1subramanyam surlaОценок пока нет

- Futures Trading: Example of A Futures ContractДокумент4 страницыFutures Trading: Example of A Futures ContractShrinivas Vaddepalli VОценок пока нет

- Bay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inДокумент5 страницBay'-Salam: Musharakah and Mudarabah Are Two of Several Financial Instruments Which Are Used inAbdelnasir HaiderОценок пока нет

- Task-1 Explain With Suitable Examples, Hedging in Forward Market. Meaning of HedgingДокумент6 страницTask-1 Explain With Suitable Examples, Hedging in Forward Market. Meaning of HedgingAnita ThakurОценок пока нет

- Problems On Futures and ForwardsДокумент1 страницаProblems On Futures and ForwardsManoj NepalОценок пока нет

- 5 DRM Future Hedging StrategiesДокумент21 страница5 DRM Future Hedging StrategiesPrasanjit BiswasОценок пока нет

- Capmark DiscussionДокумент6 страницCapmark DiscussionAngela HierroОценок пока нет

- CHAPTER 3: Applications of Derivatives: 3.1 Participants in The Derivatives MarketДокумент3 страницыCHAPTER 3: Applications of Derivatives: 3.1 Participants in The Derivatives Marketmanishpawar11Оценок пока нет

- Quick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Документ13 страницQuick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Rushabh ShahОценок пока нет

- Derivative BasicsДокумент37 страницDerivative Basicsdragondota123Оценок пока нет

- Understanding Currency Derivatives': by Prof. Simply SimpleДокумент15 страницUnderstanding Currency Derivatives': by Prof. Simply SimpleHeisnam BidyaОценок пока нет

- Siddhant Sisodia GS113 Rahul Joshi - Gg051Документ24 страницыSiddhant Sisodia GS113 Rahul Joshi - Gg051Rahul JOshiОценок пока нет

- Module 1 - Introduction To DerivativesДокумент29 страницModule 1 - Introduction To DerivativesSunny SinghОценок пока нет

- Beginner's Guide To FuturesДокумент15 страницBeginner's Guide To FuturesAnupam BhardwajОценок пока нет

- Commodity Futures TradingДокумент23 страницыCommodity Futures Tradingoz buloОценок пока нет

- Presented by-K.Bidyashree SinghaДокумент17 страницPresented by-K.Bidyashree SinghaHeisnam BidyaОценок пока нет

- Lec 51Документ15 страницLec 51swastikОценок пока нет

- The Markets Ways To TradeДокумент8 страницThe Markets Ways To TradeNassim Alami Messaoudi100% (1)

- Off-Balance Banking Activities and Risk Management For Financial InstitutionsДокумент29 страницOff-Balance Banking Activities and Risk Management For Financial InstitutionsSahiba MaingiОценок пока нет

- Derivative MarketДокумент15 страницDerivative MarketKamran MehboobОценок пока нет

- Commodity PrimerДокумент6 страницCommodity PrimerSammus LeeОценок пока нет

- Futures in Stock Market Definition, Example, and How To TradeДокумент4 страницыFutures in Stock Market Definition, Example, and How To TradeACC200 MОценок пока нет

- Options Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)От EverandOptions Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)Оценок пока нет

- 2019 Optiver Fact SheetДокумент3 страницы2019 Optiver Fact SheetRon KurtzbardОценок пока нет

- Basics of Investment BankingДокумент23 страницыBasics of Investment BankingsanbybharwajОценок пока нет

- Commodity Futures Trading For Beginners by Bruce BabcockДокумент17 страницCommodity Futures Trading For Beginners by Bruce BabcockPrabhu RamachandranОценок пока нет

- Mechanics of OptionsДокумент39 страницMechanics of Optionsluvnica6348Оценок пока нет

- Quanttrading 1bДокумент93 страницыQuanttrading 1bRatnadeep BhattacharyaОценок пока нет

- Mastering Options Trading: by Mentor - Ravi ChandiramaniДокумент120 страницMastering Options Trading: by Mentor - Ravi ChandiramanivivekОценок пока нет

- Subjects at Iift PDFДокумент7 страницSubjects at Iift PDFavneesh_munjal8777Оценок пока нет

- Total Exports of Meat Products by India: CAGR 27%Документ1 страницаTotal Exports of Meat Products by India: CAGR 27%avneesh_munjal8777Оценок пока нет

- OmniДокумент3 страницыOmniavneesh_munjal8777Оценок пока нет

- List of Importing Markets For A Product Exported by IndiaДокумент3 страницыList of Importing Markets For A Product Exported by Indiaavneesh_munjal8777Оценок пока нет

- Airtel 4G Bill InvoiceДокумент1 страницаAirtel 4G Bill Invoiceavneesh_munjal8777Оценок пока нет

- Sources: ITC Calculations Based On UN COMTRADE Statistics.: Product: 0904 Pepper, Peppers and CapsicumДокумент3 страницыSources: ITC Calculations Based On UN COMTRADE Statistics.: Product: 0904 Pepper, Peppers and Capsicumavneesh_munjal8777Оценок пока нет

- Food Security BillДокумент17 страницFood Security Billavneesh_munjal8777Оценок пока нет

- Airtel in Africa Key Factors & SWOT Analysis 2012Документ17 страницAirtel in Africa Key Factors & SWOT Analysis 2012avneesh_munjal8777Оценок пока нет

- Behavior Analysis of Sanjay DuttДокумент2 страницыBehavior Analysis of Sanjay Duttavneesh_munjal8777Оценок пока нет

- Ginger HotelsДокумент5 страницGinger HotelsAkashdeep Singh MakkarОценок пока нет

- Maturity Organization Level ISO 9004Документ7 страницMaturity Organization Level ISO 9004abimanyubawonoОценок пока нет

- 167 Sep2019 PDFДокумент13 страниц167 Sep2019 PDFShah KhanОценок пока нет

- Management Accounting Level 3/series 2 2008 (Code 3024)Документ14 страницManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- Enotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Документ291 страницаEnotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Hari GovindОценок пока нет

- 3.1.1. Understanding Forex RolloverДокумент5 страниц3.1.1. Understanding Forex RolloverWishnu Okky Pranadi TirtaОценок пока нет

- 601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEДокумент5 страниц601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDomingo VillanuevaОценок пока нет

- Student ID: MC190407267 Name: Mehwish Qandil: AssignmentДокумент2 страницыStudent ID: MC190407267 Name: Mehwish Qandil: AssignmentHasnain aliОценок пока нет

- Endowment vs. GrantДокумент6 страницEndowment vs. GrantamalekhОценок пока нет

- Internship ReportДокумент51 страницаInternship Reportshubhangi gargОценок пока нет

- Early Career Masters ProgrammesДокумент20 страницEarly Career Masters ProgrammesAnonymous dNcT0IRVОценок пока нет

- GM Annual Report 2015 Mar2016 Final VersionДокумент25 страницGM Annual Report 2015 Mar2016 Final Versionstephen francisОценок пока нет

- Horngren Fin13 F01Документ52 страницыHorngren Fin13 F01Andres Deza NadalОценок пока нет

- Industry 4.0 Engages CustomersДокумент24 страницыIndustry 4.0 Engages CustomersAries SantosoОценок пока нет

- The Venezuelan Enterprise Current Situation Challenges and OpportunitiesДокумент74 страницыThe Venezuelan Enterprise Current Situation Challenges and OpportunitiesRuben Gonzalez CortesОценок пока нет

- Amul & GyanДокумент5 страницAmul & GyanSrinidhi GovindОценок пока нет

- 4 AIQS APC Q A Workshop Ramesh PDFДокумент16 страниц4 AIQS APC Q A Workshop Ramesh PDFRajkumar ChinniahОценок пока нет

- International Ch3Документ16 страницInternational Ch3felekebirhanu7Оценок пока нет

- TQM Chapter 7Документ7 страницTQM Chapter 7Khel PinedaОценок пока нет

- Leida Kristin GardeДокумент4 страницыLeida Kristin Garderealjosh21Оценок пока нет

- Current Status and Solutions To Reduce Logistics Costs in VietnamДокумент4 страницыCurrent Status and Solutions To Reduce Logistics Costs in Vietnamgianggiang114Оценок пока нет

- VTU Question Paper On Security AnalysisДокумент56 страницVTU Question Paper On Security AnalysisVishnu PrasannaОценок пока нет

- Cmmi ScrumДокумент8 страницCmmi ScrumOscar MendozaОценок пока нет

- General Pricing Approaches Final (By Bilal)Документ19 страницGeneral Pricing Approaches Final (By Bilal)Bilal100% (10)

- Branch Accounts: Where The Head Office Maintains All The AccountsДокумент6 страницBranch Accounts: Where The Head Office Maintains All The AccountsTawanda Tatenda HerbertОценок пока нет

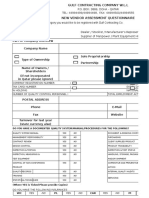

- QMS F 09A Rev 05 New Vendor Assessment QuestionnaireДокумент16 страницQMS F 09A Rev 05 New Vendor Assessment QuestionnairermdarisaОценок пока нет

- JBDДокумент50 страницJBDShahbaz Hassan WastiОценок пока нет

- Dispute Form - Bilingual 2019Документ2 страницыDispute Form - Bilingual 2019Kxng MindCtrl OrevaОценок пока нет

- Cost Accounting (Chapter 1-3)Документ5 страницCost Accounting (Chapter 1-3)eunice0% (1)

- Nestle Success StoryДокумент3 страницыNestle Success StorySaleh Rehman0% (1)