Академический Документы

Профессиональный Документы

Культура Документы

Overcoming The Fear of The Unknown

Загружено:

Bharat SahniОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Overcoming The Fear of The Unknown

Загружено:

Bharat SahniАвторское право:

Доступные форматы

Body

23/06/2012 17:46

Overcoming The Fear of the Unknown

Despite political uncertainty, investors should not defer their stock purchases Thanks to recent developments, the words "political uncertainty" are back in vogue in the Indian financial markets. Over the next few days, the majority of money managers, stockbrokers and market commentators will offer you their advice that is likely to run along the following lines: "Expert" Advice "Due to recent political upheavals, investors would be wise to get out of the market altogether and reenter only when the stability returns." "After the 300 point crash of 31 March 1997, FII's have deserted the Indian markets. Indian investors would be wise to take hint from FII's and defer any commitments." "Due to political uncertainty, the market will go down further in the near term. Investors should adopt a wait and watch attitude and defer any stock purchases until the market has bottomed out." "Nobody knows if the historic Budget will be passed or not. Investors should wait and see what happens." "If the Gowda government falls, and a new coalition government is formed, the market will react positively only if the reform process is continued. Investors are adviced to wait and see what happens." "If the Gowda government falls, and a new coalition government is formed, the market will react positively only if political stability returns. Investors are adviced to wait and see what happens." "It is likely that there will be mid-term polls sooner rather than later. Under the circumstances, investors should seek the safety of bonds, while avoiding stocks altogether, at least until India has a stable, market friendly government." "There is no doubt that by using standard yardsticks of value, Indian stocks are cheap. But this time it's different. Standard yardsticks of value no longer apply. There are huge problems. Until the dark clouds of political uncertainty have cleared, market experts are of the opinion that it would be wise on the part of investors to exercise restraint." Ignore the "Experts" Should you listen to these experts and follow their advice? In other words, should you, because of worries about some macro event such as political uncertainty, defer your stock purchases that you would have otherwise made absent that macro event? My advice is that you should ignore these so-called experts and listen to what the real experts have to say on the subject - those who have really made money in the stockmarkets. People like Warren Buffett and Philip Fisher, for example. Warren Buffett in 1966 In the spring of 1966, when Buffett was running a private investment partnership, the American stock market went into a steep decline. Increasingly, investors were focusing on the shorter term. Some of Buffett's partners called to "warn" him that the market might go down further. Inevitably the advice of

file:///Volumes/Data/sanjaybakshi/Dropbox/Personal%20Site/SB's%20Sshi/Articles_&_Talks_files/Overcoming_The_Fear_Of_The_Unknown.HTM Page 1 of 5

Body

23/06/2012 17:46

Buffett's partners called to "warn" him that the market might go down further. Inevitably the advice of these partners was to sell or at-least defer any further purchases until the future was "clear." Such advice, Buffett shot back, raised two questions: (1) if they knew in February that the Dow was going to 865 in May, why didn't they let me in on it then; and (2) if they didn't know what was going to happen during the ensuing three months back in February, how do they know in May? The problem with market commentators is that, for some reason, they routinely assume that once the "uncertainty" of the immediate moment is lifted they will have a clear view of the future right till eternity. The fact that they failed to foresee the present uncertainty will not deter them from thinking that no new clouds will trouble the future. Buffett told his partners that if he ever sold stocks or deferred his decisions to buy stocks just because some astrologer thought the quotations may go lower, they would all be in trouble. He wrote to them: "Let me again suggest that the future has never been clear to me (give us a call when the next few months are obvious to you - or, for that matter, the next few hours). Warren Buffett and Wells Fargo During 1989, Warren Buffett started accumulating a large number of shares in Wells Fargo & Company, a big Californian bank. Because of a huge bad debt crisis faced by the American banking industry at that time, bank shares were down in the dumps. Moreover, Californian banks such as Wells Fargo were thought to be even more risky due to the specific risk of a major earthquake in the state. For this reason, Wells Fargo stock was even more in the dumps that those of other banks outside California and was selling for less than five times after-tax earnings. Buffett did not agree with this valuation placed by the market on the bank. According to him, even after considering the risks specific to Californian banks, the price of less than five times earnings for one of America's best managed banks was ridiculously low. Then, in early 1990, due to another banking crisis - this time related to real-estate loans, shares of banks exposed to real-estate backed loans were hammered down even further. Because Wells Fargo had a large exposure to Californian real estate, its shares fell in early 1990 to prices which were 50 percent below those paid by Buffett in 1989. Undeterred, Buffett continued buying more shares. His total investment in the bank which cost him less than 500 million dollars is worth more than 2 billion dollars today. His explanation to his shareholders made soon after the investment is worth noting. Here's what he told them: "Even though we had bought some shares at the prices prevailing before the fall, we welcomed the decline because it allowed us to pick up many more shares at the new, panic prices. Investors who expect to be ongoing buyers of investments throughout their lifetimes should adopt a similar attitude toward market fluctuations; instead many illogically become euphoric when stock prices rise and unhappy when they fall. They show no such confusion in their reaction to food prices: Knowing they are forever going to be buyers of food, they welcome falling prices and deplore price increases. It's the seller of food who dislikes declining prices . . . Identical reasoning guides our thinking about Berkshire's investments. We will be buying businesses - or small parts of businesses, called stocks - year in, year out . . . Given these intentions, declining prices for businesses benefit us, and rising prices hurt us." Capital Deployment and Uncertainty Suppose a foolish man were to offer you genuine 500-rupee notes for Rs 300 each but with one condition:

file:///Volumes/Data/sanjaybakshi/Dropbox/Personal%20Site/SB's%20Sshi/Articles_&_Talks_files/Overcoming_The_Fear_Of_The_Unknown.HTM Page 2 of 5

Body

23/06/2012 17:46

you cannot sell these notes for the next two years. What would you do? If you were smart, you would go right ahead and buy those 500-rupee notes for 300 rupees. Now suppose, before you bought the notes, some expert came to you and said: "Right now there is a lot of political uncertainty in India. This is not the right time to buy these 500-rupee notes. One doesn't know if the government will survive or not. Moreover, there is every chance that the price of these 500-rupee notes will fall further to Rs 200 or maybe even lower. You should, therefore, defer your purchase and wait until the future become more clear or at-least until the price has fallen even further." What will be your reaction to such a statement? I think, you will laugh at this expert and go right ahead and buy those 500-rupee notes for 300 rupees each. Moreover, you will buy as many shares as you can afford, regardless of this expert's predictions of even lower prices in the future. Now think carefully, why will you do that? I can think of two reasons: (1) You will be certain that a genuine 500-rupee note is a bargain for Rs 300 even if you cannot sell it for another two years; and (2) you can never be certain that the sale price of that note will fall below the bargain price of Rs 300 offered to you currently. In other words, you will refuse to reject an outstanding investment at a bargain price because of worries about some macro event or because of the predictions of even lower future prices made by some market pundit. But, in the stockmarket, that is exactly what these "experts" recommend you should do. In effect they ask investors to defer buying stocks of great companies at reasonable prices, because of political uncertainty etc. This, in my opinion, is the height of lunacy. To quote Buffett: "It is sheer folly to forego buying shares in an outstanding business whose long-term future is predictable, because of short-term worries about an economy or a stock market that we know to be unpredictable. Why scrap an informed decision because of an uninformed guess? We purchased National Indemnity in 1967, See's in 1972, Buffalo News in 1977, Nebraska Furniture Mart in 1983, and Scott Fetzer in 1986 because those are the years they became available and because we thought the prices they carried were acceptable. In each case, we pondered what the business was likely to do not what the Dow, the Fed, or the economy might do. If we see this approach as making sense in the purchase of businesses in their entirety, why should we change tack when we are purchasing small pieces of wonderful businesses in the stock market?" On another occasion Buffett wrote: "We will continue to ignore political and economic forecasts, which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. But, surprise - none of these blockbuster events made the slightest dent in Ben Graham's investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices. Imagine the cost to us, then, if we had let the fear of unknowns cause us to defer or alter the deployment of capital." Investors should understand that the future has never been clear and it will never be clear. If one

file:///Volumes/Data/sanjaybakshi/Dropbox/Personal%20Site/SB's%20Sshi/Articles_&_Talks_files/Overcoming_The_Fear_Of_The_Unknown.HTM Page 3 of 5

Body

23/06/2012 17:46

uncertainty will vanish another will emerge. Investors who are interested in intelligent deployment of their capital will have to learn to live with uncertainty. In fact, the smart ones will use uncertainty as a means of making money from those who get carried away by the advice of the "experts" recommending a "wait-until-things-become-clearer" approach. (Given enough practise, you can actually learn to enjoy uncertainty.) Listen to Philip Fisher Philip Fisher, an outstanding investor, learnt long ago about the folly of deferring intelligent investment decisions based on fears of some macro political or economic event. According to him, companies with truly unusual prospects for appreciation are quite hard to find for there are not too many of them. However, for someone who understands and applies sound fundamentals, a truly outstanding company can be differentiated from a run-of-the-mill company with perhaps 90 percent precision. On the other hand, it is vastly more difficult to forecast what the market or a particular stock is going to do in the next six months. If you doubt this, tell me if you find anyone who predicted the recent one-day 300 point drop in the Sensex before Mr Kesri made his move. According to Fisher, it is hard to be correct in forecasting the short-term movements of stocks more than 60 percent of the time no matter how diligently the skill is cultivated. (Incidentally, even a 60 percent chance of being right does little for the price forecaster. Transaction costs and taxes require that he must be right more than 75 percent just to break even.) Therefore, it simply doesn't make good sense to step out of a position where you have a 90 percent probability of being right because of an influence about which you might at best have a 60 percent chance of being right. In other words, there is a much greater chance of being wrong in estimating adverse short-term changes for a good stock than in projecting its strong, long-term price appreciation potential. The Reality is Different From The Perception The fact is that most political and economic developments are not as important for valuation purposes as they are made out to be. While they may have a huge impact on market prices, they have little impact on intrinsic values. Remember, the intrinsic value of any business is equal to the sum of all its future cash flows discounted back to the present at an appropriate interest rate. Therefore, the value of a business can be affected by changes in only two variables: (1) estimates of future cash flows; and/or (2) interest rates. Also remember that value is dependent upon all future cash flows not just the near-term ones. Therefore, even if there is macro event which is likely to have a significant impact on near-term cash flows, it is quite likely that cash flows further into the future will not be affected. Consequently, the impact of the macro event on the value of such a business will be marginal. A vast majority of macro events come in this category. You will, therefore, be far better off if you completely ignored macro factors which have little impact on intrinsic values even though they have dramatic impact on market prices. If you find securities which are available for less - far less - that the value of the assets behind them, then nothing else matters, least of all the thousand cacophonous voices debating the future. Conclusion If the business you have selected is sound, if the management is honest and competent, and if the price is not exorbitant, then you should ignore most macro - political as well as economic - developments and go right ahead and deploy your capital. For, if your decision is right, then regardless of what happens on the economic as well as the political fronts, you will find after a few years, that the earnings of the company you selected have increased tremendously and so has the market price of its shares. This is exactly what

file:///Volumes/Data/sanjaybakshi/Dropbox/Personal%20Site/SB's%20Sshi/Articles_&_Talks_files/Overcoming_The_Fear_Of_The_Unknown.HTM Page 4 of 5

Body

23/06/2012 17:46

has happened to investors in companies like Bajaj Auto, Castrol, Colgate, Hindustan Lever, Thomas Cook, Madras Cements, Gujarat Ambuja Cements, TVS Suzuki and many others. Long-term investors in such companies who bought their shares when their prices fell because of general fears of some macro development, have done far, far better than those who listened to the "experts" and adopted a wait-and-see approach. There is one important caveat to the principle that you should start buying the appropriate type of stocks just as soon as they become available at the right prices regardless of unfavourable political or economic developments. Having made a start, you should stagger the timing of further buying. If, for example, you receive a lump sum from somewhere, you must not invest it all at once. Take you time and stagger your purchases over several months, or even years. By doing so, if the market has a severe decline somewhere in this period, you will still have purchasing power available to take advantage of such a decline. If the price of the shares fall below your average cost, then you should buy more shares to bring down your average cost even further. In any case, as an investor you need not be concerned about factors such as political uncertainty. If you feel, as I certainly do, that India has a great future, then you will agree that there is no better way to benefit from India's prosperity than by buying stocks of companies which are creating that prosperity. To quote Fisher, you should "be undeterred by fears or hopes based on conjectures, or conclusions based on surmises." Note This article is submitted by Sanjay Bakshi who is the Chief Executive Officer of a New Delhi based company called Corporate Investment Research Private Limited. Sanjay Bakshi. 1997.

file:///Volumes/Data/sanjaybakshi/Dropbox/Personal%20Site/SB's%20Sshi/Articles_&_Talks_files/Overcoming_The_Fear_Of_The_Unknown.HTM

Page 5 of 5

Вам также может понравиться

- Perspectives and Possibilities: Riffs and Rants of a Vietnam Vet Turned OctogenarianОт EverandPerspectives and Possibilities: Riffs and Rants of a Vietnam Vet Turned OctogenarianОценок пока нет

- A House Divided Cannot Stand: Lord, Help Us Love One Another as You LoveОт EverandA House Divided Cannot Stand: Lord, Help Us Love One Another as You LoveОценок пока нет

- My Bondage And My Freedom: From The Mental Institution To The PulpitОт EverandMy Bondage And My Freedom: From The Mental Institution To The PulpitОценок пока нет

- The Power of Your Focus: Seeing and Pursuing God's Plan for Your SuccessОт EverandThe Power of Your Focus: Seeing and Pursuing God's Plan for Your SuccessОценок пока нет

- Flying Penguin Second Edition: Award-Winning Guide to Awakening Your Childhood GeniusОт EverandFlying Penguin Second Edition: Award-Winning Guide to Awakening Your Childhood GeniusОценок пока нет

- From Here to There: A Quarter-Life Perspective On The Path To MasteryОт EverandFrom Here to There: A Quarter-Life Perspective On The Path To MasteryОценок пока нет

- First Things First: Navigating Our Challenging Times Through the Words of JesusОт EverandFirst Things First: Navigating Our Challenging Times Through the Words of JesusОценок пока нет

- Comfort in Christ Cancer Devotional: Encouraging a Deeper Walk with JesusОт EverandComfort in Christ Cancer Devotional: Encouraging a Deeper Walk with JesusОценок пока нет

- Intelligent Machines in the Classroom: Unlocking the Potential of AI in K12 Education: AI in K-12 EducationОт EverandIntelligent Machines in the Classroom: Unlocking the Potential of AI in K12 Education: AI in K-12 EducationОценок пока нет

- A Practical Guide to a Successful Relationship & MarriageОт EverandA Practical Guide to a Successful Relationship & MarriageОценок пока нет

- Five Substantial Steps and More... for Success in the World of SalesОт EverandFive Substantial Steps and More... for Success in the World of SalesОценок пока нет

- Whatever You Become, Become Your Best: The College and Graduate Guide to Wisdom for Success in LifeОт EverandWhatever You Become, Become Your Best: The College and Graduate Guide to Wisdom for Success in LifeОценок пока нет

- I Have Made It....... Or Not. God's Manual On Success And Failure.От EverandI Have Made It....... Or Not. God's Manual On Success And Failure.Оценок пока нет

- The Kingdom Leader's Principles of Prayer: 54 Imparting Principles of A Kingdom Prayer LifeОт EverandThe Kingdom Leader's Principles of Prayer: 54 Imparting Principles of A Kingdom Prayer LifeОценок пока нет

- Response Ability: The Language, Structure, and Culture of the Agile EnterpriseОт EverandResponse Ability: The Language, Structure, and Culture of the Agile EnterpriseРейтинг: 3 из 5 звезд3/5 (1)

- The Art Of Public Speaking (Unabridged): Acquiring Confidence Before An Audience & Methods in Achieving Efficiency and Speech Fluency From the Greatest Motivational Speaker of 20th CenturyОт EverandThe Art Of Public Speaking (Unabridged): Acquiring Confidence Before An Audience & Methods in Achieving Efficiency and Speech Fluency From the Greatest Motivational Speaker of 20th CenturyОценок пока нет

- Towards a Re-Definition of Development: Essays and Discussion on the Nature of Development in an International PerspectiveОт EverandTowards a Re-Definition of Development: Essays and Discussion on the Nature of Development in an International PerspectiveAlain BirouРейтинг: 1 из 5 звезд1/5 (1)

- Stop Being Foul Be a Real B.I.T.C.H.: Blessing Increase Through Christ’S Holiness 2 Chronicles 7:14От EverandStop Being Foul Be a Real B.I.T.C.H.: Blessing Increase Through Christ’S Holiness 2 Chronicles 7:14Оценок пока нет

- Drop the Fig Leaf: Dropping the Barriers to Freedom for Men and WomenОт EverandDrop the Fig Leaf: Dropping the Barriers to Freedom for Men and WomenОценок пока нет

- 22 Ways To Change My Attitude and feel better about everythingОт Everand22 Ways To Change My Attitude and feel better about everythingОценок пока нет

- Why You?: You Are God’s Masterpiece, Designed to Succeed in His World!От EverandWhy You?: You Are God’s Masterpiece, Designed to Succeed in His World!Оценок пока нет

- How Not to Die: The Code to Your Amazing Life, Living Longer, Safer, and HealthierОт EverandHow Not to Die: The Code to Your Amazing Life, Living Longer, Safer, and HealthierОценок пока нет

- The Disciples We Should Make and How We Should Make Them: Christian Life Series, #9От EverandThe Disciples We Should Make and How We Should Make Them: Christian Life Series, #9Оценок пока нет

- Emotional Intelligence: Build Self-Confidence, Beat Insecurity, Improve Emotional Intelligence & Become a Stronger PersonОт EverandEmotional Intelligence: Build Self-Confidence, Beat Insecurity, Improve Emotional Intelligence & Become a Stronger PersonОценок пока нет

- Markets Move FirstДокумент385 страницMarkets Move FirstBharat Sahni100% (1)

- Portfolio CheckupДокумент84 страницыPortfolio CheckupBharat SahniОценок пока нет

- How small caps can become big multibaggersДокумент138 страницHow small caps can become big multibaggersBharat Sahni0% (2)

- Special Consideration As Per OHCДокумент3 страницыSpecial Consideration As Per OHCBharat SahniОценок пока нет

- Why-Most Investors Are Mostly Wrong Most of The TimeДокумент3 страницыWhy-Most Investors Are Mostly Wrong Most of The TimeBharat SahniОценок пока нет

- Trust MR Market, Not The Credit RatingДокумент3 страницыTrust MR Market, Not The Credit RatingBharat SahniОценок пока нет

- When Trends Are Not DestinyДокумент1 страницаWhen Trends Are Not DestinyBharat SahniОценок пока нет

- Where Everyday Is An April Fool's DayДокумент6 страницWhere Everyday Is An April Fool's DayBharat SahniОценок пока нет

- Anand Sahib - LONGДокумент210 страницAnand Sahib - LONGBharat Sahni100% (1)

- 70 Times Better Than The Next MicrosoftДокумент3 страницы70 Times Better Than The Next MicrosoftBharat SahniОценок пока нет

- Understanding Dilution: Earnings Per Share DilutionДокумент4 страницыUnderstanding Dilution: Earnings Per Share DilutionBharat SahniОценок пока нет

- When To Borrow, and When Not ToДокумент5 страницWhen To Borrow, and When Not ToBharat SahniОценок пока нет

- MCDДокумент65 страницMCDFrancisco Javier CazaresОценок пока нет

- Sample Bplan ReportДокумент29 страницSample Bplan Reportash_1982Оценок пока нет

- The Business Plan and Executive Summary513Документ22 страницыThe Business Plan and Executive Summary513Bharat SahniОценок пока нет

- Onlinemarketingstrategy 090828040645 Phpapp01Документ43 страницыOnlinemarketingstrategy 090828040645 Phpapp01Maryem YaakoubiОценок пока нет

- The South Sea BubbleДокумент6 страницThe South Sea BubbleBharat SahniОценок пока нет

- Haldiram PPT 110113235127 Phpapp01Документ17 страницHaldiram PPT 110113235127 Phpapp01Bharat SahniОценок пока нет

- Interview QutДокумент4 страницыInterview QutBharat SahniОценок пока нет

- SAP FICO Configuration MaterialДокумент20 страницSAP FICO Configuration Materialpwalenb123462% (26)

- SAP FICO Interview QuestionДокумент31 страницаSAP FICO Interview Questionrasrazy100% (1)

- The Truth About Risk and ReturnДокумент5 страницThe Truth About Risk and ReturnBharat SahniОценок пока нет

- The Hidden Risk in ICICI BondsДокумент3 страницыThe Hidden Risk in ICICI BondsBharat SahniОценок пока нет

- Sikh Rehat Maryada (Sikh Code of Conduct and Conventions) (English)Документ25 страницSikh Rehat Maryada (Sikh Code of Conduct and Conventions) (English)nss1234567890Оценок пока нет

- SAP FICO Online TrainingДокумент6 страницSAP FICO Online TrainingBharat SahniОценок пока нет

- E ShopaidДокумент2 страницыE ShopaidBharat SahniОценок пока нет

- Sap FicoДокумент6 страницSap FicoBharat SahniОценок пока нет

- The Relatively Unpopular Large CompanyДокумент6 страницThe Relatively Unpopular Large CompanyBharat SahniОценок пока нет

- The Pizza Theory of Business ValuationДокумент3 страницыThe Pizza Theory of Business ValuationBharat SahniОценок пока нет

- Union PDFДокумент2 страницыUnion PDFsv32611Оценок пока нет

- Personal Finance and Investment FundamentalsДокумент45 страницPersonal Finance and Investment FundamentalsShashikant GujratiОценок пока нет

- Negotiable Instruments Law - de Leon Book Atty. Busmente © Michelle Duguil 1Документ92 страницыNegotiable Instruments Law - de Leon Book Atty. Busmente © Michelle Duguil 1PamОценок пока нет

- Johnson Tax Statement 10.22.18Документ2 страницыJohnson Tax Statement 10.22.18Andrew KochОценок пока нет

- Budgeting GovernmentДокумент96 страницBudgeting Governmentratna sulistianaОценок пока нет

- CHAPTER 6 Caselette - Audit of InvestmentsДокумент30 страницCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- Vandell Acquisition ValuationДокумент19 страницVandell Acquisition ValuationashibhallauОценок пока нет

- Jun 2005 - Qns Mod BДокумент14 страницJun 2005 - Qns Mod BHubbak KhanОценок пока нет

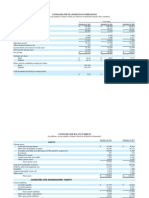

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Документ5 страницConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryОценок пока нет

- Chapter 5 QuizДокумент3 страницыChapter 5 QuizShannah100% (1)

- Fare List GEMS Founders School Al BarshaДокумент1 страницаFare List GEMS Founders School Al Barshapsivanandan3554Оценок пока нет

- Financial Statement Analysis: Course DescriptionДокумент4 страницыFinancial Statement Analysis: Course DescriptionMohsin RazaОценок пока нет

- Contribution of Mufti Taqi Us Man IДокумент11 страницContribution of Mufti Taqi Us Man IRauf JaferiОценок пока нет

- Clydesdale Bank statement summaryДокумент13 страницClydesdale Bank statement summarytrustar14100% (1)

- W6 Module 5 - Fringe Benefits and Dealings in PropertyДокумент13 страницW6 Module 5 - Fringe Benefits and Dealings in PropertyElmeerajh JudavarОценок пока нет

- Identify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetДокумент1 страницаIdentify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetTitser JeffОценок пока нет

- Corporate Finance DecisionsДокумент3 страницыCorporate Finance DecisionsPua Suan Jin RobinОценок пока нет

- Unit 5Документ50 страницUnit 5ahmed sunoosyОценок пока нет

- HDFC Bank - Bernestein - HDFC BankДокумент18 страницHDFC Bank - Bernestein - HDFC BankjoycoolОценок пока нет

- Account Statement: 4445935743 Bhayander (W)Документ17 страницAccount Statement: 4445935743 Bhayander (W)Nitin kumar SinghОценок пока нет

- Dividend PolicyДокумент42 страницыDividend PolicysubraysОценок пока нет

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Документ10 страницACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- GEN009 Quiz 1 P2 SET A KДокумент4 страницыGEN009 Quiz 1 P2 SET A KShane QuintoОценок пока нет

- Deposits in Transit and Outstanding Checks PDFДокумент1 страницаDeposits in Transit and Outstanding Checks PDFAaliyah Joize LegaspiОценок пока нет

- Facebook - DCF ValuationДокумент9 372 страницыFacebook - DCF ValuationDibyajyoti Oja0% (2)

- Paper 4 PYQДокумент16 страницPaper 4 PYQSaurabh PatelОценок пока нет

- Activity Ratio Presentation CompleteДокумент14 страницActivity Ratio Presentation CompleteMohsin RazaОценок пока нет

- STMT 19680100009011 1673186518787Документ11 страницSTMT 19680100009011 1673186518787prabha sureshОценок пока нет

- Portfolio Investment ProcessДокумент17 страницPortfolio Investment ProcessPrashant DubeyОценок пока нет

- SCF KT Document 6thmarch20 3Документ71 страницаSCF KT Document 6thmarch20 3Parag SoniОценок пока нет