Академический Документы

Профессиональный Документы

Культура Документы

Financial Planning Is The Task of Determining

Загружено:

karinadegomaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Planning Is The Task of Determining

Загружено:

karinadegomaАвторское право:

Доступные форматы

Financial planning is the task of determining how a business will afford to achieve its strategic goals and objectives.

Usually, a company creates a Financial Plan immediately after the visionand objectives have been set. The Financial Plan describes each of the activities, resources, equipment and materials that are needed to achieve these objectives, as well as the timeframes involved.

investment funding, and whether to finance that investment with equity or debt capital. Shortterm finance is the management of the company's monetary funds that deal with the short-term balance of current assets and current liabilities; the focus here is on managing cash, inventories, and short-term borrowing and lending (such as the terms on credit extended to [citation needed] customers).

The Financial Planning activity involves the following tasks; Assess the business environment Confirm the business vision and objectives Identify the types of resources needed to achieve these objectives Quantify the amount of resource (labor, equipment, materials) Calculate the total cost of each type of resource Summarize the costs to create a budget Identify any risks and issues with the budget set

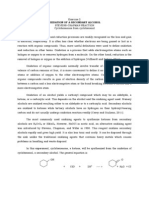

CORPIRATE

FINANCIAL

The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate the company's financial needs and raise the appropriate type of capital that best fits those needs. Thus, the terms corporate finance and corporate financier may be associated with transactions in which capital is raised in order to create, develop, grow or acquire businesses. Financial management overlaps with the financial function of the Accounting profession. However, financial accounting is the reporting of historical financial information, while financial management is concerned with the allocation of capital resources to increase a firm's value to the shareholders.

Corporate finance is the area of finance dealing with the sources of funding and the capital structure of corporations and the actions that managers take to increase the value of the firm to the shareholders, as well as the tools and analysis used to allocate financial resources. The primary goal of corporate finance [1] is to maximize shareholder value. Although it is in principle different from managerial finance which studies the financial management of all firms, rather thancorporations alone, the main concepts in the study of corporate finance are applicable to the financial problems of all kinds of firms. Investment analysis (or capital budgeting) is concerned with the setting of criteria about which value-adding projects should receive

Project finance is the longterm financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', as well as a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly nonrecourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a

decision in part supported by financial [1] modeling. The financing is typically secured by all of the project assets, including the revenueproducing contracts. Project lenders are given alien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms. Generally, a special purpose entity is created for each project, thereby shielding other assets owned by a project sponsor from the detrimental effects of a project failure. As a special purpose entity, the project company has no assets other than the project. Capital contribution commitments by the owners of the project company are sometimes necessary to ensure that the project is financially sound or to assure the lenders or the sponsors' commitment. Project finance is often more complicated than alternative financing methods. Traditionally, project financing has been most commonly used in the extractive (mining), transportation, telecommunications con tribution commitments by the owners of the project company are sometimes necessary to ensure that the project is financially sound or to assure the lenders or the sponsors' commitment. Project finance is often more complicated than alternative financing methods. Traditionally, project financing has been most commonly used in the extractive (mining), transactions (e.g., school facilities) as well as sports and entertainment venues. Risk identification and allocation is a key component of project finance. A project may be subject to a number of technical, environmental, economic and political risks, particularly in developing countries and emerging markets. Financial institutions and project sponsors may conclude that the risks inherent in project development and operation are unacceptable (unfinanceable). To cope with take place. "Several long-term contracts such as construction, supply, off-take and concession

agreements, along with a variety of jointownership structures are used to align incentives and deter opportunistic behaviour by [2] any party involved in the project." The patterns of implementation are sometimes referred to as "project delivery methods." The financing of these projects must be distributed among multiple parties, so as to distribute the risk associated with the project while simultaneously ensuring profits for each party involved. A riskier or more expensive project may require limited recourse financing secured by a surety from sponsors. A complex project finance structure may incorporate corporate finance,securitization, options (derivatives), insurance provisions or other types of collateral enhancement to mitigate [2] unallocated risk. Project finance shares many characteristics with maritime finance and aircraft finance; however, the latter two are more specialized fields within the area of asset finance.

OPERATIONAL FINANCING:

In financial accounting, a cash flow statement, [1] also known as statement of cash flows, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance [1] sheet. As an analytical tool, the statement of cash flows is useful in determining the shortterm viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7), is the International Accounting Standard that deals with cash flow statements.

People and groups interested in cash flow statements include: Accounting personnel, who need to know whether the organization will be able to cover payroll and other immediate expenses Potential lenders or creditors, who want a clear picture of a company's ability to repay Potential investors, who need to judge whether the company is financially sound Potential employees or contractors, who need to know whether the company will be able to afford compensation Shareholders of the business.

Вам также может понравиться

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomОт EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomОценок пока нет

- .Bill Finance: Finance Fixed Assets Derivatives Public Corporation Equity CapitalДокумент3 страницы.Bill Finance: Finance Fixed Assets Derivatives Public Corporation Equity CapitalAthira L TvmОценок пока нет

- Malvik ProjectДокумент95 страницMalvik ProjectKamal ShahОценок пока нет

- A STUDY ON FINANCIAL PERFORMANCE OF HCL ProДокумент26 страницA STUDY ON FINANCIAL PERFORMANCE OF HCL Proshirley100% (1)

- Corporate Finance Is The Area ofДокумент4 страницыCorporate Finance Is The Area ofJyoten PanditpautraОценок пока нет

- FinanceДокумент117 страницFinancenarendraidealОценок пока нет

- Finance - Theory & PracticeДокумент12 страницFinance - Theory & PracticeArham OrbОценок пока нет

- Smart Task 1Документ13 страницSmart Task 1devesh bhattОценок пока нет

- Chapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductionДокумент10 страницChapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductiontemedebereОценок пока нет

- Name Smart Task No. Project TopicДокумент7 страницName Smart Task No. Project TopicMd FarmanОценок пока нет

- Module 1 Task 1 VceДокумент10 страницModule 1 Task 1 VcevedantОценок пока нет

- Chapter-4 Specialization - Ii FinanceДокумент15 страницChapter-4 Specialization - Ii FinanceRahul ThakurОценок пока нет

- Smart Task 01 - VCEДокумент3 страницыSmart Task 01 - VCEHarshit AroraОценок пока нет

- Capital StructureДокумент37 страницCapital StructureIdd Mic-dadyОценок пока нет

- VCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisДокумент6 страницVCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisRISHAV RAJ GUPTAОценок пока нет

- Vce Smart Task 1 (Project Finance)Документ7 страницVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- Financial Planning 2Документ35 страницFinancial Planning 2Kanchan YadavОценок пока нет

- Manager Cash Management Project Manager: Understanding Financial Statements and Reports GenerallyДокумент6 страницManager Cash Management Project Manager: Understanding Financial Statements and Reports GenerallyZeba ShaikhОценок пока нет

- VCE InternshipsДокумент6 страницVCE Internshipsabhishek100% (1)

- Toturial 1 - SoalanДокумент2 страницыToturial 1 - Soalanchongjiale5597Оценок пока нет

- FinanceДокумент2 страницыFinanceSheanne GuerreroОценок пока нет

- Vardhan Consulting Finance Internship Task 1Документ6 страницVardhan Consulting Finance Internship Task 1Ravi KapoorОценок пока нет

- Finance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofДокумент50 страницFinance (Pronounced /fɪ Nænts/ or / Faɪnænts/) Is The Science ofSonal JainОценок пока нет

- Module 1 FiscalДокумент17 страницModule 1 FiscalAngelica Gentolia HipolitoОценок пока нет

- Capital Raising Strategies: Tejshree KapoorДокумент27 страницCapital Raising Strategies: Tejshree KapoorVinod ReddyОценок пока нет

- KCP Capital BudgetingДокумент98 страницKCP Capital BudgetingVamsi SakhamuriОценок пока нет

- Lecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmДокумент22 страницыLecture 9 18042020 051242pm 29112020 123126pm 01012022 063406pm 1 18062022 052305pmSyeda Maira BatoolОценок пока нет

- Business Finance 1 ÖZETДокумент23 страницыBusiness Finance 1 ÖZETÖmer Faruk AYDINОценок пока нет

- Project - Financial Apprasial of ITI LTDДокумент67 страницProject - Financial Apprasial of ITI LTDSATHISHОценок пока нет

- Capital BudgetingZuari CementsДокумент74 страницыCapital BudgetingZuari CementsAnusha ReddyОценок пока нет

- Final Financial Management-Jeannitte G. OnanДокумент4 страницыFinal Financial Management-Jeannitte G. OnanJeannitte Gelos OnanОценок пока нет

- Business Finance ReviewerДокумент4 страницыBusiness Finance ReviewerDubu GloryОценок пока нет

- ch-5 4Документ34 страницыch-5 4danielОценок пока нет

- Iincearca) Obligațiuni (Bilete La Ordin: EncompassДокумент2 страницыIincearca) Obligațiuni (Bilete La Ordin: EncompassVitalie VasiliuОценок пока нет

- Smart Task 1 SubmissionДокумент8 страницSmart Task 1 SubmissionPrateek JoshiОценок пока нет

- The Financial System: Personal FinanceДокумент4 страницыThe Financial System: Personal FinanceIsmayil ElizadeОценок пока нет

- 403 All UnitsДокумент73 страницы403 All Units505 Akanksha TiwariОценок пока нет

- Fundamentals of Finance and Financial ManagementДокумент4 страницыFundamentals of Finance and Financial ManagementCrisha Diane GalvezОценок пока нет

- Smart Task 1 ShailputriДокумент8 страницSmart Task 1 ShailputriShailОценок пока нет

- Unit - 4Документ15 страницUnit - 419UME117 Praveen KumarОценок пока нет

- Mrunalini's Task-1Документ5 страницMrunalini's Task-1Pampana Bala Sai Saroj RamОценок пока нет

- Business FinanceДокумент52 страницыBusiness FinanceJayMoralesОценок пока нет

- Smart Task 1Документ6 страницSmart Task 1RISHAV RAJ GUPTAОценок пока нет

- Corporate FinanceДокумент8 страницCorporate FinanceNeha KesarwaniОценок пока нет

- MCO 106 UNIT-1 Business Finance 2023Документ14 страницMCO 106 UNIT-1 Business Finance 2023daogafugОценок пока нет

- Financial and Economic EvaluationДокумент40 страницFinancial and Economic EvaluationBiruk BirhanuОценок пока нет

- Mefa R19 - Unit-5Документ26 страницMefa R19 - Unit-5KaarletОценок пока нет

- Lecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amДокумент23 страницыLecture 9 18042020 051242pm 29112020 123126pm 31052022 095838amSyeda Maira Batool100% (1)

- An Overview of Finantial ManagementДокумент30 страницAn Overview of Finantial ManagementGizaw BelayОценок пока нет

- Finance Is The Lifeline of Any BusinessДокумент22 страницыFinance Is The Lifeline of Any BusinessmeseretОценок пока нет

- Project FinanceДокумент39 страницProject FinancepreetsohОценок пока нет

- Financial Management ReviewДокумент8 страницFinancial Management Reviewkooruu22Оценок пока нет

- Net Present Value Payback Period Analysis Mutually ExclusiveДокумент11 страницNet Present Value Payback Period Analysis Mutually ExclusiveDahlia Abiera OritОценок пока нет

- Last Chapter - Financial EvaluationДокумент34 страницыLast Chapter - Financial EvaluationAmdu BergaОценок пока нет

- Capital Budgeting: A Brief OverviewДокумент14 страницCapital Budgeting: A Brief OverviewJanica BerbaОценок пока нет

- Advance Financial ManagementДокумент11 страницAdvance Financial ManagementRutik PatilОценок пока нет

- Chapter-1 Part-A: Introduction of FinanceДокумент39 страницChapter-1 Part-A: Introduction of FinanceIncredible IndiaОценок пока нет

- P3 RSW 01 - Running A PracticeДокумент4 страницыP3 RSW 01 - Running A PracticeZane BevsОценок пока нет

- The Role of Managerial Accounting: Managerial Finance Is The Branch of Finance That Concerns Itself With The ManagerialДокумент5 страницThe Role of Managerial Accounting: Managerial Finance Is The Branch of Finance That Concerns Itself With The ManagerialKhozem Kach'sОценок пока нет

- From Exam 2 2002Документ9 страницFrom Exam 2 2002Fredrick MutungaОценок пока нет

- Refractive IndexДокумент10 страницRefractive Indexkarinadegoma100% (1)

- GSДокумент26 страницGSkarinadegomaОценок пока нет

- Why Is Sex FunДокумент2 страницыWhy Is Sex FunkarinadegomaОценок пока нет

- Crude FatДокумент9 страницCrude FatkarinadegomaОценок пока нет

- Agro EcosystemДокумент34 страницыAgro EcosystemkarinadegomaОценок пока нет

- Diazotization of AminesДокумент10 страницDiazotization of AmineskarinadegomaОценок пока нет

- Pinacol RearrangementДокумент2 страницыPinacol RearrangementkarinadegomaОценок пока нет

- Insect OrderДокумент5 страницInsect OrderkarinadegomaОценок пока нет

- Course Outline:: (Groups 1 and 2)Документ3 страницыCourse Outline:: (Groups 1 and 2)karinadegomaОценок пока нет

- Exer2 PrelabДокумент3 страницыExer2 Prelabkarinadegoma100% (1)

- Insect OrderДокумент5 страницInsect OrderkarinadegomaОценок пока нет

- Exe 1 Nucleophilic Aromatic SubstitutionДокумент5 страницExe 1 Nucleophilic Aromatic Substitutionkarinadegoma67% (3)

- Because They Have A Lower H:C Ratio and Can Undergo Addition ReactionsДокумент4 страницыBecause They Have A Lower H:C Ratio and Can Undergo Addition ReactionskarinadegomaОценок пока нет

- Sci PaperДокумент16 страницSci PaperkarinadegomaОценок пока нет

- Critical ThinkingДокумент4 страницыCritical ThinkingDivya GoyalОценок пока нет

- Khurasan University Faculty of Economics (BBA) : Cost AccountingДокумент47 страницKhurasan University Faculty of Economics (BBA) : Cost AccountingTalaqa Sam Sha100% (2)

- Samuel Berro 221 Kingsbury Ave DEARBORN, MI 48128-1552: PO BOX 2577 OMAHA NE 68103-2577Документ9 страницSamuel Berro 221 Kingsbury Ave DEARBORN, MI 48128-1552: PO BOX 2577 OMAHA NE 68103-2577Israe BerateОценок пока нет

- Capital StrutureДокумент11 страницCapital StrutureJoshua CabinasОценок пока нет

- 2023.03.01 - Entain - Annual ReportДокумент240 страниц2023.03.01 - Entain - Annual ReportLexi EisenbergОценок пока нет

- Manual 16 Jun 2021 - Part 1Документ6 страницManual 16 Jun 2021 - Part 1Feni AlvitaОценок пока нет

- Problem No. 1: Business Combination Quiz No. 2Документ2 страницыProblem No. 1: Business Combination Quiz No. 2Caelah Jamie TubleОценок пока нет

- Partnership Test YoutubeДокумент14 страницPartnership Test YoutubeRiddhi GuptaОценок пока нет

- Tesco 2022 Ar Primary StatementsДокумент5 страницTesco 2022 Ar Primary StatementsJayath BogahawatteОценок пока нет

- DCF (Tesla 2023)Документ8 страницDCF (Tesla 2023)marquelОценок пока нет

- F7 - C2 & C3A PPE & Borrowing Cost AnsДокумент53 страницыF7 - C2 & C3A PPE & Borrowing Cost AnsK59 Vo Doan Hoang AnhОценок пока нет

- Ashok Leyland - Annual Report 2017-18Документ220 страницAshok Leyland - Annual Report 2017-18Kumar Prakash100% (1)

- Brealey6ce Ch08 Final2Документ54 страницыBrealey6ce Ch08 Final2Derron WhittleОценок пока нет

- Core Word List For Unit 8Документ7 страницCore Word List For Unit 8jeruskaОценок пока нет

- MANAGEMENT SERVICES (MAS) (70) Multiple Choice Questions. 1.0 Management AccountingДокумент9 страницMANAGEMENT SERVICES (MAS) (70) Multiple Choice Questions. 1.0 Management AccountingAnthony Koko CarlobosОценок пока нет

- University of Mauritius: Faculty of Law and ManagementДокумент10 страницUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïОценок пока нет

- Securities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationДокумент5 страницSecurities Fraud, Stock Price Valuation, and Loss Causation: Toward A Corporate Finance-Based Theory of Loss CausationMoin Max ReevesОценок пока нет

- Financial Statement Anaysis-Cat1 - 2Документ16 страницFinancial Statement Anaysis-Cat1 - 2cyrusОценок пока нет

- 2021 GameStop (GME) Stock SurgeДокумент7 страниц2021 GameStop (GME) Stock SurgeAurelОценок пока нет

- Presentation On: Project FinanceДокумент80 страницPresentation On: Project FinanceSachinОценок пока нет

- Public Final ExamДокумент5 страницPublic Final Examsenbetotilahun8Оценок пока нет

- SCH 03Документ7 страницSCH 03Naseeb Ullah TareenОценок пока нет

- Daftar Akun KompakДокумент2 страницыDaftar Akun Kompak-Оценок пока нет

- CH - 04 Dissolution of Partnership FirmДокумент10 страницCH - 04 Dissolution of Partnership FirmMahathi AmudhanОценок пока нет

- Zerodha FundamentalAnalysisPt2Документ87 страницZerodha FundamentalAnalysisPt2rajeshksm100% (2)

- FM W11Документ5 страницFM W11Syifa AureliaОценок пока нет

- AlShaheer Quarterly Report 2016Документ35 страницAlShaheer Quarterly Report 2016faiqsattar1637Оценок пока нет

- Fund Flow AnalysisДокумент66 страницFund Flow AnalysisJohnson NuОценок пока нет

- Fixed Assets - Q&AДокумент3 страницыFixed Assets - Q&AgopalarajadudduОценок пока нет

- Accounting Standards Made EasyДокумент36 страницAccounting Standards Made Easymiththegreat100% (2)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterОт EverandMind over Money: The Psychology of Money and How to Use It BetterРейтинг: 4 из 5 звезд4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsОт EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsОценок пока нет

- Product-Led Growth: How to Build a Product That Sells ItselfОт EverandProduct-Led Growth: How to Build a Product That Sells ItselfРейтинг: 5 из 5 звезд5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistОт EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistРейтинг: 4 из 5 звезд4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)От EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Рейтинг: 4 из 5 звезд4/5 (5)