Академический Документы

Профессиональный Документы

Культура Документы

Market Watch Daily 10.09.2013

Загружено:

Randora LkИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Market Watch Daily 10.09.2013

Загружено:

Randora LkАвторское право:

Доступные форматы

First Capital Equities (Private) Limited

Market Indices

ASI S&P SL20

10th 2013 16th September August 2013

Market Performance

3,600 3,400 3,200

Daily

09.09.2013 5,605 3,132 323.7 143.5 36.3 229 15.9 2,309 17.1 2.8 2.1

6,000 5,800 5,600

ASI S&P SL20

MARKET WATCH

5,400

04/09/2013 05/09/2013 06/09/2013 09/09/2013 10/09/2013

3,000

ASPI S&P SL 20 Turnover (mn) Foreign Purchases (mn) Foreign Sales (mn) Traded Companies Market PER (X) Market Cap (LKR bn) Market Cap (US$ bn) Dividend Yield (%) Price to Book (X)

10.09.2013 5,667 3,151 629.7 87.0 373.8 228 16.1 2,334 17.3 2.8 2.2

%Chg. 1.1 0.6 94.5 -39.4 929.8 -0.4 1.1 1.1 1.1 0.0 1.0

Market Outlook

The market closed modestly up with the ASPI increasing 1.1% to end the trading session at 5667. Turnover recorded LKR629.7 mn with trading in John Keells Holdings and Ceylon Guardian Investment Trust accounting for 66% of the days total. Gainers marginally offset losers with Environmental Resources Investments(W003), Environmental Resources Investments(W006) and Ceylon Leather(W0013) rising by 33.3%, 25.0% and 20.0% and offsetting declines in Royal Palms Beach Hotels, Kahawatte Plantations and Lanka Ceramic which fell by 8.7%, 7.7% and 5.4% respectively. Meanwhile, World shares climbed to a near one-month high and oil and government bonds slipped, helped by receding expectations of US-led military action against Syria and after better-than-expected Chinese data.

12

Turnover Composition & Net Foreign Flows

18,000

14%

15,000 12,000

LKR Mn

9,000 6,000 3,000 0 YTD MTD WTD

86%

Foreign

Domestic

-3,000

Gainers /Losers (%)

Associated Motor Finance Lanka Ceramic Kahawatte Plantations Royal Palms Beach Hotels Citrus Leisure(W0019) Ceylon Leather(W0013) Env. Resources Invest(W006) Env. Resources Invest(W003)

Market Trajectory Given the fact that most investors would now agree that the potential for short term trading opportunities are markedly limited, selecting medium to longer term investments would depend on a number of parameters, most importantly the strength of the top line and its sustainability. While we do not rule out the importance of earnings as a strong indicator of growth, it is highly important to determine the source of profits, whether a result of top line growth or an increase in other income or a dramatic cut in costs that could have a negative impact on future productivity. Of perhaps even more significance is the sustainability of such earnings. In this respect, while we advise investors to seek quality, both in terms of the top line and the bottom line, we accentuate the need to select stocks that may not only pass the quality test in terms of fundamentals but are also sufficiently liquid.

-5.1 -5.4 -7.7 -8.7 20.0 20.0 25.0 33.3

Significant Trades

400

LKR Mn

300 200 100 0 JKH GUAR COMB NDB

BRICS Performance Vs ASPI (YTD dollarised)

16.0% 8.0% 0.0% -8.0% -16.0% -24.0%

Market Liquidity (Turnover)

800

LKR Mn

600

400

200

04/09/2013 05/09/2013 06/09/2013 09/09/2013 10/09/2013

0

Brazil Russia India China South Africa Sri Lanka

Global Markets

Sri Lanka - ASPI India - Sensex Pakistan - KSE 100 Taiwan Weighted Singapore - Straits Times Hong Kong - Hang Seng S&P 500 Euro Stoxx 50 MSCI Asia Pacific

Index 5667 19,882 22,976

8,209

3,124

22,977

1,672 2,833 136

%Chg. 1.11 3.17 0.6 0.20 1.16 0.99 1.00 1.23 1.35

Interest Rates & Currencies

Prime Lending Rate (Avg. Weighted) Deposit Rate (Avg. Weighted) Treasury Bill Rate (364 Days) Dollar Denominated Bond Rate Inflation Rate (YoY) LKR/US$ (Selling Rate) LKR/EURO (Selling Rate) Gold (USD/oz) Oil (Brent) (USD/barrel)

10.09.2013 11.82% 10.10% 10.56% 5.88% 6.30% 134.67 179.30 1,372.50 113.15

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, First Capital Equities (Pvt) Ltd and/or its Directors, employees, are not responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt) Ltd may act as a Broker in the investments which are the subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is based, before its publication. First Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise interested in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with respect to the Review and agree to indemnify and hold First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and employees harmless to the fullest extent allowed by law regarding all matters related to your use of this Review. No part of this document may be reproduced, distributed or published in whole or in part by any means to any other person for any purpose without prior permission.

Disclaimer

Вам также может понравиться

- Joby Aviation - Analyst Day PresentationДокумент100 страницJoby Aviation - Analyst Day PresentationIan TanОценок пока нет

- Book Index The Art of Heavy TransportДокумент6 страницBook Index The Art of Heavy TransportHermon Pakpahan50% (2)

- Why Moats Matter: The Morningstar Approach to Stock InvestingОт EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingРейтинг: 4 из 5 звезд4/5 (3)

- Yoga SadhguruДокумент6 страницYoga Sadhgurucosti.sorescuОценок пока нет

- Market Watch Daily 27.09.2013Документ1 страницаMarket Watch Daily 27.09.2013Randora LkОценок пока нет

- Market Watch Daily 20.01.2014Документ1 страницаMarket Watch Daily 20.01.2014Randora LkОценок пока нет

- Market Watch Daily 05.07.2013 DNHДокумент1 страницаMarket Watch Daily 05.07.2013 DNHRandora LkОценок пока нет

- Market Watch Daily 28.06.2013Документ1 страницаMarket Watch Daily 28.06.2013Randora LkОценок пока нет

- Market Watch Daily 25.02.2014Документ1 страницаMarket Watch Daily 25.02.2014Randora LkОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingОценок пока нет

- Daily Technical Report, 26.07.2013Документ4 страницыDaily Technical Report, 26.07.2013Angel BrokingОценок пока нет

- Derivative Report Derivative Report: CommentsДокумент3 страницыDerivative Report Derivative Report: CommentsAngel BrokingОценок пока нет

- Head and Shoulders Broken: Punter's CallДокумент5 страницHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluОценок пока нет

- Market Watch Daily 10.01Документ1 страницаMarket Watch Daily 10.01ran2013Оценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Daily Technical Report, 17.06.2013Документ4 страницыDaily Technical Report, 17.06.2013Angel BrokingОценок пока нет

- Bulls Say Happy Weekend: Punter's CallДокумент5 страницBulls Say Happy Weekend: Punter's CallGauriGanОценок пока нет

- Daily Technical Report, 07.05.2013Документ4 страницыDaily Technical Report, 07.05.2013Angel BrokingОценок пока нет

- Daily Technical Report, 13.05.2013Документ4 страницыDaily Technical Report, 13.05.2013Angel BrokingОценок пока нет

- Deirvatives Report 27th DecДокумент3 страницыDeirvatives Report 27th DecAngel BrokingОценок пока нет

- Technical Format With Stock 07.09Документ4 страницыTechnical Format With Stock 07.09Angel BrokingОценок пока нет

- Technical Format With Stock 20.09Документ4 страницыTechnical Format With Stock 20.09Angel BrokingОценок пока нет

- Daily Technical Report, 29.07.2013Документ4 страницыDaily Technical Report, 29.07.2013Angel BrokingОценок пока нет

- Goodpack LTDДокумент3 страницыGoodpack LTDventriaОценок пока нет

- Daily Technical Report, 08.08.2013Документ4 страницыDaily Technical Report, 08.08.2013Angel BrokingОценок пока нет

- Daily Technical Report, 29.05.2013Документ4 страницыDaily Technical Report, 29.05.2013Angel BrokingОценок пока нет

- Stock Option Latest News by Theequicom For Today 12 September 2014Документ7 страницStock Option Latest News by Theequicom For Today 12 September 2014Riya VermaОценок пока нет

- Daily Derivative 23 September 2013Документ10 страницDaily Derivative 23 September 2013hemanggorОценок пока нет

- Daily Technical Report, 29.04.2013Документ4 страницыDaily Technical Report, 29.04.2013Angel BrokingОценок пока нет

- Technical Format With Stock 11.09Документ4 страницыTechnical Format With Stock 11.09Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (20666) / Nifty (6141)Документ4 страницыDaily Technical Report: Sensex (20666) / Nifty (6141)angelbrokingОценок пока нет

- Derivative Report Derivative Report: CommentsДокумент3 страницыDerivative Report Derivative Report: CommentsAngel BrokingОценок пока нет

- Derivatives Report, 03 May 2013Документ3 страницыDerivatives Report, 03 May 2013Angel BrokingОценок пока нет

- Daily Technical Report, 17.05.2013Документ4 страницыDaily Technical Report, 17.05.2013Angel BrokingОценок пока нет

- Technical Format With Stock 12.09Документ4 страницыTechnical Format With Stock 12.09Angel BrokingОценок пока нет

- Daily Option News Letter: Ption Nalysis - AilyДокумент7 страницDaily Option News Letter: Ption Nalysis - Ailyapi-234732356Оценок пока нет

- Daily Technical Report, 18.07.2013Документ4 страницыDaily Technical Report, 18.07.2013Angel BrokingОценок пока нет

- Derivatives Report, 20th May 2013Документ3 страницыDerivatives Report, 20th May 2013Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (17491) / NIFTY (5288)Документ4 страницыDaily Technical Report: Sensex (17491) / NIFTY (5288)Angel BrokingОценок пока нет

- Daily Technical Report, 10.05.2013Документ4 страницыDaily Technical Report, 10.05.2013Angel BrokingОценок пока нет

- Daily Technical Report 07.02.2013Документ4 страницыDaily Technical Report 07.02.2013Angel BrokingОценок пока нет

- Technical Report, 24 January 2013Документ4 страницыTechnical Report, 24 January 2013Angel BrokingОценок пока нет

- Market Watch Daily 14.10Документ1 страницаMarket Watch Daily 14.10LBTodayОценок пока нет

- Daily Technical Report, 21.05.2013Документ4 страницыDaily Technical Report, 21.05.2013Angel BrokingОценок пока нет

- Technical Format With Stock 10.09Документ4 страницыTechnical Format With Stock 10.09Angel BrokingОценок пока нет

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Документ7 страницStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaОценок пока нет

- Daily Technical Report, 09.05.2013Документ4 страницыDaily Technical Report, 09.05.2013Angel BrokingОценок пока нет

- Daily Technical Report, 23.07.2013Документ4 страницыDaily Technical Report, 23.07.2013Angel BrokingОценок пока нет

- Daily Technical Report, 22.08.2013Документ4 страницыDaily Technical Report, 22.08.2013Angel BrokingОценок пока нет

- Technical Format With Stock 14.09Документ4 страницыTechnical Format With Stock 14.09Angel BrokingОценок пока нет

- Daily Technical Report: Sensex (18519) / NIFTY (5472)Документ4 страницыDaily Technical Report: Sensex (18519) / NIFTY (5472)Angel BrokingОценок пока нет

- Market Outlook 23rd August 2011Документ3 страницыMarket Outlook 23rd August 2011angelbrokingОценок пока нет

- Daily Technical Report: Sensex (16668) / NIFTY (5054)Документ4 страницыDaily Technical Report: Sensex (16668) / NIFTY (5054)Angel BrokingОценок пока нет

- Technical Format With Stock 04.09Документ4 страницыTechnical Format With Stock 04.09Angel BrokingОценок пока нет

- Stock Market Prediction For 22 MayДокумент7 страницStock Market Prediction For 22 MayTheequicom AdvisoryОценок пока нет

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Документ4 страницыDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Derivatives Report, 22 February 2013Документ3 страницыDerivatives Report, 22 February 2013Angel BrokingОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Документ2 страницыSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Оценок пока нет

- Daily Technical Report, 16.07.2013Документ4 страницыDaily Technical Report, 16.07.2013Angel BrokingОценок пока нет

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingДокумент4 страницыGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlОценок пока нет

- 03 September 2015 PDFДокумент9 страниц03 September 2015 PDFRandora LkОценок пока нет

- Wei 20150904 PDFДокумент18 страницWei 20150904 PDFRandora LkОценок пока нет

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingДокумент4 страницыWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkОценок пока нет

- Global Market Update - 04 09 2015 PDFДокумент6 страницGlobal Market Update - 04 09 2015 PDFRandora LkОценок пока нет

- Global Market Update - 04 09 2015 PDFДокумент6 страницGlobal Market Update - 04 09 2015 PDFRandora LkОценок пока нет

- Weekly Update 04.09.2015 PDFДокумент2 страницыWeekly Update 04.09.2015 PDFRandora LkОценок пока нет

- Results Update Sector Summary - Jun 2015 PDFДокумент2 страницыResults Update Sector Summary - Jun 2015 PDFRandora LkОценок пока нет

- Sri0Lanka000Re0ounting0and0auditing PDFДокумент44 страницыSri0Lanka000Re0ounting0and0auditing PDFRandora LkОценок пока нет

- Daily 01 09 2015 PDFДокумент4 страницыDaily 01 09 2015 PDFRandora LkОценок пока нет

- Press 20150831ebДокумент2 страницыPress 20150831ebRandora LkОценок пока нет

- CCPI - Press Release - August2015 PDFДокумент5 страницCCPI - Press Release - August2015 PDFRandora LkОценок пока нет

- Microfinance Regulatory Model PDFДокумент5 страницMicrofinance Regulatory Model PDFRandora LkОценок пока нет

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCДокумент3 страницыICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkОценок пока нет

- Press 20150831ea PDFДокумент1 страницаPress 20150831ea PDFRandora LkОценок пока нет

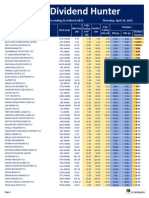

- Dividend Hunter - Mar 2015 PDFДокумент7 страницDividend Hunter - Mar 2015 PDFRandora LkОценок пока нет

- Earnings & Market Returns Forecast - Jun 2015 PDFДокумент4 страницыEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkОценок пока нет

- Results Update For All Companies - Jun 2015 PDFДокумент9 страницResults Update For All Companies - Jun 2015 PDFRandora LkОценок пока нет

- Daily - 23 04 2015 PDFДокумент4 страницыDaily - 23 04 2015 PDFRandora LkОценок пока нет

- Dividend Hunter - Mar 2015 PDFДокумент7 страницDividend Hunter - Mar 2015 PDFRandora LkОценок пока нет

- Dividend Hunter - Apr 2015 PDFДокумент7 страницDividend Hunter - Apr 2015 PDFRandora LkОценок пока нет

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFДокумент9 страницJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkОценок пока нет

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFДокумент9 страницChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkОценок пока нет

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Документ5 страницN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkОценок пока нет

- Earnings Update March Quarter 2015 05 06 2015 PDFДокумент24 страницыEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkОценок пока нет

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFДокумент12 страницCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkОценок пока нет

- GIH Capital Monthly - Mar 2015 PDFДокумент11 страницGIH Capital Monthly - Mar 2015 PDFRandora LkОценок пока нет

- BRS Monthly (March 2015 Edition) PDFДокумент8 страницBRS Monthly (March 2015 Edition) PDFRandora LkОценок пока нет

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFДокумент4 страницыWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkОценок пока нет

- The Morality of Capitalism Sri LankiaДокумент32 страницыThe Morality of Capitalism Sri LankiaRandora LkОценок пока нет

- Daily Stock Watch 08.04.2015 PDFДокумент9 страницDaily Stock Watch 08.04.2015 PDFRandora LkОценок пока нет

- SR No Service CodeДокумент30 страницSR No Service CodeShiva KrishnaОценок пока нет

- Para Lec CombinedДокумент83 страницыPara Lec CombinedClent Earl Jason O. BascoОценок пока нет

- 9A02502 Transmission of Electric PowerДокумент6 страниц9A02502 Transmission of Electric PowersivabharathamurthyОценок пока нет

- Automatic Train OperationДокумент6 страницAutomatic Train OperationAnupam KhandelwalОценок пока нет

- ECE199R-C12 Final Document OJTДокумент48 страницECE199R-C12 Final Document OJTRigel ZabateОценок пока нет

- 1.1.3.12 Lab - Diagram A Real-World ProcessДокумент3 страницы1.1.3.12 Lab - Diagram A Real-World ProcessHalima AqraaОценок пока нет

- Stopping by Woods On A Snowy EveningДокумент9 страницStopping by Woods On A Snowy EveningJulia Garces100% (2)

- EDS-A-0101: Automotive Restricted Hazardous Substances For PartsДокумент14 страницEDS-A-0101: Automotive Restricted Hazardous Substances For PartsMuthu GaneshОценок пока нет

- Kimi No Na Wa LibropdfДокумент150 страницKimi No Na Wa LibropdfSarangapani BorahОценок пока нет

- Discrete Wavelet TransformДокумент10 страницDiscrete Wavelet TransformVigneshInfotechОценок пока нет

- Phrasal Verbs Related To HealthДокумент2 страницыPhrasal Verbs Related To HealthKnuckles El Naco Narco LechugueroОценок пока нет

- AS and A Level: ChemistryДокумент11 страницAS and A Level: ChemistryStingy BieОценок пока нет

- B737-3 ATA 23 CommunicationsДокумент112 страницB737-3 ATA 23 CommunicationsPaul RizlОценок пока нет

- Harmonic Analysis of Separately Excited DC Motor Drives Fed by Single Phase Controlled Rectifier and PWM RectifierДокумент112 страницHarmonic Analysis of Separately Excited DC Motor Drives Fed by Single Phase Controlled Rectifier and PWM RectifierGautam Umapathy0% (1)

- BIF-V Medium With Preload: DN Value 130000Документ2 страницыBIF-V Medium With Preload: DN Value 130000Robi FirdausОценок пока нет

- Flow Zone Indicator Guided Workflows For PetrelДокумент11 страницFlow Zone Indicator Guided Workflows For PetrelAiwarikiaar100% (1)

- Electronic Ticket Receipt, January 27 For MS NESHA SIVA SHANMUGAMДокумент2 страницыElectronic Ticket Receipt, January 27 For MS NESHA SIVA SHANMUGAMNesha Siva Shanmugam ShavannahОценок пока нет

- Crma Unit 1 Crma RolesДокумент34 страницыCrma Unit 1 Crma Rolesumop3plsdn0% (1)

- Matters Signified by The Sublord of 11th Cusp in KP SystemДокумент2 страницыMatters Signified by The Sublord of 11th Cusp in KP SystemHarry HartОценок пока нет

- Multi Pressure Refrigeration CyclesДокумент41 страницаMulti Pressure Refrigeration CyclesSyed Wajih Ul Hassan80% (10)

- Kami Export - Subject Complements-1 PDFДокумент3 страницыKami Export - Subject Complements-1 PDFkcv kfdsaОценок пока нет

- Preview: Proquest Dissertations and Theses 2002 Proquest Dissertations & Theses Full TextДокумент24 страницыPreview: Proquest Dissertations and Theses 2002 Proquest Dissertations & Theses Full TextFelipe AguilarОценок пока нет

- Raneem AlbazazДокумент33 страницыRaneem AlbazazGordana PuzovicОценок пока нет

- Data SiEMEx School SafetyPreparedness 25 26 NOVДокумент81 страницаData SiEMEx School SafetyPreparedness 25 26 NOVSuraj RajuОценок пока нет

- Medical GeneticsДокумент4 страницыMedical GeneticsCpopОценок пока нет

- YoungMan EN131 GUIDEДокумент16 страницYoungMan EN131 GUIDErcpawar100% (1)

- ELS 06 Maret 223Документ16 страницELS 06 Maret 223Tri WinarsoОценок пока нет