Академический Документы

Профессиональный Документы

Культура Документы

12.1 Partnership Form of Organization

Загружено:

canteroalexАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

12.1 Partnership Form of Organization

Загружено:

canteroalexАвторское право:

Доступные форматы

Accounting for Partnerships

8/29/13 11:26 PM

Print this page

PARTNERSHIP FORM OF ORGANIZATION

1. Identify the characteristics of the partnership form of business organization. A partnership is an association of two or more persons to carry on as co-owners of a business for profit. Partnerships are sometimes used in small retail, service, or manufacturing companies. Also accountants, lawyers, and doctors find it desirable to form partnerships with other professionals in the field.

Characteristics of Partnerships

Partnerships are fairly easy to form. People form partnerships simply by a verbal agreement or more formally by written agreement. We explain the principal characteristics of partnerships in the following sections.

ASSOCIATION OF INDIVIDUALS

A partnership is a legal entity. A partnership can own property (land, buildings, equipment) and can sue or be sued. A partnership also is an accounting entity. Thus, the personal assets, liabilities, and transactions of the partners are excluded from the accounting records of the partnership, just as they are in a proprietorship. The net income of a partnership is not taxed as a separate entity. But, a partnership must file an information tax return showing partnership net income and each partner's share of that net income. Each partner's share is taxable at personal tax rates, regardless of the amount of net income each withdraws from the business during the year.

MUTUAL AGENCY

Mutual agency means that each partner acts on behalf of the partnership when engaging in partnership business. The act of any partner is binding on all other partners. This is true even when partners act beyond the scope of their authority, so long as the act appears to be appropriate for the partnership. For example, a partner of a grocery store who purchases a delivery truck creates a binding contract in the name of the partnership, even if the partnership agreement denies this authority. On the other hand, if a partner in a law firm purchased a snowmobile for the partnership, such an act would not be binding on the partnership. The purchase is clearly outside the scope of partnership business.

LIMITED LIFE

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref Page 1 of 8

Accounting for Partnerships

8/29/13 11:26 PM

Corporations have unlimited life. Partnerships do not. A partnership may be ended voluntarily at any time through the acceptance of a new partner or the withdrawal of a partner. It may be ended involuntarily by the death or incapacity of a partner. Partnership dissolution occurs whenever a partner withdraws or a new partner is admitted. Dissolution does not necessarily mean that the business ends. If the continuing partners agree, operations can continue without interruption by forming a new partnership.

UNLIMITED LIABILITY

Each partner is personally and individually liable for all partnership liabilities. Creditors' claims attach first to partnership assets. If these are insufficient, the claims then attach to the personal resources of any partner, irrespective of that partner's equity in the partnership. Because each partner is responsible for all the debts of the partnership, each partner is said to have unlimited liability.

CO-OWNERSHIP OF PROPERTY

Partners jointly own partnership assets. If the partnership is dissolved, each partner has a claim on total assets equal to the balance in his or her respective capital account. This claim does not attach to specific assets that an individual partner contributed to the firm. Similarly, if a partner invests a building in the partnership valued at $100,000 and the building is later sold at a gain of $20,000, the partners all share in the gain. Partnership net income (or net loss) is also co-owned. If the partnership contract does not specify to the contrary, all net income or net loss is shared equally by the partners. As you will see later, though, partners may agree to unequal sharing of net income or net loss.

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref

Page 2 of 8

Accounting for Partnerships

8/29/13 11:26 PM

Organizations with Partnership Characteristics

If you are starting a business with a friend and each of you has little capital and your business is not risky, you probably want to use a partnership. As indicated above, the partnership is easy to establish and its cost is minimal. These types of partnerships are often called regular partnerships. However if your business is riskysay, roof repair or performing some type of professional serviceyou will want to limit your liability and not use a regular partnership. As a result, special forms of business organizations with partnership characteristics are now often used to provide protection from unlimited liability for people who wish to work together in some activity. The special partnership forms are limited partnerships, limited liability partnerships, and limited liability companies. These special forms use the same accounting procedures as those described for a regular partnership. In addition, for taxation purposes, all the profits and losses pass through these organizations (similar to the regular partnership) to the owners, who report their share of partnership net income or losses on their personal tax returns.

LIMITED PARTNERSHIPS

In a limited partnership, one or more partners have unlimited liability and one or more partners have limited liability for the debts of the firm. Those with unlimited liability are general partners. Those with limited liability are limited partners. Limited partners are responsible for the debts of the partnership up to the limit of their investment in the firm. The words Limited Partnership, Ltd., or LP identify this type of organization. For the privilege of limited liability, the limited partner usually accepts less compensation than a general partner and exercises less influence in the affairs of the firm. If the limited partners get involved in management, they risk their liability protection. International Note Much of the funding for successful new U.S. businesses comes from venture capital firms, which are organized as limited partnerships. To develop its own venture capital industry, China believes that it needs the limited liability form. Therefore, China has taken steps to model its partnership laws to allow for limited partnerships like those in the United States.

LIMITED LIABILITY PARTNERSHIP

Most states allow professionals such as lawyers, doctors, and accountants to form a limited liability partnership or LLP. The LLP is designed to protect innocent partners from malpractice or negligence claims resulting from the acts of another

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref Page 3 of 8

Accounting for Partnerships

8/29/13 11:26 PM

partner. LLPs generally carry large insurance policies as protection against malpractice suits. These professional partnerships vary in size from a medical partnership of three to five doctors, to 150 to 200 partners in a large law firm, to more than 2,000 partners in an international accounting firm.

Helpful Hint

In an LLP, all partners have limited liability. There are no general partners.

LIMITED LIABILITY COMPANIES

A hybrid form of business organization with certain features like a corporation and others like a limited partnership is the limited liability company or LLC. An LLC usually has a limited life. The owners, called members, have limited liability like owners of a corporation. Whereas limited partners do not actively participate in the management of a limited partnership (LP), the members of a limited liability company (LLC) can assume an active management role. For income tax purposes, the IRS usually classifies an LLC as a partnership.

ACCOUNTING ACROSS THE ORGANIZATION

Limited Liability Companies Gain in Popularity

The proprietorship form of business organization is still the most popular, followed by the corporate form. But whenever a group of individuals wants to form a partnership, the limited liability company is usually the popular choice. One other form of business organization is a subchapter S corporation. A subchapter S corporation has many of the characteristics of a partnershipespecially, taxation as a partnershipbut it is losing its popularity. The reason: It involves more paperwork and expense than a limited liability company, which in most cases offers similar advantages.

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref

Page 4 of 8

Accounting for Partnerships

8/29/13 11:26 PM

Why do you think that the use of the limited liability company is gaining in popularity?

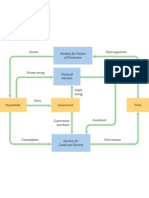

Illustration 12-1 summarizes different forms of organizations that have partnership characteristics.

Source: www.nolo.com (accessed June 2010).

Illustration 12-1

Different forms of organizations with partnership characteristics

Advantages and Disadvantages of Partnerships

Why do people choose partnerships? One major advantage of a partnership is to combine the skills and resources of two or

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref Page 5 of 8

Accounting for Partnerships

8/29/13 11:26 PM

more individuals. In addition, partnerships are easily formed and are relatively free from government regulations and restrictions. A partnership does not have to contend with the red tape that a corporation must face. Also, partners generally can make decisions quickly on substantive business matters without having to consult a board of directors. On the other hand, partnerships also have some major disadvantages. Unlimited liability is particularly troublesome. Many individuals fear they may lose not only their initial investment but also their personal assets, if those assets are needed to pay partnership creditors. Illustration 12-2 summarizes the advantages and disadvantages of the regular partnership form of business organization. As indicated in the previous section, different types of partnership forms have evolved to reduce some of the disadvantages.

Illustration 12-2

Advantages and disadvantages of a partnership

>

DO IT!

Partnership Organization Indicate whether each of the following statements is true or false. ________ 1. Partnerships have unlimited life. Corporations do not. ________ 2. Partners jointly own partnership assets. A partner's claim on partnership assets does not attach to specific assets. ________ 3. In a limited partnership, the general partners have unlimited liability. ________ 4. The members of a limited liability company have limited liability, like shareholders of a corporation, and they are taxed like corporate shareholders. ________ 5. Because of mutual agency, the act of any partner is binding on all other partners. Action Plan When forming a business, carefully consider what type of organization would best suit the needs of the business. Keep in mind the new, hybrid organizational forms that have many of the best characteristics of partnerships and corporations.

Solution

1. False. Corporations have unlimited life. Partnerships do not. 2. True. 3. True. 4. False. The members of a limited liability company are taxed like partners in a partnership. 5. True. Related exercise material: E12-1 and DO IT! 12-1.

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref

Page 6 of 8

Accounting for Partnerships

8/29/13 11:26 PM

The Partnership Agreement

Ideally, the agreement of two or more individuals to form a partnership should be expressed in a written contract, called the partnership agreement or articles of co-partnership. The partnership agreement contains such basic information as the name and principal location of the firm, the purpose of the business, and date of inception. In addition, it should specify relationships among the partners, such as: 1. Names and capital contributions of partners. 2. Rights and duties of partners. 3. Basis for sharing net income or net loss. 4. Provision for withdrawals of assets. 5. Procedures for submitting disputes to arbitration. 6. Procedures for the withdrawal or addition of a partner. 7. Rights and duties of surviving partners in the event of a partner's death. We cannot overemphasize the importance of a written contract. The agreement should attempt to anticipate all possible situations, contingencies, and disagreements. The help of a lawyer is highly desirable in preparing the agreement.

Ethics Note

A well-developed partnership agreement reduces ethical conflict among partners. It specifies in clear and concise language the process by which the partners will resolve ethical and legal problems. This issue is especially significant when the partnership experiences financial distress.

ACCOUNTING ACROSS THE ORGANIZATION

How to Part Ways Nicely

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref

Page 7 of 8

Accounting for Partnerships

8/29/13 11:26 PM

What should you do when you and your business partner do not agree on things, to the point where you are no longer on speaking terms? Given how heated business situations can get, this is not an unusual occurrence. Unfortunately, in many instances the partners do everything they can to undermine the other partner, eventually destroying the business. In some instances people even steal from the partnership because they either feel that they deserve it or they assume that the other partners are stealing from them. It would be much better to follow the example of Jennifer Appel and her partner. They found that after opening a successful bakery and writing a cookbook, they couldn't agree on how the business should be run. The other partner bought out Ms. Appel's share of the business. Ms. Appel went on to start her own style of bakery, which she ultimately franchised.

Source: Paulette Thomas, As Partnership Sours, Parting Is Sweet, Wall Street Journal, (July 6, 2004), p. A20.

How can partnership conflicts be minimized and more easily resolved?

Copyright 2013 John Wiley & Sons, Inc. All rights reserved.

http://edugen.wileyplus.com/edugen/courses/crs7040/weygandt9781Q5NzgxMTE4MTMwMDMyYzEyXzJfMC54Zm9ybQ.enc?course=crs7040&id=ref

Page 8 of 8

Вам также может понравиться

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessОт EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessОценок пока нет

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessОт EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessОценок пока нет

- Dda 2 12Документ7 страницDda 2 12genius_blueОценок пока нет

- CODE:BBA 1004: November Semester 2011Документ36 страницCODE:BBA 1004: November Semester 2011Happii MikoОценок пока нет

- Document - 2Документ9 страницDocument - 2kakadhondupОценок пока нет

- Chapter 12Документ42 страницыChapter 12Ivo_Nicht100% (4)

- Chapter 6 Partnership Formation Operation and LiquidationДокумент6 страницChapter 6 Partnership Formation Operation and Liquidationanwaradem225Оценок пока нет

- Comparative Matrix Phil USДокумент27 страницComparative Matrix Phil USDenzel Edward CariagaОценок пока нет

- AccountsДокумент8 страницAccountsAlveena UsmanОценок пока нет

- Law in Enforcement Introduction To Financial ManagementДокумент13 страницLaw in Enforcement Introduction To Financial ManagementSamsuarPakasolangОценок пока нет

- Chapter 4Документ12 страницChapter 4Chalachew EyobОценок пока нет

- MNR College of Engineering & TechnologyДокумент38 страницMNR College of Engineering & TechnologyDJSATYAMОценок пока нет

- Form of Business OrganizationДокумент15 страницForm of Business OrganizationDivyansh SinghОценок пока нет

- Saito University College: Introduction To Financial Accounting BHRM 1144 Individual AssignmentДокумент15 страницSaito University College: Introduction To Financial Accounting BHRM 1144 Individual AssignmentDehbban Sandran SkyОценок пока нет

- Limited Liability PartnershipДокумент10 страницLimited Liability PartnershipPalak GulabaniОценок пока нет

- Advanced Accounting IДокумент133 страницыAdvanced Accounting IGirma NegashОценок пока нет

- LM01 Corporate Structures and OwnershipДокумент15 страницLM01 Corporate Structures and OwnershipSYED HAIDER ABBAS KAZMIОценок пока нет

- Entrepreneurship, Sole Proprietorships, and Partnerships: What Type of Business Should I Choose?Документ10 страницEntrepreneurship, Sole Proprietorships, and Partnerships: What Type of Business Should I Choose?Loushayne MolatoОценок пока нет

- Innovations in Equity InstrumentsДокумент62 страницыInnovations in Equity Instrumentsvikas_7464Оценок пока нет

- Corporate Law (Dba354)Документ67 страницCorporate Law (Dba354)Awini ShadrachОценок пока нет

- PartnershipДокумент4 страницыPartnershipqwertyОценок пока нет

- Week 2-AFДокумент15 страницWeek 2-AFZainab AshrafОценок пока нет

- How To Revive A Struggling Business Back To LifeДокумент42 страницыHow To Revive A Struggling Business Back To Lifejohn ChukwuemekaОценок пока нет

- Week 5 Quiz - EssayДокумент3 страницыWeek 5 Quiz - EssayJohn Edwinson JaraОценок пока нет

- Notes For Finals - AFM101Документ10 страницNotes For Finals - AFM101MHIL RAFAEL DAUGDAUGОценок пока нет

- Company Structure: Post NavigationДокумент6 страницCompany Structure: Post NavigationHimal AcharyaОценок пока нет

- Material Lecto 2017 - Unidad 7Документ36 страницMaterial Lecto 2017 - Unidad 7Andrea Alejandra GazconОценок пока нет

- Advantages of A Sole ProprietorshipДокумент3 страницыAdvantages of A Sole Proprietorshiplaur33nОценок пока нет

- How To Write Your Own Business Plan Chapter One Business OwnershipДокумент27 страницHow To Write Your Own Business Plan Chapter One Business OwnershipjakirОценок пока нет

- Activity 4 TUDLAS GRICHENДокумент9 страницActivity 4 TUDLAS GRICHENGrichen TudlasОценок пока нет

- Om Q2L1Документ2 страницыOm Q2L1dschunglebuchОценок пока нет

- Module 5 1Документ6 страницModule 5 1Manvendra Singh ShekhawatОценок пока нет

- Forms of BusinessДокумент33 страницыForms of BusinessCelito-Jose MacachorОценок пока нет

- Forms of Business: Sole Proprietorship, Partnership, CorporationДокумент4 страницыForms of Business: Sole Proprietorship, Partnership, CorporationLaurever CaloniaОценок пока нет

- What Is A PartnershipДокумент3 страницыWhat Is A PartnershipCHARMAINE ROSE CABLAYANОценок пока нет

- (ACC 003 - Fundamentals of Accounting Part 2) Lesson Title: Defining Partnership Lesson Objectives: ReferencesДокумент2 страницы(ACC 003 - Fundamentals of Accounting Part 2) Lesson Title: Defining Partnership Lesson Objectives: ReferencesRochelle Joyce CosmeОценок пока нет

- Faculty of Industrial Technology: Department of Electronic EngineeringДокумент4 страницыFaculty of Industrial Technology: Department of Electronic Engineeringfredn87Оценок пока нет

- Chapter 4 Legal Issues 1Документ24 страницыChapter 4 Legal Issues 1AjayОценок пока нет

- Cours 6 PartnershipsДокумент4 страницыCours 6 PartnershipsAchraf SabbarОценок пока нет

- Lectura en InglésДокумент4 страницыLectura en InglésDavid JerezОценок пока нет

- Advance Chapter OneДокумент42 страницыAdvance Chapter OneSolomon Abebe100% (4)

- What Is Climate ActionДокумент6 страницWhat Is Climate ActionSmiley MovementОценок пока нет

- Business Organisation 3Документ46 страницBusiness Organisation 3Manish Singh100% (1)

- RRL (Javier Genelza Lapiz)Документ10 страницRRL (Javier Genelza Lapiz)neil licatanОценок пока нет

- Company Types: August 2005Документ8 страницCompany Types: August 2005Rizwan AhmedОценок пока нет

- TYPESOFBUSINESSFORMSДокумент6 страницTYPESOFBUSINESSFORMSMissy ArticaОценок пока нет

- PartnershipДокумент16 страницPartnershipJasmandeep brar100% (1)

- Legal Docc 3Документ4 страницыLegal Docc 3anukshalallchand13Оценок пока нет

- ADV Accounting IIДокумент177 страницADV Accounting IIbrook buta100% (1)

- ABMG12-Business Ethics Lesson 1Документ24 страницыABMG12-Business Ethics Lesson 1andreaОценок пока нет

- Accounts Assignment 2022 CompleteДокумент11 страницAccounts Assignment 2022 Completepavi ARMYОценок пока нет

- Seminar Report of Partnership ActДокумент23 страницыSeminar Report of Partnership ActDeepika JainОценок пока нет

- Advantages of A Sole ProprietorshipДокумент4 страницыAdvantages of A Sole Proprietorshipdin shaОценок пока нет

- This Article Is Excerpted FromДокумент11 страницThis Article Is Excerpted FromBen Abdallah RihabОценок пока нет

- How To Choose The Best Legal Structure For Your BusinessДокумент4 страницыHow To Choose The Best Legal Structure For Your Businessmuhammad tayyab100% (3)

- Chương 18Документ20 страницChương 18Quy Nguyen QuangОценок пока нет

- NOTES Shipping BusinessДокумент44 страницыNOTES Shipping BusinessSharon AmondiОценок пока нет

- What Is A Partnership?: Types of Partnership Arrangements Limited LiabilityДокумент3 страницыWhat Is A Partnership?: Types of Partnership Arrangements Limited LiabilityBella AyabОценок пока нет

- Questions: Advantages of Sole ProprietorshipsДокумент5 страницQuestions: Advantages of Sole ProprietorshipsAbdullahiОценок пока нет

- Entrepreneurship - Types of Business VenturesДокумент5 страницEntrepreneurship - Types of Business VenturesJerissa SennonОценок пока нет

- SOA FM Sample QuestionsДокумент59 страницSOA FM Sample QuestionsAdamОценок пока нет

- Mroz DescriptionДокумент1 страницаMroz DescriptioncanteroalexОценок пока нет

- Most Common Interview Questions and Answers.Документ13 страницMost Common Interview Questions and Answers.canteroalexОценок пока нет

- Circular FlowДокумент1 страницаCircular FlowcanteroalexОценок пока нет

- Review of Statistics Basic Concepts: MomentsДокумент4 страницыReview of Statistics Basic Concepts: MomentscanteroalexОценок пока нет

- Improving Ef®ciency of On-Campus Housing: An Experimental StudyДокумент18 страницImproving Ef®ciency of On-Campus Housing: An Experimental StudycanteroalexОценок пока нет

- Partnership LawДокумент24 страницыPartnership LawNoorhidayah Sunarti100% (1)

- 2022 UP PreWeek - Commercial LawДокумент42 страницы2022 UP PreWeek - Commercial LawML Banzon100% (1)

- Dance Studio Contract Sample 1Документ5 страницDance Studio Contract Sample 1Denise Harper100% (1)

- Ca Foundation Important QuestionsДокумент5 страницCa Foundation Important QuestionsIsha Jain XI EОценок пока нет

- Rights of A Tenant: Date: February 28, 2019Документ3 страницыRights of A Tenant: Date: February 28, 2019oliver pankrasОценок пока нет

- Asset Privatization Trust vs. T.J. Enterprise G.R. No. 167195 May 8, 2009 FactsДокумент4 страницыAsset Privatization Trust vs. T.J. Enterprise G.R. No. 167195 May 8, 2009 FactsAlexander DruceОценок пока нет

- Manifestation With Motion To Allow Oppositor To Conduct Engage in Business in The Properties Included in The Estate of The Late Teodoro Salanga JRДокумент5 страницManifestation With Motion To Allow Oppositor To Conduct Engage in Business in The Properties Included in The Estate of The Late Teodoro Salanga JRJaime GonzalesОценок пока нет

- Pacific Banking Corp. Employees Org. vs. CAДокумент20 страницPacific Banking Corp. Employees Org. vs. CAakosierikaОценок пока нет

- Business LawДокумент23 страницыBusiness LawCris EzechialОценок пока нет

- Doctrine of Constructive Notice & Indoor ManagementДокумент11 страницDoctrine of Constructive Notice & Indoor ManagementEkta ChaudharyОценок пока нет

- Extra Judicial Settlement With WaiverДокумент3 страницыExtra Judicial Settlement With WaiverAtty Reynan Dollison86% (7)

- Fabre Vs CAДокумент4 страницыFabre Vs CAaldinОценок пока нет

- Midterm Oblicon Set AДокумент5 страницMidterm Oblicon Set Alhemnaval100% (1)

- Licensing Criteria CIS (Single Fund) - SEC-3.1AДокумент9 страницLicensing Criteria CIS (Single Fund) - SEC-3.1Aee sОценок пока нет

- A2001 HKIS - Notice As Time Bar 2Документ3 страницыA2001 HKIS - Notice As Time Bar 2PameswaraОценок пока нет

- Wisconsin - Landlord.and - Tenant.statues 704.03 Oct 26 2013Документ12 страницWisconsin - Landlord.and - Tenant.statues 704.03 Oct 26 2013nufusionОценок пока нет

- Property Reviewer For FinalsДокумент23 страницыProperty Reviewer For Finalsdodong123100% (1)

- Business Law Chapter 31Документ7 страницBusiness Law Chapter 31Placida LendofОценок пока нет

- Allodial Title BookletДокумент10 страницAllodial Title BookletJames Jones100% (1)

- Balane WillsДокумент158 страницBalane WillsYelena VictoriaОценок пока нет

- Request To ReturnДокумент2 страницыRequest To ReturnXirkul TupasОценок пока нет

- Non-Commercial LicenseДокумент3 страницыNon-Commercial LicenseRosen AnthonyОценок пока нет

- Hire Purchase AbridgedДокумент7 страницHire Purchase AbridgedMaggie Wa MaguОценок пока нет

- Tibay V CAДокумент5 страницTibay V CAMarioneMaeThiamОценок пока нет

- Whereas: Rakesh Venkata Trainee Engineer-Electrical (Amc For ITC AMLF, Pudukottai, Trichy)Документ4 страницыWhereas: Rakesh Venkata Trainee Engineer-Electrical (Amc For ITC AMLF, Pudukottai, Trichy)Anusree RoyОценок пока нет

- BIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncДокумент6 страницBIR RULING NO. OT-421-2021: Sun Life of Canada (Philippines), IncCarlota VillaromanОценок пока нет

- DEFENDANTДокумент15 страницDEFENDANTAyushi Srivastava100% (3)

- Agency Extinguishment ReviewerДокумент4 страницыAgency Extinguishment ReviewerZaireXandraReyes0% (1)

- Factors Influencing ConsensusДокумент25 страницFactors Influencing ConsensusSnr Berel ShepherdОценок пока нет

- Maid FormДокумент2 страницыMaid FormhutuguoОценок пока нет