Академический Документы

Профессиональный Документы

Культура Документы

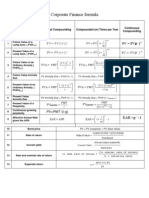

Corporate Finance - Formulas

Загружено:

Abhijit PanditАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Corporate Finance - Formulas

Загружено:

Abhijit PanditАвторское право:

Доступные форматы

==================================Capital Structure====================================

1. Total risk of equity shareholders = ROE

2. Business risk = ROE (u)

3. Financial risk = ROE - ROE (u)

Without Corporate Taxes;

[V(lev) = market value of a leveraged company, V(unlev) = market value of an unleveraged company,

Ko = weighted average cost of capital (WACC) of a leveraged company, Keu = cost of equity of an

unleveraged company, EBIT = earnings before interest and tax]

[Ko = overall capitalization rate (WACC), Ke = cost of equity capital, Kd = cost of debt, We =

proposition of equity in total capital, Wd = proposition of debt in total capital, E = amount of

equity capital, D = amount of debt capital]

4. V(lev) = V(unlev) = EBIT / Ko = EBIT / Keu

5. Ke = Ko + (Ko Kd) * D/E

With Corporate Taxes (t);

[Vu = value of unlevered company, Keu = cost of equity of unlevered company, t = corporate tax rate]

[V(lev) = market value of levered company, Vu = market value of unlevered company, D = market

value of debt, t = corporate tax rate]

[Ke = cost of equity of levered company, Keu = cost of equity of unlevered company, Kd = cost of debt,

D/E = debt equity ratio, t = corporate tax rate]

6. Vu = EBIT*(1-t) / Keu

7. V(lev) = Vu + Dt

8. Ke = Keu + (Keu Kd) * D/E * (1-t)

9. V(lev) = D + E

10. WACC = We * Ke + Wd * Kd * (1 t)

==================================Personal Tax====================================

11. A stockholder receives the net amount = (1-TC) x (1-TS)

12. The bondholder receives = (1-TB)

13. If T

S

= T

B

then the firm should be financed primarily by debt (avoiding double tax).

14. The firm is indifferent between debt and equity when: (1-T

C

) x (1-T

S

) = (1-T

B

)

15. Tax advantage of debt is positive when:

(1-T

C

) x (1-T

S

) < (1-T

B

)

16. Tax advantage of debt is negative when:

(1-T

C

) x (1-T

S

) > (1-T

B

)

17. Vu = EBIT * (1-T

C

)* (1-T

S

) / Keu

18.

19. EBIT Interest = EBT; EBT Taxes = EAT; EAT Preference Div = Earnings avail = EPS * No of Shares

D *

) T (1

) T (1 * ) T (1

1 V V

B

S C

U L

+ =

==================================

[Po =Current value of the equity share; Do=Dividend per share paid at time 0; g=Constant rate of

growth of dividends; Ke = Cost of the retained earnings

1. Ke = Do*(1+g) /Po + g

[gr = Rapid growth rate of dividend during the first n years; gn =Normal growth rate of dividend

continuously for ever; Pn = Share price at the end of n years]

2. Pn = Do*(1+gr)^n*(1+gn) / (Ke

3. Po = Do*(1+gr) / (1+Ke) + Do*(1+gr)^2 / (1+Ke)^2 + .

[E(Rs) = Expected rate of return of the security; Rf= Risk

return of the market; s = Beta co

4. E(Rs) = Rf + s [E(Rm) Rf]

5. E(Rs) = Rf + s [E(Rm) Rf]

6.

=====Cost of Equity========

7. Net proceeds = Po (1 f).

8. Cost of the new equity

9. Adjustment for flotation costs

=====Cost of Preference Capital

10. Kp = D / [Po*(1-f)]

11. Kat= (1-t) * Kbt

[We = Proportion of equity in the total capital; Wp = preference shares; Wd = debt ; Ke = Cost

of retained earnings / external equity; Kp = Cost of preference capital; Kd = Pre

t=corporate tax rate; We + Wp + Wd = 1.0

12. WACC = We * Ke + Wp * Kp

13. With constant D/E ratio;

14. With constant amount of D

===============================

FV = C

0

(1 + r)

C

0

is cash flow today (time zero),r is the appropriate interest rate.

FV = C

0

(1 + r)

T..

T is the number of periods over which the cash is invested.

NPV = Cost + PV

Continuous Compounding, FV =

==================================Cost of Capital====================================

e equity share; Do=Dividend per share paid at time 0; g=Constant rate of

Ke = Cost of the retained earnings]

Constant Dividend Growth Model

= Rapid growth rate of dividend during the first n years; gn =Normal growth rate of dividend

continuously for ever; Pn = Share price at the end of n years]

gn) Two Stage Growth Model

*(1+gr)^2 / (1+Ke)^2 + . + Do*(1+gr)^n / (1+Ke)^n +Pn / (1+Ke)^n

Using Discounted Cash Flow (DCF) approach

[E(Rs) = Expected rate of return of the security; Rf= Risk-free rate of return; E(Rm) = Expected rate of

Beta co-efficient of the security]

Capital Asset Pricing Model (CAPM) Approach

or, E(Rs) = (1-s) Rf + s E(Rm)

. [Po = Gross amount received per share; f =Percent floatation costs.]

= Cost of the existing equity + Adjustment for the flotatio

= Do*(1+g)*f / [Po*(1-f)]

=====Cost of Preference Capital========

[Kp = Cost of Preference share capital; D = Annual dividend]

[Kat=post-tax cost; Kbt=pre-tax cost; t=corporate income tax rate.]

[We = Proportion of equity in the total capital; Wp = preference shares; Wd = debt ; Ke = Cost

of retained earnings / external equity; Kp = Cost of preference capital; Kd = Pre

We + Wp + Wd = 1.0]

+ Wp * Kp + Wd * Kd * (1-t)

(equity) = (asset) (1+D/E)

(equity) = (unlevered firm) [1+(1-t)*D/E]

===============================Discounted Cash Flow==================================

is cash flow today (time zero),r is the appropriate interest rate.

T is the number of periods over which the cash is invested. ; e is a transcendental number approximately equal to 2.718.

= C

0 .

e

rT

2

2

) (

) , (

M

i

M

M i

R Var

R R Cov

= =

r

C

PV

+

=

1

1

C FV =

====================================

e equity share; Do=Dividend per share paid at time 0; g=Constant rate of

Constant Dividend Growth Model

= Rapid growth rate of dividend during the first n years; gn =Normal growth rate of dividend

+ Do*(1+gr)^n / (1+Ke)^n +Pn / (1+Ke)^n

Using Discounted Cash Flow (DCF) approach

free rate of return; E(Rm) = Expected rate of

Capital Asset Pricing Model (CAPM) Approach

f =Percent floatation costs.]

+ Adjustment for the flotation costs

[Kp = Cost of Preference share capital; D = Annual dividend]

t=corporate income tax rate.]

[We = Proportion of equity in the total capital; Wp = preference shares; Wd = debt ; Ke = Cost

of retained earnings / external equity; Kp = Cost of preference capital; Kd = Pre-tax cost of debt;

==================================

is cash flow today (time zero),r is the appropriate interest rate.

e is a transcendental number approximately equal to 2.718.

T m

m

r

C

+ 1

0

Perpetuity

Growing

Perpetuity

Annuity

Growing

Annuity

T

T

r

g C

r

g C

r

C

PV

) 1 (

) 1 (

) 1 (

) 1 (

) 1 (

1

2

+

+

+ +

+

+

+

+

=

L

1

1

]

1

|

|

\

|

+

+

=

T

r

g

g r

C

PV

) 1 (

1

1

T

r

C

r

C

r

C

r

C

PV

) 1 ( ) 1 ( ) 1 ( ) 1 (

3 2

+

+

+

+

+

+

+

= L

+

=

T

r r

C

PV

) 1 (

1

1

L +

+

+

+

+

+

+

+

=

3

2

2

) 1 (

) 1 (

) 1 (

) 1 (

) 1 ( r

g C

r

g C

r

C

PV

g r

C

PV

=

L +

+

+

+

+

+

=

3 2

) 1 ( ) 1 ( ) 1 ( r

C

r

C

r

C

PV

r

C

PV =

Вам также может понравиться

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesОт EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesОценок пока нет

- Corporate Finance Formulas: A Simple IntroductionОт EverandCorporate Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- Finance Cheat SheetДокумент4 страницыFinance Cheat SheetRudolf Jansen van RensburgОценок пока нет

- CheatSheet (Finance)Документ1 страницаCheatSheet (Finance)Guan Yu Lim100% (3)

- Kelly's Finance Cheat Sheet V6Документ2 страницыKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Corporate Finance Formula SheetДокумент4 страницыCorporate Finance Formula Sheetogsunny100% (3)

- CorpFinance Cheat Sheet v2.2Документ2 страницыCorpFinance Cheat Sheet v2.2subtle69100% (4)

- BF2201 Cheat Sheet FinalsДокумент2 страницыBF2201 Cheat Sheet Finalssiewhong93100% (1)

- Overview of Financial Management Concepts and ToolsДокумент4 страницыOverview of Financial Management Concepts and ToolsPeixuan Zhuang100% (1)

- Cheat Sheet Corporate - FinanceДокумент2 страницыCheat Sheet Corporate - FinanceAnna BudaevaОценок пока нет

- Fnce 100 Final Cheat SheetДокумент2 страницыFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Corporate Finance Math SheetДокумент19 страницCorporate Finance Math Sheetmweaveruga100% (3)

- Cheat Sheet Final - FMVДокумент3 страницыCheat Sheet Final - FMVhanifakih100% (2)

- Cheat Sheet - AccountingДокумент2 страницыCheat Sheet - AccountingJeffery KaoОценок пока нет

- Equation Formula: 1 1 FV PMT 1Документ3 страницыEquation Formula: 1 1 FV PMT 1JMSB09Оценок пока нет

- Cheat Sheet - EXAM Version - BARBARAДокумент2 страницыCheat Sheet - EXAM Version - BARBARAJosé António Cardoso RodriguesОценок пока нет

- FMV Cheat SheetДокумент1 страницаFMV Cheat SheetAyushi SharmaОценок пока нет

- Midsem Cheat Sheet (Finance)Документ2 страницыMidsem Cheat Sheet (Finance)lalaran123Оценок пока нет

- Corporate FinanceДокумент19 страницCorporate FinanceBilal Shahid100% (4)

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolДокумент6 страницFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenОценок пока нет

- Fin Cheat SheetДокумент3 страницыFin Cheat SheetChristina RomanoОценок пока нет

- Session 2 - Doing VC Deals - Lecture Presentation Slides IM 5 Mar 12Документ58 страницSession 2 - Doing VC Deals - Lecture Presentation Slides IM 5 Mar 12Henry So E Diarko100% (1)

- CheatДокумент1 страницаCheatIshmo KueedОценок пока нет

- Finance ProblemSets11Документ323 страницыFinance ProblemSets11Stefan CN100% (2)

- The Ultimate Financial Management Cheat SheetДокумент3 страницыThe Ultimate Financial Management Cheat SheethazimОценок пока нет

- Accounting Cheat SheetДокумент2 страницыAccounting Cheat Sheetanoushes1100% (2)

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Документ27 страницBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Summary - Corporate Finance Beck DeMarzoДокумент54 страницыSummary - Corporate Finance Beck DeMarzoAlejandra100% (2)

- DCF Intrinsic ValuationДокумент38 страницDCF Intrinsic ValuationKritika KoulОценок пока нет

- FIN6215-Cheat Sheet BigДокумент3 страницыFIN6215-Cheat Sheet BigJojo Kittiya100% (1)

- Cfa Level I - Us Gaap Vs IfrsДокумент4 страницыCfa Level I - Us Gaap Vs IfrsSanjay RathiОценок пока нет

- Cheat Sheet For Financial AccountingДокумент1 страницаCheat Sheet For Financial Accountingmikewu101Оценок пока нет

- Accounting Cheat Sheet FinalsДокумент5 страницAccounting Cheat Sheet FinalsRahel CharikarОценок пока нет

- Corporate Finance Cheat SheetДокумент3 страницыCorporate Finance Cheat Sheetdiscreetmike50Оценок пока нет

- 3 - FCF CalculationДокумент2 страницы3 - FCF CalculationAman ManjiОценок пока нет

- Practice MidtermДокумент8 страницPractice MidtermghaniaОценок пока нет

- Cohen Finance Workbook FALL 2013Документ124 страницыCohen Finance Workbook FALL 2013Nayef AbdullahОценок пока нет

- Intl Finance Cheat SheetДокумент6 страницIntl Finance Cheat Sheetpradhan.neeladriОценок пока нет

- Corporate Finance FormulasДокумент3 страницыCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Corporate FinanceДокумент24 страницыCorporate Financeapi-3719687100% (3)

- Financial Modeling and Analysis 3Ed-LibreДокумент14 страницFinancial Modeling and Analysis 3Ed-LibremjcstimsonОценок пока нет

- Managerial Accounting Mid-Term Cheat SheetДокумент6 страницManagerial Accounting Mid-Term Cheat SheetĐạt Nguyễn100% (1)

- Atlassian 3 Statement Model CompleteДокумент24 страницыAtlassian 3 Statement Model CompleteShrey JainОценок пока нет

- Corporate Finance Cheatsheet Zhiwei NewДокумент2 страницыCorporate Finance Cheatsheet Zhiwei NewZaggie NgОценок пока нет

- Technical Finance Interview Prep (Student)Документ261 страницаTechnical Finance Interview Prep (Student)fernando.torrealbatesiОценок пока нет

- Handout # 1 Solutions (L)Документ10 страницHandout # 1 Solutions (L)Prabhawati prasadОценок пока нет

- Finance Cheat SheetДокумент2 страницыFinance Cheat SheetMarc MОценок пока нет

- Dividend Discount and Residual Income Models ExplainedДокумент2 страницыDividend Discount and Residual Income Models ExplainedMohammad DaulehОценок пока нет

- Cheat SheetДокумент2 страницыCheat SheetDimana Dollo100% (1)

- Capital Structure and Cost of CapitalДокумент3 страницыCapital Structure and Cost of CapitalAbhijit PanditОценок пока нет

- FIN 401 - Cheat SheetДокумент2 страницыFIN 401 - Cheat SheetStephanie NaamaniОценок пока нет

- Corporate Finance Formula SheetДокумент9 страницCorporate Finance Formula SheetWilliamОценок пока нет

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceДокумент6 страницFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemОценок пока нет

- Financial Management - Formula SheetДокумент8 страницFinancial Management - Formula SheetHassleBustОценок пока нет

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVДокумент9 страницR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoОценок пока нет

- CFA Formula Cheat SheetДокумент9 страницCFA Formula Cheat SheetChingWa ChanОценок пока нет

- Cost of CapitalДокумент31 страницаCost of CapitalMadhuram Sharma100% (1)

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- Geneva IntrotoBankDebt172Документ66 страницGeneva IntrotoBankDebt172satishlad1288Оценок пока нет

- Victor's Letter Identity V Wiki FandomДокумент1 страницаVictor's Letter Identity V Wiki FandomvickyОценок пока нет

- Course Syllabus: Aurora Pioneers Memorial CollegeДокумент9 страницCourse Syllabus: Aurora Pioneers Memorial CollegeLorisa CenizaОценок пока нет

- Lec - Ray Theory TransmissionДокумент27 страницLec - Ray Theory TransmissionmathewОценок пока нет

- Civil Aeronautics BoardДокумент2 страницыCivil Aeronautics BoardJayson AlvaОценок пока нет

- Tyron Butson (Order #37627400)Документ74 страницыTyron Butson (Order #37627400)tyron100% (2)

- Mayor Byron Brown's 2019 State of The City SpeechДокумент19 страницMayor Byron Brown's 2019 State of The City SpeechMichael McAndrewОценок пока нет

- CORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Документ2 страницыCORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Sanjeev MansotraОценок пока нет

- Asian Construction Dispute Denied ReviewДокумент2 страницыAsian Construction Dispute Denied ReviewJay jogs100% (2)

- Wind EnergyДокумент6 страницWind Energyshadan ameenОценок пока нет

- Benchmarking Guide OracleДокумент53 страницыBenchmarking Guide OracleTsion YehualaОценок пока нет

- Case Study 2 F3005Документ12 страницCase Study 2 F3005Iqmal DaniealОценок пока нет

- ZOOLOGY INTRODUCTIONДокумент37 страницZOOLOGY INTRODUCTIONIneshОценок пока нет

- Introduction To Succession-1Документ8 страницIntroduction To Succession-1amun dinОценок пока нет

- Chill - Lease NotesДокумент19 страницChill - Lease Notesbellinabarrow100% (4)

- Safety QualificationДокумент2 страницыSafety QualificationB&R HSE BALCO SEP SiteОценок пока нет

- ITSCM Mindmap v4Документ1 страницаITSCM Mindmap v4Paul James BirchallОценок пока нет

- ADSLADSLADSLДокумент83 страницыADSLADSLADSLKrishnan Unni GОценок пока нет

- NEW CREW Fast Start PlannerДокумент9 страницNEW CREW Fast Start PlannerAnonymous oTtlhP100% (3)

- Improvements To Increase The Efficiency of The Alphazero Algorithm: A Case Study in The Game 'Connect 4'Документ9 страницImprovements To Increase The Efficiency of The Alphazero Algorithm: A Case Study in The Game 'Connect 4'Lam Mai NgocОценок пока нет

- High Altitude Compensator Manual 10-2011Документ4 страницыHigh Altitude Compensator Manual 10-2011Adem NuriyeОценок пока нет

- Department Order No 05-92Документ3 страницыDepartment Order No 05-92NinaОценок пока нет

- DSA NotesДокумент87 страницDSA NotesAtefrachew SeyfuОценок пока нет

- Advance Bio-Photon Analyzer ABPA A2 Home PageДокумент5 страницAdvance Bio-Photon Analyzer ABPA A2 Home PageStellaEstel100% (1)

- Micromaster 430: 7.5 KW - 250 KWДокумент118 страницMicromaster 430: 7.5 KW - 250 KWAyman ElotaifyОценок пока нет

- 50TS Operators Manual 1551000 Rev CДокумент184 страницы50TS Operators Manual 1551000 Rev CraymondОценок пока нет

- 1LE1503-2AA43-4AA4 Datasheet enДокумент1 страница1LE1503-2AA43-4AA4 Datasheet enAndrei LupuОценок пока нет

- International Convention Center, BanesworДокумент18 страницInternational Convention Center, BanesworSreeniketh ChikuОценок пока нет

- GS Ep Cor 356Документ7 страницGS Ep Cor 356SangaranОценок пока нет

- Resume Ajeet KumarДокумент2 страницыResume Ajeet KumarEr Suraj KumarОценок пока нет