Академический Документы

Профессиональный Документы

Культура Документы

SAP SD Third Party Sales

Загружено:

Dinbandhu TripathiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SAP SD Third Party Sales

Загружено:

Dinbandhu TripathiАвторское право:

Доступные форматы

TRADING GOODS THIRD PARTY SALES

Business Process

___Sundara rami reddy 9989134470

The Following information from SAP help elaborates the business process thereafter the business process in SAP has been shown through Steps followed by FAQs Third-Party Order Processing Purpose In third-party order processing, your company does not deliver the items requested by a customer. Instead, you pass the order along to a third-party vendor who then ships the goods directly to the customer and bills you. A sales order may consist partly or wholly of third-party items. Occasionally, you may need to let a vendor deliver items you would normally deliver yourself. The following graphic shows how a third party business transaction is processed.

If you order products from a third-party vendor, who delivers the goods directly to you so that you can then deliver them to the customer yourself, you can use individual purchase order processing..

Process Flow The processing of third-party orders is controlled via material types. Material types define whether a material is produced only internally, can be ordered only from thirdparty vendors, or whether both are possible. For example, a material that is defined as a trading good can only be ordered from a third-party vendor. However, if you manufacture your own finished products, you may also want, from time to time, to be able to order the same type of product from other vendors. Processing Third-Party Orders in Sales Third-party items can be created automatically by the system, depending on how your system is set. However, you can also change a standard item to a third-party item during sales processing manually.

Automatic third-party order processing

If a material is always delivered from one or more third-party vendors, you can specify in the material master that the material is a third-party item. During subsequent sales order processing, the system automatically determines the appropriate item category for a third-party item: TAS. To specify a material as a thirdparty item, enter BANS in the Item category group field in the Sales 2 screen of the material master record.

Manual third-party order processing

In the case of a material that you normally deliver yourself but occasionally need to order from a third-party vendor, you can overwrite the item category during sales order processing. For a material that you normally deliver yourself, you specify the item category group NORM in the material master. If, as an exception, you use a third-party material, change the entry TAN to TAS in the ItCa field when processing the sales document. The item is then processed as third-party item. If address data for the ship-to party is changed in the sales order in third-party business transactions, the changed data will automatically be passed on to purchase requisition and also to the purchase order ,if one already exists. In the purchase order, you can display the address data for the ship-to party in the attributes for the item. You can only change the address data for the ship-to party in the sales order for third-party business transactions, and not in the purchase order.

Processing Third-Party Orders in Purchasing When you save a sales order that contains one or more third-party items, the system automatically creates a purchase requisition in Purchasing. Each third-party item in a sales order automatically generates a corresponding purchase requisition item. During creation of the requisition, the system automatically determines a vendor for each requisition item. If a sales order item has more than one schedule line, the system creates a purchase requisition item for each schedule line. Purchase orders are created from purchase requisitions in the usual way. For more information about creating purchase orders, see the Purchasing documentation. During creation of the purchase order, the system automatically copies the delivery address of your customer from the corresponding sales order. In a sales order, you can enter purchase order texts for each third-party item. When you create the corresponding purchase order, the texts are automatically copied into the purchase order. The number of the purchase order appears in the document flow information of the sales order. All changes made in the purchase order are automatically made in the sales order as well. For example, if the vendor confirms quantities and delivery dates different from those you request and enters them in the purchase order, the revised data is automatically copied into the sales order. How Purchasing Data Affects Delivery Scheduling During the automatic delivery scheduling of third-party items, the system takes into account lead times specified by the purchasing department. For example, the system allows for the time required by the vendor to deliver the goods to your customer and also the time required by the purchasing department to process third-party orders. Comparing Purchasing Data with Sales Data You can create a list of all sales orders with third party items for which there are discrepancies between the quantities ordered, invoiced, canceled, or credited in Sales and the quantities ordered, invoiced or credited in Purchasing.

Step1 Create the Sales Order

Select the Item screen and check the item category: The Item category is TAS Save the order Step2 VA02 and in the order check Item level -- > schedule line and select procurement 12082

We can see a Purchase requisition No 10013643 And again from schedule line select Purchase requisition tab

We can see the Vendor No : . 77777 And the info record Save order

Step III Now create the Purchase order by copying the purchase requisition

Transaction code ME58 Enter the details and execute the program

Select the vendor and select Process assignment

Order Type

NB

Continue

Select the Purchase requisition and select adopt Now it copies data from Purchase REQ

Check the tax

Save the Purchase order

PO 4500017180 Step IV Now we have to do Invoice verification Use TCODE MIRO

Enter the Invoice date and PO NO

Select simulation

Here can see the vendor account is shown for credit , Tax account for debit and most important the cost of the Goods sold for debit Note : Here the system is considering the material as consumed and debiting the cost of the goods sold and unless this happens the customer Invoice can not be prepared ie the reason why MIRO has to be done then only customer can invoice can be prepared Now POST

Posting document prepared Step V Create the Sales Invoice VF01

It is referring the sales order

Check the document Flow

Вам также может понравиться

- SAP PR Release Strategy Concept and Configuration Guide: A Case StudyОт EverandSAP PR Release Strategy Concept and Configuration Guide: A Case StudyРейтинг: 4 из 5 звезд4/5 (6)

- Determination Rule in SD For Quick Reference: SL.N o Determination Object Rules For DeterminationДокумент4 страницыDetermination Rule in SD For Quick Reference: SL.N o Determination Object Rules For DeterminationRajanikanth AnnaluruОценок пока нет

- Fico and SD NotesДокумент29 страницFico and SD NotesViswanadha Sai MounikaОценок пока нет

- Automatic Account DeterminationДокумент17 страницAutomatic Account Determinationsaif78692100% (1)

- Availability Check (ATP) & Transfer of Requirement (TOR)Документ6 страницAvailability Check (ATP) & Transfer of Requirement (TOR)nandi12345Оценок пока нет

- SAP SD Third-party sales process overviewДокумент13 страницSAP SD Third-party sales process overviewsumit patilОценок пока нет

- Third-party Order Process ConfigurationДокумент4 страницыThird-party Order Process ConfigurationChandrshikarОценок пока нет

- Inbound Delivery: for Document DefinitionДокумент7 страницInbound Delivery: for Document Definitionమనోహర్ రెడ్డిОценок пока нет

- Release Strategy For Sales Document Using Status ProfileДокумент34 страницыRelease Strategy For Sales Document Using Status ProfileMuralikrishnaKommineni75% (4)

- Subsequent Debits, Delivery Costs and Credit MemosДокумент37 страницSubsequent Debits, Delivery Costs and Credit MemosSrini VasanОценок пока нет

- Invoice List ConfigurationДокумент6 страницInvoice List ConfigurationsudheerravulaОценок пока нет

- How To Goods Movements With BAPIДокумент17 страницHow To Goods Movements With BAPIrrshankar123Оценок пока нет

- Rebates ConfigurationДокумент35 страницRebates ConfigurationS Joseph RajОценок пока нет

- BC Sets Guide OverviewДокумент6 страницBC Sets Guide Overviewandy7820Оценок пока нет

- Sales BOMДокумент6 страницSales BOMAniruddha ChakrabortyОценок пока нет

- Inter-Company STO With SD Delivery, Billing & LIVДокумент39 страницInter-Company STO With SD Delivery, Billing & LIVpraveen adavellyОценок пока нет

- Include Actual Costs in COGS With Material Ledger in Release 4.7Документ7 страницInclude Actual Costs in COGS With Material Ledger in Release 4.7Huba Horompoly100% (1)

- SOP - HOtel Credit Policy and PRoceduresДокумент4 страницыSOP - HOtel Credit Policy and PRoceduresImee S. YuОценок пока нет

- Tax Procedure Configuration PDFДокумент18 страницTax Procedure Configuration PDFDinbandhu TripathiОценок пока нет

- Business Blueprint Document FI03-01 - Customer / Vendor Account GroupsДокумент8 страницBusiness Blueprint Document FI03-01 - Customer / Vendor Account GroupsDinbandhu TripathiОценок пока нет

- Business Blueprint Document FI03-01 - Customer / Vendor Account GroupsДокумент8 страницBusiness Blueprint Document FI03-01 - Customer / Vendor Account GroupsDinbandhu TripathiОценок пока нет

- SD Revenue Account Determination SetupДокумент10 страницSD Revenue Account Determination SetupkarthikbjОценок пока нет

- Hitech Security BrochureДокумент9 страницHitech Security BrochureKawalprit BhattОценок пока нет

- Rebate Processing PDFДокумент42 страницыRebate Processing PDFrajesh1978.nair238186% (7)

- Keka Module StackДокумент59 страницKeka Module StackNaveenJainОценок пока нет

- 2011-1-Training Manual On Material ManagementДокумент119 страниц2011-1-Training Manual On Material ManagementPrudhvikrishna GurramОценок пока нет

- PR Release StrategyДокумент21 страницаPR Release StrategyabdulОценок пока нет

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- Item Category Controls in SapДокумент6 страницItem Category Controls in SapkarthikbjОценок пока нет

- Finding The Enhancement Project When User Exit Is ProvidedДокумент6 страницFinding The Enhancement Project When User Exit Is ProvidedHarsha Thelikorala100% (5)

- Stock Transport OrderДокумент34 страницыStock Transport Orderkumarmahesh100% (3)

- STO Configuration StepsДокумент3 страницыSTO Configuration Stepsbeema1977100% (1)

- 3 SDДокумент16 страниц3 SDMiguel P BerumenОценок пока нет

- 2 4 2 1 Fs Otc Form f002 Intercompany v2Документ19 страниц2 4 2 1 Fs Otc Form f002 Intercompany v2Rahul Ravi0% (1)

- PEN KY Olicy: Need For Open Skies PolicyДокумент5 страницPEN KY Olicy: Need For Open Skies PolicyDebonair Shekhar100% (1)

- VT01N Config StepsДокумент14 страницVT01N Config Stepsmeti kota100% (2)

- Milestone BillingДокумент4 страницыMilestone BillingDinbandhu Tripathi100% (1)

- Commercial Contractor Business PlanДокумент35 страницCommercial Contractor Business PlanAMANUEL BABBAОценок пока нет

- Stock Transfer Plant To PlantДокумент36 страницStock Transfer Plant To Plantbalu4indians100% (1)

- Status Profiles in SAPДокумент8 страницStatus Profiles in SAPnathaanmaniОценок пока нет

- SAP Stock Transfers With Valuated SIT PostingsДокумент18 страницSAP Stock Transfers With Valuated SIT PostingsSugata BiswasОценок пока нет

- SD QuestionsДокумент227 страницSD QuestionschaurasiaОценок пока нет

- Billing Type ControlsДокумент18 страницBilling Type ControlsRam KLОценок пока нет

- Test 1 Ma2Документ15 страницTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- SAP SD Configuration GuideДокумент363 страницыSAP SD Configuration Guiderajendrakumarsahu94% (52)

- Project Report on IPO in IndiaДокумент7 страницProject Report on IPO in IndianeetliОценок пока нет

- Pricing Condition Type KUMU, Cumiliate Sub Item Cost To Main Item CostДокумент1 страницаPricing Condition Type KUMU, Cumiliate Sub Item Cost To Main Item CostSOUMEN DASОценок пока нет

- Sap (TSCM60)Документ12 страницSap (TSCM60)Raj Kumar0% (1)

- V of M Data Transfer RoutinesДокумент28 страницV of M Data Transfer RoutinesSamik Biswas100% (2)

- Rebate Process Configuration - SAP BlogsДокумент18 страницRebate Process Configuration - SAP BlogsbossОценок пока нет

- Batch Determination - KSLДокумент12 страницBatch Determination - KSLapi-3718223100% (1)

- Invoice ListДокумент19 страницInvoice ListRinna Belle Cruz-Soliva100% (1)

- SDBilling Document Consolidation and SplitДокумент43 страницыSDBilling Document Consolidation and Splityangontha55sg100% (1)

- Status ProfileДокумент12 страницStatus ProfileDeependra TomarОценок пока нет

- Sap SD PricingДокумент3 страницыSap SD PricingSachin SinghОценок пока нет

- Individual Purchase Order End User Document ERP SAP ECCДокумент17 страницIndividual Purchase Order End User Document ERP SAP ECCbalashowryraju100% (1)

- Customization SD LEДокумент88 страницCustomization SD LEKamleshSaroj100% (1)

- Copy Control Settings: PurposeДокумент4 страницыCopy Control Settings: PurposeLokesh DoraОценок пока нет

- Copy Contro in SDДокумент4 страницыCopy Contro in SDHuseyn IsmayilovОценок пока нет

- SAP Best Practices for S/4 HANA On-Premise ImplementationsДокумент16 страницSAP Best Practices for S/4 HANA On-Premise Implementationssanketsurve14gmailcoОценок пока нет

- Create Transfer Order - DirectДокумент3 страницыCreate Transfer Order - Directmehboob hafizОценок пока нет

- ALE-IDOC EXA. Sales Order AleДокумент8 страницALE-IDOC EXA. Sales Order AleSaroshОценок пока нет

- Tax Calculation on Freight in Different ScenariosДокумент15 страницTax Calculation on Freight in Different Scenarioslostrider_991Оценок пока нет

- Sales Related UserexitsДокумент13 страницSales Related UserexitsJmarVirayОценок пока нет

- How To Transport Requirement Routines From One Client To The OtherДокумент4 страницыHow To Transport Requirement Routines From One Client To The OtherAnupa Wijesinghe100% (2)

- SAP SD Depot ProcessДокумент47 страницSAP SD Depot ProcessLu VanderhöffОценок пока нет

- Requirement RoutinesДокумент3 страницыRequirement RoutinesRajesh SrinathanОценок пока нет

- Articles On SAP Import ProcurementДокумент4 страницыArticles On SAP Import Procurementnoor ahmed100% (1)

- Configure custom format for subcontracting excise challan 57F4Документ1 страницаConfigure custom format for subcontracting excise challan 57F4lojo123Оценок пока нет

- Calculation On Freight - Different ScenariosДокумент5 страницCalculation On Freight - Different ScenariosDISHIMUKH YADAVОценок пока нет

- Availability Check For Stock Transport Order - Managing Special Stocks (MM-IM) - SAP LibraryДокумент7 страницAvailability Check For Stock Transport Order - Managing Special Stocks (MM-IM) - SAP LibraryPavilionОценок пока нет

- Gate Module: Process ID Process Name Sub-Process Sub-Process ID Number Key Consideration IDДокумент6 страницGate Module: Process ID Process Name Sub-Process Sub-Process ID Number Key Consideration IDDinbandhu TripathiОценок пока нет

- Distributorship Agreement Final DraftДокумент8 страницDistributorship Agreement Final DraftDinbandhu TripathiОценок пока нет

- Annexure - A - SSILДокумент1 страницаAnnexure - A - SSILDinbandhu TripathiОценок пока нет

- Process For Configuration / Development SERVERДокумент1 страницаProcess For Configuration / Development SERVERDinbandhu TripathiОценок пока нет

- Expert Advice Form Guide User QuestionsДокумент2 страницыExpert Advice Form Guide User QuestionsDinbandhu TripathiОценок пока нет

- OBYC Important account transaction keysДокумент3 страницыOBYC Important account transaction keysDinbandhu TripathiОценок пока нет

- Book24 1 2017OPДокумент262 страницыBook24 1 2017OPDinbandhu TripathiОценок пока нет

- Advance Payment To SubДокумент1 страницаAdvance Payment To SubDinbandhu TripathiОценок пока нет

- Step 1: SPRO: To Create TDS CodeДокумент3 страницыStep 1: SPRO: To Create TDS CodeDinbandhu TripathiОценок пока нет

- Faq'S Related To ConstructionДокумент1 страницаFaq'S Related To ConstructionDinbandhu TripathiОценок пока нет

- Book24 1 2017DДокумент262 страницыBook24 1 2017DDinbandhu TripathiОценок пока нет

- Shyam Steel Industries Interview Assessment SheetДокумент1 страницаShyam Steel Industries Interview Assessment SheetDinbandhu TripathiОценок пока нет

- Accounting Entries in SAP FICO - FICO S..Документ5 страницAccounting Entries in SAP FICO - FICO S..Dinbandhu TripathiОценок пока нет

- ExcelFormulas TF Jul1605Документ164 страницыExcelFormulas TF Jul1605ShaluaОценок пока нет

- Ayurveda Medicine Workshop PDFДокумент19 страницAyurveda Medicine Workshop PDFరమణి శ్రీ అడుసుమల్లిОценок пока нет

- Functional Specification: Project SAP SupportДокумент7 страницFunctional Specification: Project SAP SupportDinbandhu TripathiОценок пока нет

- SAP ECC 6.0 Master Data Maintenance and Plant Hierarchical Structure CreationДокумент14 страницSAP ECC 6.0 Master Data Maintenance and Plant Hierarchical Structure CreationDinbandhu TripathiОценок пока нет

- Proc. of Stock Materials-Revised-2Документ119 страницProc. of Stock Materials-Revised-2Dinbandhu TripathiОценок пока нет

- Rate Contract For MaterialДокумент14 страницRate Contract For MaterialDinbandhu TripathiОценок пока нет

- Mi 10Документ1 страницаMi 10Dinbandhu TripathiОценок пока нет

- Proc. of Services-RelДокумент23 страницыProc. of Services-RelDinbandhu TripathiОценок пока нет

- Sales Order Change ReportДокумент6 страницSales Order Change ReportDinbandhu TripathiОценок пока нет

- Returns Discounts and Sales TaxДокумент1 страницаReturns Discounts and Sales TaxSwapnaKarma BhaktiОценок пока нет

- Calculate Earnings Per Share (EPSДокумент24 страницыCalculate Earnings Per Share (EPSAbdul RehmanОценок пока нет

- Roborobo Co., LTDДокумент26 страницRoborobo Co., LTDUnitronik RoboticaОценок пока нет

- Entrepreneurship Assignment YUSUFДокумент15 страницEntrepreneurship Assignment YUSUFShaxle Shiiraar shaxleОценок пока нет

- 03 - Literature ReviewДокумент7 страниц03 - Literature ReviewVienna Corrine Q. AbucejoОценок пока нет

- Intermediate Accounting 1 Module - The Accounting ProcessДокумент16 страницIntermediate Accounting 1 Module - The Accounting ProcessRose RaboОценок пока нет

- Buku Teks David L.Debertin-293-304Документ12 страницBuku Teks David L.Debertin-293-304Fla FiscaОценок пока нет

- Energy Crisis PPT in Macro EconomicsДокумент34 страницыEnergy Crisis PPT in Macro Economicsmansikothari1989100% (2)

- Sales Budget PlanningДокумент18 страницSales Budget PlanninganashussainОценок пока нет

- Ba7022 Merchant Banking and Financial ServicesДокумент214 страницBa7022 Merchant Banking and Financial ServicesRitesh RamanОценок пока нет

- Ass 2016Документ6 страницAss 2016annaОценок пока нет

- Executive SummaryДокумент3 страницыExecutive SummaryKanchan TripathiОценок пока нет

- Deloitte AnalyticsДокумент5 страницDeloitte Analyticsapi-89285443Оценок пока нет

- Distribution Channel in Wagh Bakri TeaДокумент5 страницDistribution Channel in Wagh Bakri TeaJuned RajaОценок пока нет

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент11 страницDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAryan JaiswalОценок пока нет

- For A New Coffe 2 6Документ2 страницыFor A New Coffe 2 6Chanyn PajamutanОценок пока нет

- Chapter 5 - Working Capital ManagementДокумент24 страницыChapter 5 - Working Capital ManagementFatimah Rashidi VirtuousОценок пока нет

- Design Sus NR Scheme PlanДокумент23 страницыDesign Sus NR Scheme PlanFelekePhiliphosОценок пока нет

- Accounting in ActionДокумент7 страницAccounting in ActionIda PaluszczyszynОценок пока нет

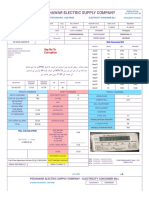

- PESCO ONLINE BILL Jan2023Документ2 страницыPESCO ONLINE BILL Jan2023amjadali482Оценок пока нет

- Business Exit Strategy - 1Документ2 страницыBusiness Exit Strategy - 1SUBRATA MODAKОценок пока нет

- KU Internship Report on Nepal Investment BankДокумент39 страницKU Internship Report on Nepal Investment Bankitsmrcoolpb100% (1)

- 1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanДокумент16 страниц1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanMBI TABEОценок пока нет