Академический Документы

Профессиональный Документы

Культура Документы

Oman Bank 2007 PDF

Загружено:

Mahmood KhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Oman Bank 2007 PDF

Загружено:

Mahmood KhanАвторское право:

Доступные форматы

Oman International Bank S.A.O.

G - Pakistan Branches

Balance Sheet

As at 31 December 2007 2007 2006 ---- Rupees in '000 ----

Note ASSETS Cash and balances with treasury banks Balances with other banks Lendings to financial institutions Investments Advances Operating fixed assets Deferred tax assets Other assets 6 7 8 9 10 11

2,391,751 42,807 220,506 5,646 33,221 2,693,931

2,304,786 67,683 368,321 4,583 17,253 2,762,626

LIABILITIES Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Deferred tax liabilities Other liabilities 12 13 14 2,754 178,000 459,937 19,617 660,308 2,033,623 4,415 98,000 618,017 17,065 737,497 2,025,129

15

NET ASSETS REPRESENTED BY: Head office capital account Reserves Accumulated losses 16

2,289,217 (255,594) 2,033,623 2,033,623

2,188,856 (163,727) 2,025,129 2,025,129

Surplus / (deficit) on revaluation of assets

CONTINGENCIES AND COMMITMENTS The annexed notes 1 to 42 form an integral part of these financial statements.

17

________________________ Country Manager

Senior Manager

Oman International Bank S.A.O.G - Pakistan Branches

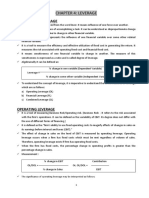

Profit and Loss Account

For the year ended 31 December 2007 2007 2006 ---- Rupees in '000 ---38,268 (47,636) (9,368) (40,468) (40,468) (49,836) 47,204 (41,313) 5,891 (1,183) (1,183) 4,708

Note Mark-up / return / interest earned Mark-up / return / interest expensed Net mark-up / interest (expense) / income Provision against non-performing loans and advances Provision for diminution in the value of investments Bad debts written off directly Net Mark-up/ interest (expense) / income after provisions NON MARK-UP / INTEREST INCOME Fee, commission and brokerage income Dividend income Income from dealing in foreign currencies Gain / (loss) on sale of securities Unrealized gain / (loss) on revaluation of investments classified as held for trading Other income Total non-markup / interest income NON MARK-UP/INTEREST EXPENSES Administrative expenses Other reversals / (provisions) / (write offs) Other charges Total non-markup / interest expenses Extra ordinary / unusual items LOSS BEFORE TAXATION Taxation - Current - Prior years - Deferred 24 LOSS AFTER TAXATION Earnings / (loss) per share - Basic and diluted 25 22 23 19 20

8.4

2,329 622 1,520 4,471 (45,365)

4,004 52 2,177 6,233 10,941

21

(44,273) (2,229) (46,502) (91,867) (91,867) (91,867) -

(35,501) 29 (23) (35,495) (24,554) (24,554) (24,554) -

The annexed notes 1 to 42 form an integral part of these financial statements.

Country Manager

Senior Manager

Oman International Bank S.A.O.G - Pakistan Branches

Statement of Changes in Equity

For the year ended 31 December 2007

Head office capital Accumulated account loss Total ------------------- Rupees in '000 ------------------Balance as at 01 January 2006 Loss after taxation for the year ended 31December 2006 Remittances received from head office Exchange adjustments on revaluation of capital Balance as at 01 January 2007 Loss after taxation for the year ended 31 December 2007 Remittances received from head office Exchange adjustments on revaluation of capital Balance as at 31 December 2007 1,168,934 999,409 20,513 2,188,856 79,904 20,457 2,289,217 (139,173) (24,554) (163,727) (91,867) (255,594) 1,029,761 (24,554) 999,409 20,513 2,025,129 (91,867) 79,904 20,457 2,033,623

The annexed notes 1 to 42 form an integral part of these financial statements.

_____________________ Country Manager

Senior Manager

Oman International Bank S.A.O.G - Pakistan Branches

Cash Flow Statement

For the year ended 31 December 2007 2007 2006 ---- Rupees in '000 ----

Note CASH FLOWS FROM OPERATING ACTIVITIES Loss before taxation Adjustments: Depreciation Amortisation Provision against non-performing advances Provision / (reversal) against other assets

(91,867) 22 22 8.4 11.1 1,624 82 40,468 2,654 44,828 (47,039)

(24,554) 1,389 20 1,183 (29) 2,563 (21,991)

(Increase) / decrease in operating assets Advances Others assets (excluding advance taxation)

107,347 (21,821) 85,526

149,428 3,210 152,638

Increase/ (decrease) in operating liabilities Bills payable Borrowings Deposits Other liabilities

Income tax refunded / (paid) Net cash (used in) / flow from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Investments in operating fixed assets Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Remittances received from head office Net cash flow from financing activities Effects of exchange adjustment on revaluation of capital Increase / (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year 26

(1,661) 80,000 (158,080) 2,552 (77,189) (38,702) 3,199 (35,503)

2,718 (172,700) 124,591 (971) (46,362) 84,285 (111) 84,174

9.1 & 9.2

(2,769) (2,769)

(3,049) (3,049)

79,904 79,904 20,457 62,089 2,372,469 2,434,558

999,409 999,409 20,513 1,101,047 1,271,422 2,372,469

The annexed notes 1 to 42 form an integral part of these financial statements.

Country Manager

Senior Manager

Oman International Bank S.A.O.G - Pakistan Branches

Notes to the Financial Statements

For the year ended 31 December 2007

1. 1.1

STATUS AND NATURE OF BUSINESS Oman International Bank S.A.O.G. is an Omani Joint Stock Company incorporated and domiciled in the Sultanate of Oman. The Oman International Bank S.A.O.G. presently operates through two branches in Pakistan i.e. at Karachi and Lahore. The Pakistan branches (the Bank) operate as branches of a foreign entity in Pakistan and are engaged in banking activities permissible under the Banking Companies Ordinance, 1962. The registered office of the Bank is located at Nadir House, I.I. Chundrigar Road, Karachi. The Bank obtained a rating of BBB for its medium to long-term debt and A2 for short-term debt, from JCR-VIS Credit Rating Agency. BASIS OF PRESENTATION In accordance with the directives of the Federal Government regarding shifting of the banking system to the Islamic modes, the State Bank of Pakistan has issued various circulars from time to time. Permissible form of trade related mode of financing includes purchase of goods by the bank from its customers and immediate resale to them at appropriate mark-up in price on deferred payment basis. The purchases and sales arising under these arrangements are not reflected in these financial statements as such but are restricted to the amount of facility actually utilised and the appropriate portion of mark-up thereon. Consistent with prior years, expenses of the head office allocable to the Pakistan branches are not incorporated in the books of account. STATEMENT OF COMPLIANCE These financial statements have been prepared in accordance with approved accounting standards as applicable in Pakistan. Approved accounting standards comprise of such International Financial Reporting Standards issued by the International Accounting Standards Board as are notified under the Companies Ordinance, 1984, provisions of and directives issued under the Companies Ordinance, 1984, Banking Companies Ordinance, 1962 and the directives issued by State Bank of Pakistan (SBP). In case the requirements differ, the provisions of and directives issued under the Companies Ordinance, 1984 and Banking Companies Ordinance, 1962 and the directives issued by SBP shall prevail. The Securities and Exchange Commission of Pakistan (SECP) has approved and notified the adoption of International Accounting Standard 39 - Financial Instruments; Recognition and Measurement and International Accounting Standard 40 - Investment Property. The requirements of these standards have not been followed in preparation of these financial statements as the State Bank of Pakistan has deferred the implementation of these standards, vide its BSD Circular No.10 dated 26 August 2002, for banks in Pakistan till further instructions. Accordingly, the requirements of these standards have not been considered in the preparation of these financial statements. However, investments have been classified and valued in accordance with the requirements prescribed by the State Bank of Pakistan through various circulars. Amendment to IAS 1 - "Presentation of Financial Statements - Capital Disclosures", introduces new disclosures about the level of an entity's capital and how it manages capital. Adoption of this amendment has only resulted in additional disclosures given in note 33 to the financial statements. International Financial Reporting Standard (IFRS) 2 - Share Based Payment, IFRS 3 - Business Combinations, IFRS 5 - Noncurrent Assets Held for Sale and Discontinued Operations, IFRS 6 - Exploration for and Extraction of Mineral Resources, IFRIC 8 Scope of IFRS 2 Share Based Payment and IFRIC 10 - Interim Financial Reporting and impairment became effective during the year. The application of these standards and interpretations did not have any material effect on the Bank's financial statements.

1.2

2. 2.1

2.2

3.

3.1

Standards, interpretations and amendments to published approved accounting standards that are not yet effective The following standards, amendments and interpretations of approved accounting standards will be effective for accounting periods beginning on or after 01 January 2008: Revised IAS 1 - Presentation of financial statements (effective for annual periods beginning on or after 01 January 2009). Th objective of revising IAS 1 is to aggregate information in the financial statements on the basis of shared characteristics. The changes affect the presentation of owner changes in equity and of comprehensive income. It introduces a requirement to include in a complete set of financial statements a statement of financial position as at the beginning of the earliest comparative period whenever the entity retrospectively applies an accounting policy or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

Revised IAS 23 - Borrowing costs (effective from 01 January 2009). Revised IAS 23 removes the option to expense borrowing costs and requires that an entity capitalize borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. The application of the standard is not likely to have an effect on Bank's financial statements. IFRIC 9 - Reassessment of embedded derivatives. The IFRIC is effective during the year and will be applied together with application of IAS 39. IFRIC 11 - IFRS 2 - Group and Treasury Share Transactions (effective for annual periods beginning on or after 01 March 2007). IFRIC 11 requires that a share based payment arrangement in which an entity receives goods or services as consideration for its own equity instruments to be accounted for as equity settled share based payment regardless of how the equity instruments are obtained. IFRIC 11 is not expected to have any material impact on the Banks financial statements. IFRIC 12 - Service Concession Arrangements (effective for annual periods beginning on or after 01 January 2008). IFRIC 12 provides guidance on certain recognition and measurement issues that arise in accounting for public-to-private concession arrangements. IFRIC 12 is not relevant to the Banks operations. IFRIC 13 - Customer Loyalty Programmes (effective for annual periods beginning on or after 01 July 2008). IFRIC 13 addresses the accounting by entities that operates, or otherwise participate in, customer loyalty programmes for their IFRIC 14 IAS 19 - The Limit on Defined Benefit Asset, Minimum Funding Requirements and their interaction (effective for annual periods beginning on or after 01 January 2008). IFRIC 14 clarifies when refunds or reductions in future contributions in relation to defined benefit assets should be regarded as available and provides guidance on minimum funding requirements (MFR) for such asset.

4.

BASIS OF MEASUREMENT These financial statements have been prepared under the historical cost convention except for certain financial assets and derivative financial instruments which are stated at fair values. The financial statements are presented in Pakistan Rupees, which is the Bank's functional and presentation currency. The amounts are rounded to nearest thousand The preparation of financial statements in conformity with the approved accounting standards requires the use of certain critical accounting estimates. It also requires the management to exercise its judgment in the process of applying the Bank's accounting policies. Estimates and judgments are continually evaluated and are based on historical experience, including expectations of future events that are believed to be reasonable under the circumstances. Judgements made by management in the application of accounting policies that have significant effect on the financial statements and estimates with a significant risk of material adjustment are explained in note 40 to these financial statements

5. 5.1

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Lendings/ borrowings to financial institutions The Bank enters into transactions of reverse repos and repos at contracted rates for a specified period of time. These are recorded a under: Purchase under resale obligation Securities purchased with a corresponding commitment to resell at a specified future date (reverse repos) are not recognised in the balance sheet. Amounts paid under these obligations are included in reverse repurchase agreement lendings. The difference between purchase and resale price is accrued as income over the term of the reverse repos agreement. Sale under repurchase obligation Securities sold with a simultaneous commitment to repurchase at a specified future date (repos) continue to be recognised in the balance sheet and are measured in accordance with accounting policies for investments. Amounts received under these agreements are recorded as repurchase agreement borrowings. The difference between sale and repurchase price is amortised as expense over the term of the repos agreement.

Other lendings/ borrowings These are recorded at the time of receipt / payment. Mark-up received / paid on such lending / borrowings is charged to the and loss account over the period of lending / borrowings. 5.2 Investments All investments acquired by the Bank are initially recognised at fair value. The Bank classifies its investment portfolio into held-for-trading, held-to-maturity and available-for-sale portfolios as follo

Held-for-trading These are securities which are acquired with the intention to trade by taking advantage of short-term market / interest rate movements and are to be sold within 90 days. These are carried at market value, with the related s / deficit being taken to profit and loss account. Held-to-maturity These are securities with fixed or determinable payments and fixed maturity that are held with the intention and ability to hold to maturity. These are carried at amortised cost, less provision for impairment in value, if a Available-for-sale These are investments that do not fall under the held-for-trading or held-to- maturity categories. T are carried at market value with the surplus / deficit taken to surplus/deficit on revaluation of assets account below eq

On derecognition or impairment in available for sale investments the cumulative gain or loss previously reported as 'Surplu (deficit) on revaluation of assets' is included in the income statement for the year. Premium and discount on debt securities classified as available-for-sale or held-to-maturity are amortised using the effecti interest rate method and taken to interest income or expense. Gains and losses on disposal of investments are dealt with through the profit and loss account in the year in which they ari 5.3 Advances Advances are stated at cost less any amount written off and specific and general provisions made, if any. Provision for spe non-performing advances (and relevant mark-up) is determined on the basis of the Prudential Regulations issued by the St Bank of Pakistan and according to the Bank's own criteria. General provisions are made based on the requirements of the C Bank of Oman. The Bank as a policy believes in full recovery of all outstanding amounts. Only when all possible avenues for recovery of are fully exhausted the Bank considers write-off. 5.4 Operating fixed assets and depreciation Tangible These are stated at cost less accumulated depreciation and impairment losses, if any. Depreciation is charged to income ap the straight line method whereby the cost of an asset is written off over its estimated useful life. The rates used are specifie note 9.1 to the financial statements. Normal repairs and maintenance are charged to income as and when incurred. Major renewals and improvements are capit

Subsequent costs are included in the asset carring amounts or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Bank and the cost of the item can be measu reliably. The carrying amount of the replaced part is derecognised. All other repairs and maintenance are charged to the in statement during the financial period in which they are incurred. The assets' residual values, useful lives and method of depreciation are reviewed, and adjusted if appropriate, at each balan sheet date. Gains and losses on the disposal of fixed assets are included in income currently.

Intangible These are stated at cost less accumulated amortisation and impairment losses, if any. The cost of the intangible assets repre their purchase cost, together with any incidental costs. Amortisation is charged to income applying the straight line method whereby the cost of an asset is written off over the estimated useful life at the rates specified in note 9.2 to the financial statements. 5.5 Taxation Income tax expense comprises of current and deferred tax. Income tax expenses are recognised in profit and loss account except to the extent that it relates to the items recognised directly in equity, in which case it is recognised in equity. Current Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the balance sheet date and any adjustments to the tax payable in respect of previous years. Deferred Deferred tax is provided using the balance sheet liability method providing for all temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and amounts used for taxation purposes. The amount of deferred tax provided is based on the expected manner of realisation or settlement of the carrying amount of assets and liabilities using tax rates enacted or substantively enacted at the balance sheet date. A deferred tax asset is recognised only to the extent that it is probable that future taxable profits will be available and the credits can be utilized. Deferred tax assets are reviewed at each balance sheet date and are reduced to the extent that it is no longer probable that the related tax benefits will be realised. 5.6 Staff retirement benefits Defined benefit plan The Bank operates an approved funded gratuity scheme. Annual contribution to the scheme are made on the basis of actua valuation using Projected Unit Credit Method. Actuarial gains and losses are recognised as income or expense when the cumulative unrecognised actuarial gains or losse exceed 10% of the higher of defined benefit obligation and the fair value of plan assets. These gains or losses are recognis the expected average remaining working lives of the employees participating in the plan. Defined contribution plan The Bank operates an approved contributory provident fund for all its permanent employees. Contributions are made mont accordance with the fund rules. 5.7 Provisions Provision for guarantee claims and other off balance sheet obligations is recognised when intimated and reasonable certain exists for the Bank to settle the obligation. Expected recoveries are recognised by debiting the customers account. Charg profit and loss account is stated net-of expected recoveries. Other provisions are recognized when the Bank has a legal or constructive obligation as a result of past events, it is probab an outflow of resources will be required to settle the obligation and a reliable estimate of the amount can be made. Provisio reviewed at each balance sheet date and are adjusted to reflect the current best estimate. 5.8 Revenue recognition Mark-up income and expenses are recognized on a time proportion basis taking into account effective yield on the instrument, except in case of advances classified under the Prudential Regulations issued by the State Bank of Pakistan on which mark-up is recognized on receipt basis. Fee, commission and brokerage income are recognized as services are performed. 5.9 Foreign currencies Foreign currency transactions are translated into rupees at the exchange rates prevailing on the date of transaction. Moneta assets and liabilities denominated in foreign currencies are translated into rupees at the exchange rates prevailing at the bal sheet date. Outstanding forward foreign exchange contracts and foreign bills purchased are valued at the market rates appl

to the respective maturities. Exchange gains and losses are includes in income currently.

5.10

Off Setting of financial assets and financial liabilities Financial assets and financial liabilities are only off-set and the net amount reported in the financial statements when there legally enforceable right to set-off the recognised amount and the Bank intends either to settle on a net basis, or to realise t assets and to settle the liabilities simultaneously. Income and expense items of such assets and liabilities are also off-set an net amount is reported in the financial statements.

5.11

Impairment of non-financial assets Assets that have an indefinite useful life are not subject to amortisation but are tested annually for impairment. Assets that subject to amortisation are reviewed for impairment whenever events or changes in circumstances indicate that the carryin amount may not be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount ex its recoverable amount.

5.12

Derivatives Derivative financial instruments are recognized at fair value on the date on which the derivative contract is entered into an subsequently remeasured at fair value using appropriate valuation techniques. Derivatives with positive market values (unr gains) are included in other assets and derivatives with negative market values (unrealised losses) are included in other lia in the balance sheet. The resultant gains and losses are taken to income currently.

5.13

Cash and cash equivalents Cash and cash equivalents comprise of cash and balances with treasury banks and balances with other banks.

5.14

Fiduciary assets Assets held in a fiduciary capacity are not treated as assets of the Bank in these financial statements.

5.15

Segment reporting A segment is a distinguishable component of the Bank that is engaged in providing product or services (business segment), or in providing products or services within a particular economic environment (geographical segment), which is subject to risk. Business segments Retail banking It consists of retail lending, deposits and banking services to private individuals and small businesses. The retail banking activities includes provision of banking and other financial services, such as current and savings accounts, etc to individual customers, small merchants and SMEs. Commercial banking The commercial banking represents provision of banking services including International Trade related activities to large corporate customers, multinational companies, government and semi government departments and institutions and SMEs treated as corporate under the Prudential Regulations issued by the State Bank of Pakistan. Trading & sales Trading business represents lending and borrowing from money markets and other treasury operations. Geographical segments The Bank operates in Pakistan only.

e profit

ows

m surplus

any. These quity. us /

ive

ise.

ecific tate Central

loans

pplying ed in

talised.

s ured ncome

nce

esents d

arial

es ed over

thly in

nty ge to

ble that ons are

ary lance licable

e is a the nd the

t are ng xceeds

nd are realised abilities

2007 2006 ------ Rupees in '000 -----6. CASH AND BALANCES WITH TREASURY BANKS In hand: Local currency Foreign currency With State Bank of Pakistan in: Local currency current account Local US Dollar collection account Foreign currency deposit account: Capital deposit with the SBP Cash reserve Special cash reserve - Remunerative

14,653 3,211 6.1 6.2 77,796 1,346 2,289,217 2,764 2,764 2,391,751

18,117 4,790 77,494 733 2,188,856 3,653 11,143 2,304,786

6.3 6.4

6.1

This represents current account maintained with SBP under the requirements of section 22 (Cash Reserve Requirement) of the Banking Companies Ordinance, 1962. This represents US Dollar settlement account opened with the SBP in accordance with FE Circular No. 2 and is remunerated at the rate of 4.24% (2006: 4.32%). This represents statutory cash reserve (at nil return) in the current account maintained with the SBP under the requirements of the SBP. This represents statutory cash reserve maintained against foreign currency deposits mobilised under FE 25 Circular issued by the SBP and is remunerated at the rate of 4.24% (2006: 4.32%). BALANCES WITH OTHER BANKS In Pakistan On current accounts Outside Pakistan On current accounts - remunerative 2007 2006 ------ Rupees in '000 -----699 7.1 42,108 42,807 476 67,207 67,683

6.2

6.3

6.4

7.

7.1

This includes Rs. 21.851 million (2006: Rs. 29.593 million) held with the Bank's head office Oman International Bank S.A.O.G. Muscat, Sultanate of Oman. ADVANCES Loans, cash credits, running finances, etc. - In Pakistan - Outside Pakistan Bills discounted and purchased (excluding treasury bills) - Payable in Pakistan - Payable outside Pakistan Advances - gross Provision for non-performing advances - specific - general 8.4 Advances - net of provision

8.

8.1

280,948 280,948 280,948 (55,905) (4,537) (60,442) 220,506

388,295 388,295 388,295 (15,437) (4,537) (19,974) 368,321

8.1

This includes a house loan to the Country Manager - Pakistan of Rs. 3.390 million (2006: 3.552) carrying a mark-up rate of 4.00% per annum. The loan is secured against the related property. Particulars of advances (Gross) 280,948 280,948 275,353 5,595 280,948 388,295 388,295 261,659 126,636 388,295

8.2

8.2.1 In local currency In foreign currencies

8.2.2 Short term ( for upto one year) Long term ( for over one year)

8.3

Advances include Rs.56.166 million (2006: Rs. 16.166 million) which have been placed under non-performing status as detailed below: 2007 Classified Advances Specific Provision Required Specific Provision Held Domestic Overseas Total Domestic Overseas Total Domestic Overseas Total ---------------------------------------------- Rupees in '000 --------------------------------------------Category of Classification Substandard Doubtful Loss 56,166 56,166 56,166 56,166 55,905 55,905 55,905 55,905 55,905 55,905 55,905 55,905

2006 Specific Provision Required Specific Provision Held Classified Advances Total Domestic Overseas Total Domestic Overseas Total Domestic Overseas ---------------------------------------------- Rupees in '000 -------------------------------------------Category of Classification Substandard Doubtful Loss

885 15,281 16,166

885 15,281 16,166

156 15,281 15,437

156 15,281 15,437

156 15,281 15,437

156 15,281 15,437

8.4

Particulars of provision against non-performing advances 2006 2007 Specific General Total Specific General Total ----------------------- Rupees in '000 ----------------------Opening balance Charge for the year Amounts written off Reversals Closing balance 15,437 40,468 55,905 4,537 4,537 19,974 40,468 60,442 15,281 156 15,437 3,510 1,027 4,537 18,791 1,183 19,974

8.4.1

Particulars of provisions against non-performing advances 2006 2007 Specific General Total Specific General Total ----------------------- Rupees in '000 ----------------------In local currency In foreign currencies 55,905 55,905 4,537 4,537 60,442 60,442 15,437 15,437 4,537 4,537 19,974 19,974

8.4.2

The Central Bank of Oman vide its Circular No. BM 977 requires that all banks create a 1% and 2% general provision on its corporate and retail loans respectively. To meet this requirement, the Bank has created the said provision.

8.5

Particulars of write offs In terms of sub-section 3 of section 33A of the Banking Companies Ordinance, 1962, there were no written off loans or any other financial relief allowed to a person(s) during the year ended December 31, 2007.

8.6

PARTICULARS OF LOANS AND ADVANCES TO COUNTRY MANAGER, ASSOCIATED COMPANIES, ETC. Debts due by country manager, executives or officers of the Bank or any of them either severally or jointly with any other persons Balance at beginning of year Loans granted during the year Repayments Balance at end of year

2006 2007 ----- Rupees in '000 -----

5,480 (363) 5,117 5,117

2,095 3,790 (405) 5,480 5,480

Note 9. OPERATING FIXED ASSETS Property and equipment - tangible Intangible assets 9.1 9.2

2007 2006 Rupees in '000

4,984 662 5,646

4,504 79 4,583

9.1

Property and equipment - tangible COST 2007 ACCUMULATED DEPRECIATION Book Value

As at Additions/ As at As at Charge for As at as at January 01, (Deletions) December 31, January 01, the year / December 31, December 31, Rate of 2007 2007 2007 (Deletions) 2007 2007 Depreciation % ---------------------------------------------------- Rupees in '000 ---------------------------------------------------Leasehold improvements Furniture and fixture Electrical, office and computer equipments Vehicles 10,804 5,081 10,413 5,411 31,709 1,549 555 2,104 10,804 5,081 11,962 5,966 33,813 9,795 4,637 10,022 2,751 27,205 473 223 294 634 1,624 10,268 4,860 10,316 3,385 28,829 536 221 1,646 2,581 4,984 10 10 20 20

COST

2006 ACCUMULATED DEPRECIATION

Book Value

As at Additions/ As at As at Charge for As at as at January 01, (Deletions) December 31, January 01, the year / December 31, December 31, 2006 2006 2006 (Deletions) 2006 2006 ---------------------------------------------------- Rupees in '000 ---------------------------------------------------Leasehold improvements Furniture and fixture Electrical, office and computer equipments Vehicles 10,804 5,040 10,301 2,611 28,756 41 112 2,800 2,953 10,804 5,081 10,413 5,411 31,709 9,322 4,407 9,702 2,385 25,816 473 230 320 366 1,389 9,795 4,637 10,022 2,751 27,205 1,009 444 391 2,660 4,504

Rate of Depreciation % 10 10 20 20

9.1.1 The gross carrying value of fully depreciated items in use amounts to Rs. 20.821 million (2006: Rs. 20.821 million). 9.1.2 The fair value of property and equipment as per the managements estimate is not materially different from the carrying amount. 9.2 Intangible assets 2007 ACCUMULATED AMORTISATION Book Value As at As at As at Charge for As at as at January 01, December 31, January 01, the year / December 31, December 31, Rate of 2007 2007 2007 (Deletions) 2007 2007 Amortisation % ---------------------------------------------------- Rupees in '000 ---------------------------------------------------COST Additions/ (Deletions) Computer software 632 632 665 665 1,297 1,297 553 553 82 82 635 635 662 662 33.33

2006 ACCUMULATED AMORTISATION Book Value As at As at As at Charge for As at as at January 01, December 31, January 01, the year / December 31, December 31, 2006 2006 2006 (Deletions) 2006 2006 ---------------------------------------------------- Rupees in '000 ---------------------------------------------------COST Additions/ (Deletions) Computer software 536 536 96 96 632 632 533 533 20 20 553 553 79 79

Rate of Amortisation % 33.33

9.2.1 The gross carrying value of intangible assets (computer software) not capitalized but still in use amounts to Rs. 2.103 million (2006: Rs. 2.103 million). 9.2.2 The gross carrying value of fully amortized intangible assets in use amounts to Rs. 0.536 million (2006: Rs. 0.536 million). 10. DEFERRED TAX ASSETS At year end net deductible temporary differences amounted to Rs. 61.218 million (2006: Rs. 25.838 million) which result in a net deferred tax asset of Rs. 21.426 million (2006: Rs. 9.044 million). Furthermore, as at year-end unused tax losses amounted to Rs. 117.944 million (2006: Rs. 70.244 million), which results in a deferred tax asset of Rs.41.280 million (2005: Rs.24.586 million). However, the net deferred tax asset has not been recognised for, as per the accounting policy of the Bank, as it is not probable that taxable profits will be available in the future against which the deductible temporary differences and tax losses can be utilised.

11.

OTHER ASSETS Income/ mark-up accrued in local currency Advances, deposits, advance rent and other prepayments Advance taxation (payments less provisions Receivable from staff gratuity fund Stationery and stamps in hand Others Provision held against other assets Other Assets (net of provisions)

2006 2007 Rupees in '000 8,512 21,930 160 256 5,700 36,558 (3,337) 33,221 11,772 2,417 3,359 104 281 3 17,936 (683) 17,253

28.1.4

11.1

11.1

Provision against other assets Opening balance Charge for the year Reversals Amount written off Closing balance 683 2,654 2,654 3,337 712 43 (72) (29) 683

12.

BILLS PAYABLE In Pakistan Outside Pakistan 2,754 2,754 4,415 4,415

13.

BORROWINGS In Pakistan Outside Pakistan 178,000 178,000 98,000 98,000

13.1

Particulars of borrowings with respect to Currencies In local currency In foreign currencies 178,000 178,000 98,000 98,000

13.2

Details of borrowings Secured Borrowings from State Bank of Pakistan under export refinance scheme Unsecured Call borrowings

13.2.1 13.2.2

28,000 150,000 178,000

40,000 58,000 98,000

13.2.1 These represents borrowings from SBP under export refinance scheme at the rate of 6.5% (2006: 6.5%) per annum 13.2.2 These represents borrowings at the rate of 10.25% & 11% (2006: 10%) per annum having maturities upto January 2007 14. DEPOSITS AND OTHER ACCOUNTS Customers Fixed deposits Savings deposits Current Accounts - Remunerative Current Accounts - Non-remunerative Margin Deposits Financial Institutions Remunerative deposits Non-remunerative deposits 2006 2007 Rupees in '000 261,361 63,949 66,614 64,808 1,105 457,837 538 1,562 2,100 459,937 327,071 96,942 23,835 49,393 1,819 499,060 110,047 8,910 118,957 618,017

14.2

2006 2007 Rupees in '000 14.1 Particulars of deposits In local currency In foreign currencies 416,727 43,210 459,937 555,669 62,348 618,017

14.2

15.

This includes deposit of Rs. 0.330 million (2006: Rs.0.621 million) held by the Bank's Head Office Oman International Bank, S.A.O.G, Muscat, Oman. 2006 2007 Rupees in '000 OTHER LIABILITIES Mark-up / Return / Interest payable in local currency Accrued expenses Due to head office Others 8,157 2,118 8,904 438 19,617 6,150 1,860 8,904 151 17,065

15.1

15.1 16.

Represent expenses incurred by the head office at the time of establishment of branches in Pakistan. HEAD OFFICE CAPITAL ACCOUNT Capital held as: Interest free deposit in foreign currency Remitted from head office Revaluation surplus allowed by the State Bank of Pakistan 2006 2007 Rupees in '000

16.1

2,007,923 281,294 2,289,217

1,928,019 260,837 2,188,856

16.1

Represents an amount of US Dollar 37.272 million (2006: US Dollar 35.95 million) deposited with SBP in compliance with subsection (3) of Section 13 of the Banking Companies Ordinance, 1962 and the requirements of the SBP issued from time to time. CONTINGENCIES AND COMMITMENTS Direct Credit Substitutes Includes general guarantees of indebtedness, bank acceptances guarantees, serving as financial guarantees for loans and securities issued in favour of: 2006 2007 Rupees in '000 Government Others 28,834 6,329 35,163 41,593 2,052 43,645

17. 17.1

17.2

Transaction-related contigent liabilities

Including performance bonds, bid bonds: Government Others 19,830 19,447 39,277 24,089 16,497 40,586

17.3

Trade-related Contingent Liabilities Short-term self-liquidating trade-related arising from the movement of goods, such as documentary credits where the underlying shipment is used as security. Others Commitments in respect of forward exchange contracts Purchase Sale 11,275 15,748

17.4

7,002 6,089

18.

DERIVATIVE INSTRUMENTS The Bank carried out derivative transactions in respect of forward foreign exchange contracts and foreign exchange swaps. The management is committed to managing risk and controlling business and financial activities in a manner which enables it to maximize profitable business opportunities, avoid or reduce risks, which can cause loss or reputation damage, ensure compliance with applicable laws and regulations and resilience to external events. The Bank's business is conducted within a develop control framework, duly approved by the management. The management has developed a structure that clearly defined roles, responsibilities and reporting lines. The management regularly reviews the Bank's risk profile in respect of derivatives. Operational procedures and controls have been established to facilitate complete, accurate and timely processing of transactions and derivative activities. These controls include appropriate segregation of duties, regular reconciliation of accounts, and the valuation of assets and positions. The Bank has established trading limits, allocation processes, operating controls and reporting requirements that are specifically designed to control risk of aggregate positions, assure compliance with accounting and regulatory standards and provide accurate management information regarding these activities. Accounting policies in respect of derivative financial instruments are prescribed in note 5.12.

18.1

Product Analysis Interest Rate Swaps No. of Notional Contracts Principal Rs. in '000 2007 Forward Rate Agreements No. of Notional Contracts Principal Rs. in '000 FX Options No. of Notional Contracts Principal Rs. in '000 -

Counterparties

With Banks for Hedging Market making Total Hedging Market making

Counterparties

Interest Rate Swaps No. of Notional Contracts Principal Rs. in '000 -

2006 Forward Rate Agreements No. of Notional Contracts Principal Rs. in '000 3 3 3 913 913 913

FX Options No. of Notional Contracts Principal Rs. in '000 -

With Banks for Hedging Market making Total Hedging Market making

18.2

Maturity Analysis Forward Rate Agreements Remaining maturity 2007 Notional Mark to Market Principal Negative Positive Net -------------------- (Rs. in '000) -------------------2006 Notional Mark to Market Principal Negative Positive Net -------------------- (Rs. in '000) -------------------913 16 16 2007 2006 Rupees in '000

No. of Contracts -

Upto 1 month Forward Rate Agreements Remaining maturity

No. of Contracts 3

Upto 1 month

19.

MARK-UP / RETURN / INTEREST EARNED On loans and advances to: Customers Financial institutions On deposits with financial institutions

22,906 7,696 7,666 38,268

26,342 18,002 2,860 47,204

20.

MARK-UP / RETURN / INTEREST EXPENSED Deposits Other short term borrowings 40,771 6,865 47,636 29,047 12,266 41,313

21.

OTHER INCOME Service charges Others

2007 2006 Rupees in '000 661 859 1,520 972 1,205 2,177

21.1

21.1

Includes income from various general banking services such as cheque book charges, cheque return charges, cheque handling charges, recovery of telex, courier and postage charges ADMINISTRATIVE EXPENSES Salaries, allowances, etc. Charge for defined benefit plan Contribution to defined contribution plan Rent, taxes, insurance, electricity, etc. Legal and professional charges Communications Repairs and maintenance Stationery and printing Advertisement and publicity Auditors' remuneration Depreciation Amortization Brokerage and commission Fees and subscription Travelling & Entertainment Vehicle running expenses Security charges Training Bank Charges Others 18,617 217 717 5,765 1,743 3,358 2,446 618 403 814 1,624 82 86 949 1,515 362 840 37 650 3,430 44,273 13,593 256 567 5,641 502 3,052 1,574 595 342 1,452 1,389 20 142 1,167 975 669 959 19 753 1,834 35,501

22.

28.1.5

22.1 9.1 9.2

22.1

Auditors' remuneration Audit fee - statutory Special certifications, reviews and other services Tax services Out-of-pocket expenses 300 500 14 814 273 727 386 66 1,452

23.

OTHER CHARGES Penalties imposed by State Bank of Pakistan 2,229 23

24.

TAXATION As the Bank has accumulated tax losses, no provision for taxation is required. Assessments for the assessment years 19961997 to 2002-2003 have been finalised. Appeals had been filed against the orders of Taxation Officer (TO) to Commissioner Income-Tax (Appeals) [CIT-A]. Subsequent to the orders of CIT-A for assessment years 1996-1997 to 199 2000, appeals have been filed by the tax department and the Bank to the Income Tax Appellate Tribunal (ITAT) against orders of CIT-A. These appeals have been decided by the ITAT partly in favour and partly against the Bank. The Bank has now filed a reference to the High Court through the ITAT for the assessment years 1996-1997, 1997-1998, 1998-1999 and 1999-2000 in respect of matters decided against the Bank.

The orders have been finalised by the CIT-A for the assessment year 2000-2001, 2001-2002 and 2002-2003 and approval of the final order is pending. The returns for the tax years 2003, 2004, 2005, 2006 and 2007 have been filed and the same i deemed as assessed, as per Section 120 of the Income Tax Ordinance, 2001. However, the cases of the tax years 2003, 2004 and 2005 has been re-opened under section 122 of the Income Tax Ordinance, 2001 of which appeals are pending. Notwithstanding the above appeals, full provision for taxation has been made in the financial statements on the basis of latest assessment for the respective years. 25. EARNINGS / (LOSS) PER SHARE The Bank operates as a branch of a foreign entity and does not have share capital. Hence, no figures of basic and diluted earnings / (loss) per share have been reported in these financial statements. 2007 2006 Rupees in '000 26. CASH AND CASH EQUIVALENTS Cash and balance with treasury banks Balance with other banks 6 7 2,391,751 42,807 2,434,558 2,304,786 67,683 2,372,469

27.

STAFF STRENGTH Permanent Temporary / on contractual basis Total Staff Strength 26 2 28 21 1 22

28. 28.1

DEFINED BENEFIT AND CONTRIBUTION PLAN Defined benefit plan

28.1.1 General description The scheme provides for terminal benefits for all its permanent employees, equivalent to thirty days of last drawn basic salary for each year of service or part thereof for employees who have completed the qualifying period of three years.

Annual contribution is based on actuarial valuation carried out on December 31, 2006, using the Projected Unit Credit Method. An actuarial valuation is conducted once every three years.

28.1.2 Principal actuarial assumptions Following are significant actuarial assumptions used in the valuation: 2007 Discount rate - percent (per annum) Estimated rate of increase in salaries of the employees - percent (per annum) Estimated rate of return on plan assets - percent (per annum) Normal retirement age - years 10 9 10 58 2006 10 9 10 58

2006 2007 Rupees in '000 28.1.3 Reconciliation of payable to defined benefit plan Present value of defined benefit obligations Fair value of any plan assets Net actuarial gain / (loss) not recognised 1,484 (3,189) 1,705 1,553 (3,506) 1,953 -

28.1.4 Movement in defined benefit obligation Opening balance Current service cost Interest cost Benefits paid Actuarial gain Closing balance 28.1.5 Movement in plan assets Opening balance Expected return Contribution made by bank Benefits paid Actuarial (loss) / gain Closing balance 28.1.6 Charge for defined benefit plan Current service cost Interest cost Expected return on plan assets Actuarial (gain) / loss recognized 22 28.1.7 Actual return on plan assets 28.2 Defined contribution plan 11 11

2006 2007 Rupees in '000 1,553 521 160 (645) (103) 1,486 1,779 414 162 (802) 1,553

3,506 350 217 (645) (239) 3,189

2,860 264 360 22 3,506

521 160 (350) (114) 217 111

414 162 (264) (56) 256 390

The Bank operates a contributory provident fund for all its permanent employees. Equal contributions are made monthly by the Bank and the employees at the rate of 10% of basic salary. 28.3 Five year data on surplus / (deficit) of the plans and experience adjustments

2007

2006 2005 2004 2003 ---------------(Rupees in '000)--------------1,553 (3,506) (1,953) 1,779 (2,860) (1,081) 1,256 (2,542) (1,286) 1,943 (3,149) (1,206)

Defined benefit obligation Fair value of plan assets (Surplus) / deficit Experience adjustments (loss) / gain - net

1,484 (3,189) (1,705)

114

56

50

44

60

29.

COMPENSATION OF COUNTRY MANAGER AND EXECUTIVES Country Manager 2007 2006 Rupees in '000 Fees Managerial remuneration Charge for defined benefit plan Contribution to defined contribution plan Rent and house maintenance Utilities Medical Bonus 2,188 190 219 875 219 37 175 3,903 1 1,912 160 158 765 191 13 145 3,344 1 Executives 2007 2006 Rupees in '000 1,604 80 152 642 160 54 143 2,835 2 1,179 48 118 471 118 35 205 2,174 2

Number of persons 29.1

The Country Manager and certain executives have been provided with free use of Bank maintained cars in accordance with their terms of employment. Executives means employees, other than Country Manager, whose basic salary exceeds five hundred thousand rupees in a financia year. FAIR VALUE OF FINANCIAL INSTRUMENTS Fair value is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable willing parties in an arm's length transaction. The table below as set out carrying value and estimated fair value of on-balance sheet and off-balance sheet financial instruments.

29.2

30. 30.1

On-balance sheet financial instruments 2006 2007 Fair value Book value Book value Fair value ----------------------Rupees in '000------------------Assets Cash balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets 2,391,751 42,807 220,506 14,212 2,669,276 2,391,751 42,807 220,506 14,212 2,669,276 2,304,786 67,683 368,321 11,879 2,752,669 2,304,786 67,683 368,321 11,879 2,752,669

Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities

2,754 178,000 459,937 17,499 658,190

2,754 178,000 459,937 17,499 658,190

4,415 98,000 618,017 15,205 735,637

4,415 98,000 618,017 15,205 735,637

Off-balance sheet financial instruments Forward purchase of foreign exchange Forward sale of foreign exchange 7,002 6,089 7,002 6,089

Fair value of fixed term financing, other assets, other liabilities and fixed term deposits cannot be calculated with sufficient reliability due to absence of current and active market for assets and liabilities and reliable data regarding market rates for similar instruments. The provision for non-performing advances has been calculated in accordance with the Bank's accounting policy as stated in note 5.3 of these financial statements.

In the opinion of the management, the fair value of the financial assets and financial liabilities are not significantly different from their carrying values since assets and liabilities are either short term in nature or in the case of customer financing and deposits are frequently repriced. 31. SEGMENT DETAILS WITH RESPECT TO BUSINESS ACTIVITIES Trading & Sales December 31, 2007 Total income Total expenses Net (loss) / profit Segment assets (gross) Segment non performing loans Segment provision required Segment liabilities Segment return on net assets (ROA) (%) Segment cost of funds (%) December 31, 2006 Total income Total expenses Net loss Segment assets (gross) Segment non performing loans Segment provision required Segment liabilities Segment return on net assets (ROA) (%) Segment cost of funds (%) 3,883 11,002 (7,119) 2,373,386 58,016 4.75 8.52 1,476 5,674 (4,198) 35,158 16,166 15,840 180,771 6.62 5.96 48,078 61,315 (13,237) 374,739 4,134 498,710 9.93 8.10 53,437 77,991 (24,554) 2,783,283 16,166 19,974 737,497 8,288 5,132 3,156 2,434,808 150,043 6.68 9.63 1,061 9,128 (8,067) 27,009 16,166 16,327 164,352 8.13 5.34 33,390 120,346 (86,956) 295,893 40,000 44,115 345,913 10.46 7.12 42,739 134,606 (91,867) 2,757,710 56,166 60,442 660,308 Retail Banking Commercial Banking Total

32.

RELATED PARTY TRANSACTIONS Transactions with related parties comprise of transactions in the normal course of the business with the Bank's head office Oman International Bank S.A.O.G, Muscat, Sultanate of Oman and key management personnel. These transactions were made on substantially the same commercial terms as those prevailing at the same time for comparable transactions with unrelated parties and did not involve more than a normal amount of risk. The details of transactions with related parties are as follows. 2007 2006

Oman Oman International International Bank S.A.O.G Key management Key management Bank S.A.O.G Muscat personnel Muscat personnel ---------------------- Rupees in '000 ----------------------

Bank balances At 01 January Deposited during the year Withdrawn during the year Exchange adjustment At 31 December Advances At 01 January Disbursed during the year Repaid during the year At 31 December Deposits At January 01 Received during the year Withdrawn during the year At December 31 Mark-up / return / interest earned Remuneration paid Post employment benefits

29,593 396,485 (404,491) 264 21,851

4,631 442,437 (417,475) 29,593

5,480 (363) 5,117

2,095 3,790 (405) 5,480

551 7,242 (7,600) 193 205 5,688 269

620 78,816 (79,106) 330 753 -

1 5,610 (5,060) 551 207 4,003 258

1,798 62,694 (63,872) 620 671 -

33. 33.1

CAPITAL ADEQUACY Capital management The objective of managing capital is to safe guard the Bank's ability to continue as a going concern, so th continue to generate adequate returns by pricing products and services commensurately with the level of Bank manages capital with the goal of optimally using its capital in relation to business development pla competitiveness, overall risk profile and shareholder returns. Measurement of capital is kept as risk-sens possible so that the Bank is adequately capitalised for covering unexpected loss - and hence contributing stability of the Pakistani financial system we are part of. By doing so, we aim to maintain our external ra be compliant with the State Bank of Pakistan's directives on capital adequacy. Goals of managing capital The goals of managing capital of the Bank are as follows: To be an appropriately capitalised institution, as defined by regulatory authorities and comparable Maintain strong ratings and to protect the Bank against unexpected events; Availability of the adequate capital (including the quantum) at the reasonable cost so as to enable t expand; and achieve low overall cost of capital with appropriate mix of capital elements.

Statutory minimum capital requirement and management of capital The State Bank of Pakistan through its BSD circular No.6 dated 28 October, 2005 requires the minimum capital (net of losses) for Banks / Development finance institutions to be raised to Rs. 6 billion by the ye December 2009. The branches of foreign Banks operating in Pakistan will also be required to increase th capital to Rs. 6 billion within the above timelines prescribed for the locally incorporated banks / DFIs. H branches of foreign banks whose Head Offices hold a minimum paid up capital of US $ 100 million (ne losses) and have a CAR of 9% (determined as per Basel-I or Basel-II Accord) can be allowed to continu the minimum assigned capital of Rs. 2 billion (net of losses). All such branches of foreign banks shall, h required to seek specific permission from the State Bank to maintain the minimum assigned capital (net Rs 2 billion effective from 31 December, 2005. The Bank has specifically obtained such approval. In add banking companies carrying business in Pakistan are also required to maintain a Minimum Capital Adeq (CAR) of 8% of risk weighted exposure of the banking company. The Bank's CAR, as at 31 December 2 763.15% of its risk weighted assets using Basel-I approach. 33.2 CAPITAL ADEQUACY The risk weighted assets to capital ratio, calculated in accordance with the State Bank's guidelin adequacy was as follows:2007 Rupees Regulatory Capital Base Tier I Capital Shareholders capital/assigned capital Reserves Unappropriated / unremitted profits (net of losses) Less: Adjustments Total Tier I Capital Tier II Capital

2,289,217 (255,594) 2,033,623

Subordinated debt (upto 50% of total Tier I Capital) General provisions subject to 1.25% of total risk weighted assets Revaluation reserve (upto 50%) Total Tier II Capital Eligible Tier III Capital Total Regulatory Capital

3,336 3,336 2,036,959

(a)

Risk-Weighted Exposures

2007 200 Book Value Risk Adjusted Book Value Value ---------------- Rupees in '000 ---------

Credit Risk Balance Sheet Items:Cash and other liquid assets Money at call Investments Loans and advances Fixed assets Other assets 2,434,558 179,639 5,646 36,558 2,656,401 8,562 146,348 5,646 36,398 196,954 2,372,469 335,188 4,583 17,253 2,729,493

Off Balance Sheet Items Loan repayment guarantees Purchase and resale agreements Performance bonds etc Revolving underwriting commitments Stand by letters of credit Outstanding foreign exchange contracts - Purchase - Sale Credit risk-weighted exposures 35,163 38,172 11,275 84,610 35,163 19,086 5,638 59,887 256,841 40,033 36,313 13,893 7,002 6,088 103,329

Market Risk General market risk Specific market Risk Market risk-weighted exposures Total Risk-Weighted exposures Capital adequacy ratio [ (a) / (b) x 100) ] (b) 10,074 10,074 266,915 763.15%

33.3

Advances secured against government securities and cash margin amounting to Rs. 44.210 million (200 million) have been deducted from gross advances.

hat it could f risk. The ans, market sitive as g to the atings and to

to the peers.

the Bank to

m paid-up ear ending 31 heir assigned However, those et of ue to maintain however, be of losses) of ddition quacy Ratio 2007 was

nes on capital

2006 in '000

2,188,856 (163,727) 2,025,129

4,537 4,537 2,029,666

06 Risk Adjusted Value --------

13,537 295,223 4,583 13,894 327,237

40,033 18,157 6,947 25 24 65,186 392,423

23,088 23,088 415,511 488.47%

06: Rs.33.133

34. 34.1

RISK MANAGEMENT Credit Risk Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Bank attempts to control credit risk by monitoring credit exposures, limiting transactions with specific counterparties, and continually assessing the creditworthiness of counterparties. Concentration of credit risk arises when a number of counterparties are engaged in similar business activities, or activities in the same geographical region, or have similar economic features that would cause their ability to meet contractual obligations to be similarly affected by changes in economic, political or other conditions. Concentrations of credit risk indicate the relative sensitivity of the Bank's performance to developments affecting a particular industry or geographic location. The Bank seeks to manage its credit exposure through diversification of its financing activities to avoid undue concentration of risk with individuals or groups of customers in specific locations or businesses. It also obtains security when appropriate. 2007 Advances (Gross) Rupees Percent in '000 71,169 3,483 38,935 4,498 89,266 1,259 26,129 16,281 1,111 20,000 6,515 2,302 280,948 25.33 1.24 13.86 1.60 31.77 0.45 9.30 5.80 0.40 7.12 2.32 0.82 100 Deposits Rupees Percent in '000 17,839 161 5,532 2,100 3,359 8,975 162,299 3,116 834 14,004 1,929 209,388 30,401 459,937 2006 Advances (Gross) Rupees Percent in '000 67,782 6,997 1,370 179,028 20,000 32,534 40,010 2,444 25,242 12,888 388,295 17.46 1.80 0.35 46.11 5.15 8.38 10.30 0.63 6.50 3.32 100 Deposits Rupees Percent in '000 91 5,821 4,463 2,171 27,490 102,487 15,000 6,730 242,515 1,911 10,121 22,262 168,500 8,455 618,017 0.01 0.94 0.72 0.35 4.45 16.58 2.43 1.09 39.24 0.31 1.64 3.60 27.27 1.37 100 Contingencies and Commitments Rupees Percent in '000 2,051 38,053 2,639 14,412 913 1,730 20,265 740 692 19,397 100,892 2.03 37.72 2.62 14.28 0.90 1.71 20.09 0.73 0.69 19.23 100 3.88 0.04 1.20 0.46 0.73 1.95 35.29 0.68 0.18 3.04 0.42 45.53 6.61 100 Contingencies and Commitments Rupees Percent in '000 2,000 11,744 6,682 7,830 150 24,268 6,618 18,065 8,358 85,715 2.33 13.70 7.80 9.13 0.17 28.31 7.72 21.08 9.75 100

34.2

Segments by class of business

Textile Chemical and pharmaceuticals Automobile and transportation equipment Power (electricity), gas, water, sanitary Wholesale and retail trade Financial Insurance Services Individuals Agribusiness & food processing Wires and cables Information technology Health and education Iron and steel Electrical machinery and apparatus Packaging PVC pipes Trust and funds Others

Segments by class of business

Textile Chemical and pharmaceuticals Automobile and transportation equipment Power (electricity), gas, water, sanitary Wholesale and retail trade Financial Insurance Services Individuals Agribusiness & food processing Wires and cables Information technology Health and education Iron and steel PVC Pipes Trust and funds Others

2007 Advances (Gross) Rupees Percent in '000 280,948 280,948 100.00 100.00 Deposits Rupees Percent in '000 5,532 454,405 459,937 2006 Advances (Gross) Rupees Percent in '000 388,295 388,295 100.00 100.00 Deposits Rupees Percent in '000 2,171 615,846 618,017 0.35 99.65 100.00 Contingencies and Commitments Rupees Percent in '000 100,892 100,892 100.00 100.00 1.20 98.80 100.00 Contingencies and Commitments Rupees Percent in '000 85,715 85,715 100.00 100.00

34.3

Segment by sector

Public / government Private

Segment by sector

Public / government Private

34.4

Details of non-performing advances and specific provisions by class of business segmen 2006 2007 Classified Specific Classified Specific Provisions Advances Provisions Advances Held Held ------------- Rupees in '000 ------------Individuals Financial 16,166 40,000 56,166 15,905 40,000 55,905 16,166 16,166 15,437 15,437

34.5

Details of non-performing advances and specific provisions by secto Public / government Private 56,166 56,166 55,905 55,905 16,166 16,166 15,437 15,437

35.

GEOGRAPHICAL SEGMENT ANALYSIS Pakistan

2007 Contingencies and Loss before Total assets Net assets commitments employed employed taxation ----------------------- Rupees in '000 ----------------------(91,867) (91,867) 2,693,931 2,693,931 2,033,623 2,033,623 85,715 85,715

Total assets employed includes intra group items of Rs. 21.851 million. 2006 Contingencies and Loss before Total assets Net assets commitments taxation employed employed ----------------------- Rupees in '000 ----------------------Pakistan (24,554) (24,554) Total assets employed includes intra group items of Rs. 29.593 million. 2,762,626 2,762,626 2,025,129 2,025,129 100,892 100,892

36.

MARKET RISK Market risk is the risk of loss arising from movements in market variables including observable variables such as interest rates, exchange rates and equity indices, and others which may be only indirectly observable such as volatilities and correlations. The Bank warehouses market risk for customer facilitation, and also positions itself in the financial markets for proprietary trading. The Bank's policy is that all market risk taking activity is undertaken within approved market risk limits, and that the Bank's standards / guiding principles are upheld at all times. Market Risk Management is an independent control function with clear segregation of duty and reporting line with the business-line. It means responsibility is to ensure that the risk-taking units manage the Bank's market risk exposure within a robust market risk framework and within the Bank's risk appetite. The Bank standard systems are used to furnish senior trading and Market Risk staff with risk exposures. All trading activities and any business proposal that commit or may commit the Bank (legally or morally) to deliver risk sensitive products require approval by independent authorised risk professionals or committees, prior to commitment.

36.1

Foreign Exchange Risk The Bank has adopted a comprehensive system for the measurement and management of foreign exchange risk. Part of this risk management process involves managing the Banks exposure to fluctuations in foreign exchange rates in order to minimize its exposure to currency and risk to acceptable levels as determined by management. The management sets limits on the level of exposure by currency and in total for overnight positions. Positions are monitored on a daily basis and hedging strategies are used to ensure positions are maintained within established limits. 2007 Net foreign Off-balance currency Assets Liabilities sheet items exposure ------------------------------------------ Rupees in '000 -----------------------------------------Pakistan rupee United States dollar Great Britain pound Swiss Francs Japanese yen Euro 352,521 2,338,871 1,729 115 37 658 2,693,931 617,098 42,592 557 61 660,308 2006 Net foreign Off-balance currency Assets Liabilities sheet items exposure ------------------------------------------ Rupees in '000 -----------------------------------------Pakistan rupee United States dollar Great Britain pound Swiss Francs Japanese yen Euro 486,246 2,270,195 5,645 42 59 439 2,762,626 675,149 58,956 3,267 125 737,497 (913) 913 (189,816) 2,212,152 2,378 42 59 314 2,025,129 (264,577) 2,296,279 1,172 115 37 597 2,033,623

36.2

Interest Rate Risk The Bank has clear objectives, strategies, and risk tolerance level in order to protect it from interest rate risk. To achieve this objective, the Bank matches the interest rate sensitivity of its assets and liabilities by placing them into various time buckets according to the earlier of contractual re-pricing or maturity dates. The Bank is exposed to interest rate risk as a result of mismatches or gaps in the amounts of assets and liabilities and off-balance sheet instruments that mature or re-price in a given period. The Bank manages this risk by matching the re-pricing of assets and liabilities through risk management strategies. The Bank has also a system in place to monitor the effectiveness of its policies and limits.

36.3

Equity Position Risk As of the balance sheet date, the Bank is not exposed to equity position risk.

37.

MISMATCH OF INTEREST RATE SENSITIVE ASSETS AND LIABILITIES Yield / interest rate sensitivity position for on balance sheet instruments is based on the earlier of contractual re-pricing and maturity date and for off-balance sheet instruments is based on settlement date.

2007 Effective Yield / Interest rate % On-balance sheet financial instruments Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities On-balance sheet gap Off-balance sheet financial instruments Forward purchase of foreign exchange Forward sale of foreign exchange Off-balance sheet gap Total Yield / Interest Risk Sensitivity Gap Cumulative Yield / Interest Risk Sensitivity Gap (122,958) (122,958) (128,455) (251,413) (31,381) (282,794) 8,651 (274,143) (274,143) 2006 Effective Yield / Interest rate % On-balance sheet financial instruments Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Other liabilities On-balance sheet gap Off-balance sheet financial instruments Forward purchase of foreign exchange Forward sale of foreign exchange Off-balance sheet gap Total Yield / Interest Risk Sensitivity Gap Cumulative Yield / Interest Risk Sensitivity Gap 7,002 6,089 913 (193,960) (193,960) 70,606 (123,354) 7,224 (116,130) (147,122) (263,252) 105,000 (158,252) (1,800) (160,052) (160,052) 2,693 (157,359) 8,915 (148,444) 7,002 6,089 913 2,164,563 2,016,119 15,205 735,637 2,017,032 273,071 (193,960) 141,079 70,606 27,776 7,224 152,122 (147,122) 105,000 1,800 (1,800) 2,693 8,915 15,205 139,789 2,165,476 8.36 6.07 4,415 98,000 618,017 58,000 215,071 40,000 101,079 27,776 152,122 1,800 4,415 120,169 2.92 5.25 9.76 2,304,786 67,683 368,321 11,879 2,752,669 79,111 11,876 67,207 28 211,685 211,685 35,000 35,000 5,000 5,000 105,000 105,000 2,693 2,693 8,915 8,915 2,292,910 476 11,879 2,305,265 Total Upto 1 month Over 1 to 3 months Over 3 to 6 months Exposed to Yield / Interest risk Over 6 months to 1 year Over 1 to 2 years Over 2 to 3 years Over 3 to 5 years Over 5 to 10 years Over 10 years Non-interest bearing financial instruments 716 (273,427) 704 (272,723) (272,723) 4,062 (268,661) 2,279,747 2,011,086 17,499 658,190 2,011,086 275,923 (122,958) 167,054 (128,455) 42,288 27,390 50,120 (50,120) 716 704 4,062 17,499 122,805 2,279,747 8.35 6.73 2,754 178,000 459,937 150,000 125,923 28,000 139,054 42,288 50,120 2,754 102,552 3.24 5.49 9.03 2,391,751 42,807 220,506 14,212 2,669,276 4,110 42,108 106,747 152,965 38,599 38,599 69,678 69,678 716 716 704 704 4,062 4,062 2,387,641 699 14,212 2,402,552 Total Upto 1 month Over 1 to 3 months Over 3 to 6 months Exposed to Yield / Interest risk Over 6 months to 1 year Over 1 to 2 years Over 2 to 3 years Over 3 to 5 years Over 5 to 10 years Over 10 years Non-interest bearing financial instruments

---------------------------------------------------------------------- Rupees in '000 ----------------------------------------------------------------------

---------------------------------------------------------------------- Rupees in '000 ----------------------------------------------------------------------

37.1 Interest rate risk is the risk that the value of a financial instrument will fluctuate due to changes in the market interest rates. Sensitivity to interest rate risk arises from mismatches of financial assets and liabilities that mature or reprice in a given period. The Bank manages these mismatches through risk management strategies where significant changes in gap positions can be adjusted. 37.2 The interest rate exposure taken by the Bank arises from investing in corporate, small medium enterprises, consumer financing, investment banking and interbank activities where variation in market interest rates may affect the profitability of the Bank. This risk is addressed by the management which reviews the interest rate dynamics at regular intervals and decides repricing of assets and liabilities ensuring that the spread of the Bank remains at acceptable level. 37.3 The advances and deposits of the Bank are repriced on a periodical basis based on the interest rates scenario.

38.

MATURITIES OF ASSETS AND LIABILITIES The table below summarises the maturity profile of the Bank's assets and liabilities. The contractual maturities of assets and liabilities at the year end have been determined on the basis of the remaining period at the balance sheet date to the contractual maturity date and do not take account of the effective maturities as indicated by the Bank's deposit retention history and the availability of liquid funds. Assets and liabilities not have a contractual maturity are assumed to mature on the expected date on which the assets / liabilities will be realised / settled. 2007 Over 1 Over 3 Over 6 Over 1 Over 2 Over 3 Over 5 Upto 1 to 3 to 6 months to 1 to 2 to 3 to 5 to 10 Over Total month months months year years years years years 10 years -------------------------------------------------------- Rupees in '000 -------------------------------------------------------Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Operating fixed assets Deferred tax assets Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Deferred tax liabilities Other liabilities Net assets Head office capital account Accumulated loss

2,391,751 42,807 220,506 5,646 33,221 2,693,931 2,754 178,000 459,937 19,617 660,308 2,033,623 2,289,217 (255,594) 2,033,623

102,534 42,807 106,747 5,746 257,834 2,754 150,000 126,253 10,713 289,720 (31,886)

38,599 11,179 49,778 28,000 226,803 254,803 (205,025)

10,907 13 6,137 17,057 42,288 42,288 (25,231)

58,658 357 2,303 61,318 64,593 64,593 (3,275)

113 209 393 715 715

716 624 7,463 8,803 8,803

704 4,392 5,096 5,096

51 51 51

2,289,217 4,062 2,293,279 8,904 8,904 2,284,375

2006 Over 1 Over 3 Over 6 Over 1 Over 2 Over 3 Over 5 Upto 1 to 3 to 6 months to 1 to 2 to 3 to 5 to 10 Over Total month months months year years years years years 10 years -------------------------------------------------------- Rupees in '000 -------------------------------------------------------Assets Cash and balances with treasury banks Balances with other banks Lending to financial institutions Investments Advances Operating fixed assets Deferred tax assets Other assets Liabilities Bills payable Borrowings Deposits and other accounts Sub-ordinated loans Liabilities against assets subject to finance lease Deferred tax liabilities Other liabilities Net assets Head office capital account Accumulated loss

2,304,786 67,683 368,321 4,583 17,253 2,762,626 4,415 98,000 618,017 17,065 737,497 2,025,129 2,188,856 (163,727) 2,025,129

115,930 67,683 28 44 183,685 4,415 58,000 336,240 8,161 406,816 (223,131)

211,685 21 12,249 223,955 40,000 101,079 141,079 82,876

35,000 399 35,399 27,776 27,776 7,623

5,000 54 3,783 8,837 151,122 151,122 (142,285)

105,000 1,000 778 106,778 106,778

282 282 1,800 1,800 (1,518)

2,832 2,832 2,832

2,693 394 3,087 3,087

2,188,856 8,915 2,197,771 8,904 8,904 2,188,867

38.1

Liquidity risk is the risk that the Bank will be unable to meet its net funding requirements. Liquidity risk can be caused by market destruction of credit downgrad

q y g q q y y g which may cause certain sources of fundings to become unavailable. To guard against this risk the Bank's assets are managed with liquidity in mind, maintaining a healthy balance of cash, cash equivalents and readily marketable securities. The maturity profile is monitored to ensure adequate liquidity is maintained.

The Bank holds sufficient liquid assets to enable it to continue normal operations even in the unlikely even unable to obtain fresh resources from the money market for an extended period of time. The Banks policy maintaining a minimum level of liquid asset at all times. Equally, the Banks policy permits the increase of resources up to an operating level based on the undisbursed and irrevocable commitments to take advantag cost funding opportunities as they arise. The contractual maturities of assets and liabilities have been determined on the basis of the remaining perio balance sheet date to the contractual maturity date and do not take account of the effective maturities as ind the Banks deposit retention history and the availability of liquid funds. Management monitors the maturity ensure that adequate liquidity is maintained. In accordance with SBP regulations, the Bank maintains a statutory cash reserve requirement (CRR) with S to weekly average of 7% (subject to daily minimum of 6%) of total Demand Liabilities (including Time De with tenor of less than 1 year). In addition to that, the Bank maintains statutory liquidity requirement (SLR (excluding CRR) of total Time and Demand Liabilities. The Bank have successfully manages its CRR and requirements. 39. OPERATIONAL RISK The Bank has prepared itself against operational risk by devising well defined strategies and oversight by t management, a strong operational risk culture and internal control culture (including, among other things, c of responsibility and segregation of duties), effective internal reporting, and contingency planning. Over th the Bank has introduced wide-ranging reforms intended not only to improve the efficiency with which the executes its mandate, but also to strengthen the overall internal control environment. The Banks operation activities currently comprise improvements in the systems environment and process changes and are expec include the implementation of an integrated control framework. 40. ACCOUNTING ESTIMATES AND JUDGMENTS Provision against non-performing loans and advances The bank reviews its loan portfolios to assess amount of non-performing loans and advances and provision there against on a quarterly basis. The 'provision is made in accordance with the Prudential Regulations iss State Bank of Pakistan. Income taxes In making the estimates for income taxes currently payable by the Bank, the management looks at the curre tax law and the decisions of appellate authorities on certain issues in the past. During the year, a new schedule has been introduced for taxation of banks in Pakistan. The schedule is app for the financial year ending 31 December 2008. The current and deferred tax calculations may require cha on the revised schedule and transitory provisions, which are currently being discussed by Pakistan Banks A with Federal Board of Revenue. Property and equipment The Bank reviews the rate of depreciation, useful life, residual value and value of assets for possible impair an annual basis. Any change in the estimates in future years might effect the carrying amounts of the respe items of property and equipments with a corresponding effect on the depreciation charge and impairment.

Intangible assets The Bank reviews the rate of amortisation and value of intangible assets for possible impairment on an an Any change in the estimates in future years might affect the carrying amounts of intangible asse corresponding affect on the amortisation charge and impairment, if any. Retirement benefits The bank has adopted certain actuarial assumptions as disclosed in note 28 to the financial state determining present value of defined obligations and fair value of plan assets, based on actuarial advice. A in assumptions from actual results would change the amount of unrecognised gain and losses for 2008. 41. GENERAL Captions, as prescribed by BSD Circular No. 04 of 2006 dated February 17, 2006 issued by the Sta Pakistan, in respect of which there are no amounts, have not been reproduced in these financial statements, the captions of the balance sheet and profit and loss account. 42. DATE OF AUTHORIZATION These financial statements were authorized for issue on _________________ by the management of the Ba

Country Manager

Senior M

nt that it is y requires f liquid ge of low

od at the dicated by y profile to

SBP equal eposits R) of 18% SLR

the clear lines he last year, Bank nal risk cted to also

n required sued by the

ent income

plicable ange based Association

rment on ctive

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)