Академический Документы

Профессиональный Документы

Культура Документы

Midwest Office Systems: Balance Sheet Spreadsheet As of December 31

Загружено:

SolidSnake7787Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Midwest Office Systems: Balance Sheet Spreadsheet As of December 31

Загружено:

SolidSnake7787Авторское право:

Доступные форматы

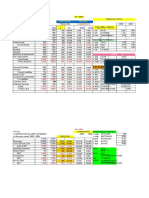

Midwest Office Systems

Balance Sheet Spreadsheet as of December 31

Year 1

ASSETS:

Cash

Accounts Receivable

Inventory

Other - A/R Officer

Prepaid

Other

Total Current Assets

Leasehold Improvements

Vehicles

Furniture/Fixtures/Office Equip

Equipment

Buildings

Land

Accumulated Depreciation

Fixed Assets (net)

Other - patent acquisition

Total Assets

LIABILITIES & NET WORTH

Notes Payable - bank

Current Portion LTD

Accounts Payable - Trade

Accruals

Other

Total Current Liabilities

Long-Term Debt (LTD)

Mortgages

Other

Total Long-Term Liabilities

Total Liabilities

Capital Stock (30,000 shares)

Additional Paid-In Capital

Retained Earnings

Net Worth

Total Liabilities and Net Worth

41,700

169,400

212,200

3,000

10,700

437,000

25,700

24,300

108,300

130,000

20,000

(85,000)

223,300

660,300

Year 2

Year 3

16,500

185,000

172,000

12,300

270,000

419,000

16,700

24,800

390,200

726,100

30,700

28,300

120,300

267,700

20,000

(106,000)

361,000

751,200

30,700

59,700

120,300

267,700

30,000

(132,000)

376,400

28,500

1,131,000

52,800

32,500

99,800

44,100

26,700

255,900

144,300

80,600

30,000

135,800

55,200

33,400

335,000

114,300

282,400

25,000

310,100

67,300

49,600

734,400

89,300

144,300

400,200

114,300

449,300

89,300

823,700

60,000

60,000

60,000

200,100

260,100

660,300

241,900

301,900

751,200

247,300

307,300

1,131,000

Trends +/ -

Midwest Office Systems

Income Statement Spreadsheet as of December 31

Sales

Cost of Goods Sold

Gross Profit

Expenses

Salary

Payroll Taxes

Advertising

Rent

Utilities

Office Supplies

Insurance

Bad Debts

Depreciation

Vehicles

Accounting

Travel/Entertainment

Ship Supplies

Taxes

Other

Total Expenses

Year 1

1,520,000

1,200,000

320,000

Year 2

1,670,000

1,336,000

334,000

Year 3

2,160,000

1,760,000

400,000

152,000

16,400

2,000

4,800

5,500

7,800

4,000

19,000

8,600

5,800

9,500

5,500

4,000

2,100

247,000

158,000

16,900

10,500

219,900

27,000

12,200

5,200

4,500

8,200

4,000

21,000

6,400

6,200

4,700

5,500

4,500

700

256,300

6,100

5,000

8,800

8,000

26,000

5,200

6,800

1,200

7,000

7,000

6,000

346,200

Operating Profit (EBIT)

73,000

77,700

53,800

Other Inocme/(Expenses)

Interest

Other Income

(26,600)

8,000

(27,600)

(49,500)

2,000

Net Profit Before Taxes

Tax

Net Profit After Tax

54,400

9,500

44,900

50,100

8,300

41,800

6,300

900

5,400

Trends +/-

Midwest Office Systems

Ratio Analysis

Year 1

Year 2

Year 3

Industry

1. Liquidity:

Current (CA/CL)

Quick (CA-Inv/CL)

2x

1x

2. Asset Management:

Inv Turn Days (COGS/Inv = N) (360/N)

A/R Turn Days (Sales/AR = N) (360/N)

A/P Turn Days (A/P * 360/COGS)

Asset Turn - (Sales/TA)

60

40

40

2.5x

3. Debt Management:

Debt Ratio (TL/TA)

DSC (EBITDA/P+I Pmts) [1]

Debt/Equity (TL/TE)

60%

2x

1.2 x

4. Profitability:

ROS (NI/Sales)

ROA (NI/TA)

ROE (NI/TE)

Gross Profit Margin (GP/Sales)

3.5%

7%

19%

22.5%

5. Market Value:

EPS (NI/Shares Outstanding)

BV (Equity/Shares Outstanding)

[1] P+I Pmts

[2] EBITDA

59,000

92,000

60,100

98,700

80,000

79,500

Midwest Office Systems

Source and Use of Funds as of December 31

Year 2

Year 3

CASH FROM OPERATING ACTIVITIES

Net Income

Depreciation

Accounts Receivable

Inventory

Other

Prepaids

Notes Payable

CPLTD

Accounts Payable

Accruals

Other

CASH FROM OPERATING ACTIVITIES

CASH FROM INVESTING ACTIVITIES

Vehicles

FF&E

Equipment

Buildings

Land

Patent

CASH FROM INVESTING ACTIVITIES

CASH FROM FINANCING ACTIVITIES

Change in LTD

CASH FROM FINANCING ACTIVITIES

Net Cash Change

Beginning Cash

Ending Cash

Note: Shaded areas are set up to calculate.

Asset Increase = Use of Cash

Asset Decrease = Source of Cash

Liability Increase = Source of Cash

Liability Decrease = Use of Cash

Вам также может понравиться

- Ebix, Inc.: FORM 10-QДокумент39 страницEbix, Inc.: FORM 10-QalexandercuongОценок пока нет

- DellДокумент5 страницDellAbhishek AnandОценок пока нет

- Statement of Retained EarningДокумент3 страницыStatement of Retained EarningSamson HeОценок пока нет

- Fame Export 1Документ16 страницFame Export 1Seine LaОценок пока нет

- TCS Condensed IndianGAAP Q3 12Документ29 страницTCS Condensed IndianGAAP Q3 12Neha SahaОценок пока нет

- ICBC Statement of OperationsДокумент1 страницаICBC Statement of OperationsProvinceNewspaperОценок пока нет

- Cash Flow Assessment - TaskДокумент5 страницCash Flow Assessment - TaskAshish SinghalОценок пока нет

- Office MaxДокумент21 страницаOffice MaxBlerta GjergjiОценок пока нет

- EddffДокумент72 страницыEddfftatapanmindaОценок пока нет

- Dabur Balance SheetДокумент30 страницDabur Balance SheetKrishan TiwariОценок пока нет

- Accounting Cycle IДокумент21 страницаAccounting Cycle IChristine PeregrinoОценок пока нет

- Macys 2011 10kДокумент39 страницMacys 2011 10kapb5223Оценок пока нет

- Consolidated Balance Sheet: As at 31st December, 2011Документ21 страницаConsolidated Balance Sheet: As at 31st December, 2011salehin1969Оценок пока нет

- Balance Sheet of M/s Free Flow Fluids As On 30th June 2007 Liabilities Amount Assets AmountДокумент1 страницаBalance Sheet of M/s Free Flow Fluids As On 30th June 2007 Liabilities Amount Assets AmountRiya NaikОценок пока нет

- Ratio Analysis AssignmentДокумент4 страницыRatio Analysis AssignmentMark Adrian ArellanoОценок пока нет

- SolutionsДокумент5 страницSolutionsSahil NandaОценок пока нет

- Balance Sheet: Notes 2010 Taka 2009 TakaДокумент5 страницBalance Sheet: Notes 2010 Taka 2009 TakaThushara SilvaОценок пока нет

- PHN 17Q Sep2011Документ74 страницыPHN 17Q Sep2011Ryan Samuel C. CervasОценок пока нет

- Total Application of Funds Fixed Assets Fixed AssetsДокумент14 страницTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiОценок пока нет

- Group Case #1Документ3 страницыGroup Case #1Brenda Parham50% (2)

- Chapter 02 Ratio AnalysisДокумент52 страницыChapter 02 Ratio AnalysisSunita YadavОценок пока нет

- NPF Balance SheetДокумент2 страницыNPF Balance Sheetapi-242791301Оценок пока нет

- Financial Statements Review Q4 2010Документ17 страницFinancial Statements Review Q4 2010sahaiakkiОценок пока нет

- Financial Statements June 2012 Paper Ad 3rd ProofДокумент1 страницаFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiОценок пока нет

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Документ11 страницFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sОценок пока нет

- Johann Company 1dadaДокумент2 страницыJohann Company 1dadaAlyssaОценок пока нет

- Bid 03312013x10q PDFДокумент59 страницBid 03312013x10q PDFpeterlee100Оценок пока нет

- Pak Elektron Limited: Condensed Interim FinancialДокумент16 страницPak Elektron Limited: Condensed Interim FinancialImran ArshadОценок пока нет

- ACME Corp Financial StatementsДокумент1 страницаACME Corp Financial StatementsSamarth KudalkarОценок пока нет

- Balance Sheet: Period EndingДокумент2 страницыBalance Sheet: Period EndingRahul DevОценок пока нет

- RosettaStone 10Q 20130807 (Deleted)Документ48 страницRosettaStone 10Q 20130807 (Deleted)Edgar BrownОценок пока нет

- Financial Statements: December 31, 2011Документ55 страницFinancial Statements: December 31, 2011b21t3chОценок пока нет

- Cash Flow Statements - FinalДокумент18 страницCash Flow Statements - FinalAbhishek RawatОценок пока нет

- Marchex 10Q 20121108Документ60 страницMarchex 10Q 20121108shamapant7955Оценок пока нет

- CSG 10Q Sep 10Документ226 страницCSG 10Q Sep 10Shubham BhatiaОценок пока нет

- Forecasting Tata MotorsДокумент15 страницForecasting Tata Motorsamitonline09Оценок пока нет

- Cash Flow StatementДокумент27 страницCash Flow StatementMohamad Aufa ZakiОценок пока нет

- ACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)Документ11 страницACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)shower_of_gold100% (1)

- F. Financial Aspect-FinalДокумент16 страницF. Financial Aspect-FinalRedier Red100% (1)

- Group 4 Symphony FinalДокумент10 страницGroup 4 Symphony FinalSachin RajgorОценок пока нет

- SEC 17-Q (1st QRTR 31 March 2014)Документ49 страницSEC 17-Q (1st QRTR 31 March 2014)RCCruzОценок пока нет

- Myer AR10 Financial ReportДокумент50 страницMyer AR10 Financial ReportMitchell HughesОценок пока нет

- Microsoft Corporation: United States Securities and Exchange CommissionДокумент75 страницMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745Оценок пока нет

- Statement Date No. of MonthsДокумент6 страницStatement Date No. of MonthscallvkОценок пока нет

- HCL Technologies LTD 170112Документ3 страницыHCL Technologies LTD 170112Raji_r30Оценок пока нет

- 2015 Irep Financial DisclosureДокумент2 страницы2015 Irep Financial Disclosureapi-260177901Оценок пока нет

- Cover Sheet: To Be Accomplished by SEC Personnel ConcernedДокумент55 страницCover Sheet: To Be Accomplished by SEC Personnel ConcernedEiuol Nhoj ArraeugseОценок пока нет

- TB 2 Dan TB 1Документ6 страницTB 2 Dan TB 1Andita Arum CintyawatiОценок пока нет

- 2011 Consolidated All SamsungДокумент43 страницы2011 Consolidated All SamsungGurpreet Singh SainiОценок пока нет

- Shell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011Документ19 страницShell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011roker_m3Оценок пока нет

- PROBLEM Tugas AKM 2Документ33 страницыPROBLEM Tugas AKM 2Dina Dwi Ningrum67% (3)

- AC550 Course ProjectДокумент2 страницыAC550 Course ProjectPhuong Dang0% (2)

- 31-Dec-10 31-Dec-09 Assets: Period EndingДокумент4 страницы31-Dec-10 31-Dec-09 Assets: Period EndingArsal SiddiqiОценок пока нет

- Apple IncorporatedДокумент5 страницApple IncorporatedVincent Jake NaputoОценок пока нет

- 1st Quarter Report 2011Документ4 страницы1st Quarter Report 2011Smart IftyОценок пока нет

- F3ch2dilemna Socorro SummaryДокумент8 страницF3ch2dilemna Socorro SummarySushii Mae60% (5)

- General Rental Center Lines World Summary: Market Values & Financials by CountryОт EverandGeneral Rental Center Lines World Summary: Market Values & Financials by CountryОценок пока нет

- Transportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandTransportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Mariel Princess TabilangonДокумент2 страницыMariel Princess TabilangonMariel PrincessОценок пока нет

- Current LogДокумент5 страницCurrent LogCorey Frazier100% (1)

- Please DocuSign Independent Contractor AgreeДокумент9 страницPlease DocuSign Independent Contractor AgreeAkankshaОценок пока нет

- Auszug Black Law Dictionary Capitis Dememnutio Maxima 8.3. 2021 HilfeДокумент2 страницыAuszug Black Law Dictionary Capitis Dememnutio Maxima 8.3. 2021 HilfeHakeem BeyОценок пока нет

- Business Information Proposal ReportsДокумент5 страницBusiness Information Proposal Reportssam goldОценок пока нет

- Chapter 8 Institutional Plan For EMP ImplementationДокумент6 страницChapter 8 Institutional Plan For EMP Implementationangelo plumosОценок пока нет

- Ra Bill 12-WДокумент4 страницыRa Bill 12-WDass DassОценок пока нет

- SDM Case Analysis: CISCO Systems: Managing The Go-to-Market EvolutionДокумент12 страницSDM Case Analysis: CISCO Systems: Managing The Go-to-Market Evolutionmahtaabk100% (17)

- 24.3 Administrator and Business AnalystДокумент5 страниц24.3 Administrator and Business AnalystRegintala Chandra SekharОценок пока нет

- Bhimashankar Resume 2021Документ3 страницыBhimashankar Resume 2021ashnan7866250Оценок пока нет

- AAA Exam RequirementДокумент7 страницAAA Exam RequirementShahid MahmudОценок пока нет

- MPS FY2021-22:: CPD's Reaction OnДокумент49 страницMPS FY2021-22:: CPD's Reaction OnAdnan AsifОценок пока нет

- Bus Com Acq Date IllustrationДокумент1 страницаBus Com Acq Date IllustrationJhona May Golilao QuiamcoОценок пока нет

- 2022SC Lecture Notes Topic1.1 OrientationДокумент12 страниц2022SC Lecture Notes Topic1.1 OrientationAsadvirkОценок пока нет

- Irrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsДокумент4 страницыIrrevocable Corporate Purchase Order (Icpo/Loi) For: Contract 12 MonthsjungОценок пока нет

- HULДокумент10 страницHUL..sravana karthikОценок пока нет

- A Funny Incident EssayДокумент53 страницыA Funny Incident EssayafhbexrciОценок пока нет

- Vinati Organics: AccumulateДокумент7 страницVinati Organics: AccumulateBhaveek OstwalОценок пока нет

- 9 Investing Secrets of Warren BuffettДокумент31 страница9 Investing Secrets of Warren Buffettsatoni12Оценок пока нет

- Door TransfeeДокумент1 страницаDoor TransfeeSubhro BasuОценок пока нет

- Internal Auditing.2022Документ19 страницInternal Auditing.2022One AshleyОценок пока нет

- PD MitraДокумент42 страницыPD Mitraelza jiuniОценок пока нет

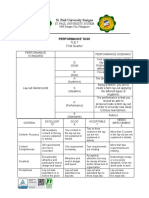

- St. Paul University Surigao: Performance TaskДокумент2 страницыSt. Paul University Surigao: Performance TaskRoss Armyr Geli100% (1)

- Forex Systems: Types of Forex Trading SystemДокумент35 страницForex Systems: Types of Forex Trading SystemalypatyОценок пока нет

- VrioДокумент2 страницыVrioRoxana GabrielaОценок пока нет

- Strategic MarketingДокумент84 страницыStrategic MarketingKameshОценок пока нет

- Quarter 1 NO ANSWER KEY Visual Graphic Design Module 1Документ35 страницQuarter 1 NO ANSWER KEY Visual Graphic Design Module 1Matt Lhouie MartinОценок пока нет

- Strategic Financial ManagementДокумент8 страницStrategic Financial Managementdivyakashyapbharat1Оценок пока нет

- 4.4.4 Practice - Modeling - Two-Variable Systems of Inequalities (Practice)Документ4 страницы4.4.4 Practice - Modeling - Two-Variable Systems of Inequalities (Practice)Bertonn0% (1)

- Company ProfileДокумент24 страницыCompany ProfileMohammad Ahbab HasanОценок пока нет