Академический Документы

Профессиональный Документы

Культура Документы

Weekly Commodity Report 16 SEP 2013 by EPIC RESEARCH

Загружено:

Nidhi JainАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Weekly Commodity Report 16 SEP 2013 by EPIC RESEARCH

Загружено:

Nidhi JainАвторское право:

Доступные форматы

MCX COMMODITY DAILY REPORT

WWW.EPICRESEARCH.CO Epic Research Private Limited Corporate Office 411 Milinda Manor (Suites 409 - 417) 2 RNT MargOpp Central Mall Indore (M.P.) Hotline: +91 731 664 2300 / 2427 / 2230 Alternate: +91 731 664 2320 / 2226 +91 97521 99966 Or give us a missed call at 026 5309 0639

EPIC Research Report

This Report contains all the study and strategy required by trader to trade on MCX commodities. Refer to the chart attracted in the Report to take proper Trading Decision.

Date: 16-September-2013

MCX Weekly Newsletter (16-September-2013)

WEEKLY COMMODITY WRAP..!!!!!

Base metals

LME base metals traded lower this week on account of mixed macroeconomic numbers. In Europe, industrial production fell 1.5% in July, as compared with the expectations of a 0.1% Increase. German industrial production fell 2.3% in July from June levels and France, Italy, Ireland and Portugal also reported lower Readings. However, the downside in metal prices was limited as Markets garnered strength from improving backdrop in China. Chinas industrial output grew at its fastest pace in 17 months In August, rising some 10.4% from a year earlier and coming in Well ahead of estimates. Steel production was up almost 16% in August on YOY basis, up from 10.9% in July, while electricity output expanded 13.4% compared with 8.1% July. Progress in Chinese economic activity should provide some support to the non-ferrous metals; however the proverbial Sept-taper may put the bulls on the back foot. The tapering Amount may vary between US$10-$20bn of monthly bond Buying, which is not that significant considering the fact that US is a $16 trillion economy. However, the intuition of an end to dirt cheap interest rates may trigger an orchestrated selloff in the entire commodity pack. Base metals should remain relatively less vulnerable, as the complex is more receptive to Chinese economic activity rather than what the wise men at Federal Reserve are contemplating at. Nevertheless, the pack Cannot defy the impact of consequential strong US dollar.

Precious metals

Precious metals fell sharply this week, with gold prices breaching The crucial support of US$1,350/oz and silver prices heading Below US$22/oz. Jitters ahead of the Federal Reserve decision next week has taken a toll on the pack. The consensus is that the apex bank may taper the monetary stimulus (bond buying programmers) by US$10bn. Meanwhile, market participants have factored in the Syrian situation, whereby the tensions heave deescalated to an extent. Syria has accepted Russian proposal of Handing over the chemical weapons to the International body. Syrian is ready to declare the location of the chemical weapons To representatives of Russia and other United Nations member States and stop the production of the chemical weapons as well. Recent weakness in gold prices seems to extending till US$1,280/oz. However at the end of the this month, gold Prices should garner an element of support, as US Congress Legislators have yet not passed a law to finance the budget For the 2014 fiscal year that commences on October 1st. The government is projected to reach its debt limit in midOctober. Although Democrats have called for a debt-limit Increase with no policy changes, House Republicans are Under pressure from committee members to withdraw the Health-care program.

WWW.EPICRESEARCH.CO CALL: +917316642300

MCX Weekly Newsletter (16-September-2013)

GOLD MCX HOURLY CANDLESTICK CHART

TRADING STRATEGY: GOLD MCX is trading too volatile and has faced correction last week. Momentum seem to be in favour of bears and also USDINR may face correction this week. Immedaite Resistance @32420 and Support @31550

1. Gold buy above 30235 TGTS 30500/31000 SL 30000 2. Gold sell below 29880 TGTS 29600/29300 SL 30100

SILVER MCX HOURLY CANDLESTICK CHART

TRADING STRATEGY: SILVER MCX faced correction last week. Momentum seem to be in favour of bears and also USDINR may face correction this week. Hence fresh Short Positions can be created. Immediate Resistance @55620 and Support @54250

1. 2. Silver buy above 50900 TGTS 51700/52500 SL 50100 Silver sell below 49850 TGTS 49050/48050 SL 50350

WWW.EPICRESEARCH.CO CALL: +917316642300

MCX Weekly Newsletter (16-September-2013)

COPPER MCX HOURLY CANDLESTICK CHART

TRADING STRATEGY: COPPER MCX also faced correction last week and May take Support around levels @470-465. Any Correction towards 470 will be buying opportunity in Copper. Immediate Resistance @476 and Support @472 1. Copper Buy above 461 TGTS 470/485 SL 451 2. Copper Sell below 450 TGTS 440/430 SL 460

CRUDEOIL MCX HOURLY CANDLESTICK CHART

TRADING STRATEGY: CRUDEOIL MCX has strong support Support around 7100-7050 levels and any correction towards those levels will be buying opportunity. Alternetively we may see selling if beaks support @7050 Immediate Resistance @7225 And Support @7135 1. Crude oil Buy above 7000 TGTS 7100/7300 SL 6850 2. Crude oil Sell below 6750 TGTS 6650/6500 SL 6900

WWW.EPICRESEARCH.CO CALL: +917316642300

MCX Weekly Newsletter (16-September-2013)

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most. Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis and up on sources that we consider reliable. This material is for personal information and based upon it & takes no responsibility The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailor-made investment advice. Epic research recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Epic research shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of NSE and BSE. The share price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to epic research might be holding positions in the stocks recommended. It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for . Any surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved. Investment in equity & bullion market has its own risks. We, however, do not vouch for the accuracy or the completeness thereof. we are not responsible for any loss incurred whatsoever for any financial profits or loss which may arise from the recommendations above epic research does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

WWW.EPICRESEARCH.CO CALL: +917316642300

Вам также может понравиться

- Daily-Commodity-Report 14 August 2013Документ8 страницDaily-Commodity-Report 14 August 2013Nidhi JainОценок пока нет

- Weekly-Commodity-Report 15 - Oct - 2013 by EPIC RESEARCHДокумент8 страницWeekly-Commodity-Report 15 - Oct - 2013 by EPIC RESEARCHNidhi JainОценок пока нет

- Weekly Commodity Report 26 AUG 2013Документ6 страницWeekly Commodity Report 26 AUG 2013Nidhi JainОценок пока нет

- Weekly-Commodity-Report by EPIC RESEACH 9 September 2013Документ6 страницWeekly-Commodity-Report by EPIC RESEACH 9 September 2013EpicresearchОценок пока нет

- Weekly-Commodity-Report 19 AUG 2013Документ6 страницWeekly-Commodity-Report 19 AUG 2013Nidhi JainОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-192953649Оценок пока нет

- Weekly Commodity Report 7 JANAURY 2012: WWW - Epicresearch.CoДокумент9 страницWeekly Commodity Report 7 JANAURY 2012: WWW - Epicresearch.Coapi-196234891Оценок пока нет

- Daily MCX Newsletter: 1 1 1 18 8 8 8 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013Документ9 страницDaily MCX Newsletter: 1 1 1 18 8 8 8 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013api-230785654Оценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- Weekly-Commodity-Report by Epic Reserach 28-01-2013Документ9 страницWeekly-Commodity-Report by Epic Reserach 28-01-2013EpicresearchОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- Commodity Market Newsletter 13-DecemberДокумент9 страницCommodity Market Newsletter 13-Decembertheequicom1Оценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-230785654Оценок пока нет

- Daily Commodity Report 4 MARCH 2013: WWW - Epicresearch.CoДокумент6 страницDaily Commodity Report 4 MARCH 2013: WWW - Epicresearch.Coapi-196234891Оценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-230785654Оценок пока нет

- MCX Tips 18 January 2012 (BUY SILVER (MAR.) ABOVE 53100)Документ8 страницMCX Tips 18 January 2012 (BUY SILVER (MAR.) ABOVE 53100)Theequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- MCX Tips 17 January 2012 (BUY COPPER (JAN.) )Документ8 страницMCX Tips 17 January 2012 (BUY COPPER (JAN.) )Theequicom AdvisoryОценок пока нет

- MCX Tips 23 January 2012 (BUY NATURAL GAS (FEB.) ABOVE 123)Документ8 страницMCX Tips 23 January 2012 (BUY NATURAL GAS (FEB.) ABOVE 123)Theequicom AdvisoryОценок пока нет

- MCX Tips 20 January 2012 (BUY ZINC (MAR.) ABOVE 102.30)Документ8 страницMCX Tips 20 January 2012 (BUY ZINC (MAR.) ABOVE 102.30)Theequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- Free MCX Tips or Commodity Tips 06 Fab 2012 (SELL SILVER (MAR.) BELOW 55900 TARGET-55750/55600/55400)Документ8 страницFree MCX Tips or Commodity Tips 06 Fab 2012 (SELL SILVER (MAR.) BELOW 55900 TARGET-55750/55600/55400)Theequicom AdvisoryОценок пока нет

- MCX Tips, Commodity Tips, Free MCX Commodity Tips On MobileДокумент8 страницMCX Tips, Commodity Tips, Free MCX Commodity Tips On MobileTheequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- MCX Tips 16 January 2012 (BUY LEAD (JAN.) )Документ8 страницMCX Tips 16 January 2012 (BUY LEAD (JAN.) )Theequicom AdvisoryОценок пока нет

- Daily MCX Newsletter: 0 0 0 09 9 9 9 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013Документ9 страницDaily MCX Newsletter: 0 0 0 09 9 9 9 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013api-230785654Оценок пока нет

- Daily Commodity Report 29-08-2013Документ7 страницDaily Commodity Report 29-08-2013Nidhi JainОценок пока нет

- MCX Tips, Commodity Tips For FREE, 24 Fab 2012 (BUY CRUDEOIL (MAR.) ABOVE 5410)Документ8 страницMCX Tips, Commodity Tips For FREE, 24 Fab 2012 (BUY CRUDEOIL (MAR.) ABOVE 5410)Theequicom AdvisoryОценок пока нет

- MCX Tips 25 January 2012 (BUY MCX COPPER (FEB.) ABOVE 423)Документ8 страницMCX Tips 25 January 2012 (BUY MCX COPPER (FEB.) ABOVE 423)Theequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- Commodity Tips - 17 FebДокумент8 страницCommodity Tips - 17 FebTheequicom AdvisoryОценок пока нет

- EPIC Research ReportДокумент10 страницEPIC Research Reportapi-221305449Оценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-230785654Оценок пока нет

- MCX Tips On Gold and Silver 04-01-2012Документ8 страницMCX Tips On Gold and Silver 04-01-2012Theequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-248643986Оценок пока нет

- Ranges (Up Till 11.40am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-247872246Оценок пока нет

- MCX Tips, Commodity Tips For FREE, 02 MArch 2012 (BUY ALUMINIUM (MAR.) ABOVE 115)Документ8 страницMCX Tips, Commodity Tips For FREE, 02 MArch 2012 (BUY ALUMINIUM (MAR.) ABOVE 115)Theequicom AdvisoryОценок пока нет

- Comex: 3 JUNE 2013Документ7 страницComex: 3 JUNE 2013api-221305449Оценок пока нет

- Comex: 1 February 2013Документ8 страницComex: 1 February 2013api-196234891Оценок пока нет

- Market Update MayДокумент6 страницMarket Update MayKSIRCapitalОценок пока нет

- Free MCX Tips, Commodity Tips 08 Fab 2012 (BUY SILVER (MAR.) ABOVE 57500 TARGET-57700/58000/58300)Документ8 страницFree MCX Tips, Commodity Tips 08 Fab 2012 (BUY SILVER (MAR.) ABOVE 57500 TARGET-57700/58000/58300)Theequicom AdvisoryОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Daily Option News Letter: 13/june/2014Документ7 страницDaily Option News Letter: 13/june/2014api-256777091Оценок пока нет

- COMEX-REPORT-DAILY by Epic Research 31-01-2013Документ8 страницCOMEX-REPORT-DAILY by Epic Research 31-01-2013EpicresearchОценок пока нет

- Commodity Analysis - Daily: The EquicomДокумент8 страницCommodity Analysis - Daily: The EquicomTheequicom AdvisoryОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Commodity Tips For 09/07Документ8 страницCommodity Tips For 09/07Theequicom AdvisoryОценок пока нет

- Daily MCX NewsletterДокумент9 страницDaily MCX Newsletterapi-258080611Оценок пока нет

- EPIC Research ReportДокумент10 страницEPIC Research Reportapi-221305449Оценок пока нет

- Daily MCX Newsletter: 1 1 1 15 5 5 5 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013Документ9 страницDaily MCX Newsletter: 1 1 1 15 5 5 5 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013api-230785654Оценок пока нет

- Stock Option Analysis by Theequicom For 4 June 2014Документ7 страницStock Option Analysis by Theequicom For 4 June 2014tinaroy7119Оценок пока нет

- MCX Tips, Commodity Tips For FREE, 10 Fab 2012 (SELL ZINC (FEB.) BELOW 103.10 TARGET-102.25/101.25/100.00)Документ8 страницMCX Tips, Commodity Tips For FREE, 10 Fab 2012 (SELL ZINC (FEB.) BELOW 103.10 TARGET-102.25/101.25/100.00)Theequicom AdvisoryОценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-256777091Оценок пока нет

- Daily MCX Commodity Newsletter 24-DecemberДокумент9 страницDaily MCX Commodity Newsletter 24-Decembertheequicom1Оценок пока нет

- Daily Option News LetterДокумент7 страницDaily Option News Letterapi-234732356Оценок пока нет

- Day Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)От EverandDay Trading: Learn How to Create a Six-figure Income (High Win Rate Trading Strategies for Scalping and Swing Trading)Оценок пока нет

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsОт EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsРейтинг: 4 из 5 звезд4/5 (1)

- Daily-Sgx-Report by Epic Research Singapore 26 Feb 2014Документ2 страницыDaily-Sgx-Report by Epic Research Singapore 26 Feb 2014Nidhi JainОценок пока нет

- Daily SGX Report 25 FebДокумент2 страницыDaily SGX Report 25 FebNidhi JainОценок пока нет

- Profitable Weekly IFOREX Signal Report by EPIC RESEARCH On 24 Feb 2014Документ6 страницProfitable Weekly IFOREX Signal Report by EPIC RESEARCH On 24 Feb 2014Nidhi JainОценок пока нет

- Daily SGX Report 25 FebДокумент2 страницыDaily SGX Report 25 FebNidhi JainОценок пока нет

- Daily Commodity Market Report - 25-Feb-2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report - 25-Feb-2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily Agri Report 26 Feb 2014Документ7 страницDaily Agri Report 26 Feb 2014Nidhi JainОценок пока нет

- Daily Commodity Market Report 26 - Feb - 2014 by Epic ResearchДокумент13 страницDaily Commodity Market Report 26 - Feb - 2014 by Epic ResearchNidhi JainОценок пока нет

- Daily IForex Report by Epicresearch 24th February 2014Документ8 страницDaily IForex Report by Epicresearch 24th February 2014Nidhi JainОценок пока нет

- Daily-Sgx-Report by Epic Research Singapore 21 Feb 2014Документ2 страницыDaily-Sgx-Report by Epic Research Singapore 21 Feb 2014Nidhi JainОценок пока нет

- Daily Agri Report 21 Feb 2014Документ7 страницDaily Agri Report 21 Feb 2014Nidhi JainОценок пока нет

- Weekly Commodity Market Report 24 - Feb - 2014 by Epic ResearchДокумент8 страницWeekly Commodity Market Report 24 - Feb - 2014 by Epic ResearchNidhi JainОценок пока нет

- Daily Commodity Market Report - 21-Feb-2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report - 21-Feb-2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily Commodity Market Report 24 - Feb - 2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report 24 - Feb - 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily Commodity Market Report - 20 Feb - 2014 by EPIC RESEARCHДокумент14 страницDaily Commodity Market Report - 20 Feb - 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily Agri Report 18 Feb 2014Документ7 страницDaily Agri Report 18 Feb 2014Nidhi JainОценок пока нет

- Daily SGX Report 21 FebДокумент2 страницыDaily SGX Report 21 FebNidhi JainОценок пока нет

- Daily-Sgx-Report by Epic Research Singapore 20 Feb 2014Документ2 страницыDaily-Sgx-Report by Epic Research Singapore 20 Feb 2014Nidhi JainОценок пока нет

- Daily Commodity Market Report 19 - Feb - 2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report 19 - Feb - 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily Commodity Market Report 18 - Feb - 2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report 18 - Feb - 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily-Agri Research Report by Epic Research 20 Feb 2014Документ7 страницDaily-Agri Research Report by Epic Research 20 Feb 2014Nidhi JainОценок пока нет

- Daily-Agri Research Report by Epic Research 19 Feb 2014Документ7 страницDaily-Agri Research Report by Epic Research 19 Feb 2014Nidhi JainОценок пока нет

- Daily SGX Report 18 FebДокумент2 страницыDaily SGX Report 18 FebNidhi JainОценок пока нет

- Daily-Sgx-Report by Epic Research Singapore 19 Feb 2014Документ2 страницыDaily-Sgx-Report by Epic Research Singapore 19 Feb 2014Nidhi JainОценок пока нет

- Daily Commodity Market Report 18 - Feb - 2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Market Report 18 - Feb - 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily SGX Report 17 FebДокумент2 страницыDaily SGX Report 17 FebNidhi JainОценок пока нет

- Weekly Commodity Report 03 Feb 2014 by EPIC RESEARCHДокумент9 страницWeekly Commodity Report 03 Feb 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Daily-Agri Research Report by Epic Research 17 Feb 2014Документ7 страницDaily-Agri Research Report by Epic Research 17 Feb 2014Nidhi JainОценок пока нет

- Weekly-Agri Research Report by Epic Research 17 Feb 2014Документ7 страницWeekly-Agri Research Report by Epic Research 17 Feb 2014Nidhi JainОценок пока нет

- Daily SGX Report 17 FebДокумент2 страницыDaily SGX Report 17 FebNidhi JainОценок пока нет

- Daily Commodity Report 17 Feb 2014 by EPIC RESEARCHДокумент13 страницDaily Commodity Report 17 Feb 2014 by EPIC RESEARCHNidhi JainОценок пока нет

- Chapter 10 AP Gov NotesДокумент2 страницыChapter 10 AP Gov NotesTostitos DoritosОценок пока нет

- Collapse of "Existing Socialism" in Eastern EuropeДокумент46 страницCollapse of "Existing Socialism" in Eastern EuropePedro DurãoОценок пока нет

- Guided Reading & Analysis: The Rise of Industrial America, 1865-11900 Chapter 16Документ9 страницGuided Reading & Analysis: The Rise of Industrial America, 1865-11900 Chapter 16Hope ThomasОценок пока нет

- Pumps & Systems August 2016Документ116 страницPumps & Systems August 2016Jesus JavierОценок пока нет

- Competing With Giants Sample ChapterДокумент34 страницыCompeting With Giants Sample Chapterjasonvulog3626Оценок пока нет

- What Role Did The Military Play in Shaping The Economy of BrazilДокумент2 страницыWhat Role Did The Military Play in Shaping The Economy of Brazilapi-264242211Оценок пока нет

- Andrew Jackson: The Good, The Bad, The Ethnic CleansingДокумент4 страницыAndrew Jackson: The Good, The Bad, The Ethnic CleansingstephanieОценок пока нет

- WARGAMES Joshua's ListДокумент9 страницWARGAMES Joshua's ListthealthnorОценок пока нет

- Wealth X World Ultra Wealth Report 2017 FINALДокумент39 страницWealth X World Ultra Wealth Report 2017 FINALStories BrasilОценок пока нет

- Howard Zinn - Writings On Disobedience and Democracy PDFДокумент3 страницыHoward Zinn - Writings On Disobedience and Democracy PDFRaghubalan DurairajuОценок пока нет

- Pest Analysis of Pharma IndustryДокумент10 страницPest Analysis of Pharma IndustryNirmal75% (4)

- An Ocean ApartДокумент360 страницAn Ocean ApartBruegelОценок пока нет

- GFS Report 2018 EN PDFДокумент80 страницGFS Report 2018 EN PDFMahmood AlyОценок пока нет

- Understanding Institutional WeaknessДокумент76 страницUnderstanding Institutional Weaknessmanuelgirbal100% (1)

- USA Literature in BriefДокумент60 страницUSA Literature in BriefsaraОценок пока нет

- Chapter 4 Section 3 NotesДокумент6 страницChapter 4 Section 3 NotesJaysway 16Оценок пока нет

- Black History Playing CardsДокумент6 страницBlack History Playing CardsAnonymous 7QjNuvoCpIОценок пока нет

- Bloomberg Philanthropies 2019 ReportДокумент120 страницBloomberg Philanthropies 2019 ReportZacharyEJWilliamsОценок пока нет

- Texas Government Term Paper TopicsДокумент8 страницTexas Government Term Paper Topicsc5eyjfntОценок пока нет

- Planet Starbucks (B) : Caffeinating The World: HistoryДокумент15 страницPlanet Starbucks (B) : Caffeinating The World: HistoryJeff YangОценок пока нет

- A Hard Look at Hard Power - Assessing The Defense Capabilities ofДокумент409 страницA Hard Look at Hard Power - Assessing The Defense Capabilities ofEugeniu CernenchiОценок пока нет

- Infografia en InglesДокумент1 страницаInfografia en InglesVasquez Velquez100% (1)

- American Corrections in Brief: November 2013Документ34 страницыAmerican Corrections in Brief: November 2013Marcela TimossiОценок пока нет

- Austin James E. - Agroindustrial Project AnalysisДокумент341 страницаAustin James E. - Agroindustrial Project AnalysisErient Tiatri0% (1)

- Hector P Garcia: in Relentless Pursuit of Justice by Ignacio M. GarciaДокумент431 страницаHector P Garcia: in Relentless Pursuit of Justice by Ignacio M. GarciaArte Público Press100% (1)

- Crisis Management Analyst Job at U S Security Associates IncДокумент5 страницCrisis Management Analyst Job at U S Security Associates Incapi-309080664Оценок пока нет

- Chapter: 1 Location Planning and Analysis: Need For Location Decisions Nature of Location DecisionsДокумент52 страницыChapter: 1 Location Planning and Analysis: Need For Location Decisions Nature of Location DecisionsHammad AshrafОценок пока нет

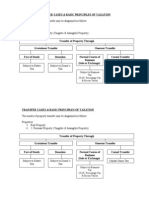

- Transfer TaxesДокумент3 страницыTransfer TaxesbeverlyrtanОценок пока нет

- Federalism in NepalДокумент8 страницFederalism in NepalRaju MahatoОценок пока нет

- Frank Boysia - Blaxicans 2 Paragraph RelfectionДокумент2 страницыFrank Boysia - Blaxicans 2 Paragraph Relfectionapi-454316276Оценок пока нет