Академический Документы

Профессиональный Документы

Культура Документы

Porter

Загружено:

Akshay SinghАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Porter

Загружено:

Akshay SinghАвторское право:

Доступные форматы

Bharti Airtel Enterprise Services BCG Matrix Study

BCG Matrix:Star SBU: Enterprise Services(Carriers & Corporates) Reason :-( Major Contributor to revenue in just 4 years of coming 0408) ? SBU: Passive Infra Reason:-(Very new approach but quick grip of market/Good Collaborations likeIndus Towers/Untapped Market)

Cash Cow

Dog

SBU: Mobile Services SBU: Telemedia Services Reason:-(Legacy of Reason:-(Significant Bharti) fall in ARPU/Other Big Players existing in Market)

Data for BCG Matrix in following Manner:Market Growth Relative Market Share (in BCG Terms)

Quadrant

Strategic Business Unit

Market Market Share(Largest Share(SBU) Competitor)

Relative Market Share

(%age change in which b/w FY 07- the SBU 10) lies

Mobile Services

70.56%

RelianceCDMA/GSM->17.94%

24.79%

1.38

33.00%

Cash Cow

Telemedia Services

9.22%

BSNL-->37%

23%

0.62

44.00%

Dog

Enterprise Services(Carriers & Corporates) 18.26%

Atire Technology->42.6%

14.50%

0.34

30.00% (SBU Started in FY08)

Star

Passive Infra

1.94%

GTL Infra->28.33%

NA(Newly 0.00 Induced SBU)

Details and Reference/Links used to draw BCG Matrix:-

Market Share & Relative Market Share Mobile Services

Group Company Airtel(GSM) Reliance (CDMA + GSM) Vodafone Essar(GSM) BSNL(GSM) IDEA(GSM) Tata (CDMA) Aircel(GSM) Spice(GSM) MTNL(GSM)

Total Subscribers 72078007 52163013 50950365 37916116 28248346 27329678 12475529 4197250 3537248

BPL(GSM) HFCL (CDMA) Shyam (CDMA) Total (All India) * CDMA figures include WLL services Link:- www.india-cellular.com/Market-Share.html

1439956 358529 115462 29,08,09,499

Market Share For Telemedia

Link:http://voicendata.ciol.com/content/vNd1 00/2007vol-II/307071901.asp

Market Share-for Enterprise services

Link:- http://voicendata.ciol.com/content/Vnd100-2008/108060305.asp

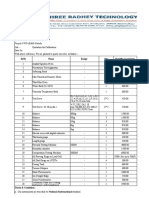

Market Share-for Passive Infrastructure:-

Company Name Last Price GTL Infra

% Chg

Gross Block 0.56

Net Block

CWIP

Total Assets

35.65

1,334.41 1,203.33 790.50 3,408.60

ITI GTL HFCL Siemens Gemini Comm

27.35 164.90 10.70 398.15 24.00

4.99 -1.41 0.94 -3.89 -5.70

3,644.06 2,710.94 2.16 373.46 467.31 870.12 115.07 222.24 236.60 463.74 95.63

2,819.88

19.62 1,625.44 10.06 1,614.74 93.29 1,592.41 0.00 283.13

Honeywell 1,145.05 8.21 Autom XL Telecom 125.70 -8.15

103.67

34.15

98.91 247.14

37.63

26.77

0.00

217.58

Avaya 101.65 GlobalCon Astra 44.20 Microwave MIC 94.00 Electronics NELCO Punj Comm Shyam Telecom Aplab 56.55 26.85

-1.21

77.30

20.91

0.96

213.60

-0.56

94.92

61.45

22.08 177.83

-1.93

25.60

18.38

15.43 173.98

0.80 -0.56

52.01 51.59

20.82 9.03

0.79 0.00

114.10 108.95

77.00

3.84

49.01

40.61

18.30 84.21

52.90

4.96

31.99

13.29

5.47

64.86

Krone Comm Kavveri Telecom

93.60

1.46

23.02

9.78

0.02

45.79

88.80

0.74

7.62

5.34

0.00

43.93

Ashco Ind 9.45 Precision Elec Valiant Comm Munoth Comm 25.70

-3.96 -4.81

28.98 29.24

17.32 16.87

1.49 1.82

36.83 31.96

22.20

-6.72

10.45

5.51

0.00

31.42

5.00

0.00

1.38

0.66

0.00

16.14

Link:http://www.moneycontrol.com/stocks/marketinfo/totassets.php?optex=BSE&ind code=Telecommunications%20-%20Equipment&opttopic=totassets

PORTERS FIVE FORCES

Threat of New Entrants The number of major players in the Indian telecom is 12 companies. This has changed the tactics followed by companies, it all started by TATA DoCoMo bringing about the concept of per second billing. This made the companies to shift focus from Average revenu e per user (ARPU) to per minute cost. So a smaller company has shaken the foundation of the sector. Moreover in the recent days the inclusion of 3G has brought about as is often said the entry of a 900 pound gorilla in the telecom industry as a major competitor. The newer players are turning the tide. Uninors variable pricing too has left feathers ruffled. This shows the increasing threat being offered by new entrants into the market.

Power of Suppliers At first glance, it might look like telecom equipment suppliers have considerable bargaining power over telecom operators. Indeed, without hightech broadbandswitching equipment, fibreoptic cables, mobile handsets and billing software, telecom operators would not be able to do the job of transmitting voice and data from place to place. But there are actually a number of large equipment makers around. There are enough vendors, arguably, to dilute bargaining power.

The largest monopoly is the allocation of the bandwidth by the government to the telecom companies. The concept of bidding should have been transparent but time and time again have proved to be anything but. This can lead to severe losses as the allocation of bandwidth is the essence of telecommunication. The limited pool of talented managers and engineers, especially those well versed in the latest technologies, places companies in a weak position. This is because the cost incurred by the company to train these new inductees is high and quite often the technology changes just as they are inducted.

Reliance Infratel has around 50,000 towers. The largest tower firm Indus Towers has around 1,00,000 towers and is a combination of Bharti Airtel, Vodafone Essar and Idea Cellular operating in 16 service areas. This is how the tower firms dictate conditions to the telecom operators.

Power of Buyers All this chaos has created one of biggest power in the telecom industry the customer. The end user will be the happiest as the price wars ensue. This will lead to a change in the method of revenue generation as the concept of manufacturing minutes goes belly up in the future. Telecom in the present day holds low brand loyalty and brand switching is becoming more and more a norm. This would be more rampant when the clearance of free transfer of number while changing the service takes place. The end user should now be targeted more like a retail customer than that of specialty goods. Availability of Substitutes In the recent years with the advent of internet into the domain of mobile, the demarcation between the two sectors has faded. As high speed internet is made available on the mobile phones the role of phone calls and short messaging services will diminish, which are major source of revenue for the telecom companies in India. The use of software like SKYPE and Gtalk will be the order of the day. This has created a new theatre for the telecom companies to look into for revenue generation because if they are not prepared the losses due to the inclusion of internet based communication devices would be a lot.

Competitive Rivalry

It is said that Indian telecom is a big pie being shared by many people and the rivalry had been dormant in the past few years when everyone used to follow the antics of the market leader, case in point Airtel. But of late the impact made by newer companies has led to a major price war among all the players. Recent statistics show that the minutes were being sold by the companies at60p in 2008 but now, are being sold at 35p. This with the cost to the company at 25p (for Airtel) has hit the bottom line drastically. Rivalry in this sector has just begun to show up because the changes being brought forward are too many and those who adapt will survive. Competitors of Airtel are flanking it from the side by trying out newer ways to woo the customer. This makes an impact because the main target for the rivals is the youth who ask for low cost. But Airtel works very similar to a bank which likes to have more money coming in through valued customers rather than low cost urban connections especially when the costing such demography is high for the company.

S.W.O.T ANALYSIS STRENGTHS

1. Largest wireless network among all the players in the market. Followed by the largest market share. Customer base of 133 million. High Customer Service and Quality. 2. The best performing (quality) network coverage in India. 3. Highly effective Value added services inform of AppCentral which had a million plus downloads last month (June 2010). 4. Penetration into the rural market through collaboration with Immobile to launch Cell Shakti.

5. Partnered with VMware to look forward into the domain of cloud computing, which is purported as the future of information? 6. Employed Ogilvy into African Marketing operation. 7. Partners with leading Phone manufacturers for distribution.

WEAKNESS 1. Reduced profit margin due to increasing cost per minute and falling selling price. 2.Increased debt by acquiring companies in newer markets. 3.Preparedness towards the changing role of telecom i.e. shifting focus from calls and SMS. 4. Penetration into rural market. 5. Charging for customer care.

OPPORTUNITIES 1. The entry into the newer markets of Africa as the domestic market goesthough a state of unrest. 2. Telecom is slowly looked upon as acommodity so higher quality at alesser price is needed. 3. Large section of the population whichis not exposed to internet and need better connectivity. 4. The scope of breaching into the sector of internet and creating anamalgamation of sorts between thetwo.

5.Mobile Banking Services. 6.Reaching out to the bottom of the pyramid

THREATS 1. Too many players which can lead to diluted focus and can give a chance to a smaller rival to move ahead. 2.Internet based services taking over a part of the telecommunicationsdomain. Likes of SKYPE and Gtalk. 3.Government regulations over the bandwidth and other telecomregulations. 4. Presence of Reliance into the thereof telecommunication. 5. Customer preference of price over performance. 6. Failure of expansion operations.

EFE MATRIX

T h e a na l y s i s o f A i r t e l t r i es t o un de r s t a nd w ha t s tep s A i r te l m u s t ta ke f o r w a r d t o sustain the market share. The Indian telecom industry as of now has almost 12 companies operating. Such a large number has pushed down the rates; this was initiated early by TATA DoCoMo through its per second rates and has changed the revenue model of Indian mobileoperators ever since. This led to the fall of the Average Revenue per User(ARPU) but the price of making thosem i n u t es r o s e. T hi s f a l l i n A R PU , t he a dv e nt o f 3G a n d a c q ui s i ti o ns b y co mp a ni e s , ha v e increased cost of making minutes. Moreover with mobile phones falling under the category of commodity goods it is not easier to pitch with just a lower price.The changing tide of mobile phones

in form of 3G will hit only a few in the initial years butthey will be that segment with a higher ARPU. They will be exposed to a domain of high speed internet on mobile phones. This can have serious repercussions because the mode of communication through internet is free/low fare and high clarity. This is a major challenge to face early to decide whether or not the company must change its approach from being something more than just selling the voice service. Because the dark side of internet is the ability to find a cheaper and better alternative to everything the mobile phone has to offer. It is high time Airtel puts a slight focus on how telecom can change in the years to come. As of now the storage capacity of the mobile phones is relatively limited but once the capacity increase so will the speed and if Eric Schmidt is to be believed the Future of Technology is mobile phones powered with high speed internet. Once that happens the role played by telecom companies would lie beyond the realm of just being a voice company but that which competes with software too. They will then have tochange their business model to go beyond manufacturing minutes. Airtel must move ahead with the idea of moving to newer markets. Because making hastydecisions in a shaky market does not make sense. Innovations such as Sent i.e.rudimentary banking through mobile phones can be implemented. As the urban market gets saturated the move must be to provide basic communication needs to the bottom of the pyramid. This can be implemented easily because of the presence of towers in almost all parts of India; they should just make it affordable. Almost 80% of the revenue generated by the telecom companies is through voice services. This is important because it means that a large chunk of these can

defect to a product such as Skype. But sustain the same level of revenue generation through voice the company can enter into a new market. S i n c e t he pr es e nc e o f t he co mp a n y i n th e r ur a l de mo g r a p hy i s a l r e a dy pr es e nt th e y c a n increase presence in the rural sector through market development. They can however change the brand name to prevent the association like that of Reliance and aam aadmi (commonman). These markets are not developed but do have the potential for growth. Cell Shaktis initiative is good but it must reach far and wide. The expansion into Africa makes sense as the market is still developing and rich dividend sc a n be g a i n ed. H o w e v er t he i m pa c t o f t he co s t i nv o l v e d w i l l a f f e c t t h e co m pa n y s I n di a n operation and can reduce their profit here. This would be in addition to the exorbitant price paid by the telecom companies for 3G circles. Airtel should not be hit badly since they have already sprouted few revenue generation portals like App Central, though the margin will fall.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- TA30 - G7 Service ManualДокумент436 страницTA30 - G7 Service ManualAndrés Aroca93% (14)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ralco R302 Collimator Service ManualДокумент173 страницыRalco R302 Collimator Service ManualMadhavesh KulkarniОценок пока нет

- Thierry Bardini - BootstrappingДокумент324 страницыThierry Bardini - Bootstrappingh0ry0% (1)

- Product and Service Design - Questions and AnswersДокумент4 страницыProduct and Service Design - Questions and Answershakim_9569Оценок пока нет

- eWPT WriteupДокумент4 страницыeWPT WriteupBertrand Lorente YanezОценок пока нет

- Software Dev Processes Project 1Документ2 страницыSoftware Dev Processes Project 1ereter50% (8)

- Rajesh BansalДокумент14 страницRajesh BansalTapasОценок пока нет

- Hilton ReportДокумент6 страницHilton ReportGibin Joseph100% (2)

- Wealth MGMT Analysis SheetДокумент2 страницыWealth MGMT Analysis SheetAkshay SinghОценок пока нет

- Customer Satisfaction Index: by Akshay Singh - 145 & Isha Sharma - 153Документ6 страницCustomer Satisfaction Index: by Akshay Singh - 145 & Isha Sharma - 153Akshay SinghОценок пока нет

- Estimating The Project Cash Flows: 1. Naveen Enterprises Is Considering A New Investment Project About WhichДокумент2 страницыEstimating The Project Cash Flows: 1. Naveen Enterprises Is Considering A New Investment Project About WhichAkshay SinghОценок пока нет

- Solo Dance: Aaja Nach LeДокумент1 страницаSolo Dance: Aaja Nach LeAkshay SinghОценок пока нет

- Sesi CVДокумент3 страницыSesi CVThabisoОценок пока нет

- MCU Based Multi Functions Automated Corn Planting RoverДокумент82 страницыMCU Based Multi Functions Automated Corn Planting Roveraldrinvic0005Оценок пока нет

- PCM 1867Документ141 страницаPCM 1867pepeluis666Оценок пока нет

- Object Oriented Programming Methodology Using Java: Prof: Pradnya Sadigale (E&Tcdepartment)Документ39 страницObject Oriented Programming Methodology Using Java: Prof: Pradnya Sadigale (E&Tcdepartment)pradnya sadigaleОценок пока нет

- U-BOOTS (1) Technical SeminarДокумент18 страницU-BOOTS (1) Technical SeminarBasavaraj M PatilОценок пока нет

- List of Lab Exercises: SL - No Name of The ProgramДокумент37 страницList of Lab Exercises: SL - No Name of The ProgrambiggerОценок пока нет

- King's CafeДокумент80 страницKing's Cafejagruti bhor0% (1)

- SRT/2020-21/11/29 To. M/S Deputy Director Research Lab: Punjab PWD (B&R) PatialaДокумент4 страницыSRT/2020-21/11/29 To. M/S Deputy Director Research Lab: Punjab PWD (B&R) PatialaAyush GoyalОценок пока нет

- BS en Iso 8655-5-2002Документ18 страницBS en Iso 8655-5-2002Carson ChowОценок пока нет

- Integrated Language Environment: AS/400 E-Series I-SeriesДокумент15 страницIntegrated Language Environment: AS/400 E-Series I-SeriesrajuОценок пока нет

- Configuring The Thomson Gateway SIP ServerДокумент15 страницConfiguring The Thomson Gateway SIP ServerFurueiОценок пока нет

- TECO Commercial Split TypeДокумент23 страницыTECO Commercial Split TypeFerdinand FernandezОценок пока нет

- SAP User License TypesДокумент1 страницаSAP User License Typesb_desarkarОценок пока нет

- Matlab/Simulink Modeling of Sic Power Mosfets: Paolo Giammatteo, Concettina Buccella, Carlo CecatiДокумент10 страницMatlab/Simulink Modeling of Sic Power Mosfets: Paolo Giammatteo, Concettina Buccella, Carlo CecatiDaniel Labiano AnduezaОценок пока нет

- Installation Instructions MODELS TS-2T, TS-3T, TS-4T, TS-5T: Rear View of PlateДокумент2 страницыInstallation Instructions MODELS TS-2T, TS-3T, TS-4T, TS-5T: Rear View of PlateXavier TamashiiОценок пока нет

- KTA-290 Manual - NOT RSPDДокумент13 страницKTA-290 Manual - NOT RSPDMagnus Clarkson100% (1)

- Design and Fabrication of Mini Surveillance Drone PresentationДокумент9 страницDesign and Fabrication of Mini Surveillance Drone PresentationSaijay ShirodkarОценок пока нет

- Data SheetДокумент24 страницыData Sheetbashok20Оценок пока нет

- Script For MediaДокумент6 страницScript For MediaAstania SelimivicОценок пока нет

- Medical Store Computer Project-FinalДокумент32 страницыMedical Store Computer Project-FinalYuvan KumarОценок пока нет

- Gs01c21b03-00e (23) Eja120aДокумент10 страницGs01c21b03-00e (23) Eja120aNguyen ThuongОценок пока нет

- Middleware Seminar ReportДокумент22 страницыMiddleware Seminar ReportSudipta Dhara33% (3)

- Mitsubishi f700 Manual PDFДокумент416 страницMitsubishi f700 Manual PDFNelsonOsmarSanchezОценок пока нет